Finance

How To Hedge In Forex

Modified: February 21, 2024

Learn how to hedge in Forex and manage your finance effectively. Implement proven strategies to protect your investments and minimize risks in the volatile Forex market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Hedging in Forex

- Different Types of Hedging Strategies

- Using Forward Contracts for Hedging

- Hedging with Options in Forex

- Hedging with Forex Swaps

- Hedging with Forex Futures

- Hedging with Correlated Currency Pairs

- Pros and Cons of Hedging in Forex

- Factors to Consider Before Hedging in Forex

- Conclusion

Introduction

When it comes to investing in the foreign exchange (forex) market, there is always an inherent level of risk involved. Currency exchange rates can fluctuate rapidly, leading to unpredictable outcomes for businesses and individuals alike. This uncertainty has led to the development of hedging strategies in forex, which aim to mitigate risk and protect against adverse market movements.

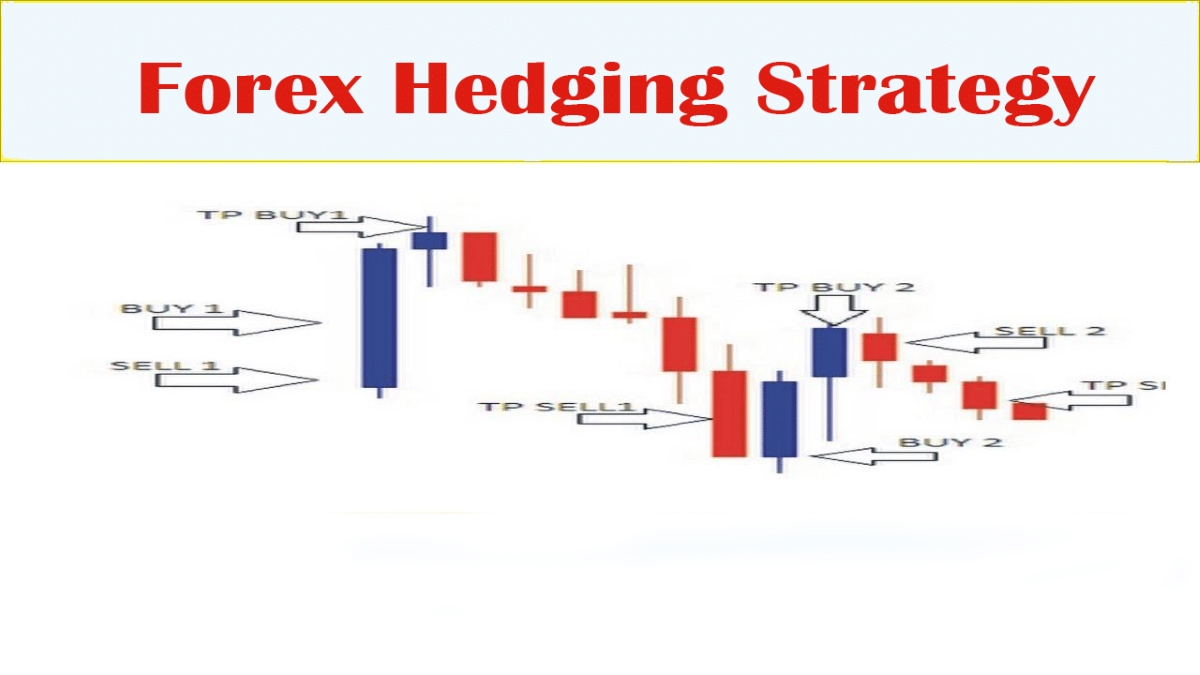

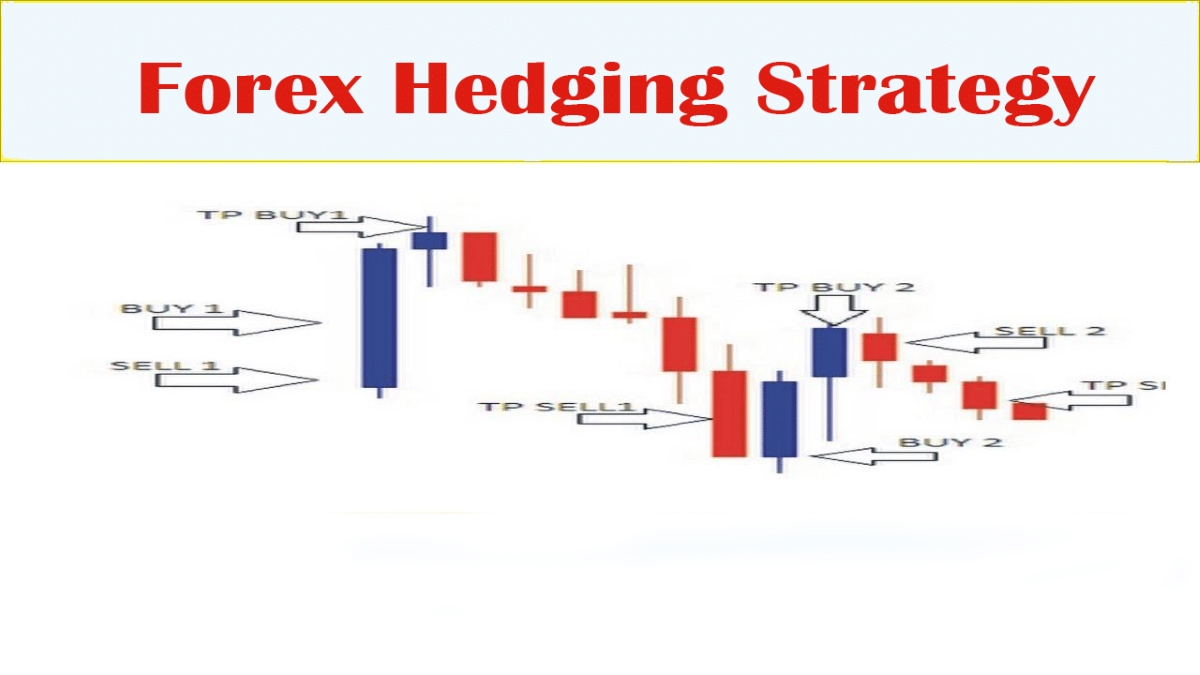

Forex hedging is a technique that involves taking positions in the forex market to offset potential losses in existing positions. By employing various hedging strategies, traders and investors can minimize their exposure to currency risk and safeguard their portfolios from volatility.

The primary objective of forex hedging is to create a level of certainty and stability in an uncertain market. Hedging allows market participants to lock in exchange rates for future transactions, thereby reducing the impact of currency rate fluctuations on their profits or losses.

While hedging provides a layer of protection, it is essential to understand the different strategies available and their implications before incorporating them into one’s trading or investment approach. This article will delve into the various hedging strategies used in forex, their benefits and drawbacks, and the factors to consider before implementing them.

