Finance

How To E-Verify ITR Through Net Banking

Published: October 11, 2023

Learn how to e-verify your income tax return through net banking in a few simple steps. Securely manage your finances with our easy-to-follow guide on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of e-verification, where the cumbersome process of manually verifying your Income Tax Return (ITR) has been simplified and streamlined. In the past, individuals had to physically sign and send a hard copy of their ITR-V (Income Tax Return Verification) to the Centralized Processing Centre (CPC) to complete the verification process. However, with the advent of technology, the e-verification process was introduced, allowing taxpayers to conveniently verify their ITRs online.

E-verifying your ITR through Net Banking is a secure and efficient method that not only saves you time and effort but also provides various benefits. By leveraging the power of internet banking, taxpayers can self-verify their ITRs without the need for any physical documentation or visits to the income tax office. This article will guide you through the step-by-step process of e-verifying your ITR using Net Banking and highlight the advantages of choosing this method.

E-verification through Net Banking is a paperless process that eliminates the need for physical signatures and significantly reduces the time taken to complete the verification process. It offers a convenient and hassle-free way for taxpayers to fulfill their statutory obligations while enjoying the ease of digital transactions.

Moreover, e-verifying your ITR through Net Banking ensures the security of your confidential financial information. The process is encrypted and authenticated by the income tax department, making it a reliable and trustworthy method of verifying your tax returns. With increased awareness of cyber threats and the need to safeguard personal data, e-verifying ITRs through Net Banking provides an added layer of protection for taxpayers.

In the following sections, we will explore the various benefits of e-verifying ITRs through Net Banking and provide a step-by-step guide to help you navigate the process with ease and confidence.

What is E-verification of ITR?

E-verification of Income Tax Return (ITR) is the process of electronically verifying your tax return to complete the filing process. It is an alternative to the traditional method of physically signing and sending the ITR-V form to the income tax department for verification. With e-verification, taxpayers can complete the verification process online, saving time, effort, and resources.

When you file your income tax returns electronically, either through the e-filing portal or by using tax preparation software, the tax return is considered “submitted” but not “verified.” Verification is a crucial step that ensures the authenticity and accuracy of the tax return. Previously, taxpayers were required to physically send a signed copy of the ITR-V form to the Centralized Processing Centre (CPC) within a specified timeframe for verification.

However, to simplify and expedite the process, the income tax department introduced the concept of e-verification. It allows taxpayers to electronically verify their tax returns using various methods, such as Net Banking, Aadhaar OTP (One-Time Password), Electronic Verification Code (EVC), or Digital Signature Certificate (DSC).

E-verification through Net Banking is a popular and convenient method that allows taxpayers to verify their ITR using their bank’s internet banking facility. With this method, taxpayers can avoid the hassle of printing, signing, and sending the physical copy of the ITR-V to the income tax department.

By opting for e-verification, taxpayers can submit their tax returns and complete the verification process seamlessly, all from the comfort of their homes or offices. It not only saves time but also eliminates the risk of delays or loss of physical documents during the postal delivery process.

It is important to note that e-verification is a mandatory step to complete the filing process and get your tax return processed by the income tax department. Failing to verify the tax return within the specified timeframe may lead to the rejection of the tax return and unnecessary complications.

In the next section, we will explore the various benefits of e-verifying ITR through Net Banking, highlighting why it is a preferred option for taxpayers.

Benefits of E-verifying ITR through Net Banking

E-verifying your Income Tax Return (ITR) through Net Banking offers a range of benefits that make the process quicker, more convenient, and secure. Let’s take a closer look at the advantages of choosing this method:

1. Time-saving and convenient: E-verifying your ITR through Net Banking eliminates the need for physical paperwork and visits to the income tax office. It allows you to complete the verification process from the comfort of your own home or office, saving you valuable time and effort.

2. Instant verification: The e-verification process through Net Banking is quick and seamless. Once you initiate the verification using your banking credentials, the process is completed instantly. There’s no waiting time or hassle of sending physical documents by post.

3. Paperless process: E-verifying ITR through Net Banking is completely paperless. You don’t need to print, sign, and send any physical documents to the income tax department. This not only saves trees but also reduces the chances of documents getting lost or delayed in transit.

