Home>Finance>How To Find A Companys Target Capital Structure

Finance

How To Find A Companys Target Capital Structure

Published: December 24, 2023

Learn how to find a company's target capital structure and optimize its financing decisions. Explore key finance strategies and tactics to achieve financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Capital Structure

- Importance of Target Capital Structure

- Factors to Consider in Determining Target Capital Structure

- How to Determine a Company’s Optimal Capital Structure

- Analyzing the Financials

- Assessing Risk and Cost of Capital

- Balancing Debt and Equity

- The Role of Leverage

- Potential Challenges in Achieving Target Capital Structure

- Conclusion

Introduction

Capital structure is a crucial aspect of financial management for any company. It refers to the way a company finances its operations through a combination of debt and equity. Finding the right balance in a company’s capital structure is essential for long-term success and growth.

The target capital structure is the ideal mix of debt and equity that a company aims to achieve. It determines the proportion of debt and equity financing that strikes a balance between risk and return. Companies need to establish their target capital structure based on their specific industry, market conditions, and financial goals.

While determining the target capital structure can seem like a complex task, it is essential for organizations to optimize their financial structure to ensure stability, growth, and profitability. In this article, we will explore the importance of a company’s target capital structure and the factors to consider when determining it. We will also discuss how companies can analyze their financials, assess risk, and balance debt and equity to achieve their optimal capital structure.

Understanding Capital Structure

Capital structure refers to the way a company finances its operations and investments by using a combination of debt and equity. Debt financing involves borrowing money from external sources, such as banks or bondholders, and repaying it with interest over time. Equity financing, on the other hand, involves raising funds by selling shares of ownership in the company to investors.

The capital structure decision is crucial for businesses as it determines the risk profile, cost of capital, and financial flexibility. A well-balanced capital structure allows a company to optimize its financial resources and generate maximum value for its shareholders.

A company’s capital structure is typically represented by the debt-to-equity ratio, which shows the proportion of debt to equity financing. A high debt-to-equity ratio indicates that a company relies more on debt financing, increasing its financial risk. Conversely, a low debt-to-equity ratio suggests a more conservative approach with a greater emphasis on equity financing. Finding the right mix depends on various factors, including industry norms, market conditions, company size, growth prospects, and tax implications.

It’s important to note that capital structure decisions are not static and can change over time. As a company grows or faces changes in the business environment, it may need to adjust its capital structure accordingly. Flexibility and adaptability are key in ensuring the optimal capital structure for a company at any given time.

Importance of Target Capital Structure

The target capital structure plays a crucial role in the financial health and sustainability of a company. Here are some key reasons why having a well-defined target capital structure is important:

- Cost of Capital: The target capital structure helps determine the company’s cost of capital, which is the weighted average cost of debt and equity. By optimizing the mix of debt and equity, a company can minimize its overall cost of capital, thus reducing the expenses associated with financing its operations.

- Risk Management: A balanced capital structure helps manage the inherent financial risks faced by a company. Too much debt can increase the risk of default, while excessive equity financing results in dilution of ownership and reduced control. Establishing the right mix allows businesses to mitigate risks associated with financial obligations and maintain healthy financial stability.

- Financial Flexibility: The target capital structure provides a company with the flexibility to adapt to changing market conditions and growth opportunities. It allows for efficient capital allocation, ensuring that the company has access to funds when needed and can make strategic investments without compromising its financial stability.

- Valuation and Investor Perception: The capital structure influences the valuation of a company and how investors perceive its financial health and growth prospects. A well-structured capital mix enhances a company’s valuation and attracts investor confidence, making it easier to raise capital for future investments and expansions.

- Tax Implications: The target capital structure also takes into account the tax implications associated with debt and equity financing. Interest payments on debt are tax-deductible, which can help reduce a company’s overall tax burden. By optimizing the capital structure, companies can achieve tax efficiency and maximize after-tax profits.

- Long-Term Sustainability: A company’s target capital structure is vital for its long-term sustainability and growth. It allows for efficient allocation of resources, improved financial performance, and the ability to weather economic downturns or unexpected challenges. A well-defined target capital structure ensures the company is positioned for long-term success.

