Home>Finance>How To Enter Late Fee On Credit Card Reconciliation In QuickBooks

Finance

How To Enter Late Fee On Credit Card Reconciliation In QuickBooks

Published: February 22, 2024

Learn how to enter late fees on credit card reconciliation in QuickBooks to manage your finances effectively. Streamline your finance process with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Late fees on credit card transactions can sometimes be a headache for businesses to manage. It’s essential for businesses to accurately record and reconcile these late fees to maintain financial transparency and compliance. QuickBooks, a popular accounting software, provides a user-friendly platform for managing credit card transactions and associated late fees. In this article, we will delve into the process of entering late fees on credit card reconciliation in QuickBooks, providing a comprehensive guide to streamline this aspect of financial management.

Navigating the intricacies of credit card reconciliation in QuickBooks can be daunting, especially when it comes to incorporating late fees into the process. However, with the right knowledge and tools, businesses can efficiently handle late fees and ensure that their financial records remain accurate and up to date. Understanding the nuances of entering and reconciling late fees in QuickBooks is crucial for maintaining a clear financial picture and making informed business decisions.

In the following sections, we will explore the concept of late fees on credit card reconciliation, elucidate the steps for entering late fees in QuickBooks, and guide you through the process of reconciling these fees within the software. By the end of this article, you will have a comprehensive understanding of how to effectively manage late fees on credit card reconciliation in QuickBooks, empowering you to navigate this aspect of financial management with confidence and ease. Let’s dive into the intricacies of managing late fees in QuickBooks and unlock the potential for seamless credit card reconciliation.

Understanding Late Fees on Credit Card Reconciliation

When it comes to credit card transactions, late fees can arise as a result of delayed payments or other specific terms outlined by the credit card issuer. Late fees are additional charges imposed on a cardholder when a payment is not made by the due date. These fees are essential for credit card companies to ensure timely payments and responsible financial behavior among cardholders.

From a business perspective, late fees can impact credit card reconciliation, which is the process of matching the transactions on a company’s credit card statement with the entries in its accounting records. When late fees are applied to credit card transactions, it’s crucial for businesses to accurately account for these fees within their financial records to maintain transparency and compliance.

Understanding the implications of late fees on credit card reconciliation is vital for businesses to uphold accurate financial reporting. Late fees can affect the overall balance owed on the credit card statement, potentially altering the reconciliation process. Moreover, failing to account for late fees can lead to discrepancies in financial records, which may result in inaccuracies in financial reporting and decision-making.

It’s important for businesses to be cognizant of the specific terms and conditions associated with late fees on credit card transactions. This includes comprehending the criteria for late fee imposition, the amount of the late fee, and any additional implications for delayed payments. By gaining a thorough understanding of these factors, businesses can proactively manage late fees and incorporate them into the credit card reconciliation process with precision and efficiency.

As we delve deeper into the process of entering late fees in QuickBooks and reconciling these fees within the software, it’s essential to grasp the significance of late fees on credit card reconciliation and the impact they can have on a company’s financial records. By doing so, businesses can navigate the complexities of credit card reconciliation with a comprehensive understanding of how late fees factor into the equation.

