Finance

How To Pay Off Credit Card Capital One

Modified: March 3, 2024

Learn effective strategies to pay off your Capital One credit card debt and improve your financial situation. Discover expert tips in finance to achieve your goals faster.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understand your Credit Card Balance

- Step 2: Create a Budget

- Step 3: Review Your Expenses

- Step 4: Cut Back on Unnecessary Spending

- Step 5: Increase Your Income

- Step 6: Prioritize Your Credit Card Payments

- Step 7: Negotiate Lower Interest Rates

- Step 8: Consider Balance Transfers

- Step 9: Set up Automatic Payments

- Step 10: Track Your Progress

- Conclusion

Introduction

Having a credit card can be a convenient way to make purchases and manage your expenses. However, if you find yourself carrying a balance on your credit card, it’s important to take steps to pay it off as soon as possible. One popular credit card option is Capital One, widely recognized for its rewards programs and low-interest rates. In this article, we will discuss effective strategies to pay off your credit card balance with Capital One.

Before diving into the strategies, it’s crucial to understand the impact of carrying a credit card balance. If you only pay the minimum amount due each month, you’ll likely end up paying significantly more in interest and it will take longer to pay off your debt. By taking control of your finances and implementing a plan, you can save money and become debt-free faster.

Keep in mind that paying off your credit card balance requires discipline, commitment, and a well-thought-out strategy. It’s important to assess your current financial situation and set realistic goals. With these factors in mind, let’s explore step-by-step how to pay off your credit card balance with Capital One.

