Finance

How To Find Out Your IRS CSED

Published: October 31, 2023

Discover how to find out your IRS Collection Statute Expiration Date (CSED) and manage your finances efficiently with our expert guidance in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances and staying on top of your tax obligations, knowledge is power. One crucial piece of information that every taxpayer should be aware of is their IRS Collection Statute Expiration Date (CSED). Your CSED determines the length of time the Internal Revenue Service (IRS) has to collect taxes that are owed to them.

Understanding your CSED is essential because it determines when the IRS can no longer pursue collection actions against you. Once the CSED expires, you are no longer legally responsible for the unpaid tax debt.

While the IRS will typically inform you of your CSED during the tax assessment process, it’s not uncommon for taxpayers to lose track of this crucial date over time. Thankfully, there are several methods you can use to find out your IRS CSED and ensure that you have a clear understanding of your tax liabilities.

In this article, we will explore different ways you can determine your CSED to better manage your tax obligations and financial future.

Understanding CSED

The Collection Statute Expiration Date (CSED) is the date that marks the end of the IRS’s legal right to collect taxes from you. It is crucial to be familiar with your CSED as it determines the timeframe within which the IRS can take collection actions against you.

The CSED is generally 10 years from the date of tax assessment, but it can vary in certain circumstances. The clock starts ticking on the CSED from the day the IRS officially assesses your tax liability, which typically occurs after you file your tax return.

Once the CSED expires, the IRS can no longer actively pursue collection actions to collect outstanding taxes. This means they cannot issue levies, garnish wages, or seize assets to satisfy the debt. However, it’s important to note that the CSED does not erase your tax liability altogether. You are still responsible for paying any outstanding taxes owed, even after the expiration of the CSED.

It’s crucial to monitor your CSED to understand your rights and responsibilities when it comes to tax liability. By staying informed about your CSED, you can make informed financial decisions and avoid unnecessary stress related to tax collection actions.

Methods to Find Your IRS CSED

Knowing your IRS Collection Statute Expiration Date (CSED) is essential for effective tax planning and managing your financial obligations. Fortunately, there are several methods you can use to find out your CSED:

- Request Transcripts from IRS: One reliable method is to request account transcripts directly from the IRS. These transcripts contain detailed information about your tax account, including the dates of tax assessments and the expiration of your CSED. You can request transcripts by mail, phone, or online through the IRS’s official website.

- Check Your Tax Return Documents: Another way to determine your CSED is to review your previous tax returns. The IRS typically includes information about the dates of assessment on these returns. Look for Form 4340, Certificate of Assessment, which provides the necessary details about your CSED.

- Contact the IRS: If you are unable to find the necessary information through transcripts or tax returns, contacting the IRS directly is an option. You can reach out to their toll-free helpline at 1-800-829-1040 and provide them with your Social Security number for assistance in retrieving your CSED.

- Use Online Tools: Several online tools and resources can help you find your CSED. The IRS offers an online tool called “Get Transcript” on their website, which allows you to access and view your tax transcripts. Additionally, there are third-party websites that provide similar services and can assist you in retrieving your CSED.

- Seek Assistance from a Tax Professional: If you’re still struggling to find your CSED or interpret the information you have, it may be beneficial to seek guidance from a tax professional. Certified public accountants (CPAs) or enrolled agents have expertise in tax matters and can help you navigate the complexities of determining your CSED.

By utilizing one or more of these methods, you can successfully identify your IRS CSED and gain a better understanding of your tax obligations and deadlines. It’s crucial to stay informed about your CSED to avoid any surprises and effectively plan your finances.

Method 1: Request Transcripts from IRS

One reliable method to determine your IRS Collection Statute Expiration Date (CSED) is to request account transcripts directly from the IRS. Transcripts provide a detailed overview of your tax account, including important dates related to your CSED.

