Finance

How To Sell Stocks On E-Trade

Published: January 17, 2024

Looking to sell stocks on E-Trade? Learn the step-by-step process and optimize your finance strategy with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in the stock market, being able to buy and sell stocks efficiently is essential. Thanks to advancements in technology, online trading platforms like E-Trade have made it easier than ever for individuals to manage their investments and execute trading strategies from the comfort of their own homes.

In this article, we will guide you through the process of selling stocks on E-Trade, one of the most popular online brokerages. Whether you are a seasoned investor or a beginner looking to grow your wealth, understanding how to sell stocks on E-Trade is an important skill to have.

Before we dive into the details, it’s important to note that selling stocks is a decision that should be based on careful analysis and consideration. It is crucial to assess the current market conditions, company performance, and any other factors that may impact your investment. If you are unsure about whether to sell a particular stock, consider consulting with a financial advisor who can provide personalized guidance.

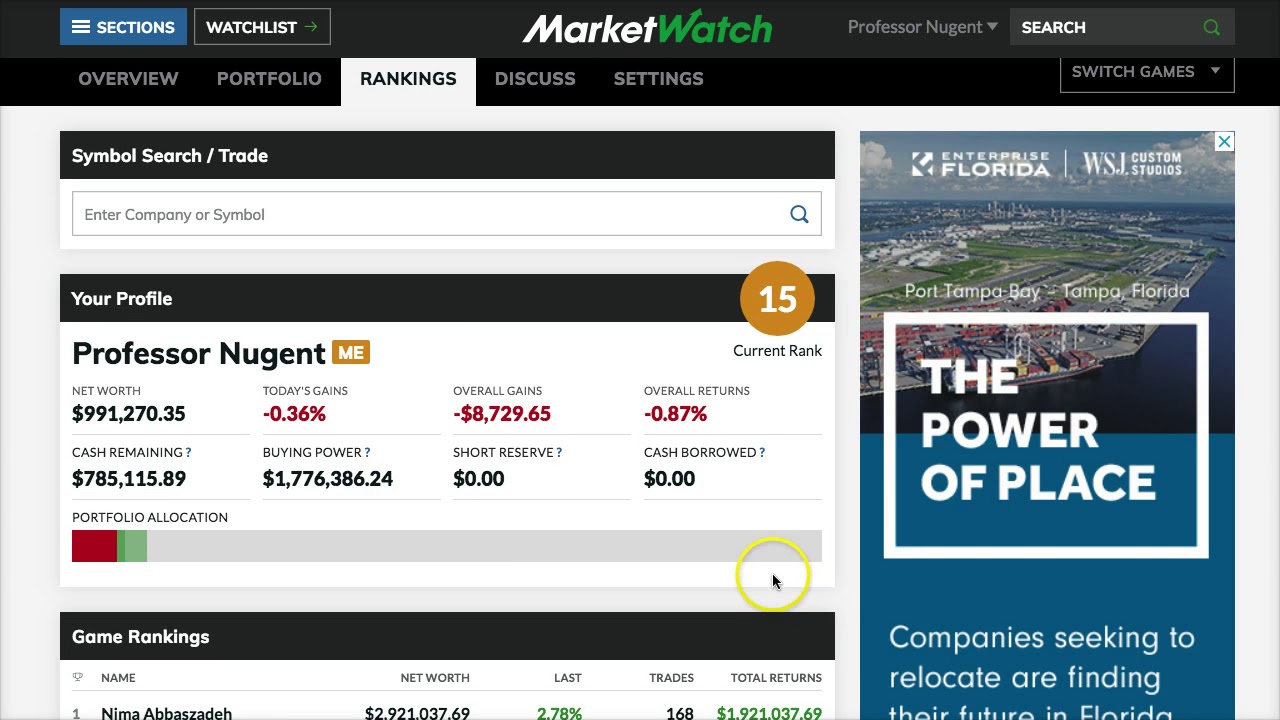

E-Trade provides a user-friendly platform that allows investors to access a wide range of investment opportunities, including stocks, bonds, exchange-traded funds (ETFs), and more. By leveraging the tools and features offered by E-Trade, you can navigate the stock market with ease and make informed decisions about when to sell your stocks.

Whether you’re looking to take profits, cut losses, or rebalance your portfolio, selling stocks on E-Trade can be done in just a few simple steps. In the following sections, we will walk you through the process, from opening an E-Trade account to placing a sell order and monitoring the sale.

Now that you have a brief overview of what to expect, let’s delve deeper into the world of E-Trade and explore how you can start selling stocks on this popular online trading platform.

