Finance

How To Set Up 401K In Quickbooks

Published: October 17, 2023

Learn how to set up 401K in Quickbooks to effectively manage your finance. Maximize your retirement savings with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Accessing QuickBooks

- Step 2: Setting Up a New Payroll Item

- Step 3: Configuring 401K Plan Details

- Step 4: Defining Contribution Options

- Step 5: Setting Up Employee Deductions

- Step 6: Enrolling Employees in the 401K Plan

- Step 7: Running Payroll with 401K Deductions

- Step 8: Tracking 401K Contributions and Balances

- Conclusion

Introduction

Setting up a 401K plan for your employees is not only a great way to attract and retain top talent, but it also provides a valuable benefit that can help your employees save for their retirement. If you’re using QuickBooks for your business’s financial management, you’ll be pleased to know that it offers a straightforward and efficient process for setting up a 401K plan.

In this article, we will guide you through the steps to set up a 401K plan in QuickBooks. We’ll cover everything from accessing QuickBooks to configuring the plan details, defining contribution options, setting up employee deductions, enrolling employees, and tracking contributions and balances.

By following this step-by-step guide, you will be able to easily navigate through the QuickBooks system and set up a comprehensive 401K plan for your employees. It’s important to note that while we will provide detailed instructions in this article, you may need to consult additional resources or seek professional advice based on your specific business requirements.

Now, let’s dive into the process of setting up a 401K plan in QuickBooks and discover how you can provide a valuable retirement benefit for your employees while efficiently managing your business’s financials.

Step 1: Accessing QuickBooks

The first step in setting up a 401K plan in QuickBooks is to access your QuickBooks account. If you’re already using QuickBooks for your business’s financial management, you know that it offers a user-friendly interface that allows you to easily navigate through the system. Here’s how to access QuickBooks:

- Open your web browser and go to the QuickBooks login page.

- Enter your username and password to sign in to your QuickBooks account. If you don’t have an account yet, you can sign up for one.

- Once you’re logged in, you’ll be directed to the QuickBooks dashboard, where you can access various features and functions of the software.

By following these simple steps, you will be able to access your QuickBooks account and start the process of setting up your 401K plan. It’s important to ensure that you have the necessary permissions and access rights within your QuickBooks account to make changes and set up new payroll items.

Now that you’re inside QuickBooks, you’re ready to move on to the next step: setting up a new payroll item for your 401K plan.

Step 2: Setting Up a New Payroll Item

After accessing your QuickBooks account, the next step in setting up a 401K plan is to create a new payroll item. The payroll item will allow you to track the contributions and deductions related to the 401K plan for each employee. Here’s how to set up a new payroll item:

- From the QuickBooks dashboard, navigate to the Payroll section.

- Click on the Employees tab and select Payroll Setup.

- Scroll down to the Deductions and Contributions section and click on Add a new deduction or contribution.

- Choose the deduction type as Employee Contribution and click Next.

- Enter a name for the deduction, such as “401K Contribution,” and provide a brief description if needed.

- Specify the tax tracking type. In most cases, it will be set as 401K.

- Assign the liability account associated with the 401K plan. If you don’t have one set up yet, you can create a new liability account specifically for the plan.

- Enter the calculation basis. You can choose a percentage of the gross wages, a fixed amount, or another method that fits your plan structure.

- Set the limits, if applicable. This includes any maximum or minimum contribution amounts for employees.

- Click Finish to complete the setup of the new payroll item.

By following these steps, you will have successfully set up a new payroll item in QuickBooks to track the 401K contributions. This item will be used to calculate the deductions from each employee’s paycheck and record the contributions for reporting purposes.

Now that you have set up the payroll item, it’s time to move on to the next step: configuring the details of your 401K plan.

Step 3: Configuring 401K Plan Details

Once you have set up the payroll item in QuickBooks, the next step in setting up your 401K plan is to configure the plan details. This includes specifying the eligibility criteria, plan start date, vesting schedule, and other important information. Follow these steps to configure the 401K plan details:

- In QuickBooks, go to the Payroll section and click on the Employees tab.

- Select Employee Center.

- Choose the employee for whom you want to set up the 401K plan.

- Click on the Payroll Info tab and select the Deductions tab within it.

- Click on Add a new deduction or contribution.

- Choose the deduction type as 401K.

- Enter the name of the plan, such as “XYZ Company 401K Plan.”

