Home>Finance>How To Work Out Closing Balance On Cash Flow Forecast

Finance

How To Work Out Closing Balance On Cash Flow Forecast

Modified: February 21, 2024

Learn how to calculate the closing balance on your cash flow forecast with our comprehensive finance guide, covering all the essential steps and formulas.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Cash Flow Forecast

- Components of a Cash Flow Forecast

- Importance of the Closing Balance

- Steps to Calculate the Closing Balance on a Cash Flow Forecast

- Determine the Opening Balance

- Add Cash Inflows

- Subtract Cash Outflows

- Account for Non-Cash Items

- Adjust for Accruals and Prepayments

- Incorporate Changes in Borrowings and Repayments

- Consider Other Adjustments

- Calculate the Closing Balance

- Conclusion

Introduction

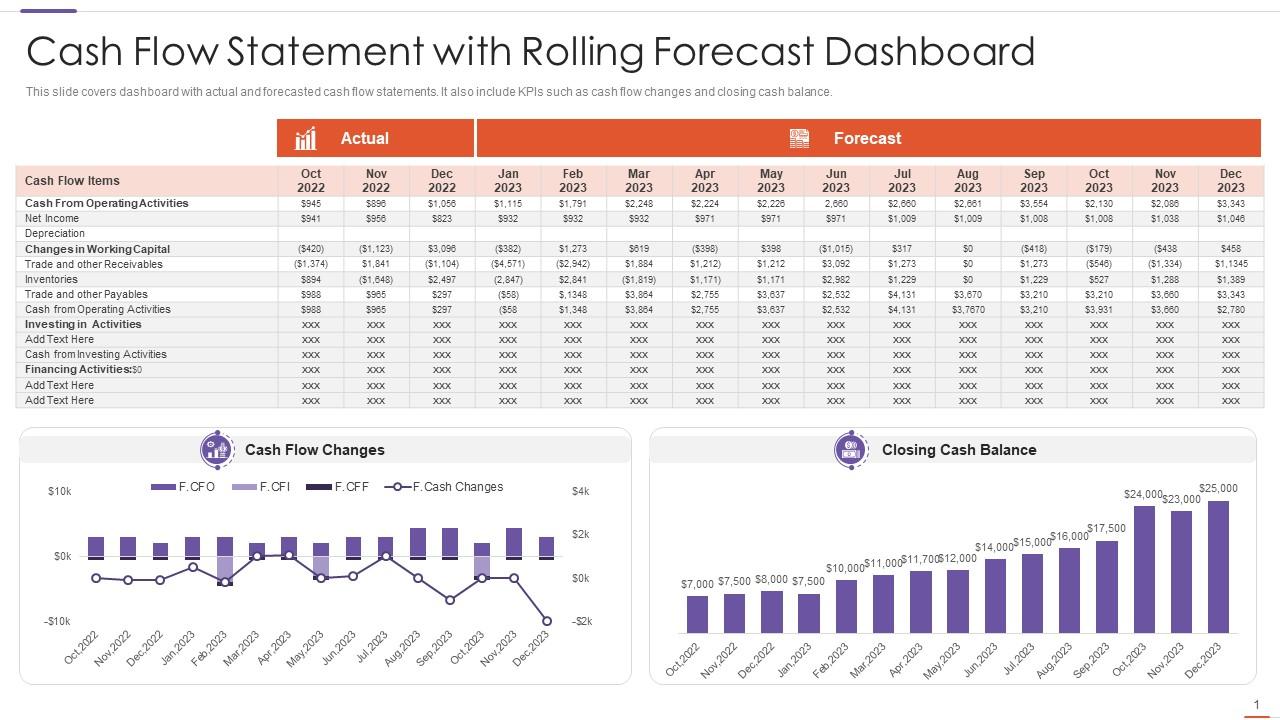

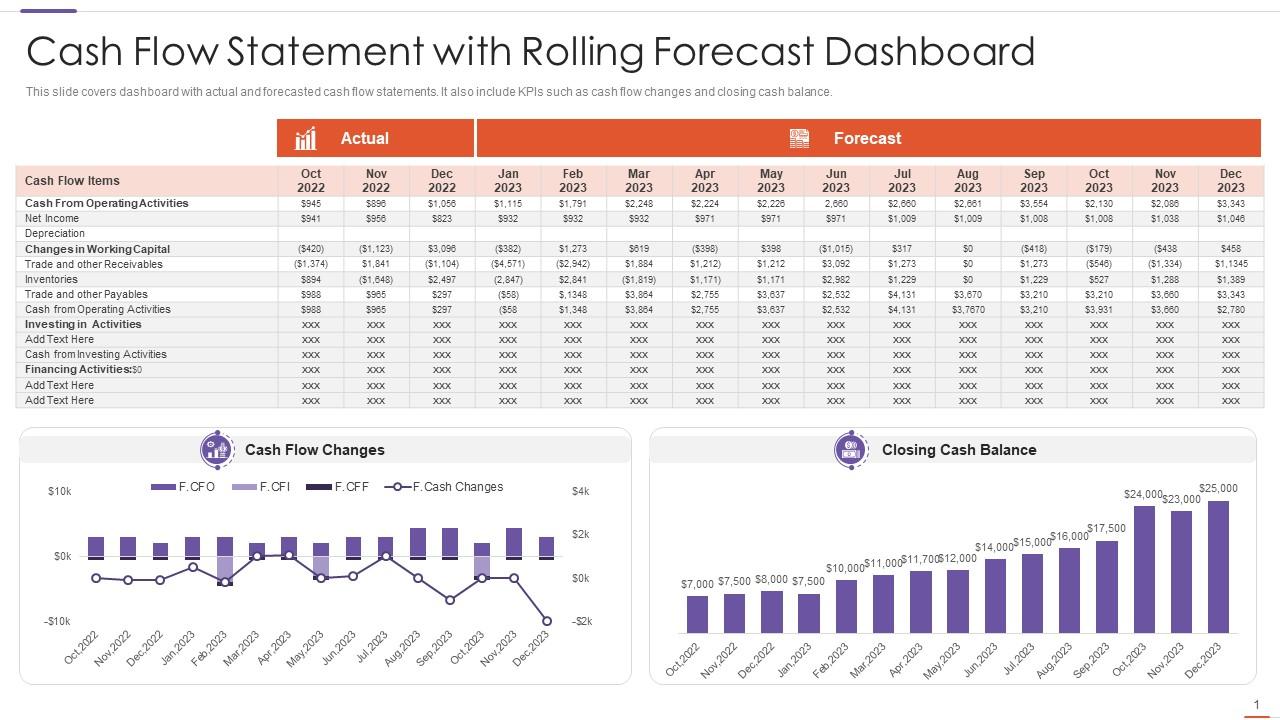

Understanding and effectively managing cash flow is crucial for the financial health and stability of any business. A cash flow forecast is a valuable tool that helps businesses project their cash inflows and outflows over a given period, typically on a monthly or quarterly basis.

The cash flow forecast provides a snapshot of how much cash a business is expected to receive and spend during a specific time period. It helps business owners and financial managers plan ahead, make informed decisions, and identify potential cash flow problems before they arise.

One important aspect of a cash flow forecast is the closing balance. The closing balance represents the amount of cash a business is expected to have at the end of the forecast period. It is a key indicator of the business’s financial position and liquidity.

Calculating the closing balance on a cash flow forecast involves taking into account various factors such as the opening balance, cash inflows, cash outflows, non-cash items, accruals and prepayments, changes in borrowings, and other adjustments.

In this article, we will delve into the importance of the closing balance on a cash flow forecast and provide a step-by-step guide on how to calculate it. By understanding how to work out the closing balance, businesses can better manage their cash flow and make informed financial decisions.

Understanding the Cash Flow Forecast

A cash flow forecast is a financial tool that helps businesses estimate the amount of cash that will flow in and out of their organization over a specific period. It allows businesses to project their future cash inflows and outflows, helping them plan and manage their finances effectively.

