Finance

What To Do For End Of Year Tax Planning

Published: January 20, 2024

Maximize your financial savings before the year ends by implementing smart tax planning strategies. Learn what you can do to optimize your finances and minimize tax liabilities with our expert guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of End of Year Tax Planning

- Evaluating Your Financial Situation

- Reviewing Deductions and Credits

- Maximizing Retirement Contributions

- Managing Capital Gains and Losses

- Taking Advantage of Tax-Efficient Investments

- Utilizing Charitable Contributions

- Communicating with a Tax Professional

- Conclusion

Introduction

As the year comes to a close, it’s time to start thinking about your finances and how you can optimize your tax situation. End of year tax planning is a crucial part of effective financial management, helping you minimize your tax liability and potentially save money. By taking proactive steps before the year-end, you can make strategic decisions that can have a positive impact on your finances.

Tax laws and regulations are constantly changing, and it’s essential to stay informed about the latest updates that can affect your tax planning strategy. Engaging in effective tax planning can help you identify opportunities to reduce your tax burden, maximize deductions and credits, and optimize your overall financial situation.

In this comprehensive guide, we will explore the key steps you can take for end of year tax planning. From evaluating your financial situation to understanding deductions and credits, maximizing retirement contributions, managing capital gains and losses, utilizing tax-efficient investments, and making charitable contributions, we will provide you with insightful tips and strategies to optimize your financial situation.

While it’s important to consider your unique circumstances and consult with a tax professional for personalized advice, this guide will equip you with the knowledge and understanding to make informed decisions for your financial future.

So, let’s dive in and discover how you can make the most of end of year tax planning to ensure a solid financial foundation and potentially reduce your tax liability.

Understanding the Importance of End of Year Tax Planning

End of year tax planning is an essential aspect of financial management that can have a significant impact on your overall financial health. It involves evaluating your financial situation, taking advantage of deductions and credits, maximizing retirement contributions, managing capital gains and losses, utilizing tax-efficient investments, and making charitable contributions, all with the goal of optimizing your tax liability.

One of the key reasons why end of year tax planning is crucial is that it allows you to minimize your tax liability and potentially save money. By strategically utilizing deductions and credits, you can reduce your taxable income and lower the amount you owe in taxes. This can provide you with more financial flexibility and resources to allocate towards other financial goals, such as saving for retirement or investing.

Additionally, end of year tax planning ensures that you are in compliance with tax laws and regulations. By staying up to date with the latest tax laws, you can avoid penalties and potential audits by the tax authorities. It also allows you to take advantage of any tax law changes or new opportunities that may benefit your financial situation.

Another important aspect of end of year tax planning is the ability to assess your financial situation and make adjustments to meet your long-term financial goals. By reviewing your income, expenses, and investments, you can identify areas that may need improvement or adjustment. This evaluation process can help you make informed decisions on how to allocate your resources and optimize your financial strategy.

Furthermore, end of year tax planning provides an opportunity to review your retirement savings strategy. By maximizing your retirement contributions by the year-end, you can take advantage of tax-deferred growth and potentially reduce your current taxable income. This can have a significant impact on your long-term financial security and ensure a comfortable retirement.

Overall, end of year tax planning is not just about minimizing your tax liability, but also about evaluating your financial situation, adjusting your strategy, and working towards your long-term financial goals. By taking a proactive approach and engaging in effective tax planning, you can make the most of your financial resources and set yourself up for financial success.

Evaluating Your Financial Situation

Before diving into end of year tax planning, it’s important to evaluate your current financial situation. This assessment will provide you with a clear understanding of your income, expenses, assets, and liabilities, enabling you to make informed decisions regarding your tax planning strategy.

Start by reviewing your income sources, such as employment wages, dividends, rental income, or any other income streams. Take note of any changes in your income compared to previous years as this will impact your tax liability. Additionally, analyze your expenses to identify areas where you can potentially reduce costs or increase deductions.

Next, evaluate your assets and investments. Consider the performance of your investment portfolio and how it may impact your capital gains or losses for the year. This assessment will help you make tax-efficient decisions when it comes to managing your investments.

In addition to evaluating your financials, consider any major life events that have occurred throughout the year. Did you get married? Have a child? Start a new job? These events can affect your tax situation and may make you eligible for different tax deductions or credits.

Furthermore, if you are a business owner or self-employed, evaluate your business performance for the year. Review your financial statements, analyze your business expenses, and consider any changes you might want to make to optimize your tax liability. Consult with a tax professional to explore potential deductions or credits that may be available to you.

