Finance

How To Send Money Through A Credit Card

Published: November 11, 2023

Learn how to send money through a credit card with our finance guide. Simplify your transactions and enjoy convenient and secure transfers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Set up a payment account

- Step 2: Verify your identity

- Step 3: Add your credit card information

- Step 4: Enter the recipient’s details

- Step 5: Select the amount to send

- Step 6: Review and confirm the transaction

- Step 7: Wait for the transaction to process

- Step 8: Confirmation and receipt

- Conclusion

Introduction

Are you looking for a convenient way to send money to someone using your credit card? Whether it is for a birthday gift, paying back a friend, or supporting a family member in a different country, sending money through a credit card can be a quick and hassle-free solution. In this article, we will guide you through the steps of sending money using your credit card, making the process simple and secure.

Sending money through a credit card offers several advantages. First, it allows you to make instant transfers, ensuring that the recipient receives the funds in a timely manner. Additionally, using a credit card provides an extra layer of security, as most credit card issuers offer fraud protection and dispute resolution services. Moreover, you can take advantage of reward programs or cashback offers provided by your credit card issuer, earning points or money back on your transactions.

However, it is important to note that sending money through a credit card may come with certain fees and limitations. Credit card companies often charge a cash advance fee or higher interest rates for these transactions. Additionally, there may be restrictions on the amount of money you can send and the countries where you can send it. It is crucial to review the terms and conditions of your credit card agreement to understand any applicable fees and restrictions before proceeding.

In the following sections, we will outline a step-by-step process to help you send money through a credit card, making the experience smooth and hassle-free. By following these steps, you can ensure that your money reaches the intended recipient securely and efficiently.

