Finance

How To Calculate The Inflation Rate Using GDP

Published: October 28, 2023

Learn how to calculate the inflation rate using GDP data in this comprehensive finance guide. Gain valuable insights into economic indicators and trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Inflation is an integral part of the economic landscape. It refers to the general increase in prices of goods and services over time, leading to a decrease in the purchasing power of money. Understanding the inflation rate is essential for individuals, businesses, and policymakers as it directly impacts various aspects of the economy.

The inflation rate is calculated using different methods, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). However, one effective approach to calculating the inflation rate is by utilizing Gross Domestic Product (GDP) data.

GDP is a widely-used measure of a country’s economic activity, representing the total value of goods and services produced within a nation’s borders. By analyzing changes in GDP, we can gain insights into the overall health and growth of an economy. It is this correlation between GDP and inflation that allows us to leverage GDP data to calculate the inflation rate.

In this article, we will dive into the process of calculating the inflation rate using GDP. We will explore the steps involved in gathering the necessary data, determining the base year, calculating the GDP deflator, and ultimately deriving the inflation rate. By understanding this methodology, you will have a better grasp of how GDP can be utilized as a powerful tool for measuring and analyzing inflation.

Understanding Inflation

Inflation is the rise in the general level of prices of goods and services in an economy over a period of time. It is essentially the decrease in the purchasing power of money, as it takes more currency to buy the same amount of goods and services. Inflation is influenced by various factors, including changes in supply and demand, government policies, and global economic conditions.

There are different types of inflation, including demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when there is an increase in demand for goods and services, exceeding the supply available, leading to higher prices. Cost-push inflation, on the other hand, occurs when the cost of production increases, forcing businesses to raise prices to maintain profitability. Built-in inflation refers to the expectations of price increases in the future, causing workers to demand higher wages and businesses to increase prices preemptively.

Inflation has both positive and negative effects on the economy. Some of the positive effects include stimulating spending and investment, reducing the burden of debts, and promoting economic growth. However, inflation also has negative consequences, such as eroding the value of savings, reducing purchasing power, and creating uncertainty in the economy.

Central banks and governments closely monitor and manage inflation to maintain price stability and promote economic growth. Typically, a target inflation rate is set, and monetary and fiscal policies are implemented to achieve and maintain that rate. It is crucial for individuals and businesses to understand and track inflation as it influences various financial decisions, such as budgeting, investments, and wage negotiations.

Now that we have a basic understanding of inflation, let’s explore how we can calculate the inflation rate using GDP data.

