Finance

How To Check Credit Score Bank Of America App

Published: October 22, 2023

Check your credit score conveniently using the Bank of America app. Manage your finances with ease and stay on top of your financial standing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Downloading the Bank of America App

- Step 2: Logging In to Your Bank of America Account

- Step 3: Finding the Credit Score Section

- Step 4: Viewing Your Credit Score

- Step 5: Understanding Your Credit Score Information

- Step 6: Monitoring Changes in Your Credit Score

- Step 7: Taking Advantage of Credit Score Resources

- Conclusion

Introduction

Having a good credit score is crucial when it comes to managing your finances and achieving your financial goals. Whether you’re applying for a loan, a credit card, or even renting an apartment, your credit score plays a significant role in the decision-making process. It reflects your creditworthiness and how responsible you are with managing your debts. One of the most convenient ways to keep track of your credit score is through the Bank of America app.

In this article, we will guide you through the process of checking your credit score using the Bank of America app. With just a few easy steps, you’ll gain access to valuable information that will help you make informed financial decisions.

Bank of America is one of the largest banks in the United States, offering a wide range of financial services to millions of customers. Their user-friendly app provides a convenient platform to access your accounts, manage your finances, and stay on top of your credit score.

By checking your credit score regularly, you can identify areas for improvement, detect any discrepancies or errors in your credit report, and take proactive steps to maintain or improve your score. Additionally, the Bank of America app offers resources and tools to help you understand the factors that influence your credit score and provides tips on how to build and maintain healthy credit.

Let’s dive in and learn how to check your credit score using the Bank of America app, so you can take control of your financial future.

Step 1: Downloading the Bank of America App

The first step to checking your credit score with Bank of America is to download the Bank of America mobile banking app. The app is available for both iOS and Android devices and can be downloaded from the respective app stores.

Here’s how you can get started:

- Open the App Store on your iPhone or the Google Play Store on your Android device.

- Search for “Bank of America” in the search bar.

- Locate the official Bank of America app and tap on “Download” or “Install” to begin the download process.

- Once the app is downloaded, tap on the icon to open it.

- Follow the on-screen prompts to sign in or create a new Bank of America account if you don’t already have one.

- Set up any required security features, such as fingerprint or facial recognition login, to ensure your account remains secure.

Once you have successfully downloaded the Bank of America app and set up your account, you can proceed to the next step of checking your credit score.

Step 2: Logging In to Your Bank of America Account

After downloading and installing the Bank of America app, the next step is to log in to your Bank of America account. This will give you access to all the features and services offered by the app, including checking your credit score.

Here’s how you can log in to your Bank of America account:

- Open the Bank of America app on your device.

- On the login page, enter your Online ID and Passcode. If you haven’t set up an Online ID and Passcode yet, you may need to enroll in online banking first.

- Tap the “Sign In” button.

- Depending on your security settings, you may be prompted to provide additional verification, such as a one-time passcode sent to your registered mobile number or email address.

- Once you have successfully logged in, you will be directed to your Bank of America account dashboard.

It’s essential to keep your login credentials secure and never share them with anyone. If you suspect any unauthorized activity or believe your account may be compromised, contact Bank of America’s customer service immediately.

Now that you’re logged in to your Bank of America account, you’re ready to proceed to the next step and find the section where you can check your credit score.

Step 3: Finding the Credit Score Section

Once you are logged in to your Bank of America account on the app, the next step is to locate the section where you can check your credit score. The Bank of America app makes it easy to find this information, ensuring that you can quickly access your credit score and monitor it regularly.

To find the credit score section, follow these steps:

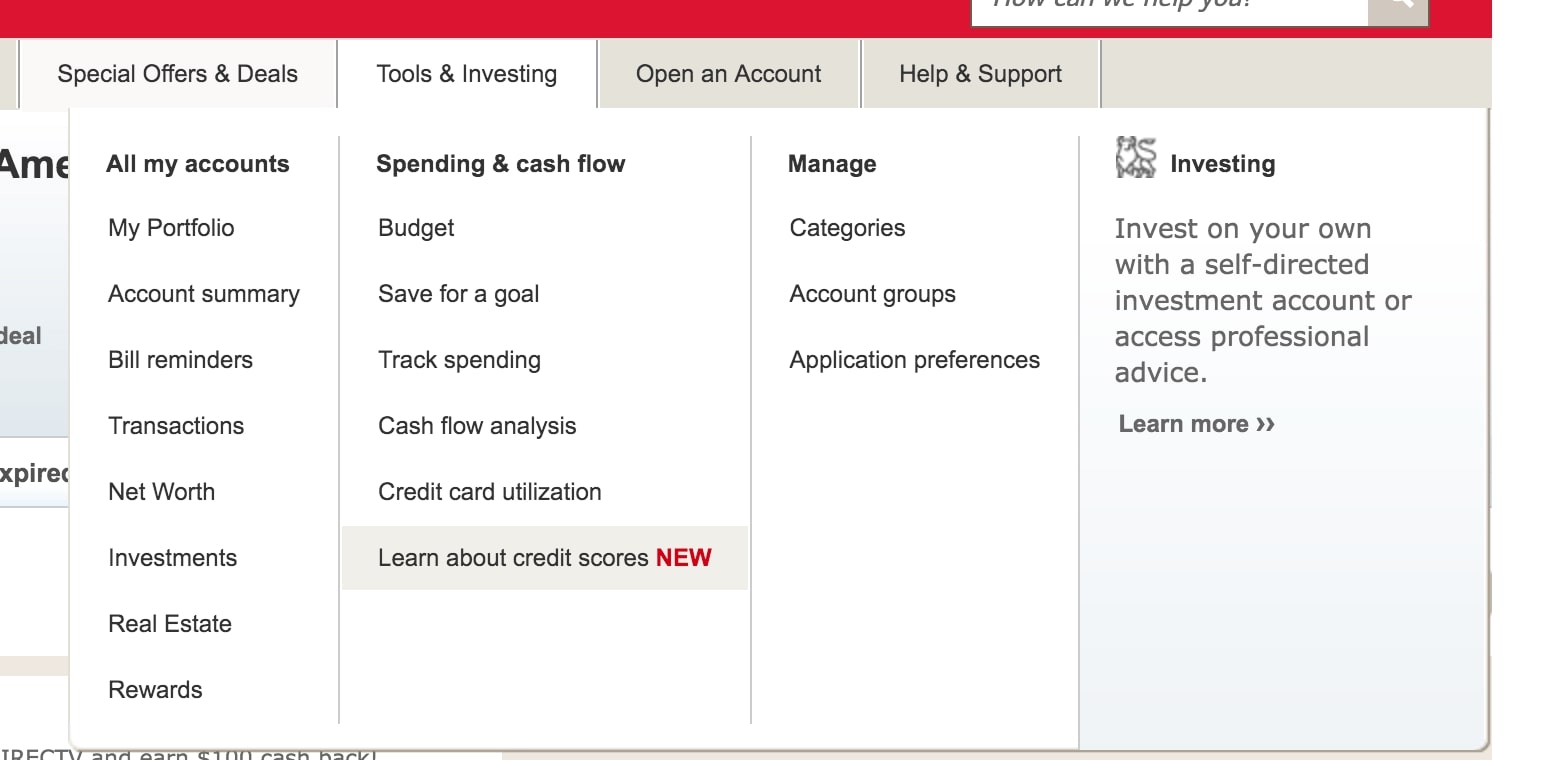

- On the Bank of America account dashboard, you will see a menu or navigation bar at the bottom or top of the screen. Tap on the “More” or “Menu” icon, which is typically represented by three horizontal lines or dots.

- In the menu, scroll or swipe through the options until you find “Credit Score” or “Credit Score & Report.” Tap on this option to proceed.

- Once you tap on the “Credit Score” section, you will be directed to a new page displaying your credit score and related information.

It’s worth noting that the exact location and labeling of the credit score section may vary slightly depending on the version of the Bank of America app you are using. If you have trouble finding it, you can refer to the app’s help section or contact Bank of America’s customer support for assistance.

Now that you have found the credit score section within the Bank of America app, you are ready to proceed to the next step and view your credit score.

Step 4: Viewing Your Credit Score

After finding the credit score section in the Bank of America app, you are just a few steps away from viewing your credit score. Bank of America provides you with a clear and easy-to-understand interface to access your credit score information.