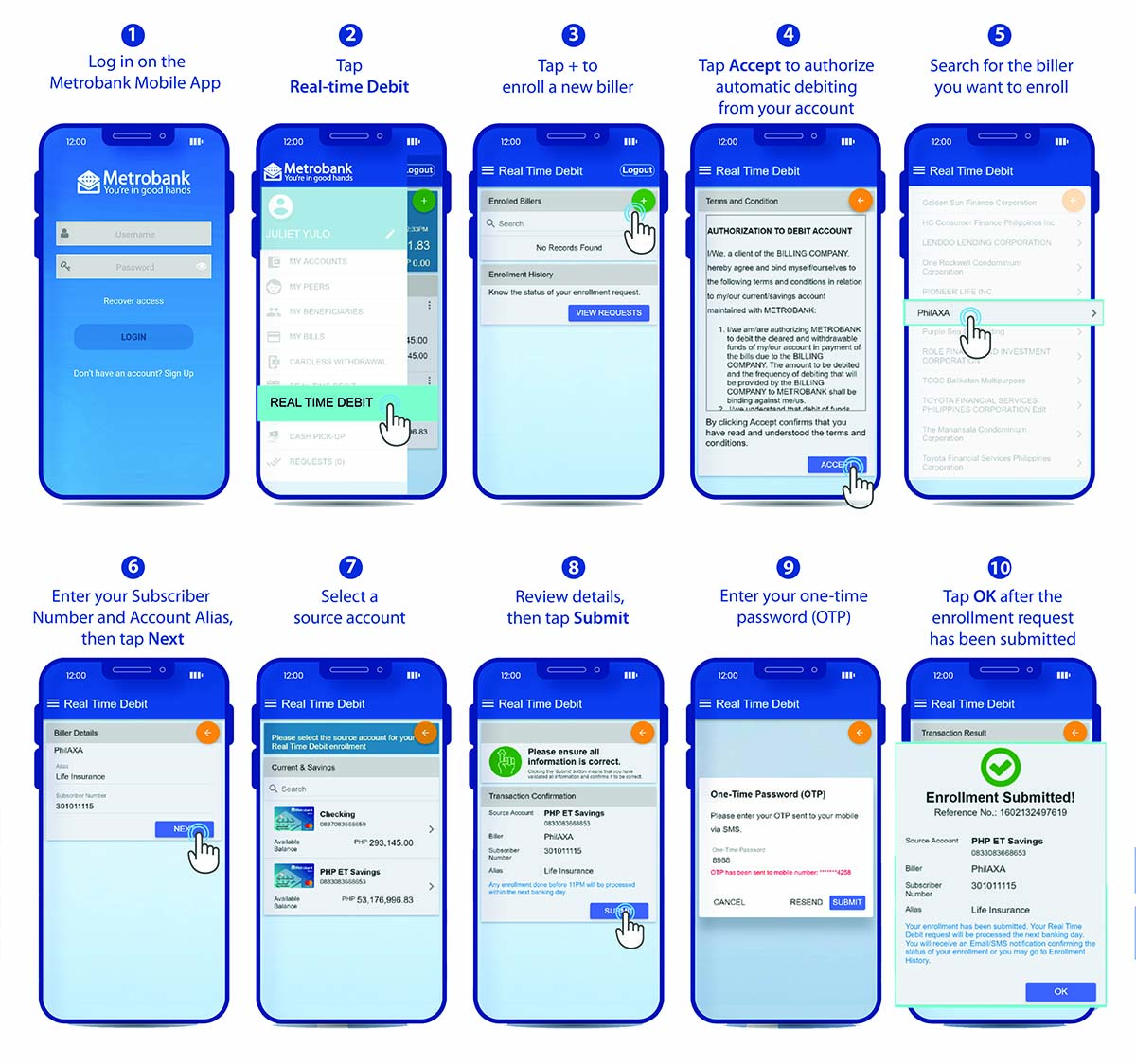

Step 1: Set up a payment account

The first step in sending money through a credit card is to set up a payment account with a trusted online payment platform. There are several reputable platforms available, such as PayPal, Venmo, or Stripe, that allow you to send money using your credit card.

To set up an account, visit the website of the payment platform of your choice. Look for the “Sign Up” or “Create Account” button and click on it. You will be prompted to provide some personal information, such as your name, email address, and a secure password. Make sure to choose a strong password to protect your account from unauthorized access.

Once you have entered the necessary information, click on the “Create Account” or “Register” button. You may receive a verification email to confirm your email address. Follow the instructions in the email to verify your account and complete the registration process.

After your account is set up, you may need to link your credit card to the payment platform. Look for the “Add a Card” or “Link a Credit Card” option on your account dashboard. Click on it and provide the required details, such as your credit card number, expiration date, and security code. Some platforms may also require you to enter your billing address for verification purposes.

It is important to ensure that the payment platform you choose is secure and reliable. Check for secure payment icons, such as the lock symbol or “https://” in the website URL, to ensure that your personal and financial information is protected during the transaction process.

Once your credit card is successfully linked to your payment account, you are ready to proceed to the next step of the process. Make sure to keep your account information and login credentials secure to prevent any unauthorized access to your account.

Step 2: Verify your identity

Before you can start sending money through your credit card, you may need to verify your identity with the payment platform. This step is crucial to ensure the security and integrity of the transaction process.

The verification process may vary depending on the payment platform you are using. Typically, you will be asked to provide certain identification documents to prove your identity. These documents may include a government-issued ID, such as a driver’s license or passport, as well as proof of address, such as a utility bill or bank statement.

To complete the verification process, login to your payment account and navigate to the “Settings” or “Profile” section. Look for the “Verify Identity” or similar option and click on it. You will be guided through the necessary steps to upload the required documents.

Ensure that the documents you provide are clear, legible, and up to date. Follow the platform’s instructions regarding the file format and size requirements for document uploads. In some cases, you may need to take a clear photo of your identification documents using a mobile device or webcam.

Once you have uploaded the necessary documents, submit them for review. The payment platform will typically verify your identity within a few business days. You may receive an email notification once the verification process is complete.

It is important to note that the verification process is a security measure implemented by payment platforms to protect against fraud and money laundering. By verifying your identity, you are ensuring that your transactions are safe and secure. Additionally, it helps the platform comply with regulatory requirements and international money transfer regulations.

Once your identity is successfully verified, you can proceed to the next step of adding your credit card information and initiating the transaction. Remember to keep your identification documents and personal information secure to prevent any unauthorized access or misuse.

Step 3: Add your credit card information

After setting up your payment account and verifying your identity, the next step is to add your credit card information to the payment platform. This will allow you to use your credit card to send money securely.

To add your credit card information, login to your payment account and navigate to the “Settings” or “Payment Methods” section. Look for the option to “Add a Credit Card” or similar. Click on it to proceed.

You will be prompted to enter your credit card details, including the card number, expiration date, and security code (CVV/CVC). Additionally, you may need to enter the billing address associated with your credit card for verification purposes.

Ensure that you are entering the correct and up-to-date information for your credit card. Double-check the card number, expiration date, and security code to avoid any errors. Mistakes in the credit card information could result in a failed transaction or delay in processing.