Overall, establishing a target capital structure is crucial as it enables companies to optimize their cost of capital, manage risks effectively, maintain financial flexibility, attract investors, and ensure long-term sustainability. It requires careful analysis and consideration of various factors to determine the right balance of debt and equity financing for each specific company.

Factors to Consider in Determining Target Capital Structure

When determining the target capital structure, companies need to consider several key factors. These factors help evaluate the optimal mix of debt and equity financing that aligns with the company’s financial goals and market conditions. Here are some important factors to consider:

- Industry and Competition: Different industries have varying levels of risk and profitability. Understanding the industry dynamics and competition is crucial in determining an appropriate capital structure. Capital-intensive industries may require higher debt financing to fund their operations and investments, while less capital-intensive sectors may rely more on equity financing.

- Business Risk: The level of business risk posed by a company’s operations and market position is another important factor. Companies with stable cash flows, diversified revenue streams, and strong market positions may have a higher tolerance for debt and can target a more leveraged capital structure. Conversely, companies with higher business risk may opt for a more conservative approach with lower levels of debt.

- Financial Flexibility: Financial flexibility refers to a company’s ability to meet its financial obligations and pursue growth opportunities. Companies with predictable cash flows and low financing needs may prefer a target capital structure with lower debt to maintain greater financial flexibility. In contrast, companies with significant growth prospects or potential capital expenditures may opt for higher debt levels to access funds for expansion.

- Tax Considerations: The tax implications of different financing options should also be taken into account. Interest payments on debt are typically tax-deductible, providing tax advantages. Companies in higher tax brackets may find it more beneficial to incorporate more debt in their capital structure to maximize tax savings. However, it’s important to strike a balance between tax advantages and the associated risks of higher debt levels.

- Market Conditions: The prevailing market conditions, such as interest rates and investor sentiment, can impact the cost and availability of debt and equity financing. Companies need to consider the cost of capital and the current market appetite for debt and equity when determining their target capital structure. During periods of low interest rates, it may be advantageous to pursue debt financing, while periods of high market volatility may favor equity financing.

- Company Size and Growth Stage: The size and growth stage of a company play a role in determining the target capital structure. Startups and early-stage companies may rely more on equity financing as they seek to raise capital for growth and demonstrate their business potential to investors. Larger, more established companies may have more access to debt financing due to their stable operations and creditworthiness.

By evaluating these factors carefully, companies can determine the target capital structure that aligns with their specific circumstances, industry dynamics, and financial goals. It is important to regularly reassess and adjust the target capital structure as the company evolves and market conditions change.

How to Determine a Company’s Optimal Capital Structure

Determining a company’s optimal capital structure involves a systematic analysis of various financial factors and considerations. Here are some steps to help determine the optimal capital structure:

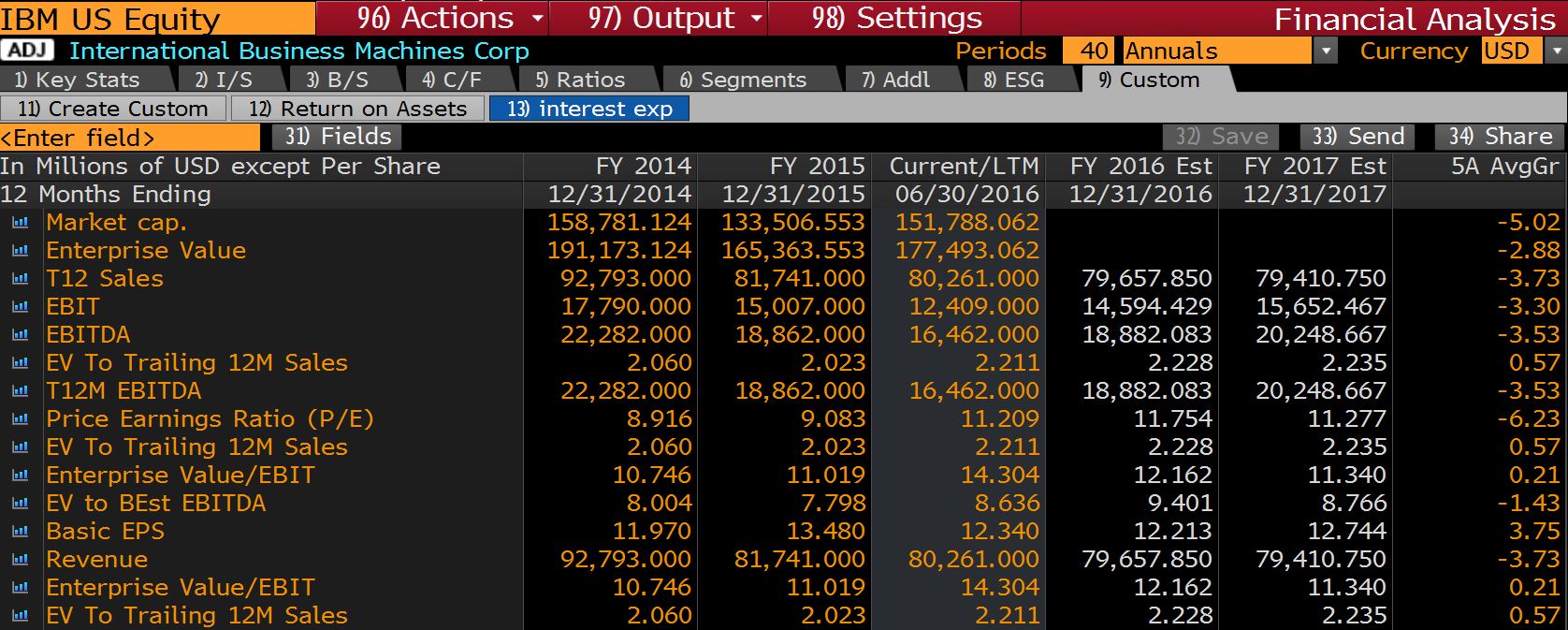

- Analyze the Financials: Start by analyzing the company’s financials, including its balance sheet, income statement, and cash flow statement. This will provide insights into the current capital structure and financial performance. Look for trends, profitability ratios, and cash flow patterns from operations to assess the company’s ability to service debt obligations.

- Assess Risk and Cost of Capital: Evaluate the company’s risk profile and cost of capital. This involves analyzing the overall business risk, industry dynamics, and market conditions. Assess the company’s creditworthiness and ability to attract debt financing at favorable interest rates. Consider the company’s beta, which measures its sensitivity to market fluctuations, as it impacts the cost of equity capital.

- Balancing Debt and Equity: Find the optimal mix of debt and equity by evaluating the trade-offs and benefits of each. Debt financing offers tax advantages, but it also increases financial risk and interest expense. Equity financing dilutes ownership but provides flexibility and doesn’t require interest payments. Consider the company’s growth prospects, cash flow stability, and potential financing needs to determine the appropriate balance.

- The Role of Leverage: Understand the concept of leverage and its impact on a company’s capital structure. Leverage magnifies returns for shareholders in favorable market conditions but also increases financial risk during downturns. Assess the company’s ability to handle debt repayment and interest expenses, considering factors such as cash flow predictability, revenue stability, and asset base.

- Consider Market and Investor Perspectives: Evaluate the market’s perception of the company’s capital structure and how it affects valuation. Understand the expectations and preferences of investors regarding the mix of debt and equity. Assess market conditions and investor sentiment to determine the most favorable financing options at a given time.

It is important to note that determining the optimal capital structure is not a one-size-fits-all approach. Each company’s circumstances, industry dynamics, and financial goals will differ, requiring a customized analysis. Regular monitoring and reassessment of the capital structure are necessary to adapt to changing market conditions and company needs.

By following these steps and conducting a comprehensive analysis, companies can determine their optimal capital structure that aligns with their financial objectives, risk tolerance, and market conditions. Striking the right balance between debt and equity financing is crucial to ensure long-term financial stability, flexibility, and growth.