- Specify the applicable start date for the plan and the eligibility criteria for employees to join, such as length of employment or age requirements.

- Select the contribution type for the plan, whether it’s a percentage of the employee’s wages or a fixed amount.

- Define the vesting schedule, which determines how long an employee must remain with the company before they are fully entitled to their employer’s contributions.

- Save the configuration to complete the setup of the 401K plan details.

By following these steps, you will have successfully configured the key details of your 401K plan in QuickBooks. This information will be used to calculate the employee and employer contributions, determine eligibility, and track the vesting schedule for each employee participating in the plan.

Now that you have set up the plan details, it’s time to move on to the next step: defining the contribution options for the 401K plan.

Step 4: Defining Contribution Options

After configuring the 401K plan details in QuickBooks, the next step is to define the contribution options for the plan. This involves specifying the contribution percentages or amounts for both the employee and the employer. Here’s how to define the contribution options:

- In QuickBooks, go to the Payroll section and click on the Employees tab.

- Select Employee Center.

- Choose the employee for whom you want to define the contribution options.

- Click on the Payroll Info tab and select the Deductions tab within it.

- Locate the 401K plan deduction and click on the Edit button.

- In the Deduction Amount field, specify the employee’s contribution percentage or fixed amount. This is the amount that will be deducted from the employee’s paycheck and contributed to their 401K account.

- Next, specify the employer’s contribution percentage or fixed amount, if applicable. This is the amount that the employer will contribute to the employee’s 401K account.

- Save the changes to complete the definition of the contribution options.

By following these steps, you will have successfully defined the contribution options for the 401K plan in QuickBooks. These settings will be used to calculate the deductions from the employee’s wages and to record the employer’s contributions accurately.

It’s important to note that the contribution options may vary for each employee depending on their employment status, salary, or other factors. You should review and update the contribution options for each employee participating in the 401K plan according to their individual circumstances.

Now that you have defined the contribution options, it’s time to move on to the next step: setting up employee deductions for the 401K plan.

Step 5: Setting Up Employee Deductions

Once you have defined the contribution options for the 401K plan in QuickBooks, the next step is to set up employee deductions. This involves assigning the 401K deduction to each employee’s payroll profile so that the deductions can be calculated accurately. Here’s how to set up employee deductions:

- In QuickBooks, go to the Payroll section and click on the Employees tab.

- Select Employee Center.

- Choose the employee for whom you want to set up the 401K deduction.

- Click on the Payroll Info tab and select the Deductions tab within it.

- Click on Add a new deduction or contribution.

- Choose the deduction type as 401K.

- Enter the deduction amount or percentage based on the employee’s contribution, as previously defined.

- Ensure the effective date is accurate and aligned with the start date of the employee’s 401K plan participation.

- Select the appropriate tax tracking type for the deduction.

- Save the changes to complete the setup of the employee’s 401K deduction.

By following these steps, you will have successfully set up the employee’s deduction for the 401K plan in QuickBooks. This ensures that the correct amount will be deducted from the employee’s paycheck and contributed to their 401K account each pay period.

It’s important to repeat these steps for each employee participating in the 401K plan, ensuring their individual deduction amounts and effective dates are accurately set up.

Now that you have set up employee deductions, it’s time to move on to the next step: enrolling employees in the 401K plan.

Step 6: Enrolling Employees in the 401K Plan

After setting up employee deductions for the 401K plan in QuickBooks, the next step is to enroll employees in the plan. This involves notifying eligible employees about the opportunity to participate and gathering their consent to deduct contributions from their paychecks. Here’s how to enroll employees in the 401K plan:

- Communicate the details of the 401K plan to your employees, including the eligibility criteria, contribution options, vesting schedule, and any other relevant information.

- Provide employees with the necessary enrollment forms or documentation required for participation. This may include a 401K plan enrollment form, beneficiary designation form, and any other required paperwork.

- Collect the completed enrollment forms from employees who wish to participate in the 401K plan. Ensure that the forms are filled out accurately and signed by the employees.

- Enter the enrollment information into QuickBooks for each employee. Go to the Payroll section, click on the Employees tab, select Employee Center, and choose the employee’s profile.

- In the Payroll Info tab, click on the Deductions tab and locate the 401K plan deduction.

- Check the “Enrollment” box to indicate that the employee is enrolled in the 401K plan.