To request transcripts from the IRS, you have several options:

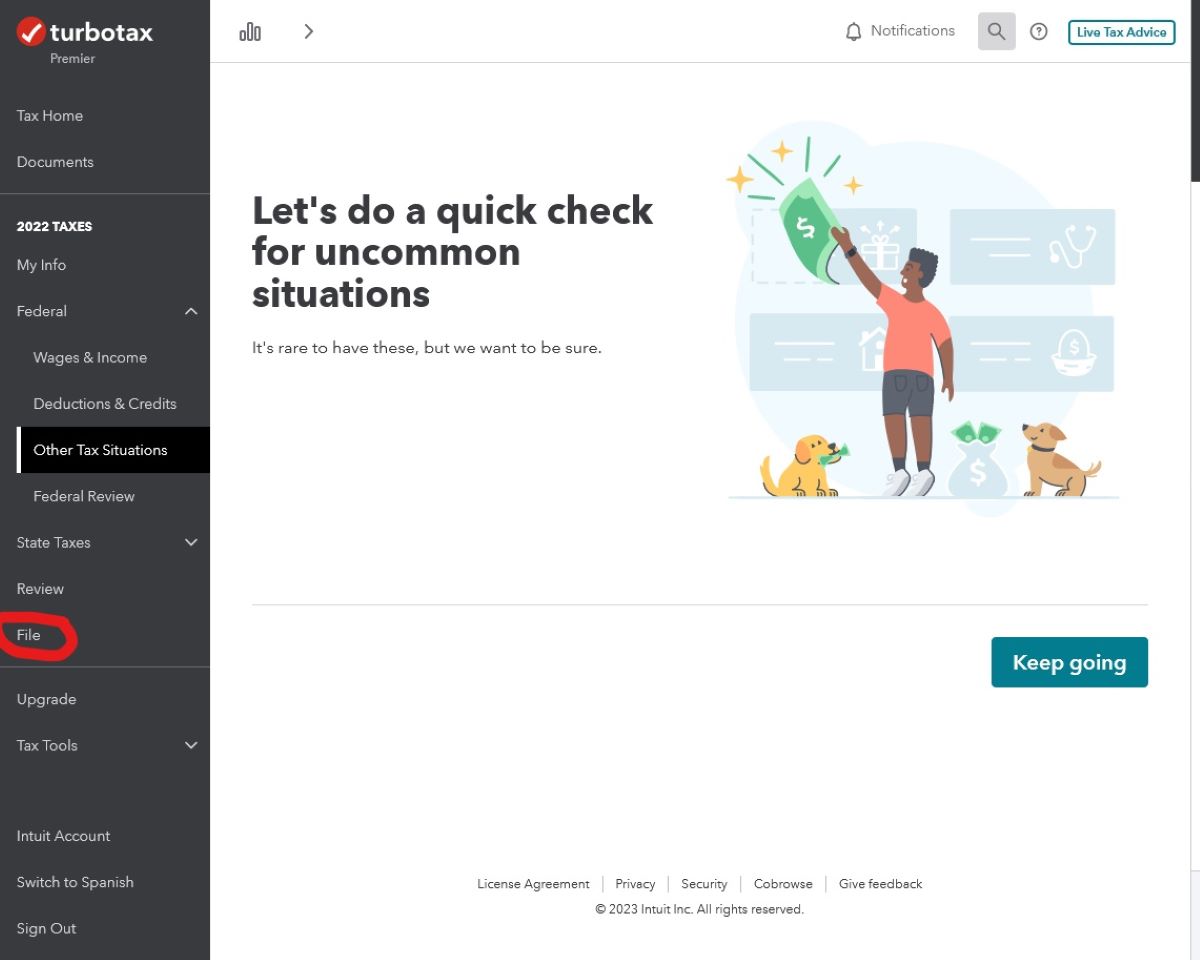

- Online: The IRS offers an online tool called “Get Transcript” on their official website. You can create an account and access your tax transcripts online. This tool provides quick and convenient access to your tax information, including your CSED.