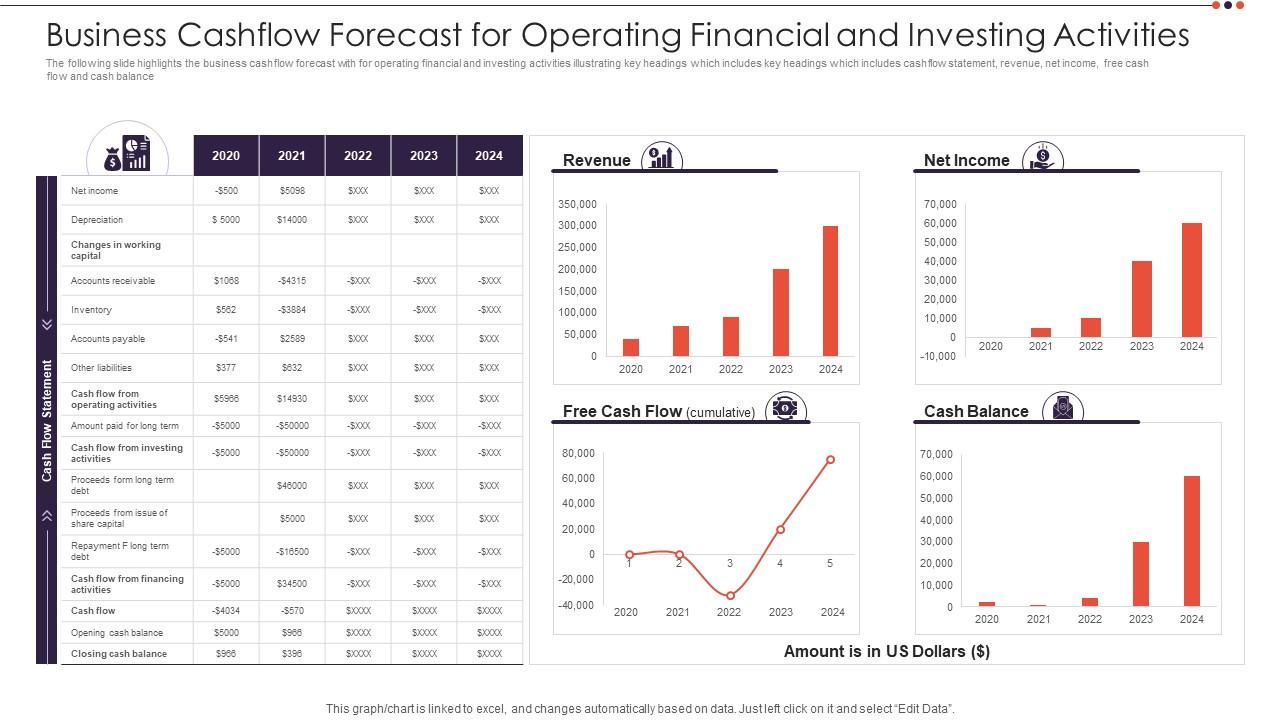

The cash flow forecast takes into account various sources of cash inflows, such as sales revenue, investments, and loans, as well as cash outflows, including expenses, salaries, and loan repayments. By analyzing these inflows and outflows, businesses can gain insights into their expected cash position and make informed decisions about their spending and investment strategies.

One of the primary purposes of a cash flow forecast is to identify potential cash flow gaps. By comparing the projected cash inflows and outflows, businesses can determine if there will be enough cash on hand to meet their financial obligations and cover any potential shortfalls. This allows businesses to take necessary actions such as adjusting their expenses or seeking additional funding to ensure they have sufficient liquidity.

Additionally, a cash flow forecast helps businesses analyze their working capital needs. By estimating the future cash inflows and outflows, businesses can determine the amount of working capital required to support their day-to-day operations. This allows them to better plan their inventory purchases, manage their receivables and payables, and optimize their working capital position.

Furthermore, a cash flow forecast provides valuable insights for financial decision-making. It helps businesses evaluate the impact of various scenarios and potential changes in their financial situation. By adjusting the projected cash inflows and outflows, businesses can assess the financial consequences of different strategies, such as introducing new products, expanding into new markets, or implementing cost-saving measures.

In summary, a cash flow forecast is an essential financial management tool that provides businesses with a clear picture of their expected cash position. It enables businesses to identify potential cash flow gaps, plan their working capital needs, and make informed financial decisions. Understanding the cash flow forecast is crucial for businesses of all sizes and industries to ensure their financial stability and growth.

Components of a Cash Flow Forecast

A cash flow forecast consists of several key components that provide a comprehensive view of a business’s anticipated cash inflows and outflows. Understanding these components is essential for effectively managing cash flow and making informed financial decisions. Let’s explore the key elements of a cash flow forecast:

- Cash Inflows: This component includes all sources of cash coming into the business, such as sales revenue, loan proceeds, investments, and any other forms of income. Identifying and accurately estimating these cash inflows is crucial for projecting the available funds that will enter the business.

- Cash Outflows: This component encompasses all the expenses and costs incurred by the business, including operating expenses, salaries, rent, utilities, loan repayments, and other financial obligations. Tracking and categorizing these cash outflows is essential for understanding the amount of cash leaving the business.

- Fixed Costs: These are the expenses that remain constant over a specific period, regardless of the business’s level of activity. Examples of fixed costs include rent, insurance premiums, and loan repayments. Including fixed costs in the cash flow forecast ensures that the business accurately accounts for these recurring expenses.

- Variable Costs: Variable costs are directly related to the level of business activity. As the business grows or faces fluctuations in demand, these costs change accordingly. Examples of variable costs include raw materials, production costs, and sales commissions. Properly estimating and tracking variable costs helps businesses anticipate changes in their cash outflows.

- One-time Expenses: These are non-recurring expenses that do not happen regularly but may have a significant impact on the business’s cash flow. One-time expenses can include equipment purchases, renovations, legal fees, or unexpected maintenance costs. Accounting for these expenses in the cash flow forecast allows businesses to be prepared for any substantial financial outlays.

- Receivables and Payables: These are the amounts owed to the business by customers (receivables) and the amounts owed by the business to suppliers and creditors (payables). Accurately monitoring and managing receivables and payables helps businesses maintain a healthy cash flow by ensuring that the timing of cash inflows aligns with cash outflows.

- Timing of Cash Flows: This component represents the estimated timing of cash inflows and outflows. By taking into account payment terms, billing cycles, and other factors, businesses can accurately project when they will receive or need to make payments. This helps avoid cash flow shortages and enables proactive cash management.

By considering these key components, businesses can create a comprehensive cash flow forecast that reflects their anticipated cash inflows and outflows. This allows them to gain a clear understanding of their cash position, identify potential challenges and opportunities, and make sound financial decisions to ensure their financial stability and success.

Importance of the Closing Balance

The closing balance is a crucial aspect of a cash flow forecast and plays a significant role in determining the financial health and stability of a business. It represents the amount of cash that a business is projected to have at the end of a specific period. Here are some key reasons why the closing balance is important:

- Financial Planning: The closing balance provides valuable insights for financial planning and decision-making. By knowing the expected cash position at the end of a period, businesses can assess their ability to cover upcoming expenses, invest in growth opportunities, and allocate funds effectively.

- Liquidity Management: The closing balance is an indicator of a business’s liquidity. It helps businesses determine if they have sufficient cash on hand to meet their immediate financial obligations and cover any potential shortfalls. Monitoring the closing balance allows businesses to proactively manage their liquidity and make informed decisions regarding cash reserves and working capital.

