Finance

Where Is Interest Expense On Balance Sheet

Modified: December 30, 2023

Learn about interest expense on the balance sheet and its importance in finance. Discover where to find interest expense and how it impacts a company's financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Balance Sheet?

- What is Interest Expense?

- Why is Interest Expense Important?

- Where is Interest Expense on the Balance Sheet?

- Common Misconceptions about Interest Expense on the Balance Sheet

- Factors Affecting Interest Expense

- Examples of Interest Expense Calculation on the Balance Sheet

- Conclusion

Introduction

A balance sheet is one of the fundamental financial statements used by businesses to provide a snapshot of their financial position at a specific point in time. It outlines the company’s assets, liabilities, and shareholders’ equity. While most people are familiar with the concept of assets and liabilities, one component that often raises questions is interest expense.

Interest expense refers to the cost of borrowing money from external sources, such as loans or bonds, to finance a company’s operations or investments. It is an essential aspect of a company’s financial health, as it directly affects its profitability and cash flow. Understanding where interest expense is located on the balance sheet is crucial for investors, creditors, and other stakeholders who analyze a company’s financial statements to make informed decisions.

In this article, we will delve into the details of interest expense and its significance on the balance sheet. We’ll explore why interest expense is important, where it is typically found on the balance sheet, common misconceptions about interest expense, factors affecting interest expense, and provide examples of interest expense calculations.

Whether you are a finance professional looking to deepen your knowledge or an individual interested in understanding financial statements, this article will shed light on the often overlooked but crucial aspect of interest expense on the balance sheet.

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial condition at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity, which together provide a comprehensive view of the company’s financial health. The balance sheet follows the basic accounting equation:

Assets = Liabilities + Shareholders’ Equity.

Assets: Assets are the resources owned by a company. They can include cash, accounts receivable, inventory, property, plant, and equipment, and investments. These assets are categorized as current assets and long-term assets. Current assets are those that can be converted into cash within one year, while long-term assets are held for a longer period.

