Finance

How To Pay Off 25K In Credit Card Debt

Modified: December 29, 2023

Learn the best strategies to pay off 25K in credit card debt and regain control of your finances with our expert finance tips and advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with credit card debt can be overwhelming and stressful, especially when you have a large balance to repay. If you find yourself in a situation where you owe $25,000 on your credit cards, you’re not alone. Many individuals struggle with mounting credit card debt, often due to overspending, unexpected expenses, or emergencies.

In this article, we will explore effective strategies to help you pay off $25,000 in credit card debt. It’s important to note that becoming debt-free requires discipline, commitment, and a plan tailored to your financial situation. By following the steps outlined in this article, you can make significant progress towards eliminating your credit card debt and achieving financial freedom.

Before diving into the strategies, take a moment to assess your current debt situation. Understand the interest rates, minimum monthly payments, and outstanding balances on each of your credit cards. This information will help you formulate an effective plan to pay off your debt in the most efficient way possible.

As you embark on your journey to become debt-free, it’s crucial to create a realistic budget. Calculate your monthly income and expenses, making note of any unnecessary expenses that can be cut back or eliminated. By prioritizing essential expenses and reducing discretionary spending, you can free up more money to put towards your debt repayment.

Choosing a repayment strategy is another critical step in tackling your credit card debt. Two popular methods are the snowball and avalanche methods. The snowball method involves paying off the smallest balances first, while the avalanche method focuses on tackling debts with the highest interest rates. Choose the approach that aligns with your financial goals and motivates you to stay on track.

Cutting expenses is essential to accelerate your debt repayment. Look for ways to reduce your monthly bills, such as renegotiating insurance rates, canceling subscriptions you no longer use, or finding cheaper alternatives for everyday expenses.

Increasing your income is another effective way to pay off your credit card debt faster. Consider taking on a part-time job, freelancing, or starting a side business to generate additional income. Direct the extra money towards your debt repayment to expedite the payoff process.

Negotiating with your creditors can also be beneficial. Contact your credit card companies and inquire about lower interest rates or repayment options that can alleviate your financial burden. Many creditors are willing to work with you to find a mutually agreeable solution.

Assessing Your Debt

Before you can effectively tackle your $25,000 credit card debt, it’s crucial to assess your current financial situation. Understanding the details of your debt will help you formulate a plan and set realistic goals for repayment.

Begin by making a list of all your credit card balances, interest rates, and minimum monthly payments. This will give you a comprehensive overview of your debt and allow you to prioritize your repayment strategy. Knowing how much you owe and the terms of each debt will help you make informed decisions moving forward.

Take note of the interest rates on your credit cards, as this will play a significant role in determining which debts to tackle first. Higher interest rates mean you’re accruing more interest each month, making it wise to focus on paying off those debts as quickly as possible to minimize the overall interest paid over time.

Next, calculate your total monthly debt payments. Add up the minimum monthly payments for each credit card to determine the amount you’re currently paying towards your debt. This will give you an idea of how much extra you can allocate towards paying off the $25,000 balance.

Assessing your debt also involves evaluating your credit score. Your credit score impacts your ability to apply for credit, secure loans, or negotiate better interest rates. Monitoring your credit score can help you understand how your debt is impacting your overall financial health and guide you in making informed decisions.

Consider using a credit monitoring service or accessing your credit report to review your current score. Understanding your credit score can also help you identify any errors or discrepancies that may be negatively affecting your creditworthiness. Disputing errors and taking steps to improve your credit score can lead to better financial opportunities in the future.

By taking the time to assess your debt, you gain a clearer understanding of your financial situation. This knowledge empowers you to set achievable goals and develop a personalized plan for repayment.

Remember, assessing your debt is the first step towards financial freedom. As you move forward, use the information gathered to create a realistic budget and select a repayment strategy that aligns with your goals and abilities. With dedication and perseverance, you can overcome your $25,000 credit card debt and pave the way for a more secure financial future.

