Finance

How To Get My 2014 Tax Return

Modified: March 1, 2024

Learn how to easily get your 2014 tax return with our helpful finance tips and advice. Ensure you maximize your refund and stay up-to-date with your financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Gather Your Documents

- Step 2: Determine the Filing Status

- Step 3: Choose the Appropriate Form

- Step 4: Fill Out the Form

- Step 5: Calculate Your Taxes

- Step 6: Claim Eligible Deductions and Credits

- Step 7: Review and Double-Check

- Step 8: File Your Tax Return

- Step 9: Track Your Refund Status

- Conclusion

Introduction

Welcome to a comprehensive guide on how to get your 2014 tax return. Whether you missed filing your tax return for 2014 or need a copy for record-keeping purposes, this article will provide you with step-by-step instructions to help you retrieve your tax return from that year.

Filing your taxes is an essential part of your financial responsibilities. It not only ensures that you are in compliance with the law but also provides an opportunity to claim deductions and credits that can potentially reduce your tax liability.

While it’s always best to file your tax return in a timely manner, we understand that life circumstances can sometimes lead to delays or oversights. Thankfully, the process of obtaining a copy of your 2014 tax return is relatively straightforward.

It’s important to note that the Internal Revenue Service (IRS) generally keeps tax records for a period of seven years. After that, they are typically archived or destroyed. Therefore, it’s crucial to act promptly to request your 2014 tax return before it becomes inaccessible.

Whether you need the tax return for personal reasons, such as applying for a mortgage or loan, or if you missed filing your return that year, the following steps will guide you through the process of obtaining your 2014 tax return.

Step 1: Gather Your Documents

Before you begin the process of obtaining your 2014 tax return, it’s crucial to gather all the necessary documents and information. This will ensure that you have everything you need when navigating the steps to retrieve your tax return.

Here are the key documents and information you should have at hand:

- Your full name, including any name changes since 2014.

- Your Social Security number (SSN) or individual taxpayer identification number (ITIN).

- Your date of birth.

- Your current mailing address.

- Employment information (including any employers you had in 2014) such as W-2 forms or pay stubs.

- Income information, including forms 1099 (if applicable) that reflect any income received.

- Bank account information for direct deposit, if you are expecting a refund.

- A copy of your 2014 tax return, if you have it available.

Having these documents handy will save you time and ensure a smoother process when requesting your 2014 tax return.

If you are missing any of the required documents, you can try contacting your employers from that year to obtain copies of your W-2 forms or other income records. Additionally, you can request a free transcript of your tax return from the IRS, which may have the necessary information you need.

Once you have gathered all the relevant documents and information, you are ready to proceed to the next step in retrieving your 2014 tax return.

Step 2: Determine the Filing Status

Before accessing your 2014 tax return, it is important to determine your filing status for that year. Your filing status is based on your marital status and has an impact on your tax rate, deductions, and credits.

There are five filing statuses recognized by the IRS:

- Single: If you were not married and did not qualify for any other filing status.

- Married Filing Jointly: If you were married and filed a joint tax return with your spouse.

- Married Filing Separately: If you were married but chose to file separate tax returns from your spouse.

- Head of Household: If you were unmarried, paid more than half the cost of maintaining a home for yourself and a qualifying dependent, and met certain other criteria.

- Qualifying Widow(er) with Dependent Child: If your spouse passed away within the past two years, you have a dependent child, and you meet specific requirements.

Review your marital status and the criteria for each filing status to determine which one applies to you for the tax year 2014.

Choosing the correct filing status is essential as it affects your tax liability, eligibility for certain deductions, and tax credits. It is important to be accurate in determining your filing status to ensure the proper completion of your tax return.

If you are unsure about your filing status, it is advisable to consult with a tax professional or use the IRS’s Interactive Tax Assistant tool, which can provide guidance based on your specific circumstances.

Once you have determined your filing status, you can proceed to the next step in the process of obtaining your 2014 tax return.

