Finance

How To Check My US Bank Credit Score

Published: October 22, 2023

Learn how to check your US Bank credit score and stay on top of your finances. Find out your creditworthiness with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why is your credit score important?

- How does your credit score affect your financial life?

- What factors determine your credit score?

- How can you check your US bank credit score?

- Option 1: Contact your bank

- Option 2: Use online banking services

- Option 3: Utilize credit monitoring apps or websites

- Option 4: Request a free credit report

- Option 5: Consider credit counseling agencies

- Conclusion

Introduction

Welcome to the world of credit scores and financial fitness! It’s no secret that your credit score plays a vital role in your financial life. Whether you’re looking to apply for a loan, rent an apartment, or even get a job, your credit score is often taken into consideration by lenders, landlords, and employers. For US bank account holders, keeping track of their credit score is essential for making informed financial decisions and understanding their overall financial health.

In this article, we will explore the importance of checking your US bank credit score and how it can impact your financial well-being. We will also delve into the various factors that contribute to your credit score, providing you with a comprehensive understanding of what lenders look for when evaluating your creditworthiness.

Additionally, we will discuss different methods to check your US bank credit score, ranging from contacting your bank directly to utilizing online banking services or credit monitoring apps. We will explore each option in detail, outlining the steps you need to take to access your credit score information.

Moreover, we will highlight the importance of requesting a free credit report and considering credit counseling agencies for a more holistic approach to managing and improving your credit health. By the end of this article, you will have a clear understanding of how to check your US bank credit score and be better equipped to make educated financial decisions.

Why is your credit score important?

Your credit score serves as a snapshot of your creditworthiness and financial stability. Lenders, landlords, and even potential employers often refer to your credit score to assess your ability to manage financial obligations responsibly. Here are a few key reasons why your credit score is important:

1. Borrowing Power: A good credit score can unlock better borrowing opportunities. It not only determines whether you qualify for loans, such as mortgages, auto loans, or personal loans, but also affects the interest rates and terms you may be offered. A higher credit score can help you secure lower interest rates, resulting in significant savings over the life of the loan.

2. Apartment Rentals: Landlords typically run credit checks on prospective tenants to evaluate their financial reliability. A higher credit score can increase your chances of getting approved for a rental property, as it demonstrates your ability to pay rent on time.

3. Utility Services: Some utility providers may require a credit check when establishing new service or upgrading your existing service. Your credit score can impact whether you are required to pay a deposit or provide a guarantor.

4. Insurance Premiums: Believe it or not, your credit score can affect your insurance premiums. Insurance companies often use credit-based insurance scores to assess the risk of insuring an individual. A lower credit score may result in higher premiums for auto, home, or even life insurance.

5. Employment Opportunities: Certain employers, particularly those in the financial industry, may review your credit history as part of their hiring process. While they won’t see your actual credit score, they may assess your financial responsibility and ability to handle job-related tasks that involve money management.

6. Financial Peace of Mind: Maintaining a good credit score can provide peace of mind and financial security. It reflects your overall financial health, shows that you are responsible with credit, and allows you to qualify for better financial opportunities when needed.

By understanding the importance of your credit score, you can take proactive steps to build and maintain a healthy credit profile. It is crucial to regularly check your credit score to monitor any potential issues and ensure its accuracy, empowering you to make informed financial decisions for a brighter and more secure future.

How does your credit score affect your financial life?

Your credit score has a significant impact on various aspects of your financial life. It not only determines your eligibility for loans and credit cards but also influences the terms and interest rates you are offered. Here are some ways in which your credit score can affect your financial life:

1. Loan Approvals: Lenders use your credit score to evaluate the risk of lending to you. A high credit score indicates that you have a history of responsible credit behavior, making you a favorable candidate for loan approvals. Conversely, a low credit score may lead to loan rejections or higher interest rates.

2. Interest Rates: Your credit score is directly correlated to the interest rates you’re offered on loans and credit cards. A higher credit score translates to lower interest rates, which can save you thousands of dollars in interest payments over time.

3. Credit Card Applications: When you apply for a credit card, the issuer assesses your credit score to determine your creditworthiness. A higher credit score increases your chances of approval and may lead to more favorable credit card terms, such as higher credit limits and lower interest rates.