Understanding E-Trade

E-Trade is an online brokerage platform that provides individuals with the ability to trade stocks, bonds, options, and other investment products. Founded in 1982, it has since grown into one of the most reputable and widely used online trading platforms in the industry.

One of the key advantages of using E-Trade is its ease of use and accessibility. The platform offers a user-friendly interface that allows investors of all levels of expertise to manage their investments efficiently. Whether you are a novice investor or an experienced trader, E-Trade provides the tools and resources necessary to navigate the stock market.

Beyond its user-friendly interface, E-Trade offers a range of features and benefits that make it a popular choice among investors. Some of these features include:

- Research and analysis tools: E-Trade provides investors with access to a wealth of research and analysis tools, including real-time market data, stock screener, and technical analysis charts. These tools can help investors make more informed decisions about when to buy and sell stocks.

- Educational resources: E-Trade offers a variety of educational resources such as articles, videos, and webinars that provide valuable insights and knowledge about investing. Whether you’re a beginner looking to learn the basics or an experienced investor wanting to expand your knowledge, E-Trade has resources to support your growth.

- Mobile app: E-Trade’s mobile app allows investors to trade on the go, providing real-time market updates, portfolio monitoring, and the ability to execute trades from your smartphone or tablet.

- Customer support: E-Trade prides itself on providing excellent customer support. Whether you have questions about your account or need assistance with a trade, E-Trade’s customer support team is available to help.

Furthermore, E-Trade offers competitive pricing and a diverse range of investment options. Whether you’re looking to invest in individual stocks, ETFs, mutual funds, or bonds, E-Trade provides access to a wide variety of investment products to suit your investment goals and risk tolerance.

Having a good understanding of the E-Trade platform is crucial when it comes to selling stocks. Familiarize yourself with the various features and tools available, as they will aid you in making informed decisions and executing trades effectively.

Now that you have a better understanding of E-Trade and its benefits, let’s move on to the next section, where we’ll explore how to open an E-Trade account.

Opening an E-Trade Account

Before you can start selling stocks on E-Trade, you’ll need to open an account with the platform. The account opening process is straightforward and can be completed online in just a few simple steps.

Here’s how to open an E-Trade account:

- Visit the E-Trade website: Start by visiting the official E-Trade website. Look for the “Open an Account” button, which is usually prominently displayed on the homepage.

- Select the account type: E-Trade offers various account types, including individual brokerage accounts, retirement accounts (such as Traditional or Roth IRA), and more. Choose the account type that aligns with your investment goals and personal financial situation.

- Provide personal information: Fill out the required personal information, including your name, address, social security number, and employment details. E-Trade takes privacy and security seriously, so you can rest assured that your information will be protected.

- Choose a funding method: Decide how you want to fund your E-Trade account. You can choose to link your bank account for electronic transfers or deposit a check. Follow the provided instructions to complete the funding process.

- Agree to the terms and conditions: Review and agree to the terms and conditions of opening an E-Trade account. It’s important to read and understand the legal agreements associated with your account, including the customer agreement and fee schedule.

- Complete the application: Once you’ve provided all the necessary information and agreed to the terms, submit your application. You may be required to provide additional documentation or verify your identity, depending on the account type and your circumstances.

- Fund your account: After your application is approved, it’s time to fund your E-Trade account. Depending on the funding method you chose, you may need to initiate the transfer from your bank or deposit a check into your new account.

Once your E-Trade account is funded, you’re ready to start buying and selling stocks!

It’s worth noting that E-Trade may have certain eligibility requirements, such as a minimum age and minimum deposit, so make sure to review the specific requirements before opening an account. Additionally, E-Trade may offer promotions or bonuses for new accounts, so keep an eye out for any current offers that you may be eligible for.

Now that you have successfully opened an E-Trade account, let’s move on to the next section, where we will guide you on how to choose the stocks to sell on the platform.

Choosing the Stocks to Sell

Once you have your E-Trade account set up, the next step in selling stocks is deciding which stocks to sell. This decision should be based on careful analysis and consideration of various factors, including your investment goals, the performance of the stocks, and market conditions.

Here are some key considerations to help you choose which stocks to sell:

- Review your portfolio: Take a thorough look at your investment portfolio and identify any stocks that are underperforming or no longer align with your investment strategy. Consider selling stocks that have not met your expectations or those that no longer fit your long-term goals.

- Analyze company performance: Dive deep into the financials and performance of the companies whose stocks you own. Pay attention to factors such as revenue growth, profitability, competitive advantage, and management strength. If you identify any red flags or a decline in company fundamentals, it may be an indication to consider selling the stock.