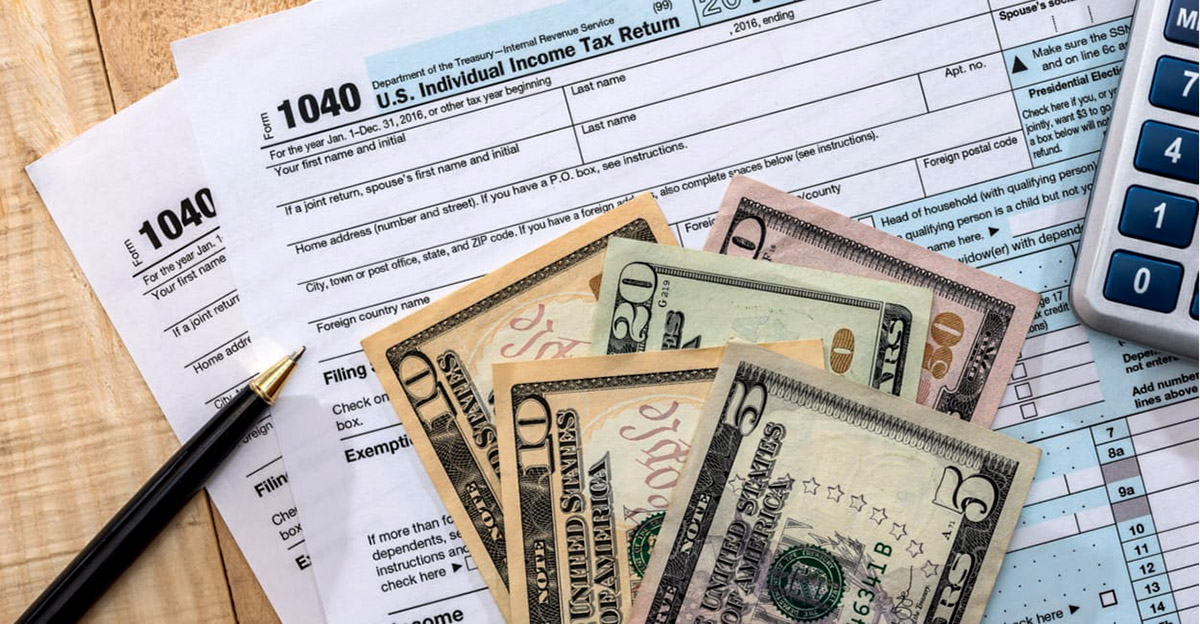

Step 3: Choose the Appropriate Form

Once you have determined your filing status for the tax year 2014, the next step is to choose the correct tax form to complete. The form you need depends on your filing status and the level of your income.

For the tax year 2014, there are three main forms to consider:

- Form 1040: This is the standard individual income tax return form. It is suitable for taxpayers with any filing status and varying incomes.

- Form 1040A: This form is a simplified version of Form 1040 and is generally used for taxpayers with a straightforward tax situation and lower incomes.

- Form 1040EZ: This is the simplest and shortest form to complete. It is designed for taxpayers with no dependents, minimal deductions, and a certain income threshold.

Consider your filing status, income level, and the complexity of your tax situation to determine the most appropriate form to fill out for your 2014 tax return.

If you are unsure which form is best suited for your situation, the IRS website provides detailed instructions on each form, including eligibility requirements and the income limits associated with each.

Once you have selected the appropriate tax form, you can move on to the next step in the process of retrieving your 2014 tax return.

Step 4: Fill Out the Form

Once you have chosen the appropriate tax form for your 2014 tax return, it’s time to fill it out with your relevant information and financial details.

The form will require you to provide personal information such as your name, Social Security number (SSN) or individual taxpayer identification number (ITIN), and your filing status. Be sure to double-check the accuracy of this information to avoid any errors.

Next, you will need to report your income for the tax year 2014. This includes wages, salaries, tips, interest income, dividends, and any other sources of income that you received during that year. Make sure to review your records and accurately report all income sources.

If you had any deductions or credits for the tax year 2014, you will need to include them on the appropriate lines of the form. Deductions reduce your taxable income, while credits directly reduce your tax liability. Common deductions and credits include student loan interest, mortgage interest, childcare expenses, and educational credits. Consult the form’s instructions or seek professional advice to ensure you claim all applicable deductions and credits.

Additionally, if you have any dependent(s), you will need to provide their information, including their names, Social Security numbers (or ITINs), and relationship to you. Dependents can affect the deductions and credits you are eligible for, so be sure to accurately report this information.

Lastly, carefully review the form and make sure all the information you have entered is accurate and complete. Small errors or omissions can result in processing delays or even trigger an audit. Taking the time to review your completed form can help avoid any potential issues.

