Finance

What Is A Travel Credit Card

Published: October 26, 2023

Discover the benefits of a travel credit card and how it can help you financially. Maximize your rewards and save on travel expenses with this popular finance tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Travel Credit Card?

- How Does a Travel Credit Card Work?

- Benefits of Using a Travel Credit Card

- Drawbacks of Using a Travel Credit Card

- Factors to Consider When Choosing a Travel Credit Card

- Best Travel Credit Cards in the Market

- Tips for Using a Travel Credit Card Effectively

- Conclusion

Introduction

Traveling is a passion for many people around the world, allowing them to experience different cultures, explore new destinations, and create memorable experiences. However, one common challenge that travelers face is managing their finances while on the go. Carrying cash can be risky, while using a regular credit card may result in hefty foreign transaction fees. This is where travel credit cards come in, offering a convenient and cost-effective solution for travelers.

A travel credit card is a specialized type of credit card that is designed to cater to the needs of frequent travelers. It offers a range of benefits and features that can make your travel experience more enjoyable, convenient, and budget-friendly. From earning reward points to accessing travel perks and avoiding foreign transaction fees, a travel credit card can be an invaluable asset in your financial toolkit.

However, understanding how travel credit cards work and choosing the right one can be a daunting task. With so many options available in the market, it’s important to have a clear understanding of the advantages and disadvantages before making a decision.

In this article, we will delve into the world of travel credit cards, exploring what they are, how they work, and the benefits and drawbacks they offer. We will also discuss key factors to consider when selecting a travel credit card and provide recommendations for some of the best travel credit cards currently available.

Whether you’re planning a once-in-a-lifetime trip or you’re a frequent jetsetter, understanding the ins and outs of travel credit cards will help you make informed decisions and maximize the benefits they provide. So, let’s embark on this journey together and explore the world of travel credit cards!

What is a Travel Credit Card?

A travel credit card is a type of credit card that is specifically designed for travelers. It offers a range of features and benefits that are tailored to meet the needs of individuals who frequently travel domestically or internationally. These cards typically come with travel-related perks, rewards programs, and special offers that can help travelers save money and enhance their travel experience.

One of the key features of a travel credit card is the ability to earn travel rewards. These rewards are often earned through a points system, where cardholders earn a certain number of points for every dollar spent on eligible purchases, such as flights, hotels, and dining. These points can then be redeemed for various travel-related expenses, including flights, hotel stays, car rentals, and more. Some travel credit cards also offer sign-up bonuses, where cardholders can earn a substantial number of bonus points after meeting a spending requirement within a specific timeframe.

In addition to earning rewards, travel credit cards often come with other travel-related benefits. For example, many travel credit cards offer travel insurance coverage, which can include trip cancellation/interruption insurance, lost luggage reimbursement, and emergency medical coverage. This can provide cardholders with peace of mind knowing that they are protected against unforeseen events that may occur while traveling.

Furthermore, travel credit cards may offer perks such as airport lounge access, free checked bags, priority boarding, and concierge services. These perks can make your travel experience more comfortable and convenient, allowing you to enjoy exclusive amenities and services.

Another notable feature of travel credit cards is the ability to make purchases in foreign currencies without incurring foreign transaction fees. When using a regular credit card abroad, you may be charged a fee (usually around 3%) for each transaction made in a currency other than your card’s default currency. Travel credit cards often waive these fees, which can lead to significant savings for international travelers.

It’s important to note that while travel credit cards offer many benefits, they also come with certain terms and conditions. These may include annual fees, minimum spending requirements, and specific restrictions on earning and redeeming rewards. Before choosing a travel credit card, it’s essential to carefully review and compare the terms of different cards to ensure that you select the one that best suits your travel needs and spending habits.

In the next section, we will explore in detail how travel credit cards work and the mechanics behind their rewards programs.

How Does a Travel Credit Card Work?

