Finance

How To Use Credit Card Points For Flights

Modified: February 21, 2024

Maximize your credit card rewards by learning how to use your points for flights. Discover the best finance strategies to save money on travel expenses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Card Points

- Types of Credit Card Points

- Finding the Best Credit Card for Travel Rewards

- Earning Credit Card Points

- Maximizing Credit Card Points for Flights

- Booking Flights with Credit Card Points

- Tips for Using Credit Card Points Effectively

- Common Mistakes to Avoid

- Conclusion

Introduction

Welcome to the world of credit card points! If you’re someone who loves to travel and wants to make the most of your expenses, then understanding how to use credit card points for flights is a game-changer. Credit card points can offer you incredible opportunities to save money and fly to your dream destinations without breaking the bank.

So, what exactly are credit card points? In simple terms, they are rewards that you earn for making purchases using your credit card. These points can be redeemed for various perks and benefits, including free or discounted flights.

There are several types of credit card points available, each with its own unique features and benefits. Understanding these different types will help you choose the best credit card for your travel needs.

Once you have the right credit card, accumulating points becomes key. You can earn credit card points through regular purchases, sign-up bonuses, and even by referring friends or family members to the credit card company.

But the true magic happens when you know how to maximize your credit card points for flights. By strategically using your points, you can unlock huge savings on airfare, upgrades, and even lounge access.

In this article, we’ll guide you through the journey of using credit card points for flights. We’ll cover everything from finding the best credit card for travel rewards to booking flights using your hard-earned points. We’ll also provide you with some tips and tricks to ensure you use your credit card points effectively.

However, it’s important to remember that credit card points can be tricky to navigate if you’re not careful. That’s why we’ll also highlight some common mistakes to avoid, so you can make the most of this valuable travel resource.

So, whether you’re a seasoned credit card points user or just starting, get ready to unlock a world of excitement and savings as we delve into the art of using credit card points for flights.

Understanding Credit Card Points

Before we dive into the intricate details of using credit card points for flights, it’s crucial to have a solid understanding of what credit card points actually are. Essentially, credit card points are a type of reward system offered by credit card companies to incentivize cardholders to use their cards for purchases.

With each purchase you make using your credit card, you earn a certain number of points. These points can then be accumulated over time and redeemed for various benefits, such as flights, hotel stays, cashback, or merchandise.

Credit card points vary in value, and the redemption options also differ based on the credit card issuer and the specific rewards program. It’s essential to familiarize yourself with the terms and conditions of your credit card’s rewards program to fully grasp the potential benefits and limitations.

Some credit card points have a fixed value, while others have flexible redemption options. In some cases, points can be transferred to airline or hotel loyalty programs, allowing you to maximize their value.

Additionally, some credit card points may have expiration dates, meaning you need to use them within a specific timeframe. Keep this in mind to avoid losing your hard-earned points.

Overall, credit card points are a versatile currency that can provide incredible value if used wisely. By understanding the ins and outs of credit card points, you can make informed decisions and get the most out of your credit card rewards.

Types of Credit Card Points

When it comes to credit card points, there is no one-size-fits-all. Different credit card issuers offer various types of rewards programs, each with its own set of features and benefits. Understanding the different types of credit card points will help you choose the right card for your travel goals. Here are some of the most common types of credit card points:

- Airline Miles: Many credit cards partner with specific airlines, allowing you to earn airline miles with each purchase. These miles can then be redeemed for flights, upgrades, and other airline-related perks. Examples of cards that offer airline miles include the Delta SkyMiles, United MileagePlus, and American Airlines AAdvantage cards.

- Hotel Points: Similar to airline miles, some credit cards partner with hotel chains, enabling you to earn hotel points. These points can be used for free or discounted hotel stays, room upgrades, and other hotel-related rewards. Popular examples include the Marriott Bonvoy, Hilton Honors, and World of Hyatt credit cards.

- Flexible Points: These are credit card points that can be used in various ways, giving you the flexibility to choose your redemption options. Examples include Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points. With these flexible points, you can transfer them to airline or hotel partners, or use them for statement credits, gift cards, and more.