In summary, evaluating your financial situation is a crucial step in end of year tax planning. By understanding your income, expenses, assets, liabilities, and any significant life events or business activities, you can make informed decisions on how to approach your tax planning strategy.

Reviewing Deductions and Credits

When it comes to end of year tax planning, reviewing deductions and credits is essential for optimizing your tax liability. Deductions and credits can help reduce your taxable income and potentially increase your tax refund or decrease the amount you owe in taxes. Here are some key deductions and credits to consider:

- Standard Deduction vs. Itemized Deductions: Determine whether you should take the standard deduction or itemize deductions. The standard deduction is a set amount determined by the IRS and is based on your filing status. Itemizing deductions, on the other hand, allows you to claim specific expenses such as mortgage interest, medical expenses, state and local taxes, and charitable contributions. Compare both options to see which one gives you the greatest tax benefit.

- Mortgage Interest Deduction: If you own a home and have a mortgage, you may be eligible to deduct the interest paid on that mortgage. Review your mortgage interest statements to ensure you are taking full advantage of this deduction.

- State and Local Taxes: Review your state and local tax payments, including income taxes and property taxes. Consider prepaying these taxes before the end of the year to increase your deductions for the current year.

- Charitable Contributions: If you made charitable donations throughout the year, gather the supporting documentation for those contributions. Make sure you have receipts or acknowledgement letters from the charitable organizations to claim these deductions.

- Education Expenses: If you or your dependents are pursuing higher education, review the available education tax credits or deductions. These may include the American Opportunity Credit or Lifetime Learning Credit, as well as deductions for student loan interest.

- Healthcare Expenses: Review your medical expenses and see if you qualify for the medical expense deduction. This deduction allows you to deduct qualified medical expenses that exceed a certain percentage of your adjusted gross income.

- Child and Dependent Care Credit: If you have childcare expenses or expenses for caring for a dependent, review the eligibility requirements for the Child and Dependent Care Credit. This credit can help offset a portion of your childcare expenses.

It’s vital to thoroughly review your deductions and credits to ensure you are taking full advantage of all available tax breaks. Keep in mind that tax laws and regulations may change, so staying informed about current deductions and credits is crucial. Consulting with a tax professional can provide valuable guidance and help you navigate through the complexities of tax deductions and credits.

Maximizing Retirement Contributions

One key aspect of end of year tax planning is maximizing your retirement contributions. Contributing to retirement accounts not only helps secure your financial future but also provides tax benefits that can reduce your current taxable income. Consider the following strategies to maximize your retirement contributions:

- 401(k) or Similar Employer-Sponsored Plans: Review your employer’s retirement plan, such as a 401(k), 403(b), or 457 plan. Determine the maximum contribution limit for the year and aim to contribute as much as possible. If you haven’t reached the maximum, consider increasing your contributions, especially if your employer offers matching contributions.

- IRA Contributions: Evaluate your eligibility to contribute to an Individual Retirement Account (IRA). For the tax year, the contribution limit is set at $6,000 (or $7,000 if you are 50 years old or older). Consider making contributions to a Traditional IRA or Roth IRA based on your tax situation and long-term financial goals.

- Spousal IRA Contributions: If you are married and your spouse does not work or has limited income, consider making contributions to a Spousal IRA on their behalf. This can help boost your overall retirement savings and potentially provide tax benefits.

- Catch-Up Contributions: If you are 50 years old or older, take advantage of catch-up contributions. This allows you to contribute additional amounts to your retirement accounts beyond the regular annual limits. For 2021, the catch-up contribution limit for 401(k) plans is $6,500, and for IRAs, it is $1,000.

- Solo 401(k) for Self-Employed: If you are self-employed or own a small business, consider setting up a Solo 401(k) plan. This retirement account allows you to contribute both as an employer and employee, providing the opportunity for potentially higher contribution limits.

- Review Employer Matching Contributions: If your employer offers a matching contribution to your retirement plan, make sure you are contributing enough to receive the full match. This is essentially free money and can significantly boost your retirement savings.

By maximizing your retirement contributions, you not only save for your future but also benefit from immediate tax advantages. Contributions to traditional retirement accounts are typically tax-deductible in the year they are made, reducing your current taxable income. However, contributions to Roth retirement accounts are made with after-tax dollars, but qualified withdrawals are tax-free in retirement.