- Cash Flow Analysis: The closing balance is essential for analyzing cash flow trends and patterns over time. By comparing the closing balances from different periods, businesses can identify fluctuations, trends, and potential problems in their cash flow. This analysis enables businesses to take necessary actions to improve cash flow management and mitigate cash flow risks.

- Stakeholder Communication: The closing balance provides important information for communicating with stakeholders such as investors, lenders, and shareholders. It demonstrates the financial strength and stability of the business, which is crucial for building trust and attracting investment or financing opportunities. The closing balance can also support forecasting and budgeting discussions with stakeholders.

- Business Performance Evaluation: The closing balance can be used as a benchmark for evaluating business performance. By comparing the actual closing balance with the projected one, businesses can assess their accuracy in forecasting and identify areas for improvement in cash flow management. It helps in tracking progress, measuring financial goals, and making adjustments to business strategies if necessary.

Overall, the closing balance on a cash flow forecast is a vital piece of information that informs financial planning, liquidity management, cash flow analysis, stakeholder communication, and business performance evaluation. It provides businesses with a clear picture of their cash position and empowers them to make informed decisions to ensure financial stability, growth, and long-term success.

Steps to Calculate the Closing Balance on a Cash Flow Forecast

Calculating the closing balance on a cash flow forecast involves several steps to ensure an accurate estimation of the expected cash position at the end of a specific period. By following these steps, businesses can effectively manage their cash flow and make informed financial decisions. Here are the key steps to calculate the closing balance:

- Determine the Opening Balance: Start by identifying the cash balance at the beginning of the period for which you are creating the cash flow forecast. This is the opening balance, which serves as the starting point for subsequent calculations.

- Add Cash Inflows: Take into account all sources of cash inflows, such as sales revenue, loans, investments, and any other forms of income. Sum up these cash inflows to determine the total cash coming into the business during the forecast period.

- Subtract Cash Outflows: Consider all cash outflows, including operating expenses, salaries, rent, loan repayments, and other financial obligations. Subtract these cash outflows from the total cash inflows to calculate the net cash flow.

- Account for Non-Cash Items: Non-cash items, such as depreciation, amortization, and changes in inventory, do not involve actual cash transactions but can impact the closing balance. Adjust the net cash flow by accounting for these non-cash items.

- Adjust for Accruals and Prepayments: Accruals and prepayments involve transactions that may not result in immediate cash flow but impact the closing balance. Consider any accrued revenues or expenses and adjust the net cash flow accordingly.

- Incorporate Changes in Borrowings and Repayments: If the business has taken on new borrowings or made loan repayments during the forecast period, account for these changes in the cash flow forecast. Include the cash inflows from new borrowings and subtract the cash outflows from loan repayments.

- Consider Other Adjustments: Analyze any other factors that may impact the closing balance, such as changes in interest rates, foreign exchange rates, or government regulations. Make appropriate adjustments to the cash flow forecast to reflect these factors.

- Calculate the Closing Balance: Once all the above steps have been completed, calculate the closing balance by adding the opening balance to the net cash flow, adjusted for non-cash items, accruals, prepayments, borrowings, repayments, and other adjustments. The result will be the estimated cash balance at the end of the forecast period.

By following these steps and accurately estimating cash inflows and outflows, businesses can calculate the closing balance on their cash flow forecast. This information provides valuable insights into their expected cash position, allowing for effective cash flow management, financial planning, and informed decision-making.

Determine the Opening Balance

When calculating the closing balance on a cash flow forecast, the first step is to determine the opening balance. The opening balance represents the amount of cash that a business has at the beginning of the forecast period.

To determine the opening balance, businesses need to take into account the cash balance from the previous period. This can be obtained from the previous cash flow statement or financial records. It is important to ensure that the opening balance is accurate and reflects the true cash position at the start of the forecast period.

The opening balance serves as the starting point for subsequent calculations on the cash flow forecast. It provides a baseline from which businesses can track and project their cash inflows and outflows over the forecast period.

When determining the opening balance, it is important to consider any important events or transactions that may have occurred between the end of the previous period and the start of the current forecast period. This may include any significant cash injections or withdrawals, loan repayments, investments, or capital contributions that have occurred.

Having an accurate opening balance is crucial for maintaining the integrity of the cash flow forecast. It ensures that the forecast is built on a solid foundation and provides a reliable starting point for subsequent calculations.

Businesses can determine the opening balance by analyzing their financial statements, bank records, and cash receipts and payments records. It is important to reconcile the opening balance with these documents to ensure accuracy and consistency in the cash flow forecast.

By determining the opening balance accurately, businesses can establish a starting point for their cash flow forecast and effectively track and manage their cash inflows and outflows over the forecast period. This step sets the groundwork for subsequent calculations and helps businesses gain a better understanding of their expected cash position at the beginning of the forecast period.

Add Cash Inflows

After determining the opening balance in the cash flow forecast, the next step is to add the cash inflows. Cash inflows represent the sources of cash entering the business during the forecast period. These can come from various revenue streams, investments, loans, or any other form of income.

To accurately add cash inflows, businesses need to consider the different sources of cash they expect to receive. This may include revenue from product sales, service fees, rental income, interest income, or any other sources specific to the business.