- By Mail: You can use Form 4506-T, Request for Transcript of Tax Return, to request transcripts by mail. Fill out the form with accurate information, including the tax years you need transcripts for and the type of transcript requested. Once completed, you can mail the form to the address provided on the IRS website.

- Phone: If you prefer a more direct approach, you can request transcripts by phone. Call the IRS transcript hotline at 1-800-908-9946 and follow the instructions to request your transcripts. Have your personal and tax-related information ready when making the call to expedite the process.

When you receive your transcripts, look for specific information related to your CSED. The transcripts will include details about the date the IRS assessed your taxes and the expiration date of your CSED. This information is typically found in the Account Transcript section of the document.

It’s important to note that IRS transcripts may contain complex terminology and codes. If you have any difficulty interpreting the information, consider seeking assistance from a tax professional who can help you understand the details and implications of your CSED.

Requesting transcripts from the IRS is a reliable method to determine your CSED. By accessing these documents, you can stay informed about your tax obligations and deadlines, allowing for better financial planning and peace of mind.

Method 2: Check Your Tax Return Documents

Another method to find out your IRS Collection Statute Expiration Date (CSED) is to review your tax return documents. Your tax returns contain valuable information about the dates of tax assessments, which can help you determine your CSED.

When examining your tax return documents, pay attention to the following:

