Home>Finance>How To Start Building Credit Without A Secured Card

Finance

How To Start Building Credit Without A Secured Card

Published: March 1, 2024

Learn how to build credit without a secured card. Discover effective finance strategies to establish a solid credit history and improve your financial standing. Start your credit journey today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Building credit is an essential step towards achieving financial stability and independence. A strong credit history can open doors to better interest rates on loans, higher credit limits, and increased approval odds for rental applications and job opportunities. While secured credit cards are a common option for establishing credit, they require a security deposit, which may not be feasible for everyone. Fortunately, there are alternative methods to start building credit without a secured card. This article will explore various strategies to help individuals kickstart their credit journey and lay a solid foundation for their financial future.

Understanding the options available for building credit without a secured card is crucial for those who may not have the means to secure a traditional credit card. By exploring alternative avenues, individuals can still establish a positive credit history and work towards achieving their financial goals. Whether it's through credit-builder loans, becoming an authorized user on someone else's credit card, or applying for a retail store credit card, there are viable pathways to begin building credit without the need for a secured card. Understanding these options empowers individuals to make informed decisions that align with their financial circumstances and aspirations.

In the following sections, we will delve into these alternative methods in detail, providing insights into the benefits and considerations associated with each approach. By gaining a comprehensive understanding of these strategies, readers will be equipped with the knowledge needed to make proactive choices regarding their credit-building journey. Let's explore the diverse pathways to establishing credit without a secured card and pave the way for a stronger financial future.

Understanding Credit

Before delving into alternative methods of building credit, it’s essential to grasp the fundamentals of credit itself. Credit, in the financial realm, refers to the trust that allows one party to provide money, resources, or goods to another party with the expectation of future repayment. When individuals engage in credit-related activities, such as using credit cards or taking out loans, their responsible behavior can contribute to the development of a positive credit history. This history, in turn, is reflected in a numerical form known as a credit score, which plays a pivotal role in various financial transactions and opportunities.

