Finance

How To Calculate Interest On Revolving Credit

Modified: March 1, 2024

Learn how to calculate interest on revolving credit with our comprehensive guide. Understand the finance behind revolving credit and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Revolving credit is a flexible financial tool that allows individuals and businesses to borrow funds up to a pre-approved limit, with the option to repay and re-borrow as needed. This type of credit is commonly associated with credit cards, lines of credit, and home equity lines of credit (HELOCs). Understanding how interest is calculated on revolving credit is essential for effectively managing one's finances and minimizing the overall cost of borrowing.

When utilizing revolving credit, it's crucial to comprehend the factors that influence interest calculation, such as the outstanding balance, annual percentage rate (APR), and billing cycle. Additionally, being aware of the various methods employed to calculate interest on revolving credit can empower borrowers to make informed decisions and optimize their repayment strategies.

In this comprehensive guide, we will delve into the intricacies of revolving credit and demystify the process of interest calculation. By exploring the key components and methodologies involved, you will gain valuable insights into managing and leveraging revolving credit to your advantage. Whether you are a seasoned borrower or new to the world of credit, this article will equip you with the knowledge needed to navigate the realm of revolving credit with confidence and proficiency.

Understanding Revolving Credit

Revolving credit is a dynamic financial arrangement that provides borrowers with ongoing access to funds up to a predetermined credit limit. Unlike installment loans, which are repaid through fixed monthly payments over a specified period, revolving credit offers greater flexibility in terms of repayment and borrowing activities. This form of credit is characterized by its revolving nature, allowing individuals and businesses to repeatedly borrow funds as long as the outstanding balance does not exceed the approved credit limit.

Credit cards and lines of credit are common examples of revolving credit facilities. With credit cards, cardholders can make purchases or cash advances up to their credit limit, and they have the option to repay the borrowed amount in full by the due date or carry the balance forward, incurring interest charges on the outstanding amount. Lines of credit, on the other hand, provide borrowers with access to a predetermined amount of funds that can be utilized as needed. Interest is typically accrued only on the utilized portion of the credit line.

One of the key advantages of revolving credit is its flexibility. Borrowers have the freedom to manage their repayment schedules based on their financial circumstances, as long as they meet the minimum payment requirements. Additionally, revolving credit can serve as a valuable financial safety net, offering quick access to funds for unexpected expenses or opportunities.

It is important to note that responsible management of revolving credit is essential to avoid potential pitfalls such as excessive debt accumulation and high interest costs. By understanding the terms and conditions of the credit agreement, monitoring spending patterns, and making timely payments, borrowers can harness the benefits of revolving credit while maintaining financial stability.

Now that we have established a foundational understanding of revolving credit, let’s explore the factors that influence interest calculation in this dynamic credit framework.

Factors Affecting Interest Calculation

Several key factors play a significant role in determining how interest is calculated on revolving credit. Understanding these factors is crucial for borrowers seeking to manage their credit effectively and minimize interest costs. The primary elements that influence interest calculation on revolving credit include the outstanding balance, the annual percentage rate (APR), and the billing cycle.

- Outstanding Balance: The outstanding balance on a revolving credit account directly impacts the amount of interest accrued. Interest is typically calculated based on the average daily balance, which considers the outstanding amount owed each day during the billing cycle. As the outstanding balance fluctuates due to new purchases, payments, and interest charges, the interest calculation adapts accordingly.