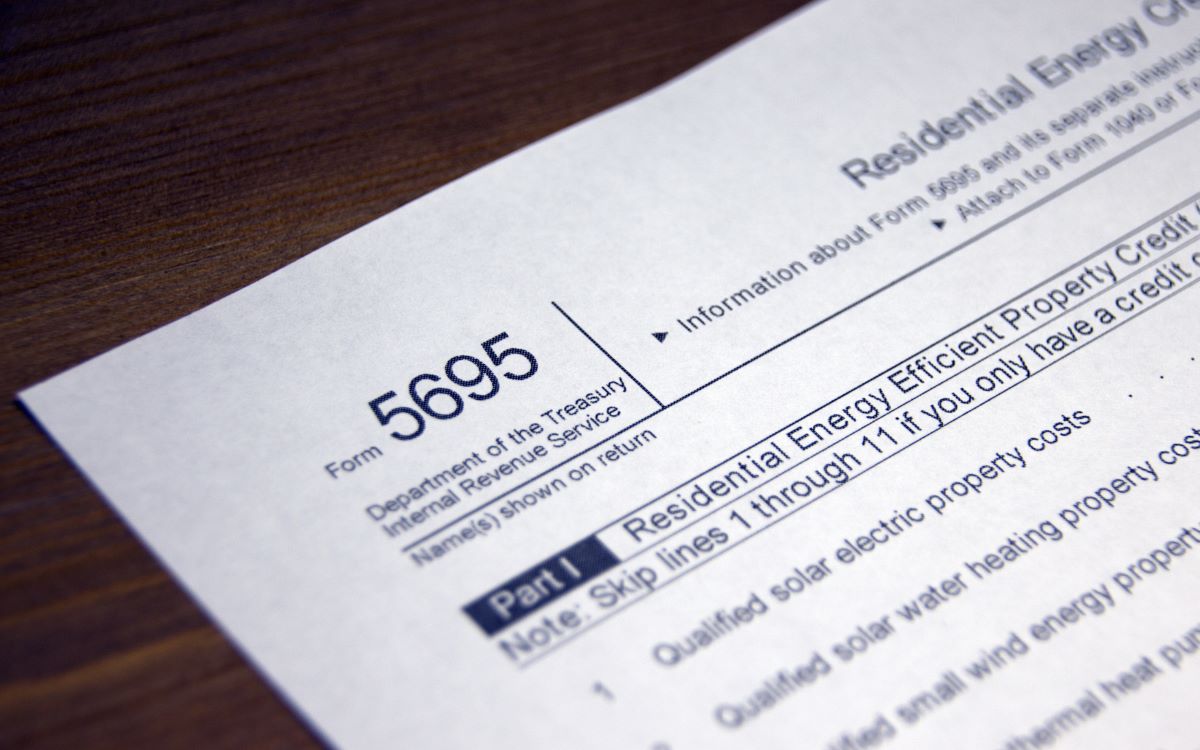

- Form 4340: Form 4340, Certificate of Assessment, is an essential document that provides information about your tax assessments. It includes details such as the date the IRS assessed your taxes and the expiration date of your CSED.

- Tax Payment Acknowledgment: If you made payments towards your tax liability, your tax return documents may include a payment acknowledgment. This acknowledgment will typically indicate the date of payment, which can help you determine the timeline of your tax assessments.

- Amended Returns: If you filed any amended tax returns, it’s crucial to review the associated documents as well. Amended returns can alter the original assessment dates and potentially modify your CSED. Make sure to take these factors into consideration when determining your CSED.

By carefully examining your tax return documents, you can retrieve important information about your CSED. Take note of the relevant dates, including the assessment date and any subsequent changes due to amended returns. By doing so, you can gain a clearer understanding of your tax obligations and timeline.

If you have difficulty locating the necessary documents or understanding the information provided, consider reaching out to a tax professional for guidance. They can assist you in interpreting the details of your tax returns and help you determine your CSED accurately.

Checking your tax return documents is a straightforward method that can provide valuable insights into your CSED. Utilize this method to stay informed about your tax liabilities and make effective financial plans for the future.

Method 3: Contact the IRS

If you are unable to determine your IRS Collection Statute Expiration Date (CSED) through other means, reaching out to the IRS directly is a viable option. Contacting the IRS can provide you with the necessary information to understand your CSED and effectively manage your tax obligations.

To contact the IRS and inquire about your CSED, follow these steps:

- Call the IRS: Start by contacting the IRS through their toll-free helpline at 1-800-829-1040. Be prepared to provide your Social Security number and any other required information to verify your identity.

- Ask for Assistance: When connected to an IRS representative, explain that you are looking to find out your CSED. They will guide you through the process and may ask you a series of questions to verify your identity and access your tax records.

- Provide Relevant Information: To assist the IRS representative in their search for your CSED, be prepared to provide any relevant details, such as the tax years you are inquiring about or any specific situations that may have impacted your CSED.

- Take Notes: During the conversation, make sure to take notes of the information provided by the IRS representative. Record the CSED date and any additional details that may be relevant to your tax situation.

By contacting the IRS directly, you can obtain accurate and up-to-date information regarding your CSED. The IRS representative can access your tax records and provide you with the necessary details to manage your tax obligations effectively.

However, keep in mind that IRS phone lines can sometimes be busy, and wait times may vary. It is advisable to be patient and allow sufficient time for the call to be answered. If you prefer a quicker and more convenient method, consider utilizing other options such as requesting transcripts or checking your tax return documents.

Regardless of the method you choose, ensuring that you have awareness of your CSED is crucial for effective tax planning and managing your financial obligations.

Method 4: Use Online Tools

In today’s digital age, utilizing online tools can simplify the process of finding your IRS Collection Statute Expiration Date (CSED). The IRS provides an array of online resources that can assist you in accessing your tax information and determining your CSED.

Here are some online tools you can use:

- Get Transcript Tool: The IRS offers an online tool called “Get Transcript” on their official website. This tool allows you to access and view your tax transcripts online. By entering the required information and selecting the appropriate tax year, you can retrieve your transcripts, which include details such as the dates of assessment and your CSED.

- Where’s My Refund? Tool: The “Where’s My Refund?” tool is designed primarily to track the status of your tax refund. However, it can also provide information about your tax returns, including the date of assessment and the estimated CSED. This tool is accessible on the IRS website and can be helpful in determining your CSED.

