Finance

How To Get A Small Business Loan For Woman

Modified: December 30, 2023

Looking for financial support for your small business? Learn how to secure a loan specifically designed for women entrepreneurs in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to get a small business loan for women. Starting and running a business can be a challenging journey, and accessing the necessary funding is often a key concern for many women entrepreneurs. Fortunately, there are various options available specifically designed to support women-owned businesses.

Research has shown that women-led businesses face unique challenges when it comes to securing financing. They are often met with gender bias and may have limited access to networks and resources compared to their male counterparts. However, with the right knowledge and preparation, women can overcome these obstacles and find the funding they need to grow their businesses.

In this article, we will explore the steps and strategies involved in obtaining a small business loan for women. We’ll cover essential topics such as researching loan options, identifying the right type of loan, building your credit score, finding the right lender, and managing your loan repayments. By following these guidelines, you’ll be equipped with the information and confidence to navigate the loan application process and secure the funds necessary to take your business to the next level.

It’s important to note that while this guide is specifically focused on women entrepreneurs, the information provided is relevant and applicable to any small business owner in search of financing. So, whether you’re a woman running your own business or you’re looking to support women-led ventures, this guide is for you.

Now, let’s dive into the details and explore the world of small business loans for women.

Researching Small Business Loans for Women

Before diving into the loan application process, it’s important to thoroughly research the available options for small business loans tailored specifically for women. Understanding the landscape will help you identify opportunities and choose the best-fit loan for your business.

Start by exploring government-sponsored programs that focus on supporting women entrepreneurs. The Small Business Administration (SBA) is a great resource to begin your research. The SBA offers various loan programs, grants, and resources specifically designed to empower women-owned businesses.

In addition to government programs, there are also private lenders that specialize in providing small business loans for women. These lenders recognize the unique challenges faced by women entrepreneurs and offer loan products tailored to their needs.

When researching loan options, consider factors such as interest rates, loan amounts, repayment terms, and eligibility criteria. Read reviews and testimonials from other business owners who have utilized these loans to gain insights into the borrower experience and overall satisfaction.

Furthermore, networking and connecting with other women entrepreneurs can provide valuable guidance and recommendations. Attend conferences, join industry associations, and participate in women-focused business events to expand your network and learn from the experiences of others who have successfully obtained loans.

Remember, knowledge is power. The more information you gather about different loan programs, the better equipped you will be to make an informed decision about the best loan fit for your specific business needs.

Identifying the Right Type of Loan

Once you’ve conducted thorough research on available loan options, it’s time to identify the right type of loan for your business. Different loans serve different purposes and come with their own terms and conditions. Understanding the specific needs of your business and choosing the appropriate loan will greatly increase your chances of success in obtaining funding.

Here are some common types of loans to consider:

- Term Loans: Term loans are a popular choice for small businesses. They offer a lump sum of money that is repaid over a predetermined term, typically with fixed monthly payments. These loans are suitable for specific projects, expansion initiatives, or large equipment purchases.

- Business Line of Credit: A line of credit is a flexible loan option that allows you to borrow funds on an as-needed basis. You’ll only pay interest on the amount you withdraw, making it a cost-effective solution for managing cash flow fluctuations and short-term financing needs.

- Equipment Financing: If your business requires new equipment or machinery, an equipment financing loan can help. These loans are secured by the equipment itself, making them easier to obtain, even with limited credit history.

- SBA Loans: The U.S. Small Business Administration (SBA) offers various loan programs, including 7(a) loans and microloans, which are specifically designed to support small businesses. SBA loans typically have longer repayment terms and lower interest rates compared to traditional loans, making them an attractive option for women entrepreneurs.

- Grants and Competitions: While not strictly a loan, grants and business competitions can provide funding without the need for repayment. These opportunities may be available through government agencies, foundations, or private organizations. Research and apply for grants and competitions that cater to women-owned businesses.

