Finance

How To Get An IRS Transcript For College

Published: October 30, 2023

Learn how to obtain an IRS transcript for college financial aid and scholarships. Get expert advice on finance and maximize your funding potential.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding IRS Transcripts

- Benefits of Obtaining an IRS Transcript for College

- Different Types of IRS Transcripts

- Step-by-Step Guide to Obtaining an IRS Transcript for College

- Option 1: Requesting an IRS Transcript Online

- Option 2: Requesting an IRS Transcript by Mail

- Option 3: Requesting an IRS Transcript by Phone

- Important Tips and Considerations

- Frequently Asked Questions

- Conclusion

Introduction

Welcome to our comprehensive guide on how to get an IRS transcript for college. If you’re a student or a parent preparing for the college application process, you may have encountered the need to provide financial documentation, such as tax records, to qualify for financial aid or scholarships. The Internal Revenue Service (IRS) transcript is a valuable resource that provides an overview of your tax return information.

But what exactly is an IRS transcript? Think of it as a summary of your tax return. It includes information like your adjusted gross income, tax liability, and deductions. It’s an official document issued by the IRS and can be used as a substitute for a copy of your tax return when applying for financial aid or scholarships.

Obtaining an IRS transcript is essential for demonstrating your financial eligibility for various college programs and funding options. It provides a snapshot of your financial situation and helps colleges and universities assess your need for financial assistance. In this guide, we’ll walk you through the process of obtaining an IRS transcript, providing you with step-by-step instructions and important tips to make the process as smooth as possible.

While the IRS transcript is primarily used for college-related purposes, it can also be beneficial in other scenarios. For example, if you’re applying for a mortgage or a loan, lenders may request an IRS transcript to verify your income. Additionally, if you’re applying for certain government assistance programs or need to resolve tax-related issues, having your IRS transcript readily available can be advantageous.

Now that we understand the importance of an IRS transcript for college and beyond, let’s dive into the different types of transcripts available and explore the step-by-step process of obtaining one.

Understanding IRS Transcripts

Before we delve into the process of obtaining an IRS transcript, it’s important to have a clear understanding of what exactly an IRS transcript is and how it differs from a tax return.

An IRS transcript is a document that provides a summary of your tax return information. It contains information such as your adjusted gross income, taxable income, tax liability, and any payments or credits applied. Essentially, it’s a snapshot of the key details from your tax return.

There are different types of IRS transcripts available, each serving a specific purpose:

- Tax Return Transcript: This transcript shows most line items from your original tax return, including any accompanying forms and schedules. It’s commonly used for financial aid verification purposes or when applying for a mortgage or loan.

- Account Transcript: An account transcript provides a comprehensive overview of your tax account, including any adjustments or changes made after the initial return was filed. It’s useful if you’re trying to track any updates or revisions to your tax information.

- Wage and Income Transcript: This transcript shows data from information returns received by the IRS, such as W-2s, 1099s, and 1098s. It’s useful if you need to provide proof of income for a specific tax year.

- Record of Account Transcript: Similar to the account transcript, the record of account transcript provides a detailed history of your tax account, including changes and updates over time.

It’s important to note that IRS transcripts are not a copy of your tax return. They don’t include any attached schedules, forms, or worksheets. The transcript provides a concise summary of the key information from your tax return, making it easier for institutions like colleges, lenders, and government agencies to review your financial information without needing a full copy of your return.

Now that we have a clear understanding of what an IRS transcript is and the different types available, let’s explore the benefits of obtaining an IRS transcript for college preparation and financial aid purposes.

Benefits of Obtaining an IRS Transcript for College

Obtaining an IRS transcript for college can provide numerous benefits for students and parents alike. Let’s take a closer look at the advantages of having an IRS transcript ready for the college application process:

- Verification of Financial Information: Colleges and universities often require documentation to verify a student’s financial information, especially when applying for financial aid. An IRS transcript serves as an official document that provides a summary of your tax return information, making it easier for colleges to verify your financial eligibility.

