Finance

How To Hide Money From The IRS

Published: October 31, 2023

Learn effective strategies on how to protect your finances and keep your money hidden from the IRS. Expert tips and advice on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Importance of Hiding Money from the IRS

- Legal Methods to Conceal Income

- Establishing Offshore Accounts

- Using Trusts and Foundations

- Utilizing Cryptocurrencies

- Maintaining Privacy through Cash Transactions

- Investing in Real Estate

- Establishing a Business Entity

- Gifting and Estate Planning Strategies

- Remaining Vigilant and Adapting to Changing Laws

- Conclusion

Introduction

Welcome to the world of finance, where the management of wealth and the minimization of taxes go hand in hand. While tax evasion is illegal and can lead to severe consequences, finding legal ways to protect your hard-earned money from the prying eyes of the IRS is a common practice among individuals and businesses alike. This article will guide you through the various methods and strategies to hide your money from the IRS legally.

Before we dive into the world of hiding money, it’s crucial to establish the importance of tax planning. As a responsible citizen, you have the right to minimize your tax liability by taking advantage of the available legal strategies. Tax planning allows you to optimize your financial situation, protect your assets, and ensure financial security for your future.

By exploring legal methods to conceal income, you can ensure that your wealth remains protected while complying with tax laws. These methods include establishing offshore accounts, using trusts and foundations, utilizing cryptocurrencies, maintaining privacy through cash transactions, investing in real estate, establishing a business entity, and utilizing gifting and estate planning strategies. However, it’s important to note that the effectiveness of these strategies may depend on your individual circumstances and the ever-changing tax laws.

Throughout this article, we will provide you with valuable insights into each of these methods, their benefits, limitations, and the potential risks involved. Please keep in mind that while these strategies may be legal, consulting with a financial advisor or tax specialist is highly recommended to ensure compliance with the law and maximize the benefits.

Now, let’s dive deeper into each of the methods and discover how you can protect your wealth while staying within the boundaries of the law.

Understanding the Importance of Hiding Money from the IRS

While the IRS is responsible for collecting taxes and ensuring compliance with the tax laws in the United States, it’s only natural for individuals and businesses to seek legal ways to minimize their tax liability and protect their hard-earned money. The importance of hiding money from the IRS lies in the need to preserve wealth, maintain financial privacy, and ensure a secure financial future.

Preserving wealth is a top priority for many individuals. By strategically planning their finances and minimizing tax obligations, they can retain more of their income and assets. This allows them to invest in their future, meet their financial goals, and provide financial security for their loved ones.

Financial privacy is another critical aspect to consider. While individuals have a responsibility to report their income and pay taxes, they also value their privacy rights. Hiding money from the IRS legally ensures that personal financial information remains confidential. By employing legal strategies to protect wealth, individuals can safeguard their financial data from unnecessary disclosure.

Additionally, hiding money from the IRS can help individuals and businesses navigate through complex tax laws and regulations. Tax codes are often intricate and subject to change. By taking advantage of legal tax planning strategies, individuals can stay ahead of the curve and adapt to new tax regulations as they arise. This allows them to remain compliant while minimizing their tax burden.

Furthermore, hiding money from the IRS helps protect assets from potential creditors or legal disputes. By strategically managing one’s finances and concealing income, individuals can shield their assets from potential claims, lawsuits, or unforeseen financial challenges. This offers an added layer of protection and safeguards their wealth for the future.

Ultimately, hiding money from the IRS legally is not about evading taxes or engaging in illegal activities. It is a practice that aims to utilize legal strategies to preserve wealth, maintain financial privacy, navigate complex tax laws, and protect assets. By understanding the importance of these objectives, individuals and businesses can make informed financial decisions and secure their financial futures.

Legal Methods to Conceal Income

When it comes to concealing income legally, there are several strategies and methods that individuals and businesses can employ. These techniques abide by the tax laws and regulations in place while allowing for the protection of wealth and minimization of tax liability.

