Finance

Who Pays For Credit Default Swaps

Published: March 4, 2024

Discover who pays for credit default swaps and the impact on the world of finance. Learn about the key players and their roles in the CDS market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Intricacies of Credit Default Swaps

Welcome to the complex world of finance, where instruments such as credit default swaps (CDS) play a pivotal role in managing risk and shaping the financial landscape. In this article, we will delve into the depths of credit default swaps, unraveling their intricacies and shedding light on the parties involved and the implications they carry within the financial markets.

Credit default swaps, often abbreviated as CDS, are financial derivatives that enable investors to mitigate the risk of default on debt instruments. These instruments have garnered significant attention and, at times, controversy due to their impact on the global financial system. As we navigate through the nuances of credit default swaps, we will explore the mechanisms that govern these instruments and the implications they hold for the entities involved.

Join us on this insightful journey as we demystify the world of credit default swaps, unraveling the complexities and shedding light on the crucial question: Who Pays for Credit Default Swaps?

What are Credit Default Swaps?

Unraveling the Mechanisms of Credit Default Swaps

Credit default swaps (CDS) are financial instruments that serve as a form of insurance against the default of a borrower. In essence, a credit default swap functions as a contract between two parties, whereby the buyer makes periodic payments to the seller in exchange for protection against potential credit events, such as default or restructuring, related to a specific debt obligation.