- Enter the employee’s enrollment date, which should align with the start date of their participation in the plan.

- Save the changes to complete the enrollment process for the employee.

By following these steps, you will have successfully enrolled employees in the 401K plan in QuickBooks. This ensures that their contributions will be deducted from their paychecks and that they are officially participating in the plan.

Remember to keep accurate records of the enrollment forms and any other documentation related to the employees’ participation in the 401K plan for future reference and compliance purposes.

Now that you have enrolled employees in the 401K plan, it’s time to move on to the next step: running payroll with 401K deductions.

Step 7: Running Payroll with 401K Deductions

After enrolling employees in the 401K plan and setting up their deductions in QuickBooks, the next step is to run payroll with the 401K deductions included. This ensures that the correct amount is deducted from each employee’s paycheck and contributed to their 401K account. Here’s how to run payroll with 401K deductions:

- Go to the QuickBooks Payroll section and click on the Employees tab.

- Select Run Payroll.

- Choose the pay period for which you want to run payroll, such as weekly, biweekly, or monthly.

- Review the list of employees and their respective earnings and hours for the pay period. Ensure that the information is accurate and up-to-date.

- Check the 401K deduction box next to each employee who is participating in the plan.

- Verify that the deduction amount for each employee is correct based on their contribution percentage or fixed amount.

- Click on Calculate to generate the payroll calculations, including the 401K deductions.

- Review the payroll summary before finalizing the process. Ensure that the deductions and net pay amounts are accurate.

- Click on Submit to authorize the payroll processing with the 401K deductions included.

- Print or save the payroll reports for your records.

By following these steps, you will have successfully run payroll with the 401K deductions included in QuickBooks. This ensures that the correct amount is deducted from each employee’s paycheck and that their contributions are properly recorded for reporting and compliance purposes.

It’s crucial to review the payroll reports and verify that the deductions are accurately calculated before finalizing the payroll process. This helps ensure the correctness of the contributions and the fairness of the payroll for each employee.

Now that you have run payroll with the 401K deductions, it’s time to move on to the final step: tracking 401K contributions and balances.

Step 8: Tracking 401K Contributions and Balances

After running payroll with 401K deductions in QuickBooks, it’s important to track the 401K contributions and balances for each employee. This allows you to monitor their retirement savings progress and keep accurate records for reporting and compliance purposes. Here’s how to track 401K contributions and balances:

- In QuickBooks, go to the Payroll section and click on the Employees tab.

- Select Employee Center.

- Choose the employee for whom you want to track the 401K contributions and balances.

- Click on the Payroll Info tab and select the Deductions tab within it.

- Locate the 401K plan deduction and click on the Edit button.

- Review the contribution amounts and ensure that they align with the deductions made from the employee’s paychecks.

