Finance

What Is The Balance Due On A Tax Return?

Published: October 28, 2023

Discover what a balance due on a tax return is and how it impacts your finances. Get insights on handling tax debts and strategies to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to filing your taxes, one of the crucial aspects to consider is the balance due on your tax return. The balance due represents the amount of money you owe to the government based on your income, deductions, and credits for a particular tax year.

Understanding the concept of the balance due is essential for all taxpayers. It allows you to properly plan your finances and ensure you meet your tax obligations. In this article, we will delve deeper into the balance due on a tax return, explore the factors that affect it, and discuss the implications of not paying it.

Whether you are a first-time taxpayer or someone with years of experience, it is important to stay informed about the balance due on your tax return. By having a clear understanding of this concept, you can take the necessary steps to manage your tax liabilities effectively.

Let’s dive into the details and equip ourselves with the knowledge needed to navigate the world of taxes with confidence.

Understanding the Balance Due on a Tax Return

When you file your tax return, the balance due refers to the amount of money you still owe to the government after taking into account your income, deductions, and credits. Essentially, it is the difference between your total tax liability and the amount you have already paid through withholding or estimated tax payments.

Several factors can contribute to the balance due on your tax return. These include:

- Income: The more income you earn, the higher your tax liability may be, resulting in a larger balance due.

- Deductions and Credits: Deductions and credits can help reduce your taxable income and overall tax liability. If you have fewer deductions or credits, it may increase the balance due on your tax return.

- Withholding and Estimated Tax Payments: If you did not have enough taxes withheld from your paychecks throughout the year or failed to make sufficient estimated tax payments, it can lead to a balance due on your tax return.

- Penalties and Interest: If you did not comply with tax laws or filed your return late, penalties and interest may be added to your balance due.

It’s important to note that a balance due is not inherently a negative thing. It simply means that you underestimated your tax liability or did not pay enough throughout the year. You are still required to pay the amount owed to the government to fulfill your tax obligations.

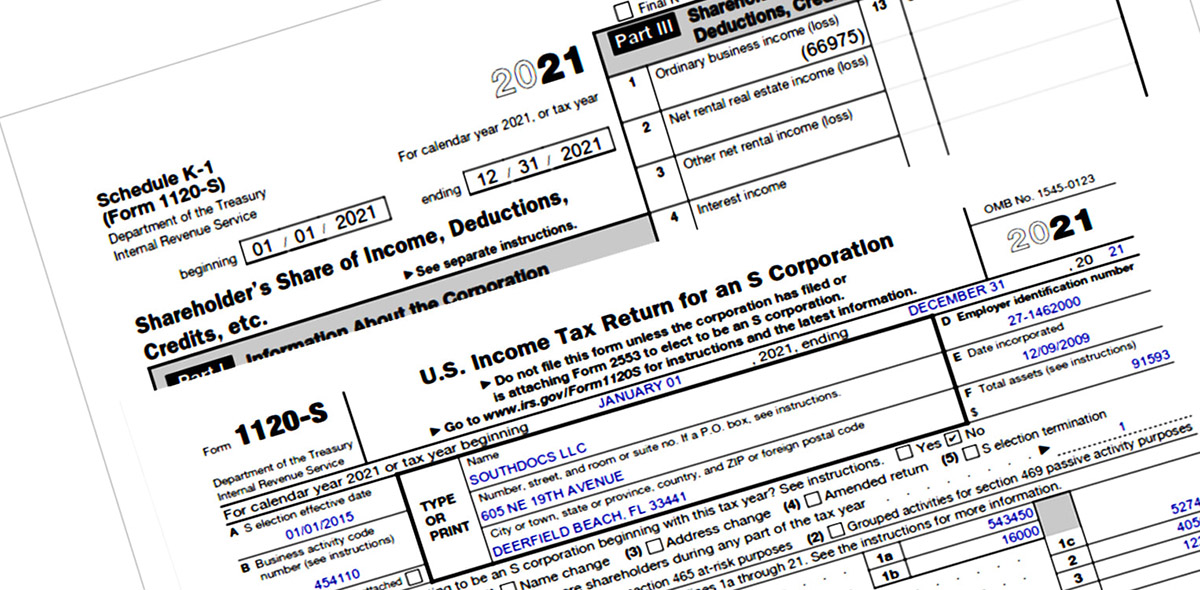

To accurately determine the balance due, you need to carefully calculate your overall tax liability based on the applicable tax rates and rules set by the Internal Revenue Service (IRS).