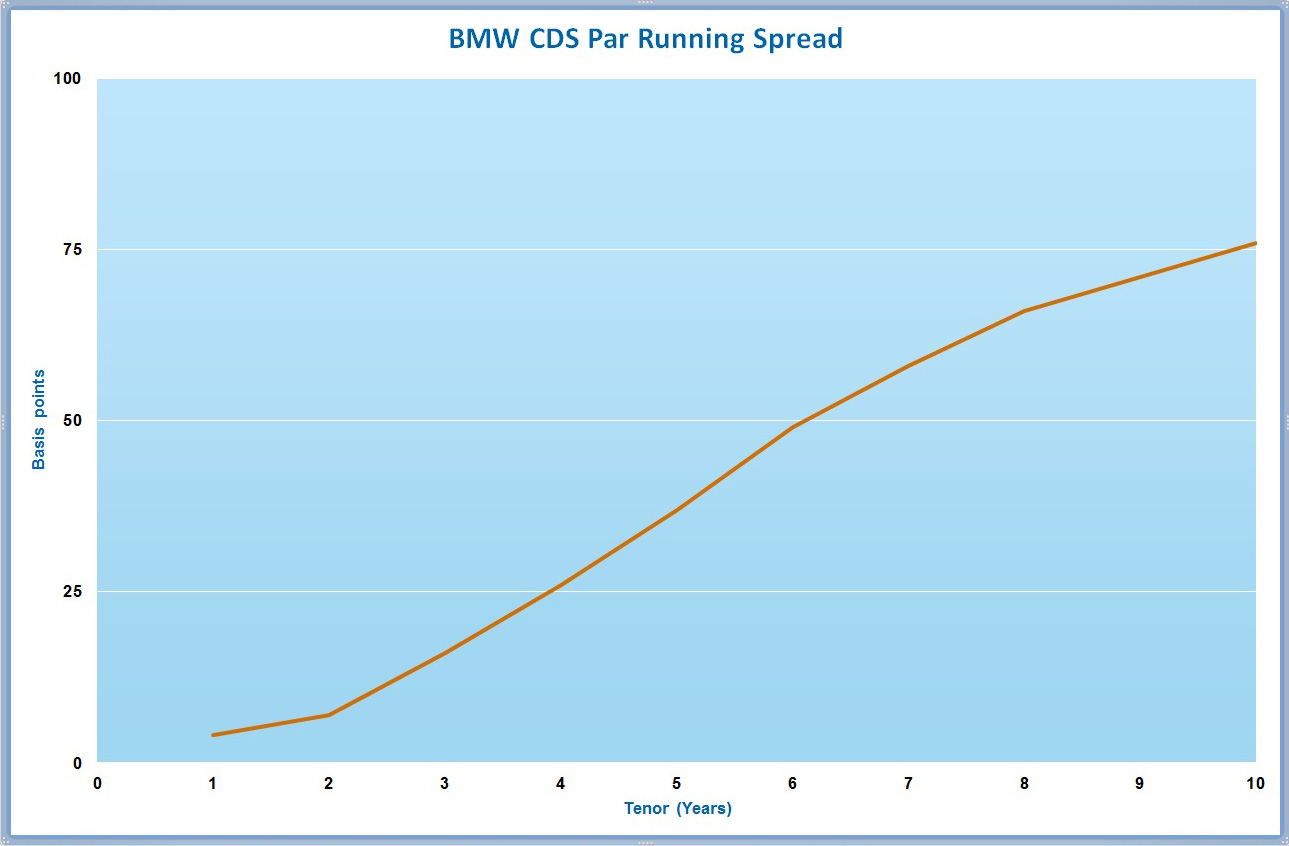

These instruments are particularly prevalent in the realm of fixed-income securities, providing investors with a mechanism to hedge against the risk of default on bonds or other debt instruments. By entering into a credit default swap, the buyer effectively transfers the credit risk associated with a particular asset to the seller in exchange for a series of payments, known as the CDS spread.

It’s important to note that credit default swaps are traded over-the-counter (OTC), meaning that they are not transacted on formal exchanges. This characteristic contributes to the flexibility and customization offered by CDS, as the terms of the contracts can be tailored to suit the specific needs and risk profiles of the parties involved.

One of the defining features of credit default swaps is their potential for speculation. While these instruments serve as a risk management tool for some market participants, they also present an opportunity for others to take speculative positions on the creditworthiness of entities. This speculative aspect has contributed to debates surrounding the role of credit default swaps in amplifying systemic risk within the financial system.

As we unravel the mechanisms of credit default swaps, it becomes evident that these instruments play a multifaceted role in the realm of finance, serving as both risk management tools and speculative vehicles that have the potential to influence the dynamics of the broader financial markets.

Parties Involved in Credit Default Swaps

Understanding the Key Players in the CDS Market

The functioning of credit default swaps involves several key parties, each playing a distinct role in the execution and management of these financial instruments. Understanding the dynamics between these entities is crucial in comprehending the broader impact of credit default swaps on the financial landscape.

1. Protection Buyer: The protection buyer, often referred to as the “long” position, is the party seeking protection against the credit risk associated with a particular debt obligation. This entity makes periodic payments to the protection seller in exchange for the assurance of compensation in the event of a credit event, such as default or restructuring, pertaining to the underlying asset.

2. Protection Seller: On the other side of the transaction, we have the protection seller, also known as the “short” position. This party assumes the risk of the underlying credit event in exchange for the payments received from the protection buyer. The protection seller effectively guarantees compensation to the protection buyer in the event of a credit event affecting the specified debt obligation.

3. Reference Entity: The reference entity is the entity whose credit risk is being transferred through the credit default swap. This could be a corporation, sovereign entity, or other forms of debt issuers. The performance of the reference entity directly impacts the dynamics of the credit default swap contract.

4. Counterparty: In the over-the-counter nature of credit default swaps, the counterparties involved in these transactions play a critical role. These counterparties could be financial institutions, hedge funds, or other market participants engaging in the CDS market to manage their risk exposure or capitalize on speculative opportunities.

By understanding the roles and interactions of these key players, we gain insight into the intricate web of relationships that underpin the credit default swap market. The dynamics between the protection buyer, protection seller, reference entity, and counterparties collectively shape the functioning and impact of credit default swaps within the broader financial ecosystem.

Who Pays for Credit Default Swaps?

Unveiling the Dynamics of CDS Payments

The question of who pays for credit default swaps revolves around the payment dynamics inherent in these financial instruments. Understanding the flow of payments is essential in unraveling the intricacies of credit default swaps and their implications for the parties involved.

1. Protection Buyer: The protection buyer is responsible for making periodic payments, often referred to as the CDS spread, to the protection seller. These payments serve as a form of insurance premium, compensating the protection seller for assuming the risk associated with the credit event on the underlying debt obligation. The frequency and magnitude of these payments are determined by the terms of the credit default swap contract.

2. Protection Seller: In exchange for assuming the credit risk of the reference entity, the protection seller receives the periodic payments from the protection buyer. These payments represent the compensation for bearing the risk of default or other credit events. If a credit event occurs, the protection seller is obligated to provide the agreed-upon compensation to the protection buyer.

