Finance

How To Obtain A 3D Secure Card

Published: March 2, 2024

Learn how to obtain a 3D Secure card and add an extra layer of security to your financial transactions. Safeguard your online purchases with this essential finance tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

In today's digital age, online transactions have become an integral part of our daily lives. Whether it's shopping for groceries, booking flights, or paying bills, the convenience of making purchases from the comfort of our homes is undeniable. However, with the increasing prevalence of cyber threats and fraudulent activities, ensuring the security of online transactions has become more crucial than ever. This is where 3D Secure cards come into play, offering an extra layer of protection and peace of mind for both consumers and merchants.

The 3D Secure card, also known as "Three-Domain Secure," is an advanced security protocol designed to authenticate the identity of the cardholder during online transactions. It adds an extra layer of security by requiring the cardholder to enter a unique password or code, thus reducing the risk of unauthorized usage and fraudulent activities. This additional authentication step minimizes the chances of unauthorized transactions, providing a safer online shopping experience for cardholders.

As the demand for secure online transactions continues to rise, understanding the benefits and application process of a 3D Secure card is essential for anyone seeking to safeguard their financial transactions in the digital realm. In this comprehensive guide, we will delve into the intricacies of 3D Secure cards, exploring their benefits, application procedures, activation methods, and best practices for secure usage. Whether you're a seasoned online shopper or a newcomer to the world of digital payments, this guide will equip you with the knowledge and confidence to make the most of your 3D Secure card while prioritizing the security of your online transactions.

What is a 3D Secure Card?

A 3D Secure card is a payment card that incorporates an additional layer of security for online transactions. It is designed to minimize the risk of unauthorized usage and provide enhanced protection for both cardholders and merchants during online purchases. The "3D" in 3D Secure stands for "Three-Domain Secure," representing the three domains involved in the authentication process: the issuer domain (the bank or financial institution that issued the card), the acquirer domain (the merchant’s bank), and the interoperability domain (the infrastructure that facilitates the secure exchange of information).

When a cardholder initiates an online transaction using a 3D Secure card, they are prompted to enter a unique password or code to verify their identity. This additional step of authentication helps prevent unauthorized usage of the card for online purchases, reducing the likelihood of fraudulent activities and unauthorized transactions. The 3D Secure protocol adds an extra layer of security to the payment process, instilling confidence in both consumers and merchants by mitigating the risks associated with online transactions.

It is important to note that 3D Secure technology has evolved over the years, with the latest version offering advanced security features and improved user experience. The most widely used version, 3D Secure 2, incorporates intelligent risk-based authentication, frictionless user experience, and enhanced data sharing between merchants, issuers, and card networks. This next-generation protocol aims to streamline the authentication process while maintaining robust security standards, making it a valuable asset in the realm of online payments.

Overall, a 3D Secure card serves as a powerful tool for combating online payment fraud and enhancing the security of digital transactions. By integrating an additional layer of authentication, cardholders can enjoy a safer and more secure online shopping experience, while merchants benefit from reduced fraud-related risks and increased trust from consumers.

Benefits of a 3D Secure Card

Obtaining and using a 3D Secure card offers a myriad of benefits for both cardholders and merchants, enhancing the security and reliability of online transactions. Let’s explore some of the key advantages associated with 3D Secure cards:

- Enhanced Security: One of the primary benefits of a 3D Secure card is the heightened level of security it provides for online transactions. By requiring additional authentication, such as a one-time password or biometric verification, the cardholder’s identity is confirmed, reducing the risk of unauthorized usage and fraudulent activities.

- Reduced Fraud: 3D Secure cards play a pivotal role in minimizing the occurrence of online payment fraud. The added layer of authentication acts as a deterrent to unauthorized transactions, making it more challenging for fraudsters to exploit cardholder information for illicit purposes.

- Consumer Confidence: For cardholders, the use of 3D Secure cards instills a sense of confidence and trust when making online purchases. Knowing that their transactions are fortified with an extra layer of security can alleviate concerns about potential fraud, ultimately enhancing the overall online shopping experience.

