Finance

How To Get A Pension Award Letter

Published: November 27, 2023

Learn how to get a pension award letter for your finances. Step-by-step guide to receiving your pension confirmation. Secure your financial future with our expert tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Pension Award Letter?

- Why Do You Need a Pension Award Letter?

- How to Request a Pension Award Letter

- Step 1: Gather Required Information

- Step 2: Contact the Pension Provider

- Step 3: Request the Pension Award Letter

- Step 4: Follow Up if Necessary

- Important Things to Know About Pension Award Letters

- Conclusion

Introduction

When it comes to planning for retirement, understanding your pension benefits is crucial. One important document that can provide valuable information about your pension benefits is the Pension Award Letter. Whether you are nearing retirement age or have already started receiving pension payments, it is important to know how to obtain and interpret this document.

So, what exactly is a Pension Award Letter? In simple terms, it is a letter issued by your pension provider that outlines the details of your pension benefits. It serves as official proof of the amount you are entitled to receive and provides essential information about your retirement income.

In this article, we will explore the importance of a Pension Award Letter and guide you through the process of obtaining one. We will also highlight key information to look for in the letter and provide insights into why it is essential to be familiar with its contents.

Understanding your pension benefits and having a clear picture of your retirement income is vital for financial planning and peace of mind. So let’s dive into the world of Pension Award Letters and discover how you can secure yours.

What is a Pension Award Letter?

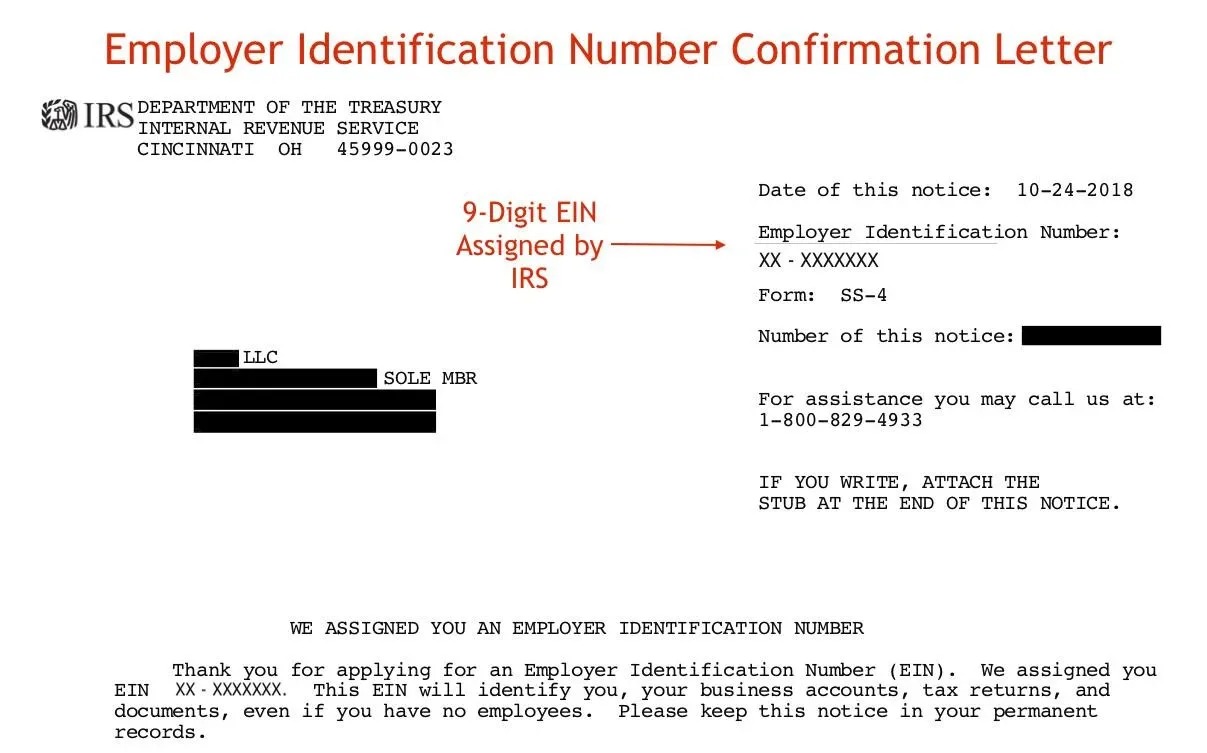

A Pension Award Letter is an official document provided by a pension provider to individuals who are eligible for pension benefits. This letter serves as confirmation of your entitlement and provides detailed information about your pension benefits.

