Finance

How Do I Get An IRS Confirmation Letter?

Published: October 31, 2023

Learn how to obtain an IRS confirmation letter for your finance needs. Find out the step-by-step process and requirements in just a few simple clicks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where knowledge and understanding about various financial matters can greatly impact your financial well-being. One important aspect of managing your finances is ensuring that you have the necessary documentation to support your financial activities and transactions.

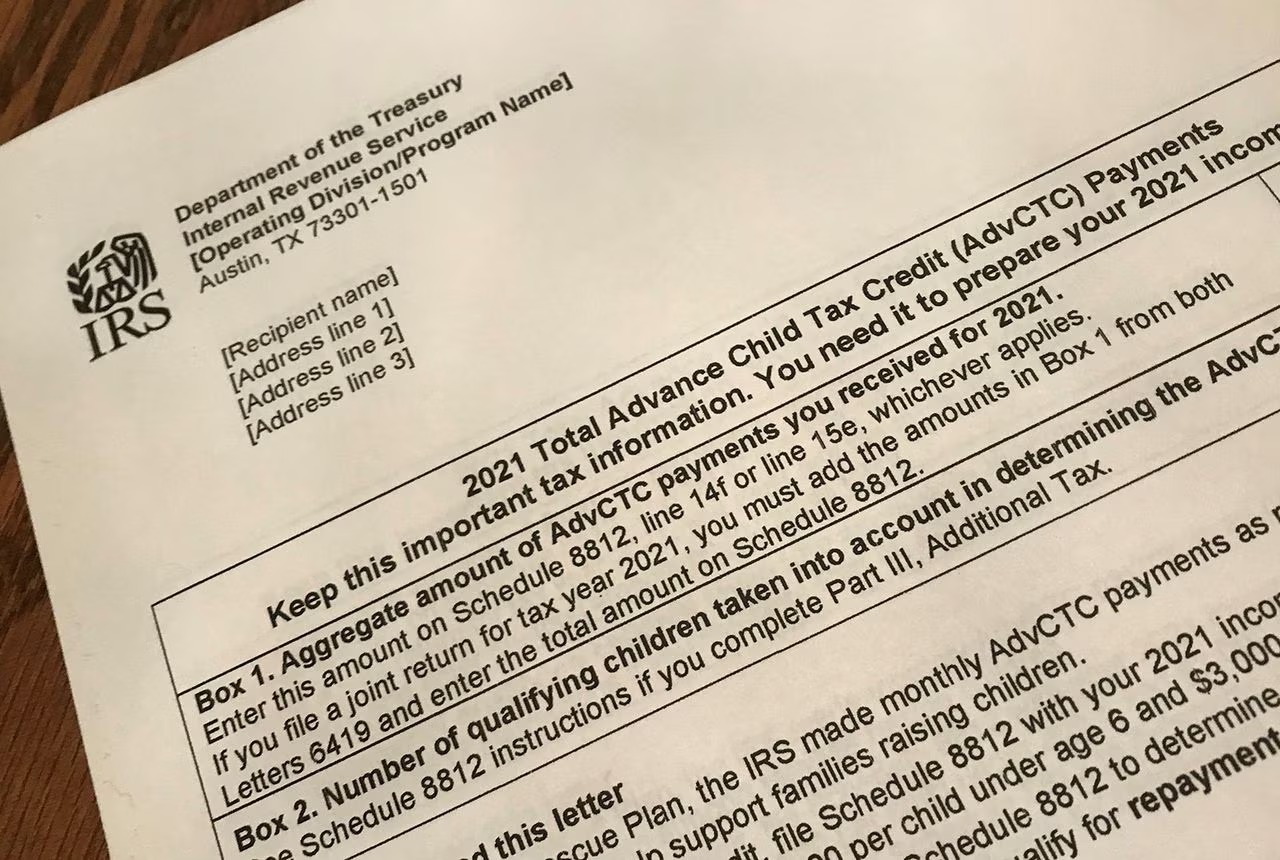

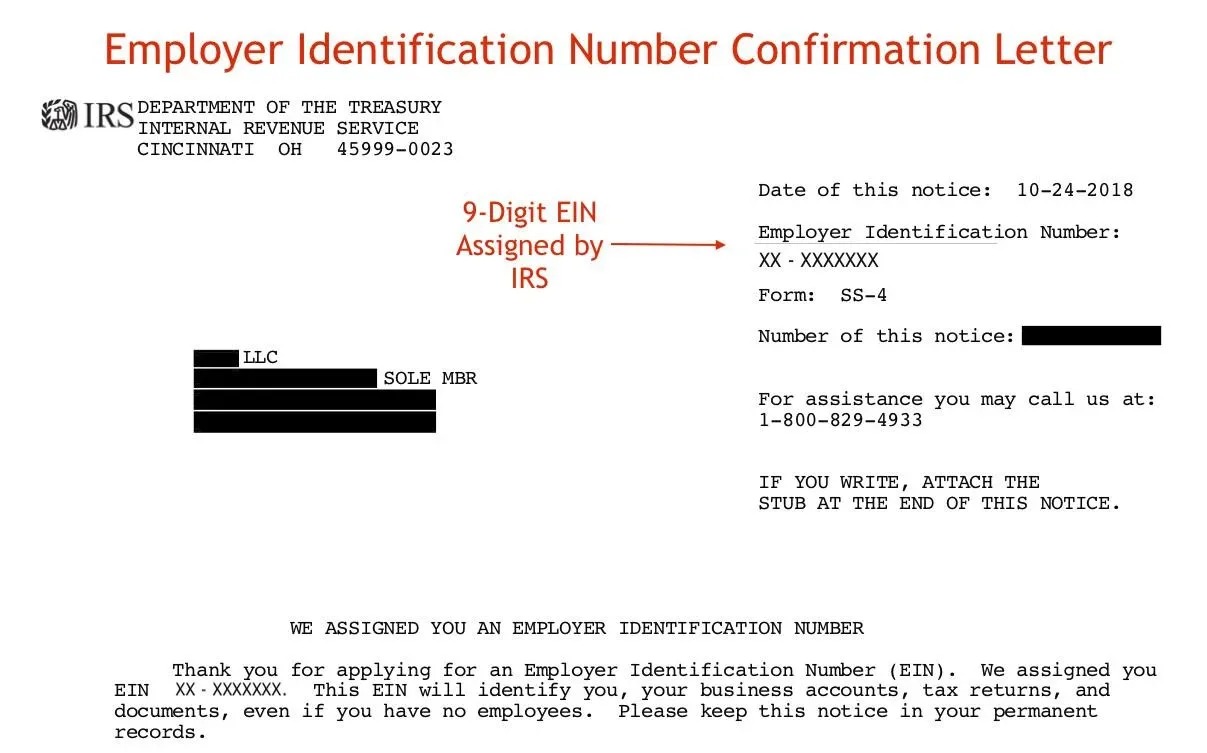

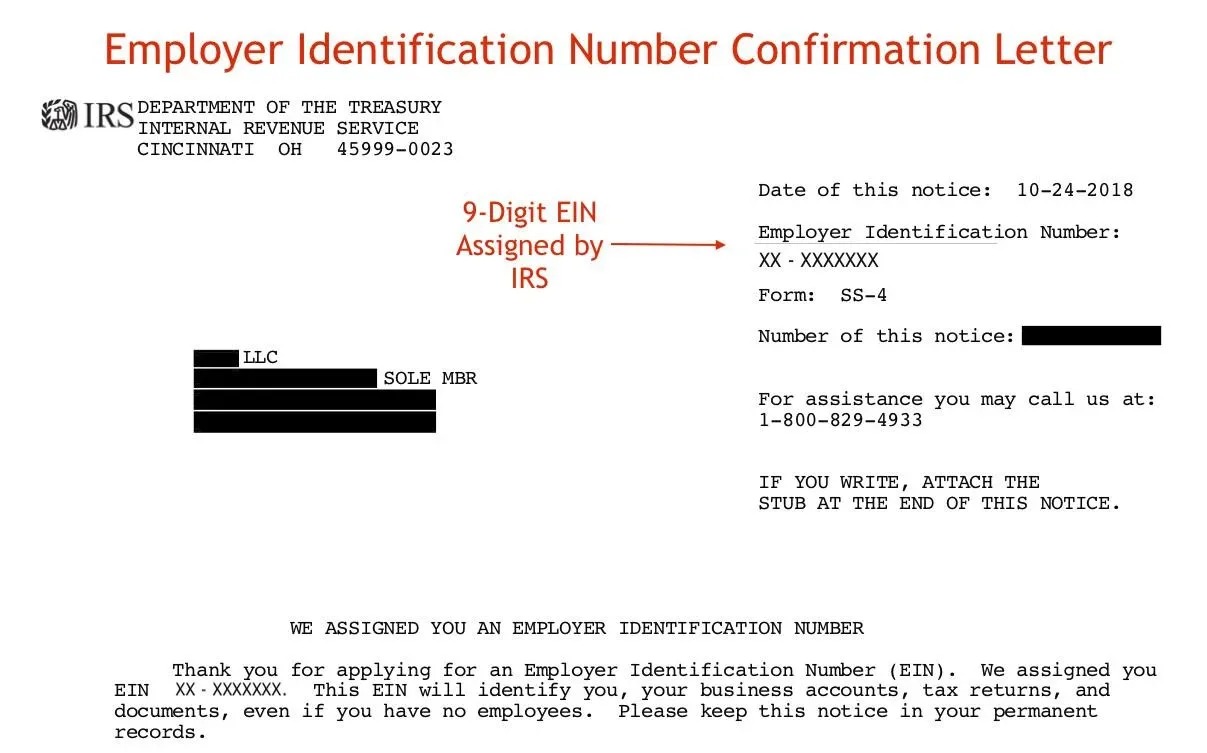

When it comes to dealing with taxes and the Internal Revenue Service (IRS) in the United States, having an IRS confirmation letter can be vital. This letter serves as proof of your tax status, which can be required for various purposes such as obtaining a loan, applying for a visa, or verifying your income for government assistance.

While the process of obtaining an IRS confirmation letter may seem daunting, it can actually be quite straightforward if you know the right steps to follow. In this article, we will guide you through the process of obtaining an IRS confirmation letter, ensuring that you have the necessary documentation to support your financial endeavors.

So, whether you’re an individual looking to secure a mortgage or a business applying for a grant, read on to discover the steps you need to take to obtain an IRS confirmation letter.

