Finance

How To Run A Credit Check On A Tenant

Published: January 12, 2024

Looking to run a credit check on a tenant? Learn how to do it effectively and efficiently, with valuable tips and insights on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understand the Importance of a Credit Check

- Step 2: Gather Necessary Information from the Tenant

- Step 3: Choose a Credit Reporting Agency

- Step 4: Obtain Tenant Consent

- Step 5: Run the Credit Check

- Step 6: Review the Credit Report

- Step 7: Consider Additional Factors

- Step 8: Make an Informed Decision

- Step 9: Communicate the Results to the Tenant

- Conclusion

Introduction

Running a credit check on a potential tenant is an essential step in the tenant screening process for landlords and property managers. A credit check provides crucial insights into an individual’s financial history and helps evaluate their ability to meet financial obligations.

Understanding a tenant’s creditworthiness can help landlords make informed decisions and minimize the risk of late or defaulted rental payments. A credit check can also reveal any past evictions or outstanding debts, giving landlords a comprehensive picture of the tenant’s financial reliability.

In this article, we will guide you through the step-by-step process of running a credit check on a tenant. From gathering the necessary information to choosing a credit reporting agency and reviewing the credit report, we will cover everything you need to know to make an informed decision.

It is important to note that requesting a tenant’s credit report requires their consent, and it is essential to familiarize yourself with the legal requirements and regulations governing tenant screening in your area before initiating the credit check process.

By following this comprehensive guide, you can ensure that your tenant selection process is thorough and reliable, allowing you to find tenants who are financially responsible and likely to meet their rental obligations. So let’s dive in and learn how to run a credit check on a tenant effectively.

Step 1: Understand the Importance of a Credit Check

Running a credit check on a tenant is a crucial step in the tenant screening process. It provides valuable information about a potential tenant’s financial history, helping you assess their creditworthiness and reliability as a renter.

