Finance

How To Find Out APR On Credit Card

Modified: March 3, 2024

Learn how to calculate the APR on your credit card and make informed financial decisions. Explore our comprehensive guide on finance and credit card management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where convenience meets financial responsibility. As a responsible credit card holder, it is crucial to understand the various terms associated with credit cards, and one of the most important terms to comprehend is the Annual Percentage Rate or APR. The APR plays a significant role in determining the cost of borrowing money through your credit card. It affects the interest you pay on balances carried over from month to month and influences the overall cost of any outstanding debt on your card.

Understanding the APR on your credit card is essential because it can impact your financial well-being. Whether you are considering obtaining a new credit card or looking to manage your existing credit card debt better, knowing how to find out the APR on your credit card is key.

This article will guide you through the process of finding the APR on your credit card, enabling you to make informed decisions about your finances. We will also explore the factors that affect credit card APRs and discuss strategies for comparing and evaluating different APRs. By the end of this article, you will have a solid understanding of credit card APRs and be equipped to make smarter financial choices.

Understanding APR

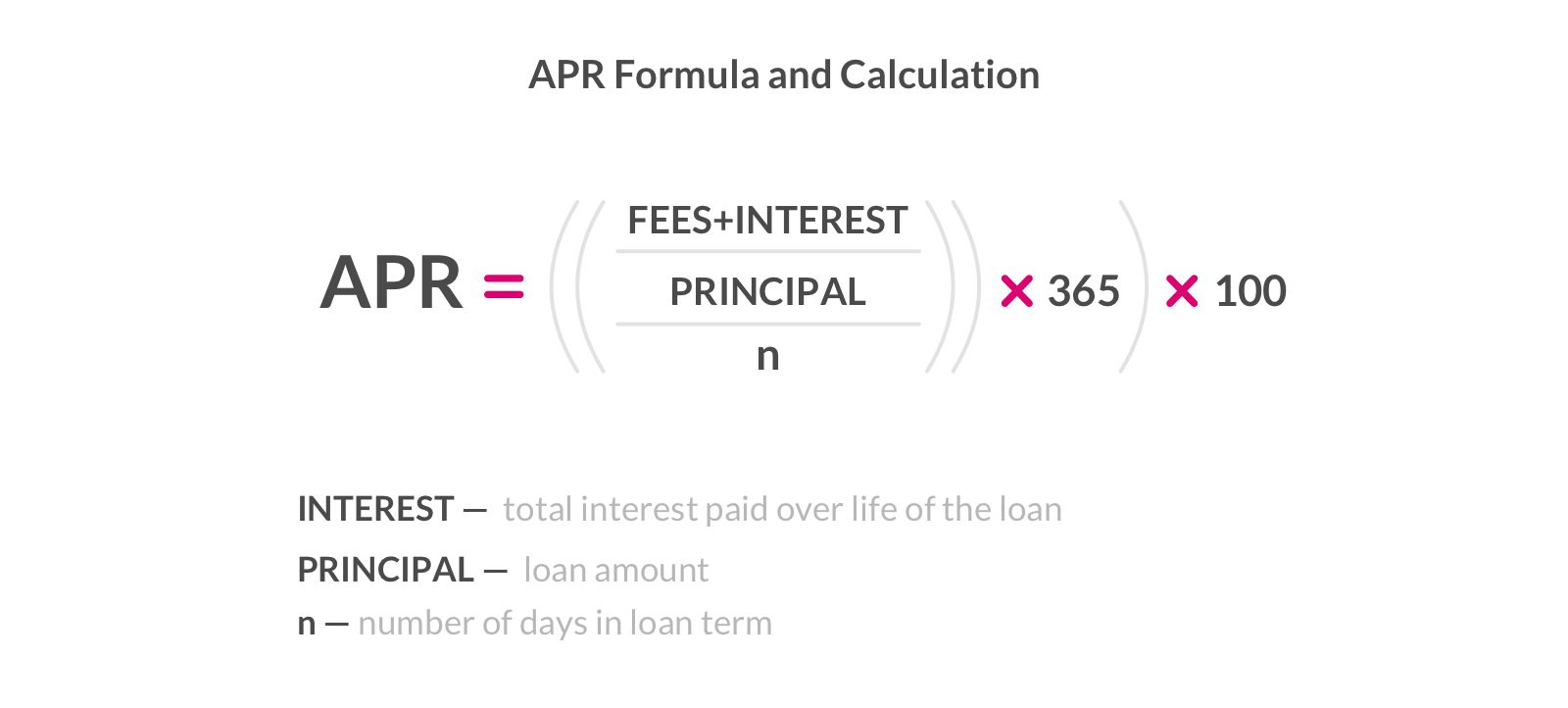

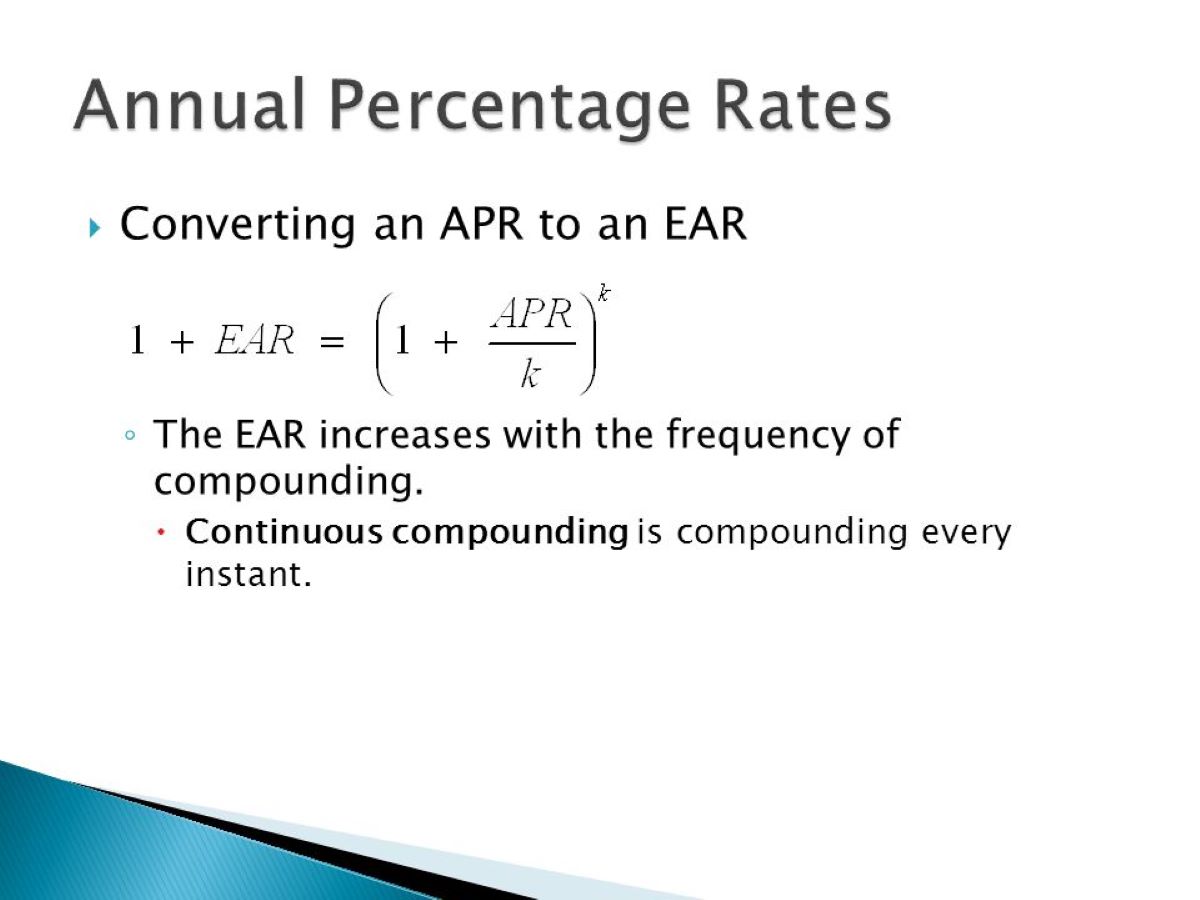

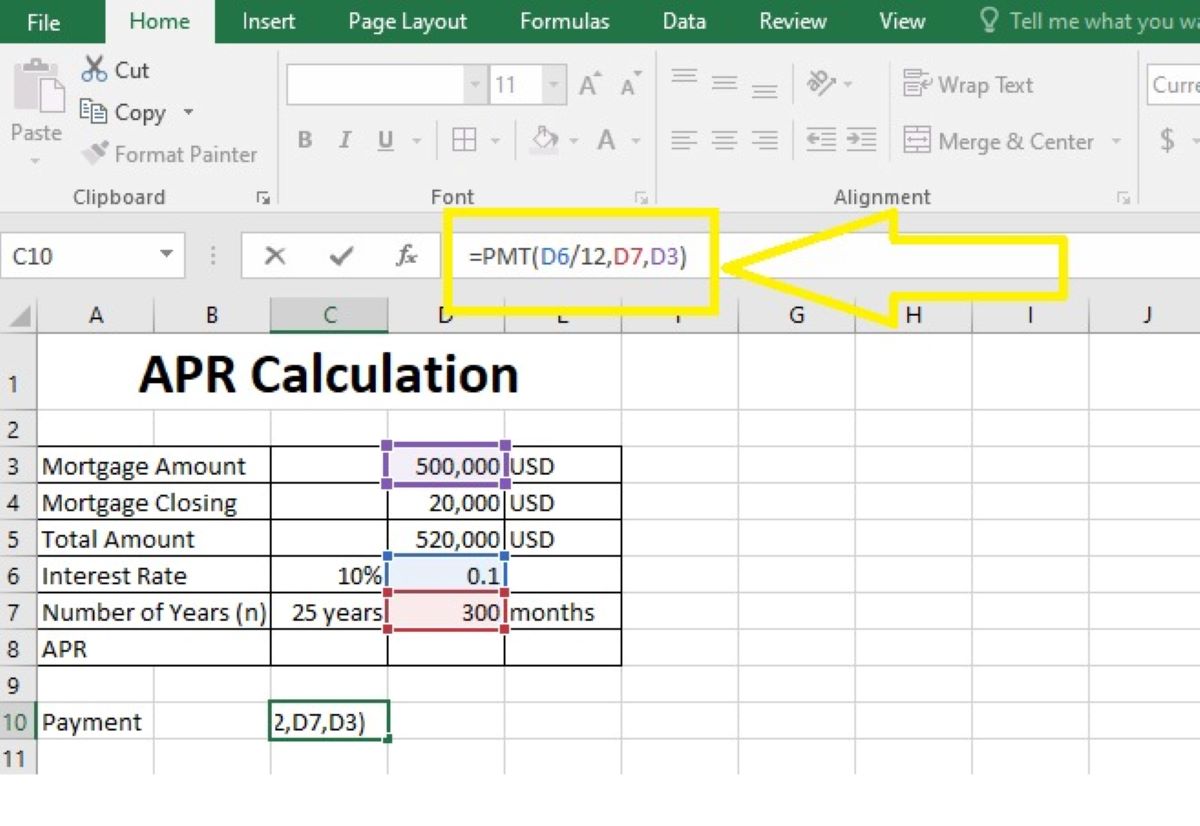

Before we delve into the specifics of finding out the APR on your credit card, it’s important to have a clear understanding of what APR actually means. APR, or Annual Percentage Rate, represents the annualized interest rate charged to borrowers for any outstanding balance on their credit card.

Unlike the interest rate, which only reflects the periodic interest charged on the balance, the APR takes into account other associated fees and charges, such as annual fees, balance transfer fees, and late payment fees. This means that the APR provides a more comprehensive assessment of the overall cost of borrowing on your credit card.

It’s important to note that APRs can vary significantly across different credit cards and can be influenced by factors such as your credit history, credit score, and the type of credit card you have. Generally, credit cards with rewards programs or premium benefits may have higher APRs compared to basic credit cards.

The APR on your credit card is typically expressed as a percentage and can be categorized into different types, including:

- Purchase APR: This is the APR applied to purchases made with your credit card. If you carry a balance from month to month, the purchase APR will determine the interest charges you accrue.