Now that we have a basic understanding of the balance due on a tax return, let’s explore how it is calculated.

Factors Affecting the Balance Due

Several factors can influence the balance due on your tax return. Understanding these factors is crucial in accurately estimating and managing your tax liability. Here are some key elements that can impact your balance due:

- Income: The amount of income you earn plays a significant role in determining your tax liability. Generally, the more income you make, the higher your tax bracket and the greater your tax liability will be. Different types of income, such as wages, self-employment income, investments, and rental income, are subject to different tax rates and rules.

- Deductions: Deductions are expenses that you can subtract from your income, reducing your taxable income. Common deductions include mortgage interest, student loan interest, state and local taxes paid, and charitable contributions. The higher your deductions, the lower your taxable income, and potentially, your balance due.

- Credits: Tax credits directly reduce the amount of tax you owe, dollar for dollar. Examples of tax credits include the child tax credit, earned income tax credit, and education credits. If you qualify for credits, they can significantly reduce your balance due or even generate a refund.

- Withholding and Estimated Payments: If you are an employee, your employer withholds taxes from your paycheck based on the information you provide on your W-4 form. If too little is withheld, you may owe a balance when you file your return. Similarly, if you are self-employed, you need to make estimated tax payments throughout the year to cover your tax liability. Failing to make accurate or timely payments can result in a balance due.

- Life Events: Major life events such as getting married, having children, buying a home, or retiring can have a significant impact on your taxes. Changes in your marital status, dependents, homeownership, or retirement income can influence your tax liability and potentially affect your balance due.

It is important to keep track of these factors and their impact on your tax situation. Regularly reviewing your income, deductions, and credits can help you estimate your tax liability more accurately and avoid surprises when it comes time to file your return.

Now that we understand the factors affecting the balance due, let’s explore how to calculate it.

Calculating the Balance Due

Calculating the balance due on your tax return requires accurately determining your total tax liability and comparing it to the amount you have already paid through withholding or estimated tax payments. Here’s a step-by-step guide to calculating the balance due:

- Calculate your total tax liability: Start by determining your taxable income based on the applicable tax rates for your filing status. Subtract any deductions and claim any eligible tax credits. The resulting amount is your total tax liability for the year.

- Summarize your payments and withholdings: Gather all relevant information regarding the taxes you have already paid throughout the year. This includes any tax withholding from your paychecks (as shown on your W-2 form) and any estimated tax payments you made during the year.

- Compare your total tax liability with your payments: Subtract the total payments and withholdings from your total tax liability. If the result is a positive number, it indicates that you have overpaid your taxes, and you may be eligible for a refund. If the result is negative, it means you still owe the government, resulting in a balance due on your tax return.

- Consider penalties and interest: If you didn’t pay enough taxes throughout the year or failed to file your return on time, the IRS may assess penalties and interest on the balance due. It’s essential to factor in these additional charges when calculating your overall tax liability.

- Review and file your tax return: Once you have determined your balance due, complete your tax return by accurately reporting your income, deductions, and credits. Include any payments already made, and ensure the balance due is reflected correctly. File your tax return by the due date to avoid further penalties and interest.

It’s important to note that the IRS provides various tools and resources, such as tax calculators and tax software, to help you calculate your tax liability and determine any balance due. Utilizing these resources can simplify the process and ensure accuracy in your calculations.

Now that we understand how to calculate the balance due, let’s explore the options available for paying it.

Options for Paying the Balance Due

Once you have determined that you owe a balance due on your tax return, it’s important to explore the various options available for making your payment. Here are some common methods to consider:

- Electronic Funds Transfer (EFT): The Electronic Federal Tax Payment System (EFTPS) allows you to make secure electronic payments directly from your bank account. You can schedule one-time or recurring payments, providing flexibility in managing your tax payment obligations.

- Credit or Debit Card: The IRS accepts credit and debit card payments through authorized payment processors. While convenience fees may apply, this option allows for immediate payment and eliminates the need for mailing a check or money order.