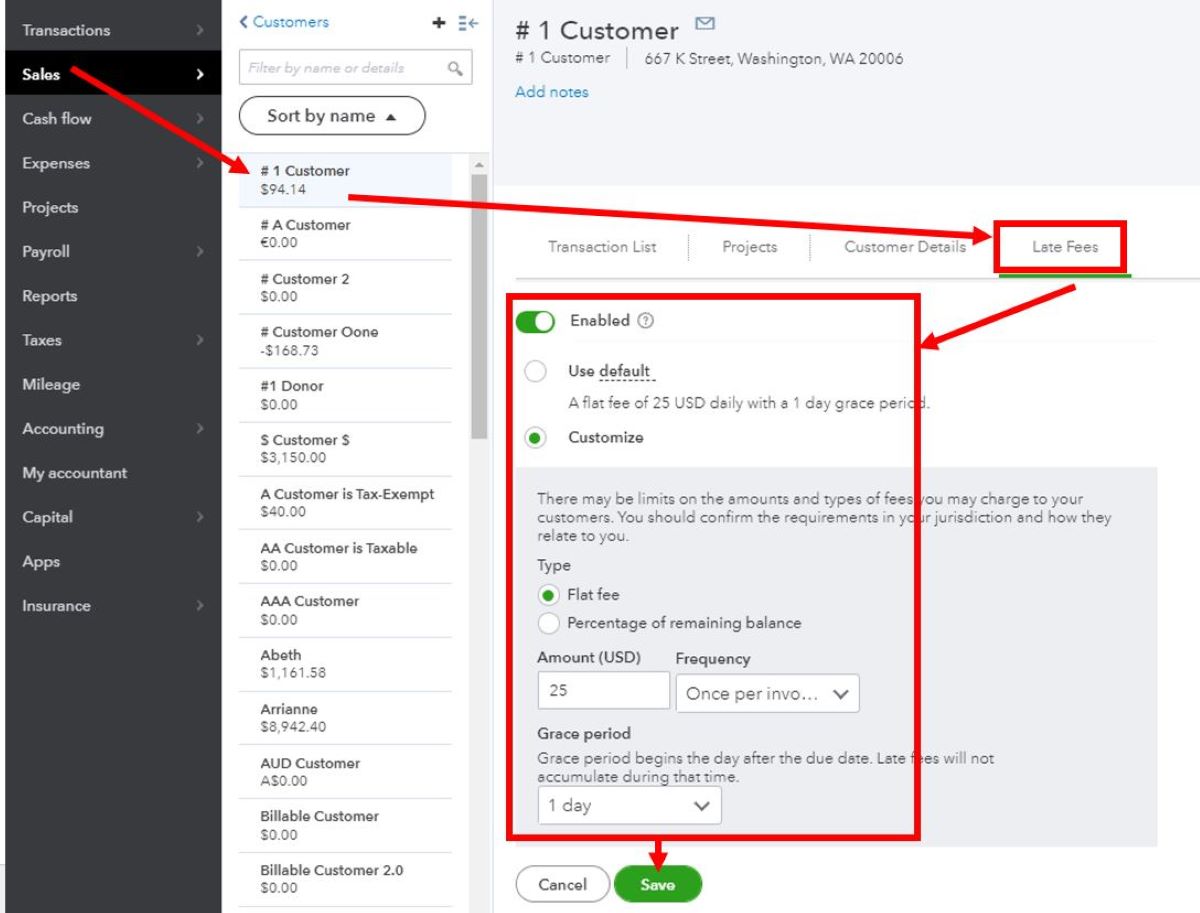

Entering Late Fees in QuickBooks

QuickBooks provides a user-friendly interface for entering late fees associated with credit card transactions, enabling businesses to accurately record these fees within their financial records. To initiate the process of entering late fees in QuickBooks, users can follow these steps:

- Accessing the Credit Card Register: Begin by accessing the credit card register in QuickBooks, which allows users to view and manage credit card transactions.

- Locating the Transaction: Identify the specific credit card transaction for which a late fee applies within the register. This could be a transaction that incurred a late fee due to a delayed payment.

- Recording the Late Fee: Once the transaction is identified, users can record the late fee as a separate transaction in the credit card register. This involves specifying the amount of the late fee and categorizing it accordingly within the register.

- Assigning the Late Fee to the Correct Account: When entering the late fee, it’s crucial to assign it to the appropriate expense or liability account within QuickBooks. This ensures that the late fee is accurately reflected in the company’s financial statements.

- Adding Descriptive Details: To maintain clarity and transparency, users can add descriptive details or memos to the late fee transaction, providing context for the late fee and facilitating easy reference in the future.