The letter is typically issued by pension plan administrators or government agencies that manage pension programs. It contains essential details about your pension, including the amount you are eligible to receive, the frequency of payments, and any additional benefits or options available to you.

The Pension Award Letter is an important document that outlines the terms and conditions of your pension plan. It serves as proof of your retirement income and can be used for various purposes, such as applying for additional benefits, seeking financial advice, or providing documentation for tax purposes.

The specific information included in a Pension Award Letter can vary depending on the type of pension plan and the rules of the pension provider. However, common elements that may be found in the letter include:

- Your full name and contact information

- Details of your pension plan, including the name of the plan and the administrator

- The amount of your monthly pension payment

- The method and frequency of payment (e.g., direct deposit or check, monthly or quarterly)

- Start date of your pension payments

- Any additional benefits you may be eligible for, such as cost-of-living adjustments

- Contact information for the pension provider or administrator, should you have any questions or concerns

It is important to review your Pension Award Letter carefully to ensure that all the information is accurate and aligns with your expectations. Any discrepancies or errors should be reported to the pension provider immediately to avoid potential issues in the future.

Now that we have a clear understanding of what a Pension Award Letter is, let’s explore why it is important to have this document in your possession.

Why Do You Need a Pension Award Letter?

A Pension Award Letter is a crucial document that serves multiple purposes and provides valuable information about your pension benefits. Here are some compelling reasons why you need a Pension Award Letter:

1. Official Proof of Your Pension Benefits: The Pension Award Letter serves as official proof of your entitlement to pension benefits. It provides documentation that can be used to verify your income, especially when dealing with financial institutions, applying for loans, or seeking other forms of financial assistance.

2. Understanding Your Retirement Income: The letter outlines the details of your pension benefits, including the amount you are eligible to receive and the frequency of payments. This information is crucial for financial planning, budgeting, and ensuring that you have a clear understanding of your retirement income.

3. Verification for Other Benefits: In some cases, having a Pension Award Letter may be necessary to apply for or receive other benefits, such as Social Security or supplemental retirement plans. The letter serves as supporting documentation to demonstrate your eligibility for these additional benefits.