- Electronic Payment Options: Some tax software or online tax filing services offer integrated electronic payment options. These platforms allow you to file your return and make your payment in one convenient transaction.

- Check or Money Order: If you prefer traditional methods, you can mail a check or money order payable to the “United States Treasury” along with a payment voucher. The voucher includes your taxpayer information and helps ensure your payment is applied correctly.

- Installment Agreement: If you are unable to pay the full balance due immediately, you may qualify for an installment agreement. This arrangement allows you to make monthly payments over a specified period of time until your tax liability is fully paid. Keep in mind that penalties and interest may still apply.

- Offer in Compromise: In certain situations, the IRS may be willing to accept an offer in compromise to settle your tax debt for less than the full amount owed. This option is typically available to taxpayers who are unable to pay their tax liability in full and can demonstrate financial hardship.

When making your payment, ensure that you include the appropriate tax year and your taxpayer identification number to ensure proper allocation of funds. Additionally, it’s essential to submit your payment by the tax filing deadline to avoid penalties and interest.

Remember, the IRS is committed to assisting taxpayers in fulfilling their tax obligations. If you are unable to pay your balance due or facing financial hardship, it’s crucial to reach out to the IRS to discuss your options and potentially seek assistance.

Understanding the available payment options and choosing the one that best suits your needs can help you meet your tax obligations and avoid any further consequences.

Now that we understand the payment options, let’s explore the potential consequences of not paying the balance due on time.

Consequences of Not Paying the Balance Due

Failing to pay the balance due on your tax return can have various consequences. It’s important to understand the potential repercussions to avoid unnecessary penalties and interest. Here are some of the consequences of not paying the balance due on time:

- Penalties: The IRS imposes penalties for late payment, typically calculated as a percentage of the unpaid balance. The penalty rate can vary depending on the length of the delay and may increase over time.

- Interest Charges: In addition to penalties, the IRS also charges interest on any unpaid taxes. The interest is typically compounded daily and accrues until the balance is fully paid.

- Damage to Credit Score: Unpaid taxes and the resulting tax liens can affect your credit score. This can make it more challenging to obtain loans, mortgages, or credit cards in the future.

- Legal Action: In extreme cases of non-payment or deliberate tax evasion, the IRS may pursue legal action, including seizing assets, placing liens on property, or garnishing wages to collect the balance due.

- Loss of Refunds: If you fail to pay the balance due, any future tax refunds you are owed may be applied to the outstanding debt. This can reduce or eliminate any potential refunds you might have received.

- Negative Impact on Future Tax Compliance: Not paying your taxes can raise red flags with the IRS and can lead to increased scrutiny on your future tax returns. This can result in audits and additional penalties if discrepancies or underreporting are discovered.

It’s important to promptly address the balance due on your tax return to avoid these consequences. If you are unable to pay the full amount, consider contacting the IRS to explore payment options, such as installment agreements or offers in compromise.

By proactively addressing your tax liabilities, you can mitigate the potential negative impacts and ensure compliance with tax laws.

Now that we understand the consequences of not paying the balance due, let’s wrap up our discussion.

Conclusion

Filing your taxes and understanding the balance due on your tax return is an essential part of fulfilling your financial responsibilities as a taxpayer. By grasping the concept of the balance due and the factors that influence it, you can make informed decisions and effectively manage your tax liabilities.

In this article, we explored the importance of understanding the balance due on a tax return and how it is calculated. We discussed the various factors that can affect the balance due, such as income, deductions, credits, and payment amounts. Moreover, we explored the different options available for paying the balance due, ranging from electronic methods to installment agreements.

We also highlighted the potential consequences of not paying the balance due on time, including penalties, interest charges, and the negative impact on credit scores. It’s crucial to address any outstanding tax liabilities promptly to avoid these consequences and maintain a positive financial standing.

By staying informed about your tax obligations, planning ahead, and seeking assistance when needed, you can effectively manage the balance due on your tax return and maintain compliance with tax laws.

Remember, if you have any questions or are facing challenges in paying your balance due, consult with a tax professional or reach out to the IRS for guidance. Taking proactive steps will help ensure a smooth tax filing process and financial well-being.

Now that you have a comprehensive understanding of the balance due on a tax return, you can confidently navigate the world of taxes and fulfill your tax obligations with ease.