Finance

How To Calculate Line Of Credit Interest

Published: January 10, 2024

Learn how to calculate line of credit interest and manage your finances effectively. Discover useful tips and techniques for understanding and calculating interest rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Line of Credit

- Factors Affecting Line of Credit Interest

- Calculating Line of Credit Interest

- Step 1: Determine the Principal Amount

- Step 2: Identify the Interest Rate

- Step 3: Determine the Time Period

- Step 4: Calculate Simple Interest

- Step 5: Include any Additional Fees or Charges

- Example Calculation

- Conclusion

Introduction

Are you considering applying for a line of credit but aren’t quite sure how the interest is calculated? Understanding how line of credit interest works is crucial, as it can significantly impact your borrowing costs. In this article, we will delve into the intricacies of line of credit interest and guide you through the process of calculating it. Whether you’re seeking a personal line of credit or a business line of credit, this information will empower you to make informed financial decisions.

A line of credit is a flexible borrowing option that allows individuals and businesses to access funds up to a predetermined limit. Unlike a traditional loan, which provides a lump sum of money upfront, a line of credit grants borrowers the freedom to withdraw only the funds they need at any given time. This flexibility is ideal for managing ongoing expenses, unforeseen emergencies, or taking advantage of investment opportunities.

Line of credit interest is the cost associated with borrowing money from your line of credit. The interest rate, which is typically variable, is a percentage charged on the outstanding balance that fluctuates based on market conditions. It’s essential to understand the factors that can influence the interest rate and how to calculate it accurately to effectively manage your line of credit.

Calculating line of credit interest involves a straightforward process. By following a few simple steps, you can determine the interest amount and better plan your repayment strategy. It’s essential to have a clear understanding of the principal amount, interest rate, and time period to make accurate calculations. Additionally, be aware that some line of credit products may have additional fees or charges that need to be considered in the calculation.

Now that we have an overview of what line of credit interest entails, let’s explore the factors that can affect the interest rate and dive into the step-by-step process of calculating line of credit interest.

Understanding Line of Credit

A line of credit is a type of revolving credit that provides borrowers with access to a predetermined amount of funds. Unlike a traditional loan where you receive a lump sum upfront, a line of credit allows you to withdraw the necessary funds as needed, up to the maximum limit set by the lender.

One of the primary advantages of a line of credit is its flexibility. It gives borrowers the freedom to use the funds on an ongoing basis, making it ideal for situations where expenses fluctuate or unforeseen expenses arise. Whether you need to cover business expenses, home renovations, or unexpected medical bills, a line of credit can provide the necessary financial flexibility.

There are different types of lines of credit available, tailored to meet specific needs. Personal lines of credit are commonly used for personal expenses, such as paying for education, consolidating debt, or funding vacations. Business lines of credit, on the other hand, are designed to help businesses cover operational costs, manage inventory, or seize new opportunities.

Interest rates on lines of credit are typically variable, meaning they can fluctuate over time. This is in contrast to fixed-rate loans, where the interest rate remains constant throughout the loan term. Variable interest rates are often tied to a benchmark rate, such as the prime rate or the London Interbank Offered Rate (LIBOR), which can change in response to economic conditions.

When it comes to repayment, lines of credit offer flexibility as well. Minimum monthly payments are typically required, with the option to repay the balance in full or make additional payments at any time. As you repay the borrowed amount, the funds become available again, allowing you to borrow against the line of credit as needed.

It’s important to note that obtaining a line of credit is subject to approval based on factors such as your credit history, income, and overall financial health. Lenders will review these factors to determine your creditworthiness and assign an appropriate credit limit and interest rate.

Now that we have a basic understanding of what a line of credit is, it’s time to explore the factors that can influence the interest rate on your line of credit.

Factors Affecting Line of Credit Interest

Several factors can influence the interest rate on your line of credit. It’s essential to be aware of these factors, as they can affect your borrowing costs and determine how much you’ll pay in interest over time. Here are the key factors that impact line of credit interest:

- Credit history: Your credit history plays a significant role in determining the interest rate you’ll receive on a line of credit. Lenders use your credit score and credit report to assess your creditworthiness. A higher credit score indicates a history of responsible borrowing and makes you more eligible for a lower interest rate. On the other hand, a lower credit score may result in a higher interest rate.

- Market conditions: Line of credit interest rates are often tied to market conditions and can fluctuate accordingly. If market rates increase, you may experience an increase in your line of credit interest rate, resulting in higher borrowing costs. Keeping an eye on market trends can help you anticipate potential changes in your interest rate.

- Collateral: Some lines of credit require collateral, such as a home or other valuable asset. When collateral is involved, lenders may offer lower interest rates since they have an added layer of security in case of default. If you opt for an unsecured line of credit, where no collateral is required, the interest rate may be slightly higher to compensate for the increased risk to the lender.