Step 1: Understand your Credit Card Balance

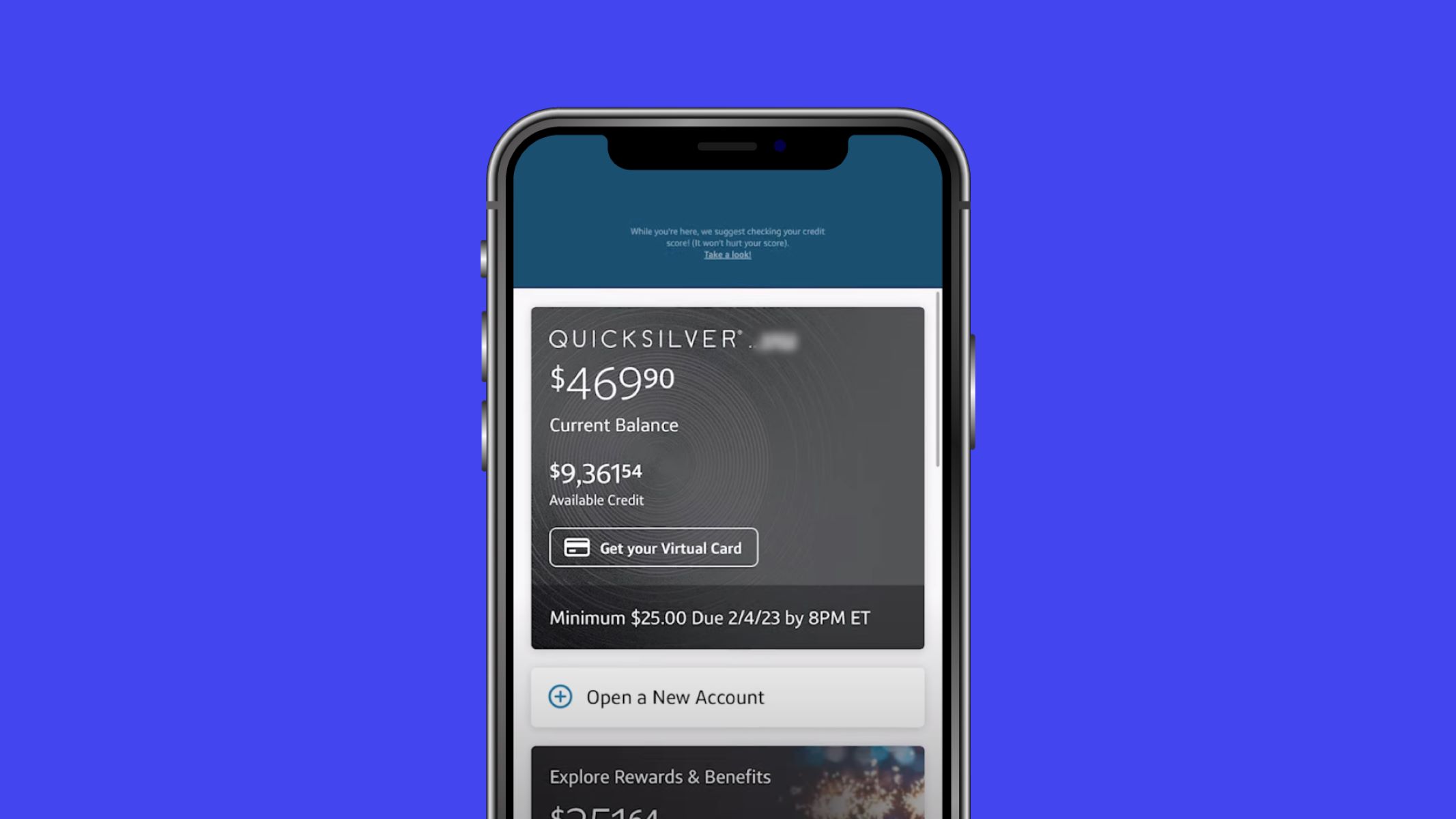

The first step in paying off your credit card balance with Capital One is to have a clear understanding of the amount you owe. Take the time to carefully review your credit card statement and note the outstanding balance. It’s important to know the exact amount you need to pay off in order to create an effective repayment plan.

Additionally, familiarize yourself with the interest rate charged by Capital One on your credit card. This information is crucial because it will determine how much interest you will accrue on your balance over time. Understanding your interest rate will motivate you to pay off your balance more quickly in order to avoid excessive interest charges.

Once you have a clear understanding of your credit card balance and the associated interest rate, you can establish a timeline for paying off the debt. Consider setting a realistic deadline based on your financial capabilities. Having a specific goal in mind will help motivate you to stay on track and make the necessary sacrifices to achieve debt-free status.

Furthermore, it’s also important to be aware of any additional fees or penalties associated with your Capital One credit card. For example, late payment fees can be costly and can set you back in your repayment journey. By understanding the terms and conditions of your card, you can avoid unnecessary charges and focus on reducing your credit card balance.

Understanding your credit card balance is essential in formulating a successful repayment plan. By having a clear picture of what you owe, the interest rate being charged, and any additional fees, you can take positive steps towards paying off your credit card balance with Capital One.

Step 2: Create a Budget

Creating a budget is a key step in paying off your credit card balance with Capital One. A budget provides a clear overview of your income and expenses, allowing you to allocate your money strategically and prioritize debt repayment.

The first step in creating a budget is to assess your monthly income. Calculate your total earnings, including salary, freelance work, or any other sources of income. This will give you a realistic starting point for budgeting your expenses.

Next, list all your expenses. Categorize them into fixed expenses (such as rent/mortgage, utilities, and insurance) and variable expenses (such as groceries, entertainment, and transportation). Take note of any recurring payments, like subscriptions or memberships, that can be reduced or eliminated.

Once you have a comprehensive list of your expenses, compare them to your income. If your expenses exceed your income, it’s important to make adjustments. Look for areas where you can cut back and reduce unnecessary expenses. For example, consider cooking at home instead of eating out or finding more affordable recreational activities.

Allocate a specific amount from your budget towards your credit card payments. This should be more than the minimum payment required, enabling you to make progress towards paying off your balance. By including credit card payments as a fixed expense in your budget, you ensure that it becomes a priority in your financial planning.

