Finance

How Much Is Flood Insurance In Florida?

Published: November 19, 2023

"Discover the cost of flood insurance in Florida and make informed financial decisions. Protect your property from potential flood damage with the right coverage."

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Flood insurance is an essential consideration for homeowners in Florida, a state known for its susceptibility to flooding due to its low-lying geography and proximity to water bodies. Living in a coastal state like Florida comes with the risk of hurricanes, heavy rainfall, storm surges, and tidal flooding, making flood insurance crucial to protect your property and finances.

In this article, we will explore the factors that affect flood insurance rates in Florida, the average cost of flood insurance in the state, high-risk flood zones, ways to lower flood insurance premiums, and how to compare flood insurance providers.

Florida’s unique geographical characteristics, including its extensive coastline and numerous waterways, contribute to its vulnerability to flooding. The state experiences both coastal and inland flooding, with heavy rainfall events and hurricanes being the primary culprits.

Most homeowners insurance policies do not cover flood damage, which means you will need a separate flood insurance policy to safeguard your property and possessions in the event of a flood. It is essential to understand the factors that influence flood insurance rates in Florida to make informed decisions about obtaining coverage.

The cost of flood insurance in Florida is determined by various factors, including the location of the property, elevation, building materials, and the type and extent of flood risk. Properties located in high-risk flood zones, such as those near bodies of water or in areas prone to hurricanes, typically have higher insurance rates.

By understanding the intricacies of flood insurance in Florida and taking proactive steps to mitigate risks, homeowners can make informed decisions about obtaining coverage and potentially lower insurance premiums. This article will provide valuable insights into the average cost of flood insurance in Florida, high-risk flood zones, and strategies to reduce insurance costs.

Furthermore, we will explore how homeowners can compare flood insurance providers in Florida to find the best coverage options and rates. It is crucial to review multiple insurance providers, assess their policies, and consider factors such as customer service, financial stability, and claims processes before making a decision.

By delving into these topics, this article aims to equip homeowners in Florida with the necessary knowledge to make informed decisions about protecting their properties and finances through flood insurance coverage.

Factors Affecting Flood Insurance Rates in Florida

Several factors influence flood insurance rates in Florida, which vary from property to property and can have a significant impact on the cost of coverage. Understanding these factors can help homeowners make informed decisions about obtaining flood insurance and estimating potential premiums.

- Location: The location of your property is a critical factor in determining flood insurance rates. Properties located in high-risk flood zones, such as those near the coast or in areas prone to hurricanes, typically have higher premiums. Additionally, the proximity to bodies of water, such as lakes, rivers, and canals, can also impact insurance rates.

- Elevation: The elevation of your property plays a role in flood insurance rates. Homes located in low-lying areas or areas with a high risk of storm surge are more prone to flooding and, as a result, may have higher insurance premiums. On the other hand, properties situated at higher elevations may be eligible for lower rates as they are considered to be at a lower risk of flooding.

- Building Materials: The construction materials used in your home can affect flood insurance rates. Properties built with materials that are more resistant to flood damage, such as concrete or brick, may be eligible for lower premiums compared to homes constructed with more vulnerable materials like wood.

- Flood Zone: The flood zone classification of your property can significantly impact flood insurance rates. Florida has several flood zone classifications designated by the Federal Emergency Management Agency (FEMA). Properties located in high-risk flood zones, such as Zone A or Zone V, are more susceptible to flooding and, as a result, typically have higher insurance rates. On the other hand, properties in moderate-to-low-risk zones, such as Zone B or Zone X, may enjoy lower premiums.

- Age of the Property: The age of your property can also affect flood insurance rates. Older homes may have outdated construction standards and may be more prone to flood damage, resulting in higher insurance premiums. Newer homes built to more modern flood-resistant standards may be eligible for lower rates.

- Previous Flood History: If your property has a history of flood damage, previous flood claims, or repetitive loss, this can impact the cost of flood insurance. Properties with a higher risk of experiencing future flood damage may have higher premiums due to the perceived increased likelihood of filing insurance claims.

It is important to note that these factors are not exhaustive and can vary depending on the insurance provider and the specific circumstances of your property. To determine accurate and personalized flood insurance rates, it is advisable to consult with insurance professionals who can assess your property’s unique characteristics and provide you with a tailored insurance quote.

Average Cost of Flood Insurance in Florida

The average cost of flood insurance in Florida can vary significantly depending on various factors, including the location of the property, flood zone classification, property value, and coverage limits. While there is no one-size-fits-all answer to the cost of flood insurance, understanding the average costs can provide homeowners with a general idea of what to expect.