- Merchant Protection: Merchants also benefit from the implementation of 3D Secure technology. With reduced instances of fraud and unauthorized transactions, merchants can conduct business with greater confidence, knowing that the risk of financial losses due to fraudulent activities is mitigated.

- Global Acceptance: 3D Secure cards are widely accepted across various online platforms and e-commerce websites, offering a seamless and secure payment experience for cardholders worldwide. This global acceptance makes 3D Secure cards a versatile and reliable payment solution for online transactions.

- Regulatory Compliance: By utilizing 3D Secure technology, both card issuers and merchants can align with regulatory requirements and industry standards related to online payment security. This compliance not only fosters a secure payment ecosystem but also enhances the overall integrity of the digital payment landscape.

Overall, the adoption of 3D Secure cards brings forth a host of benefits that encompass heightened security, fraud prevention, consumer confidence, and global usability. As the digital economy continues to evolve, the significance of 3D Secure technology in safeguarding online transactions remains paramount, underscoring its indispensable role in fortifying the security and trustworthiness of electronic payments.

How to Apply for a 3D Secure Card

Acquiring a 3D Secure card involves a straightforward application process facilitated by your card issuer, typically a bank or financial institution. Here are the general steps to apply for a 3D Secure card:

- Check Eligibility: Before applying for a 3D Secure card, ensure that you meet the eligibility criteria set forth by your card issuer. Eligibility requirements may vary based on factors such as credit history, income, and existing banking relationships.

- Contact Your Card Issuer: Reach out to your card issuer, either through their website, customer service hotline, or a visit to a local branch, to express your interest in obtaining a 3D Secure card. The issuer will guide you through the application process and provide necessary details regarding the card’s features and associated terms.

- Submit Application: Complete the application form provided by the card issuer, furnishing accurate personal information, contact details, and any additional documentation as required. The application form may be available online or in physical format, depending on the issuer’s preferences.

- Verification and Approval: Upon submission of the application, the card issuer will review your details, conduct necessary verifications, and assess your eligibility for the 3D Secure card. Once approved, you will receive confirmation along with the issuance of the card.

- Receive and Activate the Card: Upon successful approval, the 3D Secure card will be dispatched to your registered address. Upon receipt, follow the activation instructions provided by the issuer to enable the card for online transactions.

It is important to note that the specific application process and requirements may vary among different card issuers and financial institutions. Some institutions may automatically issue 3D Secure cards to eligible customers, while others may require explicit application and approval.

Prior to applying for a 3D Secure card, it is advisable to review the associated terms, fees, and features to make an informed decision aligned with your financial needs and preferences. By proactively engaging with your card issuer and adhering to the application guidelines, you can seamlessly obtain a 3D Secure card and leverage its enhanced security features for your online transactions.

Activating Your 3D Secure Card

Upon receiving your 3D Secure card, the next crucial step is to activate it to enable secure online transactions. The activation process typically involves setting up the unique authentication credentials required to validate your identity during online purchases. Here’s a guide to activating your 3D Secure card:

- Review Activation Instructions: Carefully review the activation instructions provided by your card issuer, which may be included in the card package or communicated through digital channels. The instructions will outline the steps to activate your 3D Secure card and may include a dedicated activation website or customer service hotline.

- Access the Activation Platform: Follow the provided instructions to access the designated activation platform, which could be an online portal or a secure authentication page. Ensure that the platform is legitimate and affiliated with your card issuer to prevent falling victim to fraudulent activation attempts.

