Finance

How To Calculate Loss Ratio Insurance

Published: November 20, 2023

Learn how to calculate loss ratio in insurance and improve your knowledge in finance. Discover the essential steps and formulas for accurate loss ratio calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Loss Ratio

- Importance of Calculating Loss Ratio in Insurance

- Components of Loss Ratio Calculation

- Formula for Loss Ratio Calculation

- Steps to Calculate Loss Ratio

- Examples of Loss Ratio Calculation

- Factors Affecting Loss Ratio

- Interpreting Loss Ratio Results

- Limitations of Using Loss Ratio in Insurance

- Conclusion

Introduction

Insurance plays a vital role in providing financial protection against unforeseen risks. Whether it’s car insurance, health insurance, or property insurance, individuals and businesses rely on insurance policies to safeguard their assets and manage potential losses. Loss ratio is a crucial metric used in the insurance industry to assess the profitability and risk management practices of insurance companies.

In simple terms, loss ratio is the ratio of the losses and claims paid out by an insurance company to the premiums collected from policyholders. Calculating loss ratios is essential for insurance companies to understand their claims experience, evaluate the adequacy of premium rates, and make informed decisions regarding risk selection and underwriting practices.

This article will delve into the details of loss ratio calculation in insurance, its significance, and how it is interpreted in the context of insurance operations. We will explore the components of loss ratio, the formula for its calculation, and the steps involved in determining the loss ratio. Additionally, we will examine examples of loss ratio calculations and discuss the factors that can influence the results.

Understanding loss ratio is essential not only for insurance companies but also for policyholders. It allows customers to assess the financial stability and claims-paying ability of an insurer. By monitoring loss ratios, insurance companies can identify potential issues, such as underwriting losses, and take corrective actions to maintain profitability and sustainability.

Definition of Loss Ratio

The loss ratio is a crucial metric used in the insurance industry to measure the financial performance and risk exposure of an insurance company. It is the ratio of the claims or losses incurred by the company to the premiums collected from policyholders during a specific period.

The loss ratio provides valuable insights into the company’s ability to manage and cover potential losses. By comparing the amount paid out in claims to the premiums received, insurance companies can evaluate the effectiveness of their underwriting and risk assessment practices. A lower loss ratio indicates that the company is efficiently managing risks and generating profit, while a higher loss ratio suggests higher claim payments and potential financial challenges for the insurer.

The loss ratio is typically expressed as a percentage and is calculated by dividing the total claims or losses incurred by the company by the total premiums earned during a specific period. For example, if an insurance company incurs $10 million in claim payments and collects $15 million in premiums, the loss ratio would be 66.7% ($10 million / $15 million x 100).

Insurance companies closely monitor their loss ratios to ensure they are within an acceptable range. The acceptable range varies depending on the type of insurance and market conditions. In general, a loss ratio below 100% indicates that the company is profitable, as claims payments are lower than premiums collected. Conversely, a loss ratio above 100% suggests that the company is paying out more in claims than it is receiving in premiums, resulting in underwriting losses.

Loss ratios serve as a key benchmark for insurance companies to assess their financial performance, profitability, and risk management practices. By analyzing loss ratios over time, insurers can identify trends, potential issues, and make necessary adjustments to maintain a balance between generating revenue and managing risks.

Importance of Calculating Loss Ratio in Insurance

Calculating the loss ratio is of utmost importance in the insurance industry. It serves as a vital tool for insurers to assess their financial performance, make informed decisions, and ensure the sustainability of their business. Here are some key reasons why calculating loss ratios is crucial in insurance:

- Profitability Assessment: The loss ratio provides valuable insights into the profitability of an insurance company. By comparing the claims paid out to the premiums collected, insurers can determine if they are operating at a profit or a loss. A low loss ratio indicates profitability, as claims payments are lower than the premiums received, while a high loss ratio suggests potential financial challenges.