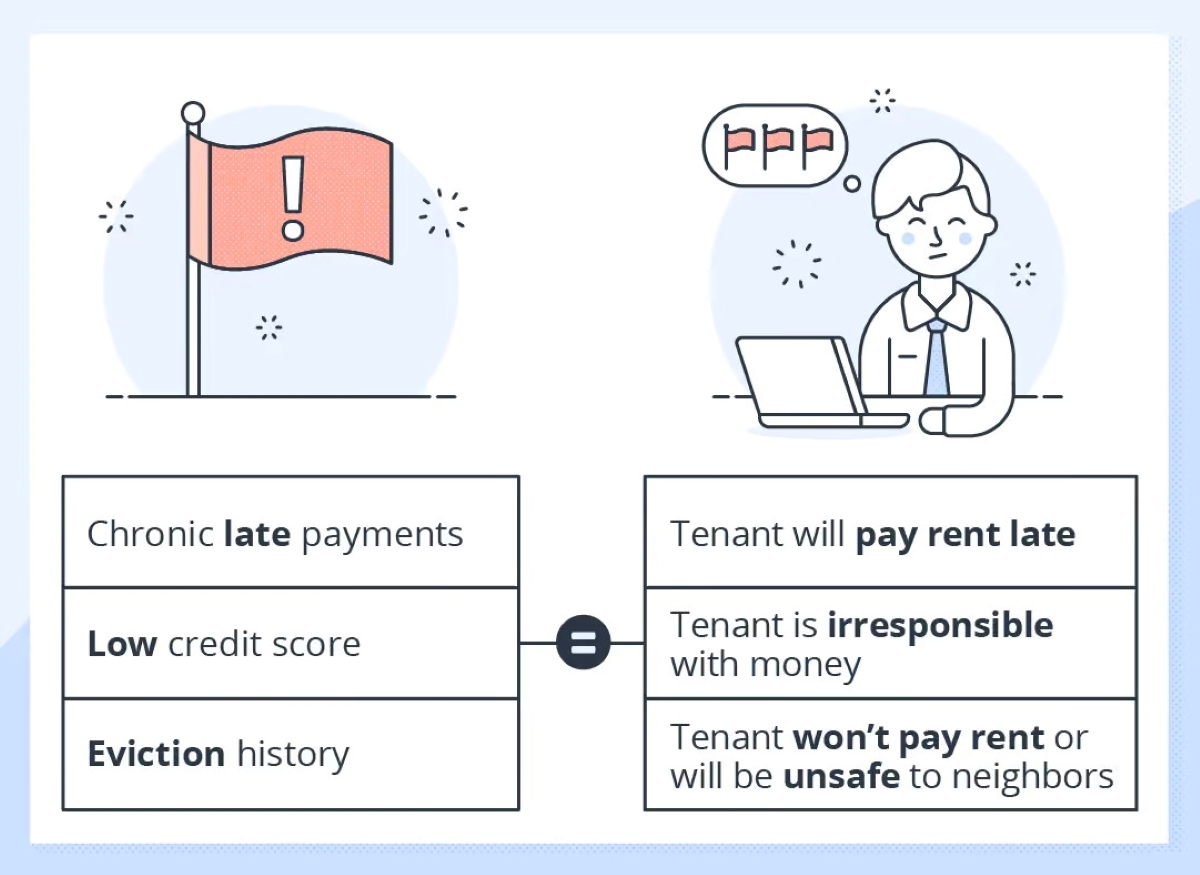

A credit check reveals important details such as the tenant’s credit score, payment history, outstanding debts, and any previous bankruptcies or evictions. By reviewing this information, landlords and property managers can make more informed decisions when selecting tenants for their rental properties.

Here are a few key reasons why understanding the importance of a credit check is vital:

1. Assessing Financial Responsibility

A credit check allows you to evaluate a tenant’s financial responsibility by examining their credit history. A high credit score and a record of timely payments indicate that the tenant is likely to fulfill their rent payments on time and in full. On the other hand, a low credit score or a history of missed payments may raise concerns about the tenant’s ability to meet their financial obligations.

2. Minimizing the Risk of Late Payments or Default

By reviewing a tenant’s credit report, you can identify any patterns of late payments or defaulted debts. This insight helps you gauge the likelihood of the tenant making timely rent payments. Avoiding tenants with a history of financial troubles can help minimize the risk of dealing with late payments, partial payments, or costly evictions down the line.

3. Identifying Potential Red Flags

A credit check can uncover red flags that may be indicators of potential problems. These red flags could include a high debt-to-income ratio, frequent credit applications, or a history of evictions. By identifying these issues early on, you can make informed decisions about whether to proceed with the tenant.

4. Legal Protection

Conducting a credit check as part of the tenant screening process can provide legal protection for landlords. It helps ensure fairness by treating all applicants equally and avoiding discriminatory practices. It also allows landlords to demonstrate that their decision-making process is based on objective criteria and not influenced by personal biases.

By understanding the importance of a credit check, you can make well-informed decisions when selecting tenants and reduce the potential risks associated with renting out your property. In the next step, we will discuss the necessary information you need to gather from the tenant in order to run a credit check effectively.

