Finance

How To Get A CAF Number From The IRS

Published: October 31, 2023

Learn how to obtain a CAF number from the IRS and manage your finances effectively. Get step-by-step guidance and expert tips today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers and paperwork play a vital role. If you are familiar with the intricacies of the financial world, you might have come across the term CAF number. But what exactly is a CAF number, and why do you need it?

A CAF number, also known as a Centralized Authorization File number, is a unique identifier assigned by the Internal Revenue Service (IRS) to tax professionals, third-party designees, and organizations. It serves as a means of authorization and allows them to represent taxpayers before the IRS.

Obtaining a CAF number can be a crucial step for tax professionals who regularly interact with the IRS on behalf of their clients. Whether you are a certified public accountant (CPA), an enrolled agent (EA), or a tax attorney, having a CAF number is essential for effectively navigating the complex world of tax regulations.

In this article, we will delve into the process of obtaining a CAF number from the IRS. We will discuss the importance of having a CAF number and guide you through the steps required to obtain one. So, let’s get started and unravel the mystery behind the CAF number.

What is a CAF Number?

A CAF number, short for Centralized Authorization File number, is a unique identifier issued by the Internal Revenue Service (IRS). It is assigned to tax professionals, third-party designees, and organizations that represent taxpayers before the IRS. Think of it as a key that grants access to confidential taxpayer information and allows authorized individuals to communicate with the IRS on their behalf.

When you have a CAF number, it means you have the authority to act as a representative for taxpayers and handle various IRS-related matters. This includes filing tax returns, addressing tax issues, requesting information, and resolving disputes. It streamlines the process by granting authorized individuals the ability to speak on behalf of their clients directly to the IRS.

As a tax professional, having a CAF number is crucial for maintaining a smooth and efficient workflow. It allows you to navigate the intricacies of the tax system and advocate for your clients’ best interests. With a CAF number, you can effectively communicate with the IRS and ensure accurate and timely resolution of tax matters.

It’s important to note that individuals cannot obtain a CAF number for personal use. It is specifically designed for tax professionals and authorized organizations who provide tax services to clients. So, if you are an individual taxpayer, you don’t need a CAF number. Instead, you can directly communicate and interact with the IRS on your own behalf.

Now that we have a clear understanding of what a CAF number is, let’s explore why it is important to have one in the world of tax representation and how it benefits both tax professionals and their clients.

Why Do You Need a CAF Number?

Obtaining a CAF number is essential for tax professionals, third-party designees, and organizations who regularly represent taxpayers before the IRS. Here are some key reasons why having a CAF number is important:

1. Representing Clients

A CAF number allows tax professionals to act as representatives for their clients in front of the IRS. This means they can communicate on behalf of their clients, file tax returns, resolve tax issues, and provide necessary documentation to the IRS. It streamlines the process and enables a seamless flow of information between the tax professional and the IRS.

2. Accessing Confidential Information

As a tax professional with a CAF number, you have access to confidential taxpayer information. This includes tax returns, payment history, communication records with the IRS, and other sensitive data. Having this access is crucial for understanding your clients’ financial situations and effectively resolving any tax-related matters that may arise.

3. Enhancing Professionalism and Expertise

Obtaining a CAF number showcases your professionalism and expertise in the field of tax representation. It demonstrates your commitment to serving your clients’ best interests and your ability to navigate the complexities of the IRS. It gives your clients confidence that their tax matters are in capable hands.

4. Streamlining Communication with the IRS

Having a CAF number allows for direct communication with the IRS. This eliminates the need for your clients to be involved in every interaction with the IRS. It saves time, reduces administrative burdens, and ensures efficient resolution of tax issues.

5. Building Trust with Clients

A CAF number is a testament to your professionalism and credibility as a tax professional. It provides reassurance to your clients that you have the necessary authorization to represent them accurately and effectively. It helps build trust and fosters a strong client-professional relationship.

