Finance

How To Pull Credit Report For Tenant

Published: October 20, 2023

Learn how to pull a credit report for your potential tenant and make informed financial decisions. Get valuable insights to protect your finances

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why Pulling a Credit Report is Important for Landlords

- Step-by-Step Guide to Pulling a Credit Report for a Tenant

- Understanding the Tenant Screening Process

- What to Look for in a Tenant’s Credit Report

- Alternative Methods for Assessing a Tenant’s Financial Responsibility

- Important Considerations when Pulling a Credit Report

- Conclusion

Introduction

Welcome to our comprehensive guide on how to pull a credit report for a tenant. As a landlord or property manager, it is essential to conduct thorough tenant screenings to ensure the financial stability and reliability of potential renters. One crucial step in this process is pulling a credit report, which provides valuable insights into a tenant’s financial history and behavior.

By reviewing a credit report, you can gain a better understanding of an applicant’s creditworthiness, debt obligations, payment history, and potential red flags. This information can help you make informed decisions and mitigate the risk of renting to individuals with a history of financial instability or irresponsibility.

In this guide, we will walk you through the step-by-step process of pulling a credit report for a tenant. We will discuss the importance of conducting tenant screenings, the key information you can extract from a credit report, and alternative methods for assessing a potential renter’s financial responsibility.

Additionally, we will highlight important considerations to keep in mind when pulling a credit report, such as legal requirements, privacy concerns, and recommended credit reporting agencies to use. By the end of this guide, you will have all the tools and knowledge necessary to effectively evaluate a prospective tenant’s creditworthiness and make informed rental decisions.

Why Pulling a Credit Report is Important for Landlords

As a landlord, your top priority is to find reliable tenants who will pay rent on time and take care of your property. Pulling a credit report is an essential step in the tenant screening process because it provides valuable information about a potential renter’s financial history and behavior. Here are a few key reasons why pulling a credit report is important:

- Evaluating Financial Responsibility: A credit report allows you to assess an applicant’s financial responsibility by providing insight into their creditworthiness. It shows their credit score, previous loans, payment history, and any outstanding debts. This information helps you determine if they have a track record of timely payments and managing their financial obligations.

- Identifying Potential Red Flags: A credit report can reveal any past or current financial issues that may raise concerns. This includes bankruptcies, foreclosures, collection accounts, or high levels of debt. Identifying these red flags can help you make informed decisions and avoid tenants who may be at risk of defaulting on rent payments or causing financial problems.

- Preventing Rental Income Loss: By assessing a tenant’s creditworthiness, you can minimize the risk of rental income loss. A tenant with a poor credit history or a pattern of late payments is more likely to default on rent or struggle to meet their financial obligations. Pulling a credit report helps you identify tenants who pose a higher risk and make alternative arrangements if necessary.

- Complying with Legal Requirements: In some jurisdictions, landlords are legally required to conduct tenant screenings, which may include pulling a credit report. Adhering to these legal obligations helps protect you from potential lawsuits and ensures a fair and consistent screening process for all applicants.

Overall, pulling a credit report allows you to make more informed decisions when selecting tenants and reduces the chances of experiencing financial issues or conflicts down the line. It provides valuable insights into an applicant’s financial responsibility, helping you choose tenants who are more likely to fulfill their rental obligations and maintain a positive relationship throughout their tenancy.

Step-by-Step Guide to Pulling a Credit Report for a Tenant

Pulling a credit report for a tenant is a straightforward process that requires a few simple steps. Let’s walk through the process step-by-step:

- Obtain Written Consent: Before pulling a credit report, you must obtain written consent from the applicant. This can be done by including a consent form as part of the rental application or by having the applicant sign a separate authorization form.

- Choose a Credit Reporting Agency: Select a reputable credit reporting agency to obtain the tenant’s credit report. There are several agencies available, such as Experian, Equifax, and TransUnion. Consider factors like cost, ease of use, and the level of detail provided in the reports when choosing an agency.