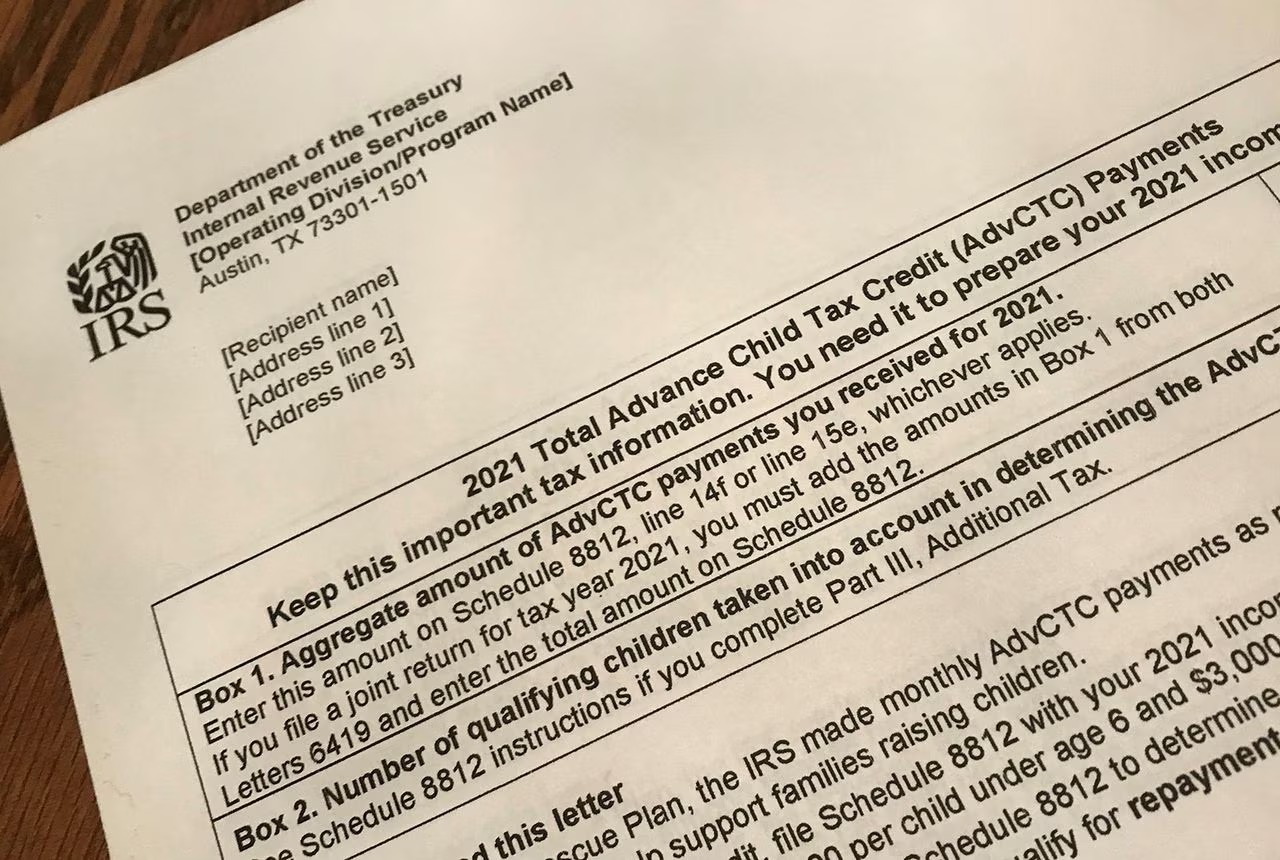

One of the most common methods is establishing offshore accounts. Offshore banking provides individuals with the option to hold assets and funds in foreign countries with favorable tax laws. This allows for increased financial privacy and potential tax benefits, as well as diversification of assets. However, it’s crucial to adhere to the reporting requirements and disclose any offshore accounts to the IRS to avoid penalties and legal issues.

Using trusts and foundations is another effective way to conceal income legally. By transferring assets into a trust or foundation, individuals can separate ownership from control, thereby minimizing tax liabilities. Trusts and foundations offer flexibility, asset protection, and potential tax benefits, while still maintaining compliance with tax laws and regulations.