- Risk Management Evaluation: Loss ratios allow insurers to evaluate and manage the risks they face. By analyzing the ratio, insurers can assess the effectiveness of their underwriting and risk assessment practices. A high loss ratio may indicate a need for better risk selection, stricter underwriting guidelines, or adjustments in premium rates to mitigate potential losses.

- Premium Rate Determination: Calculating loss ratios helps insurance companies determine appropriate premium rates. A thorough analysis of loss ratios can help insurers set rates that adequately cover potential claims while remaining competitive in the market. Insurers with unfavorable loss ratios may need to increase premiums to maintain profitability or adjust their risk appetite.

- Policyholder Protection: Loss ratios are important for the protection of policyholders. Monitoring loss ratios allows policyholders to assess the financial stability of an insurer before purchasing a policy. If an insurer consistently has high loss ratios, it may indicate a higher risk of claim denials, delayed payments, or potential insolvency.

- Industry Benchmarking: Loss ratios provide a basis for benchmarking and comparing the performance of insurance companies. Insurers can analyze their loss ratios against industry averages and competitor ratios to identify their market position, competitive advantages, and areas for improvement.

In summary, calculating the loss ratio is essential for insurers to assess profitability, evaluate risk management practices, determine premium rates, protect policyholders, and benchmark performance. By analyzing loss ratios, insurance companies can make informed decisions that contribute to their long-term success and sustainability in a highly competitive industry.

Components of Loss Ratio Calculation

Calculating the loss ratio in insurance involves several important components that contribute to understanding the financial performance of an insurance company. These components provide insight into the relationship between premiums collected and claims paid out. Here are the key components of loss ratio calculation:

- Claims Incurred: This component represents the total amount of claims reported and paid out by the insurance company during a specific period. It includes all valid claims made by policyholders that qualify for coverage as per the terms and conditions of the insurance policy.

- Premiums Earned: Premiums earned refer to the total amount of premium revenue collected by the insurance company during the same period. This includes all premiums received for insurance policies and covers the time frame in which the policies are in effect.

- Loss Adjustment Expenses: Loss adjustment expenses (LAE) are the costs associated with investigating, adjusting, and settling insurance claims. These expenses include salaries of claims adjusters, legal fees, administrative costs, and other expenses directly related to the handling and processing of claims.

The loss ratio calculation takes into account these components to provide an accurate assessment of an insurance company’s performance. It measures the proportion of claims and loss-related expenses to the premiums earned. The loss ratio formula is as follows:

Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned

The result is typically expressed as a percentage. A loss ratio of 100% indicates that an insurer is paying out an equal amount in claims and expenses as it is collecting in premiums. A loss ratio below 100% signifies profitability, as the claims and expenses are lower than the premiums earned, while a ratio above 100% suggests potential underwriting losses.

It’s important to note that loss ratio calculation may vary depending on the specific insurance industry or line of business. For example, property insurance loss ratios may include additional factors such as deductible reimbursements, salvage and subrogation recoveries, and non-loss-related expenses.

By understanding and analyzing the components of loss ratio calculation, insurance companies can gain valuable insights into their financial performance, make informed decisions, and implement strategies to manage risks and maintain profitability.

