Finance

How To Rent Your Home To Insurance Companies?

Published: November 11, 2023

Learn how to rent your home to insurance companies and generate passive income. Get expert tips and advice on finance for renting to insurance companies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understanding Insurance Company Rental Programs

- Step 2: Preparing Your Home for Insurance Company Rentals

- Step 3: Marketing Your Home to Insurance Companies

- Step 4: Evaluating and Selecting Insurance Companies

- Step 5: Negotiating Rental Terms and Agreements

- Step 6: Managing the Rental Process with Insurance Companies

- Step 7: Maintaining and Inspecting Your Home during the Rental Period

- Step 8: Dealing with Issues and Concerns during the Rental Period

- Conclusion

Introduction

Welcome to the world of insurance company rentals! Renting your home to insurance companies can be a lucrative and rewarding experience. Insurance companies often seek temporary housing solutions for their clients who have experienced damage to their homes due to natural disasters, fire, or other unforeseen events. By offering your property as a rental, you not only provide a valuable service to these companies but also have the opportunity to generate income in the process.

In this comprehensive guide, we will walk you through the process of renting your home to insurance companies step by step. From understanding insurance company rental programs to managing the rental process and addressing any issues that may arise, we’ll cover it all. Whether you’re a first-time rental property owner or an experienced host looking to explore a new avenue, this guide is designed to provide you with the knowledge and tools you need to successfully navigate the insurance rental market.

Throughout this guide, we’ll share valuable insights, tips, and strategies to help you make informed decisions and maximize your rental income potential. We’ll also highlight key considerations and precautions to keep in mind to ensure a smooth and hassle-free rental experience.

Before we delve into the details, it’s important to note that renting your home to insurance companies is not without its challenges. As with any rental endeavor, there are risks and responsibilities involved. However, with careful planning, effective marketing, and diligent management, these challenges can be mitigated, and the rewards can outweigh the potential drawbacks.

So, whether you’re looking to rent out your primary residence, a second home, or an investment property, let’s embark on this journey together and unlock the full potential of renting your home to insurance companies!

Step 1: Understanding Insurance Company Rental Programs

Before you dive into renting your home to insurance companies, it’s crucial to understand how their rental programs operate. Each insurance company may have its own specific requirements and procedures, so taking the time to familiarize yourself with their programs will help you navigate the process with confidence.

Insurance company rental programs are designed to provide temporary housing solutions for their policyholders who have experienced damage to their homes. These programs aim to offer a seamless transition for clients while their homes are being repaired or rebuilt.

To get started, research insurance companies in your area that offer rental programs. Visit their websites or contact their customer service departments to gather information about the rental procedures, rental rates, and any specific criteria they may have for properties to be considered.

Some key factors to consider when understanding insurance company rental programs include:

- Rental Length: Insurance company rental programs typically require accommodations for short-term stays, ranging from a few weeks to several months, depending on the extent of the damage to the policyholder’s home.

- Furnished vs. Unfurnished: Insurance companies often prefer fully furnished properties to provide a comfortable and convenient living space for their clients. Assess whether your home is furnished or if you’re willing to invest in furnishings to meet the insurance company’s requirements.

- Property Types: Insurance companies may have preferences for certain types of properties, such as single-family homes, apartments, or condos. Consider whether your property aligns with their desired criteria.

- Insurance Requirements: Insurance companies may require property owners to maintain specific insurance coverage, such as liability coverage, to protect against any potential issues that may arise during the rental period.

Understanding these program details will help you determine whether your property is a good fit for insurance company rentals and set appropriate expectations for the rental process. It’s important to note that each insurance company’s program may vary, so be prepared to adjust your approach accordingly.

By familiarizing yourself with insurance company rental programs, you’ll be equipped with the knowledge needed to effectively market your home and attract the attention of insurance companies seeking rental properties. So let’s move on to the next step and prepare your home for insurance company rentals!