Note: It is crucial to consult with a financial advisor or experienced forex professional before engaging in hedge strategies, as they can offer personalized guidance based on your unique financial goals and risk tolerance.

Understanding Hedging in Forex

Hedging in forex refers to the practice of offsetting potential losses in existing positions by taking opposite positions in the market. The primary objective of hedging is to protect against adverse currency rate movements, minimizing the impact of market volatility on one’s portfolio.

To understand hedging in forex, it is essential to grasp the concept of exposure. In the forex market, exposure refers to the risk associated with holding a specific currency or currencies. Currency exposure can arise from various factors, such as conducting international trade, holding foreign investments, or being involved in cross-border transactions.

Forex hedging involves identifying and analyzing the sources of currency exposure and implementing strategies to mitigate those risks. By doing so, traders and investors aim to achieve a balanced and protected portfolio, irrespective of the market conditions.

There are two main types of forex exposure: transaction exposure and economic exposure. Transaction exposure refers to the potential gain or loss arising from a specific transaction, such as buying or selling goods or services in a foreign currency. Economic exposure, on the other hand, refers to the impact of currency fluctuations on a company’s overall competitive position and future cash flows.

Hedging strategies in forex vary depending on the type of exposure being addressed. For transaction exposure, the objective is to minimize the risk associated with a specific transaction. On the other hand, economic exposure often requires more comprehensive strategies that consider the long-term impact of currency fluctuations on a company’s financial health.