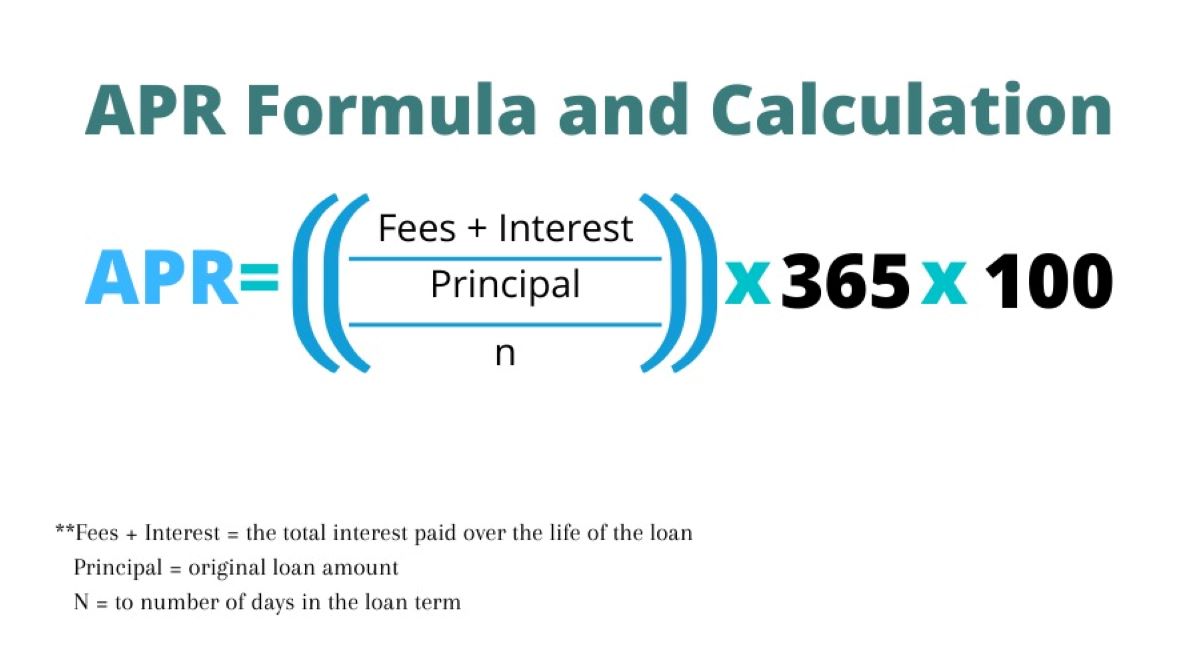

- Annual Percentage Rate (APR): The APR represents the annualized cost of borrowing and is a critical factor in interest calculation. This percentage encompasses the interest rate and any additional finance charges associated with the credit facility. A higher APR results in greater interest expenses on the outstanding balance.

- Billing Cycle: The billing cycle, also known as the statement period, plays a vital role in interest calculation. It is the duration during which transactions are recorded, and the billing statement is generated. The length of the billing cycle can impact the amount of interest accrued, especially if the payment due date falls near the beginning or end of the cycle.

Furthermore, the timing of purchases and payments within the billing cycle can influence the average daily balance and, consequently, the interest calculation. By strategically managing spending and repayment activities, borrowers can optimize interest costs and minimize the impact on their overall financial position.

Additionally, factors such as promotional interest rates, balance transfer offers, and penalty fees for late payments or exceeding the credit limit can also impact interest calculation on revolving credit. Borrowers should carefully review the terms and conditions of their credit agreements to gain a comprehensive understanding of these factors and their implications for interest accrual.

Now that we have explored the key factors influencing interest calculation, let’s delve into the various methods employed to calculate interest on revolving credit.

Methods of Interest Calculation

When it comes to revolving credit, various methods are utilized to calculate interest, each with its unique implications for borrowers. Understanding these methods is essential for making informed financial decisions and optimizing interest costs. The two primary methods of interest calculation commonly employed in revolving credit arrangements are the daily balance method and the average daily balance method.

- Daily Balance Method: Under this approach, the interest is calculated based on the daily outstanding balance on the credit account. The daily periodic rate, derived from the APR, is applied to the balance each day to determine the daily interest charges. This method offers borrowers the potential to reduce interest costs by making frequent payments to lower the outstanding balance throughout the billing cycle.

- Average Daily Balance Method: With this method, the average daily balance over the billing cycle serves as the basis for interest calculation. The average daily balance is determined by adding the outstanding balances for each day of the billing cycle and dividing the total by the number of days. This method provides a more stable interest calculation, as it considers the fluctuation of the outstanding balance over the entire billing cycle.