- Cashback: Instead of earning points, some credit cards offer cashback rewards. These rewards can be redeemed for statement credits or deposited directly into your bank account. Cashback credit cards are an excellent option if you prefer simplicity and want to use your rewards for any expense, including flights.

- Rewards Programs: Some credit card issuers have their own proprietary rewards programs that offer a range of redemption options. These programs may allow you to earn points that can be used for travel, merchandise, experiences, and more. Examples include the Capital One Venture Rewards and Discover it cards.

It’s important to carefully consider the type of credit card points that align with your travel preferences and spending habits. Evaluate the redemption options, transfer partners, and any associated fees to ensure you maximize the value of your rewards.

Each type of credit card points has its own advantages and potential limitations, so take the time to research and choose the rewards program that best suits your travel goals.

Finding the Best Credit Card for Travel Rewards

If you’re eager to make the most of your travel experiences using credit card points, it’s essential to find the right credit card for travel rewards. With so many options available, it can feel overwhelming, but conducting thorough research will lead you to the best card for your needs. Here are some key factors to consider when searching for the ideal travel rewards credit card:

- Sign-Up Bonus: Many travel rewards credit cards offer enticing sign-up bonuses to attract new cardholders. These bonuses typically require you to meet a minimum spending requirement within a specified time frame. Look for cards with generous sign-up bonuses that align with your spending habits and travel goals.

- Earning Structure: Evaluate how many points or miles you can earn for each dollar spent on the credit card. Some cards offer accelerated earning on travel-related expenses, while others provide a flat rate for all purchases. Identify the card that aligns with the majority of your spending categories to maximize your rewards.

- Redemption Options: Consider the flexibility and variety of redemption options offered by the credit card. If you value the ability to transfer points to airline or hotel partners, ensure that the card provides this feature. Alternatively, if you prefer simplicity, look for cards that offer statement credits or cashback as redemption options.

- Annual Fee: Many travel rewards credit cards have an annual fee associated with them. Evaluate the benefits and rewards offered by the card and determine if they outweigh the cost of the annual fee. Additionally, some cards may waive the annual fee for the first year, providing an opportunity to test out the card before committing.

- Additional Benefits: Beyond earning and redeeming rewards, some travel rewards credit cards offer additional perks and benefits. These may include travel insurance, airport lounge access, concierge services, or elite status with airlines or hotels. Consider these extra benefits and assess if they align with your travel preferences.

- Foreign Transaction Fees: If you frequently travel internationally, be mindful of credit cards that charge foreign transaction fees. Look for cards that waive these fees, as it can save you money when using your card abroad.

Once you have a clear understanding of your travel goals and preferences, compare different credit cards based on the factors mentioned above. Utilize online resources, credit card comparison websites, and read reviews to gather as much information as possible. Ultimately, finding the best credit card for travel rewards involves finding a card that offers a strong earning structure, desirable redemption options, and valuable additional benefits.

Remember, the best credit card for travel rewards is subjective and depends on your specific needs and spending patterns. Take the time to evaluate your options, weigh the benefits against the costs, and choose a card that aligns with your travel aspirations. With the right card in hand, you’ll be well on your way to turning your expenses into memorable travel experiences.

Earning Credit Card Points

When it comes to earning credit card points, there are several strategies you can employ to maximize your accumulation. By being strategic in your spending and taking advantage of opportunities to earn bonus points, you can expedite your journey towards free or discounted flights. Here are some effective ways to earn credit card points:

- Everyday Expenses: Use your credit card to pay for everyday expenses such as groceries, gas, and bills. By making these purchases with your credit card instead of cash or debit, you can earn points on every transaction. It’s important to stick to a budget and avoid overspending to ensure that you can pay your balance in full each month.

- Sign-Up Bonuses: When applying for a new credit card, look for ones with enticing sign-up bonuses. These bonuses often require you to reach a minimum spending threshold within a specific timeframe. By utilizing your new card for your regular expenses or planning for larger purchases during the bonus period, you can quickly accumulate a significant number of points.