Cryptocurrencies have gained popularity as a way to hide income due to their decentralized nature and potential anonymity. While the use of cryptocurrencies for financial privacy is legal, it’s essential to note that tax authorities are increasingly focusing on digital currencies. Proper reporting and compliance with tax obligations related to cryptocurrencies are crucial to avoid penalties and legal consequences.

Maintaining privacy through cash transactions is another method individuals can use to shield income. Cash transactions provide anonymity and can be used for purchases or investments. However, it’s important to remember that large cash transactions may raise suspicions and trigger scrutiny from tax authorities, so careful consideration should be made when utilizing this method.

Investing in real estate can also serve as a legal method to conceal income. Real estate investments offer potential tax advantages, such as depreciation deductions, mortgage interest deductions, and the opportunity for capital gains. By strategically investing in real estate properties, individuals can reduce their taxable income while building wealth and diversifying their investment portfolio.

Establishing a business entity, such as a corporation or a limited liability company (LLC), can also provide legal avenues for concealing income. By structuring income-generating activities through a business entity, individuals can take advantage of deductions and minimize personal tax liability. However, it’s crucial to establish and operate the business entity in compliance with all applicable laws and regulations.

Lastly, gifting and estate planning strategies can be utilized to transfer wealth and assets legally while minimizing estate taxes. By strategically gifting assets to family members or utilizing trusts, individuals can pass on their wealth while minimizing potential tax obligations.

It’s important to note that the effectiveness and legal compliance of these methods may vary depending on individual circumstances, tax laws, and regulations. Consulting with a financial advisor or tax specialist is highly recommended to ensure proper implementation and compliance with the law.

Establishing Offshore Accounts

One popular method to legally conceal income is through the establishment of offshore accounts. Offshore banking refers to the utilization of financial institutions located in foreign countries that offer favorable tax laws and regulations. These accounts provide individuals with the opportunity to hold assets and funds outside their home country, thereby increasing financial privacy and potentially reducing tax liabilities.

Offshore accounts offer several benefits, such as enhanced asset protection, potential tax advantages, and diversification of assets. By holding funds and assets in a jurisdiction that provides strong privacy protections and favorable tax treatment, individuals can keep their financial information confidential and potentially reduce their tax obligations.

When opening an offshore account, it’s crucial to select a reputable and well-regulated financial institution. Researching the jurisdiction’s banking laws, regulations, and reputation is essential to ensure the safety and security of your funds. Look for countries with strong financial sectors, political stability, and a robust legal framework.

Transparency is key when it comes to offshore banking. It’s important to comply with reporting requirements and disclose any offshore accounts and income earned to the tax authorities in your home country. Failing to report offshore accounts can result in severe penalties and legal consequences.

The Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) have significantly increased transparency and reporting requirements for offshore accounts. Financial institutions in many countries are now required to share account information with the tax authorities of their clients’ home countries. It’s vital to be aware of these reporting obligations and ensure compliance to avoid any legal issues or penalties.

It’s important to note that while offshore banking is legal, it must be used for legitimate purposes and not for tax evasion or illegal activities. Working with a reputable financial advisor or tax specialist is highly recommended to navigate the complexities of offshore banking, ensure compliance with tax laws, and maximize the benefits available.

Overall, establishing offshore accounts can provide individuals with the opportunity to diversify assets, enhance privacy, and potentially reduce tax liabilities. By carefully selecting a reputable jurisdiction and maintaining transparency with reporting requirements, it is possible to legally conceal income and safeguard wealth.

Using Trusts and Foundations

Another legal method to conceal income is through the use of trusts and foundations. Trusts and foundations are legal entities that offer individuals the opportunity to separate ownership from control of assets, thereby providing financial privacy and potential tax benefits.

A trust is a legal arrangement where a trustee holds assets on behalf of beneficiaries. By transferring assets into a trust, individuals can remove them from their personal ownership, potentially reducing tax liabilities and protecting them from potential creditors or legal disputes. Trusts can be established in various jurisdictions, each with its own set of rules and regulations.