Step 1: Determine the Type of Confirmation Letter Needed

Before you begin the process of requesting an IRS confirmation letter, it’s essential to determine the specific type of letter you need. The IRS offers different types of confirmation letters depending on the purpose and nature of your request. Here are a few common types:

- Verification of Non-Filing Letter: This letter confirms that the IRS has no record of a filed tax return for the requested tax year.

- Account Transcript: This document provides a summary of your tax account transactions, including payments, penalties, and refund history.

- Tax Return Transcript: This transcript shows most line items from the original tax return, including any accompanying forms and schedules.

- Wage and Income Transcript: This transcript provides information about your reported wages, income, and tax withholdings for a specific tax year.

Identifying the specific type of confirmation letter you need will help you navigate the IRS website and streamline the request process. Take some time to determine which letter best suits your requirements.

Step 2: Request Confirmation Letter Online

The IRS provides a convenient online platform where you can request your confirmation letter. This method is often the quickest and easiest way to obtain the documentation you need. Here’s how you can request your IRS confirmation letter online:

- Visit the official IRS website at www.irs.gov

- Search for the “Get Your Tax Record” page or navigate to the “Request a Transcript” section.

- Click on the “Get Transcript Online” option to begin the request process.

- Provide the necessary information, such as your Social Security Number, date of birth, and the tax year for which you need the confirmation.

- Choose the type of confirmation letter you require, based on the options available.

- Verify your identity through various security questions or by providing a credit card number for authentication purposes.

- Once your identity is confirmed, you will be able to view and print your requested confirmation letter directly from the website.

Note that requesting your confirmation letter online requires access to your personal tax information and may involve additional security measures to protect your data. Ensure that you have a secure internet connection and follow the IRS guidelines to safeguard your personal information.

By requesting your confirmation letter online, you can save time and effort while ensuring a prompt delivery of the document you need.

Step 3: Request Confirmation Letter by Phone

If you prefer to request an IRS confirmation letter by phone or encounter any issues with the online request process, you have the option to contact the IRS directly. Here’s how you can request your confirmation letter over the phone:

- Call the IRS toll-free number at 1-800-829-1040.