Formula for Loss Ratio Calculation

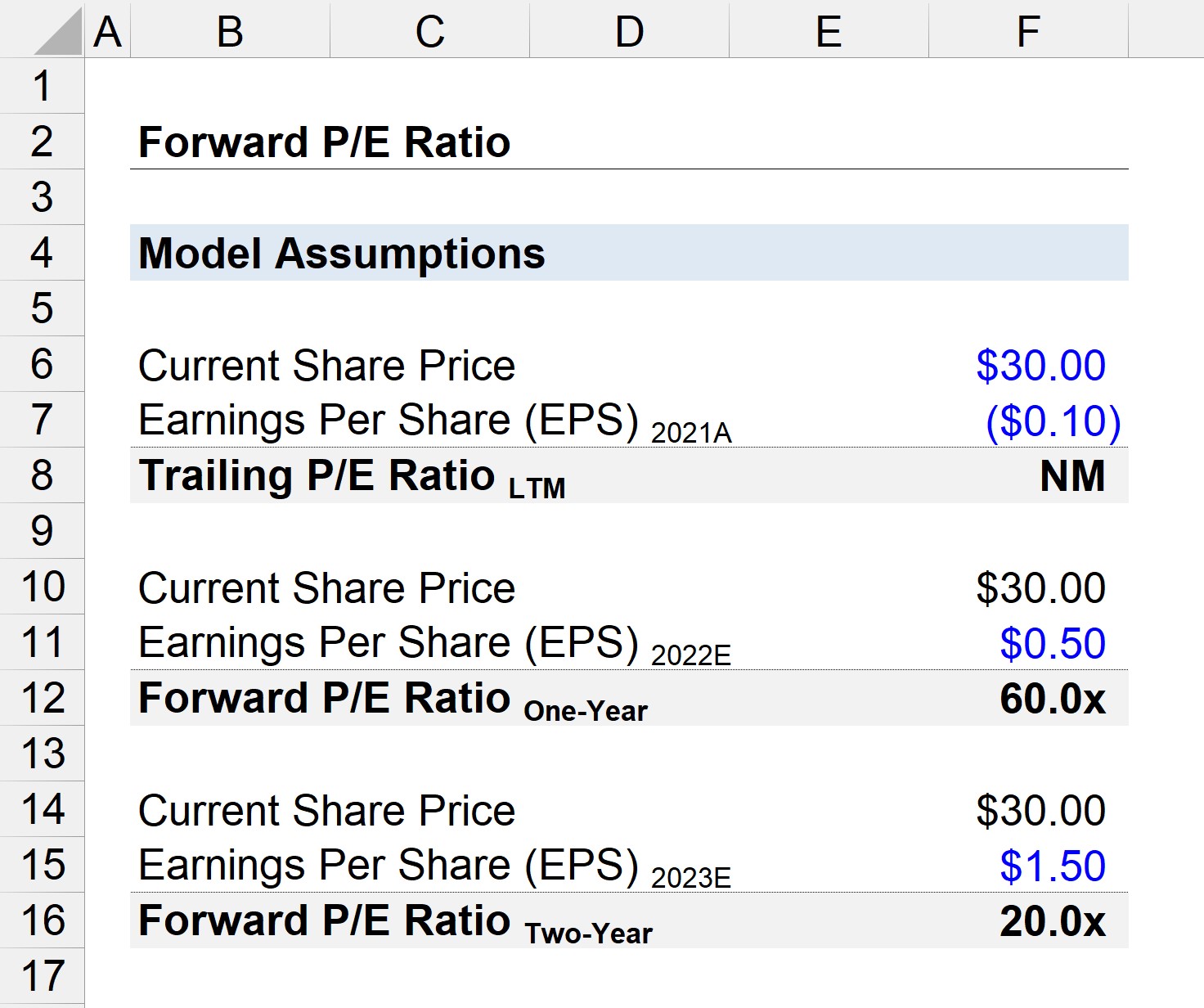

The loss ratio is a key metric used in the insurance industry to evaluate the financial performance and risk exposure of an insurance company. It is calculated using a simple formula that compares the claims incurred and loss-related expenses to the premiums earned during a specific period. The formula for loss ratio calculation is as follows:

Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned

The loss ratio formula takes into account two main components:

- Claims Incurred: This component includes the total amount of claims reported and paid out by the insurance company during the specified time period. It encompasses all valid claims made by policyholders that meet the terms and conditions of their insurance policy.

- Loss Adjustment Expenses: This component represents the expenses associated with investigating, adjusting, and settling insurance claims. It includes costs such as salaries of claims adjusters, legal fees, administrative expenses, and other expenses directly related to the handling of claims.

These components are divided by the total premiums earned by the insurance company during the same period. Premiums earned refer to the total amount of premium revenue collected from policyholders for the coverage provided within the specified time frame.

