Finance

What Happens When You Max Out A Credit Card

Modified: March 6, 2024

Discover the consequences of maxing out a credit card and how it affects your finances. Learn how to manage credit wisely and avoid the pitfalls of overwhelming debt.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Cards

- What is Credit Card Maximum?

- How Does Maxing Out a Credit Card Work?

- Immediate Consequences of Maxing Out a Credit Card

- Negative Impact on Credit Score

- Accumulation of High Interest Rates

- Difficulty in Making Minimum Payments

- Potential for Overlimit Fees

- Damage to Financial Health

- Impact on Future Credit Opportunities

- Strategies for Dealing with Maxed Out Credit Cards

- Conclusion

Introduction

Credit cards have become an integral part of our financial lives, offering convenience and flexibility in our day-to-day transactions. They allow us to make purchases and pay them off over time, providing a sense of financial freedom. However, misusing or mishandling credit cards can lead to dire consequences, one of which is maxing out a credit card.

Maxing out a credit card occurs when you reach the card’s credit limit, exhausting all available funds. This situation can happen due to various reasons, such as overspending, unexpected emergencies, or lack of financial planning. While maxing out a credit card may seem harmless at first, it can have significant ramifications for both your immediate financial situation and your long-term financial health.

In this article, we will delve into the concept of maxing out a credit card, exploring its implications and consequences. We will examine the immediate effects, such as the impact on your credit score, the accumulation of high interest rates, and the difficulty in making minimum payments. Furthermore, we will discuss the potential for overlimit fees and the damage it can do to your overall financial well-being. Finally, we will outline strategies for dealing with maxed-out credit cards and regaining control of your financial situation.

Understanding Credit Cards

Before diving into the concept of maxing out a credit card, it’s essential to have a solid understanding of how credit cards work. A credit card is a financial tool that allows individuals to borrow money up to a certain limit, known as the credit limit. It functions as a revolving line of credit, meaning that you can continually borrow and repay funds as long as you stay within the credit limit.

When you make a purchase using a credit card, you are essentially borrowing money from the issuing financial institution. The available credit limit is the maximum amount you can borrow at any given time. The credit card issuer will provide you with a billing cycle, which is usually a month-long period during which you can make purchases and payments.

At the end of the billing cycle, the credit card issuer will send you a statement detailing your transactions and the minimum payment required. You have the option to pay the full outstanding balance, which allows you to avoid accruing interest, or make the minimum payment, which is a smaller amount set by the credit card issuer. However, if you choose to carry a balance and make only the minimum payment, interest will be charged on the remaining amount.

It’s important to note that credit cards often come with additional fees, such as annual fees, late payment fees, and overlimit fees. These fees can vary depending on the credit card issuer and the specific terms and conditions of your card agreement.

Understanding these fundamental aspects of credit cards lays the foundation for comprehending the implications of maxing out a credit card. With this knowledge in mind, let’s delve into what happens when you reach your credit card’s maximum limit.