Step 2: Preparing Your Home for Insurance Company Rentals

Now that you understand the basics of insurance company rental programs, it’s time to prepare your home to appeal to potential insurance company tenants. Making your property attractive and functional will help you stand out among the competition and increase your chances of securing rental agreements.

Here are some essential steps to consider when preparing your home for insurance company rentals:

- Clean and Declutter: Start by thoroughly cleaning your home and removing any clutter. A clean and clutter-free space will create a positive first impression and make it easier for insurance company representatives to envision their clients living in your property.

- Repair and Update: Address any necessary repairs or maintenance tasks to ensure your property is in good condition. This includes fixing leaky faucets, replacing broken light fixtures, and repainting walls if necessary. Consider updating outdated features to enhance the overall appeal.

- Furnish Appropriately: If your property is unfurnished, consider investing in quality furniture and essential household items. Opt for a neutral and modern style that appeals to a wide range of tastes. If your property is already furnished, ensure that all items are in good condition and provide a comfortable living environment.

- Stock Basic Necessities: Equip your home with essential items such as kitchenware, bedding, towels, and toiletries. This will make it easier for insurance company clients to settle into your property without having to worry about bringing or purchasing these items.

- Stage the Space: Arrange furniture, decor, and accessories in a way that showcases the potential of your home. Consider hiring a professional home stager to help create an inviting and stylish atmosphere that appeals to insurance companies and their clients.

- Highlight Amenities: Take stock of the amenities your property offers, such as a pool, gym, or a well-maintained garden. Emphasize these features in your rental listings and during property showings to attract insurance companies looking for added value for their clients.

- Ensure Safety and Security: Install smoke detectors, carbon monoxide alarms, and secure locks on windows and doors to prioritize the safety and security of insurance company clients. Make sure that all safety devices are in working order.

By following these steps, you’ll create an inviting and comfortable space that will appeal to insurance companies seeking temporary housing solutions for their clients. Remember, first impressions matter, and a well-prepared home can significantly increase your chances of success in the insurance rental market.

Now that your home is ready to shine, let’s move on to the next step: marketing your property to insurance companies and attracting their attention.

Step 3: Marketing Your Home to Insurance Companies

Now that your home is prepared, it’s time to market it effectively to insurance companies. Effective marketing strategies will help you reach the right audience and showcase the unique features of your property that make it an ideal choice for insurance company rentals.

Here are some key steps to consider when marketing your home to insurance companies:

- Create an Online Presence: Start by creating a compelling listing on popular rental platforms and listing websites. Include high-quality photos of your property, highlighting its best features. Craft a detailed and engaging description that speaks to the needs of insurance company clients and emphasizes the benefits of choosing your property.

- Utilize Social Media: Leverage the power of social media platforms like Facebook, Instagram, and LinkedIn to reach a wider audience. Create posts about your property, share photos, and use relevant hashtags to attract the attention of insurance company representatives.

- Network with Insurance Professionals: Attend industry events and network with insurance professionals to establish connections and promote your property. Join local business associations and chambers of commerce to expand your reach and tap into potential partnerships with insurance companies.

- Form Relationships with Insurance Adjusters: Insurance adjusters are the key players in the insurance company rental process. Reach out to local adjusters in your area and offer them information about your property. Building a rapport with adjusters can increase the likelihood of referrals for rental opportunities.

- Offer Competitive Rental Rates: Research the rental market in your area and set competitive rates for your property. Insurance companies are looking for cost-effective options, so ensure that your rental rates align with their budgets and provide a good value proposition.

- Showcase Testimonials: If you have previous experience with insurance company rentals and received positive feedback from tenants, showcase those testimonials on your rental listings or website. Positive reviews can build trust and confidence in insurance companies considering your property.

- Highlight Flexibility: Insurance company rentals often require flexibility in terms of lease length and start dates. Emphasize your willingness to accommodate the specific needs of insurance companies and flexibility in rental terms.

