Finance

How To Find Interest Expense On Bonds

Published: October 14, 2023

Learn how to calculate interest expense on bonds and understand its importance in finance. Find tips and techniques to efficiently analyze bond interest expenses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of bonds, where the allure of fixed income and predictable cash flows entices investors. Understanding the various aspects of bonds is crucial, and one element that plays a significant role is interest expense. In this article, we will delve into the concept of interest expense on bonds, its components, and how it is calculated.

Bonds are debt instruments issued by companies, governments, and other entities to raise capital. Investors purchase bonds as a way to lend money to the issuer, who promises to pay interest on a regular basis, typically semi-annually, and repay the principal amount at maturity.

Interest expense is a crucial aspect of bond investing because it represents the cost of borrowing for the issuer. It directly affects the issuer’s financial health and can impact the attractiveness of the bond to investors.

In this article, we will explore the components of interest expense on bonds, how it is calculated, and the factors that can influence it. Understanding these concepts will benefit both bond investors and issuers, as it provides insights into the financial implications of bond investments.

So, let’s dive into the fascinating world of interest expense on bonds and gain a deeper understanding of this critical aspect of fixed income investing.

Understanding Bonds

Bonds are financial instruments that represent a form of debt or borrowing. When an entity, such as a government or corporation, needs to raise money, it can issue bonds to investors. Investors purchase these bonds, effectively lending money to the issuer for a fixed period of time.

At its core, a bond is a promise by the issuer to repay the borrowed amount, known as the principal or face value, to the bondholder at a specified future date, known as the maturity date. In addition to the repayment of the principal, the issuer also agrees to pay periodic interest payments to the bondholder during the life of the bond.

Bonds have a predetermined interest rate, referred to as the coupon rate, which is expressed as a percentage of the face value. For example, a bond with a face value of $1,000 and a coupon rate of 5% would pay the bondholder $50 in annual interest payments.

There are various types of bonds, including government bonds, corporate bonds, municipal bonds, and treasury bonds. Each type may have different features and characteristics, such as different levels of risk, tax implications, and interest rates.

Investors are attracted to bonds for several reasons. Bonds are generally considered less risky than stocks because bondholders have a higher claim on the issuer’s assets in case of bankruptcy. Additionally, bonds offer fixed income, providing investors with a predictable stream of cash flows over the life of the bond.

Understanding the fundamentals of bonds is essential for investors and issuers alike. It allows investors to make informed decisions about which bonds to invest in based on their risk tolerance and investment objectives. For issuers, understanding bonds helps them assess the cost of borrowing and make strategic decisions on how to structure their debt obligations.

With a basic understanding of bonds in place, let’s move on to exploring the concept of interest expense on bonds and its significance in the financial world.

What is Interest Expense on Bonds?

Interest expense on bonds refers to the cost of borrowing for the issuer of the bond. It is the amount of money that the issuer must pay to bondholders in the form of periodic interest payments. These interest payments are typically made semi-annually or annually, depending on the terms of the bond agreement.

The interest expense is calculated based on the coupon rate and the outstanding amount of the bond. The coupon rate, which is expressed as a percentage of the bond’s face value, determines the amount of interest paid to bondholders. For example, if a bond has a face value of $10,000 and a coupon rate of 5%, the annual interest expense would be $500.

