Finance

How To Maximize Credit Card Points For Travel

Published: November 7, 2023

Learn how to maximize your credit card points for travel with our comprehensive finance guide. Unlock exclusive rewards and save money on your next adventure.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit card points and the exciting opportunity to maximize them for travel! Credit cards have become more than just a convenient way to make purchases; they also offer a plethora of rewards programs that allow you to earn points with every swipe. These points can be redeemed for various perks, including travel benefits such as flights, hotel stays, and even vacation packages.

Understanding how to navigate the world of credit card points can seem overwhelming at first, but with the right knowledge and strategies, you can make the most of your points and enjoy incredible travel experiences. In this article, we will guide you through the process of maximizing your credit card points to unlock the full potential of your travel rewards.

Before diving into the details, let’s take a moment to understand what credit card points are. Credit card points are a type of loyalty currency that you earn based on your spending habits. Different credit cards offer different rewards programs, and each program has its own set of rules and redemption options.

To get started, the key is to choose the right credit card that aligns with your travel goals and lifestyle. Not all credit cards are created equal when it comes to earning and redeeming points. Some cards offer generous sign-up bonuses, while others offer higher earning rates on specific spending categories like travel, dining, or gas. It’s important to do your research to find a credit card that fits your needs and offers the best value for your desired travel rewards.

Once you have the right credit card in hand, the next step is to actively earn credit card points. There are several ways to earn points, including making everyday purchases, taking advantage of bonus categories, and utilizing the cards’ partner programs. The more you understand the earning potential of your credit card, the more strategically you can maximize your points.

Now that you have a good understanding of credit card points and how to earn them, it’s time to dive into the nitty-gritty of maximizing their value. By implementing certain strategies and making smart redemption choices, you can stretch your points further and enjoy fantastic travel benefits.

In the following sections, we will explore how to redeem credit card points for travel, transfer partners and frequent flyer programs, utilizing hotel rewards programs, and some valuable tips and tricks for maximizing your credit card points. So, buckle up and get ready to embark on a journey that will allow you to unlock amazing travel experiences through the power of credit card points.

Understanding Credit Card Points

Before delving into the world of credit card points, it’s important to have a solid understanding of how they work. Credit card points are a form of currency that credit card companies offer as a reward for using their cards. These points can be accumulated through various spending activities and can later be redeemed for a range of rewards, including travel benefits.

Each credit card company has its own rewards program, often referred to as a loyalty program, which determines the earning and redemption rules for their points. Some credit cards offer a flat earning rate, where you earn a fixed number of points per dollar spent, while others have tiered earning structures, where certain spending categories earn higher points.

Credit card points can be earned not only through regular purchases but also through other activities such as sign-up bonuses, referrals, and promotional offers. Sign-up bonuses, in particular, are an attractive feature of many credit cards, where you can earn a substantial number of points after meeting a minimum spending requirement within a specific timeframe.

It’s important to note that credit card points typically have an expiration date. Some points expire after a certain period of time, such as two years, while others may not have an expiration date as long as the credit card account remains active. Knowing the expiration policy of your credit card points is essential to avoid losing them.

When it comes to redeeming credit card points, the options are vast. Travel rewards are among the most popular choices, allowing you to use your points for flights, hotel stays, car rentals, and more. However, you may also have the option to redeem your points for merchandise, gift cards, statement credits, or even cashback.

One of the key considerations when redeeming credit card points is their value. The value of a point can vary depending on the credit card and the redemption option you choose. For example, some credit cards may offer a higher value per point when redeemed for travel compared to cashback or merchandise. It’s important to calculate the value of your points to determine the most worthwhile redemption option.

Lastly, credit card points can often be transferred to partner programs. This means that you can convert your credit card points into airline miles or hotel loyalty points, opening up even more opportunities for travel rewards. Transferring points to partner programs can sometimes offer better value and more flexibility, especially if you have a specific airline or hotel loyalty program in mind.

