Finance

How To Check If I Have Gap Insurance

Published: November 15, 2023

Discover the easy steps to check if you have gap insurance and secure your finances today. Ensure your vehicle's protection with quick and reliable methods.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Gap Insurance?

- Why Do I Need Gap Insurance?

- How Can I Check If I Have Gap Insurance?

- Method 1: Reviewing Your Insurance Policy

- Method 2: Contacting Your Insurance Provider

- Method 3: Checking Your Vehicle Purchase Documentation

- Method 4: Consulting Your Loan or Lease Agreement

- Method 5: Utilizing Online Insurance Tools

- Conclusion

Introduction

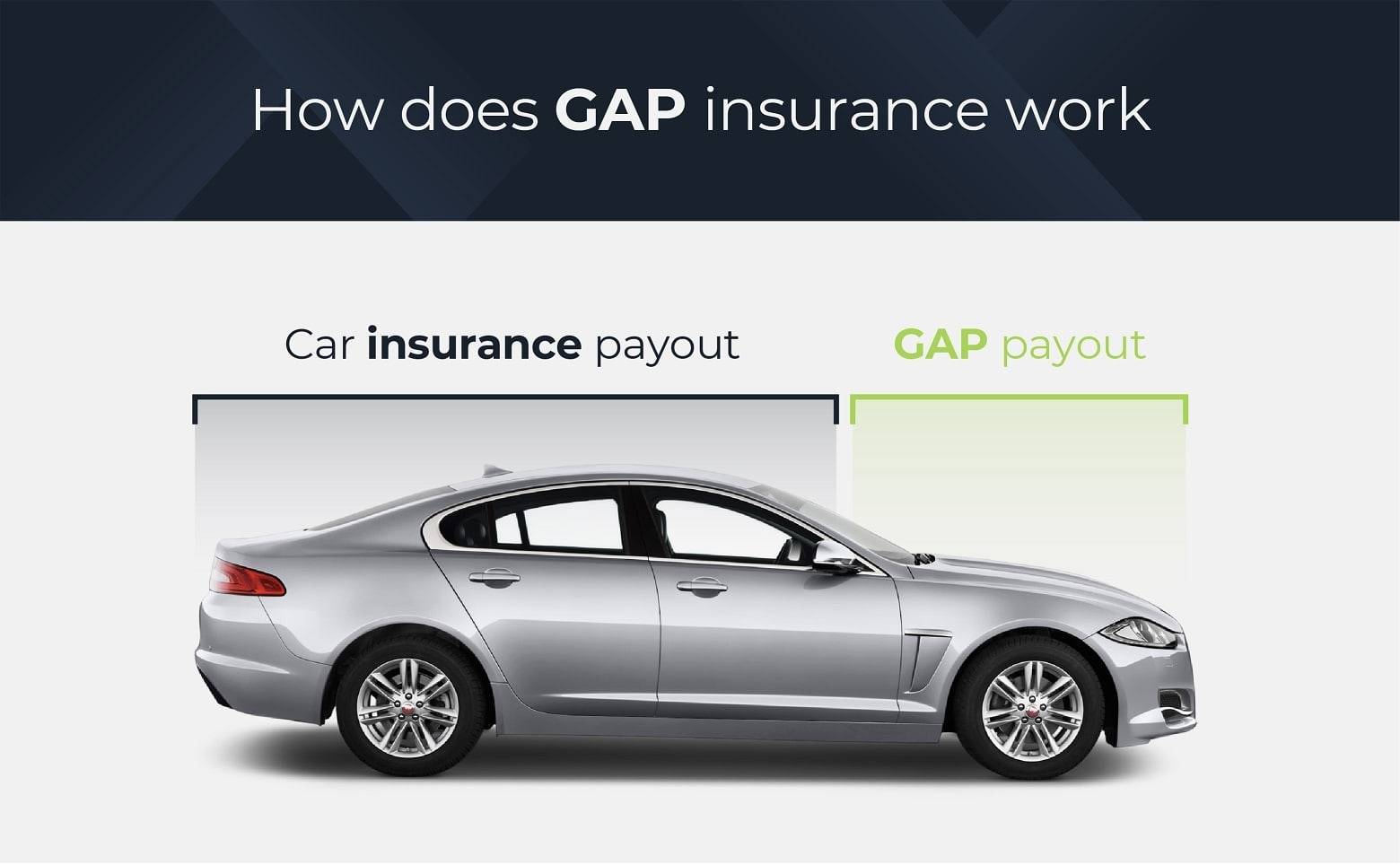

Gap insurance is a crucial component of auto insurance that protects vehicle owners from financial loss in the event of a total loss or theft of their car. It covers the “gap” between the amount owed on a car loan or lease and the actual cash value of the vehicle at the time of the loss.