- Follow the automated prompts and select the appropriate options to request a confirmation letter.

- Provide the necessary personal information, such as your Social Security Number, date of birth, and address.

- Specify the tax year for which you need the confirmation letter and the type of letter you require.

- Once your request is processed, the representative will provide you with the details of your confirmation letter over the phone or arrange for it to be mailed to your address.

When requesting a confirmation letter by phone, it is important to have all the required information readily available to ensure a smooth and efficient process. Additionally, be prepared for potential wait times when calling the IRS, as they can be busy assisting other taxpayers.

Remember to maintain a courteous and patient approach when speaking to IRS representatives, as they are there to assist you in obtaining the necessary documentation.

Requesting a confirmation letter by phone can be a helpful alternative if you prefer a more personalized interaction or encounter difficulties with the online request process.

Step 4: Request Confirmation Letter by Mail

If you prefer traditional methods or do not have access to the internet or phone, you can request an IRS confirmation letter by mail. Here’s how you can do it:

- Download and print Form 4506-T, titled “Request for Transcript of Tax Return,” from the IRS website at www.irs.gov/forms-pubs/about-form-4506-t.

- Fill out the necessary information on the form, including your name, Social Security Number, address, and the tax year for which you need the confirmation letter.

- Select the type of confirmation letter you require by checking the appropriate box on the form.

- Once completed, sign and date the form.

- Mail the form to the address provided on the form based on your state of residence.

- Allow several weeks for the IRS to process your request and mail the confirmation letter to your address.

When requesting a confirmation letter by mail, it is crucial to ensure the accuracy and legibility of the information on the form. Any incorrect details may delay the processing of your request or result in an incomplete or incorrect confirmation letter.

It is recommended to send the request via certified mail or with a return receipt to have proof of delivery and track the status of your request. This provides an added layer of security and ensures that your request reaches the IRS successfully.

While requesting a confirmation letter by mail may take longer compared to online or phone methods, it can be a suitable option for individuals who prefer a physical copy of the document or have limited access to technology.