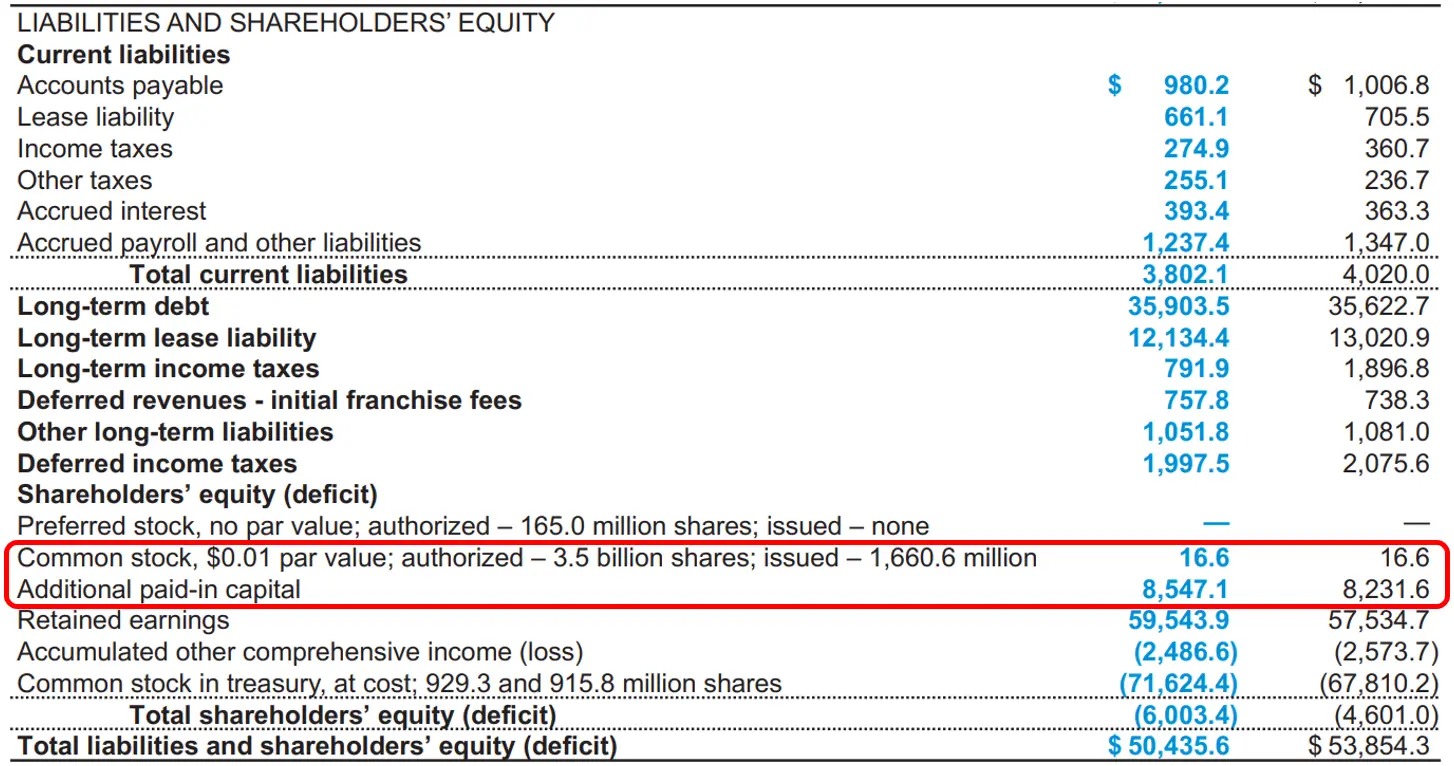

Liabilities: Liabilities are the obligations or debts a company owes to external parties. It includes accounts payable, loans, bonds, and other debts. Like assets, liabilities are categorized as current liabilities and long-term liabilities. Current liabilities are those that are due within one year, while long-term liabilities are due beyond one year.

Shareholders’ Equity: Shareholders’ equity represents the remaining interest in the assets of a company after deducting liabilities. It includes retained earnings, which are the accumulated profits of the company that have not been distributed to shareholders as dividends, and additional capital contributed by shareholders.

The balance sheet provides important information about a company’s liquidity, solvency, and overall financial position. It helps investors, creditors, and other stakeholders assess the company’s ability to meet its short-term and long-term obligations and to make informed decisions regarding investment or lending.

Ratios and metrics can be derived from the balance sheet to evaluate the company’s financial performance and effectiveness in utilizing its resources. These ratios include the current ratio, debt-to-equity ratio, and return on equity, among others.

In summary, a balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position by detailing its assets, liabilities, and shareholders’ equity. It plays a vital role in assessing a company’s financial health, stability, and ability to generate profits and meet its financial obligations.

What is Interest Expense?

Interest expense refers to the cost incurred by a company for borrowing money from external sources, such as loans, bonds, or lines of credit. It represents the interest payments made to the lenders in exchange for the use of their funds. Interest expense is a significant component of a company’s financial statements, as it directly impacts the company’s profitability and cash flow.

When a company needs additional funds to finance its operations, expansion plans, or capital expenditures, it may choose to borrow money from banks, financial institutions, or issue bonds to investors. These loans and bonds come with an agreed-upon interest rate, which is the cost of borrowing the funds.

Interest expense is typically calculated based on the outstanding amount of the debt and the interest rate. It is recorded on the income statement and represents an expense that reduces the company’s net income.

For example, if a company has a loan of $100,000 with an annual interest rate of 5%, the interest expense for the year would be $5,000 ([$100,000 x 5%]). This $5,000 is recorded as an expense on the income statement, reducing the company’s net income.

Interest expense not only affects a company’s profitability but also its cash flow. Making interest payments requires cash outflows, which can impact a company’s liquidity. It is important for businesses to ensure they have sufficient cash flow to meet their interest obligations, as failure to do so could result in default or other financial difficulties.