Step 2: Gather Necessary Information from the Tenant

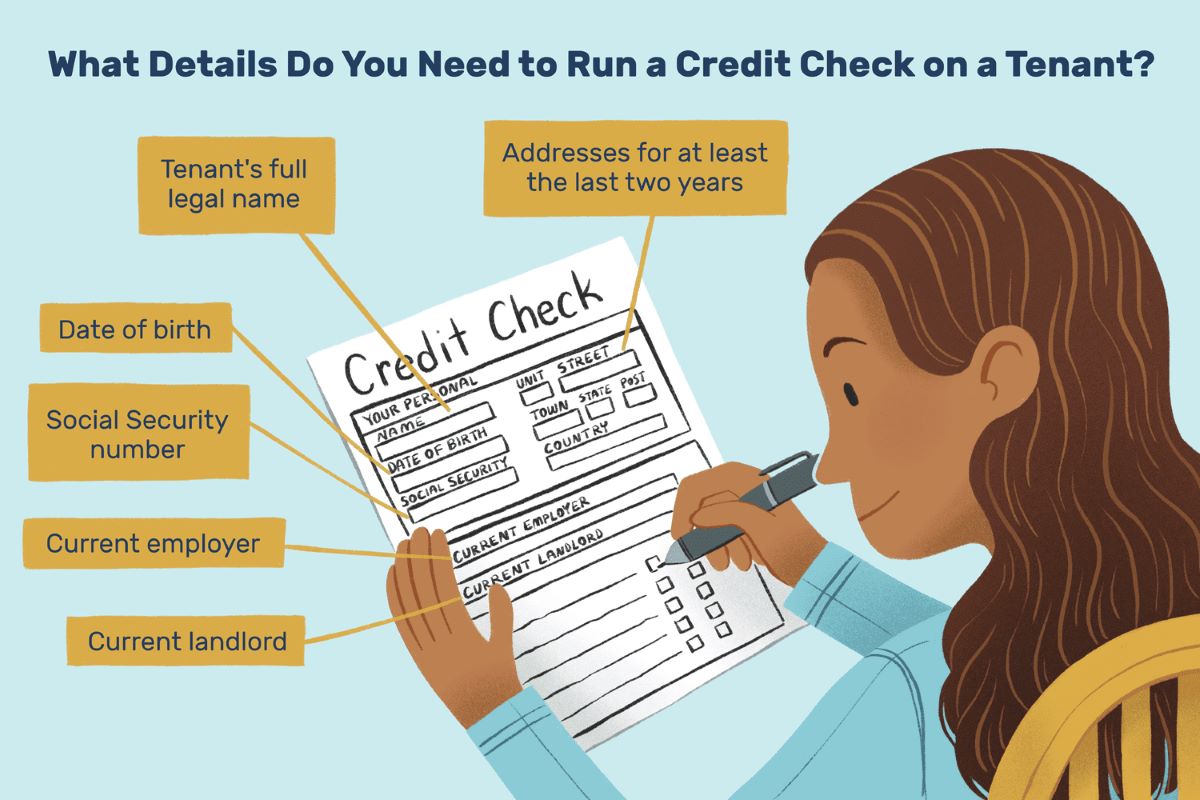

Before you can proceed with running a credit check, you will need to gather specific information from the tenant. This information will provide the necessary details required by the credit reporting agencies to generate a comprehensive credit report. Here are the essential pieces of information you should obtain from the tenant:

1. Full Name and Contact Information

Collect the tenant’s full legal name, including any middle names or initials, to ensure accuracy when requesting their credit report. Additionally, obtain their current address, phone number, and email address so you can contact them regarding the credit check and communicate the results.

2. Social Security Number or Individual Taxpayer Identification Number (ITIN)

A tenant’s social security number (SSN) or individual taxpayer identification number (ITIN) is a vital component in running a credit check. This identifier helps credit reporting agencies match the tenant’s information to their credit history accurately. Ensure that proper security measures are in place to protect this sensitive information.

3. Employment and Income Details

Ask the tenant to provide information about their employment status, including their current employer’s name, address, and contact information. Additionally, request documentation or proof of income, such as pay stubs or bank statements, to verify their ability to afford the rent payments.

4. Rental History

Inquire about the tenant’s previous rental history, including the names and contact information of previous landlords or property managers. This information allows you to reach out to past landlords to gather insights about the tenant’s rental behavior, such as their payment history, adherence to lease agreements, and any reported issues.

5. References

Ask the tenant for personal references who can vouch for their character and reliability. These references can be friends, colleagues, or mentors who are familiar with the tenant’s history and can provide additional insight into their suitability as a tenant.

By gathering this necessary information from the tenant, you will have the essential details required to initiate the credit check process. In the next step, we will explore how to choose a credit reporting agency that meets your needs.

Step 3: Choose a Credit Reporting Agency

When it comes to running a credit check on a tenant, selecting the right credit reporting agency is crucial. There are several reputable agencies available that provide comprehensive credit reports, each with its unique features and offerings. Here are some factors to consider when choosing a credit reporting agency:

1. Reliability and Accuracy

Ensure that the credit reporting agency you choose has a reputation for providing reliable and accurate credit reports. Look for agencies that collect data from multiple sources, including banks, lenders, and public records, to ensure the integrity and completeness of the credit report.

2. Coverage and Accessibility

Check the agency’s coverage area to ensure that they provide credit reports for the region where your rental property is located. Additionally, consider the accessibility and user-friendliness of the agency’s website or platform. A seamless online interface will make it easier for you to request credit reports and navigate through the provided information.

3. Price and Pricing Plans

Compare the pricing structures of different credit reporting agencies. Some agencies offer pay-as-you-go options, which are suitable if you have occasional credit check requirements. Others provide subscription-based plans that may be more cost-effective if you anticipate running credit checks on multiple tenants regularly. Evaluate the pricing plans based on your specific needs and budget.

4. Compliance with Regulations

Ensure that the credit reporting agency you choose complies with local, state, and federal regulations regarding tenant screenings. Familiarize yourself with the Fair Credit Reporting Act (FCRA) and any other relevant laws that govern the use of credit reports in tenant screening. Choosing a reputable agency will help you adhere to these regulations and avoid legal issues.

5. Additional Services

Consider whether the credit reporting agency offers any additional services that could be beneficial for your tenant screening process. For example, some agencies provide background checks or eviction history reports, allowing you to gather a more comprehensive picture of a tenant’s renting history and potential risks.