Many car owners wonder whether they have gap insurance and how they can verify its presence. In this article, we will discuss what gap insurance is, why it is essential, and provide various methods for checking whether you have gap insurance coverage.

No one anticipates being involved in an accident or having their vehicle stolen, but these unfortunate events can happen. Without gap insurance, car owners may find themselves in a tricky financial situation where they owe more on a car loan or lease than the insurance payout.

By understanding what gap insurance is and how to check if you have it, you can ensure that you are adequately protected in the event of a total loss or theft of your vehicle.

What is Gap Insurance?

Gap insurance, also known as guaranteed auto protection or loan/lease payoff coverage, is an optional insurance policy that covers the difference between the outstanding loan or lease balance on a vehicle and its actual cash value. It is designed to protect car owners from substantial financial loss in the unfortunate event of a total loss or theft of their vehicle.

When you purchase a car, its value begins to depreciate immediately. If you get into an accident or your car is stolen, your primary auto insurance policy will typically provide coverage up to the actual cash value of the vehicle at that time. However, this amount may be considerably less than what you owe on your car loan or lease.

This is where gap insurance comes into play. It bridges the “gap” between what your primary insurance covers and the amount you still owe. For example, if you owe $20,000 on your car loan, but the actual cash value of your vehicle is only $15,000, your primary insurance will only cover up to $15,000. The remaining $5,000 would be your responsibility unless you have gap insurance.

Gap insurance can be particularly beneficial for individuals who have financed their vehicles with small down payments or long-term loans. It also provides peace of mind to those who lease new cars, as lease agreements often include strict requirements for loss coverage.

It’s important to note that gap insurance is typically an optional policy and is not included automatically in your standard auto insurance coverage. It’s recommended to assess your specific financial situation and consider the value of your vehicle and the terms of your loan or lease to determine if gap insurance is appropriate for you.

Why Do I Need Gap Insurance?

While gap insurance is not mandatory, it can provide significant financial protection and peace of mind in certain situations. Here are some key reasons why you might need gap insurance:

- Vehicle Depreciation: Cars depreciate in value as soon as they are driven off the lot. In the event of an accident or theft, the insurance payout from your primary auto insurance policy is based on the actual cash value of the vehicle at the time of the incident. If you owe more on your car loan or lease than the actual cash value, gap insurance can cover the difference.

- Low or No Down Payment: If you made a small down payment or no down payment at all when purchasing your vehicle, the loan or lease amount may be higher than the vehicle’s value. In such cases, gap insurance can help protect you from being upside down on your loan if your car is declared a total loss.

- Long-Term Loans: Many car buyers opt for longer loan terms, such as 60 or 72 months, to lower their monthly payments. While this can be beneficial in terms of affordability, it also means that the outstanding loan balance may be higher than the vehicle’s value, especially during the early years of the loan. Gap insurance can provide coverage for this gap between the loan amount and the actual cash value.

- Leased Vehicles: If you are leasing a vehicle, the terms of the lease agreement may require you to have gap insurance. This is because the leasing company wants to ensure that the outstanding lease balance is covered in the event of a total loss or theft of the vehicle.

- Added Financial Protection: Gap insurance provides an added layer of financial protection in the event of unforeseen circumstances such as accidents or theft. It can help prevent you from being left with a significant financial burden, especially if you don’t have the funds to cover the difference between the insurance payout and the loan/lease balance.

Ultimately, the decision to purchase gap insurance depends on your specific circumstances and risk tolerance. Consider factors such as the value of your vehicle, the terms of your loan or lease, and your ability to cover any potential gap in the event of a total loss. Evaluating these factors will help you determine if gap insurance is necessary to protect your financial well-being.

How Can I Check If I Have Gap Insurance?

If you’re unsure whether you have gap insurance coverage, there are several methods you can use to verify its presence. Here are some effective ways to check if you have gap insurance:

- Reviewing Your Insurance Policy: The first and easiest method is to review your auto insurance policy documents. Check for any mention of gap insurance or loan/lease payoff coverage. Look for specific terms or endorsements related to gap insurance, such as “GAP,” “GAP Coverage,” or “Loan/Lease Payoff.” If you find any information related to gap insurance in your policy, you likely have coverage.

- Contacting Your Insurance Provider: Another way to check if you have gap insurance is to directly contact your insurance provider. Reach out to your agent or customer service representative and ask them about your policy details. Provide them with your policy number and ask specifically about gap insurance or loan/lease payoff coverage. They will be able to review your policy and inform you whether or not you have this coverage.

- Checking Your Vehicle Purchase Documentation: If you financed or leased your vehicle through a dealership, check your purchase documentation. Look for any indications of gap insurance or loan/lease payoff coverage. Dealerships sometimes include these policies as part of the financing or leasing agreement, so it’s worth checking your contract, purchase agreement, or any additional documents provided at the time of purchase.