Foundations, on the other hand, are similar to trusts but are known as non-profit organizations. Foundations provide the opportunity to donate funds or assets for charitable, educational, or other philanthropic purposes. By establishing a foundation, individuals can legally transfer wealth, reduce taxable income, and maintain control over how their assets are used.

Using trusts and foundations to conceal income can provide several benefits. One major advantage is enhanced privacy. Since the assets are no longer in the individual’s name, they are shielded from public scrutiny and potential legal disputes. This can be particularly useful for individuals with significant wealth or high-profile public figures who value financial confidentiality.

In addition to financial privacy, trusts and foundations can offer potential tax advantages. Depending on the jurisdiction and the type of trust or foundation established, individuals can potentially minimize their tax liabilities through provisions such as tax exemptions, capital gains tax deferrals, or reduced estate taxes.

However, it’s important to note that setting up trusts and foundations requires careful consideration and thoughtful planning. It is crucial to understand the legal and tax implications, as well as the reporting requirements in the jurisdiction where the trust or foundation is established. Compliance with laws and regulations is essential to ensure the legitimacy and effectiveness of these structures.

Working with a professional, such as a specialized attorney or financial advisor, is highly recommended when establishing trusts and foundations. They can provide guidance on the appropriate structure, legal requirements, and ongoing administration to ensure the goals of privacy and tax efficiency are met within the boundaries of the law.

Overall, trusts and foundations offer individuals a legitimate method to conceal income while providing financial privacy, potential tax advantages, and asset protection. By utilizing these structures effectively, individuals can achieve their financial objectives while complying with the legal and regulatory frameworks governing trusts and foundations.

Utilizing Cryptocurrencies

Cryptocurrencies have gained significant popularity in recent years and have also emerged as a method for individuals to legally conceal income. Cryptocurrencies, such as Bitcoin, Ethereum, and others, operate on decentralized networks and offer potential anonymity and financial privacy.

One of the advantages of utilizing cryptocurrencies is the potential for increased privacy. Cryptocurrency transactions are recorded on a blockchain, a distributed ledger that provides transparency and security. However, the identities of individuals involved in the transactions are often pseudonymous, offering a certain level of anonymity.

When using cryptocurrencies to conceal income, it is important to note that tax authorities are becoming increasingly vigilant. Many countries have implemented regulations to ensure that cryptocurrency users comply with tax laws. It is essential to report cryptocurrency transactions and income to the relevant tax authorities to avoid penalties and legal consequences.

When it comes to utilizing cryptocurrencies, there are a few strategies individuals can consider. First, they can choose to store funds in a digital wallet that provides enhanced privacy features. Some wallets offer features like onion routing and coin mixing, which aim to obscure transaction trails and enhance financial privacy.

Another method is to utilize privacy-focused cryptocurrencies that emphasize anonymity, such as Monero or Zcash. These cryptocurrencies use advanced cryptographic techniques to enhance privacy and make transactions more difficult to trace. It’s important to note that the legality and regulatory environment around these cryptocurrencies may vary in different jurisdictions.

While cryptocurrencies offer potential financial privacy, it’s essential to remain compliant with tax reporting obligations. Many tax authorities have issued guidance on how to report cryptocurrency transactions and income. It is advisable to consult with a tax professional or financial advisor to ensure compliance and optimize the tax benefits.

Additionally, it’s important to stay informed about the evolving legal and regulatory landscape surrounding cryptocurrencies. Governments and regulatory bodies are continuously updating their guidelines and implementing new regulations. Staying up-to-date with these changes will help individuals make informed decisions and avoid potential legal pitfalls.

It’s also worth noting that cryptocurrencies are subject to market volatility and risk. The value of cryptocurrencies can fluctuate significantly, which may impact the value of assets held in cryptocurrency. Proper risk management and diversification strategies should be considered when utilizing cryptocurrencies as a method to conceal income.

Overall, while cryptocurrencies can offer increased financial privacy and potential anonymity, individuals must remain compliant with tax reporting obligations. Utilizing cryptocurrencies as a method to legally conceal income requires careful consideration, understanding of the regulations, and consulting with knowledgeable professionals to ensure compliance with the law.