- Streamlined Financial Aid Process: By providing an IRS transcript, you can accelerate the financial aid application process. Instead of relying solely on copies of your tax returns, which can be time-consuming to gather and submit, the transcript condenses the necessary information into a single document, simplifying the verification process for both you and the financial aid office.

- Documentation of Income: An IRS transcript is an effective way to document your income for a specific tax year. It provides an official record of your adjusted gross income, which may be required when applying for scholarships, grants, or other forms of financial assistance.

- Proof of Non-Filing: If you didn’t file a tax return for a specific year, obtaining an IRS transcript can serve as proof of non-filing. This may be necessary to demonstrate your tax status when applying for financial aid or loans.

- Accurate and Reliable Information: IRS transcripts provide information directly from your tax returns, ensuring the accuracy and reliability of the data. This can help colleges and universities make fair and informed decisions regarding your financial aid eligibility.

It’s important to keep in mind that the benefits of obtaining an IRS transcript extend beyond the college application process. Having an IRS transcript readily available can also be beneficial when applying for other forms of financial assistance, such as loans or government programs.

Now that we understand the advantages of obtaining an IRS transcript for college, let’s explore the different types of IRS transcripts and the step-by-step process for obtaining them.

Different Types of IRS Transcripts

When it comes to obtaining an IRS transcript, it’s important to be aware of the different types available. Each type serves a specific purpose and provides different information. Let’s explore the various types of IRS transcripts:

- Tax Return Transcript: This type of transcript provides most line items from your original tax return, including any accompanying forms and schedules. It is commonly used for financial aid verification purposes or when applying for a mortgage or loan. The tax return transcript provides a summary of your income, deductions, credits, and tax liability for a specific tax year.

- Account Transcript: An account transcript provides a comprehensive overview of your tax account, including any adjustments or changes made after the initial return was filed. It includes information on any additional taxes assessed, credits applied, or payments made. The account transcript is useful if you’re tracking updates or revisions to your tax information.

- Wage and Income Transcript: This transcript shows data from information returns received by the IRS, such as W-2s, 1099s, and 1098s. It provides a record of your reported income from different sources and can be used as proof of income for a specific tax year. The wage and income transcript is particularly useful if you need to provide documentation of your income when applying for financial aid.

- Record of Account Transcript: Similar to the account transcript, the record of account transcript provides a detailed history of your tax account, including changes and updates over time. It summarizes the transactions and activities associated with your tax account, enabling you to review the progression of your tax information.

By understanding the different types of IRS transcripts, you can determine which specific transcript will best serve your needs when applying for college or other financial assistance programs. Each type of transcript provides a different level of detail and information, so it’s important to choose the one that aligns with the requirements of the institution or program you’re applying to.

Now that we are familiar with the types of IRS transcripts available, let’s move on to the step-by-step process of obtaining an IRS transcript for college.

Step-by-Step Guide to Obtaining an IRS Transcript for College

Obtaining an IRS transcript for college may seem daunting, but with the right knowledge and guidance, the process can be straightforward. Here is a step-by-step guide to help you obtain an IRS transcript:

- Step 1: Determine the Type of Transcript Needed: Identify the specific type of IRS transcript required by the college, scholarship program, or financial aid office. The most common types are tax return transcript, account transcript, wage and income transcript, and record of account transcript.

- Step 2: Choose the Method of Request: Decide how you want to request the transcript. The IRS offers three options: online, mail, or phone. Each option has its own advantages and considerations, so choose the one that best suits your preferences and circumstances.

- Step 3: Online Request: If you choose to request the transcript online, visit the IRS website and navigate to the “Get Transcript” page. Follow the instructions to create an account or sign in. Provide the necessary personal and tax-related information to authenticate your request. Once authenticated, you can view and download the transcript immediately.