According to the National Flood Insurance Program (NFIP), the average cost of flood insurance in Florida is around $700 per year. However, it is important to note that this is just an average, and individual premiums can range from a few hundred dollars to several thousand dollars annually.

Properties in high-risk flood zones, such as coastal areas or properties near bodies of water, tend to have higher insurance premiums. In these areas, homeowners may expect to pay higher annual premiums, typically in the range of $1,000 to $3,000 or more, depending on the value of the property and the desired coverage amount.

On the other hand, properties in moderate-to-low-risk flood zones may have lower insurance premiums. Homeowners in these areas can often secure flood insurance coverage for as little as a few hundred dollars per year, based on their property value and desired coverage limits.

It is important to note that these figures are approximate and can vary based on the individual insurance provider, policy coverage, deductible amounts, and other factors. Additionally, certain factors unique to Florida, such as its vulnerability to hurricanes and heavy rainfall events, can influence insurance rates in the state.

It is advisable for homeowners in Florida to obtain personalized quotes from multiple insurance providers to determine the specific cost of flood insurance for their property. Insurance agents can assess the unique characteristics of the property, including location, elevation, building materials, and flood zone classification, to provide accurate and customized insurance quotes.

Furthermore, homeowners should evaluate their coverage needs and consider factors like the replacement value of the property, personal belongings, and additional coverage options when determining appropriate coverage limits. This will help ensure that they have adequate coverage to protect their property and possessions in the event of a flood.

Comparing quotes from different insurance providers and exploring available discounts or mitigation options can also help homeowners find more affordable flood insurance rates in Florida. Taking proactive steps to mitigate flood risks, such as elevating the property, installing flood-resistant systems, or implementing drainage improvements, can potentially lead to lower insurance premiums.

By understanding the average costs of flood insurance in Florida and considering the factors that influence premiums, homeowners can make informed decisions about obtaining the right coverage to protect their property and finances.

High-Risk Flood Zones and Insurance Rates in Florida

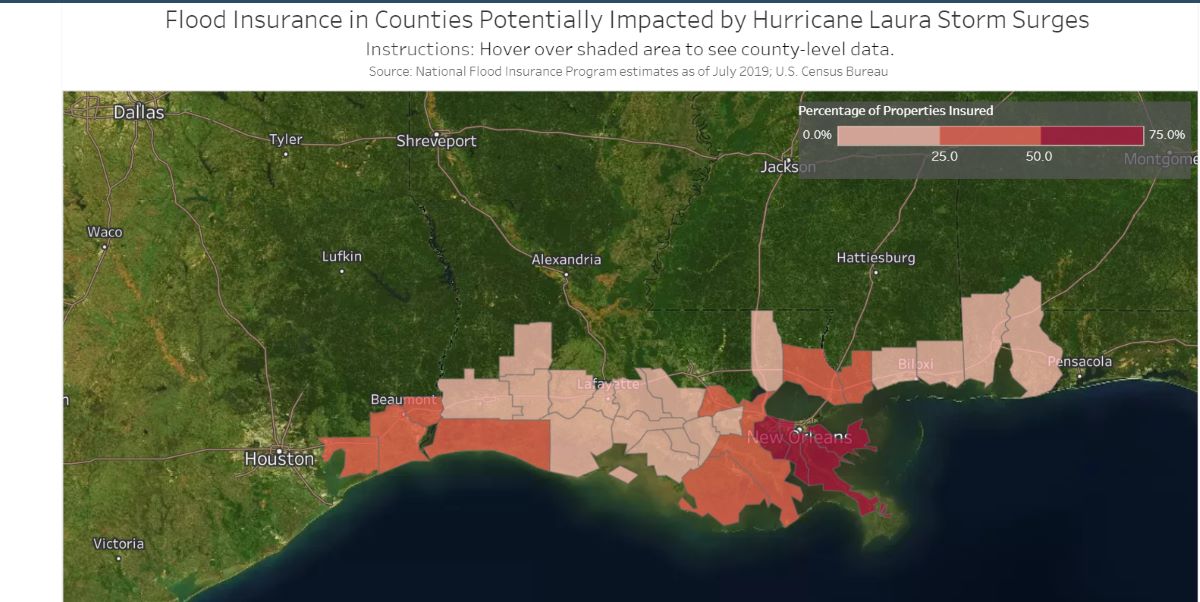

Florida is prone to various types of flooding due to its unique geography and exposure to hurricanes. Understanding the high-risk flood zones in the state and how they relate to insurance rates is crucial for homeowners seeking flood insurance coverage.

The Federal Emergency Management Agency (FEMA) designates different flood zones based on risk levels. In Florida, some of the high-risk flood zones include Zone A, Zone AE, Zone V, and Zone VE.