It is important to note that not all forex market participants engage in hedging. Speculators, for example, assume risk in the hope of profiting from currency rate movements. However, for businesses engaged in international trade or individuals wanting to protect their investments, understanding and implementing hedging strategies can be vital.

The key to effective hedging in forex lies in careful analysis and decision making. Traders and investors must assess their risk tolerance, objectives, and time horizon before selecting the most appropriate hedging strategies. It is also crucial to keep in mind that hedging is not a foolproof strategy and can have its limitations and costs.

Different Types of Hedging Strategies

There are various hedging strategies employed in the forex market, each designed to address specific types of currency exposure and risk. Here are some of the most common hedging strategies used:

- Spot Contracts: Spot contracts are one of the simplest forms of hedging in forex. This strategy involves buying or selling currencies for immediate delivery at the prevailing exchange rate. By entering into a spot contract, traders and investors can lock in the current exchange rate, thereby eliminating the risk of adverse currency rate movements.

- Forward Contracts: Forward contracts are similar to spot contracts but differ in terms of the delivery date. With a forward contract, traders and investors agree to buy or sell currencies at a predetermined exchange rate on a future date. This strategy allows market participants to hedge against potential currency fluctuations by securing a fixed exchange rate in advance.

- Options: Options provide traders and investors with the right, but not the obligation, to buy or sell currencies at a predetermined price within a specified period. By purchasing currency options, market participants can protect against unfavorable exchange rate movements while still benefiting from favorable moves. Options offer flexibility and can be tailored to individual risk preferences.

- Swaps: Forex swaps involve the exchange of currencies between two parties at an agreed-upon rate and the reversal of the transaction at a future date. This strategy is particularly useful for hedging long-term exposure, as it allows market participants to mitigate risk while still maintaining their desired currency positions.

- Futures: Forex futures contracts are standardized agreements to buy or sell currencies at a predetermined price and date. Similar to forward contracts, futures contracts enable market participants to hedge against exchange rate risk. However, futures are traded on regulated exchanges and have standardized contract sizes and expiration dates.

- Correlation Hedging: Correlation hedging involves taking positions in correlated currency pairs to offset potential losses. This strategy relies on the fact that certain currencies have a strong positive or negative correlation with each other. By identifying and taking opposite positions in correlated pairs, traders and investors can hedge their currency exposure and reduce risk.

It is important to note that each hedging strategy has its advantages and limitations. The choice of strategy depends on factors such as the type of exposure, risk tolerance, market conditions, and individual preferences. It is recommended to carefully assess these factors and consult with a financial advisor before implementing any hedging strategy.

Using Forward Contracts for Hedging

Forward contracts are widely used in forex markets to hedge against potential currency fluctuations. A forward contract is an agreement between two parties to buy or sell a specific amount of currency at a predetermined exchange rate on a future date.

When it comes to hedging, forward contracts offer a valuable tool for businesses and individuals to protect themselves from adverse movements in currency exchange rates. Here’s how forward contracts can be used for hedging:

Locking in Exchange Rates: One of the primary benefits of using forward contracts for hedging is the ability to lock in exchange rates. By entering into a forward contract, market participants can fix the rate at which they will buy or sell a specific currency in the future. This provides certainty and eliminates the risk associated with fluctuating exchange rates.

Minimizing Transaction Risk: Businesses engaged in international trade often face transaction risk when dealing with multiple currencies. The value of the goods or services being exchanged can change significantly due to exchange rate fluctuations, impacting profit margins. By utilizing forward contracts, businesses can hedge against this transaction risk, ensuring that the value of their foreign transactions remains stable.

Planning and Budgeting: Forward contracts can also be used for long-term planning and budgeting purposes. By securing exchange rates in advance, businesses can accurately forecast their future cash flows and budget accordingly. This helps reduce uncertainty and allows for better financial planning.

Flexibility and Customization: Forward contracts offer flexibility and customization options based on individual hedging requirements. Market participants can tailor the contracts to meet their specific needs, such as selecting the contract size, maturity date, and the exchange rate at which the transaction will occur. This allows for greater control over the hedging process.

Costs and Considerations: While forward contracts provide valuable hedging benefits, it is important to consider the costs involved. Forward contracts may require upfront payments or margin requirements, depending on the counterparty and the contract terms. Additionally, if market conditions change and the exchange rate moves in favor of the hedger, they may miss out on potential gains due to the fixed rate set in the forward contract.

