Home>Finance>What Is The Credit Limit For Capital One Platinum Card

Finance

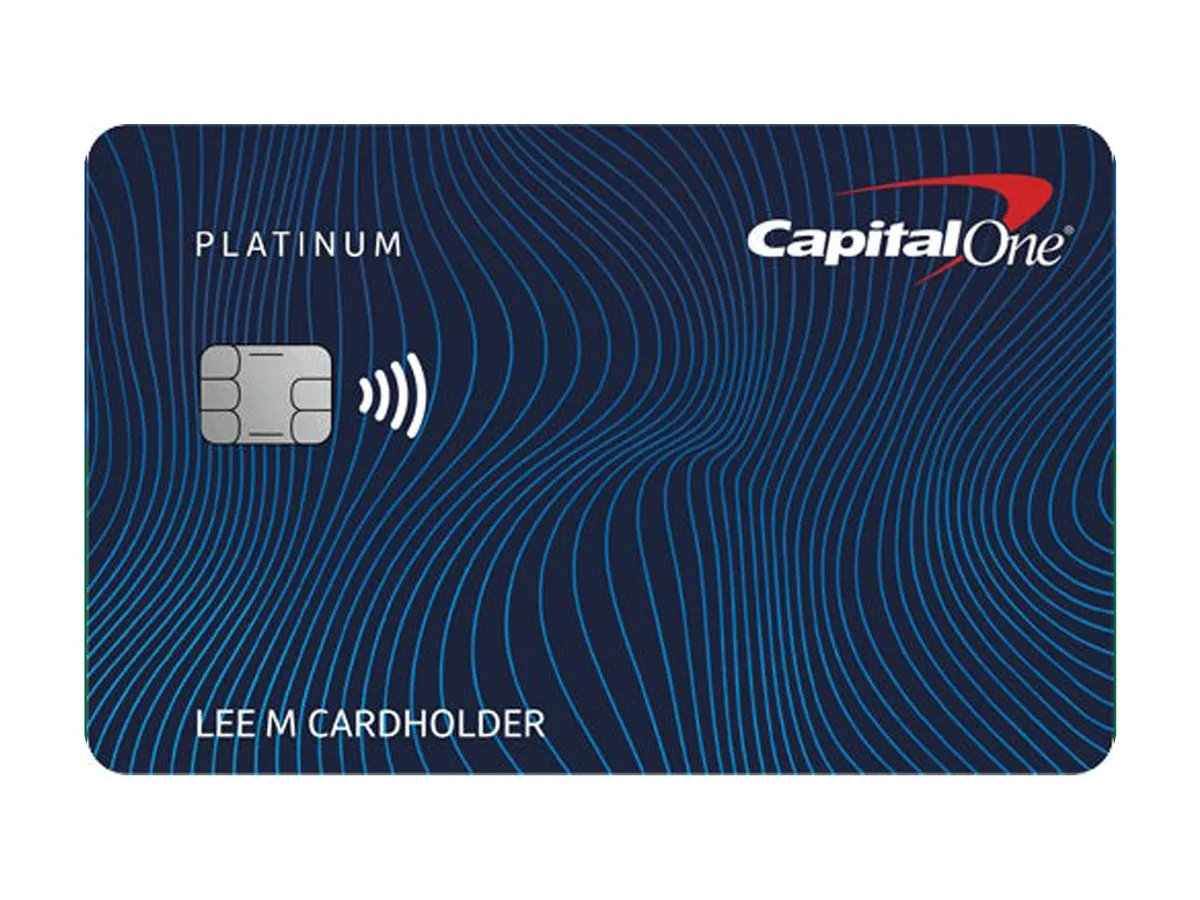

What Is The Credit Limit For Capital One Platinum Card

Published: March 5, 2024

Learn about the credit limit for Capital One Platinum Card and manage your finances wisely. Find out how to make the most of your credit limit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit limits and the exciting realm of the Capital One Platinum Card! Understanding credit limits is crucial for responsible financial management and building a strong credit profile. In this article, we'll delve into the intricacies of credit limits, explore the factors that influence them, and specifically examine the credit limit for the Capital One Platinum Card.

Credit limits play a pivotal role in the world of credit cards. They represent the maximum amount of credit extended to cardholders, dictating the highest balance that can be carried on the card. This limit is established based on various financial factors, and it's essential for cardholders to comprehend how it impacts their financial well-being.

The Capital One Platinum Card is a popular choice for individuals looking to establish or rebuild their credit. It offers a range of benefits and features, with the credit limit being a key consideration for potential cardholders. Understanding how credit limits are determined for this particular card can provide valuable insights for those considering it as an option.