Understanding how credit card points work is the foundation for maximizing their value. By familiarizing yourself with the earning, redemption, and transfer options offered by your credit card, you can make informed decisions that will help you harness the full potential of your points and make your travel dreams a reality.

Choosing the Right Credit Card

When it comes to maximizing your credit card points for travel, one of the most crucial steps is choosing the right credit card. With a wide range of options available in the market, it’s essential to consider various factors to ensure that the credit card you choose aligns with your travel goals and spending habits.

The first thing to consider is the type of rewards program offered by the credit card. Some cards offer cashback rewards, while others provide points or miles that can be redeemed for travel benefits. If travel is your main focus, opting for a credit card with a rewards program tailored to travel could be more beneficial. These cards typically offer higher earning rates on travel-related expenses and provide more flexibility in terms of redemption options for flights, hotels, and more.

Another important consideration is the sign-up bonus. Many credit cards offer enticing sign-up bonuses, which can significantly boost your point balance right from the start. Look for cards that provide a substantial bonus after meeting a minimum spending requirement within a specified time frame. These sign-up bonuses can often be enough for a free flight or hotel stay, giving you an excellent head start on maximizing your travel rewards.

The earning potential of the credit card is also crucial. Some cards offer higher earning rates on specific spending categories such as travel, dining, groceries, or gas. If your spending habits align with these categories, you can earn points at an accelerated rate, allowing you to accumulate rewards more quickly. Consider your regular expenses and choose a credit card that rewards you generously for your typical purchases.

Annual fees are another aspect to take into account. Some credit cards have annual fees, while others are fee-free. Though it may seem tempting to opt for a no-annual-fee credit card, it’s important to weigh the benefits and perks associated with cards that have annual fees. These cards often provide additional travel benefits such as airport lounge access, travel insurance, or statement credits, which can offset the annual fee’s cost and enhance your overall travel experience.

Furthermore, it’s essential to consider the additional perks offered by the credit card. This can include benefits such as travel insurance, concierge services, extended warranties, or access to exclusive events. These perks can add value to your overall experience and make your travels more enjoyable and stress-free. Evaluate the additional perks offered by different credit cards and choose the ones that align with your travel preferences.

Lastly, it’s essential to consider the acceptance and compatibility of the credit card. Ensure that the credit card you choose is widely accepted both domestically and internationally, as this will ensure you can earn points no matter where you use your card. Additionally, check if the credit card is compatible with popular mobile payment platforms, such as Apple Pay or Google Pay, for added convenience.

Choosing the right credit card is a vital step in maximizing your credit card points for travel. By considering factors such as the rewards program, sign-up bonuses, earning potential, annual fees, additional perks, and acceptance, you can find a credit card that aligns with your travel goals and helps you accumulate points quickly and efficiently.

Earning Credit Card Points

Now that you have chosen the right credit card, it’s time to start earning credit card points. Earning points is a key component of maximizing your travel rewards, and there are several strategies you can implement to accelerate your point accumulation.

The most obvious way to earn credit card points is by making regular purchases using your credit card. Every dollar you spend can translate into points, so be sure to use your credit card for everyday expenses like groceries, dining out, shopping, and more. However, keep in mind that responsible credit card usage is crucial. Always pay off your balance in full each month to avoid accruing interest charges.

Many credit cards also offer bonus categories that provide higher earning rates on specific spending. For example, a credit card may offer 2x or 3x points on travel-related expenses, such as flights, hotels, and rental cars. Take advantage of these bonus categories by using your credit card for eligible purchases. Make sure to read the terms and conditions of your credit card’s rewards program to fully understand the earning potential in each category.

In addition to regular spending, credit cards often provide opportunities to earn bonus points through promotions and partnerships. Keep an eye out for special offers, such as spending thresholds that unlock bonus points or referral programs that award points for referring friends or family members to the credit card. Take advantage of these promotions to boost your point balance.

