Home>Finance>How To Build Your Credit Score Without A Credit Card

Finance

How To Build Your Credit Score Without A Credit Card

Modified: March 6, 2024

Learn how to improve your credit score and establish financial stability even without a credit card. Discover effective ways to manage your finances and boost your creditworthiness.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- Benefits of a Good Credit Score

- How Credit Cards Affect Credit Scores

- Alternatives to Credit Cards for Building Credit

- Paying Bills on Time

- Using Rent and Utility Payments to Build Credit

- Applying for a Credit Builder Loan

- Becoming an Authorized User on Someone Else’s Credit Card

- Using Secured Credit Cards to Build Credit

- Monitoring and Managing Credit Score Progress

- Conclusion

Introduction

Building a solid credit score is crucial for financial stability and opportunities. It’s often believed that the only way to establish creditworthiness is by getting a credit card. While having a credit card can certainly help, not everyone feels comfortable or qualifies for one. The good news is that there are alternative methods to build your credit score without relying on a credit card.

A credit score is a numerical representation of an individual’s creditworthiness. Lenders, landlords, and even employers may use this score to assess the risk involved in extending credit or entering any financial agreement. A higher credit score generally means better terms and rates, which can save you money in the long run.

Having a good credit score provides numerous benefits, such as easier access to loans, lower interest rates on mortgages, auto loans, and credit cards, and increased chances of approval for renting an apartment or getting hired for a job. So, even if you don’t currently need credit, it’s important to start building your score to ensure future financial flexibility and stability.

While credit cards are commonly used to establish credit, they aren’t the only avenue available. This article will explore alternative methods that can help you build your credit score without relying on a credit card. These methods include paying bills on time, using rent and utility payments to build credit, applying for a credit builder loan, becoming an authorized user on someone else’s credit card, and utilizing secured credit cards.

By diversifying your approach and utilizing these strategies, you can gradually build your credit score and improve your financial standing. Without further ado, let’s delve into these alternatives and discover how you can build your credit score without a credit card.

Understanding Credit Scores

Before diving into the methods of building credit without a credit card, it is essential to understand what a credit score is and how it is calculated. Credit scores are numerical values that assess an individual’s creditworthiness based on their credit history.

The most commonly used credit scoring system is the FICO score, which ranges from 300 to 850. The higher the score, the better your creditworthiness is perceived by lenders. The FICO score is calculated using factors such as payment history, credit utilization, length of credit history, credit mix, and new credit applications.

Payment History: This factor accounts for the largest portion of your credit score. It reflects whether you have made timely payments on your debts and bills. Consistently paying bills on time demonstrates responsible financial behavior and positively impacts your credit score.

Credit Utilization: This measures how much of your available credit you are using. It is calculated by dividing your total balances by your total credit limit. Maintaining a low credit utilization ratio, ideally below 30%, is considered favorable for your credit score.

Length of Credit History: The length of time you have been using credit is also taken into account. Generally, the longer your credit history, the better your credit score. This factor considers the age of your oldest account, the average age of all your accounts, and the age of your newest account.

Credit Mix: Lenders like to see a diverse mix of credit accounts, such as credit cards, loans, and mortgages. Having different types of credit can demonstrate your ability to manage various financial obligations responsibly.

New Credit Applications: Opening several new credit accounts within a short period of time may raise concerns for lenders. It could be an indication of financial instability or desperation for credit. Thus, it is advisable to avoid too many new credit applications in a short span of time.

Understanding how these factors contribute to your credit score is crucial in developing a plan to build your credit without solely relying on a credit card. By focusing on these factors and employing alternative credit-building strategies, you can gradually improve your creditworthiness over time.

Benefits of a Good Credit Score

A good credit score opens up a world of opportunities and provides several benefits that can positively impact your financial life. Here are some key advantages of having a good credit score:

Access to Better Loan Terms: When applying for a loan, such as a mortgage or car loan, a good credit score can help you secure more favorable terms. Lenders are more likely to offer lower interest rates and more flexible repayment options to borrowers with higher credit scores. This can save you thousands of dollars in interest payments over the life of the loan.