Properties located in these high-risk flood zones typically face a greater risk of flooding, either due to their proximity to the coast, low-lying areas, or susceptibility to storm surge. As a result, insurance premiums for properties in these zones tend to be higher compared to properties in moderate-to-low-risk flood zones.

Insurance rates for high-risk flood zones in Florida can vary widely depending on factors such as the property’s elevation, construction materials, and other risk factors. Property owners in these areas can expect to pay higher premiums to adequately protect their homes from the potential financial devastation of flood damage.

The cost of flood insurance in high-risk flood zones can range from a few thousand dollars to several thousand dollars per year. These rates reflect the increased likelihood of flooding and the potential for significant damage to the insured property.

Homeowners in high-risk flood zones should not only consider the cost of insurance but also the potential financial consequences of not having adequate coverage. The cost of repairs and recovery from flood damage can far exceed the annual insurance premium, making it essential to have appropriate coverage in place.

It is important to note that flood insurance coverage is often a requirement for properties located in high-risk flood zones if they have a federally backed mortgage. Lenders seek to protect their investment by ensuring that homeowners have insurance coverage to mitigate the financial risk associated with flood damage.

Even for those properties not required by lenders to carry flood insurance, it is highly advisable to consider obtaining coverage. Flooding can occur in unexpected and unprecedented circumstances, and without proper insurance, homeowners may be left facing significant repair and reconstruction costs out of pocket.

Homeowners in high-risk flood zones should work with insurance providers who specialize in flood insurance to ensure they have the appropriate coverage tailored to their specific needs. These providers have expertise in assessing the unique risks associated with high-risk flood zones and can help homeowners find the best coverage options at competitive rates.

By understanding the high-risk flood zones in Florida and the associated insurance rates, homeowners can make informed decisions about obtaining the necessary flood insurance coverage to protect their property and finances from the devastating effects of flooding.

Ways to Lower Flood Insurance Premiums in Florida

Flood insurance premiums in Florida can sometimes be a significant expense for homeowners, especially those residing in high-risk flood zones. However, there are several strategies that homeowners can implement to potentially lower their flood insurance premiums while still maintaining adequate coverage.

- Elevation and Floodproofing: One effective way to reduce flood insurance premiums is by elevating your property. This involves raising the home above the base flood elevation, reducing the risk of flood damage. Additionally, installing floodproofing measures such as flood vents, foundation protection, or barrier systems can also help lower insurance costs.

- Choose a Higher Deductible: Increasing your flood insurance deductible can result in lower premiums. However, it’s important to carefully consider your financial capabilities in the event of a flood and ensure that you can cover the higher deductible if needed.

- Implement Flood Mitigation Measures: Taking proactive steps to mitigate flood risks in and around your property can lead to reduced insurance premiums. This can include measures such as installing hurricane shutters, reinforcing the roof, or improving drainage systems to minimize flood damage potential.

- Obtain an Elevation Certificate: An elevation certificate provides crucial information about the elevation of your property relative to the base flood elevation. This certificate can help insurance providers assess the flood risk accurately and may lead to lower insurance premiums, especially if your property is at a higher elevation.

- Join a Community Rating System (CRS) Program: Some communities in Florida participate in the National Flood Insurance Program’s Community Rating System (CRS), which offers premium discounts to residents who take specific flood mitigation measures. Check with your local government to see if your community participates in this program and how you can take advantage of potential premium discounts.

- Shop Around and Compare Insurance Providers: It’s always a good idea to request quotes from multiple insurance providers and compare coverage options and rates. Different providers may have different pricing structures and discounts available, so shopping around can help you find the most affordable flood insurance policy for your needs.

- Consider Private Flood Insurance: In addition to the National Flood Insurance Program, private insurance companies also offer flood insurance coverage. Exploring private flood insurance options allows homeowners to compare policies and rates, which may potentially result in lower premiums.

- Consult with a Licensed Insurance Agent: Seeking guidance from a licensed insurance agent who specializes in flood insurance can be invaluable. They can assess your property, take into account various risk factors, and provide personalized advice on how to reduce your flood insurance premiums.

It’s important to note that the specific impact of these strategies on your flood insurance premiums may vary. Depending on your property, location, and other factors, the potential savings may differ. Therefore, it is recommended that homeowners consult with insurance professionals who can provide personalized guidance tailored to their specific circumstances.

By implementing these strategies and exploring available discounts and mitigation measures, homeowners in Florida can potentially lower their flood insurance premiums without compromising the coverage needed to protect their property and assets from the financial consequences of flooding.