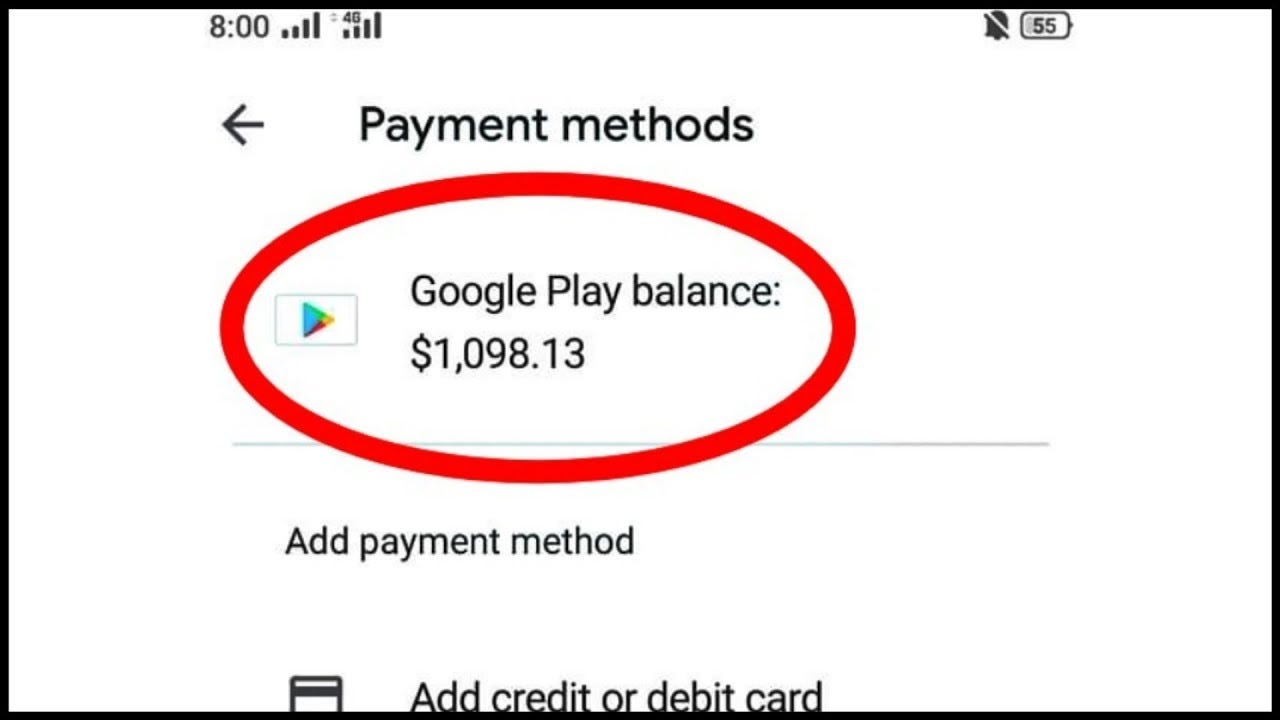

What is Credit Card Maximum?

The credit card maximum, also known as the credit limit, is the highest amount of money that a credit card holder can borrow from the issuing financial institution. It represents the upper threshold of available funds that can be utilized for purchases, cash advances, and balance transfers.

When you first open a credit card account, the issuing bank or financial institution establishes your credit limit based on various factors, including your credit history, income level, and overall creditworthiness. The credit limit serves as a safeguard for both the credit card issuer and the cardholder. It helps prevent excessive borrowing and helps manage the level of risk associated with the credit card account.

Your credit limit is not a fixed value and can be adjusted over time based on your credit card usage, payment history, and changes in your financial circumstances. Typically, responsible credit card usage and timely payments can lead to credit limit increases, allowing you access to more available credit.

It’s important to note that exceeding your credit card’s maximum limit, known as maxing out the credit card, can have significant consequences. When you reach your credit card’s maximum limit, you effectively exhaust all available credit, leaving you unable to make additional purchases unless you make payments to free up credit space. Understanding how maxing out a credit card works and the potential implications is crucial for maintaining financial stability and avoiding unnecessary financial hardships.

How Does Maxing Out a Credit Card Work?

Maxing out a credit card refers to the situation where you reach the credit card’s maximum limit, exhausting all available credit. This can happen when your outstanding balance, including both purchases and unpaid interest charges, reaches the credit limit set by the card issuer.

When you max out a credit card, several consequences come into play. First, you will no longer be able to make further purchases using that credit card unless you pay down the balance and free up available credit. Additionally, you may face financial penalties such as overlimit fees, which are charged when you exceed your credit limit.

It’s essential to understand that maxing out a credit card can have far-reaching impacts beyond immediate transactional limitations. One significant aspect is the effect on your credit score. Your credit score, which is a numerical representation of your creditworthiness, heavily relies on the credit utilization ratio – the percentage of available credit you are using. When you max out a credit card, your credit utilization ratio increases significantly, negatively impacting your credit score.

Another consequence of maxing out a credit card is the accumulation of high-interest charges. Credit card companies charge interest on the unpaid balance, and maxing out a credit card can lead to a larger amount of outstanding debt. This, in turn, leads to more interest charges, making it challenging to pay off the balance and potentially trapping you in a cycle of debt.

Moreover, maxing out a credit card makes it difficult to make the minimum payments required each month. The minimum payment is typically a small percentage of the outstanding balance. When you reach your credit card’s maximum limit, the minimum payment will likely increase as well, potentially straining your financial resources.

As you can see, maxing out a credit card goes beyond just hitting a spending limit. It can have a domino effect on multiple aspects of your financial well-being. In the next sections, we will explore the immediate consequences of maxing out a credit card and provide strategies for dealing with this challenging situation.