Regularly review your budget to ensure you’re sticking to it and making necessary adjustments as your financial situation evolves. By adhering to your budget, you’ll have a better understanding of your spending habits and gain the discipline needed to maintain a debt-free lifestyle.

A budget is an effective tool to help you stay on track while paying off your credit card balance with Capital One. By assigning a specific portion of your income towards debt repayment, you’ll be able to make consistent payments and steadily reduce your credit card balance.

Step 3: Review Your Expenses

In order to pay off your credit card balance with Capital One, it’s important to carefully review your expenses. This step involves taking a closer look at your spending habits to identify areas where you can cut back and save money.

Start by examining your monthly expenses and categorizing them into essential and non-essential items. Essential expenses include housing, utilities, transportation, and groceries, while non-essential expenses include dining out, entertainment, and luxury purchases.

Take a critical look at your non-essential expenses and identify areas where you can reduce or eliminate unnecessary spending. For example, you might consider packing your lunch instead of eating out, canceling subscription services you no longer use, or finding free or low-cost alternatives for entertainment.

Additionally, it’s important to review your recurring expenses, such as insurance policies, phone plans, and gym memberships. Shop around for better deals or consider negotiating with your providers for lower rates. By reducing these fixed expenses, you can free up more money to put towards paying off your credit card balance.

Another aspect to consider when reviewing your expenses is your discretionary spending. Keep track of your daily spending habits and identify any patterns of impulse buying or unnecessary splurges. By being mindful of your discretionary spending, you can curb impulsive purchases and redirect that money towards your debt repayment.

Regularly assessing your expenses will not only help you identify areas to cut back on, but it will also increase your awareness of your spending habits. This heightened awareness can lead to positive changes in your financial behavior, allowing you to take a more proactive approach to managing your money and paying off your credit card balance.

Reviewing your expenses is a crucial step in paying off your credit card balance with Capital One. By identifying areas where you can reduce or eliminate unnecessary spending, you’ll be able to allocate more money towards debt repayment and make significant progress in becoming debt-free.

Step 4: Cut Back on Unnecessary Spending

To accelerate the process of paying off your credit card balance with Capital One, it’s essential to cut back on unnecessary spending. By making conscious choices to reduce expenses, you can free up more money to put towards your debt repayment.

Start by evaluating your daily spending habits. Examine your lifestyle and identify areas where you tend to overspend or make impulsive purchases. This could be dining out frequently, buying expensive coffee, or indulging in unnecessary shopping sprees. By recognizing these spending patterns, you can make a conscious effort to cut back and redirect that money towards your credit card payments.

Consider implementing cost-cutting measures, such as meal planning and cooking at home, bringing your own lunch to work, or opting for affordable alternatives to expensive outings. Look for opportunities to save money on your regular bills, such as renegotiating your phone or internet plan, or switching to a more cost-effective gym membership.

Another effective strategy is to set spending limits or create a budget specifically for discretionary expenses. Allocate a fixed amount of money each month for non-essential purchases and stick to that limit. By consciously monitoring your spending and adhering to these limits, you will be able to rein in unnecessary expenses and redirect those funds towards paying off your credit card balance.

When faced with the temptation to make impulsive purchases, take a step back and assess whether it aligns with your ultimate financial goal of becoming debt-free. Consider the long-term benefits of reducing unnecessary spending and the satisfaction of paying off your credit card balance. Remind yourself that making sacrifices now will lead to increased financial freedom in the future.

It’s important to note that cutting back on unnecessary spending does not mean completely depriving yourself of all enjoyment. Find alternative ways to indulge in your interests and hobbies without breaking the bank. Look for free or inexpensive activities, explore affordable entertainment options, or embrace DIY projects. By being creative and resourceful, you can enjoy life while still making progress towards your financial goals.

By actively cutting back on unnecessary spending, you can significantly increase the amount of money available to pay off your credit card balance. This deliberate effort to reduce expenses will help expedite your journey to becoming debt-free with Capital One.