4. Secure and authenticated: Net Banking platforms are highly secure, with multiple layers of encryption and authentication protocols. When you e-verify your ITR through Net Banking, the income tax department receives the verification instantly and authenticates it, providing you with peace of mind about the security of your personal and financial information.

5. Confirmation receipt: Once you e-verify your ITR through Net Banking, you receive an acknowledgment or confirmation receipt instantly. This serves as proof of verification, which you can keep for your records.

6. Multiple banking options: E-verification through Net Banking is supported by various banks, giving you the flexibility to choose the bank you are comfortable with. This means that you can use the Net Banking facility of your preferred bank to complete the verification process.

7. Wide accessibility: Net Banking facilities are accessible to a large number of taxpayers. It doesn’t matter if you are in a metropolitan city or a rural area; as long as you have an internet connection and a bank account with Net Banking facility, you can e-verify your ITR conveniently.

8. Seamless integration: The e-verification process through Net Banking is seamlessly integrated into the e-filing portal or tax preparation software, making it easy for users to navigate and complete the verification process without any technical difficulties.

By leveraging the benefits of e-verifying ITR through Net Banking, taxpayers can complete the verification process smoothly, save valuable time, and ensure the security of their financial information.

Now that we understand the advantages of e-verifying ITR through Net Banking, let’s explore the step-by-step guide to help you navigate the process effortlessly.