- Relationship with the lender: Existing relationships with the lender can sometimes lead to more favorable interest rates. If you have a history of banking with a certain financial institution or have other accounts with them, they may offer you a discounted rate as a valued customer. It’s worth exploring the interest rates offered by your current banking institution before seeking a line of credit elsewhere.

- Loan amount and repayment term: The amount you borrow and the repayment term can impact the interest rate on your line of credit. Lenders may offer lower interest rates for larger loan amounts or longer repayment terms, as they have the potential to earn more interest over time. However, it’s essential to strike a balance between the loan amount, repayment term, and your ability to comfortably repay the borrowed funds.

Keep in mind that these factors are not exhaustive and can vary depending on the lender and the specific terms of your line of credit. Understanding these factors can help you evaluate the interest rate offered to you and make informed borrowing decisions.

Now that we understand the factors that can affect the interest rate on a line of credit, let’s delve into the step-by-step process of calculating line of credit interest.

Calculating Line of Credit Interest

Calculating line of credit interest involves a simple process that consists of a few key steps. By following these steps, you can determine the amount of interest you’ll owe on your line of credit. Here’s a step-by-step guide to calculating line of credit interest:

- Step 1: Determine the Principal Amount: Start by identifying the principal amount, which is the amount of money you have borrowed or withdrawn from your line of credit.

- Step 2: Identify the Interest Rate: Consult your line of credit agreement or contact your lender to determine the interest rate applicable to your line of credit. Note that interest rates on lines of credit are typically variable and can change over time.

- Step 3: Determine the Time Period: Next, establish the time period for which you want to calculate the interest. This could be a month, a quarter, or any other duration for which you want to determine the interest amount.

- Step 4: Calculate Simple Interest: To calculate the interest amount, multiply the principal amount by the interest rate and divide it by the number of periods in a year. For example, if your line of credit has an annual interest rate of 10% and you’re calculating interest for one month, the formula would be: (Principal Amount x Interest Rate) / 12.

- Step 5: Include any Additional Fees or Charges: Some line of credit products may charge additional fees or charges, such as an annual fee or transaction fee. Be sure to include these costs in your calculation to get a comprehensive understanding of your borrowing expenses.

It’s important to note that this calculation provides you with the simple interest for the given time period. If your line of credit has compounding interest, the calculation may differ, and you may need to consult with your lender or refer to your line of credit agreement for accurate calculations.

Now, let’s dive into an example calculation to illustrate how line of credit interest can be calculated in a practical scenario.

Step 1: Determine the Principal Amount

Before you can calculate the interest on your line of credit, you need to determine the principal amount. The principal amount refers to the total amount you have borrowed or withdrawn from your line of credit.

To identify the principal amount, you should review your line of credit statements or contact your lender. The principal amount represents the outstanding balance on your line of credit at a specific point in time. It includes any funds you have withdrawn and have not yet repaid, as well as any accrued interest or fees.

For example, let’s say you have a line of credit with a maximum limit of $10,000, and you have used $5,000 to cover various expenses. In this case, the principal amount is $5,000 as that is the actual amount you have utilized from your line of credit.

It’s important to keep track of the principal amount because the interest you will be charged is based on this outstanding balance. As you make repayments on your line of credit, the principal amount will decrease, resulting in less interest being charged over time.

Understanding the principal amount is crucial for accurate interest calculations and managing your line of credit effectively. By staying aware of your outstanding balance, you can track your borrowing and make informed decisions about how much more you can borrow or how quickly you need to repay the funds.

Now that we have determined the principal amount, let’s move on to the next step, which is identifying the interest rate applicable to your line of credit.

Step 2: Identify the Interest Rate

Once you have determined the principal amount on your line of credit, the next step is to identify the interest rate that applies to your borrowing. The interest rate is the percentage charged on the outstanding balance of your line of credit.

Your line of credit agreement or loan contract should specify the interest rate associated with your line of credit. In most cases, line of credit interest rates are variable, meaning they can fluctuate over the course of your borrowing period. Variable interest rates are typically tied to a benchmark rate, such as the prime rate or the London Interbank Offered Rate (LIBOR).

It’s important to be aware of any changes to the interest rate specified in your agreement. If market conditions change, your line of credit interest rate may be adjusted accordingly. Therefore, it’s a good idea to regularly review your line of credit statements and stay informed about any rate changes communicated by your lender.

By identifying the interest rate, you will have a crucial component in calculating the interest amount you will owe on your line of credit. The interest rate is a key factor in determining the overall cost of borrowing and directly affects the total amount you will pay in interest over time.

Understanding the interest rate on your line of credit enables you to make informed financial decisions. If you find that the interest rate is high, you may consider exploring other line of credit options or negotiating with your lender for a better rate. Being an informed borrower allows you to manage your line of credit more effectively and potentially save on interest costs.