Step 5: Verify the Requested Confirmation Letter

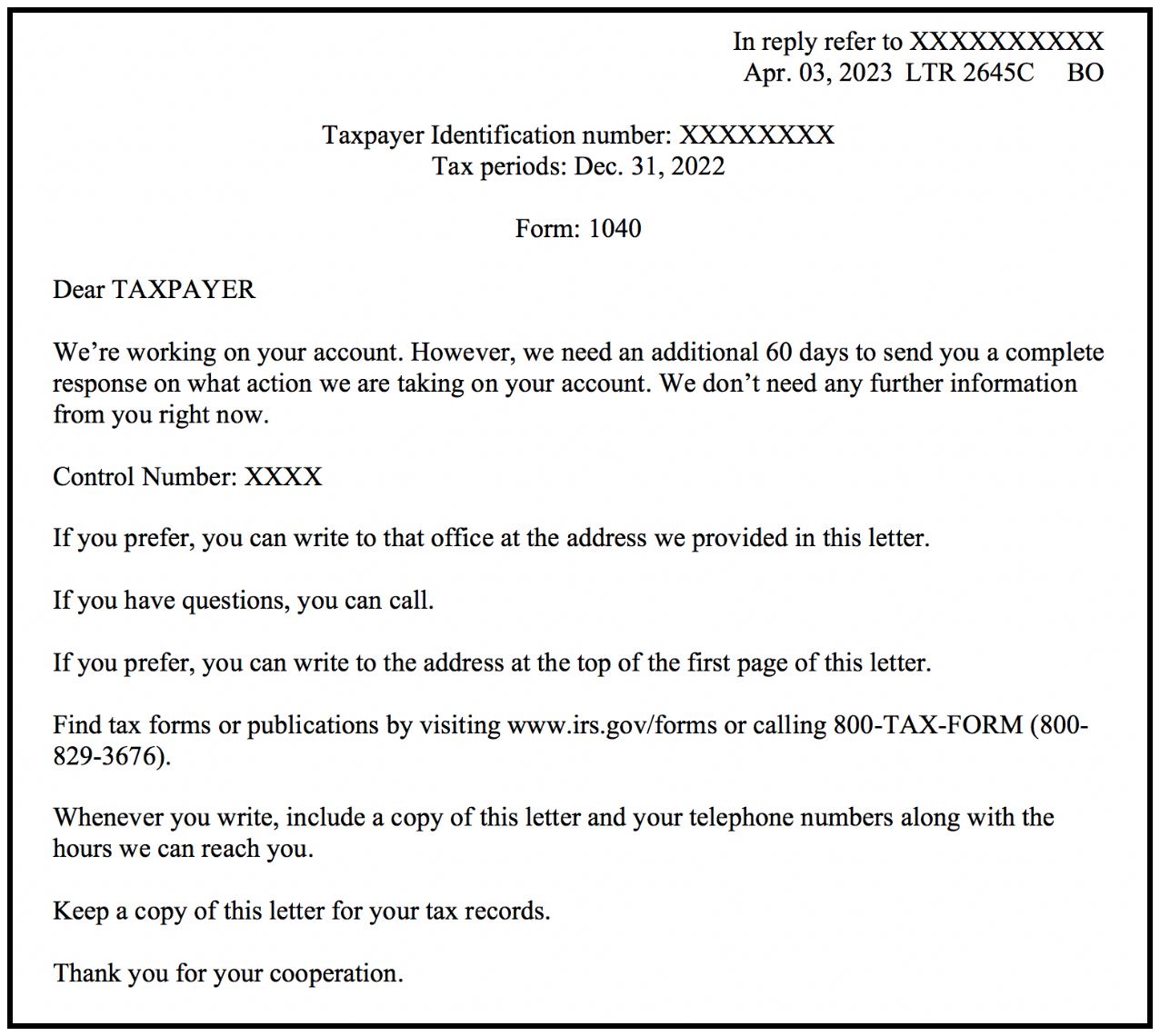

Once you receive your requested IRS confirmation letter, it is crucial to verify the accuracy and completeness of the document. Taking the time to review and confirm the information ensures that the letter serves its intended purpose and avoids any potential issues. Here are a few key steps to verify your confirmation letter:

- Carefully read through the confirmation letter and ensure that your personal information, such as your name and Social Security Number, is correctly stated.

- Check that the tax year mentioned in the letter matches the year you requested.

- If the letter includes any financial or income-related information, review the details to ensure they accurately reflect your records.

- If there are any discrepancies or errors in the confirmation letter, contact the IRS promptly to rectify the issue.

It is important to note that an IRS confirmation letter is an official document, and any inaccuracies could have serious implications for your financial matters. It is highly recommended to keep a copy of the confirmation letter for your records and retain it in a safe and easily accessible place.

By verifying the requested confirmation letter, you can have confidence in the validity and authenticity of the document and rely on it for the intended purpose, whether it is for a loan application, visa process, or other financial requirements.

Remember, if you have any doubts or concerns about the content of the confirmation letter, reach out to the IRS for clarification and guidance.

Conclusion

Obtaining an IRS confirmation letter is a crucial step in managing your finances and ensuring that you have the necessary documentation to support your financial activities and transactions. Whether you need to verify your tax status, income, or non-filing status, following the right steps can make the process seamless and efficient.

In this article, we have guided you through the process of obtaining an IRS confirmation letter. We started by emphasizing the importance of determining the specific type of letter you need, as different types serve different purposes. We then explored three methods of requesting a confirmation letter: online, by phone, and by mail.

Requesting a confirmation letter online provides convenience and speed, while making a phone call allows for a more interactive and personalized approach. Requesting a confirmation letter by mail is an alternative for individuals who prefer traditional methods or do not have access to technology.

We also highlighted the importance of verifying the accuracy and completeness of the received confirmation letter, as errors or discrepancies could have significant implications for your financial matters. By taking the time to review and ensure the integrity of the document, you can have confidence in using it for your intended purposes.

Now that you have a clear understanding of the steps involved in obtaining an IRS confirmation letter, you can navigate the process with ease and confidence. Remember to gather the necessary information, follow the instructions provided by the IRS, and maintain patience throughout the request process.

Having a valid and up-to-date IRS confirmation letter not only fulfills your financial obligations but also opens doors to various opportunities, whether it’s securing a loan, applying for a visa, or proving your income for government assistance. By staying informed and proactive, you can stay on top of your financial game and achieve your financial goals with confidence.