Travel credit cards work similarly to regular credit cards, but with specific features and benefits tailored to suit the needs of travelers. Here’s how they work:

1. Earning Rewards: Travel credit cards offer rewards programs that allow cardholders to earn points or miles for every dollar spent on eligible purchases. These rewards can be accumulated over time and redeemed for a variety of travel-related expenses, such as flights, hotel stays, car rentals, and more. The number of points earned per dollar spent may vary depending on the card and the type of purchase.

2. Sign-Up Bonuses: Many travel credit cards offer sign-up bonuses to entice new customers. These bonuses typically require cardholders to spend a certain amount within a specified time frame, such as $3,000 in the first three months. In return, cardholders can earn a substantial number of bonus points, which can jumpstart their rewards balance.

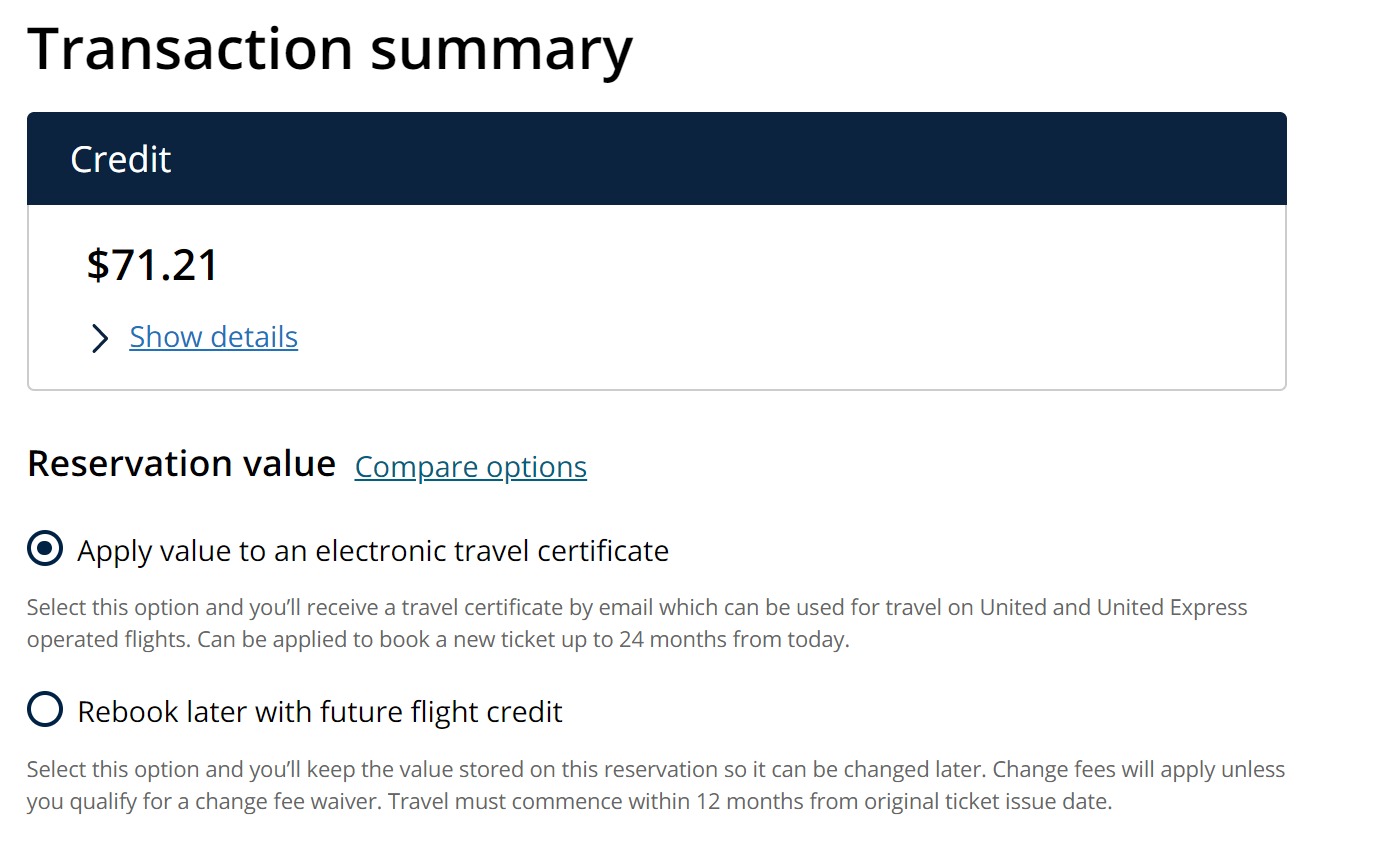

3. Redemption Options: Once you have accumulated a certain number of points or miles, you can redeem them for travel-related expenses. This can be done through the credit card’s rewards portal, where you can browse and select the available redemption options. Some travel credit cards also offer the flexibility to transfer points to partner airlines or hotels for increased value and flexibility.

4. Travel Benefits and Perks: Travel credit cards often come with additional benefits and perks. These can include complimentary airport lounge access, priority boarding, free checked bags, travel insurance coverage, concierge services, and more. These perks can enhance your travel experience and provide added value for cardholders.

5. Foreign Transaction Fees: One of the advantages of using a travel credit card is the ability to make purchases in foreign currencies without incurring foreign transaction fees. Regular credit cards typically charge a fee (usually around 3%) for transactions made in a currency other than the card’s default currency. Travel credit cards, on the other hand, often waive these fees, making them a cost-effective choice for international travelers.

It’s important to note that travel credit cards may come with annual fees. These fees can vary depending on the card and the benefits it offers. While some cards may waive the annual fee for the first year, it’s essential to consider the long-term cost and benefits before applying for a travel credit card.

In summary, travel credit cards work by allowing cardholders to earn rewards on eligible purchases, accumulate these rewards over time, and redeem them for various travel-related expenses. They also offer additional perks and benefits designed to enhance the travel experience. By understanding how travel credit cards work, you can make informed decisions and maximize the value they provide.

Benefits of Using a Travel Credit Card