Creating a Budget

Creating a budget is a crucial component of managing your finances and paying off your $25,000 credit card debt. A budget helps you track your income and expenses, allowing you to allocate funds strategically towards debt repayment while still meeting your essential needs.

To begin, start by calculating your total monthly income. This includes your salary, freelance earnings, or any other sources of income. Having a clear understanding of your income will help you determine how much you can allocate towards debt repayment.

Next, determine your monthly expenses. Start with fixed expenses such as rent or mortgage payments, utilities, insurance premiums, and loan repayments. These are essential expenses that typically remain consistent from month to month.

Next, consider your variable expenses. These include groceries, dining out, entertainment, transportation, and personal care. Look at your previous spending habits and categorize these expenses to get an idea of how much you typically spend in each category.

Once you have identified your expenses, it’s time to evaluate them. Look for areas where you can cut back or make adjustments to free up more money for debt repayment. This may involve reducing discretionary spending, finding more cost-effective alternatives, or renegotiating bills and contracts.

When setting a budget, it’s important to prioritize debt repayment. Calculate how much you have left after subtracting your essential expenses from your income. Aim to allocate a significant portion of this remaining amount towards paying off your credit card debt.

Consider utilizing the snowball or avalanche method to prioritize your debt payments. The snowball method involves focusing on paying off debts with the smallest balances first, while the avalanche method prioritizes paying off debts with the highest interest rates. Choose the approach that aligns with your financial goals and motivates you to stay on track.

Once you have established your budget, track your expenses diligently. Use budgeting apps or spreadsheets to monitor your spending and ensure that you stay within your allocated amounts for each category. Regularly review your budget and make adjustments as needed to accommodate any changes in income or expenses.

Creating a budget provides you with a roadmap for managing your finances and paying off your credit card debt. It helps you stay organized, make informed financial decisions, and take control of your financial future. By following your budget and staying disciplined, you can make significant progress towards becoming debt-free and achieving financial stability.

Choosing a Repayment Strategy

When faced with a $25,000 credit card debt, choosing the right repayment strategy is crucial to effectively manage your debt and work towards becoming debt-free. There are two popular methods to consider: the snowball method and the avalanche method.

- The Snowball Method: This strategy involves paying off your smallest credit card balances first while making minimum payments on your other debts. By focusing on clearing smaller balances, you can gain momentum and a sense of accomplishment, which keeps you motivated to continue paying off your debt. As you pay off each debt, you can move on to the next one, eventually tackling the larger balances.

- The Avalanche Method: This approach prioritizes paying off debts with the highest interest rates first. Start by making minimum payments on all your debts, but allocate any extra funds towards the debt with the highest interest rate. Once that debt is paid off, move on to the one with the next highest interest rate. By targeting high-interest debts, you can save more money in the long run by reducing the amount of interest you pay.

Both methods have their advantages, and the choice ultimately depends on your personal preference and financial situation. The snowball method provides psychological benefits by offering quick wins and increasing motivation, whereas the avalanche method is more cost-effective in terms of reducing the overall interest you’ll pay over time.

Consider your financial goals, personality, and financial resources when choosing a repayment strategy. If staying motivated and seeing progress quickly is important to you, the snowball method may be the better choice. On the other hand, if you’re focused on minimizing interest payments and are willing to prioritize long-term savings over immediate gratification, the avalanche method may be the more suitable option.

Regardless of the method you choose, it’s essential to stay consistent and disciplined in your debt repayment efforts. Make sure to make at least the minimum monthly payments on all your credit cards to avoid late fees and negative impacts on your credit score.

Regularly review your progress and reassess your strategy as needed. If you find that your chosen approach isn’t working for you, don’t be afraid to adjust or switch to a different method that better aligns with your circumstances and goals.

By choosing a repayment strategy that suits your needs, you can streamline your debt repayment journey and work towards the ultimate goal of becoming debt-free. Stay committed, stay focused, and remember that every payment brings you one step closer to financial freedom.