- Cash Advance APR: In cases where you withdraw cash from an ATM using your credit card, a separate cash advance APR may apply. This APR is typically higher than the purchase APR and often incurs additional fees.

- Introductory APR: Some credit cards may offer an introductory period with a lower or even 0% APR for a certain duration. After the introductory period ends, the regular APR will apply.

- Penalty APR: If you fail to make your minimum payment on time or violate the terms of your credit card agreement, the credit card issuer may impose a penalty APR, which is typically higher than the standard APR.

Understanding the different types of APRs associated with your credit card is essential for managing your finances effectively and avoiding unnecessary interest charges and penalties.

Where to Find APR on Credit Card

Now that you have a better understanding of what APR is and its significance, let’s explore where you can find the APR on your credit card. The APR is typically provided in the credit card agreement or disclosure statement, which outlines the terms and conditions of your card. This document is usually provided by the credit card issuer when you apply for a new card or can be accessed on their website.

Here are some specific places where you can find the APR on your credit card:

- Credit Card Agreement: The APR details are often stated clearly in the credit card agreement. You can find this document either in a physical copy provided by the issuer or by accessing your credit card account online.

- Monthly Statements: Your credit card statement will include important information about your account, including the APR. Look for a section that provides a summary of your terms and rates, where the APR will be displayed.

- Issuer’s Website or Customer Portal: Most credit card issuers provide online access to your account, where you can view and manage your credit card details. The APR should be readily available in your account information section or under the terms and conditions.

- Customer Service: If you’re unable to locate the APR on your credit card through the aforementioned methods, you can reach out to the card issuer’s customer service for assistance. They can provide you with the necessary information regarding your card’s APR.

Remember, it is essential to familiarize yourself with the specific terms and conditions of your credit card, including the APR, to make informed decisions about your finances. Take the time to review the documents provided by the issuer and ensure you understand the implications of the APR on your card.

Steps to Find Out APR on Credit Card

Discovering the APR on your credit card is a straightforward process. Here are the steps you can follow to find out the APR on your credit card:

- Check the Credit Card Agreement: Start by locating the credit card agreement provided by the issuer. You can find this document either in physical form or by accessing your online account. Look for the section that specifically mentions the APR.

- Review the Monthly Statements: Examine your monthly statements, either in physical or electronic form. Look for a section that provides a summary of your terms and rates. The APR should be clearly listed in this section.

- Access Your Online Account: Log in to your credit card issuer’s website or customer portal. Navigate to your account information or terms and conditions section. The APR should be prominently displayed in your account details.

- Contact Customer Service: If you’re unable to access or locate the APR using the methods above, reach out to the credit card issuer’s customer service. They can provide you with the necessary information regarding your card’s APR.

It’s important to note that the APR can vary based on factors such as your creditworthiness and the specific terms of your credit card. If you have multiple credit cards, make sure to follow these steps for each card to ensure you have a complete understanding of the APRs for your entire credit card portfolio.

By taking the time to find out the APR on your credit card, you can make informed decisions about managing your credit card debt, budgeting, and avoiding unnecessary interest charges.

Factors Affecting APR on Credit Card

The APR on your credit card is influenced by several factors. Understanding these factors can help you better comprehend the rate you’re being charged and potentially negotiate for a lower APR. Here are some key factors that can affect the APR on your credit card:

- Creditworthiness: Your creditworthiness, as reflected in your credit score and credit history, has a significant impact on the APR offered to you. Lenders consider borrowers with higher credit scores as less risky and may provide them with lower APRs.

- Credit Card Type: The type of credit card you have can also affect the APR. Premium or rewards credit cards often have higher APRs compared to basic credit cards due to the additional features and benefits they offer.

- Economic Factors: Economic conditions can influence credit card APRs. If interest rates are generally high, credit card issuers may increase their APRs accordingly. Similarly, during periods of low interest rates, you may find more competitive APR offers.

- Introductory Offers: Some credit cards offer promotional or introductory APRs for a limited period. These low or zero APRs are designed to attract new customers. After the introductory period ends, the regular APR will apply.

- Payment History: Your payment history with the credit card issuer can impact your APR. Making payments on time and maintaining a good payment record can result in a better APR or potential APR reductions in the future.