Take your time to research and compare different credit reporting agencies to find the one that best meets your requirements. A reliable and reputable agency will provide you with accurate credit reports, ensuring that you have the necessary information to make informed decisions about your potential tenants. In the next step, we will discuss how to obtain tenant consent before running a credit check.

Step 4: Obtain Tenant Consent

Before running a credit check on a tenant, it is crucial to obtain their consent. Tenant consent is not only a legal requirement in most jurisdictions, but it also demonstrates your commitment to transparency and ensures that you are conducting the credit check ethically. Here are the necessary steps to obtain tenant consent:

1. Communicate the Purpose

Clearly communicate to the tenant why you need their consent to run a credit check. Explain that their credit history plays a significant role in evaluating their eligibility as a tenant and ensuring a positive rental experience for all parties involved. Providing this context helps tenants understand the importance of the credit check.

2. Use a Written Consent Form

Create a written consent form that clearly outlines the purpose of the credit check, the agency you will be using, and the specific information that will be collected and shared with the credit reporting agency. Include a section for the tenant to provide their signature, indicating their agreement to the credit check.

3. Provide Privacy and Security Information

Include information in the consent form that assures the tenant of the privacy and security of their personal and financial information. Explain how their data will be handled, stored, and protected in compliance with applicable data protection regulations and industry best practices.

4. Give Ample Time to Review

Provide the tenant with sufficient time to review the consent form and ask any questions they may have. Avoid pressuring or rushing them into providing consent. It is important to ensure that the tenant fully understands the process.

5. Keep Records of Consent

Maintain a copy of the signed consent form in your records. This documentation serves as proof that the tenant has given their consent and can be referenced if needed in the future.

Remember, it is essential to familiarize yourself with the specific tenant screening and consent requirements in your jurisdiction. Some areas may have additional laws or regulations that govern the consent process. Always seek legal advice or consult local authorities if you have any uncertainties about the tenant consent process.

Once you have obtained the tenant’s consent, you are ready to move forward with running the credit check. In the next step, we will discuss the process of actually running the credit check on the tenant.

Step 5: Run the Credit Check

Now that you have obtained tenant consent and gathered the necessary information, it’s time to run the credit check. Follow these steps to initiate and complete the credit check process effectively:

1. Choose the Credit Reporting Agency

Contact the credit reporting agency you selected in Step 3. Provide them with the tenant’s information, including their full name, social security number or ITIN, and any other details required by the agency. Confirm the cost of the credit check and make the necessary payment, if applicable.

2. Submit the Request

Submit the tenant’s information and consent form to the credit reporting agency. Most agencies allow you to submit requests online, simplifying the process and saving time. Ensure that all information is accurate and complete to ensure accurate results.

3. Await the Credit Report

Wait for the credit reporting agency to process the request and generate the credit report. The processing time may vary depending on the agency and the volume of requests they handle. It’s a good practice to follow up with the agency if you haven’t received the report within the estimated timeframe.

4. Review the Credit Report

Once you receive the credit report, carefully review all the information provided. Pay attention to the tenant’s credit score, payment history, outstanding debts, and any red flags that may affect their financial reliability. Take your time to analyze the report thoroughly and make note of any significant findings.

5. Validate the Information

While credit reports are generally reliable, there may be instances of incorrect or outdated information. If you come across any discrepancies or questionable entries in the report, consider validating the information with the tenant or requesting additional supporting documents to ensure the accuracy of your evaluation.

6. Maintain Confidentiality

It is crucial to handle the tenant’s credit report with the utmost confidentiality. Store the report securely and ensure that only authorized personnel have access to it. Adhere to data protection regulations and dispose of any sensitive information in a responsible and secure manner.

By following these steps, you can successfully run a credit check on the tenant and obtain the necessary information to evaluate their creditworthiness. In the next step, we will discuss how to review the credit report and consider additional factors in the tenant screening process.

Step 6: Review the Credit Report

After obtaining the credit report, it’s crucial to review it thoroughly to gain a comprehensive understanding of the tenant’s financial history and creditworthiness. Here are some key factors to consider when reviewing the credit report:

1. Credit Score

Pay attention to the tenant’s credit score, as it provides a quick snapshot of their overall creditworthiness. A high credit score generally indicates that the tenant has a positive credit history and is likely to be financially responsible. On the other hand, a low credit score may raise concerns about their ability to meet financial obligations.