It is worth noting that interest expense is tax-deductible in most jurisdictions. This means that companies can reduce their taxable income by deducting the interest expenses paid during the year, which provides a tax advantage for businesses with significant interest-bearing debt.

Overall, interest expense represents the cost of borrowing funds and is an essential aspect of a company’s financial statements. It indicates the financial burden of debt and is a critical factor in assessing a company’s financial health, profitability, and cash flow.

Why is Interest Expense Important?

Interest expense plays a crucial role in evaluating a company’s financial health and performance. Here are key reasons why interest expense is important:

1. Profitability: Interest expense directly impacts a company’s profitability. As interest expense is recorded as an expense on the income statement, it reduces the company’s net income. Higher interest expense can eat into profits and lower the overall profitability of the business. Therefore, tracking and analyzing interest expense is essential for assessing the company’s financial performance and determining its ability to generate profits.

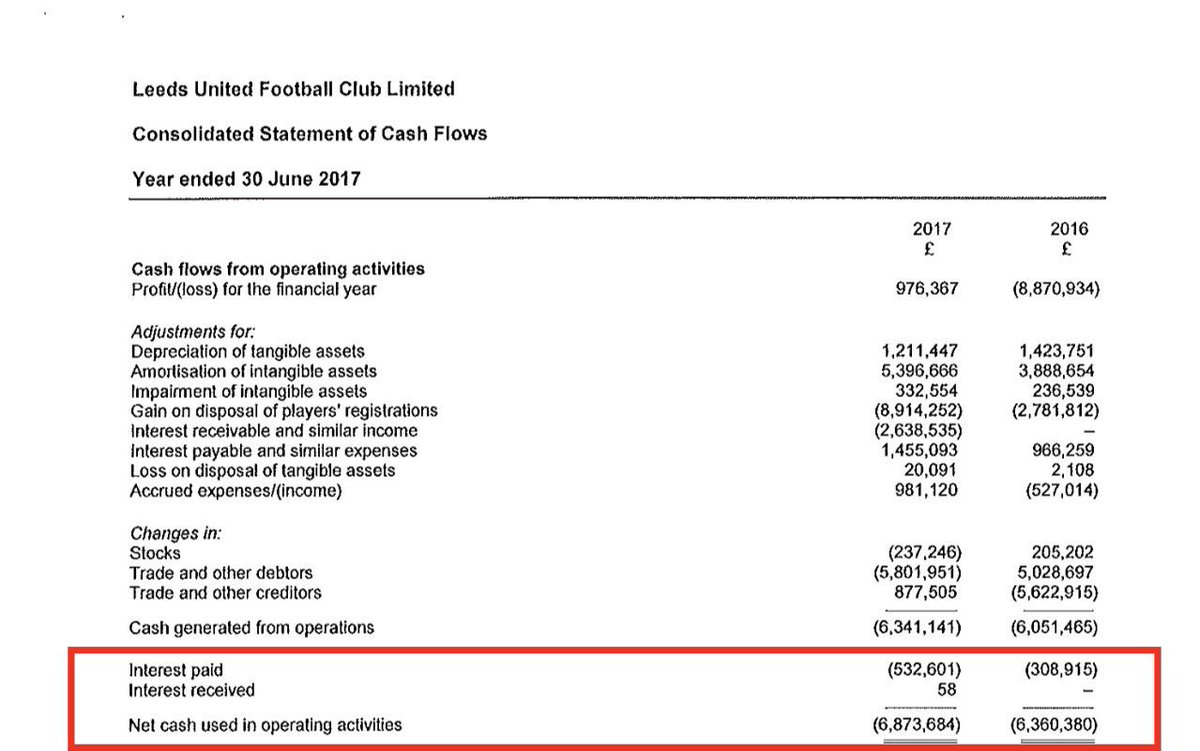

2. Cash Flow: Interest expense affects a company’s cash flow. Making regular interest payments requires cash outflows, which can impact a company’s liquidity. Failure to manage interest expense and meet interest obligations can lead to cash flow problems and potentially hinder a company’s ability to fund its operations or make necessary investments.