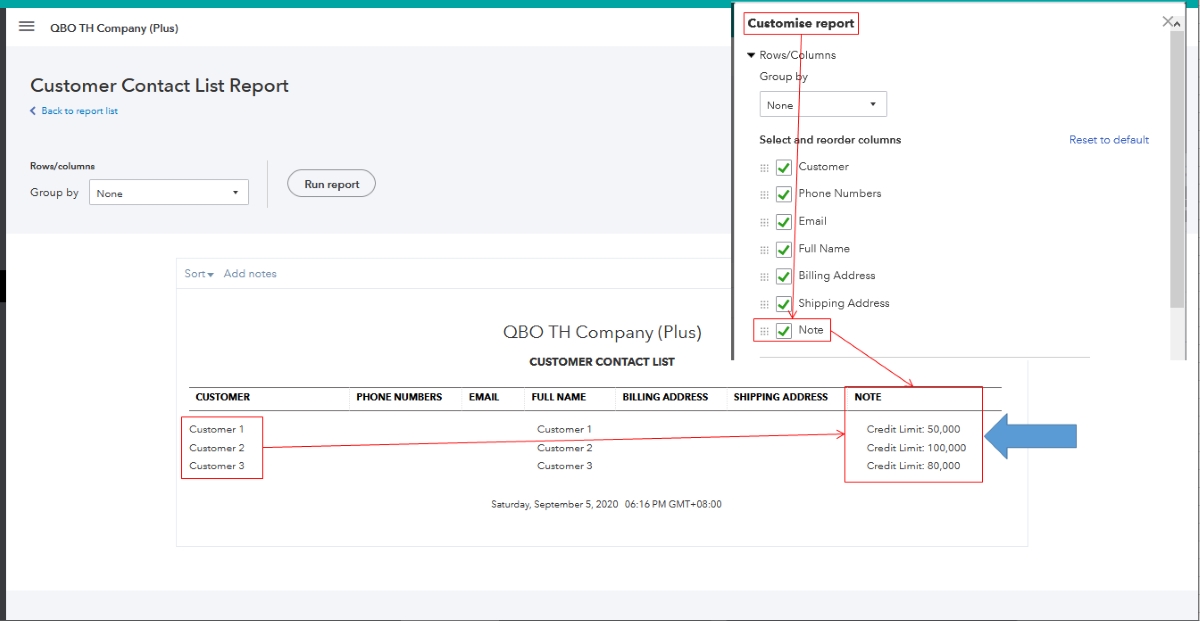

- Go to the Reports section in QuickBooks and choose the Payroll and Compensation section.

- Select the 401K-related reports, such as the 401K Contribution Report or the Employee 401K Summary Report.

- Run the reports to view the 401K contributions made by each employee and their current balances in their 401K accounts.

- Save or print the reports for record-keeping purposes and for sharing with employees, if necessary.

By following these steps, you will be able to track the 401K contributions and balances for each employee participating in the plan in QuickBooks. This allows you to stay organized, ensure accuracy, and provide valuable information to both your employees and any relevant stakeholders.

Regularly reviewing the reports and monitoring the 401K contributions and balances will help you assess the success of your employees’ retirement savings and make any necessary adjustments to the plan or employee deductions as needed.

Congratulations! You have successfully completed all the steps to set up and manage a 401K plan in QuickBooks. Your employees can now benefit from this valuable retirement savings option, and you can rest assured knowing that their contributions and balances are accurately tracked and managed.

If you require any further assistance or have additional questions, don’t hesitate to consult QuickBooks resources or seek guidance from a financial professional.

Remember, offering a 401K plan demonstrates your commitment to your employees’ financial well-being and helps attract and retain top talent. It’s a win-win for both your business and your employees!

Conclusion

Setting up a 401K plan in QuickBooks is a crucial step in providing a valuable retirement benefit for your employees while efficiently managing your business’s financials. By following the step-by-step guide outlined in this article, you can successfully navigate through the QuickBooks system and establish a comprehensive 401K plan for your employees.

Throughout the process, we’ve covered accessing QuickBooks, setting up a new payroll item, configuring 401K plan details, defining contribution options, setting up employee deductions, enrolling employees in the 401K plan, running payroll with 401K deductions, and tracking 401K contributions and balances. Each step is critical in ensuring that your employees’ retirement savings are accurately recorded and managed.

By using QuickBooks to streamline the setup and management of your 401K plan, you not only save time and effort but also gain valuable insights into your employees’ savings progress. QuickBooks offers robust reporting capabilities that allow you to track contributions, balances, and other vital metrics for each employee participating in the plan.

Remember, it’s essential to stay up-to-date with the latest regulations and ensure compliance with the Internal Revenue Service (IRS) and other relevant authorities. Consulting with a financial professional or benefits specialist can provide additional guidance and ensure that your 401K plan is in line with all legal requirements.

Offering a 401K plan demonstrates your commitment to the financial well-being of your employees and helps attract and retain top talent in your industry. It’s a powerful benefit that can set your business apart from the competition and contribute to long-term employee satisfaction and loyalty.

By investing in your employees’ future through a well-structured 401K plan, you not only help them secure a comfortable retirement but also foster a positive company culture centered around financial wellness. This can lead to increased productivity, morale, and overall satisfaction within your organization.

With QuickBooks as your financial management tool, you can efficiently manage your business’s payroll, track contributions and balances, and keep records organized. Use the step-by-step guide in this article to set up and manage your 401K plan with confidence and ease.

Remember, as your business grows and evolves, it’s essential to regularly review and adjust your 401K plan to align with changing goals, regulations, and employee needs. With QuickBooks by your side, you can adapt and optimize your 401K plan as your business thrives.

Now that you have the knowledge and guidance to set up a 401K plan in QuickBooks, you’re well-equipped to provide a valuable benefit to your employees while managing your business’s financials effectively. Embrace this opportunity to support your employees’ financial futures and create a prosperous work environment.