Finance

How To Calculate Loan Interest In Excel

Published: February 17, 2024

Learn how to calculate loan interest in Excel with step-by-step instructions. Master finance formulas and make accurate calculations easily.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding how to calculate loan interest is an essential skill for anyone managing personal or business finances. Whether you are planning to take out a loan or aiming to pay off existing debts, having a grasp of loan interest calculation can empower you to make informed financial decisions. While the concept of loan interest may seem complex, modern tools like Microsoft Excel can simplify the process, allowing you to efficiently compute interest payments and gain clarity on your financial obligations.

In this comprehensive guide, we will delve into the intricacies of loan interest calculation using Excel. We will explore the fundamental principles of loan interest, providing a solid foundation for understanding the formulas and functions involved. Additionally, we will walk through a step-by-step tutorial on how to leverage Excel's capabilities to calculate loan interest, empowering you to take control of your financial planning with confidence.

By the end of this guide, you will have a clear understanding of how loan interest works, the formulas and functions used for calculation in Excel, and valuable tips to streamline the process. Whether you are a finance professional, a small business owner, or an individual seeking to manage personal finances more effectively, mastering the art of calculating loan interest in Excel can be a game-changer in your financial journey. So, let's embark on this insightful exploration to demystify loan interest calculation and unleash the power of Excel in financial management.

Understanding Loan Interest

Loan interest is the additional amount paid on top of the principal amount borrowed, representing the cost of borrowing money from a lender. It is a crucial component of any loan agreement and plays a significant role in determining the total amount repaid over the loan term. The interest charged by the lender is essentially the compensation for the risk undertaken and the opportunity cost of lending money instead of utilizing it elsewhere.

When obtaining a loan, whether it’s a mortgage, personal loan, or business loan, the borrower agrees to repay the principal amount along with the accrued interest over a specified period. The interest can be calculated using various methods, including simple interest and compound interest. Simple interest is calculated solely on the initial principal amount, while compound interest takes into account the accumulated interest from previous periods, resulting in a more dynamic and potentially higher interest cost over time.

Understanding the concept of loan interest is pivotal in making informed financial decisions. It allows borrowers to assess the true cost of borrowing and evaluate the affordability of a loan. Moreover, comprehending the nuances of loan interest enables individuals and businesses to strategize repayment plans, optimize financial resources, and minimize the overall interest expense.

Factors such as the interest rate, compounding frequency, and loan term significantly impact the total interest payable. By gaining a deep understanding of these factors, borrowers can effectively compare loan options, negotiate favorable terms, and proactively manage their financial obligations. With this foundational knowledge, individuals can navigate the complex landscape of loans with confidence and clarity, ultimately empowering them to make sound financial choices.

Using Excel Formulas for Loan Interest Calculation

Excel, the widely used spreadsheet software, offers a range of powerful functions and formulas that streamline the process of calculating loan interest. By leveraging Excel’s computational capabilities, individuals and businesses can accurately determine interest payments, create dynamic loan amortization schedules, and gain insights into the financial implications of various borrowing scenarios.

One of the key formulas for loan interest calculation in Excel is the IPMT function, which stands for “Interest Payment.” This function allows users to calculate the interest portion of a loan payment for a specific period, providing valuable information on the interest component of each installment. Additionally, the PPMT function, or “Principal Payment,” complements the IPMT function by computing the principal repayment amount for a given period, contributing to a comprehensive understanding of the loan repayment structure.