Maintaining Privacy through Cash Transactions

In an increasingly digital world, cash transactions still hold a prominent place for those seeking to maintain financial privacy and legally conceal income. Cash transactions involve using physical currency rather than digital or electronic forms of payment, providing individuals with a higher level of anonymity.

One of the key advantages of cash transactions is the ability to keep financial information private. Unlike electronic transactions, which leave a digital trail, cash transactions offer a certain level of anonymity as they are typically conducted in person and involve physical exchange of money.

Individuals and businesses can utilize cash transactions to legally conceal income by receiving payments or making purchases in cash. By doing so, they can avoid leaving a traceable record of their financial activities, which adds an extra layer of privacy to their financial affairs.

However, it’s important to exercise caution when using cash transactions. Large cash transactions can attract attention and raise suspicions, as governments and regulatory authorities are vigilant about monitoring potential money laundering and illicit activities.

In many countries, there are legal thresholds that require reporting certain cash transactions to the authorities. These thresholds vary, so it’s crucial to familiarize oneself with the reporting requirements and comply with the regulations to avoid potential penalties or legal consequences.

While maintaining privacy through cash transactions can be beneficial, it’s important to strike a balance and consider the limitations and risks involved. Cash is not as traceable as digital transactions, making it susceptible to loss or theft. It’s essential to take appropriate security measures to protect physical currency and ensure its safekeeping.

In addition, relying solely on cash transactions may present challenges in certain situations, such as online transactions or international business dealings. Many businesses and service providers, especially those in the digital realm, prefer electronic forms of payment for convenience and efficiency.

It’s crucial to assess the specific needs and circumstances when considering cash transactions for privacy purposes. It may be beneficial to consult with a financial advisor or legal professional to understand the legal requirements and implications in your jurisdiction.

Overall, cash transactions can be a legitimate method to maintain financial privacy and legally conceal income. By utilizing physical currency, individuals and businesses can add an extra layer of anonymity to their financial activities. However, it’s important to stay informed about legal requirements, exercise caution, and consider the limitations and risks associated with cash transactions.

Investing in Real Estate

Investing in real estate offers individuals a legal and effective method to conceal income while building wealth and potentially minimizing tax liabilities. Real estate investments provide various benefits, including the potential for appreciation, rental income, tax advantages, and asset diversification.

One way individuals can conceal income through real estate is by leveraging tax deductions and benefits. Real estate investors can take advantage of deductions such as mortgage interest, property taxes, depreciation, and maintenance expenses. These deductions can help reduce taxable income, thereby minimizing tax obligations.

Another benefit of investing in real estate is the potential for long-term appreciation. Real estate can often appreciate in value over time, allowing individuals to build equity and increase their wealth. By investing in properties that are expected to appreciate, individuals can potentially generate gains without the need to report or disclose those gains unless they are realized through a sale.

Rental income is another avenue for concealing income legally through real estate investments. By earning rental income, individuals receive cash flow that can offset any reported income and reduce their taxable income. Rental income also offers flexibility in terms of how it is reported and can be beneficial in managing tax liabilities.

Diversification is an important aspect of real estate investing. By diversifying investments across different properties or locations, individuals can spread the risk and potentially optimize their return on investment. Diversification can also provide additional privacy, as the ownership of multiple properties can make it more challenging for authorities to identify and track specific income sources.

While investing in real estate can be a powerful method to conceal income, it’s essential to navigate the legal and regulatory requirements. Real estate transactions are subject to reporting requirements, especially when it comes to the purchase or sale of properties. Compliance with these reporting obligations is crucial to ensure that individuals remain within the bounds of the law.

Additionally, it’s important to conduct thorough research and due diligence before investing in real estate. Understanding the local market, property values, rental demand, and potential risks is essential for making informed investment decisions. Working with a knowledgeable real estate agent or advisor can provide valuable insights and guidance throughout the process.