3. Debt Management: Interest expense reflects a company’s debt level and its ability to manage its borrowing costs. Monitoring interest expense allows businesses to assess their debt burden, including the cost of servicing the debt. It helps evaluate whether the company has taken on an excessive amount of debt and is experiencing financial strain or if it is effectively managing its debt obligations.

4. Financial Stability: Interest expense is a key indicator of a company’s financial stability and solvency. High interest expenses relative to the company’s earnings can be a warning sign of financial distress and an indication that the company may struggle to meet its debt obligations. Lenders and creditors often scrutinize interest expense as part of their risk assessment before extending credit or loans to the company.

5. Decision-Making: Interest expense is crucial for making informed business decisions. It helps businesses evaluate the cost-benefit analysis of taking on new debt or refinancing existing debt. By comparing interest expense to potential returns on investments or the company’s growth prospects, decision-makers can evaluate the financial implications and determine the most effective use of capital.

6. Investor Perception: Interest expense can influence investor perception and the valuation of a company. Investors often analyze a company’s interest expense to assess its financial risk and evaluate its attractiveness as an investment. Higher interest expenses may be perceived as higher financial risk and could impact the company’s stock price or ability to secure investments.

Overall, interest expense is a critical aspect of a company’s financial analysis. It provides insights into a company’s profitability, cash flow, debt management, financial stability, and informs decision-making. Monitoring and managing interest expense is essential for businesses to maintain a healthy financial position and make informed strategic decisions.

Where is Interest Expense on the Balance Sheet?

Interest expense does not appear directly on the balance sheet. Instead, it is recorded on the income statement, which is another essential financial statement that summarizes a company’s revenues and expenses over a specific period of time.

On the income statement, interest expense is typically categorized as a separate line item under operating expenses or finance costs. This allows stakeholders to easily identify and analyze the amount of interest incurred by the company during the reporting period.

While interest expense is not directly included on the balance sheet, it indirectly impacts certain items that are reported on the balance sheet. For example:

- Long-term debt: Interest expense plays a significant role in the calculation of interest-bearing liabilities, such as long-term debt. The interest portion of debt payments reduces the outstanding balance of the debt, which is reported as a liability on the balance sheet. Therefore, the balance sheet reflects the net amount of the debt after deducting the interest expense paid or accrued.