Immediate Consequences of Maxing Out a Credit Card

When you max out a credit card, you will face immediate consequences that can impact your financial well-being. These consequences can range from transactional limitations to financial penalties. Let’s delve into some of the immediate effects of maxing out a credit card.

First and foremost, maxing out a credit card means you will no longer be able to make additional purchases using that specific credit card until you pay down the balance and free up available credit. This can disrupt your daily financial activities and lead to a lack of available funds in case of emergencies.

Additionally, maxing out a credit card can result in overlimit fees. These fees are charged when you exceed your credit card’s maximum limit. Overlimit fees can vary depending on the credit card issuer and the specific terms and conditions of your credit card agreement. These fees can further add to your financial burden, making it even more challenging to pay off the outstanding balance.

Moreover, maxing out a credit card has a significant impact on your credit score. Your credit score reflects your creditworthiness and is used by lenders and financial institutions to assess your creditworthiness when applying for loans or credit in the future. When your credit utilization ratio – the percentage of available credit used – increases due to maxing out a credit card, it can significantly lower your credit score. This can make it more difficult to secure favorable terms for future credit.

Lastly, maxing out a credit card can lead to a sense of financial stress and instability. You may feel overwhelmed by the burden of the outstanding balance and the inability to make additional purchases. This stress can spill over into other areas of your life, affecting your overall well-being.

It is important to address the immediate consequences of maxing out a credit card promptly. In the next sections, we will explore strategies for dealing with maxed-out credit cards and regaining control of your financial situation.

Negative Impact on Credit Score

One of the most significant consequences of maxing out a credit card is the negative impact it can have on your credit score. Your credit score is a numerical representation of your creditworthiness and is used by lenders and creditors to evaluate the level of risk when extending credit to you.

When you max out a credit card, your credit utilization ratio – the percentage of available credit you are using – increases significantly. For example, if you have a credit limit of $10,000 and you reach that limit, your credit utilization ratio is 100%. This high utilization ratio signals to lenders that you are heavily reliant on credit and may be at a higher risk of defaulting on payments.

Credit utilization ratio is a key factor that affects your credit score. In general, financial experts recommend keeping your credit utilization below 30% to maintain a healthy credit score. When you max out a credit card, your high utilization ratio can lower your credit score, making it harder for you to access favorable credit terms in the future.

Furthermore, your credit history is also impacted when you max out a credit card. Late payments and missed payments can occur when you are unable to make the minimum payments on a maxed-out credit card. These negative marks on your credit history can stay on your report for up to seven years, further damaging your credit score.

It’s important to note that rebuilding your credit score after maxing out a credit card will take time and effort. By practicing responsible credit management, such as making on-time payments and keeping credit utilization low, you can gradually improve your credit score over time.

In the next sections, we will discuss the accumulation of high interest rates and the difficulty in making minimum payments when a credit card is maxed out, as well as strategies for dealing with this challenging situation.

Accumulation of High Interest Rates

When you max out a credit card, one of the immediate consequences is the accumulation of high-interest charges. Credit card companies charge interest on the unpaid balance, and maxing out a credit card can result in a larger amount of outstanding debt, leading to increased interest charges.

The interest rate on credit cards is typically higher compared to other types of loans, such as mortgages or car loans. The exact interest rate will depend on the credit card issuer and your creditworthiness. When you carry a high balance on your maxed-out credit card, the interest charges can quickly add up, making it more challenging to pay off the balance.

It’s important to understand the compounding effect of high-interest rates on your outstanding balance. As interest accrues on your unpaid balance, it is added to the total amount owed, and future interest charges are calculated based on the new higher balance. This cycle continues until the balance is paid off, resulting in a substantial amount of money paid in interest over time.

For example, let’s say you have a maxed-out credit card with a $5,000 balance and an interest rate of 20% per year. If you only make the minimum payment required each month, which is typically a small percentage of the outstanding balance, it can take years to pay off the debt, and you will end up paying significantly more in interest charges.

To mitigate the accumulation of high-interest charges, it is essential to develop a plan to pay off the maxed-out credit card as quickly as possible. This may involve making larger payments each month, prioritizing the credit card debt over other expenses, or exploring options like balance transfers to take advantage of lower interest rates.

In the next section, we will discuss the difficulty in making minimum payments when a credit card is maxed out and provide strategies for dealing with this challenging situation.

