Home>Finance>How To Find The Capital Structure Of A Company With Preferred Stock

Finance

How To Find The Capital Structure Of A Company With Preferred Stock

Modified: December 29, 2023

Learn how to determine the capital structure of a company using preferred stock. Explore the financial aspects of businesses with this comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Capital Structure

- What is Preferred Stock?

- Importance of Capital Structure Analysis

- Steps to Find the Capital Structure of a Company with Preferred Stock

- Step 1: Identify the Total Equity of the Company

- Step 2: Calculate the Total Debt of the Company

- Step 3: Determine the Outstanding Preferred Stock

- Step 4: Calculate the Total Capital Structure

- Step 5: Analyze the Capital Structure Ratios

- Conclusion

Introduction

Welcome to the world of finance, where understanding the structure of a company’s capital is crucial for investors, analysts, and financial professionals alike. The capital structure of a company represents the way it finances its operations and growth, and it plays a significant role in determining its overall financial health and stability.

One important component of a company’s capital structure is preferred stock. While common stock is more well-known and widely traded, preferred stock offers unique characteristics that can be of interest to both investors and the company itself. In this article, we’ll explore how to find the capital structure of a company with preferred stock and understand why it is essential to analyze this aspect of a company’s financials.

Before we delve into the specifics, let’s have a brief overview of capital structure. In simple terms, capital structure refers to the mix of different sources of funds that a company uses to finance its operations and investments. These sources typically include equity (common stock and preferred stock) and debt (loans, bonds, etc.). The proportion of each component in the capital structure determines the level of financial risk the company is exposed to.

Preferred stock, also known as preference shares, is a type of equity security that sits between common stock and debt. Unlike common stock, preferred stockholders have a fixed dividend rate and are paid before common stockholders in the event of liquidation. This gives preferred stock a hybrid nature, combining characteristics of both debt and equity. While preferred stockholders don’t have voting rights like common stockholders, they have a higher claim on the company’s assets and earnings compared to common stockholders.

Understanding and analyzing a company’s capital structure, especially the portion related to preferred stock, is crucial for several reasons. Firstly, it provides insight into the financial risk and stability of the company. By examining the percentage of equity and debt in the capital structure, investors and analysts can assess the company’s ability to meet its financial obligations and generate returns for shareholders.

Secondly, analyzing the capital structure helps in determining the cost of capital for the company. The cost of capital represents the required rate of return that the company must achieve on its investments to satisfy its providers of capital (both equity and debt investors). By understanding the proportion of preferred stock in the capital structure, investors can evaluate the overall cost of capital for the company and make informed investment decisions.

Now that we understand the importance of analyzing the capital structure of a company with preferred stock, let’s dive into the steps involved in finding the capital structure and calculating the ratios to assess the company’s financial health and risk.

Understanding Capital Structure

Before we proceed with understanding how to find the capital structure of a company with preferred stock, let’s delve deeper into what capital structure entails. In essence, capital structure refers to the composition of a company’s funding sources, including equity and debt. It represents the way a company finances its operations, expansion, and investments.

The capital structure is a critical aspect of financial management as it directly influences a company’s risk profile, financial flexibility, and potential returns for investors. By analyzing the capital structure, stakeholders can gain insights into the company’s financial health and its capacity to meet its financial obligations.

Equity and debt are the primary components that make up a company’s capital structure. Equity represents ownership in the company and is typically divided into common stock and preferred stock. Common stock offers voting rights and the potential for capital appreciation, while preferred stock provides a fixed dividend rate and priority over common stock in terms of payouts.

On the other hand, debt represents borrowed funds that a company needs to repay over time. This can include bank loans, bonds, and other forms of debt instruments. Debt holders have a legal claim to the company’s assets and are entitled to interest payments and the return of principal. Unlike equity, debt does not confer ownership rights or voting power.

The proportion of equity and debt in a company’s capital structure can vary depending on various factors such as industry norms, company size, growth prospects, and financial strategies. For example, a start-up company may rely heavily on equity financing, while an established company may have a larger portion of debt in its capital structure.

A well-balanced and optimal capital structure is crucial for a company’s long-term success. It is a delicate balance between leveraging debt to benefit from tax advantages and maintaining a reasonable level of equity to minimize financial risk. A capital structure with too much debt can lead to financial distress and jeopardize the company’s ability to meet its obligations. Conversely, a capital structure with too much equity may result in suboptimal returns for shareholders.