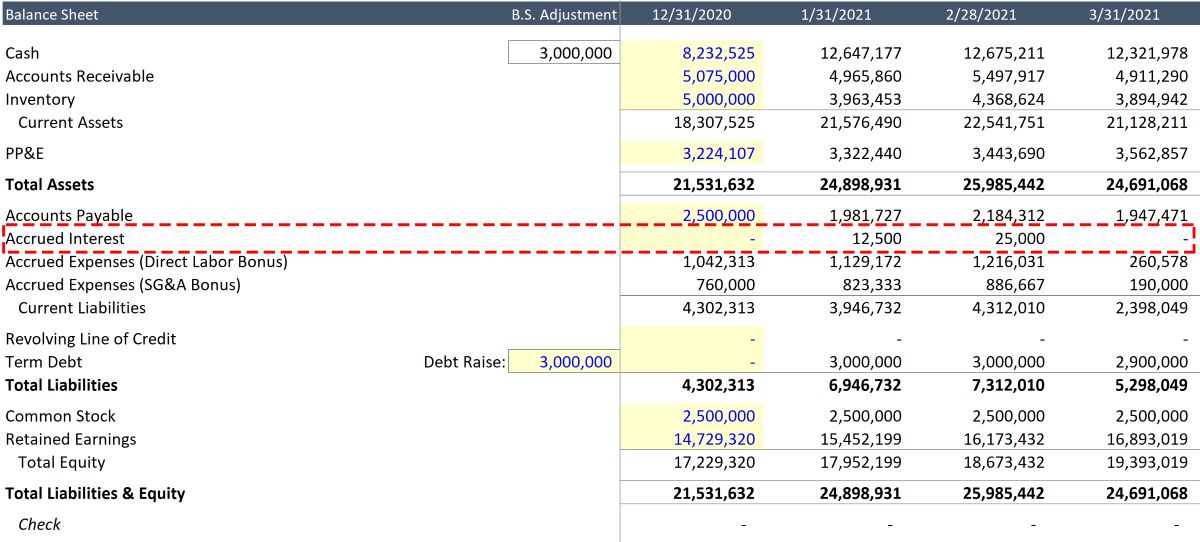

Interest expense on bonds is considered a liability for the issuer because it represents the obligation to make interest payments to bondholders. It is an essential component of the issuer’s financial statements, impacting the company’s profitability and cash flows.

Interest expense on bonds is typically tax-deductible for the issuer, which can provide a tax advantage and reduce the overall cost of borrowing. This tax benefit encourages companies and governments to finance their operations or projects through bond issuances rather than other forms of financing.

From an investor’s perspective, interest expense is an important factor to consider when analyzing a bond’s potential return. The interest payments provide income to the bondholder, and the consistency and reliability of these payments are crucial for income-oriented investors.

It’s worth noting that the interest expense on bonds can vary depending on the prevailing interest rates in the market. If interest rates rise, newly issued bonds may have higher coupon rates, resulting in higher interest expenses for issuers. Conversely, if interest rates decline, existing bonds may have higher coupon rates than the prevailing rates, effectively lowering the interest expense.

Understanding the concept of interest expense on bonds is vital for both issuers and investors. For issuers, it helps them manage their debt obligations and assess the financial implications of bond issuances. For investors, it provides insight into the income potential and risk associated with investing in bonds.

Now that we have explored what interest expense on bonds entails, let’s delve deeper into the components that contribute to this expense.

The Components of Interest Expense

Interest expense on bonds consists of several components that contribute to the total amount paid by the issuer to bondholders. Understanding these components is crucial for analyzing the cost of borrowing associated with bond issuances. Let’s explore the key components of interest expense:

- Coupon Rate: The coupon rate is the fixed interest rate stated on the bond at the time of issuance. It determines the annual interest payment as a percentage of the bond’s face value. For example, a bond with a face value of $10,000 and a coupon rate of 5% will have an annual interest payment of $500.

- Outstanding Principal: The outstanding principal refers to the remaining amount of the bond that has yet to be repaid to bondholders. As the bond issuer makes periodic interest payments, the outstanding principal decreases. The interest expense calculation is based on the outstanding principal at any given time.

- Number of Interest Payment Periods: Interest on bonds is typically paid semi-annually or annually, depending on the terms of the bond agreement. The number of interest payment periods directly affects the total interest expense. For example, a bond with a 5% coupon rate and annual interest payments will have a higher interest expense than a bond with the same coupon rate but with semi-annual interest payments.

- Day Count Convention: The day count convention determines how the number of days in an interest payment period is calculated. Bond markets may use different day count conventions, such as Actual/Actual, 30/360, or Actual/360. The choice of day count convention impacts the calculation of the interest expense.