By following these steps, businesses can effectively enter late fees associated with credit card transactions in QuickBooks, ensuring that these fees are accurately recorded and reflected in the company’s financial records. This streamlined process enables businesses to maintain comprehensive and precise financial reporting, enhancing transparency and compliance.

Furthermore, QuickBooks offers customizable features that allow users to tailor the late fee entry process to suit their specific business needs. Whether it’s assigning late fees to specific expense categories or generating detailed reports on late fee transactions, QuickBooks empowers businesses to manage late fees with flexibility and precision.

As we navigate the process of entering late fees in QuickBooks, it’s important to recognize the software’s intuitive functionality, which simplifies the task of recording late fees and integrating them seamlessly into a company’s financial records. This capability equips businesses with the tools needed to manage late fees effectively, contributing to a robust and accurate financial management system.

Reconciling Late Fees in QuickBooks

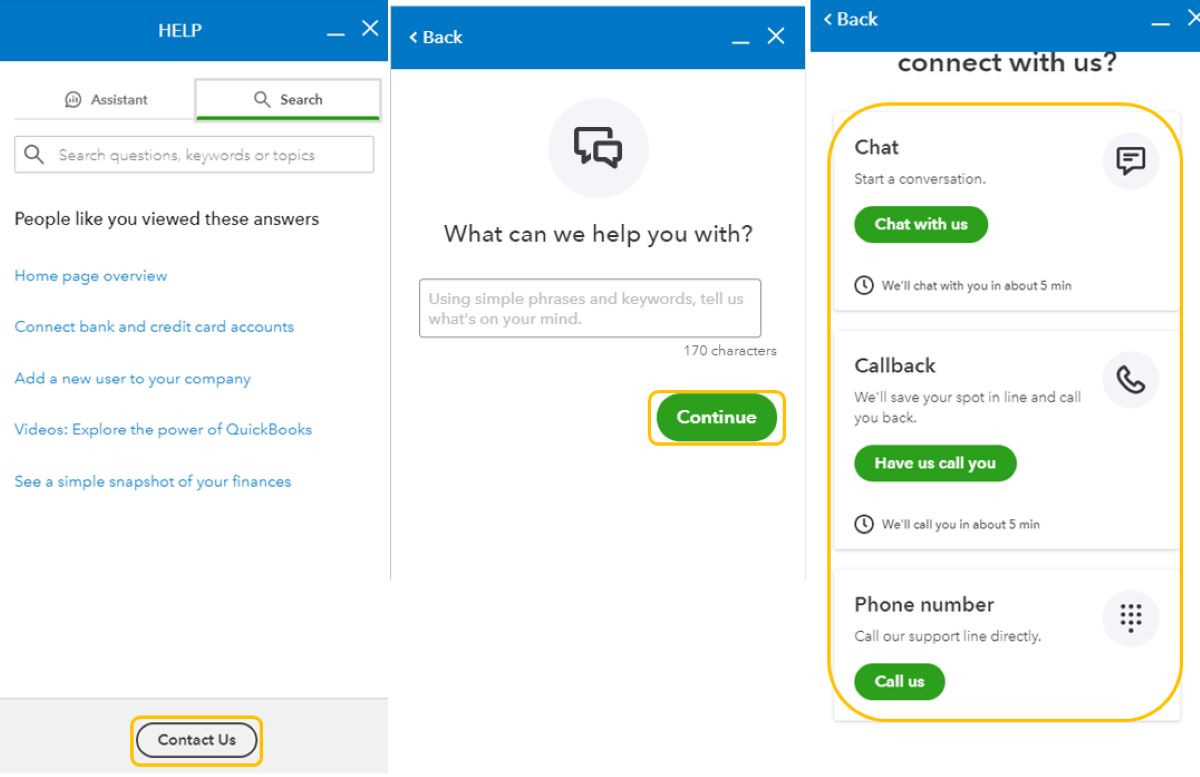

Reconciling late fees in QuickBooks involves ensuring that the recorded late fee transactions align with the credit card statement and the company’s accounting records. This process is essential for verifying the accuracy of the late fee entries and maintaining financial transparency. To reconcile late fees in QuickBooks, businesses can follow these steps:

- Reviewing the Credit Card Statement: Begin by obtaining the latest credit card statement, which outlines the transactions and any associated late fees. Compare the statement with the entries in QuickBooks to identify any discrepancies or missing late fee transactions.