In summary, obtaining a CAF number is crucial for tax professionals and authorized organizations. It enables them to represent clients before the IRS, access confidential information, streamline communication, enhance professionalism, and build trust with clients. Now that we understand the importance of a CAF number, let’s dive into the steps involved in obtaining one from the IRS.

Steps to Get a CAF Number

Obtaining a CAF number from the IRS is a relatively straightforward process. Here are the steps you need to follow:

1. Gather Required Documents

Before you can apply for a CAF number, make sure you have all the necessary documents on hand. This typically includes your personal identification information, such as your Social Security number or Employer Identification Number (EIN), proof of your professional designation (CPA, EA, tax attorney), and any additional supporting documentation required by the IRS.

2. Complete Form 2848

The next step is to complete Form 2848, also known as the Power of Attorney and Declaration of Representative form. This form is used to authorize you as a representative and grant you the ability to act on behalf of your clients. You will need to provide your personal information, your client’s information, and specify the type of tax matters you will be handling.

3. Submit Form 2848 to the IRS

Once you have completed Form 2848, you can submit it to the IRS. You can either mail the form to the appropriate IRS office or fax it, depending on the instructions provided by the IRS for submitting the form. It is recommended to retain a copy of the submitted form for your records.

4. Waiting for Approval

After you have submitted Form 2848, you will need to wait for the IRS to process your application and approve your request for a CAF number. The processing time can vary, so it is important to be patient. You can check the status of your application by contacting the IRS directly or using the online tools provided by the IRS.

5. Receive Your CAF Number

Once your application is approved, the IRS will assign you a unique CAF number, which will be sent to you via mail or through electronic means. This number will serve as your authorization to represent clients before the IRS.

It’s important to note that your CAF number is valid indefinitely, as long as you remain an authorized representative with the IRS. However, you should notify the IRS if there are any changes to your personal or professional information to ensure the accuracy of your records.

Now that you know the steps involved in obtaining a CAF number, you can begin the process and start representing clients before the IRS. Having a CAF number will open up doors for you as a tax professional and enable you to provide exceptional tax representation to your clients.

Gather Required Documents

Before you can apply for a CAF number, it’s important to gather all the required documents. By ensuring you have everything in order beforehand, you can streamline the application process and avoid any delays. Here are the key documents you will need:

1. Personal Identification

You will need to provide personal identification information such as your full name, address, and Social Security number (SSN). If you are representing an organization, you will need to provide the organization’s Employer Identification Number (EIN).

2. Professional Designation

In order to obtain a CAF number, you must have the appropriate professional designation. This includes being a certified public accountant (CPA), an enrolled agent (EA), or a tax attorney. You may need to provide proof of your professional certification or license.

3. Supporting Documentation

Depending on your specific situation, there may be additional supporting documentation required by the IRS. This can include documentation related to any special circumstances or areas of expertise you may have, such as certifications in specific tax areas (e.g., estate planning, international tax). Review the IRS guidelines and instructions to determine if any additional documents are needed.

It is important to note that the IRS may request additional documentation or clarification during the application process. Make sure to keep copies of all submitted documents for your records.

Once you have gathered all the necessary documents, you can move forward with completing Form 2848 and submitting your application for a CAF number. Taking the time to gather the required documents upfront will help ensure a smooth and efficient application process, allowing you to obtain your CAF number in a timely manner.