Comparing Flood Insurance Providers in Florida

When it comes to purchasing flood insurance in Florida, it is vital to compare different providers to ensure you are getting the best coverage at the most competitive rates. Here are some key factors to consider when comparing flood insurance providers in the state:

- Financial Stability: It is crucial to choose an insurance provider with strong financial stability. Evaluate their financial ratings provided by reputable rating agencies, such as A.M. Best and Standard & Poor’s, to ensure they have the financial strength to pay claims in the event of a flood.

- Coverage Options: Assess the coverage options offered by different providers. Look for comprehensive policies that adequately protect your property, dwelling, personal belongings, and other important assets against flood damage. Consider any additional coverage options or endorsements that providers may offer to enhance your protection.

- Customer Service: Examine the reputation of insurance providers in terms of their customer service. Read reviews, seek recommendations from friends or family, and assess their responsiveness and willingness to address queries and concerns. Prompt and reliable customer service is essential for a smooth insurance experience.

- Claims Process: Research the claims process of various providers. Look for providers that have a streamlined and efficient claims handling process, ensuring prompt resolution and fair compensation in the event of a flood. Check if they offer convenient claims filing options, such as online or phone claims reporting.

- Premium Rates: Compare premium rates from multiple providers to find the most competitive pricing. Obtain personalized quotes based on your property and coverage needs to accurately compare rates. Remember to consider other factors, such as deductibles and coverage limits, when evaluating premium rates.

- Discounts and Incentives: Inquire about any available discounts or incentives offered by providers. Some may provide discounts for certain mitigation measures, such as elevation or floodproofing. Additionally, certain insurance providers may offer discounts for policy bundling or for being a member of specific organizations or communities.

- Policy Terms and Conditions: Carefully review the terms and conditions of each provider’s policy. Pay attention to exclusions, limitations, and any unique provisions that may impact your coverage. Ensure that the policy aligns with your specific needs and provides the level of protection you require.

- Reputation and Reviews: Research the reputation of insurance providers in the market. Look for providers with positive reviews, endorsements from reputable organizations, and a good track record of customer satisfaction. Consider consulting with insurance professionals or brokers for insights into the reputability and reliability of different providers.

Comparing flood insurance providers in Florida is a vital step in securing the right coverage for your property. By evaluating their financial stability, coverage options, customer service, claims process, premium rates, discounts, policy terms, and reputation, you can make an informed decision about the provider that best meets your specific needs.

It is also beneficial to consult with licensed insurance agents or brokers who can provide expert advice and guidance based on your individual circumstances. They can assist in evaluating options, comparing quotes, and explaining the fine print of policies to ensure you are selecting the best flood insurance provider in Florida.

Remember, the goal is to find a reliable insurance provider that offers comprehensive coverage, competitive rates, excellent customer service, and efficient claims handling, ensuring you have peace of mind and the necessary protection in the face of a flood event in Florida.

Conclusion

Flood insurance is a crucial consideration for homeowners in Florida, given the state’s vulnerability to flooding due to its geographical characteristics and exposure to hurricanes. Understanding the factors that affect flood insurance rates, the average cost of coverage, high-risk flood zones, ways to lower premiums, and comparing insurance providers can help homeowners make informed decisions to protect their properties and finances.

Factors such as location, elevation, building materials, flood zone classification, age of the property, and previous flood history influence flood insurance rates in Florida. By understanding these factors, homeowners can better estimate the cost of coverage and take steps to mitigate risks to potentially lower premiums.

The average cost of flood insurance in Florida is around $700 per year, but individual premiums can vary based on specific factors and coverage needs. Properties located in high-risk flood zones generally have higher premiums, while properties in moderate-to-low-risk zones may enjoy lower rates.

It is important for homeowners in Florida to obtain personalized quotes from multiple insurance providers. By comparing coverage options, discounts, customer service, claims processes, and premium rates, homeowners can find the best flood insurance policy that meets their needs while keeping costs manageable. Consulting with licensed insurance professionals can provide valuable insights and guidance throughout the process.

Implementing measures such as elevation, floodproofing, flood mitigation, and considering higher deductibles can potentially reduce flood insurance premiums. Additionally, joining a Community Rating System (CRS) program and exploring private flood insurance options may provide additional opportunities to lower costs.

Choosing a financially stable insurance provider, understanding policy terms and conditions, and evaluating reputation and reviews are essential steps in selecting the right flood insurance provider in Florida. Homeowners should consider factors beyond just premium rates and prioritize comprehensive coverage, reliable customer service, and a smooth claims process.

By following these guidelines and taking proactive measures to protect their properties, homeowners in Florida can secure adequate flood insurance coverage at competitive rates. Safeguarding their homes and belongings against the devastating financial consequences of a flood event ensures peace of mind and long-term security.