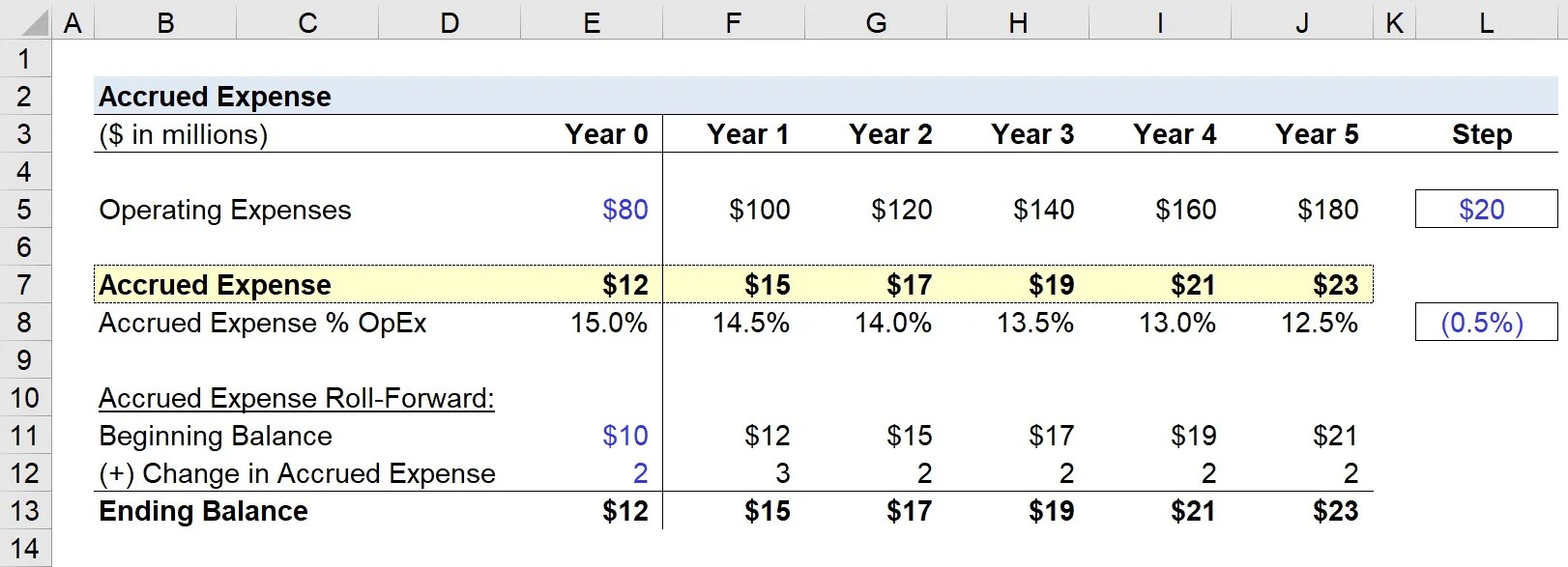

- Accrued interest payable: If a company has accrued interest expense but has not yet made the interest payment, the amount of interest accrued by the end of the reporting period is recorded as a liability on the balance sheet. This liability is known as “Accrued interest payable” and represents the obligation to pay the interest at a later date.

- Deferred financing costs: In some cases, companies incur costs related to obtaining financing, such as legal fees or underwriting fees. These costs are typically amortized over the life of the loan and are reported on the balance sheet as “Deferred financing costs.” While not directly related to interest expense, they reflect the costs associated with obtaining the financing used to incur the interest expense.

It is important to understand that the balance sheet provides a snapshot of a company’s financial position at a specific point in time, while the income statement captures the company’s financial performance over a period of time. By analyzing both the income statement and the balance sheet, stakeholders can gain a comprehensive understanding of a company’s financial condition, including its liabilities, interest-bearing debt, and the impact of interest expense on its financial health.

Common Misconceptions about Interest Expense on the Balance Sheet

Interest expense on the balance sheet can sometimes be misunderstood or misinterpreted. Here are some common misconceptions:

1. Interest expense is reported as a separate line item on the balance sheet: As mentioned earlier, interest expense does not appear directly on the balance sheet. It is recorded on the income statement as part of operating expenses or finance costs. The balance sheet reflects the impact of interest expense indirectly through items such as long-term debt and accrued interest payable.

2. Interest expense directly affects the company’s liquidity: While interest expense represents cash outflows for interest payments, it doesn’t directly impact a company’s liquidity as reported on the balance sheet. The balance sheet provides information about a company’s current assets and liabilities, which are more directly related to liquidity.

3. Higher interest expense implies poor financial health: While high interest expense can be an indicator of financial obligations, it does not necessarily reflect poor financial health. Certain industries, such as real estate development or manufacturing, may require higher levels of debt to fund operations or expansion. The overall financial health of a company cannot be solely determined by its interest expense; other factors, such as revenue, profitability, and debt management, should also be considered.

4. Interest expense is always tax-deductible: While interest expense is often tax-deductible, this may not be the case in all circumstances or jurisdictions. Tax laws and regulations vary, and there may be limitations or restrictions on the deductibility of interest expenses. It is crucial for businesses and individuals to consult with tax professionals or refer to applicable tax laws to determine the tax treatment of interest expenses.