In the following sections, we'll explore the fundamental concepts of credit limits, examine the specific factors that influence them, and take a closer look at the credit limit associated with the Capital One Platinum Card. Additionally, we'll discuss strategies for increasing your credit limit and offer practical tips for managing your credit effectively.

Whether you're new to the world of credit or seeking to expand your knowledge, this article aims to equip you with a comprehensive understanding of credit limits and their significance, particularly in the context of the Capital One Platinum Card. So, let's embark on this enlightening journey into the world of credit limits and discover the valuable insights that await!

Understanding Credit Limits

Credit limits are the proverbial guardrails that define the boundaries of your purchasing power within the realm of credit cards. They serve as a crucial determinant of your financial freedom and responsibility. When you’re issued a credit card, the issuer assigns a maximum limit that represents the highest outstanding balance you can carry on the card. This limit is not arbitrary; rather, it is meticulously calculated based on various financial factors.

It’s important to recognize that credit limits are not indicative of free money but rather a financial responsibility extended to you by the card issuer. Exceeding this limit can result in penalties, fees, and potential damage to your credit score. Therefore, understanding and respecting your credit limit is essential for maintaining a healthy financial profile.

Moreover, credit limits can vary significantly from one individual to another, reflecting the unique financial circumstances and creditworthiness of each cardholder. Factors such as income, credit history, and existing debt obligations all play a role in determining the appropriate credit limit for a cardholder.

Understanding your credit limit also involves recognizing the impact it has on your credit utilization ratio, a crucial component of your credit score. Your credit utilization ratio is the proportion of your available credit that you’re currently using. Keeping this ratio low, ideally below 30%, can positively impact your credit score, making it imperative to be mindful of your credit limit in relation to your spending habits.

By comprehending the significance of credit limits and their influence on your financial well-being, you can navigate the world of credit cards with confidence and prudence. In the subsequent sections, we’ll delve deeper into the specific factors that influence credit limits and explore how they manifest in the context of the Capital One Platinum Card.

Factors Affecting Credit Limits

The determination of an individual’s credit limit is a multifaceted process that takes into account various financial factors. Understanding these factors can shed light on the rationale behind the credit limit assigned to a cardholder. Let’s explore the key elements that influence the establishment of credit limits:

- Credit History: Your credit history serves as a crucial barometer of your creditworthiness. Lenders assess your past credit behavior, including your repayment patterns and the management of previous credit accounts. A positive credit history, characterized by timely payments and responsible credit utilization, can result in a higher credit limit.

- Income Level: Your income is a pivotal determinant of your ability to manage credit. A higher income level often correlates with a higher credit limit, as it signifies a greater capacity to repay debts and manage financial obligations.

- Debt-to-Income Ratio: Lenders evaluate your debt-to-income ratio, which compares your monthly debt obligations to your income. A lower ratio indicates a healthier financial position and may lead to a more generous credit limit.

- Employment Status: Your employment status and stability can influence the credit limit assigned to you. Lenders may consider steady employment as a positive indicator of financial reliability, potentially resulting in a higher credit limit.

- Existing Credit Lines: The total credit available to you across all your credit accounts is a factor in determining your credit limit. If you have multiple existing credit lines with substantial available credit, it may impact the limit assigned to a new credit card.

It’s important to note that these factors are not mutually exclusive, and their collective influence shapes the credit limit extended to an individual. By comprehending the interplay of these elements, cardholders can gain insights into the rationale behind their credit limits and take proactive steps to strengthen their financial standing.

Now that we’ve explored the fundamental factors that impact credit limits, we’ll shift our focus to the specific credit limit associated with the Capital One Platinum Card and the unique considerations that come into play.

Credit Limit for Capital One Platinum Card

The credit limit for the Capital One Platinum Card is determined based on several key factors that align with Capital One’s underwriting criteria. As a card designed for individuals looking to build or rebuild their credit, the credit limit may initially be conservative, reflecting the issuer’s risk management approach. However, Capital One provides opportunities for cardholders to demonstrate responsible credit behavior, potentially leading to credit limit increases over time.

When applying for the Capital One Platinum Card, individuals may receive a starting credit limit based on their creditworthiness, income level, and other pertinent financial considerations. This initial limit serves as a foundational benchmark for their credit utilization and spending capabilities.

It’s important to note that the specific credit limits associated with the Capital One Platinum Card can vary based on individual circumstances. Factors such as credit history, income, and existing debt obligations all contribute to the determination of the initial credit limit. While some applicants may receive higher limits based on strong credit profiles and financial stability, others may start with more conservative limits that reflect their credit-building journey.

