Finance

How To Get A 2015 Tax Return Transcript

Modified: March 1, 2024

Looking for your 2015 tax return transcript? Learn how to obtain it quickly and easily. Finance made simple.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Determine your purpose for obtaining the tax return transcript

- Step 2: Gather the required information

- Step 3: Choose the method to request the transcript

- Step 4: Request the tax return transcript online

- Step 5: Request the tax return transcript by mail

- Step 6: Request the tax return transcript by phone

- Step 7: Follow up on your request

- Conclusion

Introduction

Welcome to our comprehensive guide on how to get a 2015 tax return transcript. Tax return transcripts are essential documents that provide a detailed summary of the information you filed on your tax return for a specific year. They can be helpful for a variety of purposes, such as applying for a mortgage, student loan, or financial aid. In this article, we will walk you through the step-by-step process of obtaining your 2015 tax return transcript.

Before we dive into the process, it’s important to understand the significance of the 2015 tax return transcript. The IRS keeps copies of tax return information for up to six years, so accessing a transcript for a previous year is still possible. However, tax return transcripts are not the same as copies of your actual tax return. Transcripts provide a summary of your tax return, including important details like income, deductions, and credits, but do not include any attached schedules or additional documentation.

Now that we have a clear understanding of the purpose and scope of a tax return transcript, let’s delve into the steps involved in obtaining your 2015 tax return transcript. It’s worth noting that the process can vary depending on your preferred method of request. The Internal Revenue Service (IRS) provides several options for obtaining tax return transcripts, including online, by mail, and by phone. We will guide you through each of these methods to ensure you have all the information you need to successfully request your transcript.

Whether you need this transcript for personal or professional reasons, we are here to help you navigate the process with ease. So, let’s get started on obtaining your 2015 tax return transcript!

Step 1: Determine your purpose for obtaining the tax return transcript

The first step in obtaining your 2015 tax return transcript is to determine your purpose for needing this document. Identifying your specific reason will help you choose the appropriate method for requesting the transcript and ensure that you have all the necessary information at hand.

There are various reasons why you might need a tax return transcript for a specific year, such as:

- Applying for a mortgage: Many mortgage lenders require tax return transcripts as part of the application process. These transcripts provide lenders with a comprehensive overview of your income and tax information, helping them assess your eligibility for a mortgage and determine loan terms.

- Applying for student financial aid: If you or a family member is applying for student financial aid, such as federal grants, loans, or work-study programs, you may be required to submit tax return transcripts to verify your income and financial situation.

- Resolving tax issues or disputes: If you have been contacted by the IRS regarding a tax issue or dispute for the 2015 tax year, obtaining the tax return transcript can provide crucial information to help you understand the basis of the issue and work towards a resolution.

- Completing a tax audit: In the event that you are audited for the 2015 tax year, having access to the tax return transcript can assist you in gathering the necessary documentation and information to comply with the audit requirements.

- Obtaining personal records: Sometimes, individuals may need their tax return transcripts for personal reasons, such as keeping a record of their financial history, applying for government assistance programs, or fulfilling certain legal obligations.

By determining your specific purpose for obtaining the tax return transcript, you can focus on the necessary steps and requirements involved. This will streamline the process and ensure that you are well-prepared to request your 2015 tax return transcript in the most efficient manner.

Once you have identified your purpose, you can proceed to the next step, which involves gathering the required information. This includes details about your identity and the specific tax year you are requesting. Let’s explore this in the next section.

Step 2: Gather the required information

Before you proceed with requesting your 2015 tax return transcript, it is crucial to gather all the necessary information. This will ensure a smooth and hassle-free process as you navigate through the various methods of requesting the transcript.

Here is the essential information you will need:

- Your personal information: This includes your full name, Social Security Number (SSN), and date of birth. It is important to provide accurate and up-to-date information to avoid any delays or errors in obtaining your tax return transcript.

- Filing status: You will need to know your filing status for the 2015 tax year, such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This information determines your tax rates and eligibility for certain deductions and credits.

- Address: The address you used on your 2015 tax return is required to verify your identity and ensure that the transcript is sent to the correct location. If your address has changed since then, you may need to provide both your current and previous address.

- Telephone number: Providing a contact number will allow the IRS to reach you if they have any questions or need further information regarding your request.

- Verification information: To prove your identity, you may be required to provide additional information, such as your email address, adjusted gross income (AGI) from your 2014 tax return, or other specific details to authenticate your request.