4. Mortgage Financing: Buying a home is a significant financial decision, and your credit score plays a crucial role in securing a mortgage. Lenders rely heavily on credit scores to determine whether you qualify for a mortgage and the interest rate you will be offered.

5. Car Loans: Your credit score impacts the interest rates and terms you receive when financing a vehicle. A higher credit score may result in lower monthly payments and less interest paid over the life of the loan.

6. Insurance Premiums: Insurance companies often consider your credit score when setting premiums for auto, home, or renters insurance. A lower credit score could result in higher premiums, while a higher credit score may qualify you for lower insurance rates.

7. Job Opportunities: Certain employers, particularly those in the finance sector, may review your credit history as part of the hiring process. While they can’t access your actual credit score, your credit history may influence their decision, especially for roles involving financial responsibility.

8. Utility Services: Utility companies may review your credit score before providing services or setting up accounts. A low credit score may require you to provide a deposit or pay higher fees for services.

Understanding how your credit score affects your financial life is crucial for making informed decisions. By maintaining a good credit score, you can enjoy access to better loan terms, lower interest rates, and more opportunities for financial growth. Regularly monitoring your credit score allows you to identify areas for improvement and take actions to build and maintain a strong credit profile.

What factors determine your credit score?

Your credit score is a numerical representation of your creditworthiness and is influenced by several factors. While the specific algorithms used by credit scoring models can vary, there are common factors that generally determine your credit score. These factors include:

1. Payment History: This is the most crucial factor in determining your credit score. It reflects whether you make your payments on time, including credit card bills, loan installments, and other debts. Late or missed payments can significantly impact your credit score negatively.

2. Credit Utilization: This refers to the amount of credit you are currently using compared to your total available credit. High credit utilization, especially above 30% of your total credit limit, can lower your credit score. Lenders prefer to see a lower utilization rate as it indicates responsible credit management.

3. Credit History Length: The length of your credit history is another important factor. Lenders like to see a longer credit history as it provides a more comprehensive view of your borrowing habits and payment patterns.

4. Types of Credit: Having a diverse mix of credit accounts, such as credit cards, mortgages, and loans, can positively impact your credit score. It demonstrates your ability to handle different types of credit responsibly.

5. New Credit Applications: Each time you apply for new credit, a hard inquiry is recorded on your credit report. Multiple recent credit inquiries can be seen as a red flag, potentially lowering your credit score. It’s important to be selective and avoid applying for too much credit within a short period.

6. Credit Account Age: The average age of your credit accounts is considered when calculating your credit score. A longer average account age shows stability and can positively impact your score.

7. Public Records and Collections: Negative public records, such as bankruptcies, foreclosures, and collections, can significantly lower your credit score. It’s crucial to maintain a clean credit history by avoiding these issues.

It’s important to note that different credit scoring models may weigh these factors differently, resulting in variations in your credit score from one model to another. Additionally, factors like income, employment history, and assets don’t directly impact your credit score, although lenders may consider them when evaluating your creditworthiness.

Understanding the factors that determine your credit score allows you to focus on improving the areas that may be negatively impacting your score. By practicing responsible credit management, paying bills on time, and keeping your credit utilization low, you can gradually improve your credit score and enhance your overall financial well-being.

How can you check your US bank credit score?

Checking your US bank credit score is a crucial step in monitoring your financial health and ensuring the accuracy of your credit profile. Here are several methods you can use to access your credit score:

Option 1: Contact your bank: Your first option is to reach out to your US bank directly to inquire about accessing your credit score. They may have resources available for account holders to check their credit scores or provide guidance on how to obtain this information.