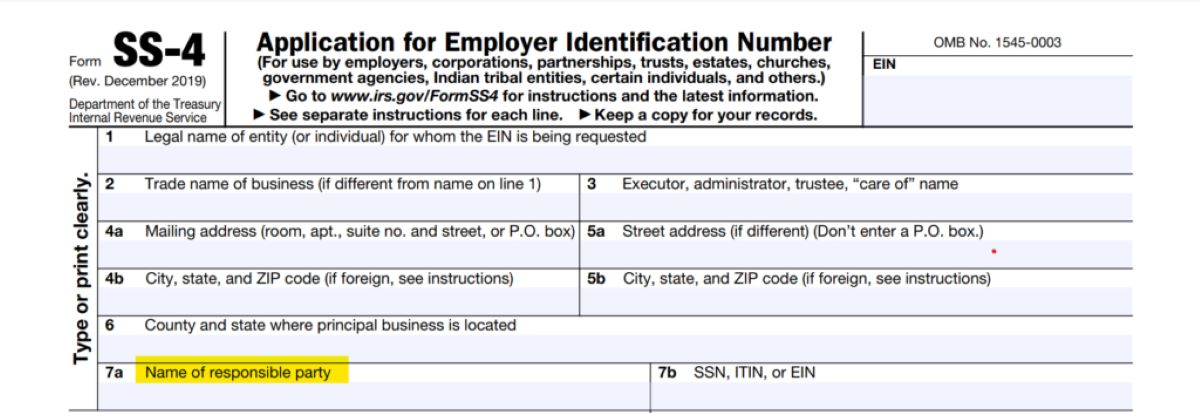

Complete Form 2848

Form 2848, also known as the Power of Attorney and Declaration of Representative form, is an essential document that you will need to complete in order to obtain a CAF number. This form authorizes you as a representative and grants you the ability to act on behalf of your clients before the IRS. Here’s a breakdown of the key steps to complete Form 2848:

Step 1: Personal Information

Begin by providing your personal information, including your name, address, phone number, and Social Security number (SSN). If you are representing an organization, provide the organization’s name, address, and Employer Identification Number (EIN). Ensure that all the information provided is accurate and up to date.

Step 2: Taxpayer Information

Next, you will need to enter the information of the taxpayer or taxpayers you will be representing. This includes their name(s), address(es), and SSN or EIN. If you will be representing multiple taxpayers, you can include additional information on a separate sheet and attach it to the form.

Step 3: Type of Tax Matters

Specify the type or types of tax matters for which you are seeking representation. This can include income tax, employment tax, estate tax, gift tax, or any other relevant tax matters. Be specific and provide as much detail as possible regarding the tax areas you will be handling on behalf of your clients.

Step 4: Signature and Date

Finally, review the completed form and make sure all the information is accurate. Sign and date the form to indicate your agreement with the authorized representation. If you are representing an organization, an authorized individual from the organization must also sign and date the form.

Keep in mind that Form 2848 can be complex, and it’s important to complete it accurately. If you have any doubts or need assistance, consider consulting a tax professional or reaching out to the IRS for guidance.

Once you have completed and reviewed Form 2848, you are ready to submit it to the IRS and proceed with your application for a CAF number. By providing accurate and detailed information on the form, you can expedite the processing of your application and increase the likelihood of obtaining your CAF number efficiently.

Submit Form 2848 to the IRS

After completing Form 2848, the next step is to submit the form to the Internal Revenue Service (IRS). The submission process can vary depending on the instructions provided by the IRS. Here are the key steps involved in submitting Form 2848:

Option 1: Mail

If you choose to submit Form 2848 via mail, make sure to select the appropriate IRS office to which you should send the form. The IRS provides specific mailing addresses for different types of applications, so it’s essential to choose the correct address to ensure timely processing. Consider sending the form via certified mail or with a return receipt to track its delivery and ensure it reaches the IRS securely.

Option 2: Fax

Alternatively, you may have the option to submit Form 2848 through fax. The IRS has designated fax numbers for different types of applications, so double-check the instructions provided by the IRS to ensure you send the form to the correct fax number. When faxing the form, it’s a good practice to keep the transmission confirmation page as proof of submission.

Option 3: Electronic Submission

In certain cases, the IRS may allow for electronic submission of Form 2848 through their online systems. This option provides convenience and faster processing times. Review the IRS guidelines and instructions to determine if electronic submission is available for your specific situation and follow the steps provided.