2. Payment History

Evaluate the tenant’s payment history to assess their reliability in meeting financial obligations. Look for patterns of on-time payments, late payments, or missed payments. Consistent late or missed payments can be red flags, as they indicate a potential risk of late rent payments or defaulting on obligations.

3. Outstanding Debts

Examine the tenant’s outstanding debts, such as credit card balances, loans, or other financial obligations. High levels of debt may affect their ability to afford rental payments or increase the risk of financial instability. Consider how their debt-to-income ratio aligns with your specific rental requirements.

4. Public Records and Collections

Look for any public records, such as bankruptcies, tax liens, or judgments, which can provide insights into the tenant’s financial stability. Additionally, take note of any collections accounts, as they indicate past debts that were not paid in full. These factors may impact the tenant’s ability to fulfill their rental obligations.

5. Length of Credit History

Consider the length of the tenant’s credit history. An established credit history with a consistent track record of responsible credit management demonstrates financial maturity and reliability. However, tenants with limited or no credit history may still be suitable candidates if they can provide other forms of financial documentation or references.

6. Identity Verification

Ensure that the tenant’s identity information on the credit report matches the information provided by the tenant. Compare names, addresses, and other identifying details to verify the accuracy and legitimacy of the credit report.

In addition to reviewing the credit report, it is essential to consider the specific criteria and rental requirements set by your property. Determine what factors carry the most weight in your decision-making process and evaluate the tenant’s creditworthiness accordingly.

Remember, a credit report is just one aspect of the tenant screening process. Consider combining it with other screening methods such as contacting references, conducting background checks, and interviewing the tenant to gather a well-rounded assessment of their suitability as a renter.

In the next step, we will discuss additional factors to consider when making your final decision on whether to approve or deny the tenant’s application.

Step 7: Consider Additional Factors

While a credit report provides valuable insights into a tenant’s financial history, it’s important to consider additional factors before making a final decision on their application. Here are some additional factors to consider during the tenant screening process:

1. Rental History

Review the tenant’s rental history, including their past landlords’ feedback and any references provided. Contact previous landlords to inquire about the tenant’s behavior, payment history, and any reported issues. A positive rental history indicates a tenant who has respected lease agreements and maintained a satisfactory rental experience.

2. Employment and Income Stability

Assess the tenant’s employment stability and income level to determine their ability to meet their financial commitments. Verify their employment details, including their job title, length of employment, and income level. A reliable and steady income stream is crucial in ensuring consistent rental payments.

3. Criminal Background Check

Conduct a criminal background check to ensure the safety and security of your property and other tenants. Check for any past criminal convictions or charges that may pose a risk to the rental property or other residents. It is essential to comply with local and federal laws regarding background checks and follow best practices in handling sensitive information.

4. Rental Criteria and Policies

Consider your specific rental criteria and policies when evaluating a tenant’s application. Determine if the tenant meets your minimum requirements concerning credit score, income level, or any specific rental restrictions. Adhering to your rental criteria helps maintain consistency and fairness in the tenant selection process.

5. Personal Interview and Gut Feeling

Although it may not be a quantitative factor, conducting a personal interview with the tenant can provide valuable insights into their personality, communication skills, and compatibility with your rental property. Trust your instincts and consider your overall impression of the tenant during the interview process.

Remember that no single factor should dictate your decision. Instead, consider the tenant’s credit report along with other relevant factors to make a well-rounded assessment. Each rental situation is unique, and it’s important to weigh the various elements to determine the best tenant for your property.

In the next step, we will discuss how to effectively communicate the credit check results to the tenant and finalize the tenant selection process.

Step 8: Make an Informed Decision

After reviewing the credit report and considering additional factors, it’s time to make an informed decision regarding the tenant’s application. Here are the key steps to ensure you make the best decision:

1. Evaluate the Overall Picture

Consider all the information you have gathered throughout the tenant screening process. Take into account the tenant’s credit report, rental history, employment and income stability, criminal background check, and how they align with your rental criteria and policies. Assessing the overall picture will help you assess the tenant’s suitability for your property.

2. Compare Against your Rental Criteria

Compare the tenant’s qualifications against your rental criteria and policies. Analyze whether they meet the minimum requirements for creditworthiness, income level, rental history, and other factors that are important to you. This comparison will help you determine if the tenant aligns with your specific requirements.