Once you have filled out the form with all the required information, move on to the next step in the process of obtaining your 2014 tax return.

Step 5: Calculate Your Taxes

Now that you have filled out the necessary form with your personal and financial information for the tax year 2014, it’s time to calculate your taxes.

The tax calculation process involves determining your taxable income and applying the appropriate tax rates and brackets to calculate your tax liability. This will be based on the information you provided on the form, including your income, deductions, and credits.

If you are using tax software or an online tax preparation service, it will automatically calculate your taxes for you based on the information you have entered. However, if you are filling out the form manually, you will need to refer to the IRS tax tables or use the tax calculation worksheet provided in the instructions for the form you are using.

Keep in mind that the tax rates and brackets may have changed since 2014. Therefore, it is important to use the correct tax tables or tax software that accounts for the applicable rates and brackets for that specific tax year.

Once you have completed the tax calculation, you will have your final tax liability for the tax year 2014. This amount represents the taxes you owe for that year.

If you have already made tax payments throughout the year or have any tax credits, these will be deducted from your tax liability to determine whether you have a refund or a remaining balance due to the IRS. The details of your refund or balance due will be reported on your completed tax form.

If you are entitled to a refund, it’s important to note that you must file your 2014 tax return within the appropriate time limit to claim it. Generally, you have three years from the original due date of the tax return to file and receive a refund for that tax year.

Once you have calculated your taxes and determined your refund or balance due, proceed to the next step in the process of retrieving your 2014 tax return.

Step 6: Claim Eligible Deductions and Credits

After calculating your taxes for the tax year 2014, it’s important to review your eligible deductions and credits to ensure you are maximizing your tax benefits.

Deductions and credits can significantly reduce your tax liability or even result in a tax refund. Here are some common deductions and credits you may be eligible to claim on your 2014 tax return:

- Standard Deduction: Depending on your filing status, you may be eligible for a standard deduction, which reduces your taxable income without the need to itemize deductions.

- Itemized Deductions: If your itemized deductions exceed the value of the standard deduction, you can opt to list and deduct specific expenses, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions.

- Educational Credits: If you paid for higher education expenses for yourself, your spouse, or your dependents, you may be eligible to claim the American Opportunity Credit or the Lifetime Learning Credit.

- Child Tax Credit: If you have dependent children under the age of 17, you may qualify for the Child Tax Credit, which can reduce your tax liability by up to $1,000 per child.

- Earned Income Tax Credit: If you had earned income and meet certain income and eligibility requirements, you may be eligible for the Earned Income Tax Credit, which can provide a substantial reduction in your tax liability.

These are just a few examples of the deductions and credits available. It’s important to thoroughly review IRS publications or consult a tax professional to determine which deductions and credits you qualify for in order to maximize your tax savings.

When filling out your tax form, make sure to carefully report and document your deductions and credits to substantiate your claims. This will help ensure accuracy and minimize the chances of an audit.

Once you have claimed all eligible deductions and credits, proceed to the next step in the process of obtaining your 2014 tax return.

Step 7: Review and Double-Check

Before submitting your 2014 tax return, it is crucial to review and double-check all the information you have entered. This step is essential to avoid any errors or omissions that could lead to processing delays or even trigger an audit.

Take the time to carefully review each section of your completed tax form, ensuring that:

- All personal information, such as your name, Social Security number (SSN) or individual taxpayer identification number (ITIN), and filing status, is accurate and up to date.

- Your income is reported correctly, including any wages, tips, interest, dividends, or other sources of income you received during the tax year 2014.

- Your deductions and credits are properly claimed and documented, including any itemized deductions, educational credits, or dependents claimed.

- Your calculations, including the taxable income and final tax liability or refund amount, are accurate.

By thoroughly reviewing your tax return, you can catch any mistakes or oversights and make necessary corrections before filing. This attention to detail can save you from unnecessary complications later on.

If you are using tax software or an online tax preparation service, take advantage of their review features to automatically check for common errors and to ensure the accuracy and completeness of your tax return.

Additionally, consider seeking assistance from a tax professional or having someone else review your tax return. Another set of eyes can help spot any mistakes or inconsistencies that may have been overlooked.

Once you are confident that your tax return is accurate and complete, you are ready to move on to the next step in the process of obtaining your 2014 tax return.