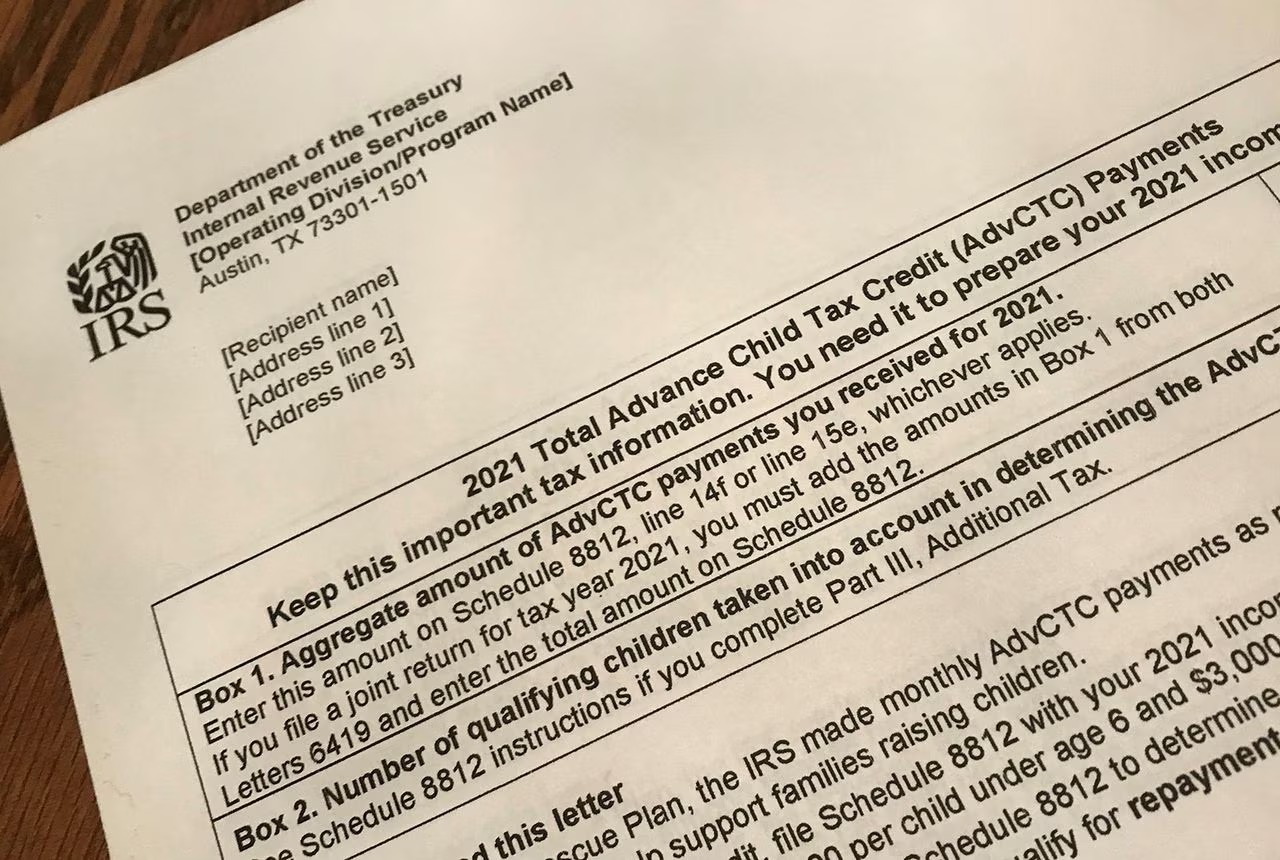

4. Tax Documentation: The Pension Award Letter provides important information for tax purposes. It includes details such as the amount of taxable income you will receive from your pension and any tax withholdings. This information is essential for accurately filing your tax returns and ensuring compliance with tax regulations.

5. Planning for the Future: Having a clear understanding of your pension benefits is crucial for financial planning and retirement preparation. The Pension Award Letter provides valuable information that can help you assess your overall financial situation, make informed decisions about your retirement, and plan for the future.

6. Resolving Disputes or Issues: In the event of a dispute or discrepancy regarding your pension benefits, the Pension Award Letter serves as a reference point. It outlines the terms and conditions of your pension plan and can be used to resolve any issues or address concerns with the pension provider or administrator.

Overall, a Pension Award Letter is an essential document that provides confirmation of your pension benefits and offers vital information for financial planning, tax purposes, and ensuring your retirement income is accurately accounted for. It is important to keep this letter in a safe place and review it regularly to stay informed about your pension benefits.

Now that we understand the significance of having a Pension Award Letter, let’s move on to the practical steps of requesting and obtaining this important document.

How to Request a Pension Award Letter

Obtaining a Pension Award Letter is a straightforward process. Here are the steps to follow:

Step 1: Gather Required Information: Before reaching out to your pension provider or administrator, gather all the necessary information you will need to request the Pension Award Letter. This may include your full name, social security number, contact information, and any other identifying details specific to your pension plan.

Step 2: Contact the Pension Provider: Reach out to your pension provider or administrator. You can find their contact information on previous correspondence, such as statements or online account access. Alternatively, check your pension plan documents or the company’s website for the appropriate contact information.

Step 3: Request the Pension Award Letter: Once you are in touch with the pension provider, inform them that you would like to request a Pension Award Letter. Provide them with the necessary information they may need to locate your pension account and process your request.

Step 4: Follow Up if Necessary: After making your request, it is a good idea to follow up with the pension provider to ensure that your request is being processed. This may involve contacting them again or waiting for a response via email or regular mail. If there are any delays or issues, don’t hesitate to reach out to them for clarification or resolution.

It is important to keep in mind that the process for obtaining a Pension Award Letter may vary slightly depending on your specific pension plan and provider. Some pension providers may offer online access to request the letter, while others may require a written request or phone call. Follow the instructions provided by your pension provider to ensure a smooth and successful request process.

Once you have received your Pension Award Letter, carefully review the information to ensure its accuracy. If you notice any discrepancies or errors, promptly contact your pension provider to have them corrected.

Now that you know how to request a Pension Award Letter, let’s explore some important things to keep in mind regarding these documents.

Step 1: Gather Required Information

Before you can request a Pension Award Letter, it is important to gather all the necessary information that may be required by your pension provider. This includes:

1. Full Name and Contact Information: Ensure you have your full legal name, current address, phone number, and email address handy. This information will help the pension provider identify your account and send the Pension Award Letter to the correct address or contact you if any additional information is required.

2. Social Security Number (or other identification number): Your social security number (or another unique identification number provided by your pension plan) is often used to match your account and verify your identity. Make sure you have this number readily available when contacting your pension provider.

3. Pension Plan Details: Have information about your specific pension plan on hand. This may include the name of the plan, the employer or organization associated with the plan, and any plan identification or account numbers that may be necessary for accurate identification.