- Step 4: Mail Request: To request an IRS transcript by mail, you’ll need to complete Form 4506-T, Request for Transcript of Tax Return. You can find this form on the IRS website or at your local IRS office. Fill out the form with the required personal and tax-related information, and select the appropriate transcript type. Once completed, mail the form to the address specified on the form. It may take several weeks to receive the transcript by mail.

- Step 5: Phone Request: If you prefer to request the transcript by phone, call the IRS Transcript Department at the phone number provided on the IRS website. Follow the prompts to provide your personal and tax-related information. Specify the type of transcript needed and verify your identity. The transcript will be mailed to the address on file within a few weeks.

- Step 6: Review and Verify: Once you receive the IRS transcript, carefully review the information to ensure its accuracy. If you notice any discrepancies or errors, contact the IRS to address the issue promptly.

Remember to keep copies of your IRS transcripts for your records. You may need them for future reference or when applying for other financial aid programs or loans.

Now that you know the step-by-step process of obtaining an IRS transcript, let’s explore the different options for requesting transcripts in more detail.

Option 1: Requesting an IRS Transcript Online

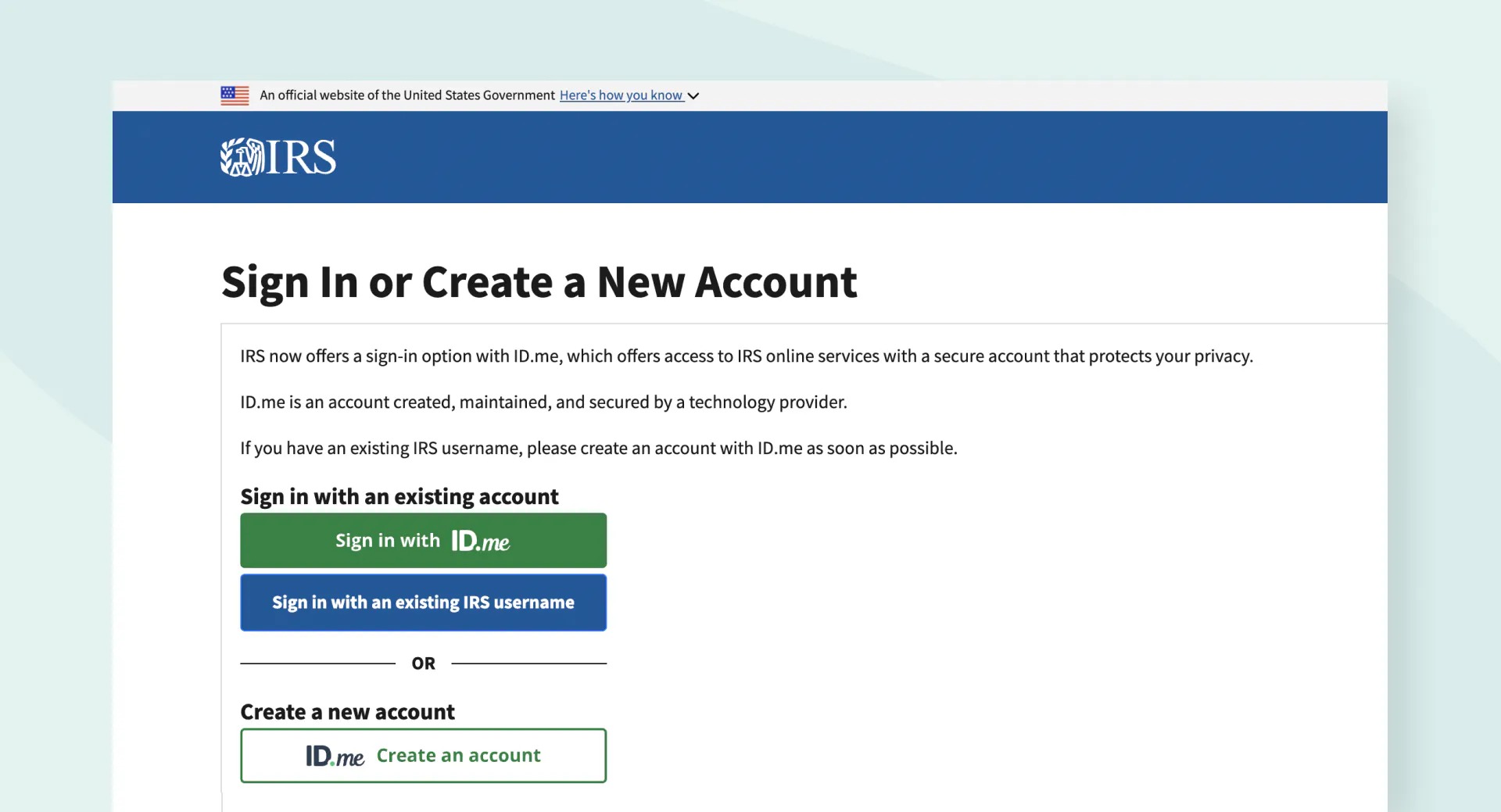

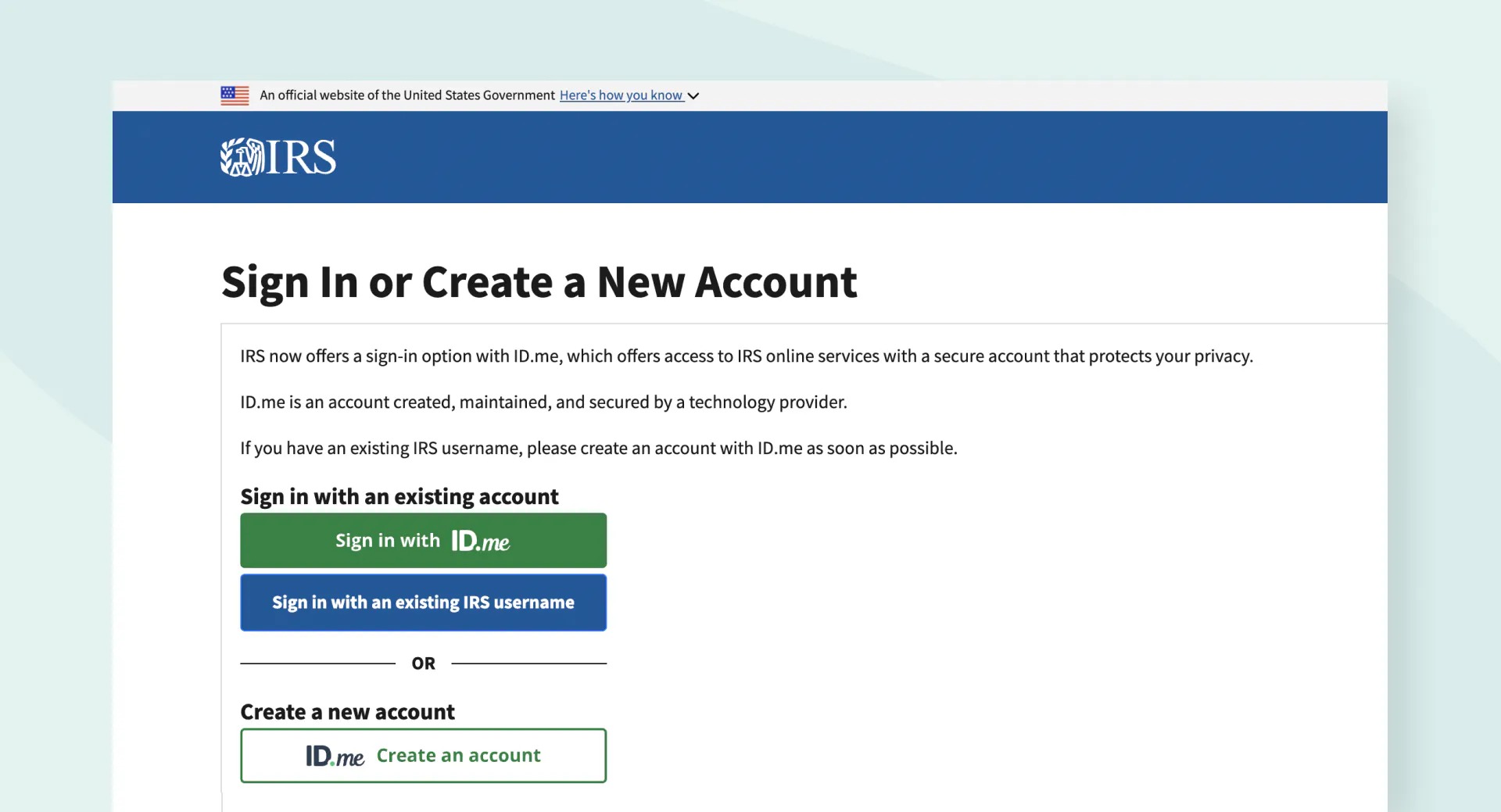

Requesting an IRS transcript online is a convenient and efficient option. It allows you to access and download your transcript immediately, saving time and effort. Here’s a detailed breakdown of the steps for requesting an IRS transcript online:

- Step 1: Visit the IRS Website: Start by visiting the official website of the Internal Revenue Service (IRS). Navigate to the “Get Transcript” page, which can be found under the “Tools” section.

- Step 2: Create an Account or Sign In: If you don’t already have an account, you’ll need to create one. Provide the necessary personal information, including your Social Security Number, date of birth, and a valid email address. Create a username and password to set up your account. If you already have an account, simply sign in using your credentials.

- Step 3: Authenticate Your Identity: To ensure the security of your information, the IRS will ask for additional verification. This may include providing personal and financial information from your tax return, such as your filing status and the amount of your refund or tax owed.

- Step 4: Select the Transcript Type: Once your identity is verified, you’ll be prompted to choose the type of transcript you need. You can select from options such as tax return transcript, account transcript, wage and income transcript, or record of account transcript. Choose the appropriate type based on the requirements of the college or financial aid office.

- Step 5: View and Download the Transcript: After selecting the transcript type, the IRS website will display the requested transcript on your screen. You can view, print, or download it as a PDF file. Make sure to save a copy for your records.

Requesting an IRS transcript online offers several advantages. It provides instant access to your transcript, eliminates the need for mailing or waiting for a response, and reduces the risk of documents getting lost in transit. However, it’s important to ensure the security of your personal information by using a secure internet connection and protecting your login credentials.