Including all relevant cash inflows in the cash flow forecast helps businesses project their anticipated cash receipts. By evaluating past revenue performance, analyzing market trends, and considering sales forecasts, businesses can estimate the amount of cash they expect to generate during the forecast period.

It is important to differentiate between cash inflows and non-cash items. Non-cash items, such as revenue recognized on credit sales or depreciation, do not involve actual cash receipts and should not be included in this step. Cash inflows should only account for actual cash receipts that will impact the closing balance.

Additionally, businesses should consider the timing of cash inflows. Some cash inflows may be received evenly throughout the period, while others may be more sporadic or one-time events. Taking into account the timing allows for a more accurate estimation of the cash inflows at specific points in the forecast period.

Accurately adding cash inflows to the cash flow forecast provides businesses with a realistic expectation of the cash they will receive during the forecast period. This helps in planning, budgeting, and managing future expenses, ensuring that there will be sufficient cash to cover the projected cash outflows.

Regular monitoring and updating of cash inflows throughout the forecast period is important to reflect any actual changes or deviations from the initial projections. This allows businesses to adjust their strategies and make informed decisions based on updated cash flow information.

By carefully adding cash inflows to the cash flow forecast, businesses can create a more accurate picture of their expected cash position and make informed financial decisions to ensure their financial stability and success.

Subtract Cash Outflows

Once cash inflows have been added to the cash flow forecast, the next step is to subtract the cash outflows. Cash outflows represent the various expenses and payments that a business will incur during the forecast period. These can include operating expenses, salaries, loan repayments, rent, utilities, and any other financial obligations.

To accurately subtract cash outflows, businesses need to identify all the different categories of expenses they have, ensuring that no significant expense is overlooked. Categorizing expenses helps in organizing and analyzing the cash outflows, making it easier to manage and track financial obligations.

It is important to consider both fixed and variable expenses when subtracting cash outflows. Fixed expenses are those that remain relatively constant over the forecast period, such as rent or loan repayments. Variable expenses, on the other hand, fluctuate based on business activity or volume, such as raw material costs or utility bills.

Including all relevant cash outflows in the cash flow forecast allows businesses to estimate the amount of cash that will be expended during the forecast period. Accurate estimation of cash outflows helps in budgeting, resource allocation, and cost control.

Timing is an important factor to consider when subtracting cash outflows. Some expenses may be incurred evenly throughout the period, while others may occur at specific points in time or as one-time payments. Taking into account the timing of cash outflows helps in accurately projecting the cash requirements at different stages of the forecast period.

Regular monitoring and updating of cash outflows throughout the forecast period is crucial to reflect any actual changes or unforeseen expenses. This ensures that the forecast remains up to date and aligns with the business’s actual cash flow movements.

By subtracting cash outflows from the cash inflows, businesses can determine the net cash flow for each period in the forecast. This net cash flow is then used in subsequent calculations to determine the closing balance. It provides businesses with insights into their expected cash position after deducting the anticipated expenses and financial obligations.

By accurately accounting for cash outflows in the cash flow forecast, businesses can make informed decisions about resource allocation, expense management, and financial planning. It allows them to have a clear understanding of their expected cash position and ensures that they manage their financial resources effectively.

Account for Non-Cash Items

When calculating the closing balance on a cash flow forecast, it is essential to account for non-cash items. Non-cash items are transactions or events that impact the financial statements but do not involve actual cash receipts or payments. Examples of non-cash items include depreciation, amortization, changes in inventory, and gains or losses on the sale of assets.

Non-cash items should be adjusted in the cash flow forecast to reflect their impact on the closing balance. This adjustment ensures that the cash flow forecast accurately represents the actual cash position of the business.

Depreciation and amortization are common non-cash items that represent the allocation of the cost of long-term assets over their useful lives. Although these expenses do not directly involve cash outflows, they affect the profitability and value of the business. When accounting for non-cash items, it is important to add back any depreciation or amortization expenses to the net cash flow, as they do not impact the closing cash balance.

Changes in inventory can also have an impact on the closing balance. If the value of the inventory increases during the forecast period, it represents a non-cash expense. On the other hand, if the value of the inventory decreases, it represents a non-cash gain. These adjustments should be made to accurately reflect the impact of inventory changes on the closing cash balance.

Gains or losses on the sale of assets should also be taken into account when accounting for non-cash items. If the business sells an asset at a gain, it represents a non-cash item that does not impact the closing cash balance. Conversely, if the business sells an asset at a loss, it represents a non-cash item that should be added back to reflect the true cash position.

By accounting for non-cash items in the cash flow forecast, businesses can ensure that the closing balance accurately reflects the cash position. This adjustment allows businesses to have a more realistic understanding of their cash flow and helps in making informed financial decisions.

It is important to regularly review and update non-cash items throughout the forecast period to align the cash flow forecast with the actual financial performance of the business. By monitoring and adjusting for non-cash items, businesses can maintain the accuracy and reliability of their cash flow forecast, facilitating effective cash management and financial planning.

Adjust for Accruals and Prepayments

Accruals and prepayments are important elements to consider when calculating the closing balance on a cash flow forecast. Accruals represent revenues earned or expenses incurred but not yet recorded in the accounting books, while prepayments represent cash payments made in advance for goods or services that will be received in the future.