- Third-Party Websites: There are also third-party websites that offer services to help you retrieve your CSED. These websites often provide user-friendly interfaces that allow you to input your personal information and retrieve your CSED quickly and conveniently.

When using online tools, it’s crucial to ensure that you are utilizing trusted and secure platforms. Stick to official IRS websites or reputable third-party websites to safeguard your personal and financial information.

By utilizing online tools, you can independently access your tax information and retrieve your CSED without the need for direct contact with the IRS. These tools offer convenience and speed in acquiring the information you need to effectively manage your tax obligations.

However, it’s important to note that online tools may have limitations, especially if there are unique circumstances or complex tax situations. If you encounter any challenges or require further clarification, considering consulting a tax professional who can offer guidance and ensure accurate interpretation of your CSED.

Take advantage of the technological advancements and accessibility of online tools to find your IRS CSED with ease and convenience.

Method 5: Seek Assistance from a Tax Professional

If you’re having difficulty finding your IRS Collection Statute Expiration Date (CSED) or interpreting the information you have, seeking assistance from a tax professional can provide valuable guidance and ensure accuracy in determining your CSED.

A qualified tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), can help in the following ways:

- Expertise and Knowledge: Tax professionals have in-depth knowledge of tax laws and regulations. They are familiar with the intricacies of the IRS guidelines and can interpret the information related to your CSED accurately.

- Access to Resources: Tax professionals have access to various resources and databases that can assist in retrieving your tax information, including your CSED. They can navigate through these tools efficiently to provide you with the necessary details.

- Personalized Guidance: Tax professionals can provide personalized guidance based on your specific tax situation. They can review your tax history, assess any potential issues or discrepancies, and advise you on the best course of action to manage your tax obligations effectively.

- Amended Returns and Complex Situations: If you have filed amended returns or have complex tax situations, a tax professional can help navigate through the intricacies and determine the implications on your CSED.

When seeking assistance from a tax professional, ensure that you choose someone with the necessary qualifications, experience, and a good reputation. You can ask for recommendations from friends, family, or colleagues or research trusted professionals in your area.

By consulting a tax professional, you can have peace of mind knowing that you are receiving accurate information and expert advice regarding your CSED. They can help you understand the implications of your CSED, provide guidance on your tax responsibilities, and assist you in making informed financial decisions.

Keep in mind that while seeking professional assistance may incur fees, the benefits of their expertise and guidance can far outweigh the costs, especially if you have complex tax concerns or find it challenging to determine your CSED independently.

Consider consulting a tax professional to ensure that you have a clear understanding of your CSED and to optimize your tax planning and financial management strategies.

Conclusion

Knowing your IRS Collection Statute Expiration Date (CSED) is crucial for effective tax planning and managing your financial obligations. By understanding your CSED, you can have clarity on the timeline within which the IRS can pursue collection actions against you.

In this article, we explored various methods to find your IRS CSED. These methods include requesting transcripts from the IRS, checking your tax return documents, contacting the IRS, utilizing online tools, and seeking assistance from a tax professional. Each method offers its own benefits and can help you determine your CSED based on your specific circumstances.

By requesting transcripts or reviewing your tax return documents, you can find important information such as the dates of tax assessments and the expiration of your CSED. Contacting the IRS directly or using online tools can provide convenient ways to access your tax information and retrieve your CSED. Alternatively, seeking guidance from a tax professional can ensure accurate interpretation of the information and personalized advice tailored to your specific tax situation.

Remember, being aware of your CSED allows you to make informed financial decisions, plan for your tax liabilities, and avoid unnecessary stress related to potential collection actions. Stay proactive, stay informed, and stay in control of your tax obligations.

Whether you choose to utilize one method or a combination of them, finding your IRS CSED is essential for effective tax management. Take the necessary steps to determine your CSED and enjoy the peace of mind that comes with having a clear understanding of your tax responsibilities and timeline.