Analyzing a company’s capital structure is not just about looking at the proportions of equity and debt. It also involves assessing the overall risk profile by evaluating various financial ratios such as debt-to-equity ratio, interest coverage ratio, and return on equity. These ratios shed light on the company’s ability to service its debt, generate profits, and provide a return to shareholders.

Now that we have a solid understanding of what capital structure is and its significance, let’s delve into how to find the capital structure of a company with preferred stock and analyze it to make informed investment decisions.

What is Preferred Stock?

Preferred stock, also known as preference shares, is a unique class of stock that combines features of both equity and debt. It represents ownership in a company but differs from common stock in terms of certain rights and privileges.

When a company issues preferred stock, it offers investors a fixed dividend rate, which is typically higher than the dividend paid to common stockholders. This means that preferred stockholders are entitled to receive their dividend payments before common stockholders. In the event of a company’s liquidation or bankruptcy, preferred stockholders have a higher claim on the company’s assets compared to common stockholders, but their claim is lower than that of debt holders.

Unlike common stock, preferred stockholders generally do not have voting rights. This means that they do not have a say in the company’s decision-making process or the election of board members. However, some types of preferred stock may have limited voting rights on certain matters.

Preferred stock is often categorized into different types based on its characteristics. For example, cumulative preferred stock accumulates unpaid dividends and must be paid before any dividends can be distributed to common stockholders. Non-cumulative preferred stock, on the other hand, does not accumulate unpaid dividends and does not have the same priority in receiving dividends.

Convertible preferred stock allows the holder to convert their preferred shares into common shares at a specified ratio. This feature provides an opportunity for preferred stockholders to benefit from potential capital appreciation if the company’s stock price increases.

Participating preferred stock allows preferred stockholders to receive additional dividends above the fixed rate if the company generates substantial profits. This feature provides the potential for increased returns for preferred stockholders.

Preferred stock is often considered a hybrid instrument because it has characteristics of both equity and debt. While it represents ownership in the company, similar to common stock, its fixed dividend and priority in liquidation resemble debt obligations. The unique nature of preferred stock makes it an attractive investment option for those seeking a relatively stable income stream and a higher claim on company assets.

Companies may choose to issue preferred stock as a way to raise capital without diluting the ownership and control of existing shareholders. It also allows them to diversify their sources of funding by incorporating both debt and equity elements into their capital structure.

In summary, preferred stock is a distinct class of stock that offers investors a fixed dividend rate and a higher claim on company assets compared to common stockholders. Although it lacks voting rights, preferred stock provides a stable income stream and the potential for capital appreciation in certain situations. Understanding the characteristics of preferred stock is essential when analyzing a company’s capital structure and making investment decisions.

Importance of Capital Structure Analysis

Analyzing the capital structure of a company, including the portion related to preferred stock, is of utmost importance for various stakeholders in the financial landscape. Let’s explore why capital structure analysis holds such significance.

1. Financial Stability and Risk Assessment: Understanding a company’s capital structure allows investors, analysts, and lenders to assess its financial stability and risk profile. By examining the mix of equity and debt, one can evaluate the company’s ability to meet its financial obligations, such as paying interest on loans and dividends on preferred stock. A robust capital structure analysis is crucial for making informed decisions regarding investment potential and creditworthiness.

2. Cost of Capital Determination: The cost of capital represents the return required by investors to invest in a company. Analyzing the capital structure, particularly the portion involving preferred stock, helps determine the overall cost of capital. A higher proportion of preferred stock increases the company’s fixed obligation to pay dividends, which impacts the cost of capital. Investors can use this information to assess potential investment returns and make calculated decisions.

3. Return on Equity Evaluation: The capital structure significantly influences a company’s return on equity (ROE). ROE measures the profitability of a company by assessing how effectively it generates profits from shareholders’ investments. Analyzing the capital structure allows investors to understand how the use of preferred stock affects the ROE and assess the company’s efficiency in utilizing its capital.

4. Flexibility in Operations and Expansion: The capital structure determines the financial flexibility of a company. By analyzing the mix of equity and debt, investors can evaluate a company’s ability to finance its operations, invest in growth opportunities, and navigate through economic downturns. Capital structure analysis provides valuable insights into how a company manages its financial resources and adapts to changing market conditions.