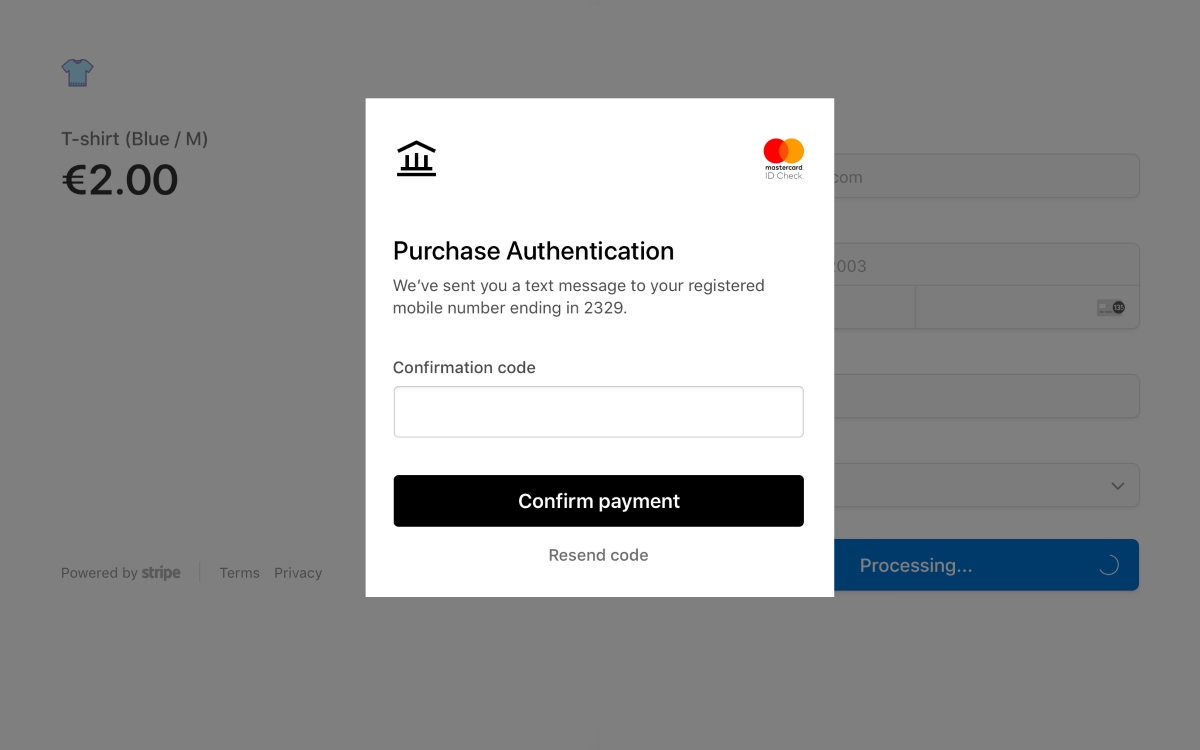

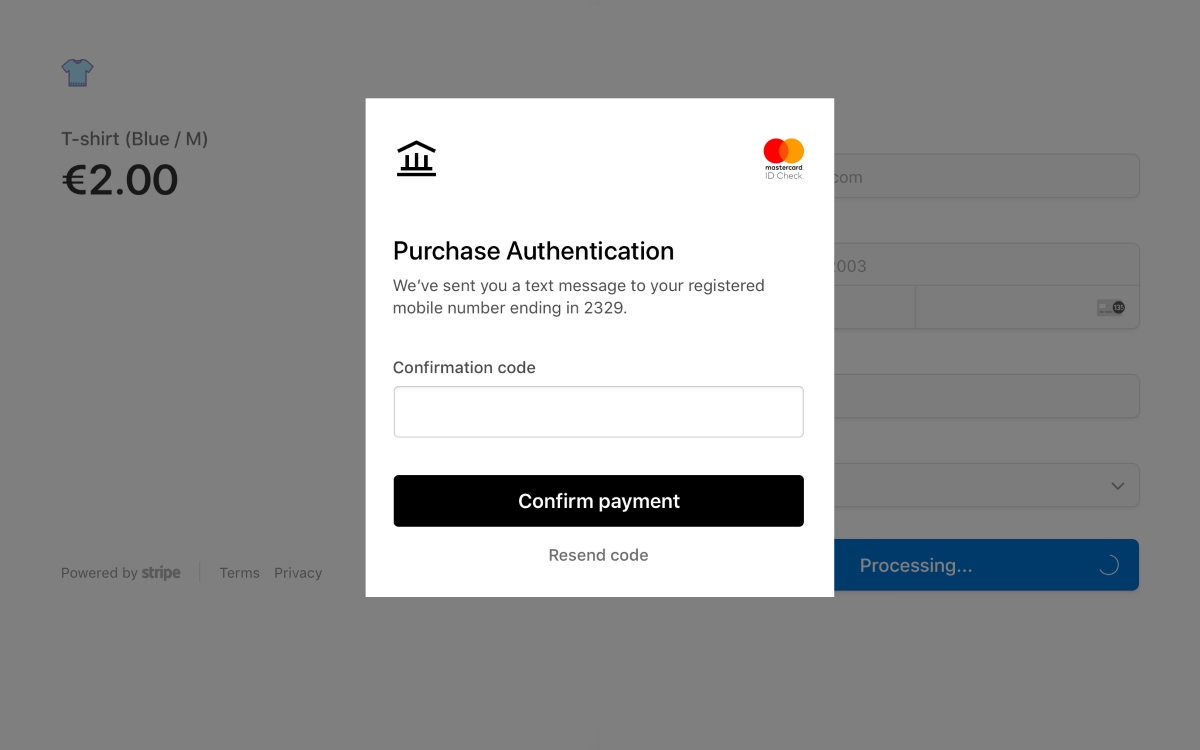

- Enter Authentication Details: Depending on the issuer’s requirements, you may need to input specific authentication details, such as a one-time password (OTP) sent to your registered mobile number or an activation code provided with the card. This step serves to link your card to the 3D Secure authentication system.

- Create Secure Password or PIN: In some cases, you may be prompted to create a secure password, personal identification number (PIN), or other unique credentials that will be used to authenticate your identity during online transactions. It is crucial to select a strong and memorable password to fortify the security of your 3D Secure card.

- Confirmation and Test Transaction: Upon successful activation, you will receive confirmation of the activation status. To ensure that the activation process is complete, consider initiating a test transaction on a trusted online platform to verify that your 3D Secure card is fully operational and the authentication process is functioning as intended.

By diligently following the activation guidelines provided by your card issuer and exercising caution when disclosing sensitive information, you can effectively activate your 3D Secure card and harness its robust security features for safeguarding your online transactions. Remember to keep your authentication details confidential and refrain from sharing them with unauthorized parties to maintain the integrity of your card’s security features.

Using Your 3D Secure Card

Utilizing your 3D Secure card for online transactions entails a seamless and secure process, empowering you to make purchases with enhanced protection against unauthorized usage and fraudulent activities. Here’s a comprehensive overview of how to effectively use your 3D Secure card for digital payments:

- Select 3D Secure Merchant: When making an online purchase, opt to transact with merchants that support 3D Secure technology. Look for prominent indicators such as "Verified by Visa," "Mastercard SecureCode," or other 3D Secure authentication logos displayed on the merchant’s website, signaling their commitment to secure online transactions.

- Initiate Payment: Upon selecting your desired products or services, proceed to the checkout or payment page. When prompted, choose the option to pay using a credit or debit card and enter your 3D Secure card details, including the card number, expiration date, and security code.

- Authentication Prompt: After entering your card details, you will encounter an authentication prompt, signaling the initiation of the 3D Secure verification process. Depending on the issuer’s authentication method, you may be required to input a one-time password (OTP) sent to your registered mobile number, verify biometric credentials, or enter the unique authentication code associated with your card.

- Complete the Transaction: Upon successful authentication, proceed to complete the transaction as usual. The additional layer of security provided by 3D Secure technology helps safeguard your payment, reducing the risk of unauthorized usage and bolstering the overall security of the online purchase.

- Confirmation and Receipt: Upon completing the transaction, you will receive confirmation of the purchase along with a digital receipt or order confirmation. This signifies the successful completion of the secure online transaction facilitated by your 3D Secure card.

By adhering to these steps and transacting with reputable merchants that prioritize 3D Secure authentication, you can leverage the enhanced security features of your 3D Secure card to conduct online purchases with confidence and peace of mind. The seamless integration of 3D Secure technology into the digital payment ecosystem underscores its pivotal role in fortifying the security and reliability of online transactions for cardholders worldwide.