It is crucial to analyze market conditions, risk tolerance, and the specific needs of the hedging strategy before entering into a forward contract. Financial advisors and experienced forex professionals can provide guidance on the suitability of forward contracts for individual hedging purposes.

Hedging with Options in Forex

Options provide another avenue for hedging in the forex market. An option is a financial derivative that grants the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined price within a specified period. Hedging with options offers market participants flexibility and tailored risk management strategies. Here’s how options can be used for forex hedging:

Protecting against Adverse Movements: One of the primary benefits of using options for hedging is the ability to protect against unfavorable currency rate movements. For example, a business with a significant exposure to a foreign currency may purchase a put option, which gives them the right to sell the currency at a predetermined strike price. If the exchange rate falls below the strike price, the put option provides a hedge by allowing the business to sell the currency at a predetermined higher rate.

Benefiting from Favorable Movements: Options not only protect against downside risk but can also allow market participants to benefit from favorable currency rate movements. By purchasing call options, traders and investors can secure the right to buy a currency at a predetermined price. If the exchange rate rises above the strike price, the call option provides an opportunity to buy the currency at a lower rate and profit from the price appreciation.

Customizable Risk Profiles: Options offer flexibility and can be tailored to individual risk preferences. Market participants can select the strike price, expiration date, and contract size that aligns with their hedging objectives. This allows for a more personalized risk management approach and can help minimize potential losses or maximize potential gains, depending on the hedger’s outlook.

Managing Premium Costs: Options are not free, and hedgers need to consider the cost of purchasing options, known as the premium. The premium is the price paid to acquire the option contract and varies based on factors such as the time to expiration, volatility, and strike price. Market participants must weigh the potential benefits of hedging with options against the cost of the premiums.

Evaluating Market Conditions: It is essential to assess market conditions and consider factors such as volatility and expected currency movements when hedging with options. Volatile markets might lead to higher premiums, while stable markets may have lower premiums. Additionally, understanding the relationship between the option’s strike price and the current spot rate is crucial in determining the effectiveness of the hedge.

Risk of Option Expiration: Options have an expiration date, and if market conditions do not align with the hedger’s expectations, the option may expire worthless. Therefore, it is important to carefully account for the time frame and monitor the market to ensure the option remains an effective hedging tool throughout its lifespan.

Hedging with options requires a comprehensive understanding of options trading and market dynamics. It is advisable to consult with experienced professionals or financial advisors to evaluate the suitability of options as a hedging strategy based on individual risk appetite and market outlook.

Hedging with Forex Swaps

Forex swaps are a popular hedging tool used in the foreign exchange market. A forex swap is a simultaneous agreement between two parties to exchange currencies for a specific period and then reverse the transaction at a predetermined rate in the future.

Hedging with forex swaps offers market participants a way to manage and mitigate long-term currency exposure. Here’s how forex swaps can be used for hedging:

Long-Term Currency Exposure: Forex swaps are particularly useful for hedging against long-term currency exposure. For example, businesses engaged in foreign trade or investors holding foreign assets may employ forex swaps to hedge against potential currency rate fluctuations over an extended period. By exchanging currencies at the start of the swap and reversing the transaction at the predetermined rate at the swap’s maturity, market participants can effectively hedge their currency risk.

Reducing Exchange Rate Fluctuations: The primary objective of using forex swaps for hedging is to minimize the impact of exchange rate fluctuations on cash flows. Companies that have significant international operations can use forex swaps to lock in future exchange rates, providing more certainty and stability for their financial planning and budgeting.

Cost Efficiency: One advantage of forex swaps is their cost efficiency compared to other hedging instruments. Unlike forward contracts or options, which may require upfront payments or premiums, forex swaps generally do not involve initial cash outflows. Instead, the cost of the swap is reflected in the difference between the spot exchange rate and the forward exchange rate.

Flexibility in Hedging: Forex swaps offer flexibility in hedging strategies as they can be customized to meet individual needs. Market participants can choose the duration of the swap, allowing them to align the hedge with their specific time frame for managing currency risk. Additionally, forex swaps can be structured to exchange different currencies, providing further flexibility in hedging multiple currency exposures.