Step 5: Increase Your Income

When it comes to paying off your credit card balance with Capital One, increasing your income can dramatically accelerate your progress. By finding ways to boost your earnings, you’ll have more money available for debt repayment and can potentially pay off your balance more quickly.

Start by exploring opportunities for additional income. Consider taking on a side job or freelance work that aligns with your skills and interests. This can include freelancing, consulting, tutoring, or gig economy platforms. By dedicating your spare time to earning extra income, you can make significant strides in paying off your credit card balance.

Another approach is to ask for a raise or promotion at your current job. Prepare a compelling case showcasing your value to the company, and highlight any accomplishments or contributions that justify a salary increase. By earning more money from your primary job, you can allocate a larger portion towards debt repayment.

If increasing your income through traditional means is challenging, think creatively and explore ways to monetize your skills or hobbies. Are you good at crafts? Consider selling your handmade products online. Do you have knowledge in a particular subject? Offer tutoring services or create digital courses. By leveraging your unique skills and passions, you can generate additional income streams.

In addition to earning more money, you should also aim to maximize your existing income. Review your current financial situation and look for ways to optimize your savings. Consider refinancing any high-interest loans or renegotiating your insurance policies to potentially lower your monthly expenses.

It’s important to note that increasing your income should be accompanied by a commitment to redirect the extra money towards paying off your credit card balance. Avoid the temptation to use the additional earnings on unnecessary expenses or lifestyle upgrades. Instead, view the increased income as a means to achieve your financial goals and prioritize debt repayment.

Increasing your income is a powerful strategy in paying off your credit card balance with Capital One. By finding ways to earn extra money and making a conscious effort to allocate those funds towards debt repayment, you can accelerate your progress and become debt-free sooner.

Step 6: Prioritize Your Credit Card Payments

When it comes to paying off your credit card balance with Capital One, it’s crucial to prioritize your credit card payments. By focusing on your credit card debt and allocating your resources accordingly, you can make significant progress in reducing your balance.

Start by making a list of all your debts, including credit cards and any other outstanding loans or balances. Take note of the interest rates and minimum payment requirements for each. While it’s important to continue making at least the minimum payments on all your debts, you should prioritize paying off your credit card balance with Capital One first, as credit card debt tends to carry higher interest rates.

Allocate as much money as possible towards your credit card payments each month. Ideally, you should aim to pay more than the minimum amount due. By paying more than the minimum payment, you will not only reduce your principal balance faster, but you’ll also save money on interest charges over time.

If you have multiple credit cards, consider implementing a debt payoff strategy such as the debt snowball or debt avalanche method. The debt snowball method involves paying off the smallest balance first while making minimum payments on the rest, gradually moving on to the next smallest balance. The debt avalanche method, on the other hand, involves prioritizing the debt with the highest interest rate. Choose the method that aligns best with your financial situation and goals.

Another strategy to consider is consolidating your credit card debt with a personal loan or a balance transfer to take advantage of a lower interest rate. This can simplify your repayment process by combining all your credit card balances into a single monthly payment. However, it’s important to carefully review the terms and conditions, including any balance transfer fees or promotional periods.

As you make progress in paying off your credit card balance, celebrate your achievements along the way. Set small milestones and reward yourself for achieving them. This will help you stay motivated and focused on your goal of becoming debt-free with Capital One.

Remember, prioritizing your credit card payments requires discipline and dedication. By making it a priority and consistently allocating funds towards debt repayment, you’ll be able to make significant strides in paying off your credit card balance and moving closer to financial freedom.

Step 7: Negotiate Lower Interest Rates

When it comes to paying off your credit card balance with Capital One, one important step you can take is to negotiate lower interest rates. By reducing the interest rate on your credit card, you can save money on interest charges and pay off your balance more efficiently.