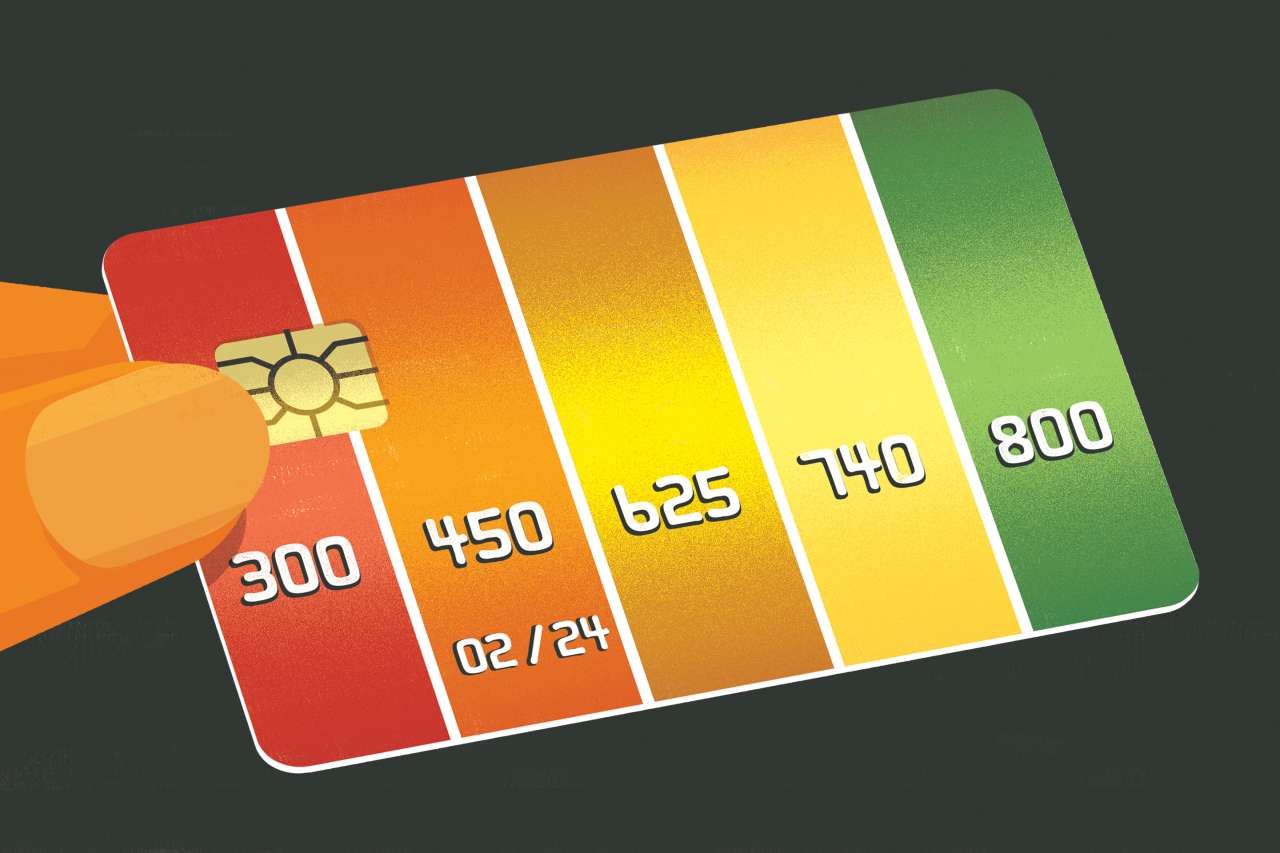

A credit score is a numerical representation of an individual’s creditworthiness, typically ranging from 300 to 850. The higher the credit score, the more favorable the individual’s credit standing. Lenders, landlords, and even potential employers often assess an individual’s credit score to evaluate their financial reliability and trustworthiness. A strong credit score can lead to lower interest rates on loans, higher credit limits, and increased access to financial products and services.

Key factors that influence a credit score include payment history, credit utilization, length of credit history, new credit accounts, and the mix of credit types. Payment history, which reflects whether an individual has made timely payments on credit accounts, holds significant weight in determining a credit score. Credit utilization, or the ratio of credit used to credit available, also plays a crucial role, with lower utilization generally being more favorable. Additionally, the length of one’s credit history, the pursuit of new credit, and the diversity of credit accounts impact the overall credit score.

Understanding these fundamental aspects of credit is integral to navigating the landscape of credit building. By comprehending the factors that influence credit scores and the significance of a positive credit history, individuals can make informed decisions and take proactive steps to establish and enhance their credit standing. With this foundational knowledge in place, let’s explore alternative pathways to building credit without relying on a secured credit card.

Alternative Ways to Build Credit

While secured credit cards are a popular choice for initiating credit building, they may not be accessible to everyone due to the requirement of a security deposit. Fortunately, several alternative methods exist to establish credit without the need for a secured card. These approaches offer viable pathways for individuals to kickstart their credit journey and pave the way for a stronger financial future. Let’s explore these alternative ways to build credit:

- Credit-Builder Loans: Credit-builder loans are designed specifically to help individuals establish or improve their credit profiles. With these loans, the borrowed funds are typically held in a savings account or certificate of deposit (CD) until the loan is fully repaid. As borrowers make regular payments, their responsible behavior is reported to credit bureaus, contributing to the development of a positive credit history. Credit-builder loans offer a structured and disciplined approach to building credit without the need for a traditional credit card.

- Authorized User on Someone Else’s Credit Card: Becoming an authorized user on a family member’s or friend’s credit card can provide an avenue for building credit. As an authorized user, individuals can benefit from the primary cardholder’s positive credit history and responsible credit usage. It’s important to choose a primary cardholder with a strong credit history, as their positive credit behavior can potentially bolster the authorized user’s credit profile.

- Retail Store Credit Cards: Applying for a retail store credit card can be another way to initiate credit building. Retailers often extend credit to individuals with limited or no credit history, making these cards more accessible than traditional credit cards. Responsible use of a retail store credit card, such as making timely payments and maintaining low balances, can contribute to the establishment of a positive credit history.

By exploring these alternative methods, individuals can find a suitable approach that aligns with their financial circumstances and goals. Understanding the benefits and considerations associated with each method empowers individuals to make informed decisions and take proactive steps towards building a solid credit foundation. In the subsequent sections, we will delve deeper into each alternative method, providing comprehensive insights to guide individuals in their credit-building journey.

Using a Credit-Builder Loan

Credit-builder loans serve as a structured and disciplined approach to establishing or enhancing one’s credit profile. These specialized loans are structured in a unique manner, with the borrowed funds typically held in a savings account or certificate of deposit (CD) until the loan is fully repaid. As borrowers make regular payments towards the loan, their responsible behavior is reported to credit bureaus, contributing to the development of a positive credit history.

One of the key advantages of credit-builder loans is their accessibility, as they are often available to individuals with limited or no credit history. This makes them an attractive option for those who may not qualify for traditional unsecured loans or credit cards. Additionally, credit-builder loans provide an opportunity for individuals to demonstrate their creditworthiness through consistent and timely payments, thereby establishing a positive track record.

When considering a credit-builder loan, it’s essential to evaluate the terms and conditions offered by various financial institutions. Factors such as interest rates, fees, and reporting to credit bureaus should be carefully assessed to ensure that the loan aligns with one’s financial goals. By selecting a reputable lender and understanding the loan terms, individuals can embark on their credit-building journey with confidence.

As individuals make regular payments on the credit-builder loan, their credit reports reflect this positive behavior, ultimately contributing to the improvement of their credit score. Over time, this can open doors to better interest rates on future loans, increased credit limits, and improved financial opportunities. By leveraging credit-builder loans as a strategic tool for credit building, individuals can lay a solid foundation for their financial future and work towards achieving their long-term goals.

Understanding the mechanics and benefits of credit-builder loans empowers individuals to make informed decisions regarding their credit-building strategy. By utilizing this structured approach, individuals can embark on a path towards establishing a robust credit history and enhancing their overall financial well-being.