Remember, retirement contributions have annual limits, and missing out on maximizing them may result in lost opportunities for tax savings and compound interest growth. Consult with a financial advisor or tax professional to determine the best retirement contribution strategy based on your specific financial circumstances and long-term goals.

Managing Capital Gains and Losses

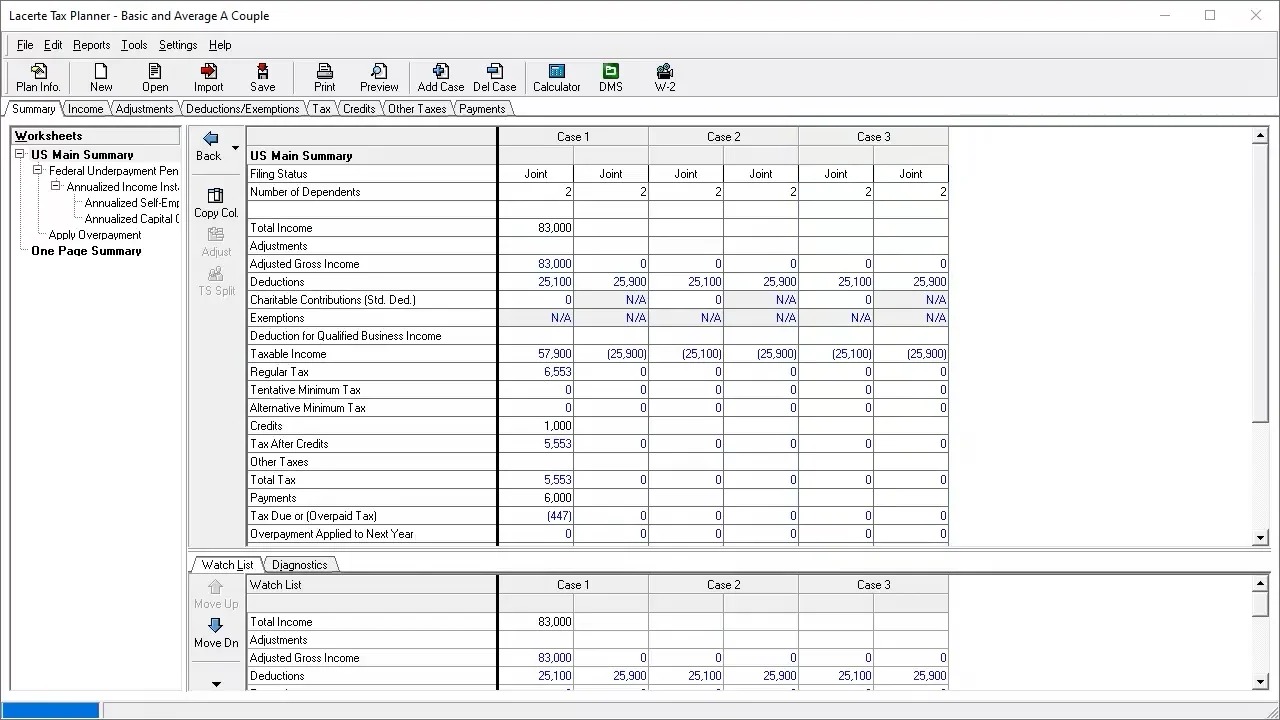

When it comes to end-of-year tax planning, managing capital gains and losses is a crucial aspect that can help minimize your tax liability. Capital gains occur when you sell an asset for a profit, while capital losses happen when you sell an asset for less than its purchase price. Here are some strategies to consider for managing capital gains and losses:

- Review Your Investment Portfolio: Evaluate your investment holdings and gains/losses realized throughout the year. Identify any assets that have appreciated significantly and consider selling them to lock in capital gains and potentially offset them with capital losses.

- Harvest Capital Losses: If you have investments with capital losses, you may consider selling them before the end of the year to utilize these losses to offset your capital gains. This strategy, known as tax-loss harvesting, can help reduce your taxable income and potentially lower your overall tax liability.

- Be Mindful of the Wash-Sale Rule: The wash-sale rule prohibits claiming a capital loss if you purchase a substantially identical asset within 30 days before or after the sale. Therefore, if you plan to sell an asset for a loss and repurchase it, ensure you wait at least 30 days to avoid disqualifying the loss for tax purposes.

- Consider Holding Investments for the Long Term: By holding investments for more than one year, you may qualify for long-term capital gains tax rates, which are usually lower than short-term capital gains rates. Consider the potential tax advantages of holding onto your investments if they have appreciated significantly.