3. Consider Risk Assessment

Assess the potential risks associated with renting to the tenant. Evaluate factors such as their ability to make timely rent payments, potential maintenance issues, compatibility with other tenants, and adherence to lease terms. Identifying and managing potential risks can help ensure a positive rental experience for both parties involved.

4. Follow Legal and Fair Housing Guidelines

Ensure that the decision-making process complies with all relevant laws and fair housing guidelines. Avoid any form of discrimination based on protected characteristics such as race, religion, gender, or disability. Familiarize yourself with the fair housing laws in your jurisdiction to ensure that your decision-making process is fair and unbiased.

5. Document the Decision

Maintain proper documentation of your decision-making process. Keep records of the tenant’s application, credit report, reference checks, and any notes or observations you made during the screening process. This documentation will serve as evidence in case of any disputes or legal issues.

Making an informed decision is crucial to ensure a successful landlord-tenant relationship. By carefully considering all the relevant information and following legal guidelines, you can select a tenant who is likely to fulfill their rental obligations and maintain a positive renting experience.

In the final step, we will discuss how to effectively communicate the credit check results to the tenant and finalize the tenant selection process.

Step 9: Communicate the Results to the Tenant

After making your decision based on the tenant’s application and credit check, it’s essential to effectively communicate the results to them. The goal is to provide clear and concise information regarding the outcome of their application and the reasons behind it. Follow these steps to communicate the results to the tenant:

1. Prompt Notification

Notify the tenant as soon as possible about the decision regarding their application. Prompt communication shows professionalism and respect for the tenant’s time and effort.

2. Provide a Reason

Explain the basis of your decision to the tenant. If the decision is based on their credit check, inform them that it played a significant role in the evaluation process. However, avoid disclosing specific information from the credit report to comply with privacy and legal regulations.

3. Clear and Respectful Communication

Be clear and respectful in your communication with the tenant. Use a professional and empathetic tone to ensure that they understand the decision and feel valued as an applicant.

4. Provide Alternatives or Suggestions

If the tenant’s application is rejected due to their credit history, consider providing alternative options or suggestions to help them improve their credit and increase their chances of being approved in the future. This demonstrates your willingness to support their efforts towards financial stability.

5. Comply with Fair Housing Laws

Ensure that your communication complies with fair housing laws. Avoid any statements that may be interpreted as discriminatory or biased based on protected characteristics. Focus on the tenant’s creditworthiness and rental qualifications as the primary factors in the decision-making process.

6. Offer Feedback (Optional)

If possible and appropriate, offer constructive feedback to the tenant about areas they can improve upon for future rental applications. This feedback can be valuable for the tenant’s personal and financial growth and may enable them to have better success in future rental endeavors.

Effective communication of the results to the tenant is crucial to maintain transparency and professionalism throughout the tenant selection process. It establishes clear expectations and helps both parties move forward in the process, whether it leads to the acceptance or denial of the tenant’s application.

Congratulations! You have now completed all the steps to run a credit check on a tenant successfully. By following these steps, you can make informed decisions regarding potential tenants and minimize the risks associated with renting out your property.

Conclusion

Running a credit check on a tenant is a critical step in the tenant screening process that allows landlords and property managers to assess a tenant’s financial history and creditworthiness. By following the step-by-step guide outlined in this article, you have learned how to effectively run a credit check on a potential tenant.

Understanding the importance of a credit check and gathering the necessary information from the tenant are crucial initial steps. Choosing a reliable credit reporting agency and obtaining tenant consent ensures that the process is conducted in compliance with legal requirements.

Running the credit check provides you with valuable insights into the tenant’s credit score, payment history, outstanding debts, and any red flags. However, it is important to consider additional factors such as rental history, employment stability, criminal background checks, and adherence to rental criteria and policies.

Throughout the process, it is essential to maintain clear and respectful communication with the tenant and comply with fair housing laws to ensure a fair and unbiased process. Finally, communicating the results to the tenant promptly and providing options or suggestions for improvement, when appropriate, helps foster transparency and professionalism.

By following these steps and making informed decisions, you can select tenants who are financially responsible and likely to meet their rental obligations. Remember, each rental situation is unique, and it’s important to weigh all factors and apply your judgment to find the best fit for your property.

Running a credit check on a potential tenant is an important tool to help mitigate risks and protect your investment. By combining the credit check with other screening methods and maintaining a thorough and fair tenant selection process, you can maximize the likelihood of finding reliable and responsible tenants who will be a great fit for your rental property.

So, put your newfound knowledge into practice and make well-informed decisions as you embark on the tenant selection process. Happy renting!