5. Investor Preferences and Risk Tolerance: Investors have varying risk preferences and investment objectives. Some prefer stable income streams and prioritize the safety of their investment, which may lead them to favor preferred stock. Others may seek higher growth potential and take on more risk by investing in common stock. Understanding a company’s capital structure helps align investments with investor preferences and risk tolerance levels.

6. Comparison and Benchmarking: Analyzing the capital structure of a company allows for meaningful comparisons and benchmarking with industry peers. By understanding the industry norms and prevailing trends, investors and analysts can assess whether a company’s capital structure is in line with its competitors and determine whether it represents an attractive investment opportunity.

Capital structure analysis serves as a vital tool in understanding the financial health, risk profile, and growth potential of a company. By evaluating the proportion of preferred stock in the capital structure, stakeholders can make informed decisions, mitigate risk, and identify investment opportunities that align with their objectives and risk tolerance.

Steps to Find the Capital Structure of a Company with Preferred Stock

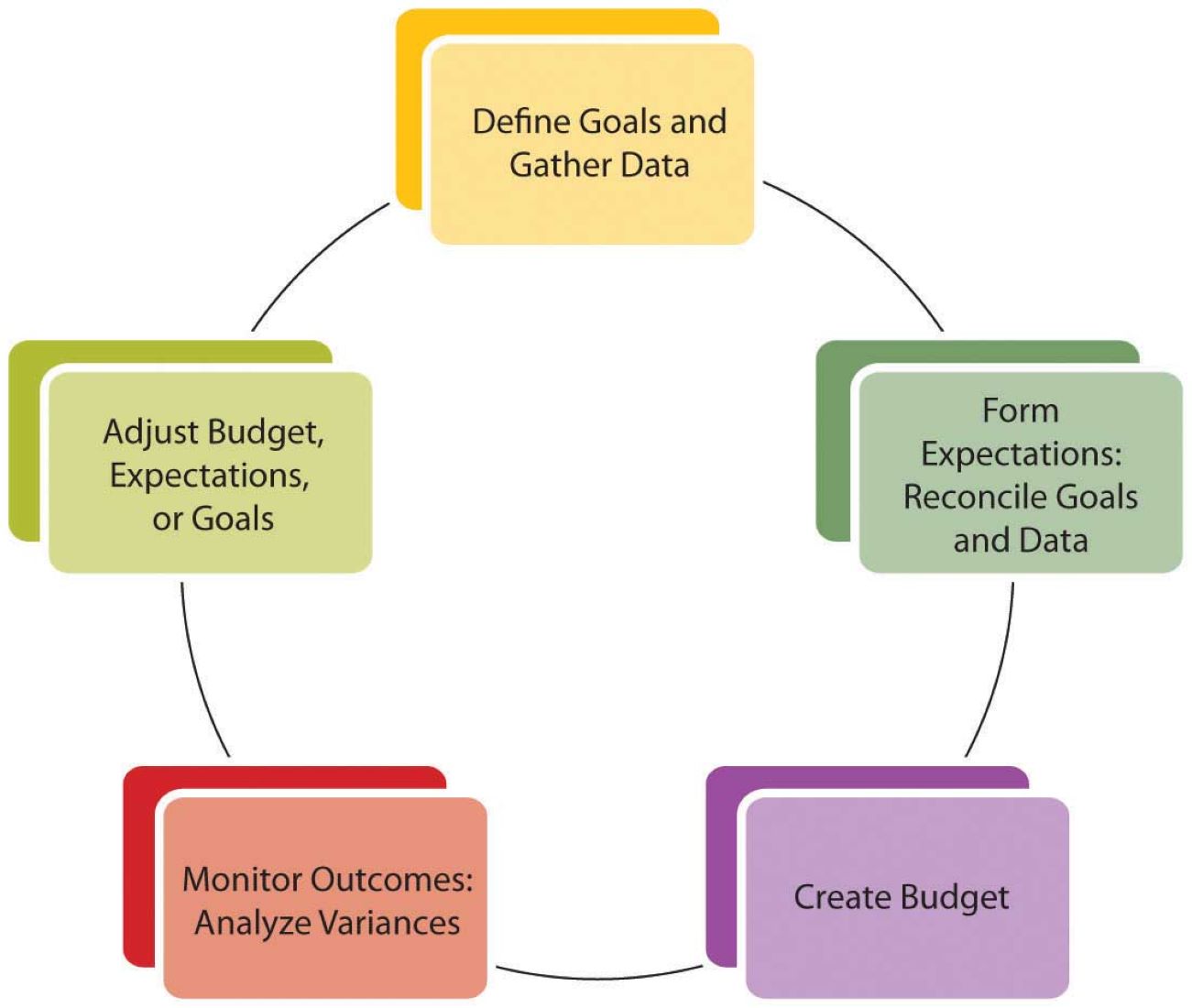

Analyzing the capital structure of a company with preferred stock requires a systematic approach. By following these steps, stakeholders can ascertain the composition and proportions of equity and debt in the company’s capital structure.

1. Step 1: Identify the Total Equity of the Company: Begin by determining the total equity of the company, which includes both common and preferred stock. This information can be found in the company’s financial statements, such as the balance sheet. It represents the ownership interest in the company and serves as a starting point for analyzing the capital structure.

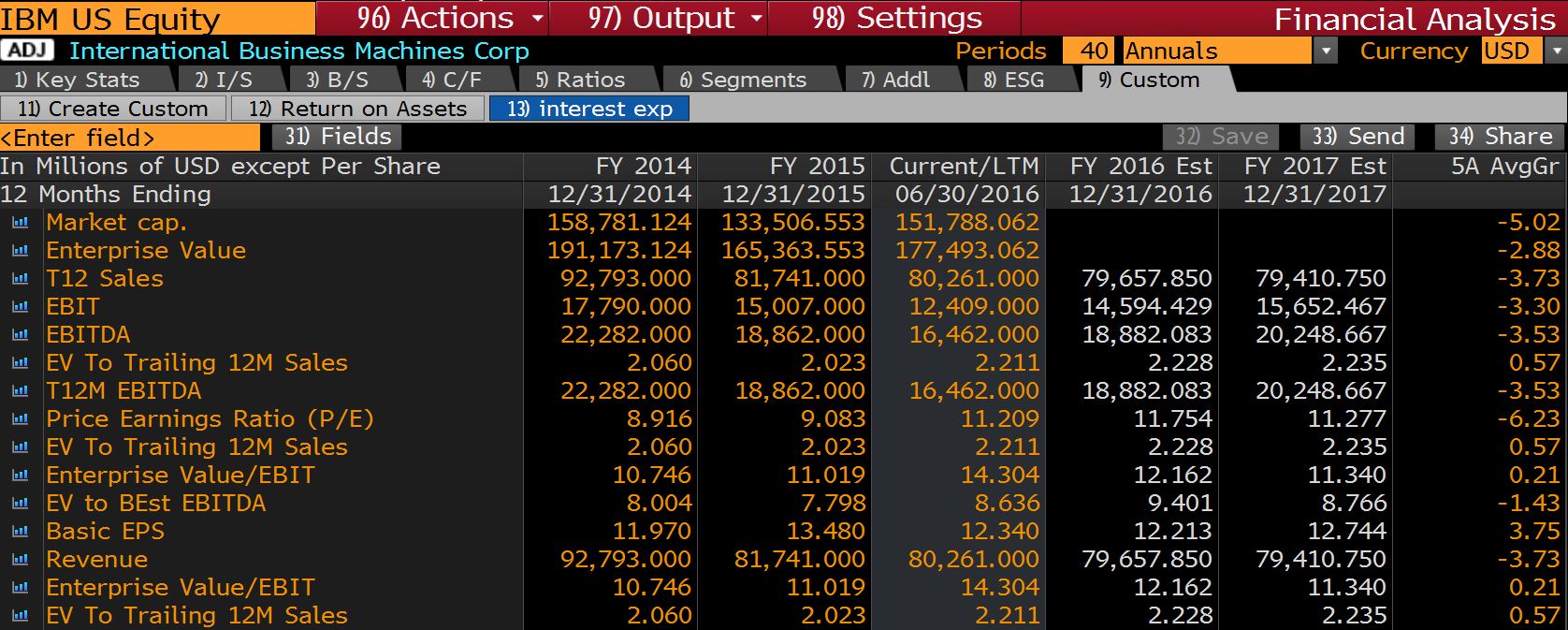

2. Step 2: Calculate the Total Debt of the Company: To assess the debt component of the capital structure, calculate the total debt of the company. This includes any outstanding loans, bonds, and other forms of debt. The information can be obtained from the company’s financial statements or by consulting external sources like credit ratings agencies or financial databases.