Some payment platforms may also provide the option to save your credit card information for future use. If you trust the platform and prefer a more streamlined experience, you can choose to save your credit card details securely.

In order to ensure the security of your credit card information, it is important to choose a trusted payment platform that implements strong security measures, such as encryption and secure servers, to protect your data. Look for trusted security icons and read the platform’s privacy policy to understand how your data is handled.

Once you have successfully added your credit card information, it will be securely stored in your payment account. You can now proceed to the next step of entering the recipient’s details and specifying the amount you want to send.

Step 4: Enter the recipient’s details

Now that you have added your credit card information, it’s time to enter the details of the person you want to send money to. This step ensures that the funds are directed to the correct recipient.

Login to your payment account and navigate to the “Send Money” or “Transfer Funds” section. Look for the option to “Send to a Recipient” or similar. Click on it to proceed.

Depending on the payment platform, you may be asked to provide the recipient’s email address, mobile number, or account username. Make sure to enter the correct and verified contact information to avoid any issues with the transfer.

If the recipient already has an account on the same payment platform, you may be able to select their name from a list of stored contacts or a searchable database. This can make the process faster and more convenient.

In case the recipient does not have an account with the payment platform, you may need to provide additional information, such as their full name, mailing address, or bank account details, depending on the method of transfer supported by the platform.

It is crucial to double-check the entered information for accuracy before proceeding. Any mistakes in the recipient’s details can result in the funds being sent to the wrong person or account, which may be difficult to rectify.

Additionally, some payment platforms provide additional features or options when entering the recipient’s details. For instance, you may have the option to specify the purpose of the transfer or include a personal message to the recipient. Take advantage of these features to provide more context or communicate your intentions effectively.

Once you have entered the recipient’s details accurately, you can proceed to the next step of selecting the amount you want to send.

Step 5: Select the amount to send

After entering the recipient’s details, it’s time to specify the amount of money you want to send using your credit card. This step allows you to determine the exact funds that will be transferred to the recipient.

In your payment account, you will typically find a field or option labeled “Amount” or “Send”. Click on it to enter the desired amount you wish to send.

Make sure to enter the amount accurately, taking into consideration any applicable fees or currency conversion charges. Some payment platforms may automatically calculate and display the total amount, including any fees, while others may require you to manually input the full amount.

It’s important to note that some payment platforms may impose minimum or maximum transfer limits. Be aware of these limits and ensure that the amount you wish to send falls within the allowable range. If your desired amount exceeds the limit, you may need to split the transaction into multiple transfers or explore alternative payment methods.

Additionally, consider the exchange rate if you are sending money to a different currency. Some payment platforms provide real-time currency conversion rates, allowing you to see the equivalent amount in the recipient’s currency before confirming the transfer.

Take a moment to review the entered amount before proceeding to the next step. Confirm that it aligns with your intended transfer and that you are comfortable with the total amount, including any fees or charges that may apply.

Once you’re satisfied with the selected amount, you can proceed to the next step to review and confirm the transaction details before finalizing the transfer.

Step 6: Review and confirm the transaction

Before finalizing the transfer, it is essential to review and confirm all the transaction details to ensure accuracy and avoid any potential issues. This step provides an opportunity to double-check the recipient’s information, transfer amount, and any additional options or features.

In your payment account, you will typically be presented with a summary or confirmation screen that displays the transaction details. Take the time to carefully review each element and verify that everything is correct.

Start by confirming the recipient’s information. Check the recipient’s name, contact details, and any other relevant information to ensure that the funds will be sent to the intended recipient. If any details are incorrect or need to be updated, look for the option to edit or modify the recipient’s details.

Next, confirm the transfer amount. Ensure that the entered amount aligns with your intention and that any applicable fees or charges are accounted for. If necessary, make adjustments to the amount before proceeding.

If your payment platform offers additional options or features, such as adding a personal message or specifying the purpose of the transfer, double-check that these details are accurate and reflect your intention.

It is also a good practice to check the estimated delivery time, especially if the transfer is time-sensitive. Payment platforms usually provide an estimated timeframe for the funds to reach the recipient. If the delivery timeframe is not satisfactory, you may need to explore alternative transfer methods or contact customer support for assistance.

Once you are confident that all the transaction details are correct, look for the option to confirm, finalize, or initiate the transfer. Depending on the payment platform, this may involve clicking a “Confirm” or “Send” button.

Keep in mind that once the transaction is confirmed, the funds will be deducted from your credit card and transferred to the recipient. In most cases, this process is irreversible, so it is crucial to ensure the accuracy of the information before proceeding.

