Finance

What Was The Inflation Rate In 1975?

Modified: February 21, 2024

Discover the inflation rate in 1975 and its impact on finance. Gain valuable insights into historical financial trends with our comprehensive analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Inflation is a fundamental component of the global economy, influencing prices, wages, and the purchasing power of individuals. It refers to the persistent increase in the general price level of goods and services over a period of time. To understand the economic landscape of a particular era, it is crucial to analyze the inflation rate during that time.

In this article, we will delve into the inflation rate of 1975 and its significance within the larger economic context. By examining the key factors that influenced inflation in that period, we can gain a better understanding of the financial challenges faced by individuals, businesses, and governments.

Throughout history, inflation has had both positive and negative effects on various sectors of the economy. It erodes the purchasing power of currency, making goods and services more expensive. However, it can also boost economic growth by increasing consumer spending and encouraging investment.

Uncontrolled inflation can be detrimental to an economy, leading to unstable prices, reduced savings, and decreased investments. Therefore, monitoring and managing inflation rates is crucial for maintaining economic stability and ensuring sustainable growth.

In the following sections, we will explore the factors that contribute to inflation and the specific circumstances that shaped the inflation rate in 1975. By examining historical data and understanding the economic climate of that time, we can gain insights into the challenges faced by individuals and businesses and identify the steps taken by policy-makers to address them.

Let’s delve into the background of inflation and the factors that influenced the inflation rate in 1975.

Background of Inflation

Inflation is a complex economic phenomenon that has been studied by economists for many years. It occurs when there is a sustained increase in the general price level of goods and services in an economy. This means that over time, the purchasing power of a currency decreases, as it requires more money to buy the same quantity of goods and services.

There are several factors that can contribute to inflation, including changes in the money supply, demand-pull inflation, cost-push inflation, and inflation expectations. Changes in the money supply, usually controlled by central banks, can directly impact the level of inflation in an economy. When there is too much money chasing too few goods, prices tend to rise.

Demand-pull inflation occurs when aggregate demand in an economy exceeds the supply of goods and services. This can happen due to increased consumer spending, government spending, or investment. As demand outstrips supply, prices are driven up.

Cost-push inflation, on the other hand, occurs when the cost of production increases, leading to higher prices for consumers. Factors that can contribute to cost-push inflation include rising wages, increased raw material costs, or changes in government policies.

Inflation expectations also play a role in shaping the inflation rate. If individuals and businesses anticipate that prices will rise, they may adjust their behavior accordingly, leading to a self-fulfilling prophecy.

Understanding the background of inflation is crucial in analyzing the inflation rate of a specific period, such as 1975. By considering the factors that influence inflation, we can better comprehend the economic circumstances that shaped the inflation rate during that time.

Next, we will explore the specific factors that affected the inflation rate in 1975 and their implications for the economy during that period.

Factors Affecting Inflation

Various factors can contribute to the inflation rate in a given year. Understanding these factors is crucial in analyzing the economic landscape and the challenges faced by individuals and businesses. In the case of 1975, several key factors influenced the inflation rate. Let’s explore them in more detail:

- Monetary Policy: The monetary policies implemented by central banks have a significant impact on inflation. In 1975, many countries were grappling with high inflation rates as a result of expansionary monetary policies. Central banks increased the money supply to stimulate economic growth, but this led to higher inflation.

- Cost of Production: Changes in the cost of production can influence inflation. In 1975, there were significant cost pressures due to rising wages and increased raw material costs. These factors contributed to higher production costs, which were passed on to consumers in the form of higher prices.

- Import Prices: The cost of imported goods and raw materials can have a significant impact on inflation. In 1975, there was an oil crisis that led to a sharp increase in oil prices. This increase in import prices had a knock-on effect on the prices of other goods and services, driving up inflation.

- Demand and Supply: The balance between aggregate demand and supply in an economy can also affect inflation. In 1975, there was a combination of high demand due to government spending and low supply due to disruptions in production. This imbalance contributed to higher prices.

- Inflation Expectations: The expectations of individuals and businesses regarding future inflation can influence their behavior. In 1975, there was a general expectation of high inflation, which led to actions such as hoarding goods and demanding higher wages. These actions further fueled inflationary pressures.