Travel credit cards can provide numerous benefits that make them a valuable tool for avid travelers. Here are some of the key advantages of using a travel credit card:

1. Travel Rewards: One of the major benefits of using a travel credit card is the ability to earn travel rewards. With every dollar spent on eligible purchases, cardholders can accumulate points, miles, or cashback that can be redeemed for flights, hotel stays, car rentals, and more. This allows travelers to save money on their travel expenses and even enjoy free or discounted travel experiences.

2. Sign-Up Bonuses: Many travel credit cards offer attractive sign-up bonuses to new cardholders. These bonuses typically require meeting a minimum spending requirement within a certain timeframe. By meeting these requirements, cardholders can earn a substantial amount of bonus rewards, which can provide a head start in earning travel rewards.

3. Travel Perks and Benefits: Travel credit cards often come with additional perks and benefits that enhance the travel experience. This can include access to airport lounges, priority boarding, free checked bags, hotel upgrades, concierge services, and more. These perks can make traveling more comfortable, convenient, and luxurious, adding value to your overall travel experience.

4. Travel Insurance Coverage: Many travel credit cards provide complimentary travel insurance coverage. This can include trip cancellation/interruption insurance, lost luggage reimbursement, travel accident insurance, and emergency medical coverage. Having these insurance benefits can provide peace of mind and financial protection in case of unforeseen travel mishaps.

5. No Foreign Transaction Fees: Using a regular credit card for international transactions often incurs foreign transaction fees, typically around 3% of the transaction amount. Travel credit cards, however, often waive these fees, making them an excellent choice for travelers who frequently make purchases abroad. By avoiding these fees, travelers can save money and avoid unnecessary expenses.

6. Exclusive Discounts and Offers: Travel credit cards may provide access to exclusive discounts and offers from partner airlines, hotels, and other travel-related merchants. These discounts can range from discounted airfare and hotel rates to special offers on dining, entertainment, and activities. By taking advantage of these deals, travelers can save money and enjoy exclusive experiences.

7. Fraud Protection: Like regular credit cards, travel credit cards offer robust fraud protection measures. This includes zero liability protection, which means that cardholders are not responsible for unauthorized charges made on their cards. Additionally, travel credit cards often come with advanced security features, such as EMV chips and contactless payments, to ensure secure transactions while traveling.

