Finance

When Can I Get My Tax Return For 2017?

Published: October 29, 2023

Learn when you can expect to receive your tax return for 2017. Stay updated with the latest finance information and get ready for your refund.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Filing your tax return is an essential part of managing your personal finances. Whether you’re an individual or a small business owner, understanding the process and timeline of tax return processing is crucial. Many people eagerly anticipate the refund they’ll receive, while others may be anxious about potential tax liabilities. Regardless, it’s important to know when you can expect to receive your tax return for the 2017 fiscal year.

A tax return is a document that individuals and businesses file with tax authorities, reporting their income, expenses, and other relevant financial information. It is used to calculate the amount of taxes owed or refundable. The tax return process can be complex and time-consuming, involving multiple forms and calculations. However, with proper planning and understanding, you can navigate this process effectively.

The deadline for filing tax returns in the United States is typically April 15th. However, if the 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. It’s important to file your tax return by the deadline to avoid any penalties or late fees. Additionally, if you need more time to prepare your tax return, you can file for an extension, which gives you an additional six months to submit your return.

Once you’ve filed your tax return, the processing time for receiving your refund or determining any tax liabilities can vary. In general, the Internal Revenue Service (IRS) aims to process tax returns within 21 days of receiving them. However, certain factors can influence the processing time, so it’s essential to understand these variables.

What is a tax return?

A tax return is a document that individuals and businesses file with tax authorities to report their income, expenses, and other relevant financial information. It is a summary of your financial activities for a specific period, usually the previous year.

For individuals, a tax return includes details about their income sources, such as wages, investments, and rental properties. It also includes deductions and credits that can reduce the amount of tax owed. These deductions can include expenses related to education, home ownership, or medical expenses, among others. By itemizing these deductions, individuals may be able to reduce their taxable income and potentially receive a larger tax refund.

Businesses, on the other hand, file a tax return to report their income and expenses. They must provide detailed records of their revenue, costs, and deductions to calculate the taxable profit or loss. Depending on the type of business, different forms and schedules may be required to accurately report their financial information.

When filing a tax return, accuracy and completeness are paramount. Even minor errors can result in delays or even penalties from tax authorities. It is important to gather all relevant financial documents, such as W-2s, 1099s, and receipts, to ensure that the tax return reflects an accurate representation of your financial activities.

Furthermore, tax returns are not only used to determine whether you owe taxes or are eligible for a refund. They also serve as a valuable source of information for tax authorities to monitor compliance with tax laws. By comparing the information provided in tax returns with other available data, tax authorities can identify discrepancies and initiate audits or investigations if necessary.

Overall, understanding what a tax return is and why it is important is essential for every taxpayer. It is not only a legal requirement, but it also allows individuals and businesses to optimize their tax situation and ensure compliance with tax regulations.

When is the deadline for filing tax returns?

The deadline for filing tax returns in the United States is typically April 15th of each year. However, this date may vary depending on weekends and holidays. If the 15th falls on a weekend or a holiday, the deadline is extended to the next business day. It’s important to note that the deadline applies to both individual taxpayers and businesses.

For individuals, the tax return deadline is a critical date to keep in mind. Failing to file your tax return by the deadline can result in penalties and interest charges. Additionally, you may miss out on potential tax benefits or opportunities to claim deductions and credits.

If you find it challenging to complete your tax return by the initial deadline, you can file for an extension. The extension request must be submitted by the original deadline to avoid any penalties. By filing for an extension, you will have an additional six months to complete and submit your tax return. However, it’s important to remember that an extension only applies to the filing deadline, not the payment of taxes owed. If you owe taxes, you are still required to estimate and pay the amount due by the original deadline to avoid penalties and interest charges.

Businesses, depending on their entity type, may have different tax return deadlines. For example, sole proprietorships and single-member LLCs typically use Schedule C as part of the individual tax return and have the same April 15th deadline. However, corporations, partnerships, and other business entities may have different due dates depending on their fiscal year. It is crucial for business owners to understand the specific filing deadline for their entity and ensure all necessary forms and schedules are submitted on time.