When adjusting for accruals and prepayments in the cash flow forecast, businesses need to account for the timing difference between the actual cash inflows or outflows and the recognition of revenue or expense in the financial statements.

For accruals, if there are revenues that have been earned but not yet received in cash, they should be added to the net cash flow. This adjustment reflects the recognition of the revenue in the financial statements, even though the cash has not been received. Similarly, if there are expenses that have been incurred but not yet paid in cash, they should be subtracted from the net cash flow. This adjustment accurately represents the true cash outflow of the business.

Prepayments, on the other hand, represent cash payments made in advance for goods or services that will be received in the future. When adjusting for prepayments, the amount of cash that has been prepaid should be subtracted from the net cash flow. This adjustment ensures that the cash flow forecast reflects the actual cash outflow occurring at the time of the prepayment.

By adjusting for accruals and prepayments in the cash flow forecast, businesses provide a more accurate representation of the expected cash flow throughout the forecast period. This adjustment aligns the cash flow forecast with the underlying financial transactions and helps in better cash management and financial planning.

Regularly reviewing and updating accruals and prepayments is crucial to ensure that the cash flow forecast remains accurate and reflects the business’s current financial position. By monitoring and adjusting for these timing differences, businesses can make informed decisions about their cash flow, anticipate future cash flows, and plan their financial resources effectively.

Incorporate Changes in Borrowings and Repayments

When calculating the closing balance on a cash flow forecast, it is important to incorporate any changes in borrowings and repayments. Borrowings, such as loans or lines of credit, can provide businesses with additional cash inflows, while repayments represent the cash outflows required to repay these borrowings.

To accurately incorporate changes in borrowings and repayments, businesses need to consider the timing and amount of these transactions. If the business plans to borrow funds during the forecast period, the cash inflows from these borrowings should be added to the net cash flow. Conversely, if repayments are expected to occur, the cash outflows from the repayments should be subtracted from the net cash flow.

It is important to account for any interest or fees associated with the borrowings as well. These costs should be factored into the cash flow forecast as they represent additional cash outflows or reduce the net cash inflow from borrowings.

Furthermore, changes in borrowings can have an impact on the closing balance beyond the immediate cash inflows or outflows. For example, if the business takes on new long-term debt, it may result in interest payments that extend beyond the forecast period. These future interest payments should be considered in the overall cash flow projection and impact the closing balance accordingly.

Monitoring and managing changes in borrowings and repayments are crucial for ensuring the accuracy of the cash flow forecast. By accurately incorporating these transactions, businesses can better plan for their financing needs, manage their debt obligations, and maintain a healthy cash position.

Regularly updating the cash flow forecast to reflect any changes in borrowings or repayments is essential. If there are deviations from the original projections, businesses should adjust the forecast to reflect the actual cash flow movement and the impact on the closing balance.

Incorporating changes in borrowings and repayments in the cash flow forecast helps businesses gain a comprehensive view of the expected cash flows and related financing activities. This enables them to make informed decisions about their borrowing strategy, debt management, and cash flow optimization.

Consider Other Adjustments

In addition to the previous steps, there may be other adjustments that need to be made when calculating the closing balance on a cash flow forecast. These adjustments account for various factors that can impact the cash flow and the overall financial position of the business.

One important consideration is changes in interest rates. Interest rates can have a significant impact on the cost of borrowing or the returns on investments. If there are expectations of interest rate changes during the forecast period, businesses should adjust their cash flow forecast to reflect the impact of these changes on interest expenses or interest income.

Foreign exchange rates are another factor to consider, especially for businesses operating internationally. Fluctuations in foreign exchange rates can affect the cash flows from international sales or foreign currency denominated expenses. These fluctuations should be accounted for in the cash flow forecast through appropriate adjustments to reflect the potential impact on cash inflows or outflows.

Legal or regulatory changes can also have financial implications for a business. For example, changes in tax legislation or government regulations can impact the cash flow forecast. It is important for businesses to monitor and analyze any upcoming changes and make appropriate adjustments to the cash flow forecast to accurately reflect the potential impact on cash flows.

Moreover, changes in market conditions, customer behavior, or industry trends can also influence the cash flow forecast. If there are expectations of significant market shifts or changes in customer demand, businesses should adjust their projections to reflect the potential impact on cash inflows or outflows.

It is crucial to regularly review and update the cash flow forecast to incorporate any relevant adjustments due to the factors mentioned above or any other material changes. By monitoring and adjusting for these factors, businesses can have a more accurate and reliable projection of their expected cash position.

Considering these other adjustments ensures that the cash flow forecast reflects the current and anticipated financial landscape of the business. It allows for more informed decision-making and helps businesses proactively manage risks and opportunities related to their cash flow.

Calculate the Closing Balance

Once all the necessary components and adjustments have been accounted for in the cash flow forecast, the final step is to calculate the closing balance. The closing balance represents the estimated amount of cash that a business will have at the end of the forecast period.