In summary, using a travel credit card can offer an array of benefits, including earning travel rewards, accessing exclusive perks and benefits, enjoying travel insurance coverage, avoiding foreign transaction fees, and benefiting from fraud protection measures. By leveraging these advantages, travelers can make their trips more affordable, convenient, and enjoyable.

Drawbacks of Using a Travel Credit Card

While travel credit cards offer numerous benefits, it’s important to be aware of the potential drawbacks associated with using them. Here are some of the common drawbacks of using a travel credit card:

1. Annual Fees: Many travel credit cards come with annual fees. These fees can range from moderate to high, depending on the card’s benefits and rewards program. While some cards may waive the annual fee for the first year, it’s essential to factor in the annual fee when evaluating the overall value and cost-effectiveness of the card.

2. Higher Interest Rates: Travel credit cards often have higher interest rates compared to other types of credit cards. If you carry a balance on your credit card and accrue interest charges, the higher interest rates of a travel credit card can offset the value of rewards earned. It’s crucial to pay off your balance in full each month to avoid interest charges.

3. Limited Acceptance: While most major credit cards are widely accepted, there may still be some merchants or establishments, especially in remote or less developed areas, that do not accept credit cards. This can be a limitation when using a travel credit card, particularly in destinations where cash is the primary form of payment.

4. Reward Redemption Restrictions: Some travel credit cards may have restrictions when it comes to redeeming rewards. This can include blackout dates, limited availability, or specific booking requirements. It’s essential to understand these restrictions to ensure that you can use your rewards when and how you want.

5. Potential Overspending: The allure of earning rewards with each purchase can tempt cardholders to overspend. It’s crucial to stick to a budget and only make purchases within your means. Accumulating credit card debt and paying interest charges can quickly negate the value of any rewards earned.

6. Foreign Transaction Fees on Non-Travel Expenses: While travel credit cards typically eliminate foreign transaction fees for purchases made abroad, some cards may still charge these fees for non-travel expenses. If you use your travel credit card for everyday purchases in a foreign currency, you may still incur these fees, reducing the value of using the card.

7. Credit Score Impact: Applying for multiple credit cards, including travel credit cards, within a short period can have a temporary impact on your credit score. Each credit card application results in a hard inquiry on your credit report. It’s important to be mindful of the potential impact on your credit score when considering multiple credit card applications.

While the drawbacks should be taken into consideration, they should not overshadow the potential benefits of using a travel credit card. By being aware of these drawbacks and using the card responsibly, you can effectively navigate the potential pitfalls and make the most of the benefits offered.

Factors to Consider When Choosing a Travel Credit Card

Choosing the right travel credit card can significantly impact your overall travel experience and the value you gain from using the card. Here are some important factors to consider when selecting a travel credit card:

1. Rewards Program: Evaluate the rewards program of the travel credit card, including how points or miles are earned, redemption options, and the value of the rewards. Look for a program that aligns with your travel preferences and offers flexibility in redeeming rewards for the type of travel you enjoy.

2. Sign-Up Bonus: Consider the sign-up bonus offered by the travel credit card. Look for a card that offers a substantial sign-up bonus and reasonable spending requirements to maximize your initial rewards earning potential.

3. Annual Fees: Take into account the annual fee associated with the travel credit card. Consider whether the benefits and rewards outweigh the cost of the annual fee. Some cards may waive the fee for the first year, while others may offer additional perks and benefits that justify the fee.

4. Travel Benefits and Perks: Assess the additional travel benefits and perks offered by the card, such as airport lounge access, travel insurance coverage, priority boarding, and hotel or airline elite status. Determine which benefits are most valuable to you and align with your travel preferences.

5. Foreign Transaction Fees: Make sure to choose a travel credit card that does not charge foreign transaction fees if you frequently travel internationally. This will allow you to make purchases abroad without incurring additional fees.