- Category Spending: Many credit cards offer higher points earning rates for specific categories, such as dining, travel, or groceries. Understanding the spending categories that offer accelerated earning can help you strategically allocate your expenses. Consider having multiple credit cards to optimize rewards for different categories.

- Online Shopping Portals: Take advantage of online shopping portals offered by credit card issuers. These portals allow you to earn additional points by shopping at popular retailers. Simply access the retailer’s website through the credit card portal, and your purchases will be tracked to earn bonus points.

- Referral Bonuses: Some credit card companies offer referral bonuses when you refer friends or family members to sign up for a specific card. If you have friends who are interested in a travel rewards credit card, take advantage of referral programs to earn extra points for every successful referral.

- Promotions and Offers: Keep an eye out for special promotions and offers from your credit card issuer. They may run limited-time promotions that allow you to earn bonus points for specific spending categories or when booking travel through their affiliated partners. Stay informed and be proactive in taking advantage of these opportunities.

It’s crucial to remember that responsible credit card usage should be your top priority. Always pay your balance in full and on time to avoid interest charges and late fees. Accumulating credit card points should not lead to excessive spending or debt. Instead, view it as a way to make your regular expenses work for you and to earn rewards for your responsible financial behavior.

By strategically earning credit card points through your everyday spending, maximizing sign-up bonuses, and taking advantage of promotional opportunities, you’ll be well on your way to accumulating a substantial amount of points that can be used towards your next flight.

Maximizing Credit Card Points for Flights

Once you’ve accumulated a substantial amount of credit card points, it’s time to maximize their value when it comes to booking flights. Here are some strategies to make the most of your credit card points for flights:

- Research Flight Redemption Options: Different credit card rewards programs have varying redemption options for flights. Research and compare the options available to find the best value for your points. Look for flexible programs that allow you to transfer points to airline partners or book flights directly through the credit card’s travel portal.

- Take Advantage of Transfer Partners: If your credit card program offers the option to transfer points to airline or hotel loyalty programs, explore the possibilities. By transferring points, you can potentially access better redemption rates or take advantage of airline alliances to book flights with different carriers.

- Look for Redemption Bonuses: Some credit card programs offer redemption bonuses when you use your points for certain flights or in specific regions. These bonuses can add extra value to your points, allowing you to stretch them further for your travel needs. Keep an eye out for promotional offers and take advantage of them when they align with your travel plans.

- Be Flexible with Travel Dates and Destinations: Being flexible with your travel plans can significantly increase your chances of finding great flight deals using credit card points. Consider traveling during off-peak seasons or on weekdays to maximize the availability of flight options. Additionally, be open to exploring different destinations, as some routes may have better redemption rates.

- Combine Points and Cash: If you don’t have enough points to cover the full cost of a flight, some credit card programs allow you to use a combination of points and cash. This can be a great option to save on out-of-pocket expenses while still utilizing your points to reduce the overall cost of the flight.

- Take Advantage of Elite Benefits: Many credit card programs offer elite benefits when it comes to booking flights. This may include priority boarding, free checked bags, or access to airport lounges. Utilize these additional perks to enhance your travel experience and maximize the value of your credit card points.

- Compare Cash Prices: Before redeeming your points for a flight, compare the cash price of the same flight. Sometimes, using your points might not offer the best value if the cash price is significantly lower. Ensure that you’re getting a good redemption rate for your points before finalizing your booking.

Remember, availability for flights using credit card points may be limited, especially during peak travel periods. It’s important to plan and book in advance to secure the best options for your desired travel dates.

By following these strategies, you can maximize the value of your credit card points and enjoy significant savings on flights, making your dream destinations more accessible than ever.