- Amortization of Premium or Discount: Bonds may be issued at a premium or discount to their face value, depending on prevailing market conditions. If a bond is issued at a premium, the issuer incurs a higher interest expense than the coupon rate due to the additional cost associated with the premium. Conversely, if a bond is issued at a discount, the interest expense may be lower than the coupon rate.

By considering these components, bond issuers can accurately calculate their interest expense, enabling them to assess the cost of borrowing and make informed financial decisions. For investors, understanding these components provides insights into the factors that contribute to the income potential and risk associated with investing in bonds.

Now that we have examined the components of interest expense on bonds, let’s move on to understanding how interest expense is calculated.

Calculating Interest Expense on Bonds

Calculating interest expense on bonds involves several key factors, including the coupon rate, outstanding principal, number of interest payment periods, and the day count convention. Let’s explore the steps involved in calculating interest expense on bonds:

- Determine the Coupon Rate: The coupon rate is the fixed interest rate stated on the bond. It represents the percentage of the bond’s face value that will be paid as annual interest. For example, a bond with a face value of $10,000 and a coupon rate of 5% will have an annual interest payment of $500.

- Identify the Outstanding Principal: The outstanding principal refers to the remaining amount of the bond that has not been repaid to bondholders. It decreases over time as the bond issuer makes periodic interest payments. The interest expense calculation is based on the outstanding principal at any given time.

- Determine the Number of Interest Payment Periods: The frequency of interest payments depends on the terms of the bond agreement, which can be semi-annual or annual. The number of interest payment periods directly affects the total interest expense. For example, a bond with a 5% coupon rate and annual interest payments will have a higher interest expense than a bond with the same coupon rate but with semi-annual interest payments.

- Select the Day Count Convention: The day count convention determines how the number of days in an interest payment period is calculated. Common day count conventions include Actual/Actual, 30/360, and Actual/360. The appropriate day count convention must be used to calculate the correct interest expense.

- Calculate the Interest Expense: The interest expense is calculated by multiplying the coupon rate by the outstanding principal and adjusting for the number of interest payment periods and the day count convention. The formula can vary depending on the specific terms and conventions used. For example, if a bond has a face value of $10,000, a coupon rate of 5%, annual interest payments, and is using the Actual/Actual day count convention, the interest expense for a one-year period would be calculated as follows:

Interest Expense = Coupon Rate * Outstanding Principal

By following these steps and using the appropriate formulas, bond issuers can accurately calculate interest expenses. This information is crucial for budgeting, financial planning, and evaluating the cost of borrowing associated with bond issuances.

Investors can also utilize these calculations to assess the income potential and risk associated with investing in bonds. Understanding how interest expenses are calculated allows investors to make informed decisions about the expected returns on their bond investments.

Now that we have explored the calculation of interest expenses, let’s delve into the factors that can influence these expenses.

Factors Affecting Interest Expense

Interest expense on bonds can be influenced by several key factors. Understanding these factors is essential for bond issuers and investors alike, as they can impact the cost of borrowing and the potential returns on bond investments. Let’s explore the factors that can affect interest expense:

- Market Interest Rates: Market interest rates play a significant role in determining the cost of borrowing. If market interest rates rise after a bond is issued, the bond’s coupon rate may become less attractive to potential investors. In such cases, the issuer may have to offer higher coupon rates on subsequent bond issuances, resulting in higher interest expense.

- Creditworthiness of the Issuer: The creditworthiness of the bond issuer, as assessed by credit rating agencies, can impact interest expense. Issuers with higher credit ratings are generally perceived as less risky and may be able to borrow at lower interest rates. Conversely, issuers with lower credit ratings may face higher borrowing costs, leading to higher interest expenses.

- Market Demand for Bonds: The demand for bonds in the market can influence interest rates and, consequently, interest expense. If investors have a high demand for bonds, issuers may be able to offer lower coupon rates, thereby reducing interest expenses. On the other hand, if demand is low, issuers may need to offer higher coupon rates to attract investors, increasing interest expenses.