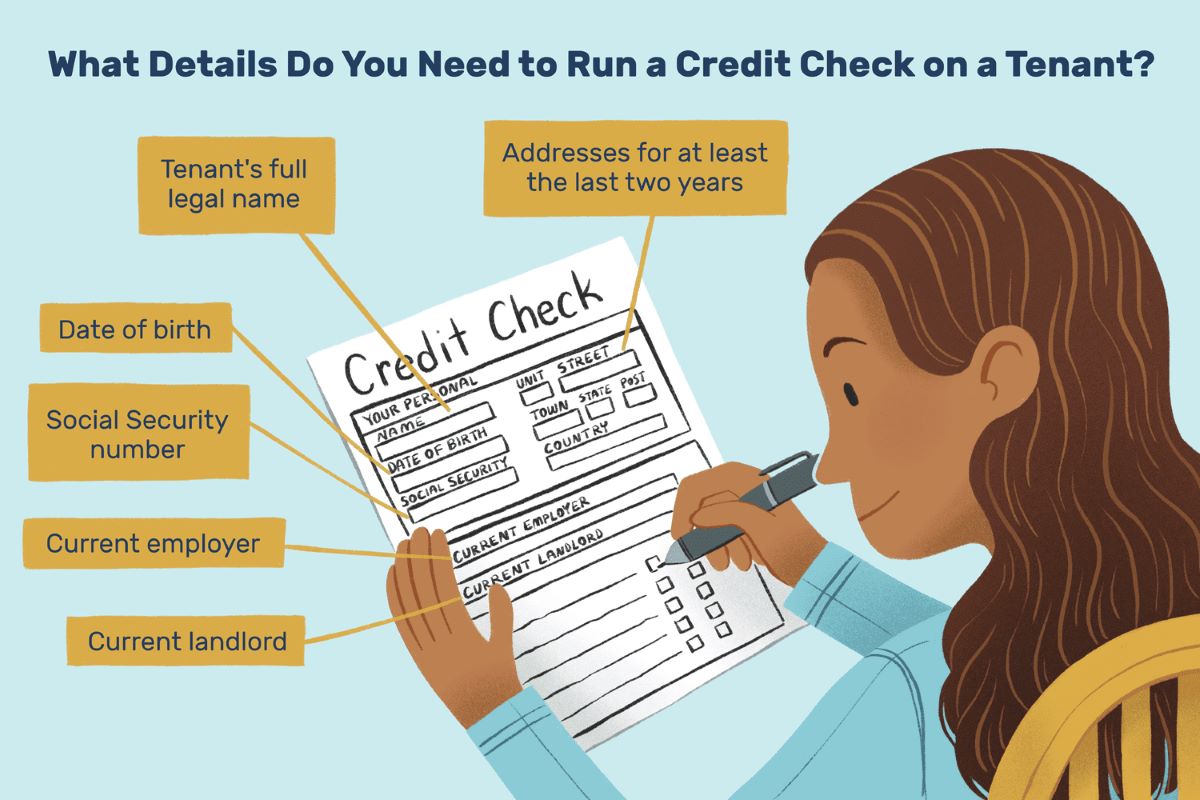

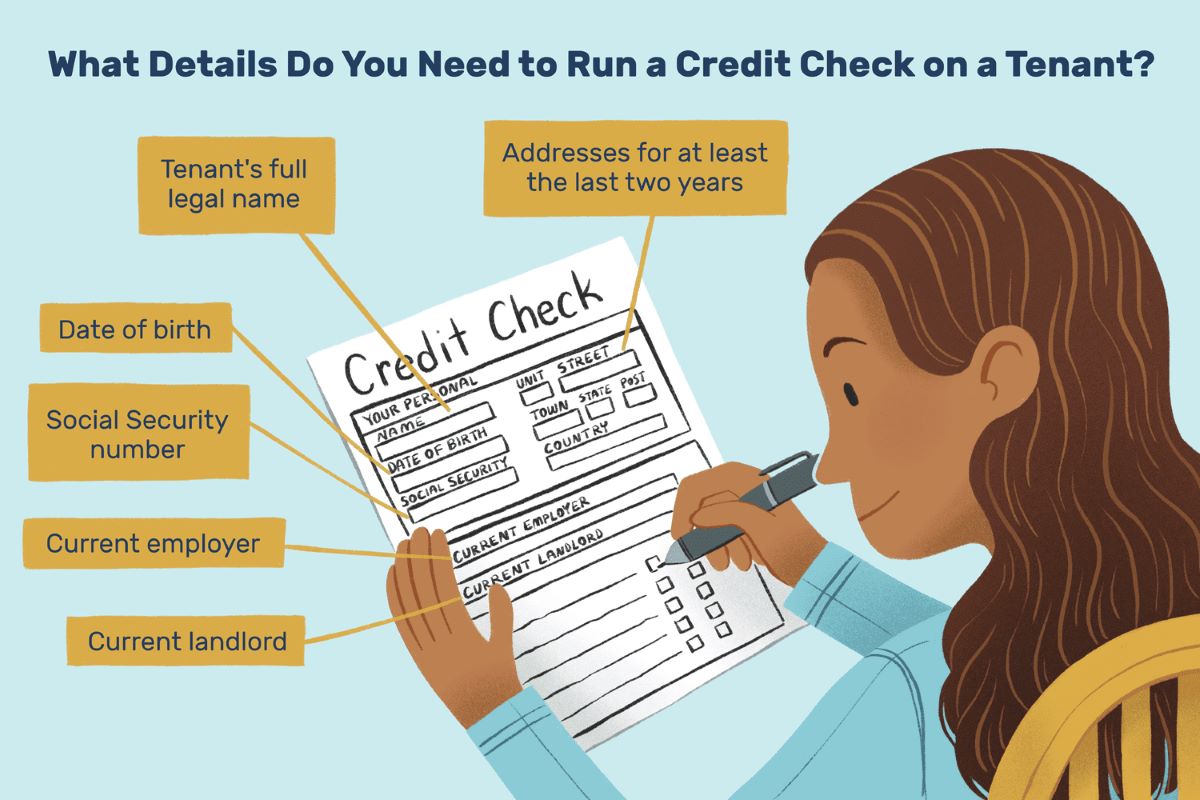

- Collect Necessary Information: Gather the required information from the applicant, such as their full name, social security number, date of birth, and current address. This information is necessary to accurately request and obtain their credit report.

- Submit the Request: Once you have the applicant’s consent and the necessary information, submit a request to the chosen credit reporting agency. This can typically be done online, over the phone, or through a secure portal provided by the agency.

- Review the Credit Report: Once you receive the tenant’s credit report, review it thoroughly. Look for important details such as their credit score, payment history, outstanding debts, and any negative marks. Pay close attention to any red flags that may indicate financial instability or irresponsible behavior.

- Make an Informed Decision: Based on the information gathered from the credit report, assess the applicant’s creditworthiness and make an informed decision regarding their tenancy. Consider factors such as their credit score, debt-to-income ratio, and overall financial responsibility. It’s important to have clear criteria and guidelines in place to ensure a fair and consistent screening process.

Remember, it’s crucial to handle this process professionally and securely. Protect the applicant’s personal information by using secure channels, and ensure compliance with legal requirements and regulations regarding tenant screenings and data protection.

By following these steps, you can effectively pull a credit report for a tenant and gain valuable insights into their financial history. This will aid in making informed decisions about renting to them and help mitigate potential financial risks associated with problem tenants.

Understanding the Tenant Screening Process

As a landlord or property manager, tenant screening is a vital step in ensuring the quality and reliability of your tenants. The tenant screening process involves assessing potential renters to determine if they meet your rental criteria and are likely to fulfill their financial obligations. Here’s a breakdown of the tenant screening process:

- Application Submission: Applicants interested in renting your property will typically submit a rental application. This application collects essential information such as personal details, employment history, income verification, references, and consent to conduct a background and credit check.

- Background Check: A background check is conducted to verify an applicant’s identity, criminal record, eviction history, and any other relevant public records. This step ensures that prospective tenants have a clean legal history and are a suitable fit for your property.

- Credit Check: A credit check is crucial for evaluating an applicant’s financial responsibility and creditworthiness. Pulling a credit report allows you to review their credit score, outstanding debts, payment history, and any red flags that may indicate potential financial issues.

- Income Verification: Verifying an applicant’s income helps assess their ability to afford rent. This can be done by requesting pay stubs, employment verification, bank statements, or by using a third-party verification service.

- References and Rental History: Speaking with previous landlords and checking rental history provides insight into an applicant’s behavior as a tenant. It helps determine how they treated their previous rental property, if they paid rent on time, and if they were respectful of the lease terms.