6. Acceptance and Accessibility: Consider the card’s acceptance and accessibility. Ensure that the card is widely accepted, domestically and internationally, enabling you to use it in most places you visit. Additionally, check if the card offers mobile payment options, such as contactless or digital wallet compatibility, for added convenience.

7. Customer Service: Research the quality of customer service offered by the credit card issuer. Look for positive reviews of their customer service responsiveness and their ability to resolve issues or inquiries promptly and efficiently, especially while traveling.

8. Credit Score Impact: Understand the potential impact on your credit score when applying for a travel credit card. Each application results in a hard inquiry on your credit report. Consider whether it is the right time for you to apply for new credit, especially if you plan to make other significant financial decisions in the near future.

9. Additional Fees and Terms: Read the fine print and understand any additional fees or terms associated with the travel credit card. These may include balance transfer fees, cash advance fees, penalty fees, and interest rates. Being aware of these fees and terms will help you avoid any unpleasant surprises.

By carefully considering these factors, you can select a travel credit card that aligns with your travel preferences, maximizes your rewards potential, and provides the benefits and features that will enhance your travel experiences.

Best Travel Credit Cards in the Market

With a wide range of options available, it can be challenging to determine the best travel credit card for your needs. The following are some of the top travel credit cards in the market, known for their attractive rewards programs, travel benefits, and overall value:

1. Chase Sapphire Preferred® Card: This card is highly regarded for its generous sign-up bonus, flexible rewards program, and valuable travel benefits. Cardholders can earn bonus points on travel and dining purchases and transfer points to various airline and hotel partners for enhanced redemption options.

2. Capital One Venture Rewards Credit Card: This card offers straightforward rewards with no blackout dates or restrictions. Cardholders earn unlimited miles on every purchase, and miles can be redeemed for travel expenses. The card also provides a valuable Global Entry or TSA PreCheck credit.

3. American Express® Gold Card: Known for its generous rewards on dining and groceries, this card offers valuable travel benefits, including airline fee credits and hotel perks. Cardholders also have access to the American Express Membership Rewards program, enabling flexible redemption options.

4. Citi Premier® Card: This card offers competitive rewards on travel, dining, and entertainment purchases. Cardholders can transfer points to airline loyalty programs, unlocking significant value for frequent travelers. The card also provides a range of travel benefits, including trip cancellation/interruption insurance.

5. Bank of America® Travel Rewards credit card: This card is an excellent option for those who prefer simplicity and no annual fee. Cardholders earn unlimited points on every purchase, and points can be redeemed for travel expenses with flexibility and no blackout dates. The card also offers a 0% introductory APR on purchases for a certain period.

6. Discover it® Miles: This card stands out for its straightforward rewards program, where cardholders earn a flat rate on every purchase. Miles can be redeemed as a statement credit toward travel purchases, and the card has no annual fee. Additionally, Discover offers a unique first-year match where all miles earned are doubled.

7. Southwest Rapid Rewards® Premier Credit Card: This airline-specific card is ideal for frequent Southwest Airlines travelers. Cardholders earn points toward free flights and have access to valuable perks such as a yearly Companion Pass and anniversary bonus points.

8. United℠ Explorer Card: This card is tailored for United Airlines enthusiasts. It offers generous rewards on United purchases, along with valuable travel benefits like priority boarding, free checked bags, and two United Club passes per year. Cardholders can also earn a substantial sign-up bonus.

9. Marriott Bonvoy Boundless™ Credit Card: This hotel credit card is a great choice for those who frequently stay at Marriott properties. Cardholders earn points on every purchase, receive elite status benefits, and have access to valuable perks such as an annual free night award.

10. Hilton Honors American Express Surpass® Card: Designed for Hilton loyalists, this card offers generous rewards on Hilton purchases and provides complimentary Hilton Honors Gold status. Cardholders also earn a substantial sign-up bonus and have access to valuable travel benefits.

Remember, the best travel credit card for you will depend on your specific travel preferences, spending habits, and financial goals. Consider your travel patterns, the rewards program that aligns with your desired redemption options, and the overall value provided by the card’s benefits.