3. Step 3: Determine the Outstanding Preferred Stock: Identify the outstanding preferred stock of the company. This can be obtained from the company’s financial statements or disclosures. The number of preferred shares outstanding and their dividend rate will help in evaluating the contribution of preferred stock to the capital structure.

4. Step 4: Calculate the Total Capital Structure: Once the total equity, total debt, and outstanding preferred stock have been identified, calculate the total capital structure of the company. Add the total equity, total debt, and the value of the outstanding preferred stock to get the complete picture of the company’s capital structure. This step allows for a comprehensive assessment of the composition and proportions of various funding sources.

5. Step 5: Analyze the Capital Structure Ratios: After obtaining the capital structure figures, it is essential to analyze key ratios to gain further insights into the company’s financial health. Some important ratios to consider are the debt-to-equity ratio, which indicates the company’s leverage level, and the interest coverage ratio, which measures the ability to meet interest payments. Additionally, analyzing return on equity (ROE) and return on assets (ROA) ratios can provide insights into the company’s profitability and efficiency in utilizing its resources.

By following these steps to find the capital structure of a company with preferred stock, investors, analysts, and financial professionals can make informed decisions regarding the company’s financial stability, risk profile, and growth potential. This analysis serves as a valuable tool in evaluating investment opportunities and understanding the overall financial health of the company.

Step 1: Identify the Total Equity of the Company

When analyzing the capital structure of a company with preferred stock, the first step is to identify the total equity of the company. Equity represents the ownership interest in the company and is divided into common stock and preferred stock.

To determine the total equity, examine the company’s financial statements, particularly the balance sheet. The balance sheet provides a snapshot of the company’s financial position, including its assets, liabilities, and shareholders’ equity.

In the shareholders’ equity section of the balance sheet, you will find the value of the company’s common stock and preferred stock. These figures represent the ownership stake held by investors in the company.

Calculate the total equity by adding the value of the common stock and the value of the preferred stock. This will provide you with the overall equity position of the company.

It is important to note that the value of the preferred stock is typically disclosed separately from common stock on the balance sheet. Preferred stockholders have rights and privileges that differ from those of common stockholders, such as a fixed dividend rate and priority in receiving dividend payments.

By identifying the total equity of the company, you gain insight into the proportion of ownership that is held by shareholders. This information serves as a foundation for analyzing the capital structure and understanding the company’s financial position and risk profile.

Furthermore, by comparing the total equity to other components of the company’s capital structure, such as total debt and outstanding preferred stock, you can assess the relative weight of equity in the overall funding mix. This assessment is crucial for evaluating the company’s ability to meet its financial obligations and determining its risk exposure.

Remember to refer to the most recent financial statements and ensure accuracy in identifying the total equity. As financial positions can change over time, it is important to use the most up-to-date information available.

Overall, identifying the total equity of a company is an essential first step in analyzing the capital structure, allowing you to gain a clear understanding of the ownership structure and its implications for the company’s financial health.

Step 2: Calculate the Total Debt of the Company

After identifying the total equity of a company with preferred stock, the next step is to calculate the total debt. Total debt represents the borrowed funds that the company must repay over time. This includes various forms of debt such as bank loans, bonds, and other financial obligations.

To calculate the total debt, you will need to gather information from the company’s financial statements and other relevant sources. The balance sheet is a primary document that provides insight into the company’s liabilities, including its debt obligations.

Begin by examining the liabilities section of the balance sheet. Look for line items such as long-term debt, short-term debt, and other forms of liabilities. These figures represent the company’s outstanding obligations to its creditors.

Add up the values of these various debt items to calculate the total debt of the company. This will give you a comprehensive understanding of the company’s overall debt burden.

It’s important to note that in some cases, companies may also have off-balance sheet debt, which may not be directly captured in the balance sheet. Examples of off-balance sheet debt include lease obligations and contingent liabilities. In such cases, it may be necessary to consult the company’s footnotes or financial disclosures to obtain a complete picture of the total debt.