It’s important to note that the payments made by the protection buyer and received by the protection seller are contingent upon the occurrence of a credit event, such as default, and the subsequent triggering of the credit default swap contract. In the absence of a credit event, the payments continue as per the terms of the contract, reflecting the ongoing insurance-like nature of credit default swaps.

Furthermore, the determination of credit events and the subsequent settlement processes play a pivotal role in dictating the payment flows within credit default swaps. The mechanics of these payments are governed by the terms and conditions outlined in the CDS contract, including the specific triggers for credit events and the calculation of compensation in the event of a default or restructuring.

By shedding light on the payment dynamics associated with credit default swaps, we gain insight into the financial obligations of the parties involved and the mechanisms through which the transfer of credit risk is facilitated within the CDS market.

Impact of Credit Default Swaps on Financial Markets

Unraveling the Influence of CDS on Market Dynamics

Credit default swaps have exerted a profound impact on the dynamics and stability of financial markets, shaping various facets of the global financial landscape. The ramifications of these instruments extend beyond the realm of risk management, encompassing market dynamics, systemic risk, and regulatory considerations.

1. Risk Management and Hedging: Credit default swaps serve as a vital tool for market participants to manage and hedge credit risk associated with debt instruments. By enabling investors to transfer the credit exposure of specific assets, CDS contribute to the efficient allocation of risk within the financial system, allowing entities to safeguard against potential defaults and credit events.

2. Systemic Risk and Contagion: The widespread use of credit default swaps has raised concerns about their role in amplifying systemic risk and propagating contagion within financial markets. The interconnected nature of CDS contracts and the potential for cascading effects in the event of credit events have underscored the need for robust risk management and regulatory oversight to mitigate systemic vulnerabilities.

3. Market Liquidity and Pricing: The presence of credit default swaps has influenced the liquidity and pricing dynamics of underlying debt securities. The availability of CDS as a mechanism for hedging and speculation can impact the perceived creditworthiness of entities, thereby influencing the pricing of bonds and other debt instruments in the primary and secondary markets.

4. Regulatory Scrutiny and Oversight: The proliferation of credit default swaps has prompted regulatory scrutiny and efforts to enhance transparency and oversight within the CDS market. Regulatory initiatives aimed at promoting central clearing, trade reporting, and standardized documentation seek to mitigate risks associated with CDS and enhance the resilience of the financial system.

As we navigate the intricate web of implications, it becomes evident that credit default swaps wield a multifaceted influence on financial markets, permeating risk management practices, market dynamics, systemic stability, and regulatory frameworks. The evolving landscape of CDS underscores the imperative of balancing their benefits with the imperative of mitigating potential risks and vulnerabilities within the global financial ecosystem.

Conclusion

Navigating the Complexities of Credit Default Swaps

In conclusion, the world of credit default swaps encompasses a dynamic interplay of risk management, market dynamics, and regulatory considerations, shaping the fabric of the global financial markets. These instruments, designed to mitigate credit risk and facilitate efficient risk transfer, have elicited diverse perspectives and debates regarding their implications for financial stability and market functioning.

As we unravel the intricacies of credit default swaps, it becomes evident that these instruments play a multifaceted role, serving as both risk management tools and speculative vehicles. The interaction between the key parties involved, including protection buyers, protection sellers, reference entities, and counterparties, underscores the complexity of the CDS market and the interdependencies within the broader financial ecosystem.

Furthermore, the impact of credit default swaps extends beyond risk management, permeating market liquidity, pricing dynamics, and systemic risk considerations. The potential for amplifying systemic vulnerabilities and propagating contagion has underscored the imperative of robust regulatory oversight and risk mitigation measures within the CDS market.

As the financial landscape continues to evolve, the role of credit default swaps in managing credit risk and influencing market dynamics remains a subject of ongoing scrutiny and adaptation. Regulatory initiatives aimed at enhancing transparency, standardizing documentation, and promoting central clearing seek to address the challenges associated with CDS and bolster the resilience of the financial system.

In navigating the complexities of credit default swaps, it is essential to strike a balance between harnessing their risk management capabilities and mitigating potential systemic implications. The evolving landscape of CDS underscores the imperative of informed decision-making, robust risk management practices, and a nuanced understanding of the interplay between financial instruments and market dynamics.

As we continue to navigate the intricacies of credit default swaps, it is essential to remain attuned to the evolving regulatory landscape and market dynamics, fostering a holistic approach to risk management and financial stability within the global financial markets.