Cutting Expenses

When facing a $25,000 credit card debt, cutting expenses is an essential step towards freeing up more funds to put towards debt repayment. By reducing your monthly expenses, you’ll have more money available to tackle your debt more aggressively and accelerate your journey to financial freedom.

Start by taking a close look at your current spending habits and identify areas where you can trim unnecessary expenses. Here are some practical tips to help you cut expenses:

- Review your recurring bills and subscriptions: Take a careful look at your monthly bills and assess whether all your subscriptions and services are necessary. Cancel any memberships or subscriptions that you no longer use or can live without.

- Evaluate your grocery and eating-out expenses: Plan your meals in advance, create a shopping list, and stick to it when grocery shopping. Consider cooking at home more often to save on dining out expenses. Look for deals and discounts, and consider buying in bulk to save money on groceries.

- Reduce entertainment and leisure expenses: Limit your spending on movies, concerts, and other forms of entertainment. Look for low-cost or free alternatives such as taking advantage of community events or spending time outdoors.

- Minimize impulse purchases: Before making a purchase, give yourself a cooling-off period. Assess whether the item is a necessity or simply a want. By avoiding impulsive shopping, you can save a significant amount of money.

- Reconsider your transportation costs: Explore cheaper transportation options such as carpooling, using public transportation, or biking when feasible. If you have multiple vehicles, consider downsizing to just one to reduce insurance, maintenance, and fuel costs.

- Lower your utility bills: Make an effort to reduce your energy consumption. Turn off lights and appliances when not in use, adjust your thermostat to conserve energy, and consider installing energy-efficient light bulbs and appliances.

- Negotiate your bills: Contact your service providers such as cable, internet, and insurance companies. Inquire about any available discounts, promotions, or alternative plans that can help lower your monthly bills.

Remember, cutting expenses doesn’t mean completely depriving yourself of the things you enjoy. It’s about being mindful of your spending and making intentional choices to prioritize debt repayment. By making small adjustments to your lifestyle and being conscious of your spending habits, you can significantly reduce your monthly expenses and allocate more funds towards paying off your credit card debt.

Stay focused on your financial goals and continually reassess your expenses to ensure you’re on track. By implementing these cost-saving measures, you’ll not only make meaningful progress towards eliminating your debt but also develop positive financial habits that will benefit you in the long run.

Increasing Income

When dealing with a $25,000 credit card debt, finding ways to increase your income can greatly accelerate your debt repayment journey. By generating additional funds, you’ll have more resources available to tackle your debt more aggressively and potentially shorten the time it takes to become debt-free.

Here are some effective strategies to consider for increasing your income:

- Take on a part-time job: Look for opportunities to work part-time in addition to your regular job. This can include freelance work, consulting, or even a temporary gig. Use the extra income earned specifically for debt repayment.

- Start a side business: Consider turning your passion or hobby into a profitable venture. Launch an online store, offer services related to your skills or expertise, or explore other entrepreneurial opportunities. The income generated from your side business can help you pay off your debt faster.

- Seek overtime or extra shifts at work: If your current job allows it, inquire about overtime or additional shifts. This can provide a significant boost to your income while still keeping a regular job.

- Freelancing or consulting: Utilize your skills and expertise to offer freelance services or consulting in your field. Many companies and individuals are willing to pay for specialized services on a project basis.

- Rent out a spare room or property: If you have extra space in your home, consider renting it out to generate additional income. Platforms like Airbnb make it easy to list and rent out your space for short-term stays.

- Take on odd jobs or gigs: Explore platforms or websites where you can find odd jobs or gigs on a part-time or freelance basis. These can include tasks like pet sitting, house cleaning, tutoring, or event assistance.

Increasing your income not only provides you with more financial resources to tackle your credit card debt but also opens up opportunities for you to diversify your income streams and build financial stability in the long run.