Calculating the total debt is crucial for assessing the company’s leverage or debt-to-equity ratio, which indicates the proportion of debt relative to equity in the capital structure. A higher debt-to-equity ratio suggests a more leveraged capital structure, which can increase the company’s financial risk and impact its ability to meet its obligations.

By comparing the total debt to the total equity, you will also gain insights into the company’s overall funding mix. This analysis aids in understanding the capital structure and evaluating the company’s financial stability, risk profile, and ability to generate returns for its shareholders.

It’s important to regularly update the calculation of total debt as it may change over time due to loan repayments, new borrowings, or other financial activities undertaken by the company.

Remember to use accurate and up-to-date financial information to ensure the reliability of your analysis. Pay attention to any specific debt instruments, such as preferred debt or convertible debt, that may have different characteristics and require separate consideration.

Calculating the total debt of a company is an essential step in analyzing the capital structure, providing valuable insights into the company’s financial obligations and risk exposure. It allows investors, analysts, and financial professionals to make informed decisions and assess the company’s ability to meet its debt obligations.

Step 3: Determine the Outstanding Preferred Stock

In the process of analyzing the capital structure of a company with preferred stock, it is crucial to determine the outstanding preferred stock. This step involves identifying the number of preferred shares outstanding and understanding their characteristics and value.

To determine the outstanding preferred stock, refer to the company’s financial statements, specifically the balance sheet or the notes to the financial statements. Look for a specific line item or disclosure that provides details on the preferred stock.

The financial statements should indicate the number of preferred shares issued by the company. This information allows you to understand the scale of preferred stock ownership within the company.

In addition to the number of shares, it is important to consider the characteristics of the preferred stock, including the dividend rate and any other special rights or features. Preferred stock typically offers a fixed dividend rate, which is specified at the time of issuance. This rate represents the amount paid to preferred stockholders before any dividends are distributed to common stockholders.

Some types of preferred stock may have additional features or rights, such as conversion options to common stock or participation in excess dividends. These factors contribute to the overall value and attractiveness of the preferred stock.

By determining the outstanding preferred stock, you can assess the impact of this class of stock on the company’s capital structure. Preferred stock has priority over common stock in terms of dividend payments and claims on company assets in case of liquidation. Understanding the number of shares and the dividend rate aids in evaluating the stability and risk profile of the company.

In addition, the value of the outstanding preferred stock contributes to the calculation of the company’s total equity, as discussed in the earlier steps. Including the value of preferred stock in the total equity calculation provides a comprehensive view of the ownership structure and the overall capitalization of the company.

Regularly updating the information on outstanding preferred stock is essential due to any potential changes, such as new issuances or retirements of preferred shares.

By determining the outstanding preferred stock, investors, analysts, and financial professionals gain a deeper understanding of the company’s capital structure and the role that preferred stock plays within it. This information is crucial for assessing risk, evaluating returns, and making informed investment decisions.

Step 4: Calculate the Total Capital Structure

In the process of analyzing the capital structure of a company with preferred stock, the next step is to calculate the total capital structure. This step involves combining the equity, debt, and preferred stock components to gain a comprehensive understanding of how the company is financed.

To calculate the total capital structure, begin by summing the total equity, total debt, and the value of outstanding preferred stock. The total equity represents the ownership interest in the company, including both common and preferred stock. The total debt encompasses all forms of borrowed funds, such as loans and bonds. The outstanding preferred stock reflects the number of preferred shares issued and their associated dividend rate.

Adding these three components together provides a holistic view of the company’s capital structure. The total capital structure represents the total amount of financing that the company has sourced from equity, debt, and preferred stock.

By calculating the total capital structure, investors, analysts, and financial professionals can determine the ratio of equity to debt and preferred stock. This ratio helps evaluate the company’s financing mix and assess the relative weight of each component in the overall capitalization of the company.

Understanding the total capital structure is essential for assessing the financial risk of the company. A capital structure heavily reliant on debt may indicate higher financial risk due to interest obligations and potential increases in borrowing costs. On the other hand, a capital structure skewed towards equity may suggest a lower risk due to a higher proportion of ownership-based funding.