It is important for borrowers to be aware of the method used by their creditors to calculate interest, as it can significantly impact the overall interest expenses incurred. Additionally, some creditors may apply a grace period for new purchases, allowing borrowers to avoid interest charges if the full balance is paid by the due date. However, cash advances and certain transactions may not be eligible for the grace period, resulting in immediate accrual of interest.

Furthermore, some credit agreements may incorporate tiered interest rates, where different balances are subject to varying interest rates. Borrowers should carefully review the terms and conditions of their credit accounts to understand the specific interest calculation methods and any associated provisions that may affect interest costs.

By being well-informed about the methods of interest calculation and the corresponding terms of their credit agreements, borrowers can strategically manage their revolving credit accounts and mitigate the impact of interest expenses on their financial well-being.

With a solid grasp of the factors influencing interest calculation and the methods employed, let’s illustrate the process of interest calculation through a practical example.

Example Calculation

Let’s consider a hypothetical scenario to demonstrate the calculation of interest on a revolving credit account using the daily balance method. Suppose a borrower has a credit card with an APR of 18% and an average daily balance of $2,500 over a 30-day billing cycle. To calculate the interest for this period, we can follow these steps:

- Determine the daily periodic rate by dividing the APR by the number of days in a year. In this case, the daily periodic rate is 0.18 / 365 = 0.00049315, or approximately 0.0493%.

- For each day of the billing cycle, calculate the daily interest charge by multiplying the average daily balance by the daily periodic rate. For example, on day 1, the interest charge would be $2,500 * 0.00049315 = $1.23.

- Repeat this calculation for each day of the billing cycle and sum the daily interest charges to obtain the total interest for the period.

Using this method, the total interest for the 30-day billing cycle would amount to approximately $37.80. It’s important to note that this example illustrates a simplified calculation and does not account for potential variations in the outstanding balance throughout the billing cycle due to new purchases or payments.

Additionally, borrowers should be mindful of any grace periods, promotional rates, or specific provisions outlined in their credit agreements, as these factors can impact the actual interest calculation and the total interest expenses incurred.

By understanding the process of interest calculation and applying it to practical examples, borrowers can gain clarity on the financial implications of revolving credit and make informed decisions regarding their borrowing and repayment strategies.

Now that we have explored the example calculation, let’s summarize the key insights and conclude our comprehensive guide to interest calculation on revolving credit.

Conclusion

In conclusion, navigating the realm of revolving credit entails a thorough understanding of interest calculation and its underlying components. By comprehending the factors influencing interest accrual, such as the outstanding balance, annual percentage rate (APR), and billing cycle, borrowers can proactively manage their credit accounts and mitigate unnecessary interest expenses.

Furthermore, familiarity with the methods of interest calculation, including the daily balance method and the average daily balance method, empowers borrowers to make informed financial decisions and optimize their repayment strategies. Being cognizant of the specific interest calculation method employed by creditors, as well as any associated provisions such as grace periods and promotional rates, is essential for effectively managing revolving credit accounts.

Through a practical example, we have illustrated the process of interest calculation using the daily balance method, shedding light on the mechanics of interest accrual and the potential impact on overall interest expenses. This demonstration underscores the importance of staying informed about the intricacies of interest calculation to make sound financial choices.

As borrowers engage with revolving credit facilities, whether through credit cards, lines of credit, or other forms of revolving credit, a proactive approach to understanding interest calculation can lead to more prudent financial management and enhanced cost-efficiency. By leveraging this knowledge, borrowers can optimize their credit utilization, minimize interest costs, and maintain greater control over their financial well-being.

In essence, the ability to navigate the complexities of interest calculation on revolving credit empowers individuals and businesses to harness the benefits of flexible borrowing while mitigating the potential drawbacks associated with interest expenses. With a comprehensive grasp of interest calculation and its implications, borrowers can embark on a path of informed financial decision-making and strategic credit management.

Armed with this comprehensive guide, individuals and businesses are better equipped to navigate the intricacies of revolving credit and leverage this financial tool to their advantage, fostering greater financial resilience and stability.