Remember to allocate the additional income received specifically towards your debt repayment. Keeping a clear focus on your financial goals will help you stay motivated and see substantial progress in reducing your debt.

While it may take extra effort to increase your income, it can significantly impact your debt repayment journey and overall financial well-being. Be proactive, explore opportunities, and embrace a growth mindset to take advantage of the many ways you can increase your income and accelerate your path to becoming debt-free.

Negotiating with Creditors

When facing a $25,000 credit card debt, negotiating with your creditors can be a valuable strategy to alleviate the financial burden and potentially reduce the overall amount you owe. Creditors are often willing to work with you to find mutually beneficial solutions that can make your debt more manageable. Here are some steps to consider when negotiating with your creditors:

1. Communicate early and proactively: Reach out to your creditors as soon as you realize you may have trouble making payments. Prompt communication demonstrates your willingness to address the situation responsibly, and it gives you the opportunity to explore potential options before your debt becomes more substantial.

2. Explain your situation: Be honest and transparent about your financial difficulties. Discuss any unexpected expenses, job loss, or other circumstances that impacted your ability to meet your debt obligations. By providing a clear explanation, your creditors may be more understanding and willing to work with you.

3. Propose a revised payment plan: Based on your current financial situation, suggest a revised payment plan that is more feasible for you. This could involve lowering the interest rate, extending the repayment period, or negotiating a settlement amount. Be prepared to provide supporting documents or a financial statement to support your proposal.

4. Seek professional help if needed: If negotiating with your creditors directly proves challenging, consider consulting with a reputable credit counseling agency or a debt settlement firm. These professionals can provide guidance, negotiate on your behalf, and help you develop a more comprehensive plan to address your debt.

5. Be persistent and follow up: Keep records of all communication with your creditors and follow up regularly to ensure that the agreed-upon modifications to your payment plan are being implemented. Stay on top of your payments and maintain ongoing communication to demonstrate your commitment to honoring your financial obligations.

Remember, creditors have a vested interest in recovering their funds, so many are willing to explore alternative arrangements rather than risk defaults or legal action. By opening a dialogue and negotiating in good faith, you increase the likelihood of finding a workable solution that promotes debt reduction without causing further financial strain.

Negotiating with creditors can provide much-needed relief and potentially lead to more favorable debt repayment terms. However, it’s essential to approach these negotiations with a realistic perspective and an understanding of the potential implications. Your goal is to find a mutually beneficial agreement that supports your journey towards becoming debt-free without compromising your long-term financial well-being.