Furthermore, some credit cards have partnerships with specific retailers, airlines, or hotel chains. By using your credit card to make purchases with these partners, you can earn additional points or even qualify for exclusive benefits. For example, a credit card may offer extra points for booking flights or hotel stays through their designated travel portal. Take advantage of these partnerships to earn more points while enjoying your favorite brands or travel experiences.

Another approach to earning credit card points is by maximizing the sign-up bonuses offered by credit card companies. These bonuses can yield a significant number of points for eligible applicants who meet a minimum spending requirement within a specified time frame, usually the first few months of card ownership. To earn the sign-up bonus, focus your spending on meeting the required amount within the given timeframe. This approach can give your point balance a significant boost right from the start.

Lastly, staying informed about your credit card’s rewards program is essential. Credit card companies may introduce limited-time promotions or targeted offers that allow you to earn extra points. Keep track of any updates or emails from your credit card company to take advantage of these opportunities for maximizing your point earnings.

By implementing these strategies, you can accelerate your credit card point accumulation and unlock more travel rewards. Remember to always review the terms and conditions of your credit card’s rewards program and stay mindful of any limitations or exclusions for earning points.

Maximizing Point Value

Once you have accumulated a substantial number of credit card points, the next step is to maximize their value. Maximizing the value of your points involves strategically redeeming them for the best possible rewards and making smart decisions to get the most out of each point.

One of the first things to consider is the redemption options available to you. While some credit cards offer a variety of redemption options, including cashback or merchandise, if your goal is to maximize your travel rewards, it’s best to focus on travel-related redemptions. Look for options that allow you to redeem your points for flights, hotel stays, car rentals, or vacation packages. These travel redemptions often provide the highest value per point and can significantly enhance your travel experiences.

When it comes to booking flights, flexibility is key. Being open to different travel dates, times, and even destinations can help you find the best value for your points. Some credit cards have their own travel portals where you can redeem points directly for flights or use a combination of points and cash to cover the cost. Alternatively, you may have the option to transfer your credit card points to partner programs, such as airline frequent flyer programs, where you can often find better redemption rates and more flight options.

Similarly, when redeeming points for hotel stays, consider the redemption value and the availability of desirable hotels within the program. Many credit card reward programs have partnerships with hotel chains, allowing you to transfer points directly or book through their designated travel portal. Research different hotel options and compare redemption rates to choose the most value-driven option.

Regardless of the redemption method you choose, it’s crucial to compare the value of your points to the actual cost of the travel-related purchase. Calculate the point value by dividing the price of the redemption by the number of points required. Aim for a redemption value of at least 1 cent per point. If the redemption value is lower, it might be worth considering alternatives or saving your points for a more valuable opportunity.

Timing also plays a role in maximizing your point value. Keep an eye out for limited-time promotions or increased redemption rates for certain destinations or flights. Additionally, be aware of blackout dates or restrictions that may limit your ability to redeem points during peak travel periods. Planning your trips and redeeming your points strategically can help you get the most bang for your buck.

Lastly, consider the overall value of the rewards you’re redeeming. Travel perks like free checked bags, priority boarding, hotel upgrades, or complimentary breakfast can add significant value to your travel experience. Take advantage of any additional benefits or perks that come with your travel redemptions to enhance your journey.

Maximizing the value of your credit card points requires careful consideration and research. By focusing on travel-related redemptions, comparing redemption values, being flexible with your travel plans, and taking advantage of any additional perks, you can make the most of your points and enjoy incredible travel experiences without breaking the bank.