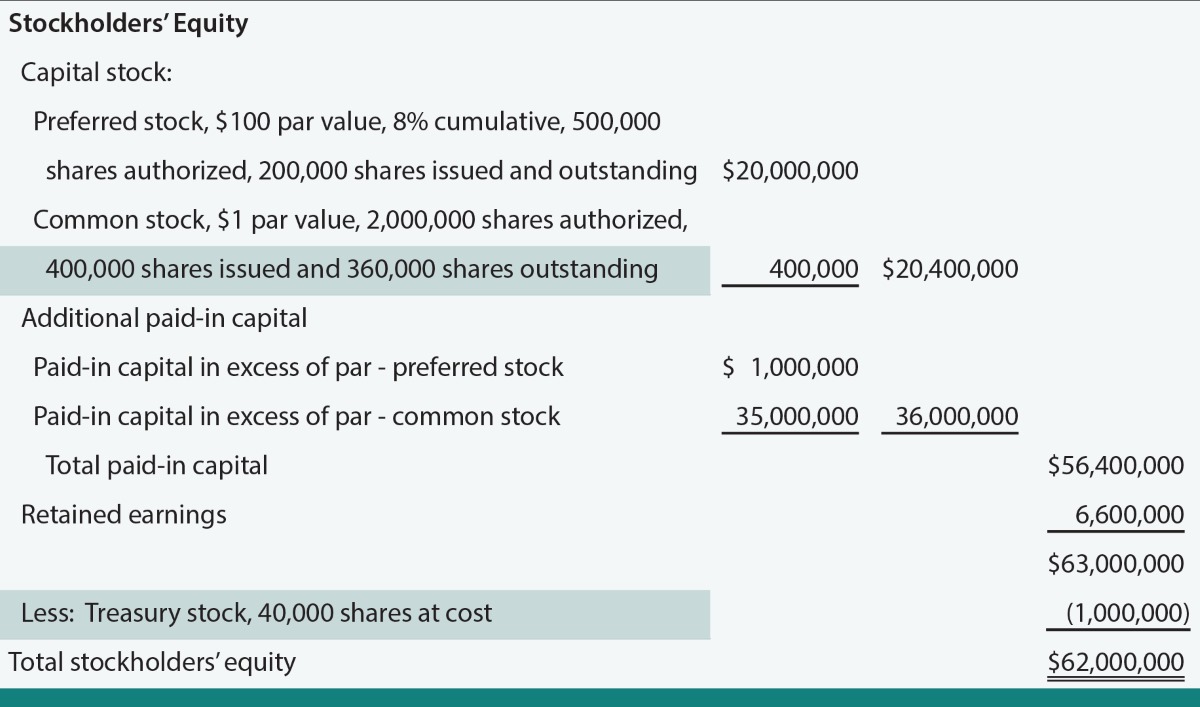

Calculation of Inflation Rate

Calculating the inflation rate involves comparing the changes in the price level of goods and services over a specific period. One common method to calculate the inflation rate is by using the percentage change in the GDP deflator. The GDP deflator measures the price changes of all goods and services produced within an economy.

The formula for calculating the inflation rate using the GDP deflator is as follows:

[(Current Year GDP Deflator – Previous Year GDP Deflator) / Previous Year GDP Deflator] x 100

Let’s break down the steps involved in calculating the inflation rate:

- Gather GDP Data: The first step is to collect the GDP data for the specific period you wish to analyze. The GDP data is available from official government sources or reputable economic databases.

- Determine the Base Year: Select a base year against which you will compare the price changes in subsequent years. The base year serves as a reference point for calculating the inflation rate.

- Calculate the GDP Deflator: To calculate the GDP deflator, divide the nominal GDP (measured in current prices) by the real GDP (measured in constant prices) and multiply the result by 100. The GDP deflator represents the ratio of current year prices to the prices in the base year.

- Calculate the Inflation Rate: Finally, subtract the previous year’s GDP deflator from the current year’s GDP deflator. Divide the result by the previous year’s GDP deflator and multiply by 100 to get the inflation rate as a percentage.

It’s important to note that the inflation rate calculated using the GDP deflator represents the average price changes across all goods and services produced within an economy. This differs from other inflation measures, such as the Consumer Price Index (CPI), which focuses on a specific basket of consumer goods and services.

Now that we understand the calculation methodology, let’s see how we can specifically use GDP data to calculate the inflation rate.

Using GDP for Inflation Calculation

Gross Domestic Product (GDP) data provides a comprehensive measure of economic performance and can be leveraged to calculate the inflation rate. By analyzing changes in GDP over time, we can capture the overall price movements in an economy and calculate the inflation rate. Here’s how we can use GDP for inflation calculation:

- Step 1: Gather GDP Data: Start by collecting the GDP data for the specific period you want to analyze. This data is typically available from government statistics agencies, central banks, or reputable economic research institutions.

- Step 2: Determine the Base Year: Select a base year against which you will compare the GDP in subsequent years. The base year is used as a reference point and allows for meaningful comparisons over time.

- Step 3: Calculate the GDP Deflator: To calculate the GDP deflator, divide the nominal GDP (measured in current prices) by the real GDP (measured in constant prices) and multiply the result by 100. The GDP deflator represents the ratio of current year prices to the prices in the base year.

- Step 4: Calculate the Inflation Rate: Calculate the percentage change in the GDP deflator from the previous year to the current year. This percentage change represents the inflation rate for that period.

Using GDP for inflation calculation provides a broader perspective on price changes throughout the entire economy compared to other inflation measures like the Consumer Price Index (CPI), which focuses on a fixed basket of goods and services.