- Reviewing the Screening Results: Once you have collected all necessary information, review the screening results. Evaluate the applicant’s overall suitability based on their background check, credit report, income verification, and rental history.

- Making an Informed Decision: Consider all the information gathered during the screening process to make an informed decision about accepting or rejecting an applicant. Ensure that your decision complies with fair housing laws and that your criteria are applied consistently to all applicants.

By following a thorough tenant screening process, you can identify reliable and financially stable tenants who will respect your property, pay rent on time, and maintain a positive tenancy. These steps help protect your investment, minimize risk, and foster a positive rental experience for both parties involved.

What to Look for in a Tenant’s Credit Report

When reviewing a tenant’s credit report, there are several key factors to consider to assess their financial responsibility and creditworthiness. Here’s what you should look for in a tenant’s credit report:

- Credit Score: The credit score is a numerical representation of an applicant’s creditworthiness. Generally, a higher credit score indicates a greater likelihood of responsible financial behavior. Look for a score that falls within an acceptable range based on your rental criteria.

- Payment History: Review the tenant’s payment history to see if they have a track record of making on-time payments. Late payments, missed payments, or a history of collections can be warning signs of financial risk.

- Outstanding Debts: Take note of any outstanding debts the tenant has. High levels of debt can impact their ability to pay rent consistently and may indicate financial instability.

- Bankruptcy or Foreclosure: Look for any past bankruptcies or foreclosures in the tenant’s credit report. While these events may not automatically disqualify an applicant, it’s important to consider the circumstances and their overall financial recovery since then.

- Credit Utilization Ratio: The credit utilization ratio reflects the amount of credit an individual is using compared to their total available credit. A high credit utilization ratio may suggest that the tenant relies heavily on credit, potentially impacting their ability to pay rent regularly.

- Derogatory Remarks: Pay attention to derogatory remarks on the credit report, such as charge-offs, collections, or judgments. These negative marks can indicate a history of financial irresponsibility or difficulties meeting financial obligations.

- Length of Credit History: Consider the length of the tenant’s credit history. A longer credit history can provide a more robust picture of their financial habits and stability.

- Recent Credit Inquiries: Take note of any recent credit inquiries on the tenant’s report. Multiple inquiries within a short period may indicate a potential reliance on credit or financial stress.

It’s important to have clear criteria in mind when reviewing a tenant’s credit report. Determine what factors are most important to you and establish a baseline threshold for acceptance. Keep in mind that you must adhere to fair housing laws and apply your criteria consistently to all applicants.

Remember, a credit report is just one piece of the puzzle when evaluating a tenant. It should be considered in conjunction with other screening steps, such as background checks, rental history, and income verification, to ensure a comprehensive assessment of an applicant’s suitability as a tenant.

Alternative Methods for Assessing a Tenant’s Financial Responsibility

While pulling a credit report is a common and effective way to assess a tenant’s financial responsibility, there are alternative methods you can consider to gain further insights into their financial stability. Here are some alternative methods for assessing a tenant’s financial responsibility:

- Income Verification: Requesting income verification documents, such as pay stubs, W-2 forms, or tax returns, can provide a clearer picture of the tenant’s financial situation. It allows you to verify their employment, income level, and the stability of their income source.

- Employment Checks: Contacting the tenant’s current employer or previous employers can help validate their employment status and assess their employment history. This can provide valuable information about their stability and reliability as an employee, which can be indicative of their financial stability as well.

- References: Speaking with the tenant’s references, particularly previous landlords, can offer insights into their character, reliability, and payment history as a tenant. References can provide valuable information about the tenant’s financial responsibility and behavior in previous rental situations.

- Bank Statements: Requesting bank statements from the tenant can give you a glimpse into their financial habits and stability. Analyzing their account balance, transactions, and regular expenses can help assess their ability to afford rent and manage their finances responsibly.

- Interviews: Conducting interviews with potential tenants allows you to assess their financial responsibility directly. Ask questions about their financial situation, their ability to pay rent on time, and their approach to managing their finances. This can help gauge their level of financial responsibility and their commitment to meeting their financial obligations.

- Previous Rental History: In addition to speaking with references, reviewing the tenant’s previous rental history can provide insight into their payment history, adherence to lease terms, and overall responsibility as a tenant. Look for any patterns or past issues that may affect their suitability as a renter.