- Consult with a Tax Professional: Managing capital gains and losses can be complex, especially if you have a diversified investment portfolio. Seeking guidance from a tax professional can help you navigate the tax implications of your specific investment situation.

It is important to keep accurate records of your investment transactions throughout the year for tax purposes. This includes the purchase and sale dates, cost basis, and any capital gains or losses realized. This information will be crucial when filing your tax return and reporting your capital gains and losses to the IRS.

Remember, effective management of capital gains and losses can help reduce your tax liability and potentially increase your after-tax returns from investments. By strategically planning your investment sales, you can take advantage of tax benefits while maintaining a diversified and profitable investment portfolio.

Taking Advantage of Tax-Efficient Investments

When engaging in end-of-year tax planning, it’s important to consider tax-efficient investments as part of your overall strategy. These investments are designed to minimize your tax liability by taking advantage of specific tax benefits. Here are some tax-efficient investment options to consider:

- Index Funds and ETFs: Index funds and exchange-traded funds (ETFs) are popular investment vehicles that aim to replicate the performance of a specific market index. They are known for their tax efficiency due to their low turnover and minimal capital gains distributions. By investing in these funds, you can potentially reduce your tax liability compared to actively managed funds.

- Tax-Advantaged Accounts: Take advantage of tax-advantaged accounts such as Individual Retirement Accounts (IRAs), Roth IRAs, and Health Savings Accounts (HSAs). Contributions to these accounts may be tax-deductible (Traditional IRA and HSA) or tax-free (Roth IRA), and withdrawals may have certain tax advantages. Maximize your contributions to these accounts before the year-end to benefit from their tax-efficient nature.

- Municipal Bonds: Municipal bonds, also known as “munis,” are debt securities issued by state and local governments. Interest income generated by these bonds is typically exempt from federal income tax and may also be exempt from state and local taxes if they are purchased from your resident state. Consider including municipal bonds in your investment portfolio to potentially earn tax-free income.

- Tax-Managed Funds: Tax-managed funds are mutual funds or ETFs that employ specific strategies to minimize taxable distributions. These funds aim to reduce taxable events, such as capital gains and dividends, by actively managing their portfolios. Investing in tax-managed funds can help you potentially reduce your tax liability while still benefiting from market returns.

- Direct Real Estate Investment: Real estate investments can offer various tax advantages. Rental income from real estate properties may be subject to favorable tax treatment, and you may be able to deduct expenses such as property taxes, mortgage interest, and depreciation. Consult with a tax professional to ensure you understand the tax implications of real estate investments and take advantage of available tax benefits.

It’s important to note that tax-efficient investments should align with your overall investment goals and risk tolerance. While tax advantages are desirable, it’s crucial to evaluate the potential returns and risks associated with these investments and consider them as part of a diversified portfolio.

Consulting with a financial advisor or tax professional can provide valuable insights and help you determine the most suitable tax-efficient investment options based on your financial situation and goals.

Utilizing Charitable Contributions

As part of your end-of-year tax planning, utilizing charitable contributions can not only make a positive impact in your community but also provide valuable tax benefits. Charitable contributions allow you to support causes you care about while potentially reducing your tax liability. Here’s how you can make the most of charitable contributions:

- Donate Cash: Cash donations to qualified charitable organizations are generally tax-deductible. Keep a record of your donations, such as receipts or acknowledgement letters, to substantiate your deductions when filing your tax return.

- Donate Appreciated Assets: Instead of donating cash, consider donating appreciated assets such as stocks, bonds, or mutual funds. By donating these assets directly to a charity, you may be eligible to claim a deduction for the fair market value of the asset, potentially avoiding capital gains tax on the appreciation.

- Qualified Charitable Distributions (QCDs): If you are 70 ½ or older and have an individual retirement account (IRA), you can make qualified charitable distributions directly from your IRA to a qualified charity. QCDs allow you to fulfill your required minimum distribution (RMD) while potentially excluding the distributed amount from your taxable income.

- Donor-Advised Funds: Consider setting up a donor-advised fund (DAF). A DAF allows you to make a charitable contribution to the fund and receive an immediate tax deduction. You can then recommend grants to specific charities over time, maximizing the tax benefits while giving carefully considered donations.

- Volunteer Your Time: While you cannot deduct the value of your time, you can deduct certain out-of-pocket expenses incurred while volunteering. This can include costs of travel, lodging, or supplies directly related to your volunteer work.