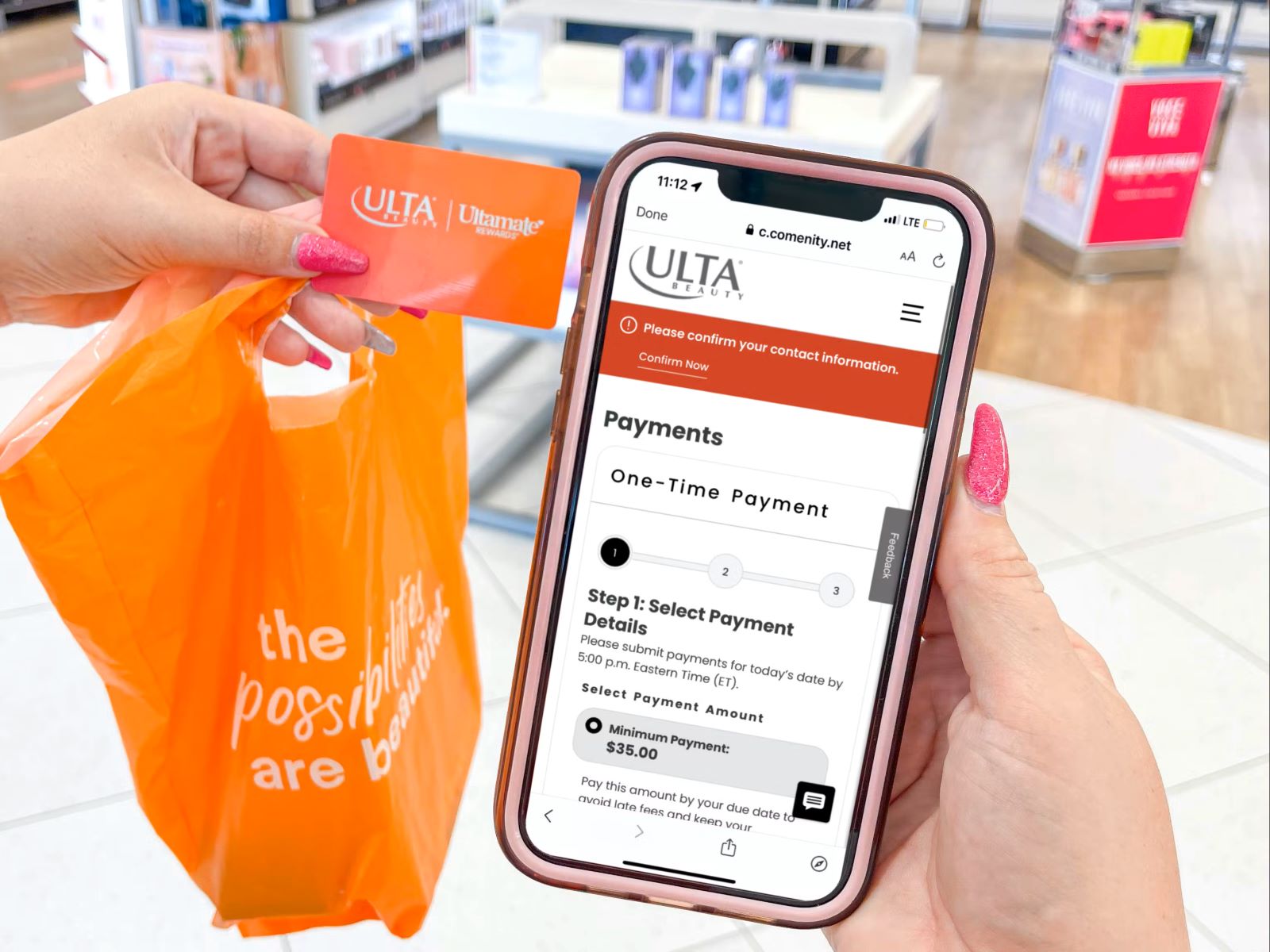

Using Balance Transfers

If you’re looking for a strategy to help manage your $25,000 credit card debt more effectively, utilizing balance transfers can be a useful tool. Balance transfers involve moving your existing credit card balances to a new credit card with a lower or 0% introductory interest rate for a specified period. Here are some key considerations and steps to take when using balance transfers:

1. Research and choose the right balance transfer credit card: Take the time to compare different credit card offers to find one that best suits your needs. Look for cards with a long introductory period, low or 0% interest rates on balance transfers, and favorable terms and conditions. Pay attention to any fees associated with the transfer.

2. Understand the terms and conditions: Read the fine print of the balance transfer offer carefully. Note the length of the introductory period, any fees or charges you may incur, and the standard interest rate that will apply after the introductory period ends. Understanding the terms will help you make informed decisions and avoid any unexpected costs.

3. Transfer your balances strategically: Determine which credit card balances to transfer based on the interest rates and fees involved. Prioritize transferring high-interest rate debts to maximize savings. Be mindful of any balance transfer limits or restrictions that may apply.

4. Create a repayment plan: Take advantage of the lower or 0% interest rate during the introductory period to aggressively pay down your debt. Calculate how much you need to pay each month to eliminate the balance before the introductory rate expires. Stick to your repayment plan to make the most of the balance transfer offer.

5. Avoid new purchases on the balance transfer card: To benefit from the lower interest rate, refrain from making new purchases on the balance transfer credit card. Focus solely on paying off the transferred balances and avoid accumulating additional debt.