- Stay informed: Stay updated with the latest news and developments related to the stocks you own. News about regulatory changes, industry disruptions, or company-specific events can significantly impact stock prices. Additionally, keep an eye on earnings reports and analyst recommendations, as they can provide valuable insights into the future performance of a stock.

- Assess market conditions: Consider the current market conditions and broader economic trends. Evaluate factors such as interest rates, inflation, consumer sentiment, and geopolitical events that may influence the stock market. If you anticipate a downturn in the market or believe that a particular sector is overvalued, it may be wise to sell stocks in those areas.

- Set clear sell criteria: Establish clear criteria for when you will sell a stock. This could be based on specific price targets, percentage gains or losses, or a predetermined holding period. Having clear sell criteria helps take emotion out of the decision-making process and ensures that you stick to your investment strategy.

- Consult with a financial advisor: If you are unsure about which stocks to sell or need professional guidance, consider consulting with a financial advisor. They can provide personalized advice based on your financial goals, risk tolerance, and market outlook.

Remember, selling stocks is not solely about cutting losses. It can also be a strategic move to take profits, rebalance your portfolio, or reallocate funds to better opportunities. By carefully assessing your investments and staying informed, you can make informed decisions about which stocks to sell on E-Trade.

Now that you have a clear understanding of how to choose the stocks to sell, let’s move on to the next section, where we’ll explore how to place a sell order on E-Trade.

Placing a Sell Order on E-Trade

Once you have decided which stocks to sell, it’s time to place a sell order on E-Trade. E-Trade provides a user-friendly platform that makes it easy for investors to execute trades and manage their portfolios.

Here’s a step-by-step guide on how to place a sell order on E-Trade:

- Log in to your E-Trade account: Start by logging in to your E-Trade account using your username and password. If you don’t have the E-Trade mobile app installed, you can access your account through the E-Trade website.

- Navigate to the trading section: Once logged in, navigate to the trading section on the E-Trade platform. You will typically find this section labeled as “Trade” or “Trading.”

- Select the stock to sell: In the trading section, search for the specific stock you want to sell. You can typically find a search bar or a stock symbol lookup tool to help you find the stock you want to sell.

- Choose the number of shares: Enter the number of shares you want to sell in the “Quantity” field. Make sure to double-check that you have entered the correct quantity.

- Select the order type: Choose the order type for your sell order. E-Trade offers various order types, including market orders, limit orders, and stop orders. Each order type has different execution rules, so it’s important to understand how each one works. For example, a market order will execute immediately at the prevailing market price, while a limit order allows you to set a specific price at which you want the stock to be sold.

- Set the price: If you choose a limit order, enter the price at which you want to sell the stock. If you are placing a market order, this step is not necessary as the order will execute at the current market price.

- Review and confirm the order: Take a moment to review the details of your sell order, including the stock symbol, quantity, order type, and price. Verify that everything is accurate before proceeding.

- Submit the sell order: Once you are satisfied with the details, click on the “Submit” or “Place Order” button to submit your sell order. E-Trade will then process your order in the market.

After submitting your sell order, E-Trade will provide you with a confirmation message or email, confirming that your order has been placed. It’s important to note that the execution of your sell order will depend on market conditions and the availability of buyers for the stocks you are selling.

It’s worth mentioning that E-Trade also provides advanced order types and additional options, such as trailing stop orders and fill-or-kill orders. These order types can be useful for more sophisticated trading strategies, but they may require a deeper understanding of their functionalities.

Now that you know how to place a sell order on E-Trade, let’s move on to the next section, where we’ll discuss reviewing and confirming the sell order.

Reviewing and Confirming the Sell Order

After placing a sell order on E-Trade, it’s crucial to thoroughly review and confirm the details of the order before it is executed. This step ensures that you have entered the correct information and that the order aligns with your intended transaction.

Here are some important steps to follow when reviewing and confirming your sell order on E-Trade:

- Double-check the stock symbol: Verify that you have entered the correct stock symbol for the stock you want to sell. It’s easy to make a typo, so take the time to ensure accuracy.

- Confirm the quantity: Review the quantity of shares you entered for the sell order. Make sure it matches the number of shares you intended to sell.

- Check the order type: Ensure that the order type you selected is indeed what you intended. Verify whether it is a market order, limit order, or stop order, and confirm that it aligns with your desired execution method.

- Review the price: If you set a specific price for a limit order, confirm that the price is accurate and aligns with your intentions. If you placed a market order, double-check that there is no specified price mentioned, as market orders execute at the prevailing market price.

- Assess the total amount: Calculate the total amount you expect to receive from the sell order. This can be done by multiplying the sell price by the number of shares, factoring in any applicable fees or commissions.