Now that you’re familiar with the online request process, let’s explore another option for obtaining an IRS transcript: requesting it by mail.

Option 2: Requesting an IRS Transcript by Mail

If you prefer to request an IRS transcript by mail, you can do so by following a few simple steps. This option is ideal if you don’t have immediate access to the internet or if you prefer to have a physical copy of your transcript. Here’s a step-by-step guide to requesting an IRS transcript by mail:

- Step 1: Obtain Form 4506-T: Start by obtaining Form 4506-T, which is the Request for Transcript of Tax Return. You can download the form from the IRS website or visit your local IRS office to obtain a printed copy.

- Step 2: Fill out Form 4506-T: Carefully fill out the form by providing the required personal and tax-related information. This includes your name, address, Social Security Number, and the tax year(s) for which you need the transcript. Make sure to select the appropriate transcript type based on your needs.

- Step 3: Specify the Mailing Address: On the form, indicate the address where you want the transcript to be mailed. Ensure that the address is accurate and up-to-date to avoid any delivery issues.

- Step 4: Sign and Date the Form: Sign and date the completed Form 4506-T. Incomplete or unsigned forms may cause delays in processing your request.

- Step 5: Mail the Form: Once you have filled out and signed the form, mail it to the address specified on the form. The IRS provides different mailing addresses based on the state you live in. Refer to the instructions on the form or the IRS website to find the correct mailing address for your location.