Tips for Using a Travel Credit Card Effectively

Using a travel credit card effectively can help you maximize the benefits, rewards, and value it offers. Follow these tips to make the most of your travel credit card:

1. Understand the Rewards Program: Take the time to familiarize yourself with the specific rewards program of your travel credit card. Learn how to earn points or miles, the redemption options available, and any restrictions or blackout dates that may apply. This will enable you to strategically earn and redeem rewards for maximum value.

2. Utilize the Sign-Up Bonus: Take advantage of the sign-up bonus offered by your travel credit card. Plan your spending accordingly to meet the required minimum spending within the specified time frame to earn a substantial amount of bonus rewards.

3. Pay Your Balance in Full: To avoid paying interest charges and potentially nullifying the value of your rewards, make it a priority to pay your balance in full each month. Carry a balance only when absolutely necessary, as the interest charges can quickly add up.

4. Redeem Rewards Wisely: Be strategic when redeeming your rewards to maximize their value. Look for opportunities to get the most out of your points or miles by booking high-value flights, hotel stays, or other travel experiences.

5. Take Advantage of Travel Benefits: Make full use of the additional travel benefits offered by your travel credit card. This may include airport lounge access, travel insurance coverage, free checked bags, and concierge services. These perks can enhance your travel experience and provide value beyond the rewards program.

6. Use your Card for Travel-Related Purchases: Use your travel credit card for all travel-related expenses, such as flights, hotel bookings, and dining. This allows you to earn more rewards and take advantage of any bonus points or category multipliers specific to these types of purchases.

7. Take Note of Annual Fees: Understand the annual fee associated with your travel credit card. Assess whether the benefits and rewards outweigh the cost. If you find that the annual fee is no longer justified, consider switching to a different travel credit card or downgrading to a card with no or lower annual fees.

8. Keep Your Card Active: Be sure to use your travel credit card regularly to keep it active and prevent any accumulated rewards from expiring. Even making small purchases and paying them off promptly can help maintain your account’s active status.

9. Monitor Your Account: Regularly monitor your credit card account to stay on top of your spending, track your rewards, and identify any unauthorized transactions promptly. Many credit card issuers offer mobile apps or online account access for easy monitoring.

10. Travel Responsibly: Finally, ensure you maintain responsible financial habits while using your travel credit card. Keep your spending within your budget, avoid unnecessary debt, and make timely payments to maintain a positive credit history.

By following these tips, you can effectively leverage your travel credit card to earn and maximize rewards, access valuable travel benefits, and enhance your overall travel experience.

Conclusion

Travel credit cards can be invaluable tools for frequent travelers, offering a range of benefits and rewards that can enhance the travel experience while saving money. From earning travel rewards to accessing valuable travel perks and avoiding foreign transaction fees, these credit cards provide a convenient and cost-effective way to manage finances while on the go.

In this article, we explored what travel credit cards are and how they work. We discussed the benefits of using a travel credit card, including the ability to earn travel rewards, access travel-related perks, and enjoy travel insurance coverage. We also discussed the drawbacks associated with travel credit cards, such as annual fees and potential overspending.

When choosing a travel credit card, it’s important to consider factors such as the rewards program, annual fees, travel benefits, and acceptance. We provided a list of some of the best travel credit cards in the market, each offering unique features and benefits to cater to different travel preferences and needs.

To effectively use a travel credit card, it’s essential to understand the rewards program, utilize the sign-up bonus, pay balances in full to avoid interest charges, and strategically redeem rewards. It’s also important to take advantage of the additional travel benefits offered by the card and to use the card for travel-related purchases. By following these tips, travelers can optimize the benefits and rewards provided by their travel credit cards.

Ultimately, the right travel credit card will depend on individual preferences, spending habits, and travel patterns. It’s important to carefully consider the features and benefits of different cards before making a decision.

So, whether you’re a frequent traveler seeking to earn and maximize travel rewards or simply looking for a cost-effective way to manage your finances while on the go, a travel credit card can be a valuable asset. By understanding how they work, choosing the right one, and utilizing it effectively, you can unlock a world of travel benefits and rewards.