Step-by-Step Guide to E-verify ITR using Net Banking

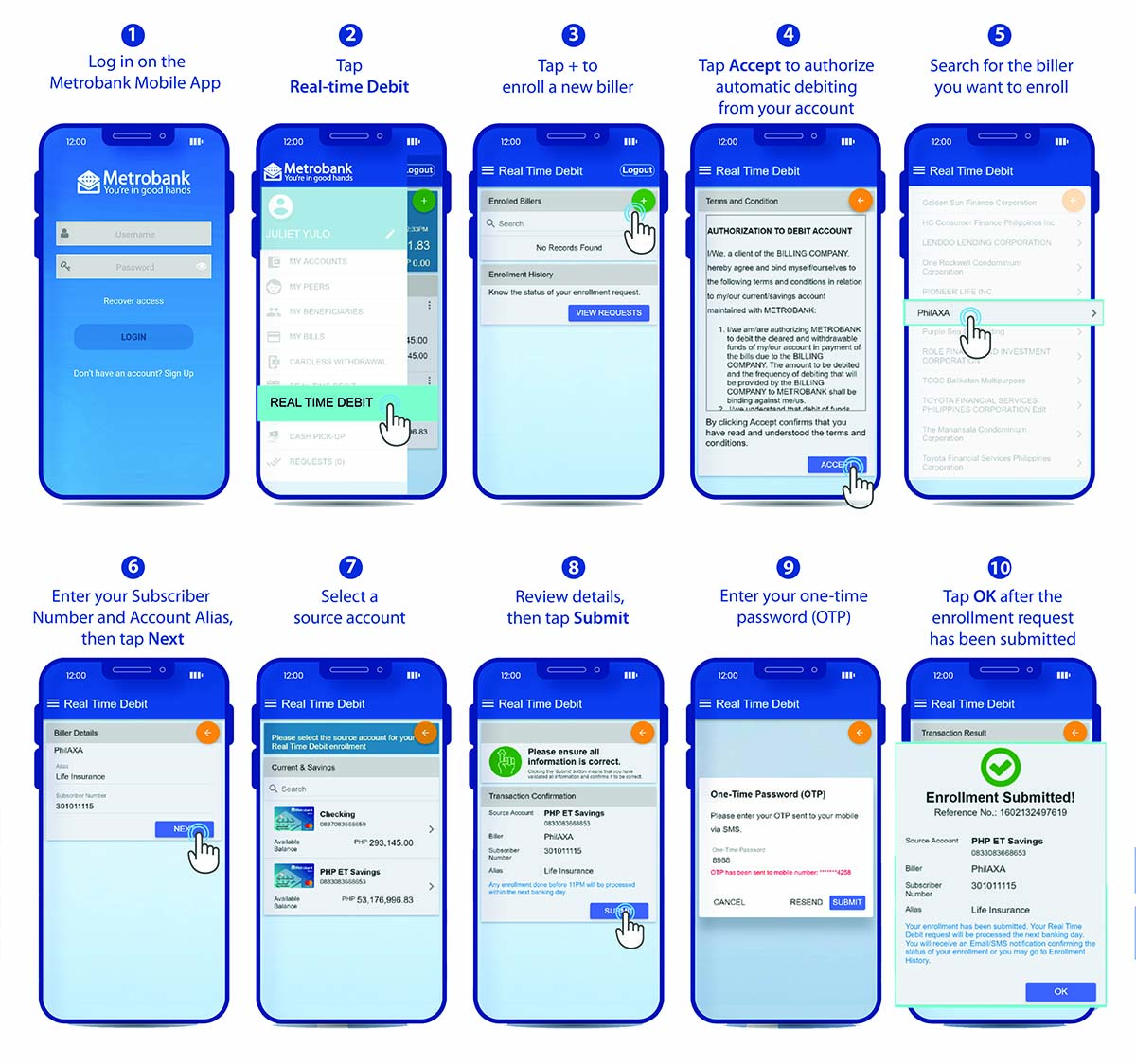

E-verifying your Income Tax Return (ITR) using Net Banking is a simple and efficient process. Here’s a step-by-step guide to help you navigate through the process:

- Visit the e-filing portal: Start by visiting the official Income Tax e-filing portal (www.incometaxindiaefiling.gov.in).

- Log in to your account: Log in to your account using your User ID (usually your PAN) and password. Enter the captcha code for security purposes.

- Go to ‘View Returns/Forms’: Once you’re logged in, click on the ‘View Returns/Forms’ tab from the dashboard. Select the appropriate assessment year for which you want to e-verify the ITR.

- Select the ITR to be verified: Under ‘Income Tax Returns’, select the ITR that you want to e-verify. You will see a list of all the ITRs filed by you for the selected assessment year.

- Choose the e-verification option: After selecting the ITR, click on the ‘e-verify’ option from the drop-down menu. A list of different e-verification methods will appear.

- Select ‘Net Banking’ option: Choose the ‘Net Banking’ option to proceed with e-verifying your ITR using your bank’s Net Banking facility.

- Choose your bank: A list of banks will appear on the screen. Select the bank where you have an active Net Banking facility. You will be redirected to your bank’s Net Banking portal.

- Authenticate through Net Banking: Log in to your Net Banking account using your credentials and follow the instructions provided by your bank to authenticate the e-verification process.

- Confirm the e-verification: Once you have successfully authenticated your Net Banking login, a confirmation message will appear on the screen, indicating that your ITR has been e-verified.

- Keep the acknowledgment receipt: After completing the e-verification process, make sure to keep a copy of the acknowledgment receipt for your records. This receipt serves as proof of verification.

It is important to note that the exact steps and options may vary slightly depending on the version of the e-filing portal and the bank you choose for Net Banking. However, the basic process remains the same.

By following these steps, you can e-verify your ITR through Net Banking smoothly and complete the verification process in a hassle-free manner.

Now that you know how to e-verify your ITR using Net Banking, let’s explore the requirements for e-verification and some common issues that taxpayers may encounter.

Requirements for E-verification through Net Banking

In order to e-verify your Income Tax Return (ITR) through Net Banking, you will need the following requirements:

- A valid PAN: Ensure that you have a valid Permanent Account Number (PAN) issued by the Income Tax Department. PAN is a unique alphanumeric identifier that serves as your tax identification number.

- Active Net Banking facility: You must have an active Net Banking facility with a bank. Most banks offer Net Banking services to their customers. If you do not have Net Banking activated, contact your bank to enable this service.

- Registered Net Banking account: It is essential to register your PAN with your bank for Net Banking services. This registration process may involve filling out a form and providing necessary identification documents to link your PAN and Net Banking account.

- Access to the e-filing portal: You need access to the official Income Tax e-filing portal (www.incometaxindiaefiling.gov.in) to complete the e-verification process. If you don’t have an account, you can create one using your PAN.

- Updated contact details: Ensure that your contact details, such as email ID and mobile number, are updated both with the income tax department and your bank. These details are crucial to receive any communication or OTPs during the e-verification process.

It is important to note that the availability of Net Banking facility for e-verification may vary from bank to bank. While most major banks offer this service, it is advisable to check with your particular bank to confirm if they provide Net Banking support for ITR e-verification.