Consider your business objectives, financial requirements, and repayment capabilities when choosing the right loan type. It’s also important to review the eligibility criteria and application process for each loan option to assess your chances of approval.

By selecting the right type of loan, you’ll maximize your chances of success in obtaining the necessary funding to fuel the growth and success of your women-owned business.

Preparing Your Business Plan

One crucial step in securing a small business loan for women is preparing a comprehensive business plan. A well-crafted business plan not only serves as a roadmap for your business but also demonstrates to lenders that you have a clear understanding of your company’s goals, market potential, and financial projections. Here are some key components to include in your business plan:

- Executive Summary: Provide a concise overview of your business, including its mission, vision, and the problem it solves.

- Company Description: Detail the nature of your business, its legal structure, industry analysis, target market, and competitive advantage.

- Product or Service Offering: Clearly explain your products or services, highlighting their unique features and benefits.

- Market Analysis: Conduct a thorough analysis of your target market, including customer demographics, market size, and trends. Identify your target audience and outline your marketing strategy.

- Management Team: Showcase the qualifications and experience of key individuals involved in your business, including your own expertise as the owner.

- Financial Projections: Present realistic financial forecasts, including sales projections, cash flow statements, and profit and loss statements. Include a breakdown of how the loan funds will be utilized.

- Collateral: If you have any assets that can serve as collateral, such as equipment, property, or inventory, include them in your business plan.

- Risk Analysis: Identify potential risks and challenges that may affect your business’s success and outline your risk management strategies.

It’s important to ensure your business plan is well-organized, concise, and professional in appearance. Consider seeking assistance from business advisors or consultants to strengthen your plan if needed.

Having a solid business plan not only helps you articulate your vision and strategy but also demonstrates to lenders that you are a serious and reliable borrower. It increases the likelihood of securing a small business loan for women and gives you a stronger foundation for future success.

Gathering the Necessary Documents

When applying for a small business loan, it’s important to gather and organize all the necessary documents to support your loan application. Lenders require specific documentation to verify your financial stability, business operations, and ability to repay the loan. Here are some essential documents you may need:

- Financial Statements: Prepare up-to-date financial statements, including balance sheets, income statements, and cash flow statements. These statements provide insights into your business’s financial performance and are essential for loan evaluation.

- Business Plan: Include a copy of your comprehensive business plan that outlines your business model, market analysis, and financial projections. This document demonstrates your preparedness and strategic vision.

- Bank Statements: Gather several months of business bank statements to provide evidence of your cash flow and financial stability. Lenders will review these statements to assess your ability to manage funds.

- Tax Returns: Prepare your personal and business tax returns for the past few years. This demonstrates your income history and tax compliance.

- Legal Documents: Include copies of legal documents such as business licenses, articles of incorporation, partnerships agreements, and any other relevant legal contracts. These documents validate the legitimacy and legal structure of your business.

- Personal Identification: Provide copies of your personal identification, such as a driver’s license or passport. This helps verify your identity as the business owner.

- Collateral Documentation: If you are offering any collateral to secure the loan, prepare documentation such as property deeds, titles, or appraisals to support its value.

- Loan Application Forms: Complete the lender’s loan application forms accurately and provide any additional information or documentation requested.

Ensure that all documents are up-to-date, organized, and easily accessible. It’s a good practice to create a digital and physical file to keep all the necessary paperwork in one place.

By gathering and providing the required documents promptly, you demonstrate your professionalism and preparedness as a borrower. This significantly improves your chances of getting approved for a small business loan for women.

Building Your Credit Score

Your credit score plays a crucial role in determining your eligibility for a small business loan. Lenders use your credit score to assess your creditworthiness and evaluate the level of risk associated with lending to you. Building and maintaining a strong credit score is essential for improving your chances of securing a loan at favorable terms. Here are some steps you can take to build and improve your credit score:

- Monitor Your Credit Report: Regularly review your credit report to ensure accuracy and identify any errors or discrepancies. You can request a free copy of your credit report from each of the major credit reporting agencies, such as Equifax, Experian, and TransUnion, once per year.