Now that we have identified the interest rate, let’s move on to the next step, which is determining the time period for calculating the line of credit interest.

Step 3: Determine the Time Period

After identifying the interest rate applicable to your line of credit, the next step is to determine the time period for which you want to calculate the interest. The time period refers to the duration over which you will be assessing the interest amount.

The time period can vary based on your specific needs and circumstances. It could be a month, a quarter, a year, or any other duration that you want to calculate the interest for. This time period will help you determine how much interest will accrue over that specific time frame.

When selecting the time period, it’s important to consider factors such as your repayment schedule and the frequency at which interest is compounded. For example, if your line of credit charges interest on a monthly basis, you may want to calculate the interest for each individual month to get a more accurate representation of your borrowing costs.

Having a clear understanding of the time period is crucial for budgeting and financial planning. It allows you to anticipate and allocate the necessary funds to cover the interest charges on your line of credit over the specified time frame. Additionally, it helps you assess the impact of different time periods on the total interest you will pay over the life of your line of credit.

Remember, the time period selected will directly impact the interest amount you calculate. So, ensure that you choose the appropriate time frame based on your specific needs and financial goals.

Now that we have determined the time period, let’s move on to the next step, which involves calculating the simple interest on your line of credit.

Step 4: Calculate Simple Interest

Calculating the interest on your line of credit involves determining the simple interest for the specified time period. Simple interest is calculated based on the principal amount, the interest rate, and the time period. It provides a straightforward way to estimate the interest amount you will owe.

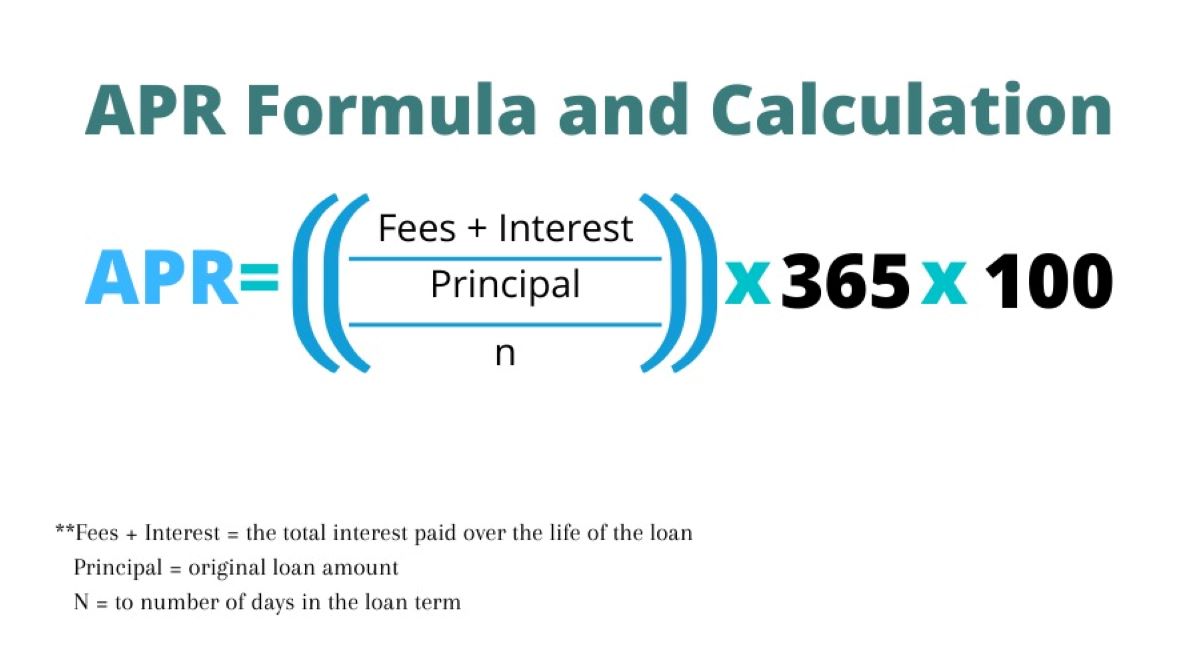

To calculate simple interest on your line of credit, you can use the following formula:

Interest = (Principal Amount x Interest Rate x Time Period) / (Number of Periods in a Year)

Let’s break down the components of the formula:

- Principal Amount: This is the total amount of money you have borrowed or withdrawn from your line of credit.

- Interest Rate: This is the percentage rate at which interest is charged on the outstanding balance of your line of credit.

- Time Period: This is the duration for which you want to calculate the interest. It can be in months, quarters, or any other specified time frame.

- Number of Periods in a Year: This represents the frequency at which interest is compounded. For example, if interest is compounded monthly, the number of periods in a year would be 12.