It’s worth noting that different countries may have different tax return deadlines. Therefore, if you are an individual or business operating outside of the United States, it’s important to consult the tax authorities in your respective country to determine the applicable deadline.

Overall, staying aware of the tax return deadline and meeting the filing requirements on time is essential to ensure compliance with tax laws and avoid unnecessary penalties or interest charges.

How long does it take to process a tax return?

The processing time for a tax return can vary depending on various factors, including the method of filing, the complexity of the return, and the volume of returns being processed by the tax authority.

In general, the Internal Revenue Service (IRS) aims to process electronic tax returns within 21 days of receiving them. This timeframe is applicable for returns filed electronically through tax software, an online platform, or by using the IRS’s e-file system. Electronic filing is the preferred method as it allows for faster and more accurate processing. It also reduces the likelihood of errors or missing information that can delay the processing of the return.

For paper tax returns, the processing time may take longer compared to electronic filing. This is because paper returns require manual entry and review by IRS personnel. The timeline for processing paper returns can range from six to eight weeks from the date they are received by the IRS. However, during peak tax season, the processing time may be longer due to the higher volume of returns being filed.

It’s worth noting that if there are errors or inconsistencies in the tax return, the processing time can be extended. The IRS may need to request additional documentation or clarification, leading to delays in processing the return. In such cases, it is important to respond to any requests from the IRS promptly to avoid further delays in receiving your refund or finalizing any tax liabilities.

In some instances, taxpayers may receive a letter from the IRS requesting further information or notifying them of an audit or adjustment to their return. This can significantly extend the processing time, as it requires additional review and verification by the IRS. It’s important to address any correspondence from the IRS promptly to ensure the timely resolution of any issues.

To expedite the processing of your tax return, it is crucial to submit a complete and accurate return. Double-checking your information, ensuring all necessary forms and schedules are included, and verifying that your calculations are correct can help minimize the likelihood of errors or omissions. Additionally, keeping copies of all documentation and relevant records can be useful in case of any questions or inquiries from the IRS.

Overall, the processing time for a tax return can vary depending on several factors. By filing electronically, providing accurate information, and promptly responding to any requests from the IRS, you can help ensure a faster and smoother processing of your return.

Factors affecting the timing of tax return processing

Several factors can influence the timing of tax return processing. Understanding these factors can help you estimate when you can expect to receive your tax refund or determine any tax liabilities.

1. Filing method: The method you choose to file your tax return can impact the processing time. Electronic filing is generally faster than paper filing. The IRS encourages individuals to file electronically as it allows for quicker and more accurate processing. When you e-file, your return is automatically checked for errors or missing information, reducing the likelihood of processing delays.

2. Return accuracy: Submitting an accurate tax return can help expedite the processing time. Errors or inconsistencies in your return may trigger additional review or requests for clarification from the IRS, delaying the processing. Double-checking your information and verifying the accuracy of your calculations can help minimize errors and potential delays.