Counterparty Risk: It is important to consider counterparty risk when engaging in forex swaps. As swaps involve agreements with other parties, there is a risk that the counterparty may default on their obligations. It is advisable to engage with reputable institutions or counterparties with strong creditworthiness to minimize this risk.

Regulatory Considerations: Depending on the jurisdiction, there may be regulatory requirements or restrictions on forex swaps. Market participants should ensure compliance with applicable regulations and seek professional advice if necessary.

Hedging with forex swaps requires a good understanding of the market, financial analysis, and risk management. It is advisable to consult with experienced professionals or financial advisors to assess the suitability of forex swaps as a hedging strategy based on individual circumstances and risk tolerance.

Hedging with Forex Futures

Forex futures contracts are standardized agreements to buy or sell a specific currency at a predetermined price and date in the future. While primarily used for speculative purposes, forex futures can also be employed as a hedging tool to manage currency risk. Here’s how forex futures can be used for hedging:

Locking in Exchange Rates: One of the primary advantages of hedging with forex futures is the ability to lock in exchange rates for future transactions. By entering into a futures contract, market participants can fix the rate at which they will buy or sell a particular currency on the specified delivery date. This helps eliminate the risk of adverse currency rate movements affecting future transactions.

Standardization and Liquidity: Forex futures are traded on regulated exchanges, which provide standardized contracts with specific sizes, delivery dates, and settlement procedures. This standardization allows for greater transparency and liquidity, enabling market participants to readily enter and exit positions. The availability of liquid markets facilitates the ease of hedging and ensures efficient execution of trades.

Margin Efficiency: Forex futures typically require margin payments, which allow market participants to control a larger contract value than the initial investment. This leverage feature can be advantageous for hedging, as it reduces the upfront cost of entering into a position. However, it is important to understand margin requirements and manage risk appropriately, as leverage can amplify both profits and losses.

Flexibility in Timeframe: Forex futures contracts are available in various maturity dates, allowing market participants to choose the timeframe that aligns with their hedging needs. Short-term contracts can be suitable for hedging immediate or near-term currency exposure, while longer-term contracts can effectively address medium to long-term risks. The ability to select the appropriate delivery date enhances the flexibility of forex futures as a hedging instrument.

Transparent Pricing: Forex futures are traded on public exchanges, providing transparent pricing influenced by supply and demand dynamics. The publicly available information enables market participants to assess market trends, monitor fluctuations, and make informed hedging decisions based on fair and competitive pricing.

Counterparty Risk: When engaging in forex futures, market participants are exposed to counterparty risk, which refers to the risk that the other party may default on their contractual obligations. However, this risk is mitigated in exchange-traded futures, as the exchange acts as an intermediary and guarantees performance. Nonetheless, it is important to be aware of the creditworthiness of the clearinghouse and understand the risk management measures implemented by the exchange.

It is essential to have a thorough understanding of forex futures, risk management techniques, and currency market dynamics before engaging in hedging strategies using futures contracts. Consulting with experienced professionals or financial advisors can provide valuable insights and guidance in developing effective hedging strategies tailored to specific needs.

Hedging with Correlated Currency Pairs

Hedging with correlated currency pairs is a strategy that involves taking positions in currency pairs that have a strong positive or negative correlation. By doing so, market participants aim to offset potential losses in one currency pair with gains in another, effectively hedging their currency exposure. Here’s how hedging with correlated currency pairs works:

Understanding Correlation: Correlation refers to the statistical measure of the relationship between two variables, in this case, currency pairs. A correlation coefficient can range from -1 to +1, with -1 indicating a perfect negative correlation, +1 indicating a perfect positive correlation, and 0 indicating no correlation. Traders and investors analyze historical data to identify currency pairs that have a significant level of correlation.

Positive Correlation Hedging: When two currency pairs have a positive correlation, it means they tend to move in the same direction. For example, the EUR/USD and GBP/USD pairs often exhibit a strong positive correlation. If a trader or investor has a long position in the EUR/USD and expects it to perform well, they can hedge their risk by taking a long position in the correlated GBP/USD. This way, if the EUR/USD experiences losses, the gains in the GBP/USD can offset those losses, resulting in a partially hedged portfolio.