- Pay Bills on Time: Payment history is one of the most significant factors influencing your credit score. Make all your loan payments, credit card bills, and other obligations on time to establish a track record of responsible financial behavior.

- Keep Credit Utilization Low: Aim to keep your credit card balances and other revolving credit utilization low. High credit utilization ratios can negatively impact your credit score. Try to use no more than 30% of your available credit.

- Build a Credit History: If you have limited or no credit history, consider applying for a secured credit card or a credit-builder loan. These tools can help you establish a positive credit history by making regular payments and demonstrating responsible credit usage.

- Manage Debt Effectively: Minimize your debt load and work towards paying off outstanding balances. Lenders are more likely to view borrowers with manageable levels of debt as less risky.

- Limit New Credit Applications: Each time you apply for new credit, it results in a hard inquiry on your credit report, which can slightly lower your credit score. Only apply for credit when necessary and avoid excessive credit applications in a short period.

- Resolve Past Credit Issues: If you have any negative marks on your credit report, such as late payments or collections, work on resolving them. Consider reaching out to creditors or working with a credit counseling service to address any outstanding issues.

- Establish Positive Trade References: Non-traditional credit sources, such as suppliers or vendors, can provide trade references that demonstrate your reliability as a borrower. These references can further strengthen your creditworthiness.

Building a strong credit score takes time and effort, but it is a worthwhile investment in your financial future. By actively managing your credit and demonstrating responsible financial behavior, you will improve your chances of qualifying for a small business loan for women on favorable terms.

Finding the Right Lender

When it comes to securing a small business loan for women, finding the right lender is crucial. The right lender will not only offer competitive interest rates and favorable terms but also understand the unique challenges and needs of women-owned businesses. Here are some key factors to consider when searching for the right lender:

- Specialization in Women-Owned Businesses: Look for lenders who specifically cater to women-owned businesses. These lenders understand the dynamics and challenges faced by women entrepreneurs and may offer specialized loan products, resources, and support.

- Loan Programs and Options: Research and assess the various loan programs and options offered by different lenders. Compare interest rates, repayment terms, loan amounts, and eligibility criteria to find the best fit for your business needs.

- Reputation and Track Record: Consider the reputation and track record of potential lenders. Read customer reviews and testimonials to gain insights into the borrower experience and the lender’s commitment to customer satisfaction.

- Customer Support and Communication: Evaluate the level of customer support and communication offered by the lender. A responsive and transparent lender will be able to address your concerns, answer your questions promptly, and guide you through the loan application process.

- Flexibility and Customization: Seek out lenders who offer flexibility and customization options. A lender who understands your unique business needs and can tailor loan terms to fit your specific circumstances will be an invaluable partner in your business journey.

- Collateral Requirements: Consider the collateral requirements of different lenders. Some lenders may require collateral to secure the loan, while others may offer unsecured loan options. Evaluate which option aligns with your business’s assets and risk tolerance.

- Application Process: Assess the ease and convenience of the lender’s loan application process. Are applications submitted online? Is the documentation process streamlined? Choosing a lender with a user-friendly and efficient application process can save you time and frustration.

- Referral and Networking: Seek recommendations and referrals from other business owners, industry associations, and networking groups. Real-life experiences and word-of-mouth recommendations can provide valuable insights into reputable lenders.

Take the time to research and compare multiple lenders to find the one that best suits your needs. Remember to consider not only the financial aspects but also the lender’s understanding and support for women-owned businesses. Selecting the right lender is a crucial step on your path to securing a small business loan for women.

Applying for the Loan

Once you have researched and identified the right lender for your small business loan, it’s time to start the application process. Applying for a loan can be a comprehensive and detailed process, but with careful preparation, you can increase your chances of a successful application. Here are the key steps to follow:

- Review the Requirements: Read and understand the lender’s requirements for the loan application. Pay attention to eligibility criteria, minimum credit score, required documentation, and any specific conditions outlined by the lender.