To view your credit score, follow these steps:

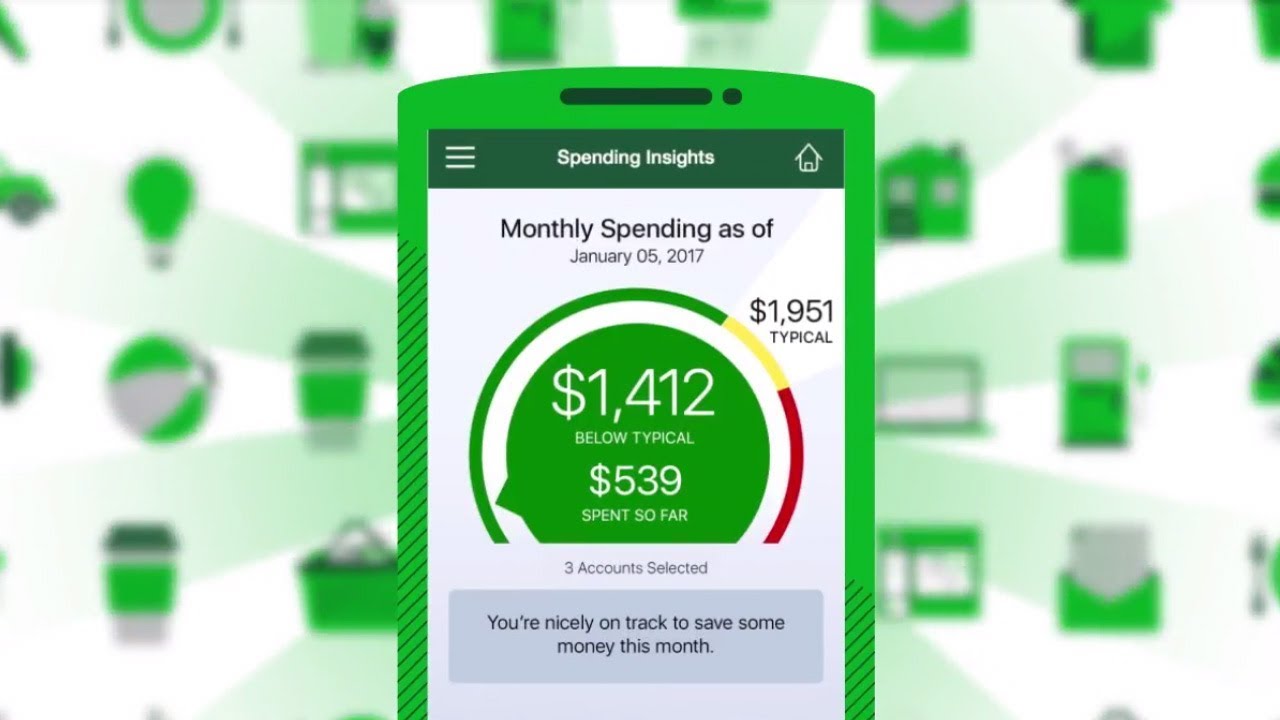

- Once you are in the credit score section of the app, you will see your credit score prominently displayed on the screen. It is typically shown at the top of the page, along with any relevant score ranges or grading.

- Take a moment to review your credit score. This number typically falls within the range of 300 to 850, with higher scores indicating better creditworthiness.

- Beneath your credit score, you may find additional information like the date the score was last updated or any factors affecting your score.

- Scroll down the page to explore more details about your credit score, such as your credit utilization ratio, payment history, and any potential negative marks or derogatory accounts.

- If you wish to see a more comprehensive credit report or delve deeper into the factors influencing your credit score, you may have the option to access a full credit report or additional insights provided by Bank of America. These features can help you gain valuable insights into your credit history and identify areas for improvement.

By regularly viewing your credit score through the Bank of America app, you can stay informed about your financial standing and make well-informed decisions regarding your credit and finances.

Now that you have successfully viewed your credit score, let’s move on to the next step and understand the information provided in more detail.

Step 5: Understanding Your Credit Score Information

Once you have viewed your credit score in the Bank of America app, it’s important to understand the information presented to you. Your credit score provides valuable insights into your creditworthiness and can help you assess your financial health. Bank of America strives to make this information understandable and relevant to you.

Here are some key aspects to consider when understanding your credit score information:

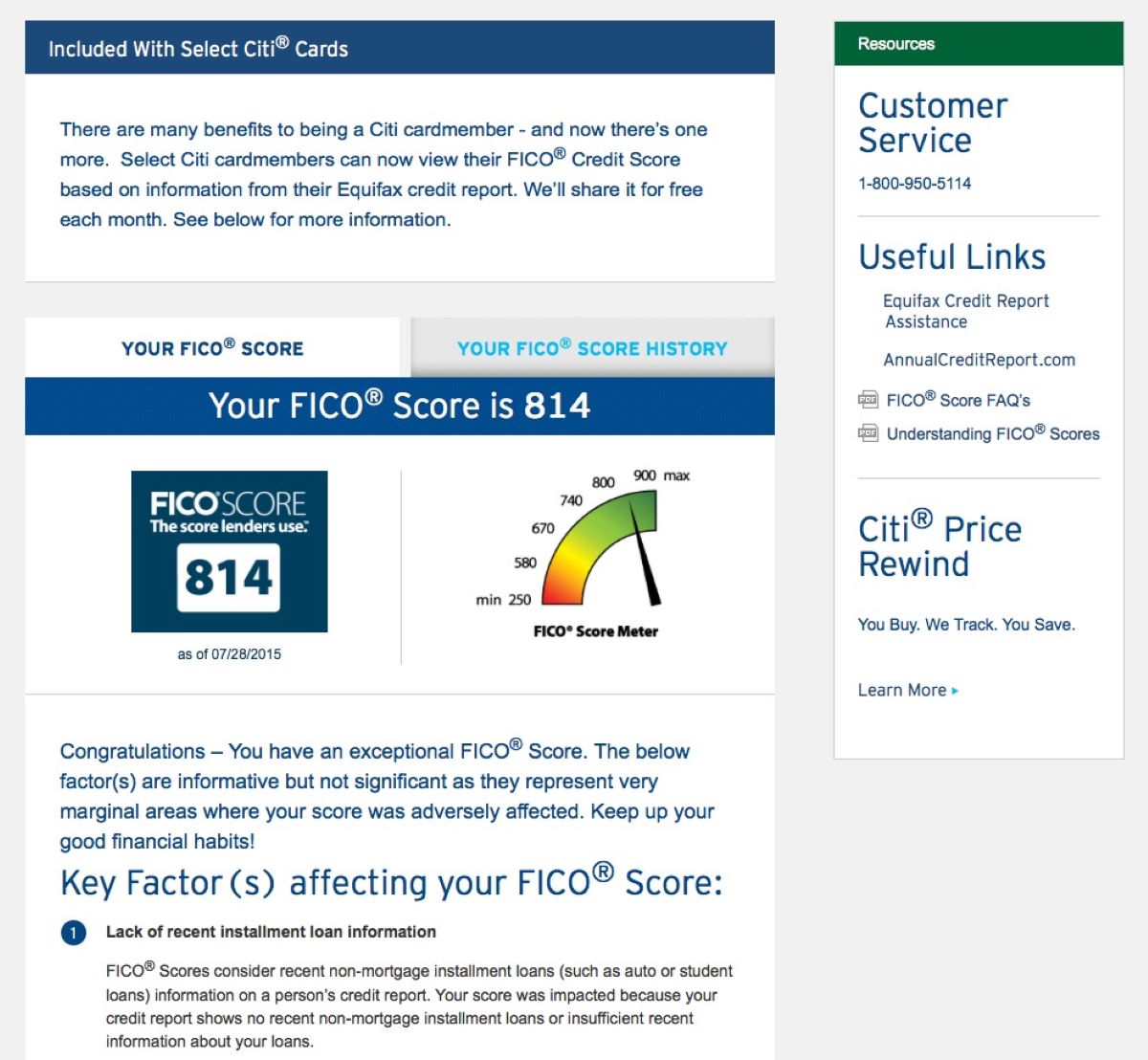

- Credit Score Range: Your credit score is typically displayed as a number ranging from 300 to 850. The higher the number, the better your overall creditworthiness. Bank of America may also provide you with a corresponding grade or range to help you interpret your score at a glance.

- Credit Score Factors: The Bank of America app may highlight the key factors impacting your credit score. These factors can include payment history, credit utilization, length of credit history, credit mix, and any negative marks or derogatory accounts. Understanding these factors will give you insights into areas where you can make improvements to boost your credit score.

- Comparison to National Average: Bank of America may provide a comparison of your credit score to the national average to offer context. This can help you gauge how your credit score stacks up against others in the country.

- Trends and Changes: The Bank of America app may also display any recent changes or trends in your credit score. This can be helpful in tracking improvements or identifying any potential issues that may be affecting your score.

- Additional Insights: Depending on the features and resources offered by Bank of America, you may have access to additional insights and information about your credit score. This can include personalized tips, educational resources, or tools to help you manage and improve your credit.

Understanding your credit score and the factors that contribute to it is essential to make informed decisions about your financial well-being. By utilizing the information provided by the Bank of America app, you can take proactive steps to improve your credit score and maintain healthy credit habits.