Negative Correlation Hedging: Conversely, currency pairs with a negative correlation tend to move in opposite directions. For instance, the USD/JPY and USD/CHF pairs tend to exhibit a negative correlation. If an investor has a long position in USD/JPY and wants to hedge against potential losses, they can take a short position in USD/CHF. If the USD weakens, the losses in USD/JPY can be offset by gains in USD/CHF, helping to mitigate overall risk.

Risk of Imperfect Correlation: It’s important to note that while currency pairs may show a historical correlation, it is not always perfect or consistent. Correlations can change due to various factors such as economic events, market sentiment, or geopolitical developments. Therefore, traders and investors should regularly monitor the correlation between currency pairs to ensure the effectiveness of their hedge. Utilizing correlation as a hedging strategy requires constant analysis and adaptation to align with changing market dynamics.

Considerations for Correlation Hedging: When hedging with correlated currency pairs, it is essential to consider factors such as transaction costs, margin requirements, and the overall market outlook. Transaction costs, including spreads and commission fees, can affect the profitability of the hedging strategy. Margin requirements must be managed to ensure sufficient capital for both positions. Additionally, having a thorough understanding of the fundamental and technical factors that influence the currency pairs involved is crucial for making informed hedging decisions.

Hedging with correlated currency pairs can be an effective way to manage currency exposure and mitigate risk. However, it requires a solid understanding of correlation analysis, market dynamics, and risk management principles. Seeking advice from experienced professionals or financial advisors can provide valuable insights when implementing correlation hedging strategies.

Pros and Cons of Hedging in Forex

Hedging in forex can provide several benefits, but it also comes with its share of drawbacks. Understanding the pros and cons of hedging is crucial for market participants to make informed decisions. Here are some of the key advantages and disadvantages of hedging in forex:

Pros:

- Risk Mitigation: Hedging allows market participants to minimize their exposure to currency risk. By taking opposite positions or utilizing derivative contracts, traders and investors can protect their portfolios from adverse currency rate movements, reducing potential losses.

- Portfolio Protection: Hedging helps protect the value of a portfolio against unforeseen market events, economic uncertainties, or geopolitical risks. It creates a level of certainty and stability, ensuring that unexpected changes in currency rates do not significantly impact overall portfolio performance.

- Flexible Risk Management: Hedging strategies in forex offer flexibility in managing risk. Market participants can choose from various hedging instruments, including spot contracts, forwards, options, swaps, and futures, allowing them to tailor their approach to match their risk tolerance, time horizon, and specific hedging needs.

- Enhanced Financial Planning: Hedging provides businesses with greater predictability when it comes to international transactions, budgeting, and cash flow management. By locking in exchange rates in advance, companies can accurately forecast costs and revenues, facilitating effective financial planning and reducing uncertainty.

- Potential for Profit: While the primary goal of hedging is risk mitigation, there is also the potential to generate profits. Hedging strategies such as options or forex swaps can allow market participants to benefit from favorable currency rate movements without exposing themselves to excessive risk.

Cons:

- Costs and Complexity: Hedging in forex often incurs costs, such as premiums, spreads, or margin requirements. These expenses can reduce overall profitability and should be carefully considered. Additionally, some hedging strategies, such as options or complex derivative contracts, may involve a level of complexity that requires a deep understanding of the market and risk management principles.

- Potential Opportunity Loss: Hedging comes with the risk of missing out on potential gains. When a hedging strategy is in place, market participants may limit their upside potential if currency rates move in their favor. This trade-off between risk mitigation and potential opportunity loss should be carefully evaluated based on individual risk appetite and market expectations.

- Market Timing Risks: Hedging requires making decisions about when to enter or exit positions, which can be challenging due to the inherent uncertainty of the forex market. Timing the market correctly is not always possible, and incorrect timing can result in losses or an ineffective hedge.

- Counterparty Risk: Hedging often involves entering into agreements with counterparties, which carries the risk that the counterparty may default on their obligations. Selecting reputable and creditworthy counterparties or trading on regulated exchanges can help mitigate this risk.

- Regulatory Considerations: Forex markets are subject to regulations that may impose restrictions or requirements on certain hedging strategies. Market participants should be aware of and comply with applicable regulations to ensure the legality and validity of their hedging activities.