These are just a few of the factors that affected the inflation rate in 1975. It is important to note that inflation is a complex phenomenon influenced by a multitude of economic and social factors. By examining these factors, we can gain insights into the challenges faced by individuals and businesses during that time.

In the next section, we will explore how the inflation rate was calculated in 1975 and its implications for the economy.

Inflation Rate Calculation

Calculating the inflation rate involves measuring the changes in the general price level of goods and services over a specific period of time. In 1975, the inflation rate was determined using various economic indicators and formulas. Let’s explore the main methods used to calculate the inflation rate during that period:

- Consumer Price Index (CPI): The CPI is a widely used indicator to measure changes in the price level of a basket of goods and services consumed by households. By tracking the prices of various goods and services, the CPI provides a representative measure of inflation. In 1975, the CPI was used to calculate the inflation rate by comparing the average price level of goods and services in that year to a reference period.

- Wholesale Price Index (WPI): The WPI measures changes in the average price of goods at the wholesale level. It includes prices of raw materials, intermediate goods, and finished goods. The WPI is often used to capture inflationary pressures in the production and distribution stages of the supply chain. In 1975, the WPI may have been considered alongside the CPI to gain a more comprehensive understanding of inflation.

- Gross Domestic Product (GDP) Deflator: The GDP deflator is a measure of price changes in the entire economy and reflects both consumer and producer price levels. It compares the nominal GDP, which includes current prices, to the real GDP, which adjusts for inflation. By calculating the ratio between nominal and real GDP, the GDP deflator captures inflationary trends. This measure may have also been used to assess the inflation rate in 1975.

These methods, along with other economic indicators, were used to estimate the inflation rate in 1975. It is important to note that different countries and institutions may have employed slightly different methodologies to calculate the inflation rate, but the underlying principles remain the same.

Calculating the inflation rate provides valuable insights into the purchasing power of money and the impact of price changes on the economy. In the next section, we will explore the economic situation in 1975 and its implications for inflation.

Economic Situation in 1975

The year 1975 was marked by various economic challenges and significant events that had a profound impact on the global economy. Understanding the economic situation during this period is essential in analyzing the factors that influenced the inflation rate in 1975. Let’s explore the key characteristics of the economic landscape in that year:

- Recession: Many countries experienced a recession in 1975, characterized by a significant decline in economic activity. The global economy was struggling with high unemployment, reduced consumer spending, and sluggish growth. This challenging economic environment influenced the inflation rate.

- Oil Crisis: The oil crisis, triggered by the OPEC (Organization of the Petroleum Exporting Countries) oil embargo during the early 1970s, continued to affect the global economy in 1975. The sharp increase in oil prices led to higher production costs and inflationary pressures across various industries.

- Government Spending: Governments around the world implemented expansionary fiscal policies to stimulate economic growth and combat the recession. Increased government spending, especially on infrastructure projects and social programs, fueled demand but also contributed to inflationary pressures.

- High Unemployment: The recession of 1975 resulted in a significant rise in unemployment rates. With fewer job opportunities and a competitive labor market, workers had limited bargaining power for wage negotiations. However, high unemployment also dampened consumer spending and contributed to the economic slowdown.

- Global Trade Imbalances: The global economy faced imbalances in trade, with some countries experiencing surpluses while others faced deficits. These imbalances had implications for exchange rates and inflation rates as countries adjusted their monetary policies to address their economic challenges.

The economic situation in 1975 presented a complex and challenging environment for individuals, businesses, and governments. The combination of recession, higher oil prices, government spending, unemployment, and global trade imbalances had a significant impact on the inflation rate during that time.

Next, we will explore how the inflation rate in 1975 was determined and put into historical context.

