Home>Finance>Dividend Per Share (DPS) Definition And Formula

Finance

Dividend Per Share (DPS) Definition And Formula

Published: November 13, 2023

Learn the definition and formula for Dividend Per Share (DPS) in finance. Maximize your understanding of dividends and their impact on shareholder value.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Dividend Per Share (DPS): Definition and Formula

When it comes to investing in stocks, there are numerous concepts and metrics that investors need to familiarize themselves with. One such important metric is Dividend Per Share (DPS). In this blog post, we will dive deep into the definition and formula of DPS, and why it matters for investors in the world of finance.

Key Takeaways:

- Dividend Per Share (DPS) represents the total amount of dividends paid to shareholders for each outstanding share of a company’s stock.

- Investors can use DPS to assess a company’s dividend-paying capacity and make informed investment decisions.

What is Dividend Per Share (DPS)?

Picture this: you are an investor looking to invest in a particular company and you come across the term Dividend Per Share (DPS). What does it actually mean? Well, DPS is a financial ratio that is widely used to measure the amount of money a company distributes to its shareholders in the form of dividends.

Dividends are a portion of a company’s profits that are distributed to shareholders as a way to share the company’s success and provide a return on their investment. DPS, as the name suggests, indicates the amount of dividend paid for each outstanding share of the company’s stock. Essentially, it shows how much dividend income an investor can expect to receive for each share they hold.

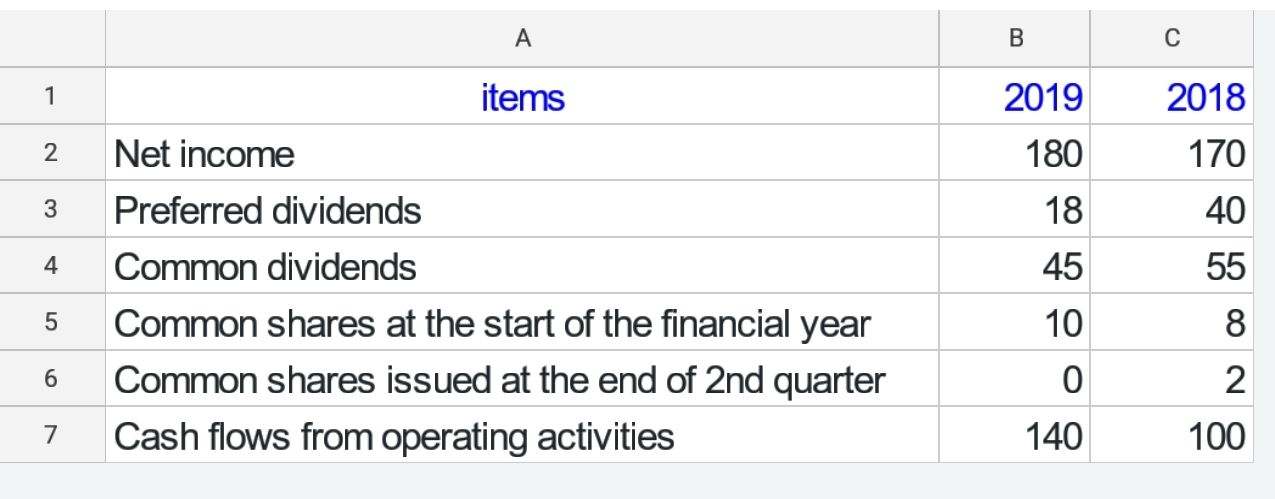

How is Dividend Per Share (DPS) Calculated?

The formula to calculate Dividend Per Share (DPS) is quite straightforward:

DPS = Dividends Paid / Number of Outstanding Shares

To determine the total amount of dividends paid, you can refer to a company’s financial statements or dividend announcements. The number of outstanding shares is usually found in the company’s financial statements or can be obtained from reliable financial data providers.

Why is Dividend Per Share (DPS) Important for Investors?

Now that we understand what DPS is and how it is calculated, let’s explore why it is important for investors in the world of finance. Here are a few key reasons:

- Assessing Dividend-Paying Capacity: DPS helps investors evaluate the capacity of a company to pay dividends consistently. By comparing the DPS over time, investors can gauge if the company’s dividend payments are stable, increasing, or decreasing. This information can be crucial for income-seeking investors who rely on dividends for regular cash flow.

- Making Informed Investment Decisions: DPS provides investors with insights into the company’s financial health and management’s commitment to returning value to shareholders. A consistent and growing DPS may indicate a well-performing company with a strong balance sheet and positive outlook, making it an attractive investment option.

In Conclusion

Dividend Per Share (DPS) is an important metric for investors interested in dividend-paying stocks. By understanding the definition and formula, investors can assess a company’s dividend-paying capacity and make informed investment decisions. Keeping track of DPS over time can provide valuable insights into a company’s financial health and its commitment to rewarding shareholders. Whether you are an income-seeking investor or looking for long-term growth, DPS can be a powerful tool to guide your investment strategy in the world of finance.