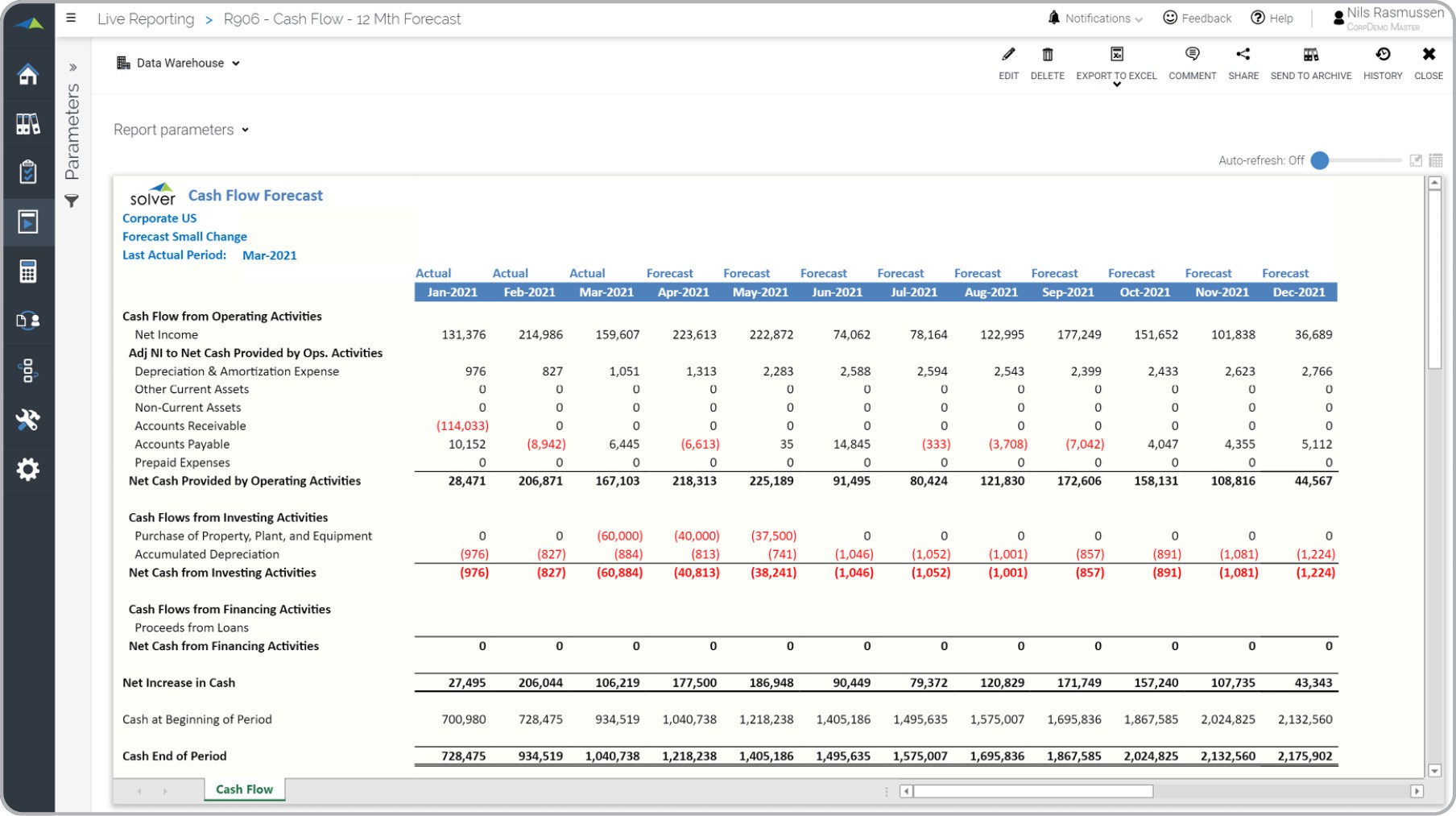

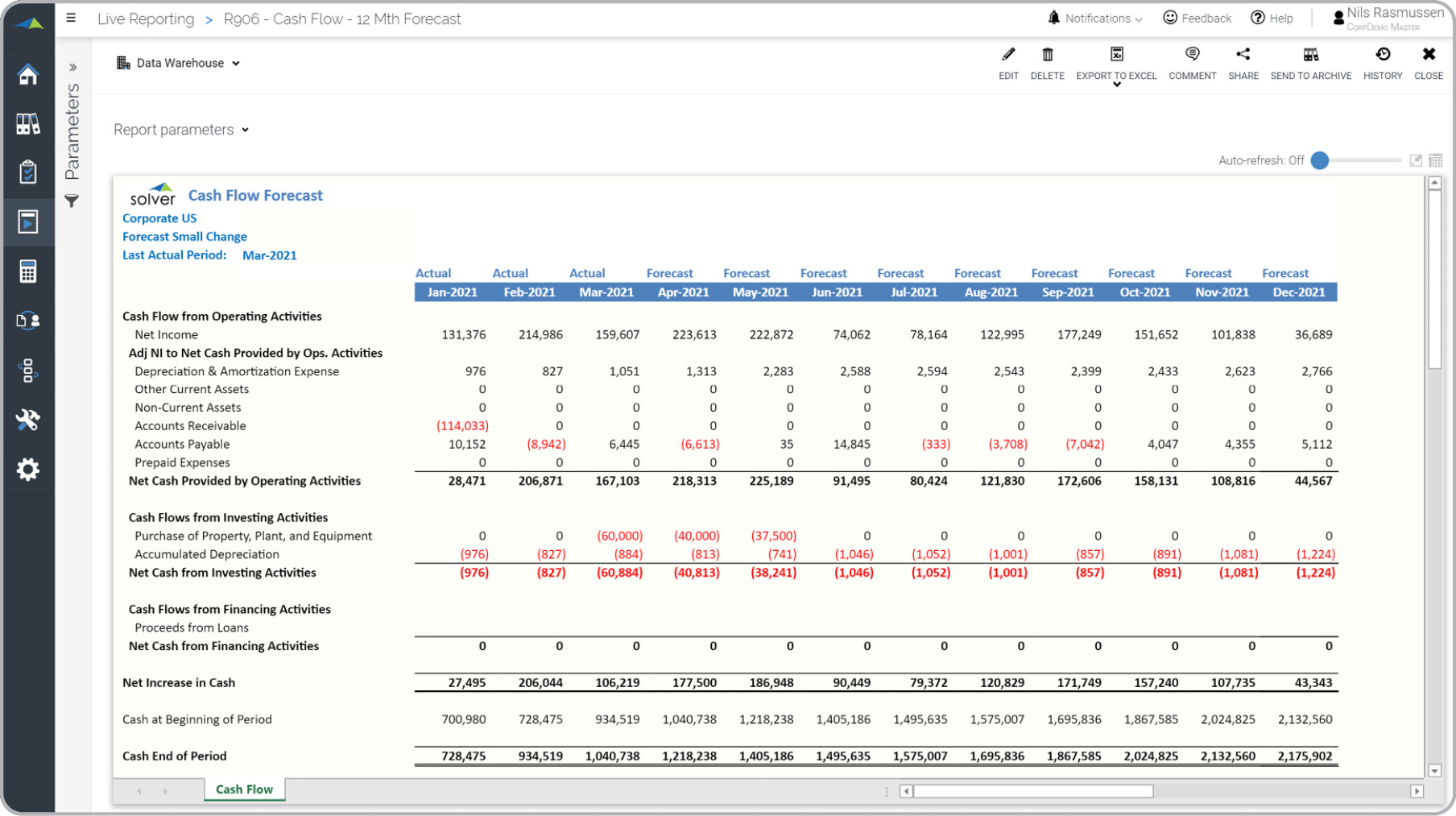

To calculate the closing balance, start with the opening balance and add the net cash inflows, adjusted for non-cash items, accruals, prepayments, changes in borrowings, and other adjustments made throughout the forecasting period. This cumulative figure represents the total cash available at a given point in time.

The closing balance is a critical indicator of a business’s financial strength and liquidity. It helps businesses assess their cash position and evaluate their ability to meet financial obligations, make necessary investments, and cover any potential shortfalls.

Regularly tracking and comparing the closing balance to the projected amounts can provide valuable insights into the accuracy of the cash flow forecast. If there are significant discrepancies or deviations between the projected closing balance and the actual cash position, businesses should review and analyze the underlying factors to understand the reasons behind these variations.

Accurate calculation of the closing balance is crucial for effective cash flow management and financial decision-making. It helps businesses evaluate their financial position, make informed investment or financing decisions, and adjust their strategies if necessary.

It is important to note that the closing balance on the cash flow forecast is an estimate and might not exactly match the actual cash position. External factors, unforeseen events, or changes in market conditions can impact the closing balance. Regular monitoring and updating of the cash flow forecast will help businesses better align their projections with the actual cash flow movements.

By calculating the closing balance and regularly reviewing it, businesses can gain valuable insights into their expected cash position and use this information to effectively manage their cash flow, optimize their financial resources, and make informed decisions that contribute to their overall financial health and success.