Additionally, it is recommended to keep the following points in mind:

- Ensure that you have a stable internet connection while accessing the e-filing portal and during the Net Banking authentication process.

- Make sure to have your Net Banking login credentials, such as User ID and password, readily available. If you are unsure about your login details, contact your bank for assistance.

- Follow the instructions provided by your bank during the Net Banking authentication process to ensure successful e-verification.

- Keep a copy of the e-verification acknowledgment receipt for your records.

By fulfilling these requirements and adhering to the necessary guidelines, you can successfully e-verify your ITR through Net Banking and complete the process effortlessly.

Now that we have covered the requirements for e-verification, let’s discuss a few common issues that taxpayers may encounter during the process and how to troubleshoot them.

Common Issues and Troubleshooting

While e-verifying your Income Tax Return (ITR) through Net Banking is generally a smooth process, there are a few common issues that taxpayers may encounter. Here are some of these issues and tips for troubleshooting them:

1. Net Banking not enabled: If you are unable to find the Net Banking option during the e-verification process, it could be because your bank’s Net Banking facility is not activated. Contact your bank to check if the service is available for your account and if it can be enabled.

2. System compatibility: Ensure that you are using a compatible system and browser to access the e-filing portal and the Net Banking portal. Outdated browsers or incompatible systems can cause errors or difficulties during the e-verification process. Try using a different browser or update your current browser to the latest version.

3. Incorrect login details: Double-check your Net Banking login credentials to ensure that you are entering the correct User ID and password. If you have forgotten your login details, contact your bank for assistance in retrieving or resetting them.

4. OTP not received: One of the common issues faced is not receiving the One-Time Password (OTP) during the Net Banking authentication process. Ensure that your contact details, especially your mobile number and email ID, are updated with both your bank and the income tax department. If you still do not receive the OTP, try requesting a re-send or check your spam folder in case the email landed there.

5. Transaction limits: Some banks may have transaction limits set for Net Banking activities. Make sure you are within the transaction limits while e-verifying your ITR. If you encounter an error related to transaction limits, contact your bank to ascertain the specific limits and request any necessary modifications.

6. Incorrect ITR selection: Ensure that you have selected the correct ITR for e-verification. It is common to have multiple ITRs filed for different assessment years. Choose the appropriate ITR to avoid any verification errors.

7. Connectivity issues: A stable internet connection is essential during the e-verification process. If you experience connectivity issues, try connecting to a stronger network or contact your internet service provider for assistance.

If you encounter any other issues or errors during the e-verification process, it is recommended to contact the income tax helpline or seek assistance from a professional tax consultant to resolve the problem.

By being aware of these common issues and following the troubleshooting tips mentioned above, you can overcome any obstacles and successfully e-verify your ITR through Net Banking.

Now that we have covered the common issues, let’s conclude the article.

Conclusion

E-verifying your Income Tax Return (ITR) through Net Banking offers a convenient, time-saving, and secure way to complete the verification process. By following the step-by-step guide, taxpayers can easily navigate the e-verification process, eliminating the need for physical paperwork and visits to the income tax office.

The benefits of e-verifying ITR through Net Banking are numerous. It saves time, as the process is instant and can be done from the comfort of your own home or office. The paperless nature of this method reduces the risk of documents getting lost or delayed in transit. With the assurance of secure and authenticated transactions through Net Banking, taxpayers can have peace of mind knowing that their financial information is protected.

It is important to ensure that you fulfill the requirements for e-verification, such as having a valid PAN, an active Net Banking facility, and updated contact details. If any issues arise during the process, familiarize yourself with common troubleshooting tips or seek assistance from the income tax helpline or a tax consultant.

By e-verifying your ITR through Net Banking, you fulfill your statutory obligations quickly and efficiently, helping to streamline the tax filing process. So, take advantage of this modern and user-friendly method to complete your ITR verification effortlessly.

Remember, e-verification is an essential step to have your tax return processed by the income tax department and avoid any unnecessary complications. So, stay updated with the latest guidelines and utilize the power of Net Banking to conveniently e-verify your ITR.

Now that you are equipped with the knowledge and understanding of e-verifying ITR through Net Banking, you can confidently navigate the process and stay compliant with your tax obligations.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal, tax, or financial advice. It is recommended to consult a professional tax advisor for specific guidance tailored to your individual circumstances.