4. Previous Correspondence: If you have any previous correspondence from your pension provider, such as statements or other letters related to your pension, keep them accessible. These documents may contain important details or references that can be useful when requesting the Pension Award Letter.

5. Additional Documentation: Depending on your unique situation or the requirements of your pension provider, there may be additional documentation or identification needed. This could include a copy of your identification card, birth certificate, or other supporting documents. Check with your pension provider to determine if any additional documentation is required.

By gathering all the necessary information beforehand, you can streamline the process of requesting your Pension Award Letter. It helps to have everything ready when contacting your pension provider, allowing for a quicker and smoother interaction.

Now that you have your information gathered, let’s move on to the next step: contacting the pension provider to request your Pension Award Letter.

Step 2: Contact the Pension Provider

Once you have gathered all the required information, the next step in obtaining your Pension Award Letter is to contact your pension provider or administrator. This can typically be done via phone, email, or through an online portal, depending on the options provided by your pension plan.

Phone: Find the contact phone number for your pension provider. This information can usually be found on previous statements, correspondence, or the provider’s website. Prepare for the phone call by having your gathered information ready, and be prepared to provide any additional details the provider may require to locate your pension account.

Email: Some pension providers offer the convenience of email correspondence. Look for the email address provided on statements, the provider’s website, or contact page. When drafting your email, be sure to include your full name, contact information, and any other necessary details as outlined in the previous step.

Online Portal: Many pension plans have online portals where you can access your account information and communicate with the provider. Log in to your account and navigate to the appropriate section for requesting the Pension Award Letter. Fill out any required forms or provide the necessary information as prompted on the portal.

When contacting the pension provider, it is essential to be polite and clear about your request. Clearly state that you would like to request a Pension Award Letter and provide all the necessary information they may need to locate your account and process your request efficiently.

The customer service representatives or support staff at the pension provider are there to assist you, so feel free to ask any questions or seek clarification if needed. They will guide you through the process and may provide you with an estimated timeframe for receiving your Pension Award Letter.

Now that you have contacted the pension provider to request your Pension Award Letter, let’s proceed to the next step: requesting the letter itself.

Step 3: Request the Pension Award Letter

After you have made contact with your pension provider, the next step is to request the Pension Award Letter. This is the official document that outlines your pension benefits and serves as proof of your entitlement to retirement income.

When requesting the Pension Award Letter, it is important to provide all the necessary information to ensure accuracy. Follow the instructions provided by the pension provider, whether it is filling out a form, providing specific details over the phone, or submitting a request through an online portal. Be prepared to provide the following information:

- Your full legal name

- Social security number or other identification number linked to your pension account

- Contact information, including address, phone number, and email

- Any specific details about your pension plan or account, such as plan name or account number

Clearly state that you are requesting the Pension Award Letter and, if necessary, specify the purpose for which you require the document. This could be for financial planning, tax purposes, or as proof of income for other benefit programs.

If you are making the request over the phone or through email, take note of any reference numbers, confirmation numbers, or documentation that the pension provider may provide as proof of your request. This will be useful for follow-up purposes and tracking the progress of your request if necessary.

Once your request has been made, the pension provider will begin processing it. The timeframe for receiving the Pension Award Letter may vary depending on the provider’s internal processes and the volume of requests they receive. In some cases, you may receive the letter within a few business days, while others may take several weeks. Be sure to ask the pension provider about their estimated timeframe or any specific updates they may provide.

Now that you have requested your Pension Award Letter, the final step is to follow up if necessary to ensure the timely receipt of the document.

Step 4: Follow Up if Necessary

After you have requested your Pension Award Letter, it is important to follow up if necessary to ensure a smooth and timely receipt of the document. While most pension providers strive to process requests promptly, occasional delays or issues may arise. If you have not received your Pension Award Letter within the expected timeframe, or if you have any concerns or questions, don’t hesitate to reach out to the pension provider for updates. Here are some steps to follow:

1. Check Notifications: If you made your request through an online portal or received any confirmation or reference numbers, log in to your account or refer to your records to see if any updates or notifications have been posted. The pension provider may have provided information regarding the status of your request.

2. Contact Customer Support: If you have not received any updates or notifications, reach out to the customer support team at the pension provider. Contact them via phone or email, using the designated contact information provided by the provider. Politely explain the situation, provide any relevant details or reference numbers, and request an update on the status of your Pension Award Letter.