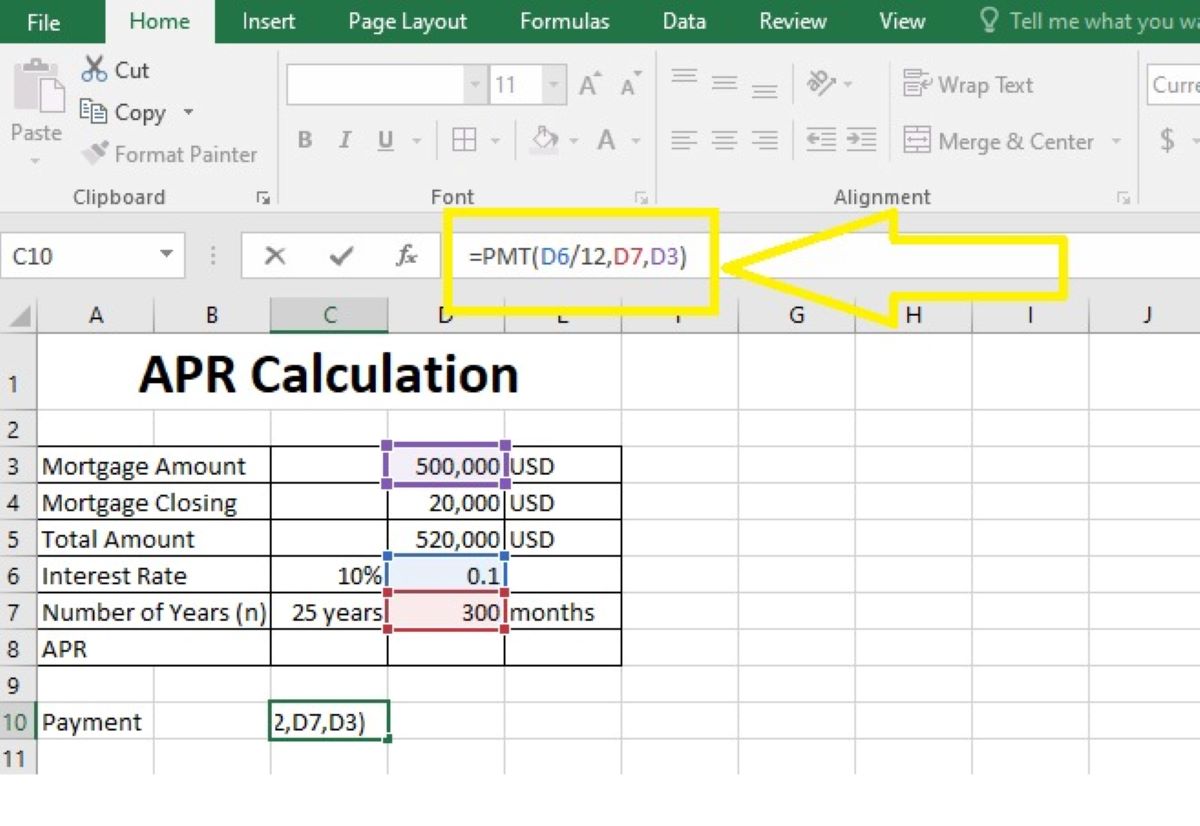

Excel also offers the flexibility to adjust parameters such as interest rate, loan term, and payment frequency, empowering users to model diverse loan scenarios and assess the impact of varying interest rates and repayment schedules. Furthermore, the PMT function, which calculates the payment for a loan based on constant payments and a constant interest rate, simplifies the process of determining the periodic payment required to repay a loan with a specified interest rate and term.