It is important to have these details readily available when requesting your tax return transcript to avoid delays or complications. Take a moment to gather all the necessary information before proceeding to the next step.

In the next section, we will explore the different methods available for requesting your 2015 tax return transcript, including the option to request it online. Stay tuned!

Step 3: Choose the method to request the transcript

Once you have gathered all the required information, it’s time to choose the method you prefer to request your 2015 tax return transcript. The Internal Revenue Service (IRS) provides several options to accommodate different preferences and convenience.

Here are the three main methods you can choose from:

- Online Request: The fastest and most convenient way to request your tax return transcript is through the IRS website. This method allows you to submit your request electronically and receive the transcript instantly or within a few business days, depending on the type of transcript you need.

- Mail Request: If you prefer a traditional approach, you can request your tax return transcript by mail. This involves filling out a specific form and mailing it to the designated IRS address. The transcript will be sent to your mailing address within 5-10 business days.

- Phone Request: Another option is to request your tax return transcript over the phone. This method allows you to speak with an IRS representative who will guide you through the process and verify your identity before providing you with the transcript. The transcript will be mailed to your address within 5-10 business days.

When choosing the method to request your tax return transcript, consider factors such as speed, convenience, and personal preference. If you need the transcript urgently or prefer an electronic format, the online request would be the best option. If you prefer a physical copy or are more comfortable with traditional methods, the mail or phone request may be more suitable.

Keep in mind that each method has specific requirements and procedures that need to be followed. In the next sections, we will guide you step-by-step through each method, providing detailed instructions to help you successfully request your 2015 tax return transcript. Let’s start with the online request method.

Step 4: Request the tax return transcript online

The online method is the fastest and most convenient way to request your 2015 tax return transcript. It allows you to submit your request electronically and receive the transcript instantly or within a few business days, depending on the type of transcript you need.

Follow these steps to request your tax return transcript online:

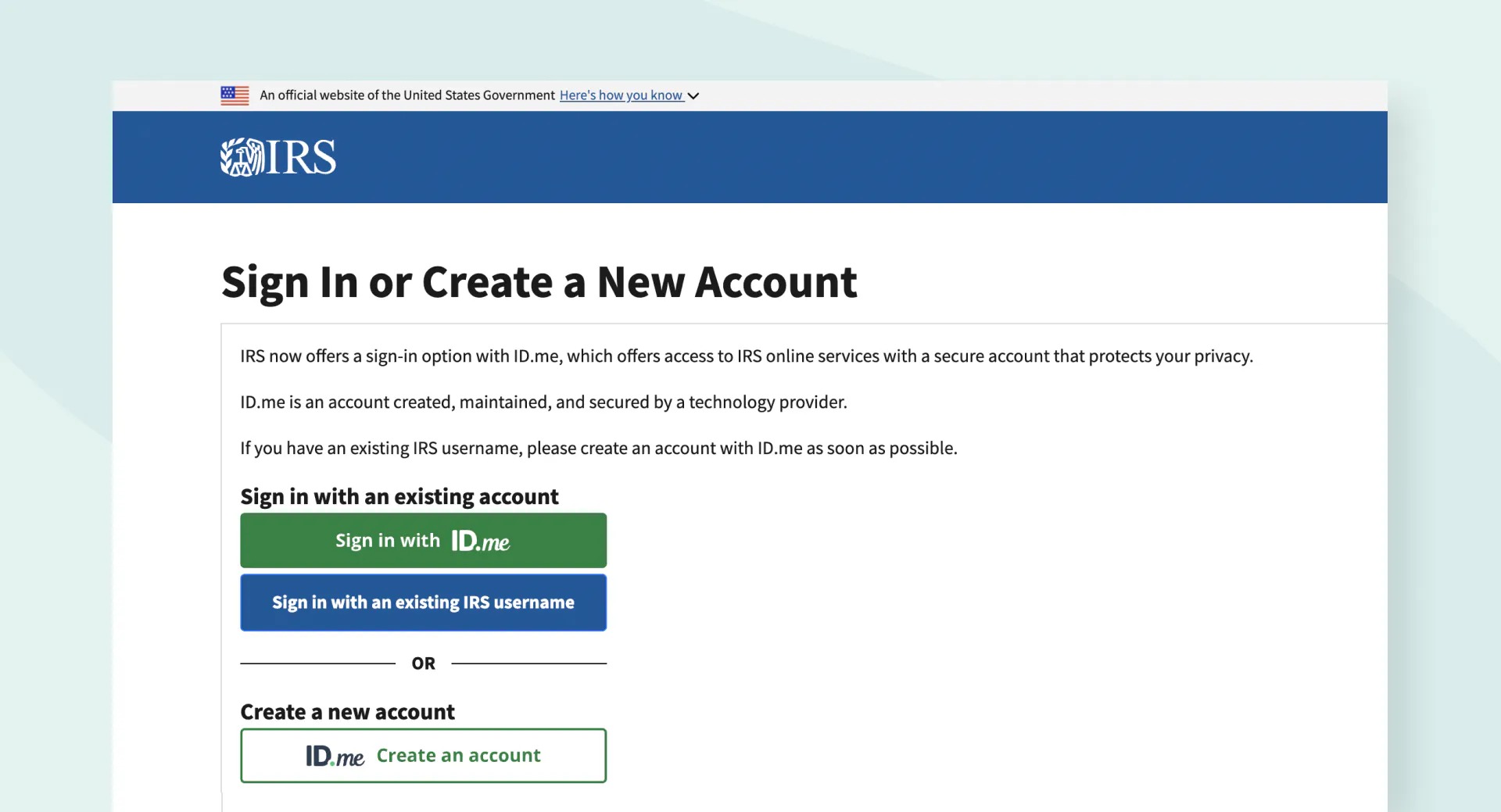

- Visit the IRS website: Go to the official IRS website at https://www.irs.gov/ and navigate to the “Get Your Tax Record” page.

- Select “Get Transcript Online”: On the “Get Your Tax Record” page, click on the “Get Transcript Online” button. This will take you to the online transcript request form.

- Verify your identity: To ensure the security of your personal information, you will need to complete the identity verification process. This may involve providing your personal details, answering security questions, and confirming your email address.

- Choose the desired transcript type: Select “Return Transcript” as the transcript type, as this will provide you with the summarized information from your 2015 tax return.

- Download or view the transcript: Once you have completed the request process, you will have the option to download and print the transcript directly from the website or view it online. If you choose to view it online, you can save a copy or take a screenshot for your records.

It’s important to note that not all transcripts may be available for instant access online. In some cases, the IRS may need to process your request manually, resulting in a delay of a few business days before the transcript becomes accessible.

Having completed the request process online, you now have your tax return transcript for the 2015 tax year. If, for any reason, you encounter difficulties or technical issues during the online request, don’t worry. The IRS provides alternative methods to request your transcript, which we will cover in the next sections.

Now that you are familiar with the online request method, let’s move on to the next section where we will explain how to request the tax return transcript by mail.

Step 5: Request the tax return transcript by mail

If you prefer a traditional approach or don’t have access to the internet, you can request your 2015 tax return transcript by mail. This method involves filling out a specific form and mailing it to the designated IRS address.

Follow these steps to request your tax return transcript by mail:

- Download the appropriate form: Visit the IRS website and search for Form 4506-T, “Request for Transcript of Tax Return” for the tax year 2015. Download and print the form.

- Fill out the form: Fill in the requested information on Form 4506-T. Provide your full name, Social Security Number (SSN), address, and the tax year you are requesting (2015). Indicate “Return Transcript” as the transcript type.

- Sign and date the form: Sign and date the form before sending it. Ensure that all the information provided is accurate and matches the information on your tax return for the 2015 tax year.

- Mail the form: Once you have completed and signed the form, mail it to the appropriate IRS address listed on the form. Make sure to double-check the mailing address to ensure your request reaches the correct destination.

- Wait for the transcript: After you have sent the form, allow 5-10 business days for the IRS to process your request and mail the tax return transcript to the address you provided on the form. It’s important to note that processing times may be longer during peak tax seasons.

By following these steps, you can request your 2015 tax return transcript by mail. It’s crucial to accurately fill out the form and include all the necessary information to avoid any delays or complications.

In the next section, we will discuss how you can request the tax return transcript by phone if you find that method more convenient. Let’s continue!

Step 6: Request the tax return transcript by phone

If you prefer a more direct and interactive method, you can request your 2015 tax return transcript by phone. This option allows you to speak with an IRS representative who will guide you through the process and verify your identity before providing you with the transcript.

Follow these steps to request your tax return transcript by phone:

- Gather your information: Before making the call, gather all the necessary information, such as your Social Security Number (SSN), date of birth, and the tax year you are requesting (2015).

- Call the IRS: Dial the IRS phone number dedicated to transcript requests: 1-800-908-9946. Be prepared for potential wait times, especially during peak tax seasons.