Booking Flights with Credit Card Points

Once you’ve identified the best redemption option and maximized the value of your credit card points, it’s time to book your flights. Here are the steps to take when booking flights with credit card points:

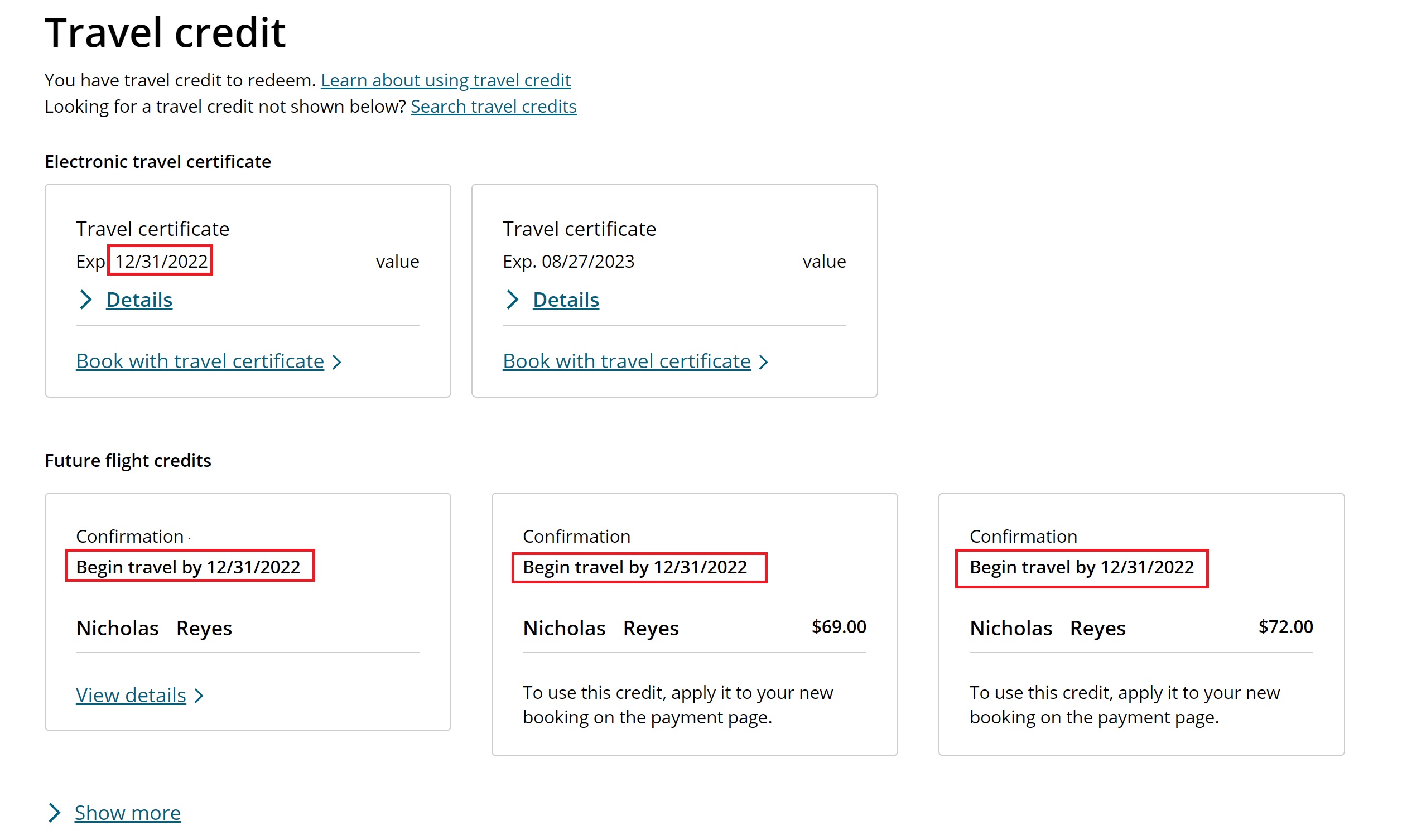

- Check Point Balance: Before you start searching for flights, check your credit card points balance to ensure you have enough for the desired itinerary. Take note of any expiration dates or requirements for redeeming points.

- Search for Flights: Begin your search for flights by using the credit card rewards portal or airline websites. Input your travel details, including dates, departure and arrival cities, and preferred cabin class. Compare the prices in both cash and points to determine the most favorable option.