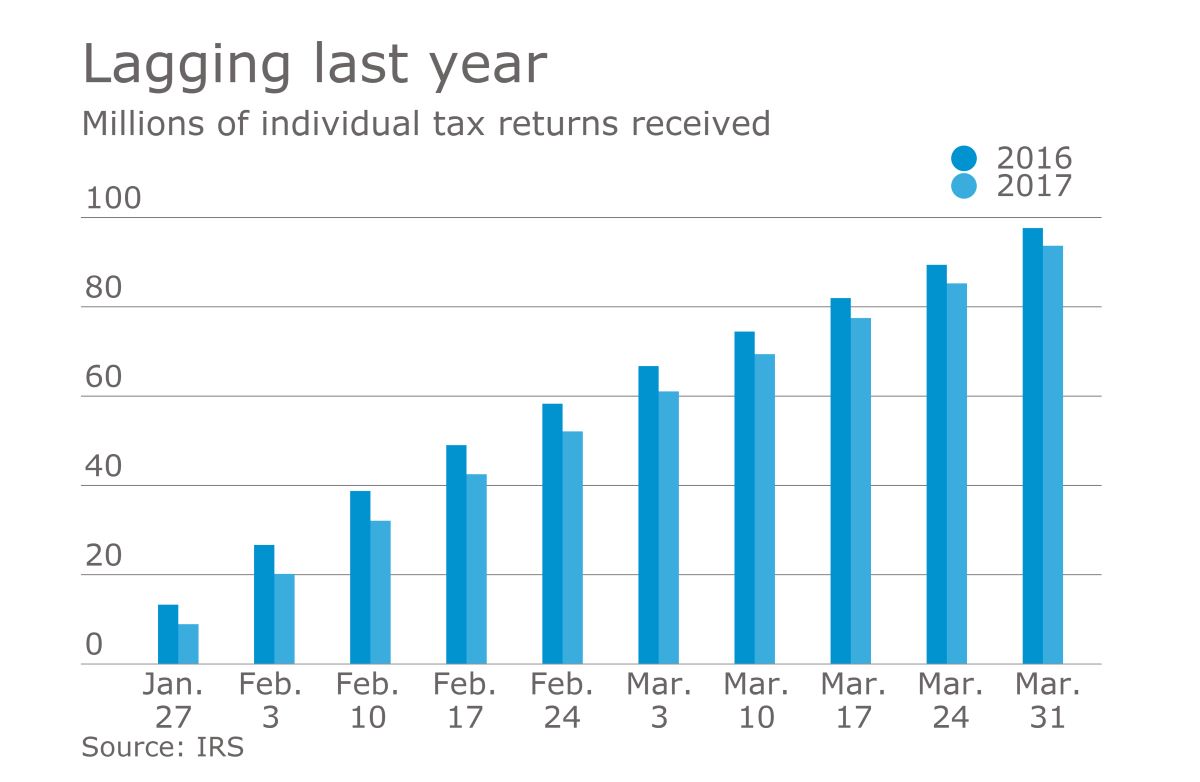

3. Volume of returns: The volume of tax returns being processed can affect the overall processing time. During peak tax season, such as in the months leading up to the deadline, the IRS receives a high volume of returns. This increased workload can lead to longer processing times. Filing your return early in the tax season may result in a faster processing time due to the lower volume of returns being filed.

4. Complexity of the return: The complexity of your tax return can also impact the processing time. More complex returns, such as those involving self-employment income, rental properties, or investment gains and losses, may require additional review and verification. This can result in longer processing times compared to simpler returns with only basic income and deductions.

5. IRS backlog: In some cases, the IRS may have a backlog of returns to process. This can be due to unforeseen circumstances, such as a significant increase in the number of returns or limited resources within the IRS. The backlog can cause processing delays, particularly if your return gets caught in the pile of returns awaiting review.

6. Requested audits or adjustments: If the IRS decides to perform an audit or makes adjustments to your return, the processing time can be significantly extended. Audits require a thorough examination of your financial records, while adjustments entail reviewing and verifying information reported on your return. Responding to any requests or inquiries from the IRS promptly can help minimize the processing time in such cases.

It’s important to note that these factors are not exhaustive and that individual circumstances may vary. While the IRS strives to process returns within a certain timeframe, it’s crucial to be prepared for possible delays. Keeping track of your return and utilizing resources provided by the IRS can help you stay informed about the status of your return and any potential processing issues.

How to file your tax return

Filing your tax return may seem like a daunting task, but with the right information and resources, you can navigate the process smoothly. Here are the steps to file your tax return:

1. Gather your documents: Start by collecting all the necessary documents, including forms such as W-2s (for wage and salary income), 1099s (for other types of income), and receipts for deductions and credits.