6. Close or minimize other credit card accounts: Once your balances are successfully transferred, consider closing or reducing the credit limit on your previous credit card accounts. This can help you avoid the temptation to accumulate more debt and simplify your financial management.

7. Monitor your progress: Regularly track your payments and progress towards paying off the transferred balances. Stay disciplined and commit to sticking to your repayment plan.

While balance transfers can be a helpful debt management tool, it’s essential to recognize their limitations. Some balance transfer offers come with fees, and if you’re unable to pay off the debt before the introductory period ends, you may face higher interest rates. Therefore, it’s crucial to use balance transfers strategically and in conjunction with a comprehensive debt repayment plan.

By leveraging balance transfers effectively and diligently sticking to your repayment plan, you can make significant progress in reducing your $25,000 credit card debt and potentially save money on interest payments.

Utilizing Debt Consolidation

If you’re struggling with a $25,000 credit card debt and finding it challenging to manage multiple payments and high interest rates, debt consolidation can be a beneficial strategy. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage and potentially saving you money on interest payments. Here are important considerations when utilizing debt consolidation:

1. Assess your financial situation: Before pursuing debt consolidation, take a thorough look at your overall financial picture. Understand the total amount of your debt, the interest rates you’re currently paying, and your repayment capabilities. This evaluation will help you determine if debt consolidation is the right option for you.

2. Research debt consolidation options: Explore different debt consolidation methods, such as personal loans, balance transfer credit cards, or home equity loans. Compare their interest rates, terms, fees, and eligibility requirements. Select an option that aligns with your financial goals and offers the most favorable terms.

3. Apply for the consolidation loan: Once you’ve identified the most suitable debt consolidation option, gather the necessary documents and apply for the loan. Provide accurate and complete information to increase your chances of approval. Keep in mind that a balance transfer credit card may require a credit limit high enough to accommodate your total debt.

4. Use the loan to pay off your credit card debt: Once approved, use the funds from the consolidation loan to pay off your existing credit card balances in full. This will consolidate your debts into a single, more manageable payment.

5. Develop a repayment plan: Take advantage of the lower interest rate on the consolidated loan to create a realistic repayment plan. Calculate how much you need to pay each month to eliminate the debt within a reasonable timeframe. Stick to your plan and make consistent payments to reduce your debt effectively.

6. Avoid accumulating new debt: After consolidating your debts, it’s crucial to avoid accumulating new debt. Cut down on unnecessary expenses, prioritize your existing debts, and be disciplined with your spending habits. Consistent financial discipline will help you stay on track towards becoming debt-free.

7. Seek professional guidance if needed: If you find yourself overwhelmed or unsure about the debt consolidation process, consider consulting with a reputable credit counseling agency. They can provide expert guidance, help you develop a customized plan, and offer valuable insights to navigate your debt consolidation journey.

Debt consolidation offers an opportunity to simplify your finances, reduce your interest rates, and make your debt more manageable. It can be an effective strategy when used in conjunction with a well-thought-out repayment plan and a commitment to financial discipline.

Remember, debt consolidation is not a magic solution. It’s essential to develop a comprehensive plan to tackle your debt and stay committed to your financial goals. With determination and responsible financial management, debt consolidation can help you regain control of your finances and work towards a debt-free future.

Seeking Professional Help

When dealing with a significant credit card debt of $25,000, seeking professional help can be a wise decision. The guidance and expertise of financial professionals can provide valuable insights to navigate the complexities of debt management and develop a tailored plan to achieve financial stability. Here are some options to consider when seeking professional help:

1. Credit Counseling Agencies: Credit counseling agencies offer free or low-cost services to help individuals manage their debt. These agencies can provide personalized advice, budgeting tools, and debt management plans. They can negotiate with creditors on your behalf, potentially reducing interest rates or consolidating your debts into one affordable payment.