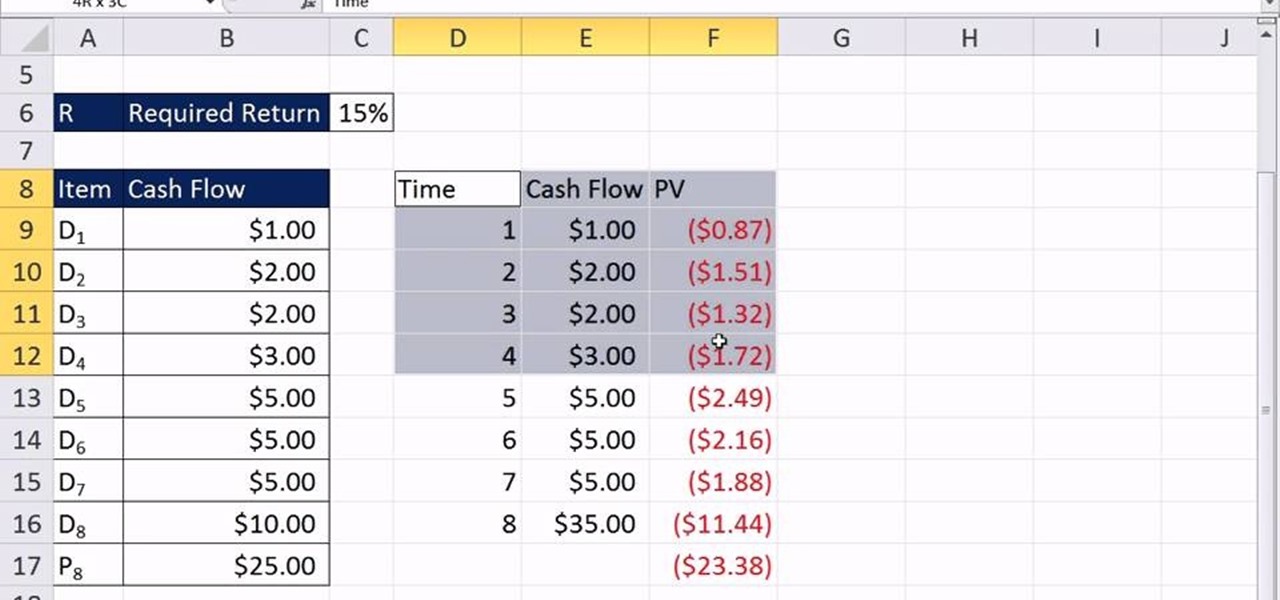

Moreover, Excel’s ability to create dynamic loan amortization tables through the use of formulas and conditional formatting enables users to visualize the breakdown of each payment into principal and interest components over the loan term. This visual representation enhances transparency and facilitates informed decision-making regarding loan management and repayment strategies.

By harnessing the capabilities of Excel formulas and functions, individuals and finance professionals can efficiently analyze loan structures, perform sensitivity analyses, and gain a deeper understanding of the financial implications associated with borrowing. Whether it’s assessing the affordability of a mortgage, evaluating the feasibility of a business loan, or optimizing debt repayment strategies, Excel serves as a valuable tool for empowering users to make sound financial decisions based on accurate and insightful loan interest calculations.

Step-by-Step Guide to Calculating Loan Interest in Excel

Calculating loan interest in Excel involves a systematic approach that leverages the software’s functions and formulas to derive accurate and comprehensive results. Follow this step-by-step guide to perform loan interest calculations with precision and efficiency:

- Organize Your Data: Begin by organizing the relevant loan details, including the principal amount, interest rate, loan term, and payment frequency. This structured approach sets the foundation for accurate calculations and clear visualization of the loan parameters.

- Understand the Formulas: Familiarize yourself with the essential Excel formulas for loan interest calculation, such as the IPMT, PPMT, and PMT functions. Understanding how these formulas operate and their specific parameters is crucial for executing accurate calculations.

- Enter Loan Details: Input the loan details into designated cells in Excel, ensuring that the data is accurately entered and aligned with the corresponding formulas. Specify the interest rate, loan term, and payment frequency to facilitate precise calculations.

- Utilize the IPMT Function: Apply the IPMT function to calculate the interest payment for a specific period. Input the period number, loan interest rate, total number of periods, and the loan amount to derive the interest component for the designated period.

- Implement the PPMT Function: Employ the PPMT function to compute the principal payment for a given period. Similar to the IPMT function, input the relevant parameters to obtain the principal repayment amount for the specified period, contributing to a comprehensive understanding of the loan amortization process.

- Calculate Total Payment: Utilize the PMT function to determine the periodic payment required to repay the loan. Input the interest rate, loan term, and loan amount to compute the consistent payment amount, facilitating a clear overview of the repayment obligations.

- Construct Amortization Schedule: Leverage Excel’s capabilities to construct a dynamic loan amortization schedule, showcasing the breakdown of each payment into principal and interest components over the loan term. This visual representation enhances transparency and facilitates informed decision-making regarding loan management and repayment strategies.

- Perform Sensitivity Analysis: Explore varying loan scenarios by adjusting parameters such as interest rates, loan terms, and payment frequencies. Conduct sensitivity analyses to assess the impact of these changes on interest payments and overall loan obligations, enabling informed decision-making.

By following this systematic guide and leveraging Excel’s functions and formulas, individuals and finance professionals can efficiently compute loan interest, create dynamic amortization schedules, and gain valuable insights into the financial implications of different borrowing scenarios. This structured approach empowers users to make informed decisions and optimize their financial strategies based on accurate and insightful loan interest calculations.