Start by contacting Capital One’s customer service department and inquire about the possibility of lowering your interest rate. Explain your financial situation and your commitment to paying off your credit card balance. Be polite, persistent, and emphasize your loyalty as a customer. In some cases, they may be willing to work with you to reduce your interest rate, especially if you have a good payment history.

If you encounter any difficulties negotiating directly with Capital One, consider transferring your balance to a credit card with a lower interest rate. Many credit card companies offer introductory 0% APR balance transfer promotions. This can provide you with a temporary reprieve from interest charges, allowing you to make more significant progress in paying down your balance. However, be mindful of any balance transfer fees or promotional periods when considering this option.

Another alternative is to explore personal loans or lines of credit from financial institutions. These may offer lower interest rates compared to credit card rates. By consolidating your credit card debt into a personal loan, you can simplify your repayment process and potentially save money on interest charges.

In addition to negotiating lower interest rates, it’s important to be proactive in managing your credit. Establishing a good credit score can also make it easier to negotiate more favorable terms. Pay your bills on time, keep your credit utilization low, and avoid opening unnecessary new lines of credit. Building a solid credit history will strengthen your bargaining power when seeking a lower interest rate.

Remember, negotiating lower interest rates may not always be successful but it’s worth the effort. Even a slight reduction in interest rates can make a significant difference in the long run. Be persistent and explore all available options to secure the best terms possible for your credit card balance repayment.

By successfully negotiating lower interest rates, you can save money on interest charges and accelerate your progress towards paying off your credit card balance with Capital One.

Step 8: Consider Balance Transfers

When working towards paying off your credit card balance with Capital One, considering balance transfers can be a strategic move to save on interest charges and expedite your debt repayment.

A balance transfer involves transferring your existing credit card balance to a new credit card with a lower interest rate. Many credit card companies offer introductory 0% APR balance transfer promotions for a certain period of time, typically ranging from six to 18 months. By taking advantage of these promotions, you can enjoy a temporary respite from interest charges, allowing you to make more significant progress in paying down your balance.

Start by researching and comparing different credit cards that offer balance transfer promotions. Look for cards with favorable interest rates and long introductory periods. Take note of any balance transfer fees, as these can impact the overall cost savings of the transfer.

Before initiating a balance transfer, it’s important to evaluate your financial situation. Consider your ability to make regular payments and pay off the transferred balance within the promotional period. If you don’t repay the full balance within the promotional period, the interest rate will revert to the regular rate, potentially nullifying the benefits of the balance transfer.

Once you have chosen a credit card, initiate the balance transfer process. Contact the new credit card issuer and provide the necessary information to transfer your balance. It’s important to continue making payments on your old credit card until the transfer is complete to avoid any late fees or penalties.

While balance transfers can be an effective strategy, there are a few considerations to keep in mind. First, be aware that opening a new credit card may have a temporary negative impact on your credit score. However, over time, as you make consistent payments and reduce your balance, your credit score will recover and potentially improve.

Additionally, it’s important to avoid using the new credit card for additional purchases, as the focus should be on paying off the transferred balance. Charging new expenses on the card will only add to your debt burden and make it more challenging to become debt-free.

Balance transfers can provide a temporary relief from high-interest charges and help you accelerate your progress towards paying off your credit card balance with Capital One. However, it’s important to approach balance transfers with caution and carefully consider the terms and your financial capability to repay the balance within the promotional period.

Step 9: Set up Automatic Payments

Setting up automatic payments is a convenient and effective way to ensure consistent and timely payments towards your credit card balance with Capital One. By automating your payments, you can avoid late fees, penalties, and the temptation to skip a payment.

Start by logging into your Capital One account or contacting customer service to set up automatic payments. You can typically choose to pay the minimum amount due or a fixed amount each month. Opting for the fixed amount allows you to make larger payments and pay off your balance more quickly.

When setting up automatic payments, it’s important to ensure that you have sufficient funds in your bank account to cover the payments. Regularly monitor your bank balance and adjust your budget if needed to accommodate the automatic payments. This will prevent any overdraft fees or missed payments.