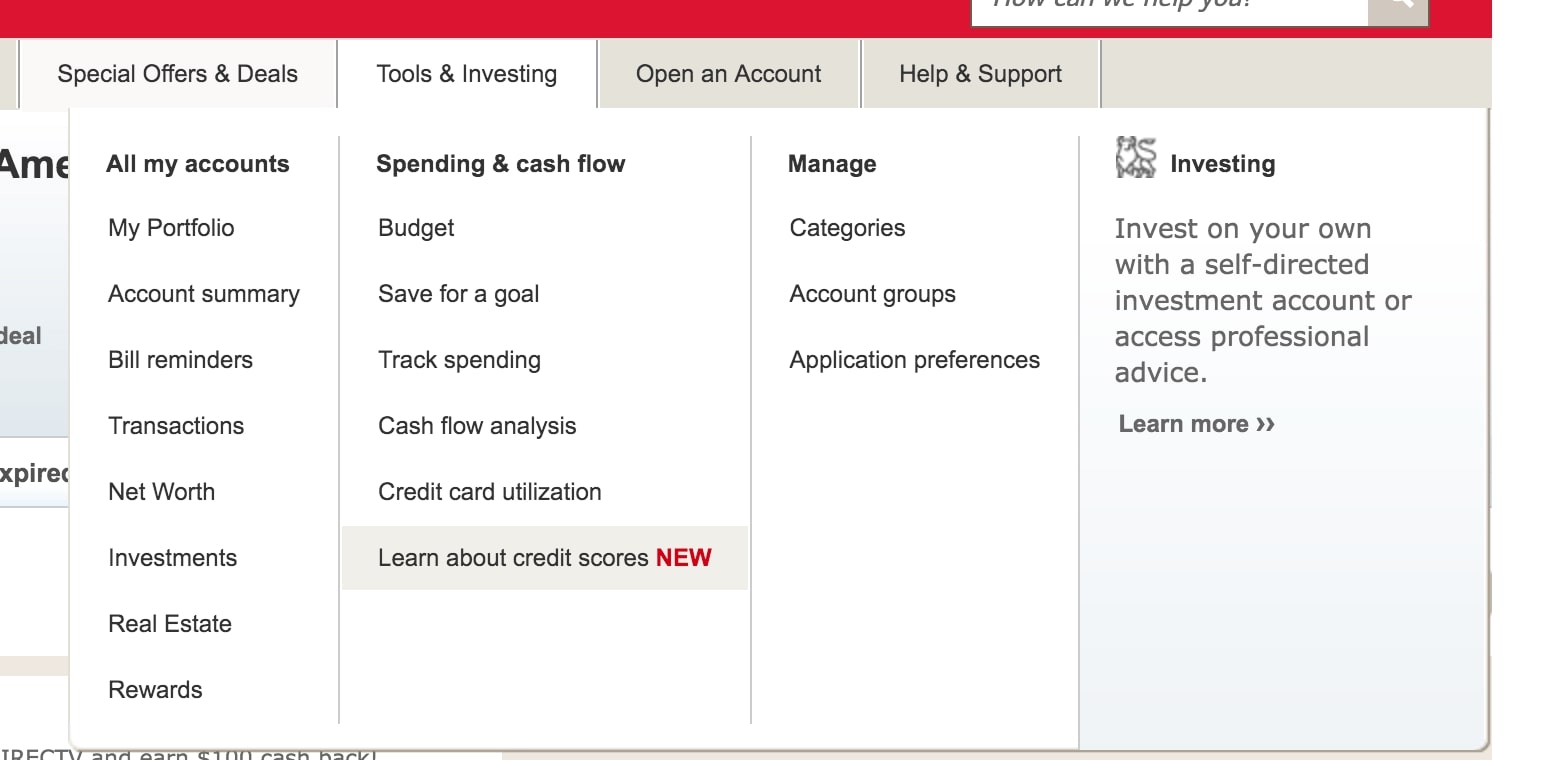

Option 2: Use online banking services: Many US banks offer online banking services that include access to your credit score. Log in to your online banking account and look for a section dedicated to your credit score or credit monitoring. This feature provides a convenient and instant way to check your credit score regularly.

Option 3: Utilize credit monitoring apps or websites: There are various credit monitoring apps and websites available that provide access to your credit score. These platforms often offer additional features, such as credit alerts, personalized recommendations, and credit history tracking. Some popular options include Credit Karma, Credit Sesame, and FreeCreditScore.com.

Option 4: Request a free credit report: The Fair Credit Reporting Act entitles you to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. You can visit AnnualCreditReport.com to request your free credit report. Although this report does not include your credit score, it allows you to review your credit history in detail and identify any potential errors or discrepancies.