- Step 6: Wait for Processing: After mailing the form, it may take several weeks to receive your transcript. Processing times can vary, so it’s important to submit your request well in advance and plan accordingly.

Requesting an IRS transcript by mail is a reliable option that allows you to have a hard copy of your transcript for your records. It’s important to ensure that you fill out the form correctly and provide all the necessary information to avoid any processing delays.

Now that you’re familiar with the process of requesting an IRS transcript by mail, let’s move on to another option: requesting it by phone.

Option 3: Requesting an IRS Transcript by Phone

If you prefer a more direct interaction, requesting an IRS transcript by phone is a convenient option. This method allows you to speak with an IRS representative who can process your request over the phone. Here’s a step-by-step guide to requesting an IRS transcript by phone:

- Step 1: Gather the Necessary Information: Before making the call, gather the information you’ll need to provide to the IRS representative. This includes your Social Security Number, date of birth, and the tax year(s) for which you need the transcript. Prepare any additional identification or verification documents that may be required.

- Step 2: Dial the IRS Transcript Department: Call the dedicated phone number for the IRS Transcript Department. The number can be found on the IRS website or by contacting the IRS directly. Be prepared for potential wait times, as IRS phone lines can be busy during peak times.

- Step 3: Follow the Phone Prompts and Provide Information: Once connected, listen carefully to the phone prompts and select the option to request an IRS transcript. Follow the instructions provided and provide the requested personal and tax-related information to authenticate your identity.

- Step 4: Specify the Transcript Type: During the call, clearly indicate the type of transcript you need, such as a tax return transcript, account transcript, wage and income transcript, or record of account transcript. Ensure that you communicate your requirements accurately to the IRS representative.

- Step 5: Verify Your Identity: As part of the request process, the IRS representative may ask you to verify your identity by providing additional information or answering specific questions related to your tax return. Cooperate and provide the requested details to complete the verification process successfully.

- Step 6: Confirm the Mailing Address: If the IRS representative confirms that your transcript will be sent by mail, verify that the mailing address they have on file is correct. If needed, provide them with an updated address to ensure the transcript reaches the right destination.

Requesting an IRS transcript by phone offers the advantage of direct communication and immediate assistance. However, it’s important to be prepared with the necessary information and mindful of potential wait times. Remain patient and provide accurate information to ensure a smooth request process.

Now that you’re familiar with the three options for requesting an IRS transcript – online, by mail, and by phone – let’s move on to some important tips and considerations to keep in mind during the process.

Important Tips and Considerations

Obtaining an IRS transcript for college requires attention to detail and adherence to certain guidelines. Here are some important tips and considerations to keep in mind during the process:

- Plan Ahead: Request your IRS transcript well in advance of any college or financial aid deadlines. Processing times can vary, so giving yourself ample time will help avoid any last-minute complications.

- Choose the Right Type: Be sure to select the correct type of IRS transcript based on the requirements of the college or institution you’re applying to. Different situations may call for different types of transcripts, so review the instructions carefully.

- Double-Check Your Information: Whether requesting online, by mail, or by phone, ensure that you provide accurate and up-to-date personal and tax-related information. Any errors or discrepancies can lead to delays or complications in obtaining your transcript.

- Keep Copies: Make copies of your IRS transcript for your records. This can come in handy when applying for other financial aid programs, scholarships, or loans in the future. Having a backup can save you time and effort down the line.

- Protect Your Personal Information: When requesting an IRS transcript online or by phone, ensure that you are using a secure connection and providing your information to legitimate sources. Be wary of fraudulent websites or scams that may try to collect your personal data.

- Check for Accuracy: Once you receive your IRS transcript, review it carefully to ensure that all the information is accurate. If you notice any errors or inconsistencies, contact the IRS for assistance in rectifying the issue.

- Keep a Record of Communication: If you need to interact with the IRS during the transcript request process, keep a record of any phone conversations or correspondence. This can be helpful in case of any future inquiries or disputes.