Hedging in forex can be an effective risk management tool, but it is not without its trade-offs and complexities. Market participants should carefully assess their risk tolerance, objectives, and market conditions before implementing a hedging strategy. Consulting with experienced professionals or financial advisors can provide valuable insights and guidance in navigating the pros and cons of forex hedging.

Factors to Consider Before Hedging in Forex

Hedging in forex requires careful consideration of several factors to ensure the effectiveness and suitability of the hedging strategy. Before implementing any hedging approach, market participants should take into account the following key factors:

- Risk Tolerance: Understanding one’s risk tolerance is essential before hedging in forex. Some individuals or businesses may have a higher risk appetite and are willing to accept more significant currency fluctuations, while others prefer a more conservative approach. Evaluating risk tolerance helps in determining the hedging instruments or strategies that align with individual preferences.

- Market Analysis: Conducting in-depth market analysis is crucial for successful forex hedging. Studying currency trends, economic indicators, geopolitical events, and market sentiment enables market participants to make informed decisions about when and how to hedge. This analysis helps identify potential risks and opportunities, informing the selection of appropriate hedging instruments and timing entry and exit points.

- Objectives: Clearly defining hedging objectives is essential. Whether the goal is to protect against currency volatility, maintain stable cash flows, or seek profit from favorable currency movements, understanding the desired outcome is crucial in selecting the most suitable hedging strategy.

- Hedging Horizon: Determining the length of time a hedging position should be maintained is an important consideration. Factors such as the duration of currency exposure, market conditions, and specific goals influence the choice between short-term hedging instruments like options or long-term strategies like forward contracts or swaps.

- Cost-Benefit Analysis: Carefully evaluating the costs associated with hedging is crucial. Hedging strategies may involve expenses such as premiums, spreads, or margin requirements. Conducting a cost-benefit analysis helps determine whether the potential benefits of hedging outweigh the associated costs and demonstrates the financial feasibility of the strategy.

- Counterparty and Regulatory Risks: Assessing counterparty risk is vital when engaging in hedging transactions. Choosing reputable counterparties or trading on regulated exchanges mitigates the risk of default. Additionally, understanding and complying with applicable regulatory requirements ensures the validity and legality of the hedging activities.

- Monitoring and Adjustments: Forex markets are dynamic, and currency rates can change rapidly. Continuously monitoring the effectiveness of the hedging strategy and making necessary adjustments is crucial. Regular evaluations help ensure that the chosen hedge remains aligned with market conditions and evolving goals.

It is important to note that forex hedging involves risk, and there is no guarantee of profitability or complete elimination of risk. Each market participant should carefully assess their unique circumstances, consult with experienced professionals or financial advisors, and stay informed about market developments to make well-informed hedging decisions.

Conclusion

Hedging in forex can be a valuable tool for managing currency risk and protecting portfolios against adverse market movements. By employing various hedging strategies such as forward contracts, options, swaps, futures, or correlation hedging, market participants can mitigate potential losses and create a level of certainty in an uncertain market.

Before implementing any hedging approach, it is crucial to consider factors such as risk tolerance, market analysis, objectives, hedging horizon, costs, counterparty and regulatory risks, and the need for ongoing monitoring and adjustments. Each of these factors plays a critical role in the effectiveness and suitability of the chosen hedging strategy.

While hedging offers numerous benefits, it is essential to acknowledge the trade-offs. Hedging has associated costs, potential opportunity losses, timing risks, counterparty risks, and regulatory considerations. These factors should be carefully evaluated and weighed against the desired risk management objectives and financial circumstances.

Successful hedging in forex requires a comprehensive understanding of the market, risk management techniques, and the chosen hedging instruments. Seeking guidance from experienced professionals or financial advisors can provide valuable insights and help navigate the complexities of forex hedging.

It is worth noting that forex hedging is not a foolproof strategy and does not guarantee profitability or eliminate all risks. However, when utilized effectively and in alignment with individual goals and market conditions, hedging can provide valuable protection, enhance financial planning, and contribute to overall portfolio stability.

Remember, before engaging in any hedging strategy, it is essential to thoroughly analyze the market, assess personal risk tolerance, and seek professional advice tailored to individual circumstances. By doing so, market participants can harness the power of hedging to manage currency risk and navigate the dynamic world of forex trading.