Analyzing the Financials

Analyzing a company’s financials is a critical step in determining its optimal capital structure. By examining key financial statements, investors and financial managers can gain insights into the company’s financial health, performance, and funding requirements. Here are some key areas to consider when analyzing the financials:

- Balance Sheet Analysis: Review the company’s balance sheet to assess its overall financial position. Analyze the composition of assets and liabilities to understand the current capital structure and leverage. Look at the levels of cash, accounts receivable, inventory, and fixed assets to evaluate liquidity and asset management efficiency. Identify the proportion of long-term debt and equity in the capital structure.

- Income Statement Analysis: Examine the income statement to assess the company’s profitability and cash flow generation. Analyze revenue growth, gross margin, operating expenses, and net income. Pay attention to trends over multiple periods to evaluate the company’s ability to generate consistent earnings. Compare the earnings to the interest expense and tax provision to assess debt-servicing capacity.

- Cash Flow Statement Analysis: Evaluate the cash flow statement to understand the company’s cash generation and utilization. Examine cash flows from operations to assess the company’s ability to generate positive cash flows from its core business activities. Analyze cash flows from investing and financing activities, looking for key sources and uses of cash, such as debt repayments, capital expenditures, and dividend payments.

- Financial Ratios and Metrics: Calculate and analyze various financial ratios and metrics to gain deeper insights into the company’s financial performance and stability. Key ratios to consider include the debt-to-equity ratio, interest coverage ratio, return on equity (ROE), and return on assets (ROA). Ratios such as the quick ratio and current ratio can shed light on liquidity and short-term solvency.

- Growth and Capital Expenditure Needs: Consider the company’s growth prospects and future capital expenditure requirements. A company with high growth potential may require additional funding for expansion, which could impact the optimal capital structure. Evaluate the company’s historical and projected cash flow patterns to assess its ability to fund growth initiatives.

By conducting a thorough analysis of the financial statements and ratios, investors and financial managers can gain a comprehensive understanding of the company’s financial health, debt-servicing capacity, and funding needs. This analysis serves as a foundation for determining the optimal capital structure that aligns with the company’s financial goals, risk tolerance, and market conditions.

Assessing Risk and Cost of Capital

Assessing the risk and cost of capital is a crucial step in determining a company’s optimal capital structure. The cost of capital represents the required return that investors expect for providing funds to the company. Here are some key factors to consider when assessing risk and cost of capital:

- Business Risk: Evaluate the level of risk associated with the company’s operations and industry. Consider factors such as competition, demand volatility, regulatory environment, and technological disruptions. Higher business risk may lead to a higher cost of capital and affect the optimal mix of debt and equity financing.

- Financial Risk: Financial risk refers to the risk of default or financial instability arising from a company’s debt obligations. Assess the company’s ability to service its debt obligations by evaluating key financial ratios such as leverage ratios and interest coverage ratio. Higher financial risk may result in higher borrowing costs and a more conservative approach to the capital structure.

- Market Risk Premium: Consider the prevailing market risk premium, which is the excess return that investors expect over a risk-free rate. This premium compensates investors for taking on systematic risk associated with investing in the stock market. A higher market risk premium may result in a higher cost of equity capital.

- Cost of Debt: Evaluate the cost of debt by assessing the interest rates that the company can secure based on its creditworthiness. Consider factors such as credit rating, market conditions, and the company’s financial stability. The interest rate on debt is a crucial component of the cost of capital and affects the capital structure decision.

- Cost of Equity: Determine the cost of equity capital by considering factors such as the company’s beta (a measure of stock price volatility), market risk premium, and risk-free rate. Higher market volatility or higher perceived risk may result in a higher cost of equity capital. This cost is crucial as it represents the return expected by equity investors.

- Weighted Average Cost of Capital (WACC): Finally, calculate the weighted average cost of capital (WACC), which represents the average cost of debt and equity financing in proportion to the company’s capital structure. The WACC determines the minimum required return on investment for projects undertaken by the company. Balancing the cost of debt and equity affects the WACC and determines the optimal capital structure.