Remember to continuously monitor and update your marketing efforts based on the feedback you receive and the changing needs of insurance companies. By implementing these strategies, you’ll increase your chances of attracting the attention of insurance companies and securing rental agreements.

Next, let’s explore the crucial step of evaluating and selecting insurance companies to partner with for your rental property.

Step 4: Evaluating and Selecting Insurance Companies

As you venture into renting your home to insurance companies, it is important to evaluate and select the right insurance companies to partner with. Choosing reputable and reliable insurance companies will not only ensure the smooth operation of your rental property but also give you peace of mind knowing that your property is in good hands.

Here are some key considerations when evaluating and selecting insurance companies:

- Research Company Reputation: Conduct thorough research on insurance companies you are considering working with. Look for customer reviews, ratings, and any potential issues or complaints. A reputable and well-established insurance company will have positive feedback and a strong track record.

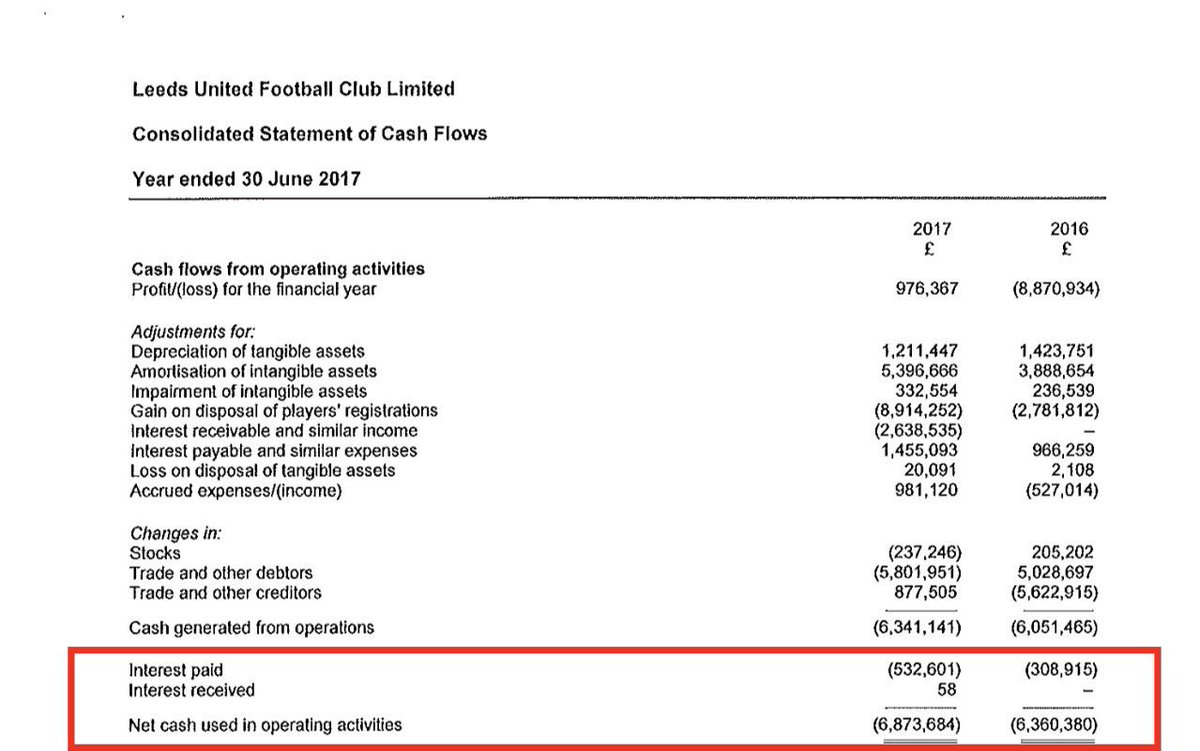

- Check Financial Stability: Evaluate the financial stability of insurance companies by reviewing their financial reports, credit ratings, and industry rankings. A financially stable company is more likely to honor rental agreements and provide timely payments.