Tips for Keeping Your 3D Secure Card Safe

Ensuring the security of your 3D Secure card is essential for safeguarding your online transactions and protecting your financial information from potential threats. Implementing best practices to keep your card safe is paramount in maintaining a secure digital payment experience. Here are valuable tips to enhance the safety and integrity of your 3D Secure card:

- Memorize Your Authentication Details: Commit your 3D Secure card’s authentication credentials, such as passwords or PINs, to memory. Avoid writing them down or storing them in easily accessible digital formats to prevent unauthorized access.

- Enable Transaction Notifications: Activate transaction alerts and notifications provided by your card issuer. These real-time alerts can promptly notify you of any unauthorized or suspicious transactions, allowing you to take immediate action if fraudulent activity is detected.

- Utilize Secure Websites: When conducting online transactions, ensure that you transact on secure and reputable websites. Look for HTTPS encryption, padlock icons, and 3D Secure authentication logos to verify the legitimacy and security of the merchant’s platform.

- Update Contact Information: Maintain up-to-date contact details with your card issuer to ensure that you receive important notifications and alerts related to your 3D Secure card. Prompt communication channels can facilitate swift responses to potential security concerns.

- Be Wary of Phishing Attempts: Exercise caution when responding to unsolicited emails, messages, or calls requesting sensitive card details or authentication information. Verify the authenticity of communications with your card issuer to mitigate the risk of falling victim to phishing scams.

- Regularly Review Statements: Routinely review your card statements and transaction history to identify any irregularities or unauthorized charges. Promptly report any discrepancies to your card issuer for further investigation and resolution.

- Secure Digital Devices: Ensure that the devices used for online transactions, such as computers, smartphones, and tablets, are equipped with updated security software and safeguards against malware and unauthorized access.

- Report Lost or Stolen Cards: Immediately report the loss or theft of your 3D Secure card to your issuer to prevent unauthorized usage. Most issuers offer 24/7 hotlines for reporting lost or stolen cards, enabling prompt card cancellation and replacement.

By incorporating these proactive measures into your card management practices, you can fortify the security of your 3D Secure card and mitigate potential risks associated with online transactions. Prioritizing the safety and integrity of your card enhances the overall security of your digital payment endeavors, fostering a trusted and secure online shopping experience.

Conclusion

As the digital landscape continues to redefine the way we engage in commerce and financial transactions, the importance of robust security measures cannot be overstated. The advent of 3D Secure cards has significantly bolstered the security of online payments, empowering cardholders and merchants with an additional layer of protection against unauthorized usage and fraudulent activities.

By delving into the intricacies of 3D Secure technology, we have uncovered its pivotal role in fortifying the security and reliability of digital transactions. From the initial application process to the safe and secure usage of 3D Secure cards, the journey toward leveraging this advanced payment solution encompasses a seamless and fortified experience for consumers and businesses alike.

The benefits of 3D Secure cards extend beyond mere transactional security, encompassing enhanced consumer confidence, reduced fraud risks, and global acceptance, thus shaping a more resilient and trustworthy digital payment ecosystem. The proactive steps outlined for activating and using 3D Secure cards, coupled with best practices for safeguarding their security, underscore the comprehensive approach required to ensure a safe and secure online payment experience.

As we navigate the dynamic landscape of digital commerce, the adoption and utilization of 3D Secure cards serve as a testament to the collective commitment toward fostering a secure, reliable, and seamless online transaction environment. By embracing the principles of vigilance, awareness, and proactive security measures, cardholders can harness the full potential of 3D Secure technology, fostering a digital payment landscape that prioritizes security, trust, and peace of mind.

In essence, the journey of obtaining and utilizing a 3D Secure card transcends the realm of mere financial transactions, embodying a commitment to security, integrity, and confidence in the digital age. As the digital economy continues to evolve, the significance of 3D Secure technology remains pivotal, serving as a cornerstone in the ongoing quest to fortify the security and reliability of online payments for individuals and businesses worldwide.