When making charitable contributions, ensure that you donate to qualified organizations recognized by the Internal Revenue Service (IRS). Not all organizations are eligible for tax deductions, so it’s important to verify their tax-exempt status before making a contribution.

Keep in mind that there are specific rules and limitations when it comes to deducting charitable contributions, depending on your income and the type of donation. Consulting with a tax professional can provide clarity and guidance on maximizing your tax benefits while ensuring compliance with tax regulations.

By strategically utilizing charitable contributions, you can give back to the community, support causes close to your heart, and potentially reduce your tax liability at the same time. Make sure to keep proper documentation and consult with a tax professional to optimize the tax benefits of your charitable giving.

Communicating with a Tax Professional

When it comes to end-of-year tax planning, one of the most valuable steps you can take is to communicate with a tax professional. Tax laws and regulations can be complex and ever-changing, making it essential to seek guidance from a qualified professional who can provide personalized advice based on your unique financial situation. Here’s why communicating with a tax professional is crucial:

- Expertise and Knowledge: Tax professionals have a deep understanding of the tax code and stay up to date with the latest changes in tax laws and regulations. They can provide valuable insights and help you navigate through any complexities related to your specific tax situation.

- Individualized Advice: Every individual’s financial circumstances are unique. A tax professional can analyze your financial situation and provide customized advice tailored to your needs. They can identify tax-saving opportunities, recommend deductions and credits that apply to your situation, and help optimize your tax liability.

- Tax Planning Strategies: A tax professional can offer proactive tax planning strategies that go beyond simply filling out your tax return. They can help you identify potential savings opportunities, guide you on the timing of deductions and contributions, and assist in long-term tax planning to ensure you are well-prepared for future tax obligations.

- Avoiding Mistakes and Audits: Filing your taxes can be complex, and making errors or overlooking important details can lead to future problems such as audits or penalties. By working with a tax professional, you can reduce the risk of making mistakes and ensure that your tax return is accurate and compliant with tax laws.

- Maximizing Refunds: Tax professionals have in-depth knowledge of tax deductions, credits, and exemptions that may be available to you. They can help identify opportunities to maximize your refunds and minimize your tax liability, potentially saving you money in the long run.

When communicating with a tax professional, it’s essential to provide them with accurate and complete information about your financial situation. Be prepared to share details about your income, expenses, investments, and any major life events that may impact your taxes.

Consider establishing an ongoing relationship with a tax professional to benefit from their guidance throughout the year. By staying in touch and seeking advice regularly, you can stay proactive with your tax planning and make informed decisions that align with your financial goals.

Remember, while a tax professional can provide guidance and expertise, ultimately, you are responsible for the accuracy of your tax return. Stay engaged in the process, review your return before submitting, and ask questions if there’s anything you don’t understand.

By working closely with a tax professional, you can feel confident that you are maximizing your tax benefits while remaining compliant with the ever-changing tax laws and regulations.

Conclusion

End of year tax planning is a critical component of effective financial management. By taking proactive steps to evaluate your financial situation, review deductions and credits, maximize retirement contributions, manage capital gains and losses, utilize tax-efficient investments, and make charitable contributions, you can optimize your tax liability and potentially save money.

Understanding the importance of end of year tax planning allows you to make informed decisions that align with your financial goals and ensure compliance with tax laws. It’s essential to stay informed about the latest tax regulations and seek guidance from a tax professional who can provide personalized advice based on your unique circumstances.

By carefully reviewing deductions and credits, you can take advantage of available tax breaks and maximize your tax savings. Maximizing retirement contributions allows you to secure your financial future while benefiting from immediate tax advantages. Managing capital gains and losses helps reduce your tax liability and maintain a tax-efficient investment portfolio.

Utilizing charitable contributions not only makes a positive impact in your community but also provides valuable tax benefits. And, of course, communication with a tax professional is crucial in ensuring you are making the most informed and strategic decisions to optimize your tax planning strategy.

As the year comes to a close, take the time to assess your financial situation, review your tax planning strategies, and seek professional advice where necessary. With the right approach and guidance, you can navigate the complexities of the tax system and set yourself up for a solid financial future.

Remember, tax planning is a continuous process, and the strategies discussed in this guide are intended as a starting point. Every individual’s financial situation is unique, so it’s important to tailor your tax planning approach to your specific needs. Stay proactive, seek professional advice, and make informed decisions to maximize your tax benefits and achieve your long-term financial goals.