- Follow the prompts: Once connected, listen carefully to the automated prompts, which will guide you through the process. Select the appropriate options to request your tax return transcript for the 2015 tax year.

- Provide necessary information: When prompted, provide your personal details, such as your SSN, date of birth, and the tax year you are requesting.

- Verify your identity: To ensure the security of your personal information, the IRS representative may ask you specific questions to verify your identity. Provide accurate answers to these questions.

- Request the transcript: Once your identity is confirmed, request your tax return transcript for the 2015 tax year. Specify “Return Transcript” as the transcript type.

- Provide mailing address: The IRS representative will ask for your current mailing address to send the tax return transcript. Ensure that the address provided is accurate and up-to-date.

- Wait for the transcript: After providing all the necessary information, the IRS will process your request and mail the tax return transcript to the address you provided. It may take 5-10 business days to receive the transcript.

By following these steps, you can easily request your 2015 tax return transcript by phone. Remember to have all the required information on hand and be prepared to answer identity verification questions for a smooth and successful request.

In the final section of this guide, we will discuss the importance of following up on your request to ensure that you receive your tax return transcript in a timely manner.

Step 7: Follow up on your request

After you have requested your 2015 tax return transcript through your chosen method – online, by mail, or by phone – it’s important to follow up on your request to ensure that you receive the transcript in a timely manner. Here are a few steps you can take to monitor the progress of your request:

- Online request: If you requested your tax return transcript online, you may be able to track the progress of your request on the IRS website. Check the “Get Your Transcript Online” page for any updates or notifications regarding the status of your request.

- Mail request: If you requested your tax return transcript by mail, allow 5-10 business days for the IRS to process your request and mail the transcript to the provided address. Keep an eye on your mailbox during this period. If you haven’t received the transcript within the expected timeframe, you can consider contacting the IRS for further assistance.

- Phone request: If you requested your tax return transcript by phone, make a note of the date and time of your call, as well as any reference number provided by the IRS representative. This information will be helpful if you need to follow up on your request or inquire about the status of your transcript.

- Contact the IRS: If you have any concerns or questions about your request, you can contact the IRS directly for assistance. Refer to the contact information available on the IRS website or any communication you have received from them.

By following up on your request, you can ensure that there are no unforeseen issues or delays in receiving your 2015 tax return transcript. It’s important to note that processing times may vary depending on the method you chose and the current IRS workload. Understanding this, the IRS recommends allowing a reasonable amount of time before reaching out for assistance.

Once you receive your 2015 tax return transcript, review it carefully to ensure the accuracy of the information. If you identify any discrepancies or errors, it is advisable to contact the IRS to address the issue promptly.

With the completion of this final step, you have successfully requested and received your 2015 tax return transcript. This valuable document can be used for various purposes, such as applying for a mortgage, student financial aid, or resolving tax issues.

Remember to store your tax return transcript in a secure place for future reference. As the IRS keeps copies of tax return information for up to six years, having this document on hand can be beneficial in the future.

Thank you for following our comprehensive guide on how to get a 2015 tax return transcript. We hope this information has been helpful in navigating the process. If you have any further questions or need additional assistance, don’t hesitate to reach out to the IRS or consult a tax professional.

Best of luck with your financial endeavors!

Conclusion

Congratulations on completing our comprehensive guide on how to obtain a 2015 tax return transcript! Throughout this article, we have walked you through the step-by-step process of obtaining this important document. From determining your purpose for obtaining the transcript to choosing the method of request, we have provided you with valuable information and guidance.

Remember, obtaining a tax return transcript for the 2015 tax year can be beneficial for a variety of reasons, including applying for a mortgage, student financial aid, resolving tax issues, or simply keeping personal records. It provides a summary of your tax return information and can serve as proof of your income and financial situation.

Whether you choose to request the transcript online, by mail, or by phone, be sure to gather all the necessary information and follow the outlined steps. Take the time to verify your identity, provide accurate details, and follow up on your request to ensure a smooth process.

Always keep in mind that the IRS processing times may vary, so it is important to be patient and allow for the indicated timeframe. If you have any questions or concerns, contact the IRS for assistance.

We hope that this guide has been informative and helpful in getting your 2015 tax return transcript. Remember to keep the transcript in a secure location for future reference, as the information may be useful for up to six years.

If you have further questions or need additional guidance, consider consulting a tax professional who can provide personalized advice based on your specific situation.

Thank you for reading, and best of luck with your financial endeavors!