The resulting loss ratio is typically expressed as a percentage. For example, if an insurance company incurs $10 million in claims and loss adjustment expenses and collects $15 million in premiums, the loss ratio would be calculated as follows:

Loss Ratio = ($10 million + $0) / $15 million = 66.7%

A loss ratio below 100% indicates that the insurance company is paying out less in claims and expenses compared to the premiums collected, implying profitability. Conversely, a loss ratio above 100% suggests that the company’s claims and expenses exceed its premium revenue, indicating potential underwriting losses.

It’s important to note that loss ratio calculations may vary in different insurance sectors or lines of business. Insurance companies may further customize the formula to consider additional factors specific to their industry, such as deductible reimbursements, salvage and subrogation recoveries, and non-loss-related expenses.

By using the formula for loss ratio calculation, insurance companies can gain insights into their financial performance, identify potential issues, and make informed decisions regarding risk management, underwriting practices, and premium rate adjustments.

Steps to Calculate Loss Ratio

The loss ratio is a crucial metric used in the insurance industry to evaluate the financial performance and risk exposure of an insurance company. Calculating the loss ratio involves a simple step-by-step process that compares the claims incurred and loss-related expenses to the premiums earned during a specific period. Here are the steps to calculate the loss ratio:

- Gather the necessary data: Collect the required data for the calculation, including the total claims incurred, loss adjustment expenses, and premiums earned during the specified time period. These figures can usually be obtained from the company’s financial records or insurance management system.

- Calculate the total claims incurred: Sum up the total amount of claims reported and paid out by the insurance company during the specified time period. Include all valid claims made by policyholders that meet the terms and conditions of their insurance policy.

- Determine the loss adjustment expenses: Identify and calculate the expenses associated with investigating, adjusting, and settling insurance claims. This includes costs such as salaries of claims adjusters, legal fees, administrative expenses, and other expenses directly related to the handling of claims.

- Calculate the total premiums earned: Determine the total amount of premium revenue collected from policyholders for the coverage provided within the specified time frame.

- Apply the loss ratio formula: Use the formula for loss ratio calculation to calculate the ratio. The formula is as follows: Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned.

- Convert to a percentage: Convert the resulting ratio into a percentage by multiplying it by 100. This provides a more easily interpretable figure for assessing the loss ratio.

By following these steps, insurance companies can calculate the loss ratio and gain insights into their financial performance and risk exposure. The loss ratio helps insurers make informed decisions regarding risk management, underwriting practices, premium rate adjustments, and overall business sustainability.

Examples of Loss Ratio Calculation

To better understand how loss ratios are calculated in the insurance industry, let’s consider a few examples:

Example 1:

An insurance company collected $10 million in premiums during a specific period. During the same period, they incurred $5 million in claims and $1 million in loss adjustment expenses. To calculate the loss ratio, we use the formula:

Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned

= ($5 million + $1 million) / $10 million

= $6 million / $10 million

= 0.6 or 60%

In this example, the loss ratio is 60%, indicating that the insurance company paid out 60% of the premium revenue in claims and loss-related expenses. This suggests that the company is profitable, as the claims and expenses are lower than the premiums collected.

Example 2:

Another insurance company collected $20 million in premiums during a specific period. However, they experienced a higher level of claims and incurred $18 million in claims and $3 million in loss adjustment expenses. Using the same formula, we can calculate the loss ratio:

Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned

= ($18 million + $3 million) / $20 million

= $21 million / $20 million

= 1.05 or 105%

In this example, the loss ratio is 105%, indicating that the insurance company paid out more in claims and expenses than the premium revenue collected. This suggests potential underwriting losses and financial challenges for the insurer.

Example 3:

Let’s consider a health insurance company that collected $50 million in premiums during a specific period. During the same period, they incurred $40 million in claims and $5 million in loss adjustment expenses. Applying the loss ratio formula:

Loss Ratio = (Claims Incurred + Loss Adjustment Expenses) / Premiums Earned

= ($40 million + $5 million) / $50 million

= $45 million / $50 million

= 0.9 or 90%

In this example, the loss ratio is 90%, indicating that the company paid out 90% of the premium revenue in claims and expenses. This suggests that the insurer is operating profitably, but it may need to monitor the ratio to ensure continued profitability and sustainability.