By evaluating these risk factors and calculating the cost of capital components, companies can assess the optimal mix of debt and equity financing. The aim is to minimize the overall cost of capital while considering the risks associated with different financing options. This analysis assists in determining the appropriate capital structure that maximizes shareholder value and aligns with the company’s risk tolerance and financial goals.

Balancing Debt and Equity

When determining a company’s optimal capital structure, finding the right balance between debt and equity is crucial. Both forms of financing have their advantages and considerations. Here are some key factors to consider when balancing debt and equity:

- Financial Stability: A high level of debt may increase financial risk and reduce financial flexibility. Companies should aim to maintain a stable and sustainable capital structure that supports their long-term financial health. Consider the company’s ability to generate consistent cash flows to cover interest payments and principal repayments on debt.

- Cash Flow and Debt Servicing: Evaluate cash flow patterns and debt-servicing capacities. Examine the company’s ability to generate sufficient cash flow to cover both operational expenses and debt obligations. Consider the stability of cash flow, taking into account any seasonality or cyclical factors that may impact the company’s ability to service debt.

- Tax Advantages: Debt financing can offer tax advantages due to interest expense deductibility. By taking advantage of tax shields, companies can reduce their overall tax burden and increase cash flows available for other uses. However, it is essential to carefully balance the tax advantages with the associated risks and costs of debt financing.

- Cost of Capital: Assess the cost of debt and equity and their impact on the company’s cost of capital. Debt financing tends to have lower costs compared to equity financing due to interest rates typically being lower than required returns on equity. Evaluate the company’s cost of capital and target a capital structure that minimizes this cost, optimizing the overall cost of funding.

- Ownership and Control: Equity financing allows companies to retain ownership and control, as there are no repayment obligations or interest payments. Consider the importance of maintaining control and the impact that diluting ownership may have on decision-making and management influence.

- Investor Perception: Consider how investors perceive the company’s financial stability, growth prospects, and risk tolerance based on its capital structure. Balance the company’s need for financing with the market’s expectations and preferences regarding the mix of debt and equity. A well-balanced capital structure can enhance the company’s credibility and attractiveness to investors.

The optimal mix of debt and equity financing will depend on the company’s financial position, risk appetite, industry dynamics, and growth plans. It is a delicate balancing act that requires careful consideration of the benefits and risks associated with each form of financing.

By analyzing the company’s financial stability, cash flow capabilities, tax advantages, cost of capital, ownership considerations, and investor perceptions, companies can strike the right balance between debt and equity. A well-crafted capital structure can support the company’s growth, financial stability, and long-term goals.

The Role of Leverage

Leverage plays a significant role in a company’s capital structure and has both benefits and risks. Leverage refers to the use of debt financing to amplify investment returns and increase the potential for growth. Here are some key points to understand about the role of leverage:

- Magnifying Returns: One of the main advantages of leverage is its ability to magnify returns for shareholders. By using debt financing, a company can generate higher returns on investment than if it had relied solely on equity funding. This can increase shareholder value and potentially drive higher profitability.

- Financial Risk: While leverage can amplify returns, it also increases financial risk. Taking on too much debt can make a company vulnerable to changes in interest rates, economic downturns, or unexpected events. As debt levels rise, so do interest payments, reducing cash flow available for other purposes.

- Default Risk: Excessive leverage increases the risk of default, which can have severe consequences for a company. If a company is unable to meet its debt obligations, it may be forced into bankruptcy or undergo financial restructuring. Default risk can adversely affect the company’s credit rating and ability to access future financing.

- Interest Expense: Another factor to consider is the burden of interest expense. As debt levels increase, so do interest payments, which can impact the company’s profitability and cash flow. It is essential to carefully manage interest costs and ensure that the company’s cash flow is sufficient to cover interest obligations.

- Flexibility vs. Control: Leverage affects the company’s financial flexibility and control. Debt holders have a claim on the company’s assets and cash flow, which can limit the company’s financial maneuverability. On the other hand, equity financing provides more flexibility and control as there are no mandatory debt repayments or interest obligations.