After confirming the transaction, you may receive a confirmation message or email that provides a receipt or summary of the transaction details. It is recommended to keep a copy of this confirmation for your records.

With the transaction confirmed, you can now proceed to the next step, which involves waiting for the transaction to process and the funds to reach the recipient.

Step 7: Wait for the transaction to process

After confirming the transaction, the next step is to patiently wait for the payment platform to process the transfer and for the funds to reach the recipient. The processing time can vary depending on the payment platform, the recipient’s location, and other factors such as bank processing times or international transfers.

While waiting, it is crucial to maintain open communication with the recipient, especially if the transfer is time-sensitive or for a specific purpose. Inform them about the transaction and provide any relevant information, such as the estimated delivery timeframe or any tracking numbers or reference codes provided by the payment platform.

During this waiting period, it is also recommended to monitor your payment account or email for any updates or notifications regarding the status of the transfer. Payment platforms may provide real-time updates on the progress of the transaction, such as when the funds have been sent, received, or deposited into the recipient’s account.

If there are any concerns or if the transfer is taking longer than expected, it is advisable to contact the customer support of the payment platform. They can provide assistance, investigate any issues, or offer guidance on the next steps to resolve any potential delays or complications.

It’s important to remain patient during this step, as robust security measures are often in place to ensure the legality and safety of the transaction. While the speed of the transaction may vary, rest assured that the payment platform is working diligently to complete the transfer successfully.

Once the transaction has been processed and the funds have reached the recipient, you can proceed to the final step, which involves confirming the completion of the transaction and receiving a confirmation and receipt for your records.

Step 8: Confirmation and receipt

After the transaction has been successfully processed and the funds have reached the recipient, the final step is to obtain confirmation and a receipt for your records. This step ensures that you have a documented record of the completed transaction.

Check your payment account or email for any notifications or confirmations regarding the completed transfer. Payment platforms often provide a confirmation message or email that includes details such as the transaction reference number, date and time of the transfer, recipient’s name, and the amount sent.

Review the confirmation to ensure that all the information is accurate and matches the details of the intended transaction. If you notice any discrepancies or errors, contact customer support for assistance in resolving the issue.

Save a copy of the confirmation or receipt for your records. This can be a digital copy, such as an email or PDF document, or a printed version if you prefer to keep physical records.

A receipt is not only useful for your personal records but may also be necessary for future reference, tax purposes, or in case there are any disputes or inquiries regarding the transaction. Having a documented record of the completed transaction provides peace of mind and can serve as proof of payment in case it is required.

It is important to keep the confirmation or receipt in a secure and easily accessible location. Consider storing it in a dedicated folder on your computer or cloud storage, or in a physical file if you prefer hard copies.

With the confirmation and receipt in your possession, you have successfully completed the process of sending money through a credit card. You can now rest assured that the funds have been securely transferred to the intended recipient.

Remember to regularly review your credit card statements and payment account activity to ensure that all transactions are accurate. If you notice any suspicious or unauthorized transactions, contact your credit card issuer or the payment platform immediately to report the issue and take appropriate action.

Congratulations! You have successfully sent money through your credit card and completed the entire process.

Conclusion

Sending money through a credit card provides a convenient and secure method of transferring funds to friends, family, or businesses. By following the step-by-step process outlined in this article, you can easily navigate the process of sending money through your credit card.

From setting up a payment account and verifying your identity to adding your credit card information and entering the recipient’s details, each step plays a crucial role in ensuring a smooth and secure transaction. Taking the time to review and confirm the transaction details before finalizing the transfer is essential to avoid any errors or issues.

While waiting for the transaction to process, maintain open communication with the recipient and monitor your payment account for any updates or notifications. Once the funds have been successfully delivered, obtaining a confirmation and receipt provides a record of the completed transaction for future reference.

It is important to remember that sending money through a credit card may come with certain fees and limitations. Familiarize yourself with the terms and conditions of your credit card agreement and the payment platform you are using to ensure that you understand any applicable fees and restrictions.

By using your credit card responsibly and following the steps outlined in this article, you can enjoy the convenience and security of sending money to your loved ones or business associates whenever the need arises.

Remember, it is always prudent to review your credit card statements regularly to ensure the accuracy of transactions. If you have any concerns or encounter any issues during the process, don’t hesitate to reach out to customer support for assistance.

Now that you have the knowledge and guidance on how to send money through a credit card, you can confidently make transactions and provide financial support to others with ease.