These examples demonstrate how loss ratios are calculated and provide insights into the financial performance and risk exposure of insurance companies. By analyzing loss ratios over time, insurers can identify trends, potential issues, and make necessary adjustments to maintain profitability and effectively manage risks.

Factors Affecting Loss Ratio

The loss ratio in the insurance industry is influenced by various factors that impact the financial performance and risk exposure of insurance companies. Understanding these factors is essential for insurers to make informed decisions, adjust underwriting practices, and manage their business effectively. Here are some key factors that can affect the loss ratio:

- Claims Experience: The claims experience of an insurance company has a significant impact on the loss ratio. If the company experiences a higher frequency or severity of claims, it can lead to a higher loss ratio. Conversely, a lower number or lower value of claims can result in a lower loss ratio.

- Underwriting Practices: The underwriting standards and practices of an insurance company play a vital role in determining the loss ratio. Effective risk assessment, proper selection of insureds, and appropriate pricing of policies can help maintain a favorable loss ratio. On the other hand, lax underwriting standards or inadequate pricing can lead to higher claims and an unfavorable loss ratio.

- Nature of Insurance Coverage: The line of insurance and the type of coverage provided can significantly impact the loss ratio. For example, high-risk lines such as healthcare or liability insurance may have a higher loss ratio compared to low-risk lines like property insurance.

- Market Conditions: Economic conditions, market competition, and regulatory factors can influence the loss ratio. In a competitive market, insurers may lower premium rates to attract more customers, potentially leading to a higher loss ratio if claims exceed the reduced premiums. Likewise, economic downturns or changes in regulations can impact claims frequency or severity.

- Loss Mitigation and Risk Management: The effectiveness of loss mitigation measures and risk management practices implemented by insurance companies can impact the loss ratio. Proactive risk assessment, loss prevention programs, and efficient claims handling processes can help reduce claims and minimize loss-related expenses.

- Catastrophic Events: Natural disasters or large-scale catastrophic events can have a significant impact on the loss ratio, especially for property and casualty insurers. These events can result in a surge in claims, leading to a higher loss ratio during the affected period.

These factors are not exhaustive, and there may be additional industry-specific or company-specific factors that can affect the loss ratio. Insurance companies must carefully monitor these factors, analyze their impact, and make necessary adjustments to maintain a balanced loss ratio and ensure sustainable business operations.

Interpreting Loss Ratio Results

Interpreting loss ratio results is crucial for insurance companies as it provides valuable insights into their financial performance and risk exposure. Understanding the implications of different loss ratios allows insurers to make informed decisions, implement effective risk management strategies, and ensure the sustainability of their operations. Here are some key points to consider when interpreting loss ratio results:

- Profitability: Loss ratios below 100% indicate that an insurance company is generating a profit, as claims and loss-related expenses are lower than the premiums collected. Conversely, ratios above 100% suggest potential underwriting losses, meaning the insurer is paying out more in claims than it is collecting in premiums.

- Efficiency in Risk Management: Lower loss ratios generally signify efficient risk management practices. A well-managed insurance business would have effective underwriting practices, proper risk assessment, and appropriate pricing of policies to maintain moderate loss ratios.

- Comparison to Industry Averages: Comparing the loss ratio to industry averages and competitors’ ratios provides a benchmark for assessing performance. If an insurer consistently maintains a lower loss ratio than competitors, it may indicate superior risk management or underwriting practices. Conversely, a higher loss ratio may suggest potential areas for improvement.

- Trend Analysis: Monitoring loss ratios over time allows insurers to identify trends. A consistent increase in the loss ratio may indicate deteriorating profitability or changing risk profiles. Similarly, a decreasing trend can suggest improved risk management practices or favorable market conditions.

- Impact of Catastrophic Events: Insurance companies should consider the impact of catastrophic events on their loss ratios. If a particular period experienced significant claims due to natural disasters or large-scale events, the loss ratio for that period may be higher than normal.