2. Choose your filing method: Decide whether you will file electronically or by paper. Electronic filing is recommended as it is faster and more accurate. You can use tax software, an online platform, or the IRS’s Free File system to e-file your return. Alternatively, you can fill out the paper forms and mail them to the appropriate tax authority.

3. Select the appropriate tax forms: Determine the specific tax forms you need to complete based on your filing status, income sources, and deductions. Common forms include Form 1040 (for individuals), Schedule C (for self-employed individuals), and Form 1065 (for partnerships).

4. Fill out the forms: Carefully fill out each form, providing accurate information and ensuring all relevant sections are completed. Take advantage of the instructions provided with each form to ensure you understand the requirements.

5. Calculate your income and deductions: Use the appropriate worksheets and schedules to calculate your income and deductions. This may involve inputting numbers from your W-2 or 1099 forms, and itemizing deductions if necessary.

6. Review and double-check: Once you have completed all the necessary forms and calculations, review your tax return for accuracy. Check for any errors or missing information that could lead to processing delays or potential penalties.

7. Sign and date your return: If filing a paper return, make sure to sign and date the forms where required. If e-filing, follow the electronic signature process provided by the tax software or platform.

8. Submit your return: If filing electronically, follow the instructions provided by the tax software or platform to submit your return electronically. If filing by paper, mail the completed forms to the appropriate tax authority’s address, which can be found on the IRS website or in the instructions for the specific form.

9. Pay any taxes owed: If you owe taxes, make sure to pay the amount due by the filing deadline to avoid penalties and interest. You can pay online, through electronic funds withdrawal, by check, or through other payment methods accepted by the tax authority.

10. Keep copies of your return: Make copies of your completed tax return, including all supporting documents, for your records. These copies will be useful for reference purposes and may be necessary in case of any inquiries or audits by the tax authority.

Remember, it’s always a good idea to consult with a tax professional or use tax software if you’re uncertain about any aspect of filing your tax return. They can provide guidance and ensure that you’re maximizing your deductions and credits while complying with applicable tax laws.

Ways to track the status of your tax return

After filing your tax return, you may be eager to know the status of your refund or whether your return has been processed. Fortunately, there are several ways to track the progress of your tax return. Here are some options:

1. IRS Online Tools: The IRS provides online tools that allow you to check the status of your tax return. The “Where’s My Refund?” tool is particularly useful for tracking your refund. This tool provides real-time information on the status of your refund, including the date it was issued or an estimated date of deposit.

2. Call the IRS: If you prefer to speak with someone directly, you can call the IRS’s toll-free number at 1-800-829-1040. This option allows you to inquire about the status of your return or refund and speak with an IRS representative.

3. Mobile Apps: The IRS also offers mobile apps, such as IRS2Go, that you can download to your smartphone or tablet. These apps provide access to tools and information, including the ability to track the status of your refund.

4. Tax Software Updates: If you filed your tax return using tax software, the software provider may offer updates on the status of your return. Some tax software programs have built-in features that allow you to track the progress of your return and receive notifications when there are updates.

5. Postal Mail Updates: If you filed a paper return by mail, the IRS may send you periodic updates via postal mail. These updates may include requests for additional information or notifications about the processing status of your return.

It’s important to note that the IRS typically processes electronic returns faster than paper returns. Therefore, if you filed your return electronically, you can expect to receive quicker updates on the status of your refund or return processing.

When using any of the tracking methods, have the following information readily available:

- Your Social Security Number or Individual Taxpayer Identification Number

- Your filing status (e.g., Single, Married Filing Jointly, etc.)

- The exact whole dollar amount of your anticipated refund or tax owed

Tracking the status of your tax return can provide you with peace of mind and help you plan your finances accordingly. If you have concerns or questions about the processing of your return, don’t hesitate to reach out to the IRS for assistance.