- Prepare the Required Documentation: Gather all the necessary documentation, as outlined by the lender. This may include financial statements, business plans, bank statements, tax returns, and any other supporting documents required to assess your loan application.

- Complete the Application Form: Fill out the lender’s loan application form accurately and provide all the required details. Clearly explain the purpose of the loan, the amount you are requesting, and how the funds will be used to support your business.

- Attach Supporting Documents: Include all the relevant supporting documents as requested by the lender. Ensure they are well-organized, legible, and easily accessible for review.

- Double-Check the Application: Take the time to review your loan application form and attached documents for accuracy and completeness. Mistakes or missing information can delay the loan approval process.

- Submit the Application: Once you have thoroughly reviewed your application, submit it to the lender according to their designated submission process. This may involve online submission, mailing physical documents, or visiting a local branch.

- Follow Up: After submitting your loan application, be proactive in following up with the lender. Stay engaged and responsive to any additional requests for information or documentation they may have.

- Patience and Communication: Understand that the loan approval process may take time. Be patient and maintain regular communication with the lender to stay informed of the status of your application.

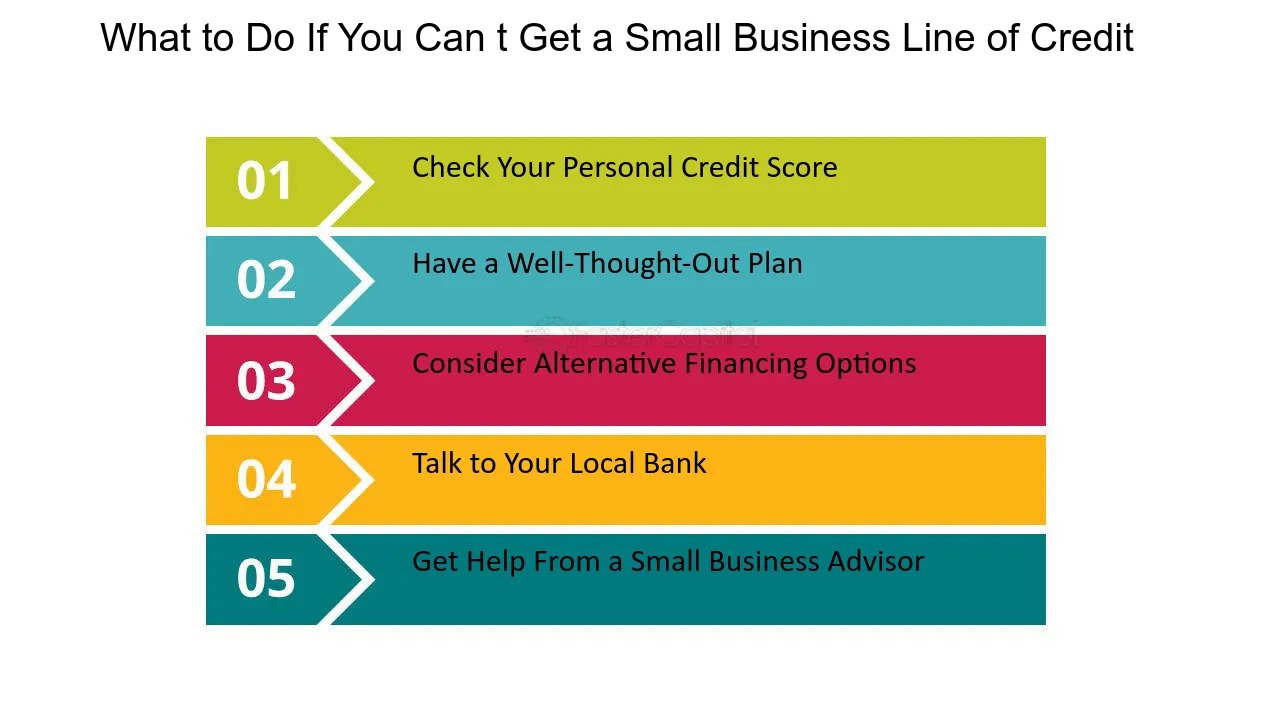

- Consider Alternatives: While waiting for your loan application to be processed, continue exploring alternative funding options, such as grants, competitions, or partnerships. It’s essential to have backups in case your loan application is not approved.