2. Debt Management Companies: Debt management companies specialize in helping individuals with debt repayment. They negotiate with creditors to create a debt management plan that suits your financial situation. With a debt management plan, you make a single monthly payment to the company, who then distributes the funds to your creditors.

3. Bankruptcy Attorneys: In more extreme cases where debt becomes overwhelming, consulting a bankruptcy attorney can provide guidance on the available options. They can advise on the types of bankruptcy and help assess whether filing for bankruptcy is a viable solution for your specific circumstances.

4. Financial Planners: A financial planner can offer comprehensive guidance on managing your finances, including debt management. They can help you develop a budget, create a repayment plan, and provide strategies for long-term financial stability. Financial planners consider your overall financial goals and tailor their advice to your specific situation.

5. Online Resources: Various online resources, including educational articles, budgeting tools, and debt calculators, can provide valuable guidance and information. Ensure that the sources you rely on are reputable and reliable to avoid misinformation and scams.

When seeking professional help, do thorough research and choose reputable organizations or professionals with a proven track record. Verify their credentials, check for client reviews or testimonials, and confirm the services they offer align with your specific needs.

Remember, seeking professional help is not a sign of failure but a proactive step towards regaining control of your financial situation. These professionals have the knowledge and experience to guide you through the process effectively, ensuring your debt management journey is efficient and tailored to your needs.

Throughout this process, remain actively involved and informed. Ask questions, understand the fees and services provided, and maintain open lines of communication with the professionals you’re working with. By working together, you can develop a plan to address your $25,000 credit card debt and set yourself on a path to financial freedom.

Staying Motivated

When tackling a $25,000 credit card debt, staying motivated is vital to maintain momentum and successfully achieve your financial goals. Here are some strategies to help you stay motivated throughout your debt repayment journey:

1. Set achievable milestones: Break down your debt repayment goal into smaller, manageable milestones. Celebrate each milestone you reach, whether it’s paying off a particular credit card or reducing your overall debt by a specific percentage. These milestones act as markers of progress and encourage you to keep going.

2. Visualize the end goal: Create a visual representation of your financial goal. This can be a graph, a vision board, or a savings tracker. Place it somewhere visible, like on your fridge or at your workspace, to remind yourself of the ultimate objective – becoming debt-free. Visualizing your progress can serve as a powerful motivator.

3. Connect with a support system: Share your journey with trusted friends or family members who can provide support and encouragement. Join online communities or forums where you can interact with others going through similar situations. Having a support system helps you stay accountable and provides a source of motivation when you need it.

4. Educate yourself: Learn about personal finance, debt management, and success stories of individuals who have overcome challenging financial situations. Educating yourself about financial strategies and success stories can inspire you and give you additional tools to navigate your own debt repayment journey.

5. Celebrate small wins: Acknowledge and celebrate your progress, no matter how small. Treat yourself to a small reward when you accomplish a significant milestone. It’s important to recognize your efforts and the progress you’re making along the way.

6. Track your progress: Keep a record of your debt repayment progress, whether it’s in a spreadsheet or a journal. Regularly update it with the latest payment milestones and balances. Seeing tangible evidence of your progress reinforces your efforts and motivates you to continue on your debt-free journey.

7. Find alternative sources of motivation: Explore different sources of inspiration to maintain your motivation. This can include reading books on personal finance, listening to podcasts or audiobooks, or following financial influencers who provide practical tips and success stories. Engaging with motivating content keeps you focused and inspired.

Remember, staying motivated is essential, but it’s also normal to have moments of discouragement or frustration. During those times, remind yourself of your financial goals, reflect on the progress you’ve made so far, and recommit to your plan. By staying motivated and determined, you can conquer your $25,000 credit card debt and set yourself on a path to a brighter financial future.