Tips for filing your tax return efficiently

Filing your tax return can be a complex process, but with some organization and preparation, you can make it more efficient. Here are some tips to help you file your tax return efficiently:

1. Start early: Don’t wait until the last minute to file your tax return. Starting early gives you plenty of time to gather necessary documents, review your financial records, and ensure accuracy. It also helps you avoid the stress and potential errors that can arise from rushing to meet the deadline.

2. Organize your documents: Keep all your tax-related documents in one place throughout the year. This includes forms like W-2s, 1099s, and receipts for deductions or credits. Having organized documentation makes it much easier to locate the necessary information when it’s time to file your return.

3. Use tax software: Consider using tax software to help streamline the tax filing process. These programs guide you through the necessary forms, perform calculations, and check for errors. They can save you time and also help maximize deductions and credits you may be eligible for.

4. Take advantage of e-filing: Electronic filing (e-filing) is faster, more accurate, and more secure than paper filing. E-filing also allows you to receive your refund faster, typically within three weeks. Additionally, the IRS provides free e-file options for those who meet certain income requirements.

5. Double-check your information: Before submitting your tax return, carefully review all the information you have entered. Check for accuracy in spelling, numbers, and calculations. Even small errors can lead to processing delays or potential audits. Taking the time to double-check your return can save you from future headaches.

6. Be aware of deductions and credits: Educate yourself on available deductions and credits that you may qualify for. This can help reduce your tax liability or increase your refund. Some common deductions and credits include education expenses, homeownership costs, and child or dependent care expenses. Research and consult a tax professional if needed to ensure you are claiming all eligible deductions and credits.

7. Save a copy of your return: After filing your tax return, make sure to save a copy for your records. Having a copy can be helpful for future reference, applying for loans, or in case of any inquiries from the IRS. Saving an electronic copy is also a good idea, as it ensures easy access and protects against loss or damage.

8. Consider e-payment options: If you owe taxes, consider electronic payment options for a hassle-free process. Electronic payment methods, such as direct debit or credit card payments, are secure and offer convenience. Just make sure to schedule the payment before the tax deadline to avoid any late payment penalties.

9. Seek professional assistance if needed: If you have complex financial situations or are unsure about any aspect of your tax return, seeking professional assistance is a wise choice. Enlisting the help of a qualified tax professional can ensure accurate filings and potentially uncover additional tax-saving opportunities.

By following these tips, you can streamline the tax filing process and file your return efficiently. Remember, proper organization, accuracy, and early preparation are key to a successful tax filing experience.

Conclusion

Filing your tax return is an important task that requires careful attention to detail and adherence to tax laws. By understanding the process and following the necessary steps, you can ensure a smooth and efficient filing experience.

In this article, we discussed what a tax return is and its significance in managing your personal or business finances. We reviewed the deadline for filing tax returns and the option to file for an extension if needed. We also explored the factors that can impact the timing of tax return processing, such as the filing method, return accuracy, volume of returns, complexity, and potential audits or adjustments.

To help you file your tax return efficiently, we provided useful tips, including starting early, organizing your documents, utilizing tax software or e-filing, double-checking your information, and being aware of deductions and credits. These strategies can help you save time, reduce errors, and maximize your tax benefits.

Additionally, we discussed ways to track the status of your tax return, such as using IRS online tools, calling the IRS, utilizing mobile apps, and staying updated through postal mail or tax software updates. These options provide you with real-time updates on the progress of your return and the status of your refund.

In conclusion, filing your tax return should not be a stressful or overwhelming process. By following the guidance provided in this article and staying informed about tax laws and regulations, you can successfully file your tax return while minimizing errors and optimizing your tax situation.

Remember, if you have specific questions or concerns about your tax return, it’s always recommended to consult with a tax professional or seek guidance from the appropriate tax authority. Their expertise and support can ensure that you are meeting all requirements and making the most of your tax return.