It’s important to note that the GDP deflator includes prices of all final goods and services produced within a country, including consumer goods, business investments, government spending, and net exports. By incorporating a comprehensive range of economic activities, the GDP deflator offers a holistic view of inflation in the economy.

Overall, utilizing GDP data to calculate the inflation rate allows policymakers, businesses, and individuals to analyze and monitor the overall price trends and fluctuations in an economy. This information can help in making informed decisions regarding fiscal and monetary policies, investments, and financial planning.

Now that we have covered the steps involved in using GDP for inflation calculation, let’s explore each step in detail.

Step 1: Gather GDP Data

The first step in using GDP for inflation calculation is to gather the necessary GDP data. GDP data can be obtained from various official sources, such as national statistics agencies, central banks, or reputable economic research institutions. These sources provide comprehensive data that reflects the economic activity of a country.

When gathering GDP data, it is important to select the specific period you wish to analyze. This could be a quarterly or annual timeframe, depending on the level of detail and frequency required for your analysis. Additionally, it is essential to ensure that the GDP data you obtain is measured in current prices, as this is necessary for calculating the inflation rate.

It’s crucial to use reliable and accurate sources for GDP data to ensure the integrity of your analysis. Government statistics agencies and reputable economic research institutions are often the most reliable sources to obtain GDP data. These organizations follow standardized methodologies and exercise quality control measures to ensure the accuracy and consistency of the data they provide.

Once you have gathered the necessary GDP data for the desired period, you can proceed to the next step of using GDP for inflation calculation, which is determining the base year.

Overall, gathering high-quality GDP data is essential for accurate and reliable inflation calculations. By using trusted sources and selecting the appropriate timeframe, you can ensure that your analysis is based on reliable data and provide meaningful insights into the inflation rate.

Step 2: Determine the Base Year

After gathering the GDP data for the desired period, the next step in using GDP for inflation calculation is to determine the base year. The base year serves as a reference point against which the changes in GDP and price levels in subsequent years will be compared.

The selection of the base year is crucial because it sets the benchmark for measuring inflation. Ideally, the base year should represent a period of relative economic stability and normal price levels. It is typically chosen based on a few key considerations:

- Economic Stability: The base year should reflect a period of stable economic conditions with minimal shocks or distortions. This allows for a more accurate representation of price changes and inflation trends.

- Recent Timeframe: The base year should be relatively recent to ensure that it reflects the current dynamics of the economy. As the economy evolves over time, using an outdated base year may not accurately capture the current price levels and inflation trends.

- Data Availability: It is important to consider the availability of reliable data for the chosen base year. Sufficient historical data is necessary to calculate the GDP deflator and derive the inflation rate accurately.

Once the base year is determined, it remains constant for the entire analysis period. Any subsequent changes in GDP and price levels will be measured relative to the base year. This allows for a clear comparison of price changes and inflation rates over time.

It’s worth noting that revising the base year periodically can provide more accurate insights into inflation trends. As the economy evolves and price levels change, updating the base year can address the potential bias that may arise from using an outdated reference point.

By carefully selecting the base year, you ensure that your analysis accurately captures changes in price levels and inflation rates over time. The base year acts as the anchor for comparison and allows for meaningful insights into the impact of inflation on the economy.

Once the base year is determined, we can move on to the next step, which involves calculating the GDP deflator.

Step 3: Calculate the GDP Deflator

After gathering the GDP data and determining the base year, the next step in using GDP for inflation calculation is to calculate the GDP deflator. The GDP deflator is a measure of the overall price level of goods and services produced within an economy.

To calculate the GDP deflator, you need two key pieces of information: the nominal GDP and the real GDP. The nominal GDP represents the value of goods and services produced in current market prices, while the real GDP represents the value of goods and services produced at constant prices, adjusted for inflation.

The formula for calculating the GDP deflator is as follows:

GDP Deflator = (Nominal GDP / Real GDP) x 100

Let’s break down the steps involved in calculating the GDP deflator:

- Determine the Nominal GDP: The nominal GDP is the total value of goods and services produced in the current year, measured in current market prices. This can be obtained from the GDP data for the specific period you are analyzing.