Overall, investing in real estate offers individuals an opportunity to legally shield income while building wealth and potentially minimizing tax obligations. By leveraging tax benefits, generating rental income, and diversifying investments, individuals can strategically utilize real estate to conceal income while adhering to legal requirements and regulations.

Establishing a Business Entity

Establishing a business entity is a legitimate method to legally conceal income while taking advantage of tax benefits and asset protection. By structuring income-generating activities through a business entity, individuals can potentially reduce their personal tax liability and separate their personal finances from their business finances.

One of the primary advantages of establishing a business entity is the opportunity for tax planning and optimization. Depending on the type of entity chosen, such as a corporation, limited liability company (LLC), or partnership, individuals can take advantage of various tax deductions, credits, and incentives. By strategically managing business expenses and income, individuals can potentially reduce their taxable income and minimize their tax liabilities.

Asset protection is another crucial aspect of establishing a business entity. By separating personal and business assets, individuals can shield their personal wealth from potential business-related liabilities. This means that in the event of a lawsuit or financial dispute, personal assets are protected from being seized or subject to claims against the business.

Furthermore, a business entity can provide a certain level of privacy by keeping personal financial information separate from business financial records. This separation can help maintain confidentiality and protect personal privacy, particularly for individuals with high-profile or sensitive financial situations.

When establishing a business entity, it’s important to carefully consider the legal and regulatory requirements. The process involves selecting the appropriate entity type, registering with the appropriate government authorities, and fulfilling ongoing administrative and reporting obligations. Consulting with a business attorney or tax professional can help ensure compliance with all necessary legal obligations.

It’s also crucial to operate the business entity in a manner consistent with its legal structure and purpose. Strict adherence to corporate governance, financial record-keeping, and tax reporting is essential for maintaining the legal protections and benefits associated with the business entity.

Overall, establishing a business entity offers individuals a legal and effective method to conceal income while optimizing tax benefits and protecting assets. By structuring income-generating activities through a separate legal entity, individuals can potentially minimize personal tax liabilities, safeguard personal assets, and maintain confidentiality. However, it’s important to adhere to all legal requirements and consult with professionals to ensure proper compliance and maximize the benefits of establishing a business entity.

Gifting and Estate Planning Strategies

Gifting and estate planning strategies offer individuals the opportunity to legally transfer wealth and assets while minimizing potential estate taxes and concealing income. These strategies involve strategic gifting, utilizing trusts, and implementing effective estate planning techniques.

One commonly used gifting strategy is to make annual exclusion gifts. The annual exclusion allows individuals to gift a certain amount of money or assets to another person without incurring gift tax. By utilizing this strategy, individuals can gradually transfer wealth over time, reducing the value of their taxable estate while potentially concealing income.

Utilizing trusts is another effective way to transfer wealth while minimizing estate taxes. Trusts provide individuals with control over how their assets are distributed and can help manage the tax implications of passing on wealth. By creating irrevocable trusts, individuals can remove assets from their taxable estate and potentially minimize estate tax obligations.

Irrevocable life insurance trusts (ILITs) are a specific type of trust commonly used in estate planning. With an ILIT, individuals can remove life insurance policies from their taxable estate and provide a source of tax-free income for their beneficiaries. This strategy allows individuals to transfer wealth and potentially conceal income through life insurance proceeds.

Charitable giving is another effective gifting strategy that offers both philanthropic benefits and potential tax advantages. By donating to qualified charitable organizations, individuals can take advantage of charitable deductions, reducing their taxable income while supporting causes they care about. Charitable giving can be a way to strategically transfer wealth while minimizing tax liabilities.

When implementing gifting and estate planning strategies, it’s crucial to work with experienced professionals, such as estate planning attorneys or financial advisors. These professionals can provide guidance on the specific strategies that align with an individual’s financial goals and ensure compliance with tax laws and regulations.

It’s important to note that gifting and estate planning strategies should be considered as part of a comprehensive financial plan. Each individual’s financial circumstances and goals are unique, and these strategies should be tailored to their specific needs. Consulting with professionals who specialize in estate planning and taxation is highly recommended to ensure optimal results.