Regardless of the submission method you choose, ensure that you have included all the necessary pages and attachments with your Form 2848. This includes any additional information regarding the taxpayers you are representing and the tax matters you will be handling.

It’s important to keep a copy of the submitted form and any supporting documents for your records. This will serve as proof of your application and allow you to refer back to the information provided if needed.

After submitting Form 2848, the IRS will process your application for a CAF number. The processing time can vary, so it’s important to be patient. You can check the status of your application by contacting the IRS directly or by using the online tools provided by the IRS.

Now that you have submitted Form 2848, you are one step closer to obtaining your CAF number. The next section will cover what you can expect while waiting for the approval of your application.

Waiting for Approval

After submitting Form 2848 to the IRS to obtain a CAF number, it’s time to patiently wait for the approval of your application. The processing time for CAF number applications can vary depending on various factors, including the IRS workload and the complexity of your case. Here are some important points to keep in mind while waiting for approval:

1. Processing Time

The processing time for CAF number applications can range from a few weeks to several months. It’s important to be aware that there may be delays in processing due to high volume or unforeseen circumstances. While waiting for approval, it is recommended to avoid submitting duplicate applications or contacting the IRS unnecessarily, as this can potentially slow down the process further.

2. Checking Application Status

You can check the status of your CAF number application by contacting the IRS directly or by using the online tools provided on the IRS website. These tools allow you to track the progress of your application and see if any additional information or documentation is needed. It’s a good practice to regularly monitor the status of your application to stay informed.

3. Contacting the IRS

If there are significant delays in the processing of your application or if you have urgent matters that require attention, you can contact the IRS for assistance. The IRS has designated helplines and support services available to answer questions and provide updates. When contacting the IRS, be prepared to provide your application details and any relevant information to facilitate the process.

4. Maintaining Accurate Records

During the waiting period, it’s crucial to keep accurate records of your application, including a copy of the submitted Form 2848 and any supporting documents. These records serve as proof of your application and will be useful for reference in the future. Additionally, if the IRS requests any additional information, respond promptly, and maintain a record of all communication.

5. Seeking Professional Assistance

If you are experiencing delays or facing challenges in obtaining your CAF number, it may be beneficial to seek professional assistance. Tax professionals, such as CPAs or enrolled agents, can provide guidance and support throughout the process. They have expertise in dealing with the IRS and can ensure that your application is handled appropriately.

Remember, obtaining a CAF number is an important step in representing clients before the IRS. While waiting for the approval of your application, continue to focus on providing excellent service to your clients and staying updated on tax regulations. Once you receive your CAF number, you can begin advocating for your clients’ tax matters with the authority granted by the IRS.

Conclusion

Obtaining a CAF number from the IRS is a crucial step for tax professionals, third-party designees, and organizations that represent clients before the IRS. With a CAF number, you gain the authorization to act as a representative, access confidential taxpayer information, and streamline communication with the IRS.

In this article, we discussed what a CAF number is and why it is essential to have one in the world of tax representation. We outlined the steps involved in obtaining a CAF number, including gathering the required documents, completing Form 2848, and submitting the form to the IRS. Additionally, we discussed what to expect while waiting for approval and provided some tips to navigate the process smoothly.

It is important to remember that the IRS processing time for CAF number applications can vary, and patience is key. However, by following the necessary steps and providing accurate information, you can increase your chances of obtaining a CAF number efficiently.

Having a CAF number allows you to effectively represent clients before the IRS, access confidential information, enhance professionalism, and build trust with your clients. As a tax professional, it opens doors for you to navigate the complexities of the tax system and provide exceptional tax representation.

Now that you understand the importance of a CAF number and the process of obtaining one, you can take the necessary steps to obtain your CAF number and begin representing clients before the IRS with confidence.

Remember to stay updated on tax regulations, communicate effectively with your clients, and continue to provide exemplary service in the world of tax representation.