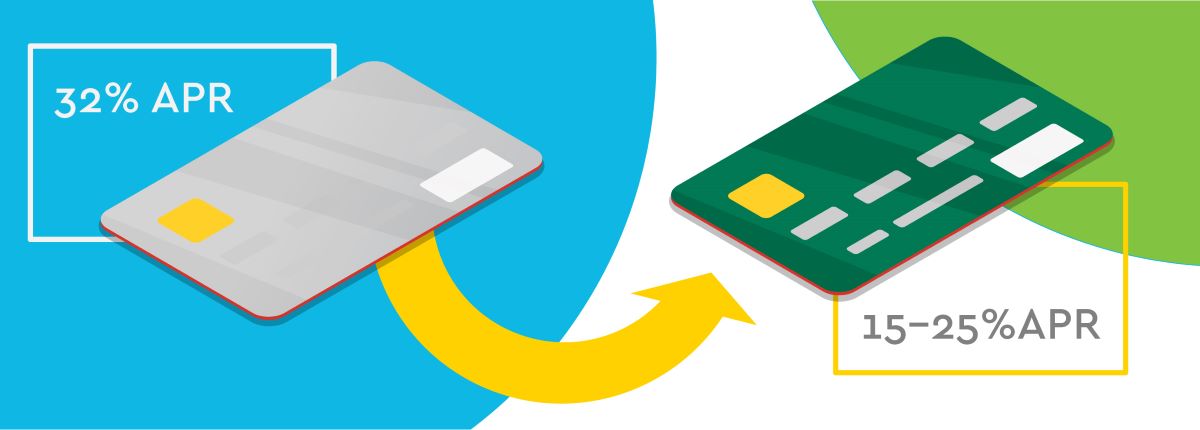

Lower Interest Rates on Credit Cards: Credit cards with low interest rates are particularly attractive to those who carry a balance from month to month. With a good credit score, you have a higher chance of qualifying for credit cards that offer favorable interest rates. This means more of your payment goes towards reducing the principal balance and less is wasted on interest charges.

Increased Chance of Renting an Apartment: Landlords often perform credit checks on potential tenants to assess their reliability and ability to pay rent on time. With a good credit score, you will have a higher chance of getting approved for rental agreements. In some cases, a good credit score may even allow you to negotiate lower rental rates or skip certain security deposit requirements.

Employment Opportunities: Certain employers may consider an applicant’s credit history when making hiring decisions, especially for positions that involve financial responsibilities or require a high level of trust. A good credit score can give you an edge over other candidates and may increase your chances of landing your desired job.

Utility Connection Without Deposits: Utility providers, such as electricity, water, and internet companies, may require a security deposit for individuals with poor credit or no credit history. However, with a good credit score, you may be able to avoid these deposits, saving you money upfront.

Approval for Higher Credit Limits: As you build your credit score, credit card issuers may offer you higher credit limits. This can provide more financial flexibility and may help improve your credit utilization ratio, as long as you continue to use credit responsibly.

A good credit score is an essential tool for achieving financial goals and securing favorable terms for various financial products and services. It demonstrates your responsibility as a borrower and paves the way for a brighter financial future.

How Credit Cards Affect Credit Scores

Credit cards have a significant impact on credit scores because they can contribute to several factors that are considered when calculating creditworthiness. Here’s how credit cards affect credit scores:

Payment History: One of the most important factors in determining your credit score is your payment history. Making timely credit card payments demonstrates responsible financial behavior and helps boost your credit score. On the other hand, missing payments or making late payments can significantly lower your score.

Credit Utilization: Credit card balances and credit limits play a crucial role in calculating credit scores. Credit utilization is the ratio of your credit card balances to your credit limits. It is recommended to keep your credit utilization below 30% to maintain a good credit score. Using a high percentage of your available credit can indicate financial dependence and potential risk to lenders, negatively impacting your credit score.

Length of Credit History: Your credit history’s length is an important component of your credit score. Credit cards can help you establish a long credit history, especially if you keep your accounts open for an extended period. Closing credit card accounts that have been open for a long time may shorten your credit history, potentially lowering your score.