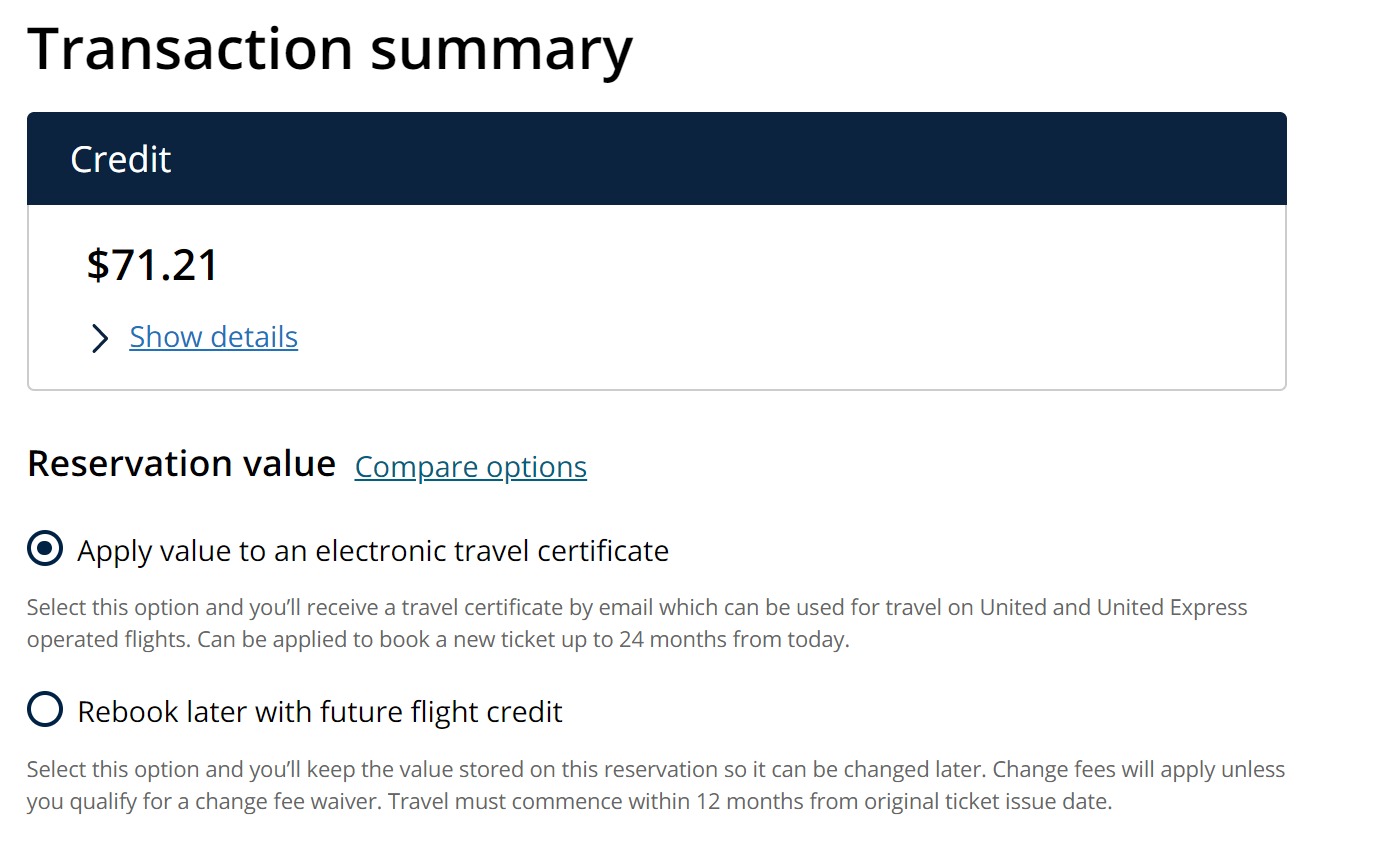

Redeeming Credit Card Points for Travel

One of the most exciting aspects of earning credit card points is the ability to redeem them for travel. Whether it’s a dream vacation, a weekend getaway, or a business trip, redeeming your credit card points for travel can make your adventures more affordable and memorable. Here’s a guide on how to effectively redeem your credit card points for travel.

First, explore the redemption options provided by your credit card’s rewards program. Some credit cards have their own travel portals where you can directly book flights, hotels, car rentals, and vacation packages using your points. These portals often offer a wide range of options, allowing you to find the best deals and customize your travel plans based on your preferences.