Difficulty in Making Minimum Payments

When a credit card is maxed out, one of the immediate challenges that arise is the difficulty in making minimum payments. The minimum payment is the smallest amount you are required to pay each month to remain in good standing with the credit card issuer. It is typically a percentage of the outstanding balance.

When you have maxed out your credit card, the outstanding balance is at its highest point. This means that the minimum payment required will also increase accordingly. The higher minimum payment can put additional strain on your finances, making it harder to meet your financial obligations.

If you are already struggling to manage your monthly expenses, the higher minimum payment can become a significant financial burden. It may require cutting back on other essential expenses, such as groceries or utilities, to meet the minimum payment requirement.

Furthermore, difficulty in making minimum payments can lead to late payments or missed payments, both of which can have severe consequences for your credit score. Late payments can result in late payment fees, increased interest rates, and negative marks on your credit history.

To address the challenge of making minimum payments on a maxed-out credit card, it’s crucial to evaluate your overall financial situation and develop a plan. Consider creating a budget that allows for larger payments towards the credit card debt. Cut back on discretionary spending to free up more funds towards debt repayment. Explore options like debt consolidation or balance transfers to lower interest rates and manage the debt more effectively.

Remember, the goal is to pay off the maxed-out credit card as quickly as possible to alleviate the financial strain and mitigate the long-term consequences. In the next section, we will discuss the potential for overlimit fees and the overall damage that maxing out a credit card can have on your financial health.

Potential for Overlimit Fees

When you max out a credit card, you not only face transactional limitations and increased financial strain, but also the potential for overlimit fees. Overlimit fees are charges imposed by credit card issuers when you exceed your credit card’s maximum limit.

The specific overlimit fee and the conditions for its application can vary depending on the credit card issuer and the terms of your credit card agreement. Overlimit fees can range from a fixed amount to a percentage of the overage, and they can be charged once or on a recurring basis until the balance is brought below the credit limit. These fees can quickly add up, further increasing the financial burden associated with maxing out a credit card.

It’s important to note that some credit card issuers may not charge overlimit fees, or they may waive the fees under certain circumstances. However, it’s crucial to review your credit card agreement or contact your credit card issuer to understand the specific policies regarding overlimit fees.

To avoid overlimit fees, it’s best to stay within your credit card’s maximum limit and monitor your spending closely. However, if you find yourself in a situation where you have maxed out your credit card, it is essential to address the outstanding balance promptly to avoid additional fees and charges.

In the next section, we will discuss the overall damage that maxing out a credit card can have on your financial health and explore strategies for dealing with this challenging situation.

Damage to Financial Health

Maxing out a credit card can inflict significant damage on your financial health. The immediate consequences, such as transactional limitations and the accumulation of high-interest charges, can have a domino effect on your overall financial well-being.

One of the primary ways maxing out a credit card harms your financial health is through its impact on your credit score. As mentioned earlier, maxing out a credit card increases your credit utilization ratio, which can lead to a lower credit score. A lower credit score can make it more difficult to secure loans, mortgages, or credit cards in the future. Even if you are approved for credit, you may face higher interest rates and less favorable terms, costing you more in the long run.

Additionally, the accumulation of high-interest charges and the difficulty in making minimum payments can cause financial stress and strain your budget. The higher financial burden can make it challenging to meet other financial obligations, save for important goals, or build emergency funds. This can lead to a cycle of debt, where you struggle to pay off the outstanding balance and become more reliant on credit.

Maxing out a credit card can also affect your financial stability in the form of adverse psychological effects. Stress, anxiety, and a sense of loss of control over your finances can take a toll on your mental well-being. It’s important to seek support and guidance during such times, whether from friends, family, or financial professionals, to help you regain control of your financial situation.

To mitigate the damage to your financial health caused by maxing out a credit card, it’s essential to take proactive steps. Develop a realistic budget, prioritize debt repayment, and explore strategies to pay off the outstanding balance efficiently. Seek professional advice if needed to help you navigate through these challenging financial circumstances.

In the next section, we will provide strategies for dealing with maxed-out credit cards and regaining control of your financial situation.

Impact on Future Credit Opportunities

Maxing out a credit card can have a lasting impact on your future credit opportunities. It can affect your ability to access credit, secure favorable terms, and build a solid financial foundation.