Conclusion

A cash flow forecast is an essential tool for businesses to project and manage their cash inflows and outflows. It provides valuable insights into the expected cash position, helping businesses make informed financial decisions, plan for future expenses, and ensure financial stability.

Throughout the process of working out the closing balance on a cash flow forecast, several key steps and considerations need to be taken into account. Starting with determining the opening balance, businesses add cash inflows and subtract cash outflows to calculate the net cash flow. They also account for non-cash items, accruals, prepayments, changes in borrowings, and other adjustments. Finally, by carefully calculating the closing balance, businesses gain a clear understanding of their expected cash position at the end of the forecast period.

The closing balance is a critical indicator of a business’s liquidity and financial health. It helps businesses evaluate their ability to meet financial obligations, make necessary investments, and sustain their operations. By incorporating other adjustments, such as changes in interest rates or legal regulations, businesses can further refine their cash flow forecast to accurately reflect the anticipated cash position.

Regular monitoring, updating, and adjusting of the cash flow forecast are necessary to ensure its accuracy and relevance. By doing so, businesses can align their projections with the actual cash flow movements and adapt their strategies accordingly.

In conclusion, understanding and working out the closing balance on a cash flow forecast is crucial for effective cash flow management and financial planning. By accurately projecting the expected cash position, businesses can make informed decisions, optimize their use of financial resources, and maintain financial stability and growth.