In addition to booking through your credit card’s travel portal, you may also have the option to transfer your points to airline frequent flyer programs or hotel loyalty programs. Transferring points can unlock even more possibilities and potentially provide higher redemption values. Research the transfer partners available to you and their respective conversion rates to determine if this option aligns with your travel goals.

When redeeming points for flights, it’s important to be flexible with your travel dates and destinations. When booking through a credit card’s travel portal or transferring points to an airline program, you may have more options and better redemption rates if you’re open to different flight times or alternate airports. Additionally, considering off-peak travel periods or shoulder seasons can often result in more favorable redemption rates.

For hotel redemptions, research the participating hotels within your credit card’s rewards program or transfer partners. Take into account factors such as location, amenities, and customer reviews to ensure you’re getting the most value out of your points. Look for opportunities to utilize point multipliers or special promotions to stretch your points further or enjoy complimentary upgrades and additional perks.

Another important consideration is the availability of award seats or hotel rooms. Some popular airlines or hotels may have limited award inventory, especially during peak travel periods. It’s recommended to plan and book well in advance to secure your desired travel accommodations. Keep an eye out for any blackout dates or restrictions that may apply to the redemption of your points.

When redeeming your points for travel, it’s essential to calculate the value of your points to ensure you’re getting the best deal. Compare the redemption value per point to the cash price of the travel purchase to determine if it’s a worthwhile redemption. Aim for a redemption value of at least 1 cent per point to maximize your rewards.

Lastly, don’t forget to consider additional travel perks that may come with your redemption. Some credit cards offer benefits such as free checked bags, priority boarding, or access to airport lounges. Taking advantage of these perks can enhance your travel experience and provide added value to your redemption.

Overall, redeeming your credit card points for travel can be a rewarding experience. By exploring different redemption options, being flexible with your travel plans, and considering the value and availability of the rewards, you can make the most of your credit card points and embark on incredible travel adventures.

Transfer Partners and Frequent Flyer Programs

One of the key strategies to maximize your credit card points for travel is by taking advantage of transfer partners and frequent flyer programs. Many credit card rewards programs allow you to transfer your points to airline and hotel partners, opening up a world of possibilities for redeeming your points for flights, hotel stays, and other travel perks. Here’s a closer look at how transfer partners and frequent flyer programs can enhance your travel redemption options.

Transfer partners are affiliated airlines or hotel chains that have a partnership agreement with your credit card’s rewards program. These partnerships allow you to convert your credit card points into airline miles or hotel loyalty points. By transferring your points to these programs, you can gain access to additional redemption options and potentially find better value for your points.

Before transferring your points, it’s essential to research and evaluate the transfer ratios between your credit card’s rewards program and its transfer partners. Conversion rates can vary, and not all partners offer a 1:1 transfer ratio. Some programs may offer bonus transfer promotions, providing an even better value for your points.

When it comes to frequent flyer programs, each airline has its own rewards program that allows members to earn and redeem miles for flights and other travel benefits. By transferring your credit card points to these frequent flyer programs, you can take advantage of their award charts and redemption options.

It’s important to research the different frequent flyer programs and their respective partner airlines to determine which ones align best with your travel preferences. Consider factors such as airline alliances, coverage to your desired destinations, and the availability of award seats. Some frequent flyer programs may also offer benefits like elite status perks or upgrades, enhancing your travel experience even further.

When utilizing frequent flyer programs, it’s crucial to be flexible with your travel dates and destinations. Award seat availability can vary, and certain flights or routes may have limited award inventory, especially during peak travel seasons. By being open to different travel options, you can increase your chances of finding available award seats and redeeming your points efficiently.

In addition to airlines, credit card rewards programs often have partnerships with major hotel chains. These partnerships allow you to transfer your credit card points to hotel loyalty programs, which can be valuable when redeeming points for hotel stays or accessing elite benefits such as room upgrades and late check-outs.