Combining alternative methods with your credit report assessment can give you a more comprehensive understanding of a tenant’s financial responsibility and stability. Each method provides a unique perspective that, when analyzed together, can help you make a well-informed decision when selecting a tenant.

However, it’s important to remember that alternative methods should be used in conjunction with a credit report to ensure a thorough evaluation. They can provide additional context and verification of the tenant’s financial situation, helping you make a more informed decision about their suitability as a tenant.

Important Considerations when Pulling a Credit Report

When pulling a credit report for a tenant, there are several important considerations to keep in mind. These considerations ensure that you handle the process ethically, legally, and in a way that protects the applicant’s privacy. Here are some key considerations:

- Written Consent: Obtain written consent from the tenant before pulling their credit report. This may be in the form of a consent form included in the rental application or a separate authorization form. Without proper consent, you cannot legally access an applicant’s credit information.

- Compliance with Laws: Familiarize yourself with the laws and regulations governing tenant screenings in your jurisdiction. Be aware of any specific requirements related to credit checks, privacy protection, and fair housing laws. Adhere to these laws to mitigate legal risks and ensure a fair and consistent screening process.

- Choose a Reputable Credit Reporting Agency: Select a reputable credit reporting agency to obtain the tenant’s credit report. Research different agencies and consider factors such as cost, ease of use, and the level of detail provided in their reports. Using a well-established agency helps ensure the accuracy and reliability of the information you receive.

- Protect Applicant’s Personal Information: Safeguard the applicant’s personal and financial information throughout the process. Use secure channels and storage methods to prevent unauthorized access or data breaches. Comply with privacy laws and regulations to maintain the confidentiality and integrity of the applicant’s sensitive data.

- Consistent Screening Process: Apply your screening criteria consistently to all applicants. Treat each applicant fairly and avoid any discriminatory practices. Use objective criteria and guidelines to evaluate credit reports and make informed decisions based on the applicant’s financial responsibility.

- Clear Communication: Clearly communicate your screening process to prospective tenants. Make them aware that a credit check will be conducted as part of the application process and inform them about the specific information you will be reviewing. This transparency helps manage expectations and ensures that applicants are aware of the evaluation process.

- Disposal of Information: Once you have reviewed the credit report and made a decision, handle the applicant’s information responsibly. Properly dispose of any sensitive information to prevent unauthorized access or misuse. Follow data protection guidelines and regulations when handling and disposing of personal information.

By considering these important factors, you can conduct credit checks in a responsible and ethical manner. It ensures that you adhere to legal requirements, respect applicant privacy, and maintain a fair and consistent screening process throughout. Following these guidelines helps protect both you and the applicants involved in the tenant screening process.

Conclusion

Pulling a credit report for a tenant is a crucial step in the tenant screening process. It provides valuable insights into an applicant’s financial history and behavior, allowing landlords to evaluate their creditworthiness and make informed decisions. However, it’s essential to consider that a credit report is just one piece of the puzzle. It should be used in conjunction with other screening methods to assess a tenant’s overall suitability.

Throughout this guide, we have explored the importance of pulling a credit report, the step-by-step process for obtaining one, and the alternative methods available for evaluating a tenant’s financial responsibility. We have also discussed the key factors to look for in a credit report and the considerations to keep in mind when conducting this process.

By conducting thorough tenant screenings and considering multiple factors, including credit reports, income verification, references, and rental history, landlords can mitigate financial risks, minimize rental income loss, and foster positive tenant-landlord relationships. It’s crucial to handle the process with professionalism, ensuring compliance with legal requirements and protecting the privacy of applicants’ personal information.

In conclusion, pulling a credit report for a tenant is an essential step in the tenant screening process. It provides valuable insights into an applicant’s financial responsibility, allowing landlords to assess their creditworthiness and make informed decisions. By combining credit reports with alternative methods for evaluating financial stability and responsibility, landlords can select reliable tenants who will pay rent on time and maintain a positive tenancy.

Remember, always follow fair housing laws, treat all applicants equally, and handle sensitive information securely. By conducting thorough screenings, landlords can minimize risks, enhance their rental businesses, and create a positive environment for both landlords and tenants.