- Optimal Leverage: The optimal level of leverage depends on various factors, including the company’s financial stability, growth prospects, cash flow predictability, and risk appetite. Each company needs to evaluate its unique circumstances and determine the balance between leverage and financial risk that aligns with its long-term goals.

It is important to strike a balance when using leverage in a company’s capital structure. Too much leverage can expose the company to significant financial risks, while too little leverage may limit its growth potential. Companies need to carefully assess their risk tolerance, evaluate the impact of leverage on profitability and financial stability, and consider the potential consequences of excessive debt. By finding the right level of leverage, companies can optimize their capital structure and enhance shareholder value.

Potential Challenges in Achieving Target Capital Structure

While determining a target capital structure is essential, there are various challenges companies may encounter in achieving this desired financial mix. These challenges can arise due to internal and external factors that affect the company’s financing options and decisions. Here are some potential challenges to consider:

- Market Volatility: Fluctuations in the financial markets and changes in investor sentiment can pose challenges in achieving the target capital structure. Market volatility may impact the availability and cost of debt and equity financing options. Companies need to adapt to changing market conditions and devise strategies to navigate uncertainty.

- Access to Financing: Companies, especially small and medium-sized enterprises (SMEs), may face challenges in accessing financing to achieve their target capital structure. Lenders and investors may have specific requirements or criteria for providing funds, such as collateral, creditworthiness, or track record. Limited access to financing sources can make it challenging to achieve the desired mix of debt and equity.

- Financial Constraints: Financial constraints, such as limited cash flow or high debt burdens, can hinder a company’s ability to achieve its target capital structure. Companies may face difficulties in repaying existing debt or raising new financing, which can impact their ability to adjust the capital structure as desired.

- Industry and Regulatory Factors: Different industries may have specific regulations or norms that impact the capital structure decision. For example, regulated industries such as utilities or banks may have limitations on leverage due to regulatory requirements. Companies need to navigate industry-specific constraints and regulations when determining and achieving their target capital structure.

- Company Size and Life Cycle: The size and life cycle stage of a company can also present challenges in achieving the target capital structure. Startups and early-stage companies may find it more difficult to attract debt financing and may rely more on equity funding. Conversely, larger, more established companies may face challenges in maintaining the desired level of equity or accessing financing at favorable terms.

- Risk vs. Reward Trade-offs: Achieving the target capital structure often involves striking a balance between risk and reward. Companies need to assess the trade-offs of different financing options and consider the impact on financial risk, profitability, and long-term sustainability. Balancing these factors can be challenging, especially when market conditions or business dynamics change.

Despite these challenges, companies can overcome them by adopting sound financial management practices, maintaining strong relationships with lenders and investors, and regularly assessing and adjusting their capital structure based on market conditions and internal capabilities. Flexibility, adaptability, and a proactive approach are key in navigating the challenges and achieving a target capital structure that aligns with the company’s financial goals and market realities.

Conclusion

Establishing and achieving a target capital structure is a critical aspect of financial management for any company. The optimal mix of debt and equity financing plays a vital role in determining a company’s financial stability, cost of capital, and growth potential. It requires careful analysis of various factors, including industry dynamics, financial health, risk tolerance, and market conditions.

Companies must strike a balance between debt and equity financing to maximize shareholder value while managing financial risks effectively. The target capital structure should align with the company’s long-term goals, cash flow predictability, and growth prospects. It is essential to regularly monitor and adjust the capital structure to adapt to evolving market conditions and internal capabilities.

While there may be challenges, such as market volatility, limited access to financing, and regulatory constraints, companies can overcome these obstacles through proactive financial management and strategic decision-making.

By analyzing financial statements, assessing risk and cost of capital, balancing debt and equity, and understanding the role of leverage, companies can determine their optimal capital structure. This structure provides the necessary financial stability, flexibility, and growth potential to position the company for long-term success.

Ultimately, achieving the target capital structure requires careful evaluation, external and internal considerations, and a forward-thinking approach. By optimizing the capital structure, companies can enhance their financial performance, attract investors, and position themselves for sustainable growth in today’s dynamic business environment.