- Bond Characteristics: The specific characteristics of a bond, such as the maturity date, coupon rate, and face value, can also impact interest expenses. Bonds with longer maturities generally have higher interest expenses, as the issuer must make interest payments over a longer period. Bonds with higher coupon rates or larger face values will also have higher interest expenses.

- Market Conditions: Market conditions, including economic factors, inflation rates, and overall market trends, can influence interest expense. In times of economic uncertainty or high inflation, bond issuers may face higher borrowing costs, leading to higher interest expenses. Conversely, during periods of low inflation or stable economic conditions, interest expenses may be lower.

By considering these factors, bond issuers can anticipate and plan for potential changes in interest expenses. For investors, understanding these factors can help in assessing the risk-return tradeoff of bond investments and making informed decisions.

It’s important to note that interest expenses on bonds are dynamic and can change over time based on these factors. As such, bond issuers and investors must regularly monitor market conditions and adjust their strategies accordingly.

Now that we have explored the factors that can influence interest expenses, let’s highlight the importance of interest expense on bonds in the financial world.

Importance of Interest Expense on Bonds

Interest expense on bonds holds significant importance for both bond issuers and investors. It serves as a key indicator of the cost of borrowing and provides insights into the financial health and attractiveness of bond investments. Let’s explore the importance of interest expense on bonds:

- Cost of Borrowing: Interest expense represents the cost of borrowing for bond issuers. It directly impacts the issuer’s financial position and profitability. By analyzing interest expense, issuers can assess the affordability and sustainability of their debt obligations. It helps them evaluate the impact of interest rates and market conditions on their borrowing costs, enabling strategic decision-making.

- Investment Returns: For bond investors, interest expense is a crucial factor for evaluating potential returns. The interest payments received from bonds form a significant portion of the total return on investment. Investors rely on these interest payments as a source of regular income, especially when seeking stable and predictable cash flows. Analyzing interest expense helps investors assess the reliability of bond income and make informed investment decisions.

- Risk Assessment: Interest expense provides insights into the risk associated with bond investments. Higher interest expenses may indicate higher borrowing costs for issuers, raising concerns about their creditworthiness and ability to honor debt obligations. By analyzing interest expense and considering other factors such as credit ratings and market conditions, investors can assess the risk-return tradeoff and make informed decisions about bond investments.