Celebrating Milestones

When working towards paying off a $25,000 credit card debt, celebrating milestones is an important aspect of staying motivated and maintaining your momentum. Recognizing and rewarding your progress along the way can help you stay focused on your financial goals and feel a sense of accomplishment. Here are some ways to celebrate milestones during your debt repayment journey:

1. Treat yourself (within reason): Once you achieve a milestone, give yourself permission to indulge in a small treat or reward. It could be something as simple as enjoying a favorite meal at a restaurant or treating yourself to a spa day. The key is to find a balance between celebrating your progress and not undoing your hard work by overspending.

2. Plan a low-cost outing or experience: Celebrating milestones doesn’t have to be expensive. Plan a fun outing or experience that fits within your budget. This could include a picnic in the park, a hike in nature, or a movie night at home with friends or loved ones. The focus is on creating meaningful memories without breaking the bank.

3. Share your achievements with loved ones: Share your milestones with your support system, such as family and close friends. They can celebrate with you and provide additional motivation and encouragement. Consider hosting a small gathering or dinner to celebrate your progress, allowing you to share your journey and express gratitude for their support.

4. Reflect on your achievements: Take time to reflect on how far you’ve come. Write in a journal or create a gratitude list, noting the milestones you’ve reached and the lessons you’ve learned along the way. This reflection can reinforce your commitment and resilience, invigorating you to continue on your debt-free journey.

5. Update your visual progress tracker: If you’re using a visual representation of your progress, such as a graph or savings tracker, take the time to update it when you reach a milestone. Seeing the visual representation of your progress can be a powerful reminder of how much you’ve accomplished and fuel your motivation to keep going.

6. Set new goals: After celebrating a milestone, set new goals to continue propelling your progress forward. These goals can be both financial and personal. For example, aim to pay off a specific credit card or set a savings goal for an emergency fund. Having new goals in sight keeps you focused and gives you something to strive for.

Remember, celebrating milestones is not just about the reward itself, but also about recognizing the effort and determination you’ve put into your debt repayment journey. By celebrating your achievements, you reinforce positive financial habits, strengthen your motivation, and remind yourself that you have the ability to overcome financial challenges.

As you progress towards becoming debt-free, make sure to find a balance between celebrating your milestones and staying disciplined with your finances. Ultimately, the greatest celebration will be achieving your final goal of being free from the burden of a $25,000 credit card debt and enjoying the financial freedom you have worked so hard to achieve.

Conclusion

Tackling a $25,000 credit card debt may seem daunting, but with a clear plan and determination, you can achieve financial freedom. This article has provided valuable strategies to help you on your journey, including assessing your debt, creating a budget, choosing a repayment strategy, cutting expenses, increasing income, negotiating with creditors, utilizing balance transfers, considering debt consolidation, seeking professional help, and staying motivated.

Assessing your debt and creating a realistic budget are essential starting points. By understanding your financial situation and prioritizing your expenses, you can allocate more money toward debt repayment. Choosing a repayment strategy, such as the snowball or avalanche method, allows you to focus your efforts and make progress in paying off your debts strategically.

Cutting expenses and increasing your income are powerful tools for accelerating your debt repayment. Seek ways to reduce unnecessary spending, negotiate bills, and explore additional sources of income to allocate more funds toward paying off your debt balances.

Negotiating with creditors, utilizing balance transfers, and considering debt consolidation can help reduce interest rates and make your debt more manageable. Seeking professional help, such as credit counseling agencies or financial planners, can provide expert guidance and support as you navigate your debt repayment journey.

Staying motivated is crucial as you work towards your financial goals. Set achievable milestones, visualize your progress, and celebrate your successes along the way. Maintain a strong support system and seek inspiration from financial resources to stay focused and motivated throughout the process.

Remember, becoming debt-free is a journey that requires perseverance and commitment. By implementing the strategies outlined in this article and staying disciplined, you can overcome your $25,000 credit card debt and achieve the financial freedom you desire.

Take control of your financial future, make informed decisions, and trust in your ability to overcome this challenge. With determination and a clear plan, you can embark on a path towards a healthier financial life. Start today, and watch as your debt diminishes and your financial dreams become a reality.