- Determine the Real GDP: The real GDP is the total value of goods and services produced in the current year, measured in constant prices. To obtain the real GDP, the GDP data must be adjusted for inflation using a price index, such as the consumer price index (CPI) or the GDP deflator from the base year.

- Calculate the GDP Deflator: Divide the nominal GDP by the real GDP and multiply the result by 100 to obtain the GDP deflator. The GDP deflator represents the ratio of current year prices to the prices in the base year, adjusted for changes in the overall price level of the economy.

The GDP deflator provides a comprehensive measure of price changes across all sectors of the economy. It includes price changes in consumer goods, investment goods, government spending, and net exports, providing a broader view of inflation compared to other price indices that focus on specific categories of goods and services.

Calculating the GDP deflator allows us to track changes in the overall price level of an economy. It serves as a key component in estimating the inflation rate using GDP data. In the next step, we will use the GDP deflator to calculate the inflation rate.

Step 4: Calculate the Inflation Rate

After calculating the GDP deflator in the previous step, we can now proceed to calculate the inflation rate using the GDP data. The inflation rate represents the percentage change in the overall price level of goods and services produced within an economy over a specific period of time.

To calculate the inflation rate using the GDP deflator, we can utilize the percentage change formula. Here’s the formula for calculating the inflation rate:

[(Current Year GDP Deflator – Previous Year GDP Deflator) / Previous Year GDP Deflator] x 100

Let’s walk through the steps involved in calculating the inflation rate:

- Determine the Current Year and Previous Year GDP Deflator: Using the GDP data, identify the GDP deflator for the current year and the GDP deflator for the previous year. The GDP deflator represents the overall price level for each respective year.

- Calculate the Change in GDP Deflator: Subtract the previous year’s GDP deflator from the current year’s GDP deflator to determine the change in the overall price level.

- Calculate the Inflation Rate: Divide the change in the GDP deflator by the previous year’s GDP deflator and multiply the result by 100 to obtain the inflation rate as a percentage.

The resulting inflation rate represents the average price increase across all sectors of the economy as measured by the GDP deflator. It provides insights into the general trend of rising or falling prices over the specific period analyzed.

It is worth noting that the inflation rate calculated using the GDP deflator reflects the changes in overall price levels across different sectors and categories of goods and services. This differs from other inflation measures, such as the Consumer Price Index (CPI), which focuses on a fixed basket of consumer goods.

By calculating the inflation rate using the GDP deflator, we can gain a broader understanding of price movements and their impact on the overall economy. This information is valuable for policymakers, businesses, and individuals in making informed decisions related to budgeting, forecasting, and financial planning.

Now that we have completed the calculation steps, let’s wrap up our discussion on using GDP for inflation calculation.

Conclusion

In conclusion, utilizing Gross Domestic Product (GDP) data is an effective approach to calculate the inflation rate. By analyzing changes in GDP over time, we can gain insights into the overall price movements in the economy and measure inflation. Using GDP for inflation calculation provides a comprehensive view of inflation, encompassing all sectors and categories of goods and services within an economy.

The process of calculating the inflation rate using GDP involves several steps. First, we gather the necessary GDP data from reliable sources. Then, we determine the base year, which acts as a reference point for comparing price changes in subsequent years. Next, we calculate the GDP deflator, which represents the overall price level of goods and services produced within the economy. Finally, by comparing the GDP deflators of different years, we can calculate the inflation rate using the percentage change formula.

The inflation rate calculated using GDP data provides policymakers, businesses, and individuals with valuable information to make informed decisions. It helps in analyzing the impact of price changes on various economic factors such as personal incomes, business profitability, and investment strategies.

It is important to note that GDP-based inflation calculations have their limitations. The GDP deflator includes all goods and services produced within an economy, which may not fully capture changes in consumer prices. Therefore, it should be complemented with other measures like the Consumer Price Index (CPI) for a more comprehensive understanding of inflation.

In conclusion, using GDP data for inflation calculation offers a broad and holistic perspective on price movements in the economy. It serves as a valuable tool for policymakers to formulate effective economic policies, businesses to make informed decisions, and individuals to manage their finances efficiently.