Comparing the proportions of equity, debt, and preferred stock to industry peers and benchmarks can provide insights into the company’s financing strategy and its adherence to industry norms. It also enables investors to gauge the company’s risk profile and its ability to generate returns for shareholders.

Regularly updating the calculations of the total capital structure is crucial to reflect any changes in the company’s financial position. As the company grows or undergoes financing activities, the proportions of equity, debt, and preferred stock may shift, impacting the overall capital structure.

Calculating the total capital structure allows for a comprehensive evaluation of the company’s financial position and risk exposure. It aids in understanding the funding mix, determining the impact of preferred stock, and making informed decisions based on the overall capitalization of the company.

Step 5: Analyze the Capital Structure Ratios

Once the total capital structure of a company with preferred stock is calculated, the next step is to analyze key capital structure ratios. These ratios provide insights into the company’s financial health, risk profile, and effectiveness in utilizing its capital resources.

Here are a few key capital structure ratios to consider:

- Debt-to-Equity Ratio: This ratio measures the proportion of debt relative to equity in a company’s capital structure. It is calculated by dividing total debt by total equity. A higher debt-to-equity ratio indicates a higher level of financial leverage and increased risk, as the company relies more heavily on borrowed funds. It is essential to compare this ratio to industry benchmarks to evaluate the company’s risk profile.

- Interest Coverage Ratio: The interest coverage ratio assesses a company’s ability to meet its interest obligations. It measures the company’s earnings before interest and taxes (EBIT) relative to its interest expense. A higher interest coverage ratio indicates a stronger capacity to service debt and implies lower financial risk.

- Return on Equity (ROE): ROE measures how effectively a company generates profits from the shareholders’ equity. It is calculated by dividing net income by total equity. A higher ROE suggests that the company is efficiently utilizing its equity to generate returns for shareholders.

- Return on Assets (ROA): ROA gauges the company’s ability to generate profits from its total assets. It is calculated by dividing net income by total assets. A higher ROA indicates the efficient utilization of assets to generate profits and signifies good management efficiency.

- Preferred Stock Ratio: This ratio represents the proportion of preferred stock relative to the total equity in the capital structure. It is calculated by dividing the value of the outstanding preferred stock by the total equity. The preferred stock ratio provides insight into the impact of preferred stock on the ownership structure and overall financing mix.

By analyzing these ratios, investors, analysts, and financial professionals can assess the financial health, risk profile, and efficiency of a company. These ratios also aid in comparing the company’s performance to industry peers and benchmarks, highlighting areas of strength or improvement.

It is essential to interpret these ratios within the context of industry norms and company-specific factors. Additionally, track the ratios over time to identify trends and potential areas of concern or improvement.

Through a thorough analysis of capital structure ratios, stakeholders can gain valuable insights into a company’s financial position and make informed decisions regarding investments, risk management, and overall financial strategies.

Conclusion

Understanding the capital structure of a company with preferred stock is vital in evaluating its financial health and making informed investment decisions. By following a systematic approach, analysts and investors can assess the composition and proportions of equity, debt, and preferred stock in the company’s capital structure.

This article has highlighted the importance of capital structure analysis in assessing financial stability, determining the cost of capital, and evaluating risk. It has outlined the steps involved in finding the capital structure of a company with preferred stock, including identifying total equity, calculating total debt, determining outstanding preferred stock, and calculating the total capital structure.

Furthermore, this article underscored the significance of analyzing capital structure ratios, such as debt-to-equity ratio, interest coverage ratio, and return on equity. These ratios provide insights into the risk profile, profitability, and efficiency of the company.

By analyzing the capital structure, stakeholders can gain a comprehensive understanding of a company’s financial position and risk exposure. This insight enables them to make more informed decisions regarding investment opportunities, risk management, and overall financial strategies.

It is important to note that when analyzing the capital structure of a company, a holistic approach should be taken, considering other factors such as industry dynamics, market conditions, and management strategies. Additionally, regular updates on financial statements and information are essential to ensure accuracy and relevance of the analysis.

In conclusion, a thorough analysis of the capital structure of a company with preferred stock provides valuable insights into its financial stability, risk profile, and growth potential. By understanding the proportions of equity, debt, and preferred stock, as well as analyzing key ratios, stakeholders can make informed decisions and navigate the complex world of finance with confidence.