- Issuer Policies: Each credit card issuer sets their own policies and guidelines for determining APRs. Different issuers may consider different factors and use different algorithms to calculate the APR for their cards.

- Market Competition: Competition among credit card issuers can also influence APRs. If there is intense competition in the credit card market, issuers may offer more attractive APRs to attract customers.

It’s important to keep in mind that the specific impact and weight of these factors can vary between different credit card issuers. It is always a good idea to research and compare credit card offers to find the best APR that suits your financial needs.

Understanding the factors that affect the APR on your credit card can empower you to make more informed decisions and potentially take steps to improve your creditworthiness, negotiate for lower rates, and save money on interest charges.

Comparing and Evaluating Credit Card APRs

When it comes to credit cards, comparing and evaluating different APRs is crucial to ensure you’re making the most financially sound decisions. Here are some key considerations to keep in mind when comparing and evaluating credit card APRs:

- Identify Your Financial Needs: Start by understanding your financial needs and how you plan to use the credit card. If you tend to carry balances and pay interest, a lower APR will be beneficial. However, if you plan to pay off your balance in full every month, the APR may be less of a priority.

- Compare Introductory vs. Regular APRs: Some credit cards offer attractive introductory APRs for a limited time. Consider how long the introductory period lasts and what the regular APR will be once it ends. Evaluate whether the card still offers a competitive APR once the introductory period is over.

- Consider Additional Fees: APR isn’t the only factor to consider. Take into account any additional fees associated with the credit card, such as annual fees, balance transfer fees, or foreign transaction fees. These fees can impact the overall cost of using the credit card.

- Review Rewards and Benefits: Premium credit cards with higher APRs often offer rewards programs, cashback opportunities, or other benefits. Assess whether the rewards and benefits offset the higher APR and align with your spending habits and preferences.

- Research Different Credit Card Issuers: Explore various credit card issuers and their offerings. Different issuers may have different APR ranges, policies, and customer service experiences. Reading reviews and comparing customer satisfaction can provide insights into the overall credit card experience.

- Consider Balance Transfer Options: If you have existing credit card debt, evaluate whether transferring balances to a card with a lower APR or a promotional balance transfer APR can save you money on interest charges.

Remember, the lowest APR isn’t always the best choice for everyone. It’s essential to consider your unique financial circumstances and individual needs when evaluating credit card APRs. Prioritize finding a credit card that aligns with your financial goals, spending habits, and ability to repay the debt.

By carefully comparing and evaluating credit card APRs, you can make an informed decision that minimizes the cost of borrowing and maximizes the benefits and rewards offered by the credit card.

Conclusion

Understanding the APR on your credit card is essential for managing your finances effectively and avoiding unnecessary interest charges. By knowing how to find out the APR on your credit card, you can make informed decisions about borrowing, budgeting, and debt repayment.

In this article, we explored the concept of APR and its significance in determining the cost of borrowing on your credit card. We discussed where to find the APR on your credit card, including the credit card agreement, monthly statements, online account access, and customer service.

We also covered the factors that can affect credit card APRs, such as creditworthiness, card type, economic conditions, payment history, and issuer policies. Understanding these factors can help you negotiate for better rates and make more informed decisions about your credit card usage.

Additionally, we provided steps to find out the APR on your credit card, including checking the credit card agreement, reviewing monthly statements, accessing your online account, and contacting customer service if needed.

To make the best use of this knowledge, we discussed the importance of comparing and evaluating credit card APRs based on your financial needs, considering both introductory and regular APRs, additional fees, rewards and benefits, and the reputation of different credit card issuers.

By taking the time to understand and evaluate credit card APRs, you can choose cards that align with your financial goals, minimize interest charges, and maximize the benefits and rewards offered by the credit card.

Remember, while APR is an important aspect of credit cards, it’s also crucial to manage your credit card responsibly by making timely payments, keeping balances low, and not overspending. By using your credit card wisely, you can build a positive credit history and achieve your financial aspirations.

Now that you have a better understanding of credit card APRs, take the next step in your financial journey by reviewing your credit card agreements, exploring your options, and making informed decisions that positively impact your financial well-being.