By setting up automatic payments, you simplify your financial management and remove the burden of remembering payment due dates. It also helps you maintain a positive payment history, which is crucial for your credit score.

In addition to automatic payments, it’s a good idea to schedule reminders or alerts on your calendar or through mobile apps to keep track of your payment due dates. These reminders will notify you in advance, giving you time to ensure sufficient funds are available in your account.

While automatic payments offer convenience, it’s important to regularly review your credit card statements and monitor your account activity. This will help you detect any errors or unauthorized transactions and ensure that everything is in order.

If you ever encounter any issues with your automatic payments or need to make changes, be sure to contact Capital One as soon as possible. They can provide guidance and assist you in making the necessary adjustments.

Setting up automatic payments is a simple yet impactful step towards paying off your credit card balance with Capital One. By removing the hassle of manual payments and ensuring consistent and timely payments, you can stay on track with your debt repayment and achieve your goal of becoming debt-free.

Step 10: Track Your Progress

Tracking your progress is a crucial step in paying off your credit card balance with Capital One. By monitoring your progress, you can stay motivated, identify any potential obstacles, and make adjustments along the way to ensure success in achieving your debt repayment goals.

Start by organizing and maintaining all your credit card statements and payment receipts. This will provide you with a clear record of your payments and allow you to track your progress over time. Use spreadsheets, budgeting apps, or online tools to create a visual representation of your journey, including your starting balance, monthly payments, and remaining balance.

Regularly review your credit card statements to ensure accuracy and identify any discrepancies or errors. Pay attention to the interest charges and fees to ensure they align with your understanding of the terms and conditions.

Take note of your progress by celebrating milestones along the way. Set targets for yourself, such as paying off a certain percentage of the balance or hitting specific payment goals. Recognize and reward yourself for reaching these milestones to stay motivated throughout the process.

Additionally, it’s important to periodically reassess your financial situation and goals. As life changes, your priorities and circumstances may evolve. Regularly review your budget, income, and expenses to determine whether any adjustments are needed. This will ensure that your debt repayment strategy remains aligned with your current financial capabilities.

Consider seeking support from friends, family, or online communities to share your progress and challenges. Engaging with others who are also on a debt repayment journey can provide valuable encouragement and guidance. You can exchange tips, strategies, and stories of success, which may inspire you to keep pushing forward.

Finally, remember that paying off your credit card balance is a marathon, not a sprint. Be patient with yourself and your progress. Recognize that setbacks or unexpected expenses may occur, but don’t let them deter you from your ultimate goal of becoming debt-free.

By tracking your progress regularly, you’ll have a clear understanding of your journey towards paying off your credit card balance with Capital One. This awareness will keep you motivated, focused, and in control of your financial future.

Conclusion

Paying off your credit card balance with Capital One is an important step towards achieving financial freedom. By implementing the ten steps outlined in this article, you can develop a solid plan to tackle your debt and become debt-free.

Understanding your credit card balance, creating a budget, reviewing your expenses, cutting back on unnecessary spending, and increasing your income are initial steps that set the foundation for a successful repayment journey. Prioritizing your credit card payments, negotiating lower interest rates, considering balance transfers, setting up automatic payments, and tracking your progress are crucial steps to stay on track and make tangible progress towards your goal.

Remember, paying off your credit card balance requires discipline, commitment, and a proactive approach to managing your finances. It may not happen overnight, but with persistence and dedication, you can overcome your debt and create a more secure financial future.

Throughout your repayment journey, celebrate milestones, seek support, and stay motivated. Consider working with reputable financial advisors or credit counseling services if you need additional guidance or assistance in managing your finances.

By taking control of your credit card debt with Capital One and adopting these strategies, you can ultimately regain financial stability, reduce stress, and pave the way for a brighter financial future. Stay focused, stay determined, and enjoy the satisfaction of becoming debt-free.