With a clear understanding of your credit score information, let’s proceed to the next step and explore how you can monitor changes in your credit score effectively.

Step 6: Monitoring Changes in Your Credit Score

Monitoring changes in your credit score is essential for staying on top of your financial health. The Bank of America app provides you with the tools and resources to effectively track and monitor any fluctuations or updates to your credit score over time.

Here’s how you can monitor changes in your credit score using the Bank of America app:

- Regular Check-Ins: Make it a habit to check your credit score periodically through the app. This will allow you to stay informed about any changes, positive or negative, in your creditworthiness.

- Alert Notifications: Enable push notifications within the Bank of America app to receive alerts whenever there are significant changes to your credit score. This will help you stay proactive in addressing any potential issues promptly.

- Trend Analysis: Take advantage of any trend analysis features provided by Bank of America. These tools can help you identify patterns or changes in your credit score over time, giving you a better understanding of your credit behavior and any areas that require attention.

- Track Credit Factors: Keep an eye on the specific factors that impact your credit score, such as payment history or credit utilization. Monitoring these factors can help you make adjustments to your financial habits and improve your overall creditworthiness.

- Utilize Credit Monitoring Services: Bank of America may offer additional credit monitoring services through the app. These services can provide comprehensive monitoring of your credit activity, including alerts for any new inquiries, account openings, or potential fraudulent activity.

By actively monitoring changes in your credit score, you can quickly identify any potential issues, such as identity theft or errors in your credit report. It also allows you to take prompt action to address any negative impacts and work towards improving your credit score over time.

Now that you know how to monitor changes in your credit score using the Bank of America app, let’s move on to the final step and explore the additional resources and advantages available to you.

Step 7: Taking Advantage of Credit Score Resources

Bank of America offers various resources and advantages to help you make the most of your credit score information. By taking advantage of these resources, you can gain a deeper understanding of your credit and make informed decisions about your financial well-being.

Here’s how you can make the most of the credit score resources provided by Bank of America:

- Educational Materials: Explore the educational materials and resources available within the Bank of America app. These materials can provide valuable insights into credit management, credit score improvement strategies, and tips for maintaining healthy financial habits.

- Guidance and Tips: Bank of America may offer personalized guidance and tips based on your credit score profile. These recommendations can help you understand the specific actions you can take to improve your credit score and overall financial health.

- Credit Building Tools: Some banking apps provide credit-building tools, such as secured credit cards or credit-building loans. These tools can help you establish or rebuild credit if you have a limited credit history or a low credit score.

- Financial Planning: Bank of America may offer financial planning resources within the app. These resources can help you create a comprehensive plan for managing your finances, setting financial goals, and improving your credit over time.

- Proactive Alerts: Enable proactive alerts within the Bank of America app to receive notifications about potential credit score improvements or actions you can take to maintain healthy credit. These alerts can help you stay on track with your financial goals.

By utilizing these credit score resources and advantages, you can take control of your credit and make informed decisions that contribute to your long-term financial success. Bank of America aims to provide you with the tools and guidance necessary to manage and improve your credit score effectively.

Now that you know how to take advantage of the credit score resources offered by Bank of America, let’s wrap up this guide and recap the importance of regularly checking your credit score.

Conclusion

Checking your credit score is an essential part of managing your finances and understanding your creditworthiness. With the Bank of America app, keeping track of your credit score has never been easier. By following the steps outlined in this guide, you can quickly and conveniently access your credit score information and gain valuable insights into your financial health.

Regularly checking your credit score through the Bank of America app allows you to monitor changes, identify potential issues, and make informed decisions about your credit and financial well-being. Understanding the factors that contribute to your credit score and utilizing the resources and advantages provided by Bank of America can help you improve your credit over time.

Remember, your credit score is not set in stone. By practicing responsible financial habits, such as making timely payments, keeping your credit utilization low, and monitoring your credit activity, you can positively impact your credit score and open doors to better financial opportunities.

Use the Bank of America app as a powerful tool to stay on top of your credit score, improve your financial knowledge, and take control of your financial future. Take advantage of the educational resources, guidance, and proactive alerts provided to help you make informed decisions regarding your credit and overall financial health.

Now that you are equipped with the knowledge of how to check your credit score with the Bank of America app, it’s time for you to take action. Download the app, log in to your Bank of America account, and start monitoring your credit score regularly. Your financial journey begins with understanding your credit, and the Bank of America app is your partner in achieving your financial goals.