- Filter Search Results: Use the available filters to narrow down the search results based on your preferences. You can filter by airlines, flight times, layovers, and more. This will help you find the most convenient and suitable flights for your travel plans.

- Explore Transfer Options: If your credit card points can be transferred to airline partners, check if any of those partners offer better redemption rates or more desirable flight options. Evaluate the transfer ratios and any associated fees before making a decision.

- Consider Stopovers or Open-Jaw Itineraries: Sometimes, booking a flight with a stopover or utilizing an open-jaw itinerary can offer better value for your credit card points. These options allow you to explore multiple destinations or spend more time in a particular location without significantly impacting your point redemption.

- Book the Flight: Once you have selected the desired flights, proceed with the booking process. Follow the prompts to enter passenger details, review the itinerary, and complete the payment using your credit card points. Ensure that all the information is accurate before finalizing the booking.

- Confirm Booking and Receive Confirmation: After completing the booking, you will receive a confirmation email containing all the details of your flight. Double-check the information and keep the confirmation for reference.

- Manage Your Reservation: It’s important to regularly check your flight reservation to ensure there are no changes or updates. Keep track of your travel dates, flight times, and any requirements for check-in or seat selection. Make any necessary adjustments or additions to your reservation as needed.

Finally, enjoy your flight! Take advantage of any additional benefits offered by your credit card, such as priority boarding or lounge access, to enhance your travel experience.

Remember, flight availability using credit card points can be limited, especially during peak travel seasons. It’s advisable to book your flights as soon as possible to secure the best options and avoid disappointment.

By following these steps and being diligent throughout the booking process, you can successfully use your credit card points to book flights and embark on your next unforgettable journey.

Tips for Using Credit Card Points Effectively

Using credit card points to their full potential requires a strategic approach. These tips will help you navigate the world of credit card rewards and maximize the value of your points:

- Plan Ahead: Create a travel goal and plan your redemption strategy accordingly. By having a clear vision of your desired travel destinations and timelines, you can optimize your point accumulation and make the most of redemption opportunities.

- Stay Organized: Keep track of your credit card points, expiration dates, and program terms and conditions. Utilize spreadsheets or mobile apps to stay organized and ensure you don’t miss out on any valuable rewards.

- Combine Points from Multiple Sources: If you have multiple credit cards or loyalty programs, consider consolidating your points. Transferring points to one account can increase your redemption options and allow you to access higher-tier benefits.

- Take Advantage of Bonus Categories: Make your everyday spending work for you by utilizing credit cards that offer bonus points for specific categories. Use the right card for each spending category to earn maximum points.

- Monitor Promotions: Keep an eye on special promotions and offers from your credit card issuer. These promotions may include bonus point earning opportunities, discounted redemptions, or exclusive travel deals.

- Leverage Airline and Hotel Partnerships: Explore transfer options to airline and hotel loyalty programs associated with your credit card. Transferring points can often provide better value and open up a wider range of redemption options.

- Be Mindful of Fees: Consider the fees associated with transferring points, booking flights, or maintaining certain credit cards. Evaluate whether the fees outweigh the benefits before making any decisions.

- Review Redemption Policies: Familiarize yourself with the redemption policies of your credit card rewards program. Understand blackout dates, seat availability, and any other restrictions that may affect your ability to redeem points for flights.

- Stay Updated on Program Changes: Credit card rewards programs can undergo changes, such as modifications to redemption rates or new benefits. Stay informed and regularly review updates to ensure you’re making the most informed decisions.

- Avoid Cashing In Points for Cashback: While cashback can be appealing, it often offers a lower value compared to redeeming points for travel-related expenses. Keep this in mind to ensure you’re maximizing the value of your credit card points.

By implementing these tips, you can effectively navigate the world of credit card rewards and make the most of your accumulated points. Remember, your points are a valuable resource that can turn your travel aspirations into reality, so use them wisely and enjoy the benefits they offer!