5. Interest expense reflects the cost of all borrowings: Interest expense represents the cost of interest on external borrowings. However, it does not necessarily capture the full cost of all types of borrowing activities. For example, interest expense does not reflect the cost of equity financing (such as dividends or dilution of ownership) or alternative financing arrangements (such as lease payments or factoring fees). These costs are not reported as interest expense and may need to be considered separately when evaluating a company’s overall financing costs.

Understanding these misconceptions can help stakeholders gain a more accurate understanding of interest expense and its implications on a company’s financial statements. It allows for a more comprehensive analysis of a company’s financial health and the impact of interest expense on its financial performance.

Factors Affecting Interest Expense

Several factors can influence the amount of interest expense incurred by a company. These factors can vary from company to company and include:

1. Interest Rate: The interest rate is one of the primary factors affecting interest expense. It is the percentage charged by lenders or creditors for borrowing funds. The interest rate is primarily based on factors such as prevailing market rates, the creditworthiness of the borrower, and the term of the loan. Higher interest rates result in higher interest expense, increasing the cost of borrowing for the company.

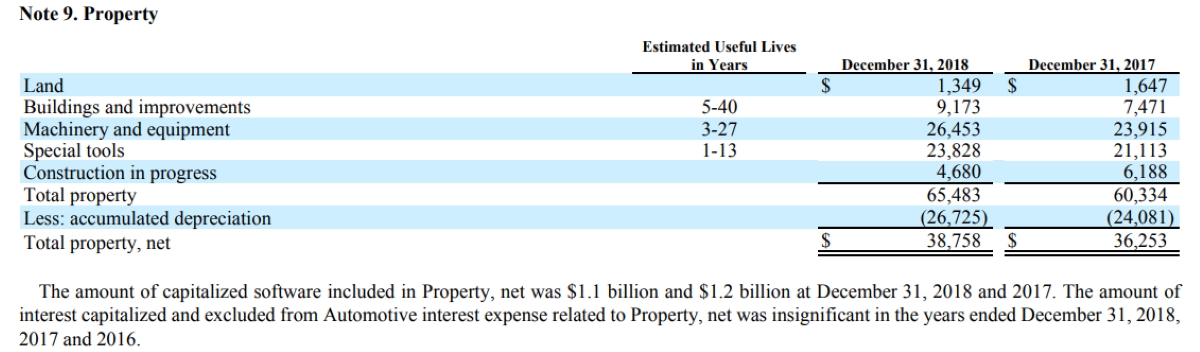

2. Debt Level: The amount of debt a company carries affects its interest expense. Generally, higher debt levels lead to higher interest expense, as the company needs to make interest payments on a larger principal amount. The level of debt is important as it determines the size of the interest-bearing liabilities recorded on the balance sheet.

3. Capital Structure: The composition of a company’s capital structure, including the mix of equity and debt, can impact its interest expense. Companies with a higher proportion of debt in their capital structure tend to have higher interest expenses due to the interest payments required on their outstanding debt. In contrast, companies with a greater proportion of equity financing may have lower interest expenses as they rely less on borrowing.

4. Creditworthiness: The creditworthiness of a company plays a crucial role in determining the interest rate it is charged. Credit rating agencies assess a company’s creditworthiness by evaluating its financial health, past financial performance, and ability to repay debt. A company with a higher credit rating is likely to receive more favorable terms and lower interest rates, resulting in lower interest expense.

5. Loan Terms: The terms and conditions of a loan or debt agreement also impact the interest expense. Factors such as the length of the loan, repayment schedule, and any embedded features (e.g., interest rate swaps or call provisions) can affect the interest payments. Longer loan terms may result in higher total interest expense due to the extended time over which interest is calculated and paid.