Following these tips and considerations will help ensure a smooth and successful experience when obtaining an IRS transcript for college. Remember to stay organized, be proactive, and seek assistance from the IRS or college financial aid office if you have any concerns or questions along the way.

Now that we’ve covered the important tips, let’s move on to addressing some frequently asked questions about obtaining an IRS transcript for college.

Frequently Asked Questions

Q: Can I request an IRS transcript for a specific tax year?

Yes, you can request an IRS transcript for a specific tax year. Whether you need it for college, applying for a loan, or other purposes, you can specify the tax year(s) for which you require the transcript when making your request.

Q: How long does it take to receive an IRS transcript?

The processing time for an IRS transcript can vary. If you request it online, you can typically access and download it immediately. However, if you choose to request it by mail, it may take several weeks to receive the transcript. It is advisable to submit your request well in advance to allow enough time for processing and potential delays.

Q: Can I request an IRS transcript for someone else?

In most cases, you can only request an IRS transcript for yourself or for your dependent(s) if you have legal authority to do so. If you need to request a transcript on behalf of someone else, such as a parent or guardian, they may need to complete and sign Form 4506-T or authorize you as their representative through a Power of Attorney.

Q: Are there any fees associated with obtaining an IRS transcript?

No, obtaining an IRS transcript is free of charge. Whether you request it online, by mail, or by phone, there is no cost involved. However, fees may apply for other IRS services, such as obtaining copies of past tax returns or certain specialized reports.

Q: Can I use an IRS transcript to file my taxes?

No, an IRS transcript is not meant to be used as a tax return or a substitute for filing your taxes. It is a summary of the information from your tax return. When it’s time to file your taxes, you will still need to prepare your tax return or use tax preparation software to accurately report your income, deductions, credits, and any taxes owed or refunds due.

Q: How long should I keep my IRS transcript?

It is recommended to keep a copy of your IRS transcript for as long as necessary. Ideally, you should retain it for at least three years following the date you filed your original tax return. Having a record of your IRS transcript can be beneficial for future reference, financial aid applications, loan applications, or in case of any tax-related inquiries or audits.

These are some of the most commonly asked questions regarding obtaining an IRS transcript for college. If you have further questions or concerns, it is advisable to reach out to the IRS or consult with a tax professional for guidance tailored to your specific situation.

Now, let’s wrap up this comprehensive guide on getting an IRS transcript for college.

Conclusion

Obtaining an IRS transcript for college is an important step in the financial aid process. It provides colleges, universities, and other relevant institutions with a summary of your tax return information, helping assess your financial eligibility for various programs and funding options. Whether you’re a student or a parent, having an IRS transcript readily available is crucial for demonstrating your financial situation.

In this comprehensive guide, we explored the different types of IRS transcripts available, including the tax return transcript, account transcript, wage and income transcript, and record of account transcript. Each type serves a specific purpose and provides different information.

We also covered the step-by-step process for obtaining an IRS transcript for college, including requesting it online, by mail, or by phone. Depending on your preference and circumstances, you can choose the method that best suits your needs.

Throughout the guide, we provided important tips and considerations to ensure a smooth and successful transcript request process. Planning ahead, double-checking your information, protecting your personal data, and keeping copies of your transcript are essential practices to follow.

Finally, we addressed common questions about obtaining an IRS transcript for college, providing clarity on topics such as specific tax years, processing times, fees, and the purpose of an IRS transcript.

Remember, the IRS transcript is a valuable resource for the college application process and beyond. It provides an official summary of your tax return information, helps verify your financial eligibility, and can be used as documentation of your income. By understanding the process and using the information provided in this guide, you can navigate the IRS transcript request process with confidence and ease.

Now that you have a comprehensive understanding of how to obtain an IRS transcript for college, you can proceed with confidence, knowing that you are well-equipped to provide the necessary financial documentation for your educational journey.