When considering hotel transfer partners, research the participating hotel chains and their redemption options. Look for hotels that align with your travel plans and offer desirable locations, amenities, and benefits. Keep in mind that some hotel loyalty programs may have award night availability restrictions, so plan ahead to secure your desired accommodations.

Transferring your credit card points to airline and hotel partners can provide you with more options and potentially better value when redeeming your points for travel. Keep an eye out for transfer bonuses, special promotions, and strategic partner relationships that can further enhance the value of your points.

By leveraging transfer partners and frequent flyer programs, you can unlock a world of possibilities and maximize the potential value of your credit card points for travel. Take the time to understand which partners align with your travel goals and explore the different redemption options available to you.

Utilizing Hotel Rewards Programs

When it comes to maximizing your credit card points for hotel stays, one powerful strategy is to leverage hotel rewards programs. Hotel rewards programs offer a range of benefits and perks for loyal customers, and by understanding and utilizing these programs, you can make the most of your credit card points and enhance your hotel experience. Here’s a closer look at how to effectively utilize hotel rewards programs.

Firstly, it’s important to join the hotel rewards programs associated with the hotel chains you frequently stay at or are interested in. Membership is typically free and allows you to earn points for each stay, which can later be redeemed for future accommodations or other travel benefits. Most hotel rewards programs also offer elite tiers based on your level of activity, providing additional perks such as room upgrades, late check-outs, and priority service.

Once you have joined a hotel rewards program, be sure to provide your membership number when making hotel reservations or checking in. This ensures that you earn the appropriate points for your stay. Additionally, consider booking directly with the hotel or through your credit card’s travel portal, as this can often provide additional point earning opportunities compared to third-party booking platforms.

To maximize your point accumulation, explore opportunities to earn bonus points within the hotel rewards program. Many programs offer promotions or partnerships that allow you to earn extra points for specific activities, such as dining at hotel restaurants, using hotel services, or opting for certain room types. Keep an eye out for these opportunities and take advantage of them to boost your point balance.

When it comes to redeeming your credit card points for hotel stays, understanding the redemption options within the hotel rewards program is crucial. Research the different award categories and the number of points required for various types of rooms. Some hotel chains offer different tiers or levels of rooms, each with its own points requirement. It’s essential to evaluate the value you will receive for your points and choose the most suitable redemption option based on your needs and preferences.

In addition to free nights, hotel rewards programs often offer other redemption options, such as room upgrades, dining credits, or even experiences like spa treatments or tours. Assess the available redemption choices and consider whether a non-standard redemption option might provide better value or enhance your overall hotel experience.

Another valuable aspect of hotel rewards programs is their partnerships with other travel providers. These partnerships allow you to redeem your hotel points for additional travel benefits, such as airline miles, car rentals, or vacation packages. Take the time to explore these options and consider whether it might be more beneficial to transfer your hotel points to a partner program or utilize them in conjunction with your credit card points for a more comprehensive travel experience.

Lastly, don’t forget to take advantage of the elite status benefits offered by hotel rewards programs. As you earn more points or stay more nights, you can unlock higher elite tiers, which provide additional perks such as room upgrades, complimentary breakfast, late check-outs, and access to exclusive lounges. These benefits can significantly enhance your hotel stays and make your travel experiences even more enjoyable.

By understanding and utilizing hotel rewards programs, you can maximize the value of your credit card points when it comes to hotel stays. Join the programs, take advantage of bonus point opportunities, assess redemption options, explore partnerships, and embrace the perks of elite status to make the most of your hotel rewards program membership and elevate your travel experiences.

Tips and Tricks for Maximizing Credit Card Points

When it comes to maximizing your credit card points, implementing certain strategies and keeping some key tips in mind can help you make the most of your rewards. Here are some tips and tricks to consider:

- Research and compare: Before applying for a credit card or redeeming your points, thoroughly research different credit cards, their rewards programs, and redemption options. Compare earning rates, redemption values, and additional perks to find the cards that align with your travel goals and offer the best value for your spending habits.