One of the primary ways maxing out a credit card affects future credit opportunities is through its impact on your credit score. As mentioned earlier, maxing out a credit card increases your credit utilization ratio, which can lower your credit score. A lower credit score signals to lenders and creditors that you may be a higher risk borrower, which can result in increased interest rates, fewer credit options, or even declined applications.

Additionally, maxing out a credit card can have a negative impact on your overall creditworthiness and financial reputation. Lenders and creditors take into account your credit history when evaluating your creditworthiness. Maxing out a credit card and demonstrating an inability to manage credit responsibly can raise red flags for future potential creditors.

It’s important to recognize that rebuilding your creditworthiness after maxing out a credit card may take time and effort. By practicing responsible credit management, such as making on-time payments, paying down debt, and keeping credit utilization low, you can gradually improve your creditworthiness and increase your chances of future credit opportunities.

It’s also crucial to exercise caution when considering new credit opportunities after maxing out a credit card. Carefully weigh the terms and conditions, interest rates, and payment obligations before taking on additional credit. It’s advisable to focus on paying off the maxed-out credit card and demonstrating responsible credit behavior before taking on further credit obligations.

In summary, maxing out a credit card can have a lasting impact on your future credit opportunities. It’s important to recognize the consequences, take proactive steps to rebuild your credit, and approach future credit opportunities with caution to regain control of your financial future.

Strategies for Dealing with Maxed Out Credit Cards

Dealing with a maxed-out credit card may feel overwhelming, but with a strategic approach, you can regain control of your financial situation. Here are some effective strategies for managing and paying off your maxed-out credit cards:

- Create a realistic budget: Evaluate your income and expenses to determine how much you can allocate towards paying off your credit card debt. Cut back on unnecessary expenses and redirect those savings towards debt repayment.

- Pay more than the minimum: Making only the minimum payment will result in more interest charges and prolong the time it takes to pay off the debt. Whenever possible, pay more than the minimum to accelerate your progress.

- Explore balance transfer options: Consider transferring your maxed-out credit card balance to a card with a lower interest rate or a 0% introductory APR. This can help reduce the amount of interest you pay and make it easier to pay off the balance.

- Consolidate your debt: If you have multiple maxed-out credit cards, consolidating them into a single loan or a balance transfer card can simplify your finances and potentially lower your interest rates.

- Consider a debt repayment plan: If your credit card debt is substantial and you’re struggling to make payments, you may benefit from enrolling in a debt repayment plan. These plans, such as a debt management program, can help negotiate lower interest rates and establish a structured repayment plan.

- Generate additional income: Explore opportunities to boost your income by taking on a side job or freelancing gig. The extra money can be used to make larger payments towards your maxed-out credit card debt.

- Communicate with your credit card issuer: Reach out to your credit card issuer to explain your situation and inquire about any hardship programs or options they may offer to help you manage your debt.

- Seek professional assistance: If you’re struggling to navigate the challenges of maxed-out credit cards, consider working with a certified credit counselor or a financial advisor who can provide guidance and personalized solutions.

Remember, it’s crucial to stay committed to your debt repayment plan and practice responsible credit management moving forward. Make timely payments, avoid unnecessary credit card spending, and gradually rebuild your creditworthiness.

By implementing these strategies and taking proactive steps, you can regain control of your finances and work towards a debt-free future.

Conclusion

Maxing out a credit card can have serious consequences for your financial health. It not only limits your ability to make additional purchases but also affects your credit score, accumulates high interest charges, and makes it difficult to make minimum payments. Moreover, it can lead to overlimit fees and cause long-term damage to your financial well-being.

However, by understanding the implications of maxing out a credit card and implementing effective strategies, you can mitigate the negative impacts and regain control of your financial situation. Creating a budget, paying more than the minimum, exploring balance transfer options, and seeking professional assistance are all helpful methods for managing and paying off maxed-out credit cards.

It’s important to prioritize responsible credit management moving forward. Make timely payments, keep credit utilization low, and avoid unnecessary debt. Rebuilding your creditworthiness takes time and effort, but by taking proactive steps and practicing wise financial habits, you can improve your credit score and increase your future credit opportunities.

Remember, dealing with maxed-out credit cards requires discipline, determination, and perseverance. Stay committed to your debt repayment plan, seek support when needed, and focus on regaining financial stability. By taking control of your finances, you can pave the way for a brighter and more secure financial future.