Overall, gifting and estate planning strategies offer individuals the opportunity to legally transfer wealth, minimize estate taxes, and potentially conceal income. By utilizing strategic gifting, trusts, and effective estate planning techniques, individuals can protect their assets, provide for their loved ones, support philanthropic causes, and optimize their financial situation in a tax-efficient manner.

Remaining Vigilant and Adapting to Changing Laws

When it comes to legally concealing income, it is crucial to remain vigilant and adapt to evolving laws and regulations. Tax laws are subject to frequent changes, and governments are continually cracking down on strategies that are perceived as abusive or non-compliant. Staying informed and proactive is key to navigating the complexities of financial privacy and tax planning.

One of the most important aspects of remaining vigilant is staying up-to-date with tax regulations and reporting requirements. Familiarize yourself with the tax laws in your jurisdiction, as well as any international tax obligations if you engage in cross-border transactions. Regularly review tax publications, consult with professionals, and attend educational seminars or webinars to stay informed about changes and developments.

It’s also essential to monitor any updates related to financial regulations, anti-money laundering measures, and offshore reporting requirements. Governments are increasingly focused on combating tax evasion, money laundering, and other illegal activities. These efforts can result in changes to reporting obligations and increased scrutiny of financial transactions.

Regularly reviewing and reassessing your financial and tax planning strategies is vital. A strategy that was effective in the past may no longer be appropriate or compliant in the current legal landscape. It’s important to evaluate the benefits, risks, and legal implications of each strategy and make adjustments as needed to ensure compliance and maintain financial privacy.

Working with reputable professionals, such as financial advisors, accountants, or tax specialists, is invaluable in navigating changing laws and regulations. These professionals can provide guidance, conduct thorough evaluations, and help develop and execute comprehensive tax planning strategies. Building a team of trusted professionals who are well-versed in tax matters can provide peace of mind and ensure compliance with the law.

Lastly, it’s essential to maintain accurate and organized financial records. Good record-keeping is crucial for documenting income, expenses, and transactions. It not only helps in complying with reporting obligations but also provides a clear trail of financial activities. In the event of an audit or inquiry, having well-organized records can help demonstrate compliance and support your tax positions.

In summary, remaining vigilant and adaptable to changing laws is imperative when it comes to legally concealing income. Staying informed about tax and financial regulations, regularly reviewing and adjusting strategies, working with professionals, and maintaining accurate records are all essential elements of effective financial planning and ensuring compliance with the law.

Conclusion

Legally concealing income is a practice that involves navigating complex tax laws and regulations while aiming to protect wealth and maintain financial privacy. Throughout this article, we have explored various methods and strategies to achieve this objective.

From establishing offshore accounts and utilizing trusts and foundations to using cryptocurrencies, maintaining privacy through cash transactions, investing in real estate, establishing business entities, and implementing gifting and estate planning strategies, each method offers unique opportunities for individuals to legally conceal income while optimizing their financial situation.

However, it is important to emphasize that while these strategies are legal, complying with reporting obligations and remaining within the boundaries of the law is crucial. Tax authorities are increasingly focused on enforcing tax regulations and combating tax evasion, making it essential to stay informed and work with professionals to ensure compliance.

Additionally, it’s important to recognize that legal and regulatory environments can change over time. Laws may be modified, reporting requirements may be enhanced, and new regulations may be introduced. Thus, it is vital to remain vigilant, adapt to changing laws, and regularly review financial strategies to maintain compliance and maximize the benefits of concealing income.

By understanding the importance of tax planning, utilizing legal methods to conceal income, and remaining proactive and informed, individuals can protect their wealth, maintain financial privacy, and optimize their financial position within the boundaries of the law.

Ultimately, consult with reputable professionals, such as financial advisors or tax specialists, to develop and implement effective strategies tailored to your specific needs and circumstances. By doing so, you can navigate the complexities of financial privacy, minimize tax liabilities, and secure your financial future.

Remember, the information provided in this article is for informational purposes only and should not be construed as legal or financial advice. It’s crucial to consult with qualified professionals to address your specific situation and ensure compliance with the law.