Determining the Inflation Rate in 1975

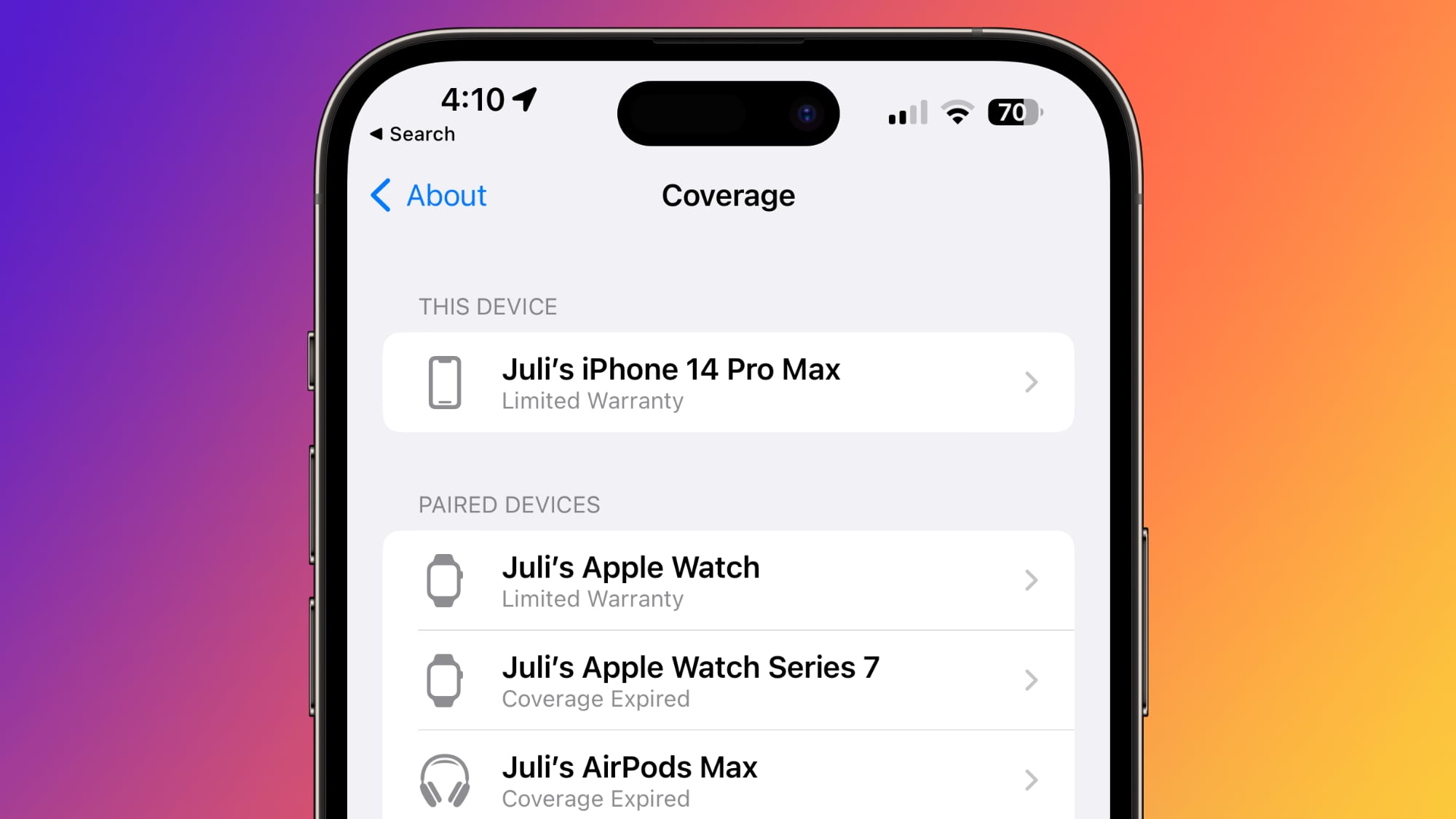

Determining the inflation rate in 1975 involved analyzing various economic indicators, including the Consumer Price Index (CPI), Wholesale Price Index (WPI), and Gross Domestic Product (GDP) deflator. These indicators provided valuable insights into the changes in price levels and overall inflationary trends during that year. Let’s explore how the inflation rate in 1975 was determined:

- Consumer Price Index (CPI): The CPI measured the average price level of goods and services consumed by households. It tracked the prices of various items, including food, housing, transportation, and healthcare. By comparing the average price level in 1975 to a reference period, the inflation rate could be calculated using the CPI.

- Wholesale Price Index (WPI): The WPI captured changes in the average price of goods at the wholesale level, including raw materials, intermediate goods, and finished goods. It provided insights into price fluctuations in the production and distribution stages of the supply chain. The WPI was another indicator used to assess the inflation rate in 1975.