3. Clarify any Issues: During your follow-up communication, if the pension provider indicates that there may be an issue or delay with your request, inquire about the specifics. Ask if there are any additional documents or information you need to provide to move the process forward. Address any concerns or discrepancies promptly to ensure a resolution and smooth processing of your request.

4. Escalate if Necessary: If you encounter ongoing delays or unresolved issues with obtaining your Pension Award Letter, consider escalating your concern to a supervisor or manager within the pension provider’s organization. Request to speak with someone who can provide further assistance and resolve the situation. Always maintain a polite and professional demeanor during your interactions.

By following up on your request, you demonstrate your commitment to receiving the Pension Award Letter and ensure that any potential issues or delays are addressed promptly. Remember to keep records of any interactions with the pension provider, including copies of emails or notes from phone conversations, in case you need to reference them in the future.

Now that you are aware of the importance of following up, let’s summarize some important factors to consider about Pension Award Letters.

Important Things to Know About Pension Award Letters

Pension Award Letters are crucial documents that provide valuable information about your pension benefits. Here are some important things to keep in mind:

1. Accuracy is Key: Carefully review your Pension Award Letter to ensure that all the information provided is accurate and aligns with your expectations. Pay close attention to details such as the amount of your monthly pension payment, payment frequency, start date of payments, and any additional benefits or options mentioned. If you notice any discrepancies or errors, promptly notify your pension provider to have them corrected.

2. Keep it Safe: Store your Pension Award Letter in a safe and easily accessible place. Treat it as an important financial document, as it serves as official proof of your pension entitlement. Make copies or digital backups and consider keeping one set in a separate location or providing a copy to a trusted family member or advisor.

3. Understand Your Benefits: Take the time to fully understand your pension benefits as outlined in the Pension Award Letter. Gain clarity on the amount of your monthly payments, how they are calculated, and any additional benefits or options available to you. This understanding will help you make informed financial decisions and plan for a secure retirement.

4. Plan for Tax Obligations: Your Pension Award Letter may provide information about any tax withholdings and the amount of taxable income you will receive. Consult with a tax advisor or accountant to ensure you are aware of your tax obligations and take advantage of any deductions or strategies to optimize your tax situation.

5. Communicate Changes: Notify your pension provider promptly if there are any changes in your personal circumstances that may impact your pension benefits. This includes changes in address, marital status, or any other relevant details. Keeping your pension provider informed ensures that your records are up to date and helps avoid any potential issues or delays in receiving your pension payments.

6. Seek Professional Advice: If you have questions or concerns about your pension benefits, consider consulting with a financial advisor or retirement planning professional. They can provide expert guidance on how to maximize your pension income, coordinate it with other sources of retirement income, and make the most of your retirement savings.

7. Be Proactive: Regularly review your Pension Award Letter and stay informed about any updates or changes in your pension benefits. Keep an eye out for annual statements and other communications from your pension provider. By staying proactive and engaged, you can ensure that you are maximizing your pension benefits and taking advantage of any opportunities to enhance your retirement income.

Pension Award Letters are valuable documents that provide essential information about your retirement income. By understanding and utilizing these letters effectively, you can make informed decisions and have peace of mind as you plan for a financially secure retirement.

Now let’s wrap up this article on how to obtain a Pension Award Letter and the importance of understanding its contents.

Conclusion

Obtaining a Pension Award Letter is a crucial step in understanding and maximizing your pension benefits. This official document provides important information about your retirement income, serving as proof of your entitlement and outlining the details of your pension plan.

In this article, we explored the process of obtaining a Pension Award Letter, starting with gathering the necessary information and contacting your pension provider. We discussed the importance of requesting the letter and following up if necessary to ensure its timely receipt.

We also highlighted key points to remember about Pension Award Letters, emphasizing the need for accuracy, safekeeping, and understanding of your benefits. Communicating changes in your circumstances, seeking professional advice, and staying proactive were emphasized as important practices.

Having a clear understanding of your pension benefits and possessing a Pension Award Letter gives you the confidence to make informed financial decisions and plan for a secure retirement. It also serves as official documentation that can be used for various purposes, such as verification of income, applying for additional benefits, and tax obligations.

Remember to review your Pension Award Letter carefully and keep it in a secure location accessible when needed. Stay proactive in managing your pension benefits by keeping your pension provider informed and seeking professional advice when necessary.

As you embark on your retirement journey, let your Pension Award Letter be a valuable resource that provides clarity, peace of mind, and financial stability. By understanding and utilizing this document effectively, you can make the most of your pension benefits and enjoy a fulfilling retirement.