Capital One emphasizes the opportunity for credit limit reviews and potential increases for cardholders who demonstrate responsible credit management. By making timely payments, managing credit utilization effectively, and showcasing positive financial behavior, cardholders can position themselves for potential credit limit upgrades.

Furthermore, the Capital One Platinum Card offers the benefit of no annual fee, making it an attractive option for individuals seeking to establish or improve their credit without incurring additional costs. This feature, combined with the potential for credit limit increases, underscores the card’s suitability for those focused on credit building and financial responsibility.

Understanding the credit limit dynamics of the Capital One Platinum Card empowers individuals to approach their credit journey with clarity and purpose. By leveraging the initial credit limit as a foundation for responsible credit management and demonstrating positive financial habits, cardholders can pave the way for potential credit limit enhancements and overall credit advancement.

As we continue our exploration, we’ll delve into strategies for increasing credit limits and offer insights into maximizing the credit potential offered by the Capital One Platinum Card.

How to Increase Your Credit Limit

Increasing your credit limit can provide greater financial flexibility and enhance your overall credit profile. For Capital One Platinum Cardholders, the prospect of securing a higher credit limit presents an opportunity to expand their purchasing power and improve their credit utilization ratio. Here are actionable strategies to consider when aiming to increase your credit limit:

- Consistent Payment History: Maintaining a consistent record of on-time payments demonstrates responsible credit management and can positively influence credit limit reviews. Timely payments showcase your reliability as a borrower and can bolster your case for a credit limit increase.

- Income Updates: Updating your income information with Capital One can provide a clearer picture of your financial capacity. If your income has increased since you initially obtained the card, sharing this updated information can potentially support a case for a higher credit limit.

- Responsible Credit Utilization: Keeping your credit utilization ratio low by using only a portion of your available credit showcases prudent financial behavior. Aim to keep your utilization below 30% to demonstrate responsible usage of your existing credit limit.

- Regular Account Reviews: Periodically reviewing your account and credit limit with Capital One can signal your proactive approach to credit management. Engaging in constructive dialogue with the card issuer and expressing your commitment to responsible credit usage may contribute to potential credit limit adjustments.

- Credit Limit Increase Requests: Capital One provides the option to request a credit limit increase through their online account management portal or by contacting customer support. When making such a request, highlighting your positive payment history and financial progress can bolster your case for a credit limit enhancement.

It’s important to approach credit limit increases with a focus on responsible credit management and a clear demonstration of financial stability. By consistently showcasing positive credit behavior and engaging with Capital One proactively, cardholders can position themselves for potential credit limit upgrades that align with their evolving financial circumstances.

Understanding the nuances of credit limit adjustments and the proactive steps to pursue them empowers cardholders to leverage their credit potential effectively and navigate their credit journey with confidence.

As we conclude our exploration of credit limits and their implications, it’s essential to recognize the significance of responsible credit management and the role it plays in shaping a strong financial foundation. By embracing the principles of prudence, diligence, and proactive engagement, individuals can harness the potential of their credit limits to propel their financial well-being forward.

Conclusion

As we conclude our insightful journey into the realm of credit limits, particularly in the context of the Capital One Platinum Card, it’s evident that these limits are not merely arbitrary numbers but rather reflections of an individual’s financial standing and creditworthiness. Understanding the factors that influence credit limits empowers individuals to navigate their credit journey with clarity and purpose.

For Capital One Platinum Cardholders, the credit limit represents a pivotal aspect of their financial management, shaping their purchasing power and credit utilization dynamics. While the initial credit limit may reflect the cardholder’s credit-building journey, the potential for credit limit increases provides a pathway for expanding financial flexibility and enhancing credit profiles.

Crucially, the strategies for increasing credit limits underscore the importance of responsible credit management, consistent payment behavior, and proactive engagement with the card issuer. By demonstrating financial reliability and prudent credit utilization, cardholders can position themselves for potential credit limit enhancements that align with their evolving financial circumstances.

It’s essential to approach credit limits not merely as static figures but as dynamic components of a broader financial landscape. By recognizing their influence on credit utilization ratios, credit scores, and overall financial well-being, individuals can leverage their credit limits effectively to support their financial goals and aspirations.

Ultimately, the journey toward optimizing credit limits is intertwined with the principles of financial responsibility, diligence, and proactive engagement. By embracing these principles and leveraging the insights shared in this article, individuals can harness the potential of their credit limits to propel their financial well-being forward and chart a path toward enduring financial success.

As you continue your credit journey, may the knowledge gained here serve as a guiding light, empowering you to make informed decisions, cultivate responsible credit habits, and navigate the ever-evolving landscape of personal finance with confidence and prudence.