- Consulting Your Loan or Lease Agreement: If you have a car loan or lease, your loan or lease agreement might mention gap insurance requirements. It’s important to review the terms and conditions of your loan or lease agreement to see if gap insurance is mandatory. If it is, your lender or leasing company may have added the coverage to your insurance policy on your behalf.

- Utilizing Online Insurance Tools: There are online insurance tools and resources available that can help you check your policy coverage. Some insurance companies have online portals or mobile apps where you can log in and view your policy details, including any additional coverage options like gap insurance. Alternatively, you can use online insurance comparison websites to input your policy information and view the details of your coverage.

By utilizing one or more of these methods, you should be able to determine if you have gap insurance coverage. If you discover that you don’t have gap insurance and feel it may be necessary, consider contacting your insurance provider to inquire about adding it to your policy.

Method 1: Reviewing Your Insurance Policy

One of the simplest and most effective ways to check if you have gap insurance is by reviewing your auto insurance policy documents. Your insurance policy provides detailed information about the coverage you have in place, including any additional options like gap insurance. Here is how you can use this method:

- Locate your insurance policy: Find a copy of your auto insurance policy. This can be a physical document provided by your insurance company or a digital copy stored in your email or online account.

- Read through your policy: Carefully read through your policy documents and look for any mention of gap insurance or loan/lease payoff coverage. The section might be labeled as “Additional Coverage,” “Optional Coverages,” or something similar. Pay attention to any specific terms or endorsements related to gap insurance.

- Check for keywords: Look for specific keywords such as “GAP,” “GAP Coverage,” “Loan/Lease Payoff,” or any other similar terms that indicate the presence of gap insurance. Insurance policies can use different terminology, so make sure to read through the policy language carefully.

- Inquire with your insurance agent or provider: If you’re unable to find a clear indication of gap insurance in your policy, it’s best to reach out to your insurance agent or customer service representative. Contact them and ask about the specific coverage options you have. Provide your policy number and inquire about the presence of gap insurance or loan/lease payoff coverage.

Reviewing your insurance policy is a convenient and reliable method to check for gap insurance coverage. By reading through your policy documents and understanding the language used, you can gain clarity on whether or not you have this coverage. If you find that you do not have gap insurance and believe it’s necessary, discuss your options with your insurance provider to add it to your policy.

Method 2: Contacting Your Insurance Provider

If you’re unsure whether you have gap insurance, one of the most reliable ways to find out is by contacting your insurance provider directly. Your insurance agent or customer service representative can review your policy details and confirm whether or not you have gap insurance coverage. Here’s how you can use this method:

- Gather your policy information: Before reaching out to your insurance provider, gather your policy information, including your policy number. This will help expedite the process and ensure that the representative can access your account.

- Contact your insurance provider: Find the contact information for your insurance provider, such as their customer service phone number or email address. Reach out to them and let them know that you have a question about your policy coverage.

- Ask about gap insurance specifically: When you speak with the insurance representative, inquire about your coverage details and specifically ask about gap insurance or loan/lease payoff coverage. Provide your policy number and any other relevant information to help them locate your policy and review the coverage you have in place.

- Discuss your options: If you discover that you do not currently have gap insurance, ask the representative about the possibility of adding it to your policy. They can provide you with more information about the coverage, including any associated costs or requirements.

Contacting your insurance provider directly allows you to get accurate and up-to-date information about your policy coverage, including the presence of gap insurance. The representatives are trained to assist with policy inquiries and can help clarify any questions you may have. If you find that you don’t have gap insurance and believe it would be beneficial, discuss your options with your insurance provider to explore adding it to your policy.

Method 3: Checking Your Vehicle Purchase Documentation

When you financed or leased your vehicle, you likely received various purchase documentation that outlines the terms of your agreement. These documents can provide valuable information about the presence of gap insurance or loan/lease payoff coverage. Here’s how you can use this method to check if you have gap insurance:

- Gather your purchase documentation: Collect all the paperwork related to your vehicle purchase, including the purchase agreement, sales contract, financing or leasing agreement, and any additional documents provided by the dealership or finance company.

- Review the documents for mentions of gap insurance: Carefully read through the purchase documentation and look for any indications of gap insurance or loan/lease payoff coverage. The documents may use specific terms or phrases related to this coverage, such as “GAP,” “GAP Coverage,” or “Loan/Lease Payoff.”

- Check for any additional product/service agreements: In some cases, dealerships may offer gap insurance as an additional product or service. Look for separate agreements or contracts related to gap insurance to determine if you have this coverage through the dealership.