- Assess Claims Process: Understand the claims process of insurance companies, as this will directly affect your rental income. Look for companies with efficient and transparent claims handling procedures to ensure a smooth payment process for any damages or losses that occur during the rental period.

- Review Rental Agreement: Carefully review the rental agreement provided by insurance companies. Ensure that the terms and conditions align with your expectations and are fair and equitable. Pay attention to rental rates, security deposits, liability insurance requirements, and any additional responsibilities outlined in the agreement.

- Consider Communication and Support: Evaluate the level of communication and support provided by insurance companies. Clear and prompt communication is crucial in resolving any issues or concerns that may arise during the rental period. Look for companies that are responsive and accessible when needed.

- Seek References: Request references from other property owners who have worked with the insurance companies you are considering. Hearing about their firsthand experiences can provide valuable insights into the companies’ professionalism, reliability, and overall satisfaction as rental partners.

- Compare Rental Terms: Compare the rental terms offered by different insurance companies. Consider factors such as lease length, rental rates, payment schedules, and any additional services or benefits provided. Choose the company that offers the most favorable terms for your rental property.

By carefully evaluating insurance companies based on these factors, you can make an informed decision and select the best partner for your rental property. Remember, a strong partnership with reputable insurance companies will not only optimize your rental income but also provide a positive rental experience for both you and the insurance company’s clients.

Now that you have assessed and selected insurance companies to work with, let’s move on to the next step: negotiating rental terms and agreements.

Step 5: Negotiating Rental Terms and Agreements

Once you have selected insurance companies to partner with, it’s time to negotiate the rental terms and agreements. Effective negotiation ensures that both parties are satisfied with the terms, leading to a successful rental arrangement. Here are some key steps to consider when negotiating rental terms and agreements:

- Determine Rental Rates: Discuss and agree upon the rental rates for your property with the insurance company. Consider factors such as the duration of the rental, the market value of similar properties in the area, and any additional services or amenities you provide.

- Clarify Lease Length: Determine the length of the lease agreement, taking into account the needs of the insurance company and your preferences as a property owner. This may vary depending on the extent of the damage to the policyholder’s home and the estimated repair time.

- Specify Payment Schedule: Establish a clear payment schedule with the insurance company. Discuss whether monthly or bi-weekly payments are preferred and clarify any late payment penalties or fees.

- Discuss Property Maintenance: Determine the responsibilities of both parties regarding property maintenance. Clarify who will be responsible for routine maintenance tasks and any repairs or damages that may occur during the rental period.

- Set Security Deposit: Discuss and agree upon the amount of the security deposit that the insurance company will provide. This deposit serves as a financial safeguard for any potential damages caused by the policyholder or their guests during the rental period.

- Review Liability Insurance: Ensure that the insurance company provides liability insurance to cover any potential accidents or damages that may occur during the rental period. Confirm that the policy is sufficient to protect both the insurance company and you as the property owner.

- Include Termination Clauses: Discuss termination clauses in case either party needs to end the rental agreement prematurely. Establish the notice period required for termination and any financial implications involved.

- Document Everything: Record all agreed-upon terms and conditions in a written agreement. Include details such as rental rates, lease length, payment schedule, maintenance responsibilities, security deposit amount, liability insurance coverage, and termination clauses. Both parties should review and sign this agreement.

Open and transparent communication is key during the negotiation process. Clearly express your expectations and concerns while remaining open to compromise and finding mutually beneficial solutions. Remember that a well-negotiated rental agreement sets the foundation for a successful and harmonious rental experience.

Once the rental terms and agreements are finalized, you’re ready to move on to the next step: managing the rental process with insurance companies. We’ll explore this step further in the following section.

Step 6: Managing the Rental Process with Insurance Companies

With the rental terms and agreements in place, it’s time to focus on effectively managing the rental process with insurance companies. Successful management ensures a positive experience for both you as the property owner and the insurance company’s clients. Here are some key steps to consider when managing the rental process:

- Regular Communication: Maintain open lines of communication with the insurance company throughout the rental period. Proactively address any concerns or questions they may have and provide regular updates on the status of the property and any necessary repairs or maintenance.