Tips and Tricks for Loan Interest Calculations in Excel

Mastering loan interest calculations in Excel requires a blend of technical proficiency and strategic insights. Here are valuable tips and tricks to enhance your efficiency and accuracy when computing loan interest using Excel:

- Utilize Absolute Cell References: When creating formulas for loan interest calculations, use absolute cell references (e.g., $A$1) to lock specific cells containing input parameters such as interest rates and loan amounts. This prevents inadvertent changes to these critical values when copying or dragging formulas across cells.

- Employ Named Ranges: Define named ranges for the loan details to enhance formula clarity and ease of use. By assigning meaningful names to cells or ranges containing loan parameters, you can streamline formula creation and improve the readability of your Excel worksheets.

- Consider Data Tables for Sensitivity Analysis: Excel’s data table feature allows you to perform extensive sensitivity analysis by systematically varying interest rates and loan terms. By setting up data tables, you can visualize the impact of changing parameters on interest payments, enabling informed decision-making.

- Implement Conditional Formatting: Apply conditional formatting to loan amortization tables to visually distinguish between interest and principal components. This visual enhancement facilitates quick comprehension of payment allocations and contributes to a clear representation of the loan repayment structure.

- Explore What-If Analysis Tools: Excel offers powerful what-if analysis tools, including Goal Seek and Scenario Manager. These tools enable users to assess the impact of different interest rates and payment frequencies on loan interest, empowering informed decision-making and scenario planning.

- Document Assumptions and Scenarios: Maintain clear documentation of the assumptions and scenarios used in your loan interest calculations. By documenting the various loan parameters, assumptions, and scenarios tested, you can ensure transparency and facilitate effective collaboration with stakeholders.

- Validate Results with Online Calculators: Cross-reference your Excel-calculated loan interest figures with reliable online loan calculators. This validation step helps ensure the accuracy of your calculations and provides additional confidence in the computed interest amounts.

- Stay Informed About Excel Updates: Continuously explore new features and updates in Excel that can enhance loan interest calculation capabilities. Staying informed about Excel’s evolving functionalities enables you to leverage the latest tools for more efficient and insightful loan interest computations.

By incorporating these tips and tricks into your loan interest calculations in Excel, you can elevate the accuracy, clarity, and efficiency of your financial analyses. Excel’s robust capabilities, combined with strategic utilization of these best practices, empower users to make informed decisions, optimize loan management strategies, and gain deeper insights into the financial implications of borrowing.

Conclusion

Mastering the art of calculating loan interest in Excel is a valuable skill that empowers individuals and businesses to make informed financial decisions, optimize repayment strategies, and gain clarity on the true cost of borrowing. By understanding the fundamental principles of loan interest and leveraging Excel’s functions and formulas, users can efficiently compute interest payments, create dynamic amortization schedules, and perform insightful sensitivity analyses.

Throughout this guide, we’ve explored the intricacies of loan interest, delving into the significance of understanding the cost of borrowing and its impact on financial planning. We’ve navigated through the step-by-step process of utilizing Excel’s computational capabilities to calculate loan interest, emphasizing the importance of accurate data organization, formula comprehension, and dynamic amortization schedule construction.

Furthermore, we’ve uncovered valuable tips and tricks to enhance the efficiency and accuracy of loan interest calculations in Excel, ranging from absolute cell references and named ranges to what-if analysis tools and conditional formatting. By incorporating these best practices, users can elevate the transparency, clarity, and reliability of their financial analyses, ultimately enabling more informed decision-making and strategic financial management.

As technology continues to evolve, Excel remains a powerful tool for financial analysis and planning. Staying abreast of Excel’s latest features and functionalities ensures that users can leverage the software’s full potential for comprehensive loan interest calculations and dynamic scenario modeling.

By honing your skills in loan interest calculations and harnessing the capabilities of Excel, you can gain a deeper understanding of the financial implications associated with borrowing, negotiate favorable loan terms, and optimize repayment strategies. Whether you’re a finance professional, a small business owner, or an individual managing personal finances, the ability to calculate loan interest in Excel equips you with a valuable tool for navigating the complexities of borrowing and making sound financial decisions.

Embark on this journey with confidence, armed with the knowledge and insights to unlock the full potential of loan interest calculations in Excel, and take control of your financial future with clarity and precision.