- Matching Late Fee Transactions: Verify that the late fee transactions recorded in QuickBooks correspond to the late fees listed on the credit card statement. This involves cross-referencing the dates, amounts, and transaction details to ensure consistency and accuracy.

- Addressing Discrepancies: If any disparities or omissions are identified during the reconciliation process, take the necessary steps to address them. This may involve adding missing late fee transactions, correcting inaccuracies, or reconciling differences between the credit card statement and QuickBooks records.

- Generating Reconciliation Reports: Utilize QuickBooks’ reporting features to generate reconciliation reports that provide a comprehensive overview of late fee transactions and their alignment with the credit card statement. These reports offer valuable insights into the reconciliation process and serve as documentation of the company’s financial accuracy.

- Ensuring Financial Accuracy: Upon completing the reconciliation process, verify that the late fees in QuickBooks accurately reflect the transactions on the credit card statement. This step is crucial for maintaining financial precision and upholding compliance with accounting standards.

By meticulously reconciling late fees in QuickBooks, businesses can uphold the integrity of their financial records and ensure that late fee transactions are accurately represented. This process contributes to a comprehensive and transparent financial management system, enabling businesses to make informed decisions based on reliable financial data.

Moreover, QuickBooks’ reconciliation features provide users with the tools to streamline the process and identify any discrepancies or irregularities promptly. The software’s intuitive interface and reporting capabilities empower businesses to navigate the reconciliation of late fees with efficiency and precision, fostering a robust financial management framework.

As businesses embrace the process of reconciling late fees in QuickBooks, they gain a deeper understanding of the software’s capacity to facilitate accurate and transparent financial reporting. This proficiency in reconciling late fees enhances the overall financial management practices, positioning businesses to maintain a clear and compliant financial landscape.

Conclusion

Managing late fees on credit card reconciliation in QuickBooks is a fundamental aspect of maintaining accurate financial records and upholding transparency in business operations. By understanding the implications of late fees, entering them accurately in QuickBooks, and reconciling these transactions with precision, businesses can ensure the integrity of their financial reporting. QuickBooks serves as a valuable ally in this process, offering intuitive features that streamline the management of late fees and contribute to a robust financial management framework.

As businesses navigate the intricacies of entering and reconciling late fees in QuickBooks, they gain a deeper appreciation for the software’s capacity to facilitate seamless financial management. The user-friendly interface, customizable features, and reporting capabilities empower businesses to manage late fees with efficiency and accuracy, fostering a comprehensive understanding of their financial landscape.

Furthermore, the ability to reconcile late fees in QuickBooks not only ensures financial accuracy but also instills confidence in the reliability of a company’s financial records. This confidence is instrumental in making informed business decisions and demonstrating compliance with accounting standards and regulations.

By embracing the comprehensive guide outlined in this article, businesses can navigate the process of entering late fees on credit card reconciliation in QuickBooks with confidence and proficiency. From recording late fees accurately to reconciling these transactions with precision, businesses can leverage QuickBooks to maintain a clear and compliant financial landscape, empowering them to make strategic financial decisions and drive business growth.

Ultimately, the seamless integration of late fee management within QuickBooks contributes to the overall efficiency and accuracy of financial reporting, positioning businesses to thrive in a dynamic and competitive marketplace. As businesses harness the power of QuickBooks to manage late fees effectively, they pave the way for sustained financial transparency and informed decision-making, laying a solid foundation for long-term success.