- Coordinate Inspections: Schedule regular inspections of the property to ensure it is being well-maintained by the insurance company’s clients. This will help identify any potential issues early on and address them promptly.

- Address Maintenance and Repairs: Communicate and coordinate with the insurance company regarding any necessary maintenance or repairs that arise during the rental period. Promptly address these issues to ensure the safety and comfort of the tenants.

- Handle Tenant Concerns: Act as a point of contact for the insurance company’s clients and address any concerns or inquiries they may have promptly. Provide timely and efficient solutions to any issues that arise during their stay.

- Collect Rental Payments: Keep track of rental payments and ensure they are received on time from the insurance company. Set up a system for documenting and recording payments to maintain financial transparency.

- Maintain Property Insurance: Keep your property insurance policy active and up to date throughout the rental period. Make sure the insurance company is aware of the rental arrangement and any adjustments needed to your coverage.

- Monitor Lease Compliance: Ensure that the insurance company’s clients are complying with the terms of the lease agreement, including adhering to any rules or regulations outlined in the agreement.

- Stay Informed: Stay updated on any changes in insurance company policies or rental requirements that may impact your rental property. Regularly review the rental agreement and make any necessary adjustments to stay in compliance.

Effective management of the rental process requires organization, proactive communication, and attention to detail. By staying actively involved and responsive, you can ensure a smooth and successful rental experience for both parties involved.

In the next step, we’ll explore the importance of maintaining and inspecting your home during the rental period to uphold its quality and protect your investment.

Step 7: Maintaining and Inspecting Your Home during the Rental Period

As a property owner renting your home to insurance companies, it’s crucial to prioritize ongoing maintenance and regular inspections to ensure the property remains in excellent condition throughout the rental period. Proper maintenance and inspections not only uphold the quality of your home but also protect your investment. Here are some key steps to consider in maintaining and inspecting your home:

- Establish a Maintenance Schedule: Create a regular maintenance schedule for your property. This should include tasks such as landscaping, HVAC system maintenance, plumbing inspections, and appliance checks. Proper maintenance helps prevent costly repairs and ensures the property remains in optimal condition.

- Document Maintenance and Repairs: Maintain detailed records of all maintenance and repairs performed on the property. This documentation helps track the property’s history and provides evidence of proper upkeep.

- Schedule Inspections: Conduct routine inspections of the property to assess its condition and identify any issues that require attention. Inspections can be done quarterly or biannually, depending on the terms of the rental agreement and local regulations.

- Communicate Inspection Schedules: Coordinate inspection dates with the insurance company to ensure their clients are aware of the upcoming visit. Provide clear instructions on access arrangements and any areas that need to be prepared for inspection.

- Thoroughly Inspect the Property: During inspections, carefully examine the interior and exterior of the home. Look for signs of damage, wear and tear, or any potential hazards that may require maintenance or repairs. Pay particular attention to areas like roofing, plumbing, electrical systems, and appliances.

- Address Maintenance and Repair Issues: If any maintenance or repair issues are identified during inspections, promptly address them. Work with the insurance company to coordinate necessary repairs and ensure the property remains in good condition for their clients.

- Keep Lines of Communication Open: Maintain regular communication with the insurance company regarding maintenance and repairs. Provide updates on any scheduled or completed maintenance tasks and address any concerns or issues that arise.

- Encourage Tenant Cooperation: Communicate with the insurance company’s clients and encourage them to report any maintenance or repair needs promptly. Foster a positive relationship with them to ensure a collaborative effort in maintaining the property.

By maintaining a proactive approach to property maintenance and conducting regular inspections, you can address any issues promptly and ensure the longevity and desirability of your rental property. Remember, a well-maintained property not only attracts insurance companies but also enhances the rental experience for their clients.