Mix of Credit: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. Credit cards contribute to this credit mix. However, it’s important to note that opening too many credit cards in a short period can negatively affect your score as it may signal potential financial instability.

New Credit Applications: Applying for new credit cards can temporarily lower your credit score. Each credit card application typically results in a hard inquiry on your credit report, which can have a negative impact. It’s important to be mindful of the number of credit card applications you make within a short period to avoid significant drops in your credit score.

Overall, credit cards can have both positive and negative effects on credit scores. When used responsibly, credit cards can help build a strong credit history and improve credit scores. Consistently making on-time payments, keeping credit utilization low, and maintaining a good mix of credit can all contribute to a positive credit score impact. However, it’s crucial to use credit cards responsibly and avoid overspending or accruing excessive debt, as this can have a detrimental effect on your credit score.

Alternatives to Credit Cards for Building Credit

While credit cards are a common tool for building credit, they are not the only option available. If you don’t have a credit card or prefer to explore alternative methods, here are some effective alternatives to consider:

Paying Bills on Time: Consistently making on-time payments for bills such as rent, utilities, and student loans can help build a positive credit history. Some credit bureaus and credit scoring models consider these payments in their calculations. Setting up automated payments or reminders can help ensure you never miss a payment.

Using Rent and Utility Payments to Build Credit: Rent reporting services, such as Experian RentBureau, allow your rental payments to be reported to credit bureaus, positively impacting your credit score. Additionally, some utility companies offer programs that report your utility payments to credit bureaus. Enrolling in these programs can help build credit without using a credit card.

Applying for a Credit Builder Loan: A credit builder loan is specifically designed to help individuals with limited or no credit history establish credit. With this type of loan, you borrow a small amount of money, usually held in an account, and make monthly payments over a fixed term. The lender reports your payment history to credit bureaus, helping you build credit over time. Once the loan is repaid, you receive the funds you borrowed, along with the added benefit of an improved credit score.

Becoming an Authorized User on Someone Else’s Credit Card: If you have a trusted family member or friend with a good credit history, you can ask them to add you as an authorized user on their credit card. Since the primary account holder’s credit card activity is reported to credit bureaus, being an authorized user can help you benefit from their positive credit history, boosting your own score.

Using Secured Credit Cards to Build Credit: Secured credit cards are an excellent option for individuals with no credit history or poor credit. They require a security deposit, which becomes your credit limit. By using the secured card responsibly and making timely payments, you can gradually build credit. Over time, with responsible financial habits, you may be able to transition to an unsecured credit card.

When pursuing these alternative methods, it is essential to ensure that the activity is reported to credit bureaus. This way, your responsible financial behavior can be reflected in your credit history and contribute to building your credit score. Additionally, regularly monitoring your credit report can help you track your progress and address any inaccuracies or discrepancies that may arise.

Remember, building credit takes time and patience, regardless of the method used. By employing these alternative strategies and practicing responsible financial habits, you can establish a solid credit history and improve your creditworthiness without solely relying on a credit card.

Paying Bills on Time

One of the simplest and most effective ways to build credit without a credit card is by consistently paying your bills on time. While it may seem like a straightforward concept, the impact of timely bill payments on your credit score should not be underestimated.

Payment history plays a crucial role in calculating credit scores, accounting for a significant portion of the overall score. When you make on-time payments for bills such as rent, utilities, and student loans, you demonstrate responsible financial behavior and reliability to lenders and credit bureaus. This positive payment history reflects well on your credit report, resulting in an improved credit score.

Here are some key considerations when it comes to paying bills on time to build credit:

- Automate Payments: Setting up automatic payments for your bills can help ensure you never miss a due date. This eliminates the risk of forgetfulness or busy schedules causing late payments, and it can give you peace of mind knowing that your bills are being paid promptly.

- Establish a Budget: Maintaining a budget helps you allocate funds for bill payments and other essential expenses. By properly managing your finances and knowing when your bills are due, you can avoid any potential cash flow issues and make timely payments.