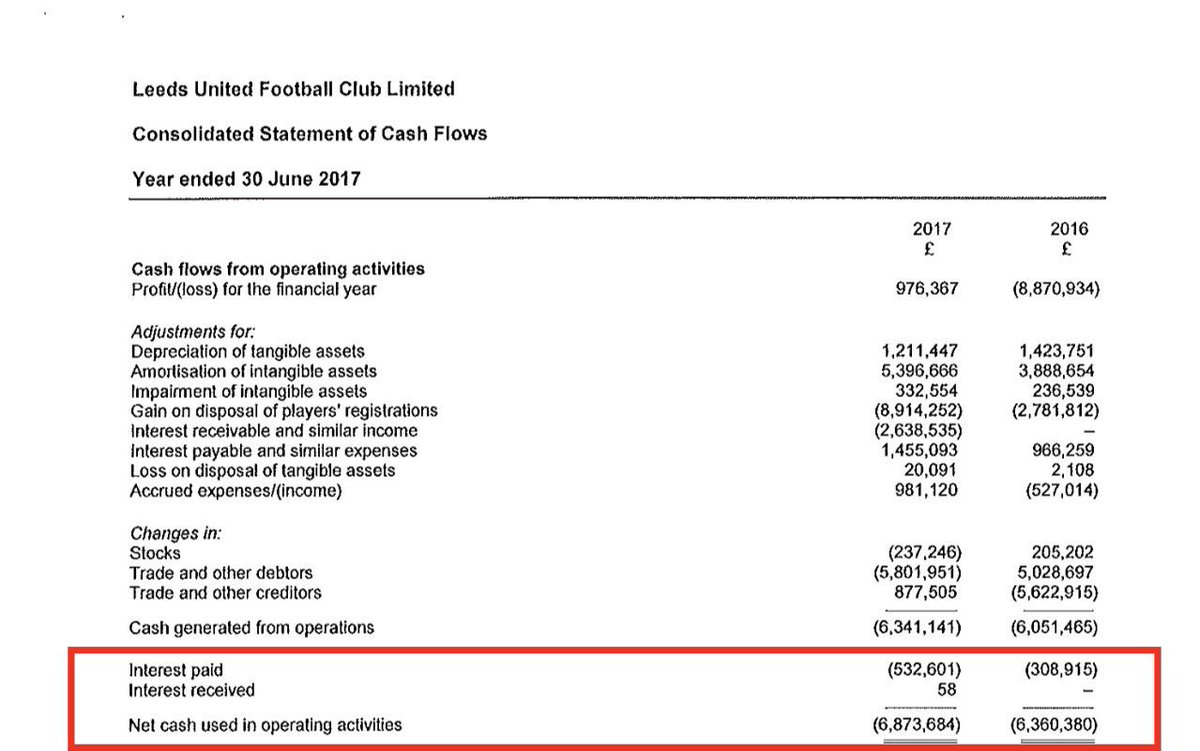

- Financial Reporting: Interest expense is a crucial element in financial reporting for bond issuers. It is reflected in the income statement as an expense, impacting the issuer’s profitability and financial performance. Accurate reporting of interest expense is essential for transparency and compliance with accounting standards. Investors rely on this information to analyze the financial health of bond issuers and make informed investment decisions.

- Economic Indicator: Interest expense on bonds can serve as an economic indicator. Changes in interest expenses may reflect shifts in market conditions, such as fluctuations in interest rates or changes in creditworthiness. Monitoring interest expenses on a broader scale can provide insights into the overall health of the economy and financial markets.

Understanding the importance of interest expense on bonds helps both bond issuers and investors in making informed decisions. For issuers, it aids in managing debt obligations and optimizing borrowing costs. For investors, it helps in evaluating the income potential, risk, and overall attractiveness of bond investments.

By analyzing interest expense alongside other factors and continuously monitoring market conditions, bond issuers and investors can navigate the complex world of bonds with greater confidence and achieve their financial objectives.

Now, let’s wrap up our exploration of interest expense on bonds.

Conclusion

Interest expense on bonds is a critical aspect of bond investing, impacting both issuers and investors. It serves as an indicator of the cost of borrowing for issuers and provides a source of regular income for investors. By understanding the components of interest expense, how it is calculated, and the factors that can influence it, stakeholders can make informed decisions about bond investments.

Bonds are essential financial instruments that enable entities to raise capital by borrowing from investors. The interest expense on bonds represents the periodic interest payments that issuers must make to bondholders. It is determined by factors such as the coupon rate, outstanding principal, number of interest payment periods, and day count convention.

The cost of borrowing, investment returns, and risk assessment are among the key aspects influenced by interest expense. Bond issuers use interest expense to evaluate their debt obligations and make strategic decisions regarding financing. For investors, interest expense influences the potential income generated from bond investments and aids in assessing risk.

Interest expense on bonds is also a crucial element in financial reporting, impacting the issuer’s profitability and compliance with accounting standards. Monitoring interest expenses can provide insights into market conditions and serve as an economic indicator.

In conclusion, understanding interest expense on bonds is vital for bond issuers and investors. It facilitates effective financial planning, risk assessment, and informed decision-making. By analyzing interest expense alongside other factors and staying attuned to market conditions, stakeholders can navigate the world of bonds successfully and achieve their financial goals.

So whether you’re an issuer looking to manage your debt obligations or an investor seeking stable income, understanding interest expense on bonds will help you make sound financial decisions in the dynamic world of fixed income investments.