In the final step, we’ll discuss how to handle any issues or concerns that may arise during the rental period and ensure a positive resolution.

Step 8: Dealing with Issues and Concerns during the Rental Period

During the rental period, it’s important to be prepared for any issues or concerns that may arise with the insurance company’s clients. By effectively addressing and resolving these matters, you can maintain a positive relationship with both the insurance company and the tenants. Here are some key steps to consider when dealing with issues and concerns:

- Promptly Address Complaints: When a complaint or concern is raised, respond promptly and attentively. Listen to the tenant’s perspective, gather all necessary information, and take appropriate action to resolve the issue to the best of your ability.

- Communication is Key: Maintain open lines of communication with the insurance company’s clients. Regularly check in to see if they have any concerns or needs related to the property. Being proactive in communication can help prevent potential issues from escalating.

- Work with the Insurance Company: In cases where the issue is beyond your control or requires the insurance company’s involvement, collaborate closely with them to find a solution. Keep them informed of the situation and provide any necessary documentation or evidence to support the resolution process.

- Document Everything: Keep thorough records of all discussions, correspondence, and actions taken to address issues or concerns. This documentation will serve as a reference point and help protect your interests in case of any disputes.

- Follow Legal Requirements: Familiarize yourself with local rental laws and regulations to ensure you are meeting all legal requirements. Adhere to eviction procedures, privacy laws, and any other applicable regulations to protect your rights and the rights of the insurance company’s clients.

- Offer Reasonable Solutions: When faced with a problem, strive to find reasonable and fair solutions that benefit all parties involved. This approach helps maintain positive relationships and fosters a harmonious rental experience.

- Address Emergency Situations: Be prepared to respond quickly to emergency situations, such as fires, floods, or any other hazardous incidents. Have an emergency plan in place and establish clear communication channels to ensure the safety and well-being of the insurance company’s clients.

- Seek Legal Assistance if Needed: In situations where disputes or legal issues arise, consult with a qualified attorney who specializes in property and rental law. They can provide guidance, advice, and assistance in navigating complex situations.

Successfully handling issues and concerns during the rental period requires effective communication, prompt action, and a proactive approach. By addressing problems in a timely and professional manner, you can create a positive rental experience for both the insurance company’s clients and yourself as the property owner.

Congratulations! You have now completed all the essential steps involved in renting your home to insurance companies. By following this comprehensive guide, you are well-positioned to make the most of this opportunity and achieve success in the insurance rental market.

Remember, each rental experience is unique, and ongoing learning and adaptation are essential for long-term success. Stay proactive, maintain open communication, and continuously reassess and improve your rental strategies to optimize your rental income and provide outstanding service to insurance companies and their clients.

Conclusion

Congratulations on reaching the end of this comprehensive guide on renting your home to insurance companies! By following the step-by-step process outlined in this guide, you have gained valuable insights and strategies for successfully navigating the insurance rental market.

Throughout the guide, we explored various crucial steps, including understanding insurance company rental programs, preparing your home for rentals, marketing to insurance companies, evaluating and selecting the right partners, negotiating rental terms, managing the rental process, maintaining and inspecting your property, and handling issues and concerns that may arise.

By implementing these steps, you have positioned yourself for success in the insurance rental market. Renting your home to insurance companies offers numerous benefits, including a reliable source of income, a built-in customer base, and the opportunity to contribute to the community by providing temporary housing solutions.

Remember, while the process may have its challenges, with careful planning, effective communication, and ongoing maintenance, you can create a positive rental experience for both yourself and the insurance company’s clients.

Continue to stay informed about industry trends and any changes in insurance company rental programs. Regularly evaluate your property, the rental market, and your partnership with insurance companies to ensure ongoing success and profitability.

Thank you for embarking on this journey with us, and best of luck in your endeavors to rent your home to insurance companies. May your rental venture be fruitful, rewarding, and provide a positive impact in the lives of those you serve.