Option 5: Consider credit counseling agencies: Credit counseling agencies can provide assistance in managing your credit and improving your credit score. Some agencies offer credit monitoring services as part of their programs, which may include access to your credit score. These agencies can also provide guidance on how to effectively manage your debt and establish healthy credit habits.

It’s important to note that while these methods can provide you with access to your credit score, the scores you receive may not necessarily be the exact same scores used by lenders. Each lender may use different scoring models, so the numbers may vary slightly. However, monitoring your credit score regularly using these methods will still give you a good indication of your overall credit health and allow you to address any issues that may arise.

By regularly checking your US bank credit score, you can stay informed about your financial standing, identify potential discrepancies, and take appropriate actions to improve or maintain a healthy credit profile.

Option 1: Contact your bank

The first and most direct way to check your US bank credit score is to contact your bank directly. Many banks offer resources and services that allow their account holders to access their credit scores. Here are the steps to take when choosing this option:

1. Reach out to your bank: Contact your bank’s customer service department via phone, email, or online messaging to inquire about checking your credit score. Provide them with the necessary details, such as your account information and identification, to authenticate your request.

2. Ask about available resources: Once you have connected with a representative, ask about any available resources or services that allow you to access your credit score through your bank’s website or mobile banking app. Some banks have partnerships with credit bureaus or credit monitoring agencies that provide this information to their customers.

3. Follow the provided instructions: If your bank offers credit score access, the representative will guide you through the necessary steps to access your credit score. This may involve registering for specific services or activating a credit monitoring feature within your online banking account.

4. Review your credit score: Once you have gained access to your credit score through your bank’s provided resources, take the time to review and understand the information presented. Pay attention to your credit score number, any factors affecting your score, and any alerts or notifications associated with your credit profile.

5. Utilize additional features: Some banks offer additional features alongside credit score access, such as credit monitoring alerts, personalized recommendations, or educational resources to help improve your credit health. Explore and take advantage of these features to maximize the benefits of checking your credit score through your bank.

It’s important to note that not all banks offer credit score access as a standard feature. Some may provide it only for certain account types or charge a fee for accessing this information. Therefore, it’s essential to reach out to your bank to inquire about their specific offerings and any associated costs.

Checking your credit score through your bank can be a convenient and reliable option, as it allows you to access all your financial information in one place. By utilizing this option, you can stay informed about your credit health and take the necessary steps to maintain or improve your credit profile. Remember to regularly check your credit score to stay updated on any changes or potential issues that may arise.

Option 2: Use online banking services

If you prefer a more convenient and immediate way to check your US bank credit score, using your bank’s online banking services is a great option. Many banks now offer credit score monitoring as part of their online banking platforms. Here’s how you can check your credit score using online banking services:

1. Login to your online banking account: Visit your bank’s website or open their mobile banking app and log in to your online banking account using your username and password.

2. Navigate to the credit score section: Once logged in, look for a section related to your credit score or credit monitoring. This section may be prominently displayed on the main dashboard or located within account settings or financial tools.

3. Verify your identity: Depending on the security measures employed by your bank, you may need to provide additional authentication, such as answering security questions or entering a one-time passcode sent to your registered email or phone number.

4. Access your credit score: After verifying your identity, you should be able to access your credit score information. The score will typically be displayed along with relevant details, such as the factors influencing your score and a historical overview of your credit profile.

5. Explore additional features: Some online banking platforms offer additional features alongside credit score access. These features may include credit monitoring alerts, credit education resources, or personalized recommendations to help you improve your credit health. Take advantage of these resources to gain a better understanding of your credit and make informed financial decisions.

6. Regularly monitor your credit score: Make it a habit to check your credit score regularly using your bank’s online banking services. This will help you stay updated on any changes to your credit profile and allow you to identify and address any potential issues or errors promptly.

Remember, not all banks offer credit score monitoring as part of their online banking services, or they may require enrollment in specific programs or services. If you are unsure whether your bank offers this feature, reach out to their customer service for clarification.

Using online banking services to check your credit score provides a convenient and accessible option. It allows you to integrate your credit monitoring with your existing banking activities, making it easier to stay on top of your financial well-being. Take advantage of this option to regularly monitor your credit score and make informed decisions about your financial future.