- Sign-up bonuses: Take advantage of credit card sign-up bonuses. These bonuses can provide a significant boost to your point balance, allowing you to enjoy immediate travel benefits. Just make sure to meet the minimum spending requirement within the specified timeframe to qualify for the bonus.

- Strategic spending: Be strategic with your spending to earn more points. Utilize bonus categories and take advantage of promotions to earn extra points in specific spending areas. Consider using your credit card for large purchases or recurring expenses to maximize your point accumulation.

- Pay your balance in full: To avoid accruing interest charges, always pay your credit card balance in full and on time. Accumulating interest will negate the value of your earned points, so strive to maintain a responsible credit card usage habit.

- Use the right card: Assess each spending situation to determine which credit card will earn you the most points. Some cards offer higher earning rates on specific categories like travel or dining, so match your card selection accordingly to optimize your points.

- Take advantage of partner programs: Transfer your credit card points to partner programs, such as airline frequent flyer programs or hotel loyalty programs, for potentially better redemption rates and increased flexibility in your travel options.

- Stay updated: Keep yourself informed about your credit card’s rewards program. Be aware of limited-time promotions, bonus point opportunities, and changes to the program policies. This knowledge can help you maximize your points and take advantage of the best redemption options.

- Combine points and cash: Some credit card reward programs allow you to use a combination of points and cash for your travel redemptions. This flexibility can be advantageous when you don’t have enough points for a full redemption but still want to utilize them towards your travel expenses.

- Plan ahead: For peak travel periods or popular destinations, plan and book your flights and accommodations well in advance to secure award seats and availability. By booking early, you increase your chances of using your points for the flights and hotels you desire.

- Use credit card portals: Explore and make use of your credit card’s travel portal. These portals can offer additional benefits, exclusive deals, and enhanced point redemption values for flights, hotels, and other travel-related expenses.

By following these tips and tricks, you can maximize the value of your credit card points and unlock incredible travel rewards. Remember to remain disciplined with your credit card usage, stay informed about your rewards program, and always assess the value and flexibility of your point redemption options. With proper planning and strategy, your credit card points can take you on unforgettable adventures while saving you money.

Conclusion

Maximizing your credit card points for travel can be an incredibly rewarding experience if done strategically. By understanding how credit card points work, choosing the right credit card, and implementing smart earning and redemption strategies, you can unlock amazing travel benefits and make the most of your rewards.

Start by choosing a credit card that aligns with your travel goals and spending habits. Look for cards that offer generous sign-up bonuses, high earning rates in relevant categories, and valuable additional perks. Research different rewards programs and compare their redemption options to find the best value for your points.

Once you have your credit card, focus on earning points strategically. Take advantage of bonus categories, promotional offers, and referral programs. Maximize your spending by using your credit card for everyday expenses and big-ticket purchases while paying off your balance in full each month to avoid accruing interest.

When it’s time to redeem your points, consider travel-related options for the highest value. Explore flights, hotel stays, and other travel perks through your credit card’s travel portal or by transferring points to partner programs. Be flexible with your travel plans to find the best redemption rates and availability.

To make the most of your credit card points, utilize hotel rewards programs, take advantage of transfer partners, and maximize the benefits of elite status. Research different hotel chains, assess their value proposition, and consider booking directly to earn additional points or utilize exclusive perks.

Lastly, remember to stay informed about your credit card’s rewards program and take advantage of promotions and limited-time offers. Plan ahead for peak travel periods and strategically combine points with cash when necessary. Regularly evaluate and adjust your strategies to ensure you’re maximizing your points and getting the best value for your rewards.

In conclusion, understanding the world of credit card points and implementing effective strategies is essential to maximizing their value for travel. With the right knowledge, careful planning, and a little creativity, you can unlock incredible travel experiences and make your dream trips a reality without stretching your budget. So, start earning, redeeming, and exploring the world with your credit card points today!