By plugging in the appropriate values into the formula, you can calculate the simple interest for your line of credit. Keep in mind that this calculation provides an estimate of the interest amount, assuming simple interest is applicable to your line of credit. If your line of credit has compounding interest, the calculation may differ, and you should refer to your line of credit agreement or consult with your lender for accurate calculations.

Calculating the simple interest on your line of credit gives you a clear picture of the interest amount you will owe within the specified time frame. It helps you budget and plan for the repayment of your line of credit and gives you a better understanding of the overall borrowing costs.

Now that we have calculated the simple interest, let’s proceed to the next step, which involves considering any additional fees or charges that may apply to your line of credit.

Step 5: Include any Additional Fees or Charges

When calculating line of credit interest, it’s important to consider any additional fees or charges that may apply to your borrowing. These fees are separate from the interest and can impact the overall cost of your line of credit.

Common additional fees or charges associated with a line of credit may include:

- Annual Fee: Some lines of credit may have an annual fee that is charged regardless of whether you use the line of credit or not. This fee is typically charged to maintain the account and access the available credit.

- Transaction Fee: Depending on the terms of your line of credit, you may incur a fee for each transaction or withdrawal made from the line of credit. This can include cash advances, balance transfers, or other types of transactions.

- Late Payment Fee: If you fail to make your minimum payment by the due date, you may be subject to a late payment fee. This fee is charged as a penalty for not meeting your repayment obligations on time.

- Overlimit Fee: If you exceed the credit limit on your line of credit, you may incur an overlimit fee. This fee is triggered when you borrow more than the maximum amount allowed on your line of credit.

It’s important to carefully review your line of credit agreement or consult with your lender to understand all the fees and charges associated with your specific line of credit. Including these additional fees or charges in your interest calculations will give you a more accurate representation of the total borrowing costs.

Remember, the inclusion of these fees can have a significant impact on the overall amount you will owe on your line of credit. Taking them into account allows you to make more informed financial decisions and properly plan for the repayment of your line of credit.

Now that we have considered any additional fees or charges, let’s move on to an example calculation to illustrate the process of calculating line of credit interest.

Example Calculation

Let’s walk through an example to demonstrate how to calculate line of credit interest. Suppose you have a line of credit with a principal amount of $10,000 and an interest rate of 12% per year. You want to calculate the interest for a three-month time period.

- Step 1: Determine the Principal Amount: In this case, the principal amount is $10,000.

- Step 2: Identify the Interest Rate: The interest rate is 12% per year.

- Step 3: Determine the Time Period: The time period is three months.

- Step 4: Calculate Simple Interest: Utilize the formula (Principal Amount x Interest Rate x Time Period) / (Number of Periods in a Year) to calculate the interest. The formula becomes: ($10,000 x 0.12 x 3) / 12 = $300.

- Step 5: Include any Additional Fees or Charges: If there are any additional fees or charges, such as an annual fee of $50, it should be added to the calculated interest. The total borrowing cost would then be $300 + $50 = $350.

Based on this calculation, for a three-month period, you would owe $300 in interest on your line of credit. However, when considering the additional annual fee of $50, the total borrowing cost for the three months would be $350.

Keep in mind that this is just a simplified example, and the actual interest calculations may differ based on your specific line of credit terms, compounding frequency, and any other applicable fees or charges.

By understanding the calculation process with an example, you can better assess the interest amount you will owe and effectively manage your line of credit.

Now that we have gone through the example calculation, let’s wrap up our discussion on calculating line of credit interest.

Conclusion

Understanding how to calculate line of credit interest is crucial for managing your borrowing costs and making informed financial decisions. By following the step-by-step process outlined in this article, you can determine the interest amount accurately and plan for the repayment of your line of credit more effectively.

We started by introducing the concept of a line of credit and its flexibility in providing access to funds as needed. We then explored the factors that can impact the interest rate on your line of credit, such as credit history, market conditions, collateral, relationship with the lender, and loan amount and repayment term.

Next, we delved into the step-by-step process of calculating line of credit interest. We discussed the importance of determining the principal amount, identifying the interest rate, and selecting the time period. We also explained how to calculate simple interest using the appropriate formula and highlighted the significance of considering any additional fees or charges associated with your line of credit.

Lastly, we provided an example calculation to illustrate how line of credit interest can be calculated in a practical scenario.

By familiarizing yourself with these concepts and understanding the calculation process, you can make informed decisions regarding your line of credit. It enables you to plan your finances better, manage your borrowing costs, and ensure that you are utilizing your line of credit in a responsible and cost-effective manner.

Remember, if you have any specific questions about your line of credit or its interest calculation, it’s always a good idea to consult with your lender or a financial advisor who can provide personalized guidance based on your unique situation.

Now that you have a comprehensive understanding of how to calculate line of credit interest, you can confidently navigate your borrowing journey and stay in control of your financial obligations.