Becoming an Authorized User on Someone Else’s Credit Card

Becoming an authorized user on a family member’s or friend’s credit card can be a strategic method for individuals looking to initiate or enhance their credit journey. This approach involves being added to an existing credit card account as an authorized user, allowing the individual to benefit from the primary cardholder’s positive credit history and responsible credit usage. It’s important to select a primary cardholder with a strong credit history, as their positive credit behavior can potentially bolster the authorized user’s credit profile.

One of the key advantages of becoming an authorized user is the potential impact on the individual’s credit score. When the primary cardholder’s credit card activity, including on-time payments and low credit utilization, is reported to credit bureaus, it can positively influence the authorized user’s credit history. This can be particularly beneficial for individuals with limited or no credit history, as it provides an opportunity to establish a credit footprint based on the primary cardholder’s credit behavior.

It’s important for individuals considering this approach to establish clear communication and trust with the primary cardholder. While the authorized user receives the benefit of the primary cardholder’s positive credit history, any negative credit activity on the account could also impact the authorized user’s credit standing. Therefore, open dialogue and mutual understanding between the authorized user and the primary cardholder are essential to ensure responsible credit management.

As an authorized user, individuals can observe and learn about responsible credit usage and management from the primary cardholder, gaining valuable insights into building and maintaining a positive credit profile. This firsthand exposure to credit management practices can be instrumental in shaping the authorized user’s financial habits and decision-making skills.

By leveraging the opportunity to become an authorized user on someone else’s credit card, individuals can kickstart their credit journey and lay the groundwork for a solid credit history. This collaborative approach to credit building can provide a supportive framework for individuals to establish a positive credit footprint and work towards achieving their financial aspirations.

Applying for a Retail Store Credit Card

Another avenue for initiating credit building is through the application for a retail store credit card. Retailers often extend credit to individuals with limited or no credit history, making these cards more accessible than traditional credit cards offered by financial institutions. Retail store credit cards can serve as a stepping stone for individuals looking to establish a credit history and demonstrate responsible credit management.

One of the primary advantages of retail store credit cards is their accessibility, as they are designed to cater to a broader consumer base, including those with limited credit history. The application process for these cards may be less stringent compared to traditional credit cards, offering individuals an opportunity to access credit and begin building a credit profile.

When considering the option of applying for a retail store credit card, individuals should assess the terms and conditions associated with the card, including interest rates, fees, and rewards or benefits offered. It’s important to prioritize responsible credit usage, making timely payments, and maintaining low balances to leverage the retail store credit card as a tool for building credit.

Responsible use of a retail store credit card, coupled with consistent and timely payments, can contribute to the establishment of a positive credit history. By demonstrating creditworthiness and financial responsibility, individuals can lay the groundwork for a strong credit profile, setting the stage for future financial opportunities.

Furthermore, the disciplined management of a retail store credit card can instill valuable financial habits and discipline, providing individuals with the opportunity to learn and practice responsible credit utilization. This hands-on experience with credit management can be instrumental in shaping positive financial behaviors and decision-making skills.

By leveraging the accessibility and potential benefits of a retail store credit card, individuals can embark on their credit-building journey with a practical and attainable approach. Responsible credit management and strategic use of the retail store credit card can pave the way for a robust credit history and position individuals for future financial success.

Conclusion

Building credit without a secured card is not only feasible but also offers diverse pathways for individuals to establish a solid credit foundation. By understanding the alternative methods available, individuals can embark on their credit-building journey with confidence and purpose, laying the groundwork for a stronger financial future.

Through the exploration of credit-builder loans, becoming an authorized user on someone else’s credit card, and applying for a retail store credit card, individuals can identify a strategy that aligns with their unique financial circumstances and goals. Each approach presents distinct advantages and considerations, empowering individuals to make informed decisions regarding their credit-building strategy.

Credit-builder loans offer a structured and disciplined approach, providing accessibility to individuals with limited or no credit history. By making regular payments, borrowers can demonstrate creditworthiness and contribute to the development of a positive credit history, setting the stage for future financial opportunities.

Becoming an authorized user on someone else’s credit card provides a collaborative approach to credit building, leveraging the positive credit history of the primary cardholder to establish a credit footprint. This method fosters a supportive framework for individuals to learn about responsible credit management and develop sound financial habits.

Applying for a retail store credit card offers accessibility and the opportunity to demonstrate responsible credit usage. By prioritizing timely payments and low balances, individuals can utilize the retail store credit card as a tool for building credit, laying the groundwork for a strong credit profile.

Ultimately, the journey to building credit without a secured card is a dynamic and empowering process. By leveraging alternative methods and understanding the nuances of credit building, individuals can pave the way for improved financial prospects and enhanced access to financial products and services. With a proactive and informed approach, individuals can establish a positive credit history and work towards achieving their long-term financial aspirations.

By embracing the diverse avenues available for credit building, individuals can embark on a path towards financial empowerment and resilience, setting the stage for a future defined by financial stability and opportunity.