Step 8: File Your Tax Return

Now that you have reviewed and double-checked your 2014 tax return, it’s time to file it with the appropriate tax authority. There are several methods available for filing your tax return for the tax year 2014:

- Mail: You can print and mail your completed tax return to the IRS using the appropriate mailing address provided in the instructions for your chosen tax form.

- Electronic Filing: E-filing is a convenient and secure method of submitting your tax return. You can use IRS-approved tax software or online tax preparation services to electronically file your 2014 tax return.

- Assistance from a Tax Professional: If you prefer to have a tax professional handle the filing process, you can provide them with your completed tax return, and they will file it on your behalf.

Make sure to follow the instructions provided by the IRS or the tax software/service you are using to ensure the proper submission of your tax return. Pay attention to any filing deadlines for the tax year 2014 to avoid penalties or interest charges.

If you have a balance due on your tax return, ensure you include the appropriate payment method, such as a check or electronic payment, when filing. Alternatively, if you expect a refund, consider opting for direct deposit to receive your refund faster.

Keep copies of all the relevant documents, including your completed tax return, for your records. This will help in case of any future inquiries or requests for information related to your 2014 tax return.

Once you have successfully filed your tax return, it’s time to move on to the final step in the process of obtaining your 2014 tax return.

Step 9: Track Your Refund Status

After you have filed your 2014 tax return and claimed a refund, you may be eager to know the status of your refund. The IRS provides several methods to track the progress of your refund for the tax year 2014.

Here’s how you can monitor the status of your refund:

- Where’s My Refund? Visit the IRS website and use their “Where’s My Refund?” tool. You will need to provide your Social Security number, filing status, and the exact amount of your expected refund. The tool will provide real-time updates on the status of your refund.

- IRS2Go Mobile App: If you prefer to track your refund on your mobile device, you can download the IRS2Go app. This app provides similar functionality to the “Where’s My Refund?” tool, allowing you to check the status of your refund on the go.

- Phone Inquiry: If you don’t have internet access or prefer to speak with an IRS representative, you can call the IRS Refund Hotline at 1-800-829-1954. Make sure to have your Social Security number, filing status, and the exact amount of your expected refund ready when calling.

It’s important to note that it may take some time for the IRS to process your refund. Typically, refunds for electronically filed tax returns are issued within 21 days, while paper returns may take longer.

While tracking your refund, keep in mind that the IRS may require additional information or documentation to process your claim. If this is the case, they will contact you directly.

If there are any discrepancies or issues with your refund, the IRS will also provide instructions on how to resolve the matter.

By regularly tracking the status of your refund, you can stay informed about the progress and estimated arrival of your refund for the tax year 2014.

Congratulations! By following the nine steps outlined in this guide, you have successfully completed the process of obtaining your 2014 tax return. It’s important to keep records of your tax returns and supporting documents for future reference.

Conclusion

Obtaining your 2014 tax return may seem like a daunting task, but by following the steps outlined in this comprehensive guide, you can easily navigate the process. Taking the time to gather your documents, determine your filing status, choose the appropriate form, fill it out accurately, and calculate your taxes will ensure that your tax return reflects your financial situation for the tax year 2014.

Remember to review and double-check your completed tax form, claim all eligible deductions and credits, and file your tax return correctly. By doing so, you can minimize errors, maximize your tax benefits, and meet any deadlines imposed by the IRS.

Once you have filed your tax return, don’t forget to track the status of your refund using the tools provided by the IRS. This will keep you informed about the progress of your refund and help you anticipate its arrival.

As with any tax-related process, it is advisable to seek guidance from a tax professional if you have any uncertainties or complex situations. They can provide personalized advice and ensure that you comply with the appropriate tax laws and regulations.

By successfully obtaining your 2014 tax return, you are taking a proactive step towards maintaining accurate financial records and fulfilling your tax obligations. This process not only helps you stay in good standing with the IRS but also ensures that you have the necessary documents should they be required for future financial endeavors, such as applying for loans or mortgages.

Remember, filing your tax return is just one aspect of your overall financial responsibility. It is important to continuously educate yourself about tax laws and changes, seek professional assistance when necessary, and maintain proper financial records to stay organized and prepared.

With this guide, you have the knowledge and tools to confidently retrieve your 2014 tax return and move forward with your financial endeavors. Stay proactive, stay informed, and stay on top of your tax obligations.