Option 3: Utilize credit monitoring apps or websites

If you prefer a more independent and comprehensive approach to checking your US bank credit score, utilizing credit monitoring apps or websites is an excellent option. These platforms offer various features that not only provide access to your credit score but also offer additional tools to help you manage and improve your credit health. Here’s how you can check your credit score using credit monitoring apps or websites:

1. Research reputable credit monitoring apps or websites: Start by researching and identifying reputable credit monitoring apps or websites. Look for platforms with positive user reviews, a solid reputation, and features that align with your specific needs and preferences.

2. Download the app or visit the website: Once you have selected a credit monitoring app or website, download the app from your preferred app store or visit the website through your internet browser.

3. Create an account: Sign up and create an account by providing the required information, such as your name, email address, and sometimes your Social Security Number. Make sure to choose a secure password to protect your personal information.

4. Link your bank accounts: To access your US bank credit score, you may need to link your bank accounts or provide necessary authorization. Follow the instructions provided by the app or website to securely connect your bank accounts.

5. Complete the verification process: Some credit monitoring apps or websites may require additional identity verification steps. This could include answering personal questions based on your credit history to ensure that you are the rightful owner of the account.

6. Access your credit score: Once your account is set up and verified, you should be able to access your credit score. The app or website should display not only your credit score but also provide details about the factors influencing your score and any available credit history information.

7. Explore additional features: Credit monitoring apps and websites often offer additional features to help you better understand and manage your credit health. These features may include credit alerts, credit history tracking, financial goal setting, and educational resources. Take the time to explore these features and utilize them to improve your credit knowledge and financial well-being.

8. Regularly monitor your credit score: With credit monitoring apps or websites, you can frequently check your credit score to stay informed about any changes or potential issues. Regular monitoring allows you to address any discrepancies or errors and take proactive steps to improve your credit health.

It’s essential to research and choose credit monitoring apps or websites from reputable sources to ensure the security and accuracy of your credit information. Additionally, be aware of any associated costs or subscription fees that may be required for continued access to your credit score or additional features.

Utilizing credit monitoring apps or websites provides a comprehensive and independent way to monitor your US bank credit score. These platforms offer valuable insights into your credit health and empower you to take control of your financial well-being. Make it a habit to regularly check your credit score and leverage the additional tools and resources provided to make informed decisions and improve your financial future.

Option 4: Request a free credit report

If you prefer a more detailed overview of your credit history along with your US bank credit score, requesting a free credit report is a valuable option. By law, you are entitled to receive a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. Here’s how you can request your free credit report:

1. Visit AnnualCreditReport.com: Start by visiting the official website, AnnualCreditReport.com, to access your free credit reports. This is the only authorized platform for obtaining your annual credit reports from the major credit bureaus.

2. Click “Request your free credit reports”: On the homepage, you’ll find a prominent button or link that says “Request your free credit reports.” Click on it to initiate the process.

3. Provide your personal information: You will be asked to provide basic information, including your name, date of birth, Social Security Number, and current address. This information is necessary to verify your identity and ensure that the credit reports are obtained by the rightful owner.

4. Select the credit bureaus: You can choose to request credit reports from one, two, or all three of the major credit bureaus. It’s generally recommended to request reports from all three to obtain a comprehensive overview of your credit history.

5. Answer security questions: To further authenticate your request, you may be asked a series of security questions to confirm your identity. These questions are based on information from your credit history and may include inquiries about previous addresses or loan accounts. Answer these questions to proceed with your request.

6. Review and download your credit reports: Once your identity is confirmed, you’ll have access to your credit reports from the selected credit bureaus. Review each report carefully, paying attention to account information, payment history, and any discrepancies or errors.

7. Check for your credit score: While the free credit report does not include your credit score, you may have the option to purchase your credit score from the credit bureaus’ websites or opt for free credit score services offered on certain platforms.

By requesting your free credit report, you can obtain a comprehensive view of your credit history, including information on loans, credit cards, and payment history. It allows you to identify any errors, spot fraudulent activities, and gain insights into your overall credit health.