- Verify the account information: Ensure that the sell order is linked to the correct account. If you have multiple accounts with E-Trade, confirm that the sell order is associated with the account you intended to use.

- Consider the timing: Take into account the current market conditions and any other factors that may impact the execution of your sell order. Review any recent news or events that could potentially affect the stock price.

By diligently reviewing and confirming your sell order, you reduce the risk of potential errors or discrepancies. It is important to note that once the sell order is executed, it is usually irreversible, so taking the time to review and confirm is crucial for accuracy.

Once you are confident that the sell order details are accurate and align with your intended transaction, you can proceed with confirming the order through the E-Trade platform. After confirmation, the order will be submitted for execution.

Now that you have learned how to review and confirm the sell order on E-Trade, let’s move on to the next section where we will discuss monitoring the sale process.

Monitoring the Sale

After placing a sell order on E-Trade and confirming the details, it is important to actively monitor the sale process to ensure a smooth transaction. Monitoring the sale allows you to stay informed about the progress of your order and make any necessary adjustments if needed.

Here are some key steps to effectively monitor the sale of your stocks on E-Trade:

- Track the order status: E-Trade provides real-time updates on the status of your sell order. Monitor the order status within your E-Trade account, where you can find details such as whether the order has been received, executed, or cancelled.

- Check the execution price: Take note of the executed price for your sell order. Compare it to the price at which you placed the order and assess whether it meets your expectations. Keep in mind that the execution price may vary due to changing market conditions and the availability of buyers.

- Monitor the market: Stay informed about the market conditions and how they may impact the price of the stocks you are selling. Keep an eye on any news or events that could potentially affect the stock price and make adjustments to your strategy if necessary.

- Set alerts: Utilize E-Trade’s alert feature to receive notifications about any significant changes in the stock price or order status. Setting alerts allows you to stay proactive and respond promptly to market movements or order developments.

- Consider tax implications: Understand the tax implications of selling your stocks. Depending on your jurisdiction and holding period, the profits from your sale may be subject to capital gains tax. Consult with a tax professional to ensure compliance with tax regulations and to optimize your tax strategy.

- Review and analyze: After the sale has been completed, review and analyze the outcome of your trade. Assess whether the decision to sell was successful and aligns with your investment goals. Analyzing your trades can help you refine your future strategies and improve your overall trading performance.

- Keep documentation: Maintain a record of the transaction details, including the sell order confirmation, executed price, and any other relevant information. Documentation is important for record-keeping purposes and for reporting purposes, such as tax filings.

By actively monitoring the sale process, you can stay on top of your investments and make informed decisions throughout the transaction. Remember, markets can be volatile, and circumstances can change rapidly, so monitoring your sale order is essential to react to any unexpected developments or opportunities.

Now that you understand the importance of monitoring the sale process, you are ready to take a look at the next section where we will conclude our discussion on selling stocks on E-Trade.

Conclusion

Congratulations! You have learned the essential steps and considerations for selling stocks on E-Trade. Understanding the process of selling stocks is crucial for managing your investments and making informed decisions to achieve your financial goals.

We started by introducing E-Trade as a user-friendly online brokerage platform that offers a range of features and benefits for investors. We then discussed the process of opening an E-Trade account, including selecting the account type, providing personal information, and funding the account.

Next, we explored how to choose the stocks to sell. We highlighted the importance of reviewing your portfolio, analyzing company performance, staying informed about market conditions, and setting clear sell criteria. Consulting with a financial advisor can also provide valuable guidance in making well-informed decisions.

We then explained the process of placing a sell order on E-Trade, including navigating the platform, selecting the stock, choosing the order type, setting the price, and submitting the order. After placing the order, we emphasized the significance of reviewing and confirming the order details to ensure accuracy.

Furthermore, we discussed the importance of actively monitoring the sale process. By tracking the order status, checking the execution price, monitoring the market, setting alerts, considering tax implications, and reviewing the outcome, you can stay informed and make any necessary adjustments.

Remember, selling stocks should be based on thorough analysis, careful consideration, and a clear understanding of your investment goals. It’s important to always stay informed about market trends and company-specific events that can impact stock prices.

By following the steps and considerations outlined in this article, you are well-equipped to sell stocks on E-Trade with confidence and efficiency.

Whether you are looking to take profits, cut losses, or rebalance your portfolio, the process of selling stocks on E-Trade is designed to be accessible and straightforward. However, it’s always recommended to conduct further research, stay updated with market trends, and consult with financial professionals when needed.

Happy trading and may your investment journey be prosperous!