Remember that each lender may have slightly different requirements and processes, so it’s important to carefully review their instructions and follow them accordingly. By being well-prepared and organized, you can increase your chances of a successful loan application and secure the necessary funding for your business.

Managing Your Loan Repayments

Once you have been approved for a small business loan, it’s important to develop a plan to manage your loan repayments effectively. Proper loan repayment management ensures that you stay on track with your financial obligations and maintain a positive relationship with your lender. Here are some tips for managing your loan repayments:

- Create a Repayment Schedule: Develop a repayment schedule that includes the amount, frequency, and due date of each payment. Stick to this schedule to ensure timely payments and avoid any penalties or late fees.

- Set Up Automatic Payments: Consider setting up automatic payments from your business bank account. This ensures that your loan repayments are made on time without the risk of forgetting or missing a payment.

- Track Your Expenses and Cash Flow: Keep a close eye on your business’s expenses and cash flow to ensure that you have enough funds available to cover your loan repayments. Proper cash flow management helps prevent any financial strain or missed payments.

- Prioritize Loan Repayments: Make loan repayments a top priority in your business’s financial hierarchy. Allocate funds accordingly to ensure that loan payments are made before other discretionary expenses.

- Communicate with Your Lender: Establish clear and open communication with your lender. If you encounter any financial challenges or anticipate difficulty in making a payment, contact your lender proactively. They may be able to provide assistance or offer alternative solutions to help you manage your repayments.

- Budget for Repayments: Incorporate loan repayments into your overall business budget. Consider the repayment amount as a fixed cost and factor it into your revenue projections and expense planning.

- Monitor Your Credit Score: Regularly check your credit score to ensure that your loan repayments are being reported accurately and positively impact your credit history. This is especially important if you plan to apply for future loans or lines of credit.

- Repaying Early: If your business experiences a boost in revenue or receives unexpected funds, consider repaying the loan ahead of schedule. Early repayments can save you money on interest and improve your relationship with the lender.

- Stay Organized: Keep all loan-related documents and payment records organized. This allows for easy reference and provides documentation in case of any disputes or discrepancies.

Remember, managing your loan repayments responsibly contributes to your business’s financial health and credibility. By making timely payments and maintaining a good relationship with your lender, you build a solid foundation for future borrowing opportunities and ensure the long-term success of your business.

Conclusion

Obtaining a small business loan for women is an important step towards fueling the growth and success of your business. While the process may seem daunting, with thorough research, careful preparation, and strategic execution, you can secure the necessary funding to achieve your entrepreneurial goals.

In this comprehensive guide, we have covered the essential steps involved in obtaining a small business loan for women. We explored the importance of researching loan options specific to women entrepreneurs, identifying the right type of loan for your business, preparing a solid business plan, gathering the necessary documents, building your credit score, finding the right lender, applying for the loan, and managing your loan repayments.

Remember, the key to success lies in thorough preparation and attention to detail. Take the time to research and identify lenders who specialize in supporting women-owned businesses. Craft a compelling business plan that showcases your vision and potential. Build a solid credit score through responsible financial management. And communicate openly with your lender throughout the loan application process.

While securing a loan is a significant milestone, it’s important to remember that responsible repayment is equally crucial. Develop a repayment plan, prioritize loan repayments, and stay on top of your financial obligations to maintain a positive relationship with your lender and safeguard the financial health of your business.

By following the guidelines and strategies outlined in this guide, you are well-equipped to navigate the process of obtaining a small business loan for women. Stay persistent, stay focused, and stay confident in your abilities as a business owner. With the right funding, dedication, and determination, there is no limit to what you can achieve.