6. Market Conditions: Market conditions, including macroeconomic factors and interest rate fluctuations, can impact interest expense. In a low-interest-rate environment, companies can benefit from lower borrowing costs and reduced interest expense. Conversely, during periods of high interest rates, companies may experience higher interest expenses, affecting their profitability and financial performance.

7. Refinancing or Debt Restructuring: Decisions to refinance existing debt or restructure financing arrangements can impact interest expense. Through refinancing, companies may negotiate better terms, such as lower interest rates or longer repayment periods, which can result in reduced interest expense. However, costs associated with refinancing, such as fees or penalties, should also be considered in analyzing the overall impact on interest expense.

These factors interact and can have varying degrees of influence on a company’s interest expense. It is important for businesses to monitor these factors and assess their impact to effectively manage their interest costs and optimize their financial position.

Examples of Interest Expense Calculation on the Balance Sheet

Calculating interest expense on the balance sheet involves understanding the interest rate, the outstanding balance of the debt, and the period for which the interest is being calculated. Let’s look at a couple of examples to illustrate how interest expense is calculated:

Example 1:

A company has a long-term loan with an outstanding balance of $1,000,000 and an annual interest rate of 6%. The interest is payable on a monthly basis. To calculate the monthly interest expense:

- Determine the monthly interest rate: Divide the annual interest rate by 12 to get the monthly interest rate. In this case, 6% / 12 = 0.5%.

- Calculate the monthly interest expense: Multiply the outstanding balance by the monthly interest rate. In this case, $1,000,000 x 0.5% = $5,000.

- Record the interest expense on the income statement: Each month, the company would record $5,000 as interest expense on the income statement, thereby reducing the company’s net income.

Example 2:

A company has a revolving line of credit with an outstanding balance of $500,000. The line of credit has an interest rate of prime rate plus 2%, and the interest is payable annually. The prime rate is currently 3%. To calculate the annual interest expense:

- Calculate the annual interest rate: Add the prime rate of 3% to the 2% margin. In this case, 3% + 2% = 5%.

- Calculate the annual interest expense: Multiply the outstanding balance by the annual interest rate. In this case, $500,000 x 5% = $25,000.

- Record the interest expense on the income statement: The company would record $25,000 as interest expense on the income statement for the year.

It is important to note that these examples illustrate simple calculations. In practice, factors such as compounding interest, amortization schedules, and accruals may affect the actual calculation of interest expense. Companies should consult their financial statements and loan agreements to accurately determine their interest expense for specific periods.

By accurately calculating and analyzing interest expense, businesses can gain insights into their borrowing costs, track the impact on profitability, and make informed financial decisions.

Conclusion

Understanding interest expense and its implications on the balance sheet is crucial for evaluating a company’s financial health and performance. While interest expense does not directly appear on the balance sheet, it is recorded on the income statement as a key operating expense or finance cost.

Interest expense reflects the cost of borrowing funds from external sources, such as loans or bonds. It affects a company’s profitability by reducing net income and its cash flow by requiring regular interest payments. Monitoring and managing interest expense is essential for maintaining a healthy financial position, assessing debt management, and making informed business decisions.

On the balance sheet, interest expense indirectly impacts items such as long-term debt and accrued interest payable. These items reflect the impact of interest expense on a company’s financial obligations and liquidity.

Common misconceptions about interest expense include its direct appearance on the balance sheet, immediate impact on liquidity, and association with poor financial health. Clarifying these misconceptions helps stakeholders gain a more accurate understanding of interest expense and its effects.

Factors that influence interest expense include the interest rate, debt level, capital structure, creditworthiness, loan terms, market conditions, and decisions regarding refinancing or debt restructuring. These factors interplay to determine the amount of interest expense a company incurs.

Examples of interest expense calculations demonstrate how interest rates, outstanding balances, and borrowing terms affect the calculation of interest expenses.

In conclusion, understanding interest expense and its relationship to the balance sheet is essential for comprehensive financial analysis. By considering interest expense alongside other financial indicators, stakeholders can make informed decisions and assess the financial strength of a company.