Remember to stagger your requests throughout the year to ensure regular monitoring of your credit reports. For example, you can request a report from one credit bureau every four months. This maximizes your ability to monitor for changes or discrepancies in your credit history.

Regularly reviewing your credit reports helps you stay informed and take necessary actions to maintain or improve your creditworthiness, ensuring a solid financial foundation.

Option 5: Consider credit counseling agencies

If you’re looking for professional guidance and support in managing your US bank credit score, considering credit counseling agencies is an excellent option. These agencies specialize in providing personalized financial counseling and can offer valuable insights and strategies to help you improve and maintain a healthy credit profile. Here’s how credit counseling agencies can assist you:

1. Research reputable credit counseling agencies: Start by researching and identifying reputable credit counseling agencies. Look for agencies that are accredited by recognized organizations and have positive reviews from clients. Make sure to choose a nonprofit agency, as they have a commitment to providing unbiased advice and assistance.

2. Consult with a credit counselor: Schedule a consultation with a credit counselor from the chosen agency. During the consultation, you can discuss your financial situation, credit concerns, and specific goals you want to achieve.

3. Review your credit profile: The credit counselor will analyze your credit profile, which may include reviewing your credit reports from the major credit bureaus. They will be able to identify any red flags, errors, or negative factors impacting your credit score.

4. Create a personalized action plan: Based on the analysis of your credit profile, the credit counselor will work with you to create a personalized action plan. This plan may include steps to improve your credit score, such as paying off debts, establishing a budget, and developing healthy credit habits.

5. Receive ongoing support and education: Credit counseling agencies provide ongoing support and education to help you navigate the complexities of credit management. They can offer resources, workshops, and educational materials to enhance your financial knowledge and empower you to make informed decisions moving forward.

6. Utilize credit monitoring services: Some credit counseling agencies offer credit monitoring services as part of their programs. These services may include access to your credit score, alerts for any changes in your credit profile, and guidance on how to address issues or discrepancies.

7. Follow the recommended strategies: It’s essential to follow the strategies and recommendations provided by the credit counselor. Stick to the action plan, make timely payments, reduce debt, and practice responsible credit behavior. By following their guidance, you can gradually improve your credit score over time.

Working with a credit counseling agency provides you with expert guidance and support in managing your credit. They can help you develop a solid financial plan, provide solutions for overcoming debt, and offer strategies to rebuild your creditworthiness. By taking advantage of their resources and expertise, you can take control of your financial future and achieve long-term financial success.

It’s important to note that while credit counseling agencies can be immensely helpful, it’s crucial to choose a reputable and trustworthy agency. Do your research, read reviews, and ensure that the agency is accredited and has a proven track record of assisting clients in improving their credit health.

Conclusion

Your US bank credit score plays a significant role in your financial life, impacting your ability to secure loans, rent an apartment, and even land a job. It’s crucial to check your credit score regularly to monitor your financial health and ensure accuracy in your credit profile. By doing so, you can take proactive steps to maintain a good credit score or work towards improving it.

There are several options available to check your US bank credit score. You can start by contacting your bank directly to inquire about accessing your credit score or utilize online banking services that often provide this feature. Credit monitoring apps or websites also offer convenient ways to access your credit score and provide additional tools for credit management.

For a more comprehensive view of your credit history, you can request free credit reports from the major credit bureaus once a year through AnnualCreditReport.com. Additionally, considering credit counseling agencies can provide professional guidance, personalized action plans, and ongoing support to help you navigate the complexities of credit management and improve your credit health.

No matter which option you choose, regular monitoring of your credit score is crucial. It allows you to identify any issues, errors, or discrepancies in your credit profile, enabling you to take appropriate measures to address them. By maintaining a good credit score, you can unlock better borrowing opportunities, secure favorable interest rates, and enjoy financial peace of mind.

Remember that building and maintaining a healthy credit score takes time and effort. It requires responsible credit behavior, such as making timely payments, keeping credit utilization low, and managing debt effectively. Take advantage of the resources available to you, such as credit counseling agencies and educational materials, to enhance your financial knowledge and make informed decisions.

By staying attentive to your US bank credit score and actively managing your credit health, you can position yourself for financial success and achieve your future goals with confidence.