- Contact the dealership: If you don’t find any information about gap insurance in your purchase documentation, consider reaching out to the dealership. Inquire about the coverage options you have and specifically ask about gap insurance. They can review your purchase records and provide clarity on whether gap insurance was included in your financing or lease agreement.

Checking your vehicle purchase documentation can help you determine if you have gap insurance coverage. These documents often provide explicit details about the additional coverages included in your agreement. If you find that you don’t have gap insurance and believe it would be beneficial, consider discussing your options with the dealership or exploring the possibility of adding it to your policy through an insurance provider.

Method 4: Consulting Your Loan or Lease Agreement

If you have financed your vehicle through a loan or leased it, your loan or lease agreement may contain information about gap insurance requirements. Consulting these agreements can help you determine if you have gap insurance coverage. Here’s how you can use this method:

- Locate your loan or lease agreement: Find a copy of your loan or lease agreement. This document outlines the terms and conditions of your financial arrangement with the lender or leasing company.

- Read through the agreement: Carefully review the terms of your loan or lease agreement and look for any mentions of gap insurance or loan/lease payoff coverage. Pay attention to any specific requirements or recommendations related to this coverage.

- Check for references to gap insurance: Look for keywords or phrases such as “GAP,” “GAP Coverage,” “Additional Insurance,” or any other language that indicates the requirement or recommendation of gap insurance. The agreement might explicitly state that you must have gap insurance as a condition of the loan or lease.

- Reach out to your lender or leasing company: If you cannot find clear information about gap insurance in the loan or lease agreement, consider contacting your lender or leasing company directly. Inquire about the coverage requirements and whether or not gap insurance is included in your agreement.

Consulting your loan or lease agreement is essential to understanding the specific requirements and recommendations for gap insurance. If the agreement states that you must have gap insurance, it’s crucial to ensure that you have this coverage in place. If the agreement does not mention gap insurance and you believe it would be beneficial, consider contacting your insurance provider to explore adding it to your policy.

Method 5: Utilizing Online Insurance Tools

Another convenient way to check if you have gap insurance is by utilizing online insurance tools and resources. There are various online platforms that can help you access and review your insurance policy details. Here’s how you can use this method:

- Find online insurance tools: Search for reputable online insurance tools or platforms that allow you to access and manage your policy information. These tools are typically provided by insurance companies or independent insurance comparison websites.

- Create an account or log in: If necessary, create an account or log in to the online insurance tool using your credentials. This may require providing your policy information or creating a username and password.

- Locate your policy details: Once logged in, navigate to the section or tab that displays your policy details. This may be labeled as “Policy Information,” “Coverage Summary,” or something similar.

- Review your coverage options: Look for any information related to gap insurance or loan/lease payoff coverage in your policy details. Some platforms may have specific sections or toggles for additional coverages like gap insurance.

- Contact your insurance provider: If you cannot find any specific information about gap insurance in your online policy details, consider reaching out to your insurance provider through the online tool. Look for a customer service or contact option and send a message or request for information about your coverage.

Utilizing online insurance tools can save time and provide quick access to your policy information. These platforms allow you to review your coverage options and determine if you have gap insurance in place. If you cannot locate the information or have any doubts, consider contacting your insurance provider directly for clarification or to discuss adding gap insurance to your policy.

Conclusion

Checking if you have gap insurance is an important step in safeguarding your financial well-being in the event of a total loss or theft of your vehicle. By understanding what gap insurance is, why it’s beneficial, and utilizing various methods to check for its presence, you can ensure that you have the necessary coverage in place.

Reviewing your insurance policy documents is a simple and effective way to determine if you have gap insurance. Look for specific terms or endorsements related to gap insurance in the policy language. Additionally, contacting your insurance provider directly allows you to inquire about your coverage details and specifically ask about gap insurance or loan/lease payoff coverage.

Checking your vehicle purchase documentation, such as the sales contract or financing agreement, can also provide valuable insights into the presence of gap insurance. These documents may indicate if gap insurance was included in your financing or lease agreement.

If you have a loan or lease agreement, reviewing its terms and conditions can provide clarity on any gap insurance requirements or recommendations. These agreements often outline specific coverage requirements, including the need for gap insurance.

Utilizing online insurance tools and resources can also be helpful in checking for gap insurance. Many insurance companies provide online portals or mobile apps where policyholders can access and review their coverage details. These platforms allow you to navigate to the section that displays your policy information and look for any additional coverage options like gap insurance.

In conclusion, it’s important to be proactive and verify the presence of gap insurance to protect yourself from potential financial burdens. By using the methods discussed in this article, you can confidently determine if you have gap insurance coverage or explore options to add it to your policy if needed. Remember to assess your specific financial situation and consult with your insurance provider to ensure that you have the appropriate level of protection for your vehicle.