Common Mistakes to Avoid

When it comes to using credit card points for flights, there are some common mistakes that many people make. By being aware of these pitfalls, you can avoid them and ensure that you are making the most of your credit card rewards. Here are some common mistakes to avoid:

- Not Understanding Program Rules: Failing to familiarize yourself with the rules and terms of your credit card rewards program can lead to missed opportunities and frustrations. Take the time to understand expiration dates, redemption restrictions, and any applicable fees.

- Carrying a Balance: Carrying a balance on your credit card can quickly diminish the value of your credit card points. The interest charges you incur can outweigh the benefits of the points you earn. Make it a priority to pay off your balance in full each month to avoid interest fees.

- Ignoring Sign-Up Bonuses: Many credit cards offer generous sign-up bonuses that can significantly boost your points balance. Failing to take advantage of these bonuses means potentially missing out on valuable rewards. Research and apply for credit cards with attractive sign-up offers that align with your travel goals.

- Overlooking Transfer Opportunities: Some credit card rewards programs allow you to transfer points to airline or hotel loyalty programs at a favorable conversion rate. Neglecting to explore these transfer options can result in missed opportunities for higher redemption values and more flexible travel options.

- Redeeming Points for Low-Value Options: Be cautious when redeeming points for low-value options, such as merchandise, gift cards, or cashback. While these options may be tempting, they often provide a lower redemption value compared to using your points for flights or other travel-related expenses.

- Missing Out on Limited-Time Promotions: Credit card rewards programs frequently offer limited-time promotions, including bonus point offers or discounted redemptions. Failing to stay updated and take advantage of these promotions means potentially missing out on valuable opportunities to maximize your points.

- Not Taking Advantage of Additional Card Benefits: Beyond earning points, many credit cards offer additional benefits such as travel insurance, airport lounge access, or concierge services. Failing to utilize these benefits means missing out on valuable perks that can enhance your travel experience.

- Forgetting to Check Cash Prices: Before redeeming your points for a flight, always check the cash price of the same flight. In some cases, the cash price may be significantly lower than the value of the points required for redemption. Assess whether using points offers a better value and make an informed decision.

- Not Planning in Advance: Availability for flights using credit card points can be limited, especially during peak travel seasons. Not planning in advance may result in restricted options or the inability to redeem your points for flights at desirable times. Plan your travel well in advance to secure the best options.

- Letting Points Expire: Many credit card rewards programs have expiration dates for their points. Failing to keep track of these dates can result in forfeiting your hard-earned points. Be mindful of expiration dates and utilize your points before they expire or consider cards with no expiration policy.

By avoiding these common mistakes, you can ensure that you make the most of your credit card points and enjoy the full benefits of your travel rewards. Stay informed, plan ahead, and make strategic decisions to optimize your credit card rewards program for a seamless and rewarding travel experience.

Conclusion

Using credit card points for flights is a powerful tool that can transform the way you travel. By understanding how credit card points work, identifying the best credit card for your travel goals, and implementing effective strategies, you can unlock incredible savings and enjoy memorable experiences without breaking the bank.

Throughout this article, we have explored the fundamentals of credit card points, the different types of points available, tips for finding the best credit card for travel rewards, and strategies for earning and maximizing points specifically for flights. We have also discussed the importance of being aware of common mistakes to avoid and provided insights to help you make the most of your credit card rewards.

Remember, careful planning, being organized, and staying informed are key to using your credit card points effectively. Whether it’s taking advantage of sign-up bonuses, utilizing transfer partners, or planning your travel in advance, every decision you make can help you accumulate more points and stretch their value to the maximum.

As you embark on your credit card points journey, be sure to keep an eye on program updates, stay informed about promotional offers, and make choices that align with your travel goals and preferences. With careful strategy and responsible financial habits, you can enjoy the thrill of traveling while saving money and leveraging the benefits of your credit card rewards.

So, start exploring the various credit card options available, evaluate your spending habits, and set your travel goals. With the right credit card and a strategic approach, you’ll be on your way to unlocking the incredible possibilities that credit card points offer for your future flights.