- Long-Term Sustainability: Insurers should aim for a balanced loss ratio that allows for sustainable operations. Consistently high loss ratios can signal potential financial challenges, while very low loss ratios may indicate inadequate risk coverage or underpricing of policies, which can lead to future underwriting losses.

It is important to note that interpreting loss ratio results should take into account other factors such as industry norms, regulatory requirements, and specific business models. The optimal loss ratio may vary depending on the insurance sector, the company’s risk appetite, and market conditions.

By effectively interpreting loss ratio results, insurance companies can gain valuable insights to drive decision-making, monitor profitability, improve risk management practices, and ensure the long-term success and sustainability of their business.

Limitations of Using Loss Ratio in Insurance

The loss ratio is a valuable metric used in the insurance industry to assess the financial performance and risk exposure of insurance companies. However, it’s important to recognize that the loss ratio has certain limitations, and relying solely on this metric may not provide a complete understanding of an insurer’s operations. Here are some limitations to consider when using the loss ratio in insurance:

- Timeframe: The loss ratio is typically calculated for a specific period, such as a fiscal year. This timeframe may not capture the full picture of an insurer’s performance, as factors like seasonality and long-term claims development can impact results. Therefore, it’s important to analyze loss ratios over multiple periods to identify trends and make accurate assessments.

- Delayed Reporting: Claims can be reported and settled over an extended period of time. As a result, loss ratios may not reflect the full impact of claims incurred during the reporting period, particularly in long-tail lines of insurance, like liability or professional indemnity. This can lead to potential distortions in loss ratio calculations.

- Loss Reserving: Loss ratios do not consider the impact of loss reserving, which refers to the estimation of future claims liabilities. Insurers set aside reserves to account for expected future claims payments. The adequacy and accuracy of loss reserving practices can significantly affect the ultimate loss ratio, and this aspect is not captured by a simple loss ratio calculation.

- Variation by Line of Business: Different lines of insurance may have varying risk profiles and claim patterns, making it challenging to compare loss ratios across different sectors. For example, a property insurance loss ratio can differ significantly from a health insurance loss ratio due to the unique characteristics and risk factors associated with each line of business.

- Non-Loss Expenses: Loss ratios can be influenced by non-loss expenses, such as acquisition costs, administrative expenses, and policy issuance costs. These expenses are not directly related to claims and can distort the calculation of the loss ratio. It is important to consider these factors when assessing an insurer’s financial performance.

- External Factors: Loss ratios can be significantly impacted by external factors beyond an insurer’s control, such as natural disasters or changes in regulatory requirements. These factors can lead to abnormal claims experience and distort the loss ratio calculations for a specific period.

Despite these limitations, the loss ratio remains a useful tool in evaluating an insurer’s financial performance and risk exposure. It is important, however, to consider these limitations and use additional metrics, data, and analysis to gain a comprehensive understanding of an insurer’s operations and make informed decisions.

Conclusion

The loss ratio is a fundamental metric in the insurance industry that plays a pivotal role in assessing the financial performance and risk exposure of insurance companies. By calculating the ratio of claims incurred and loss-related expenses to premiums earned, insurers can gain valuable insights into their profitability, risk management practices, and overall business sustainability.

Understanding the components and formula for calculating the loss ratio enables insurers to make informed decisions regarding underwriting, pricing, and risk selection. Monitoring loss ratios over time allows for trend analysis, benchmarking against industry averages, and identification of areas for improvement.

While loss ratios provide critical insights, it is crucial to acknowledge their limitations. Factors such as delayed reporting, loss reserving practices, and non-loss expenses should be considered alongside loss ratio calculations to obtain a comprehensive understanding of an insurer’s operations.

Ultimately, the loss ratio serves as a valuable tool for insurance companies to assess profitability, evaluate risk management practices, set premium rates, and ensure the long-term sustainability of their business. By effectively interpreting loss ratio results and considering additional metrics and data, insurers can make informed decisions and take necessary actions to maintain profitability, manage risks, and provide the necessary financial protection for policyholders.