- Gross Domestic Product (GDP) Deflator: The GDP deflator analyzed the overall price level changes in the economy. It reflected both consumer and producer price levels by comparing the nominal GDP (current prices) to the real GDP (adjusted for inflation). The ratio between nominal and real GDP determined the inflation rate as measured by the GDP deflator.

These indicators, along with other economic data, were utilized to calculate the inflation rate in 1975. However, it is important to note that different countries and institutions may have used slightly different methodologies or weights for the various components in their inflation calculations.

The inflation rate in 1975 was a crucial measure to assess the impact of rising prices on the economy, purchasing power, and overall financial well-being of individuals and businesses. It provided valuable information to policymakers and allowed for the implementation of appropriate measures to address inflationary pressures and maintain economic stability.

In the next section, we will put the inflation rate in 1975 into historical context to gain a deeper understanding of its significance.

Historical Context of Inflation in 1975

The inflationary trends of 1975 were influenced by various historical events and economic factors that shaped the global landscape. Understanding the historical context surrounding inflation during this period provides insight into the challenges faced by economies and their responses to these challenges. Let’s explore the historical context of inflation in 1975:

1. Oil Crisis: The oil crisis, triggered by the OPEC oil embargo in the early 1970s, continued to impact economies worldwide in 1975. The significant increase in oil prices led to higher production costs, affecting industries across the globe. The subsequent increase in the prices of goods and services contributed to inflationary pressures.

2. Recession and Unemployment: The global economy faced a severe recession in 1975, characterized by high unemployment rates and reduced economic activity. The recession dampened consumer spending and weakened demand, but high unemployment also exerted downward pressure on wages, mitigating some inflationary pressures.

3. Fiscal Stimulus: Many governments implemented expansionary fiscal policies in response to the recession. Increased government spending on infrastructure projects and social programs aimed to stimulate economic growth and create job opportunities. While this fiscal stimulus had positive effects on the economy, it also contributed to inflationary pressures.

4. Monetary Policies: Central banks faced the challenge of managing inflation and stimulating economic growth simultaneously. Expansionary monetary policies, such as increasing the money supply and lowering interest rates, were implemented to combat the recession. However, these policies also contributed to inflationary pressures.

5. Global Trade Imbalances: The imbalances in trade between countries affected exchange rates and inflation rates. Some countries experienced trade surpluses, while others faced deficits. Adjusting monetary policies to address trade imbalances had implications for inflation rates and overall economic stability.

The historical context of inflation in 1975 demonstrates the interconnectedness of various economic and geopolitical factors on inflationary trends. The oil crisis, recession, fiscal stimulus, monetary policies, and trade imbalances all influenced the inflationary pressures experienced by economies during that period.

Next, we will conclude our analysis and summarize the key insights gained from exploring the inflation rate in 1975 and its historical context.

Conclusion

Examining the inflation rate in 1975 and its historical context provides valuable insights into the economic challenges and developments during that period. The various factors influencing inflation, including monetary policies, cost of production, import prices, demand and supply dynamics, and inflation expectations, played a significant role in shaping the inflation rate.

The economic situation in 1975 was marked by a global recession, high unemployment, and an oil crisis that led to increased production costs and inflationary pressures. Governments responded with expansionary fiscal policies, which fueled demand but also contributed to inflation. Central banks grappled with balancing the need for economic stimulus and managing inflation through monetary policies.

The calculation of the inflation rate in 1975 relied on indicators such as the Consumer Price Index (CPI), Wholesale Price Index (WPI), and GDP deflator. These measures provided valuable insights into the changes in price levels, helping policymakers assess the overall impact on the economy.

Understanding the historical context of inflation in 1975 reveals the significant impact of events such as the oil crisis and the global recession. It emphasizes the interconnectedness of various factors, including fiscal and monetary policies, trade imbalances, and labor market conditions, in driving inflationary trends.

An analysis of the inflation rate in 1975 not only sheds light on the economic challenges of that time but also demonstrates the importance of monitoring and managing inflation to maintain economic stability. By studying past inflationary periods, policymakers can draw lessons and implement appropriate measures to address inflationary pressures and promote sustainable economic growth.

As we reflect on the inflation rate in 1975 and its historical context, it serves as a reminder of the complexities and dynamics of inflation and its far-reaching impact on individuals, businesses, and governments. By understanding these intricacies, we can navigate economic challenges more effectively and foster a stable and prosperous financial future.