- Stay Organized: Keeping track of your bills and due dates is essential. Consider using a calendar or a reminder app to stay on top of payment deadlines. By organizing your finances, you can ensure that each bill is paid on time and avoid any negative impact on your credit score.

- Manage Cash Flow: It’s important to plan your expenses in a way that allows you to cover your bills when they are due. Understanding your cash flow and having a buffer for unexpected expenses can help prevent missed payments and late fees.

- Communicate with Creditors: If you encounter any financial difficulties that may affect your ability to make timely payments, it’s crucial to communicate with your creditors. They may be willing to work with you and offer alternative payment arrangements, such as payment plans or adjusted due dates.

By consistently paying your bills on time, you establish a positive payment history that can significantly improve your credit score over time. Even though these bills may not be directly reported to credit bureaus, some credit scoring models take them into consideration when calculating your creditworthiness.

Remember, building credit is a long-term process, and it requires discipline and consistency. By prioritizing timely bill payments and maintaining responsible financial habits, you will gradually build a solid credit history without relying solely on a credit card.

Using Rent and Utility Payments to Build Credit

While rent and utility payments may not typically appear on your credit report, there are now options available to utilize these payments to build credit and improve your credit score. This is especially beneficial for individuals who prefer not to rely on credit cards or who may not have access to traditional credit-building opportunities.

Here are some methods to leverage rent and utility payments to build your credit:

- Rent Reporting Services: Some companies, such as Experian RentBureau and RentTrack, allow you to report your rental payments to credit bureaus. By opting into these services, you can have your consistent on-time rent payments reflected on your credit report, positively impacting your credit history and score.

- Utility Payment Reporting Programs: Some utility companies now offer programs that report your utility payments to credit bureaus. This means that your timely payments for services such as electricity, water, and internet can contribute to your credit history. Reach out to your utility providers to enquire about their reporting options.

- Alternative Credit Reporting: There are alternative credit reporting agencies, such as PRBC (Payment Reporting Builds Credit), that consider rent and utility payments in their credit assessments. These agencies provide lenders with an alternative credit evaluation that includes these payment histories, allowing individuals without traditional credit lines to demonstrate their creditworthiness.

- Build a Positive Rental History: Even if your rent payments are not directly reported to credit bureaus, building a positive rental history can help establish your creditworthiness. This can be valuable when applying for a credit card or other forms of credit. Request a rental reference letter from your landlord or property management company to document your responsible payment history.

When utilizing rent and utility payments to build credit, it is essential to ensure that the reported information is accurate and up-to-date. Regularly review your credit report to confirm that your rental payments are being properly reported and positively impacting your credit score.

It’s important to note that not all rental and utility payment reporting services are free of charge. Some may require a fee for their services or collaboration with your property management company. Consider the costs and benefits before deciding which option is best for you.

By taking advantage of these opportunities, you can demonstrate responsible financial behavior and establish a positive credit history without relying solely on credit cards. Building a strong credit score through rent and utility payments can provide you with more financial flexibility and better borrowing prospects in the future.

Applying for a Credit Builder Loan

If you’re looking to build credit without a credit card, one option worth considering is applying for a credit builder loan. This type of loan is specifically designed to help individuals with limited or no credit history establish a positive credit profile, making it an excellent alternative to traditional credit cards.

Here’s how a credit builder loan works and how it can benefit your credit-building journey:

Understanding Credit Builder Loans: A credit builder loan is typically offered by credit unions, community banks, or online lenders. Unlike traditional loans, the funds from a credit builder loan are not immediately disbursed to you. Instead, they are held in a designated account, and you make monthly payments towards the loan balance.

Building Credit: The lender reports your loan payments to the credit bureaus, helping you establish a positive payment history. As you make consistent, on-time payments, your credit score gradually improves. By the end of the loan term, which is typically six to twenty-four months, you would have paid off the loan in full, and the funds (minus any interest or fees) are returned to you. Not only do you build credit during this process, but you also have a savings fund to use as you please.

Loan Considerations: When applying for a credit builder loan, lenders typically do not require a credit check or collateral. This makes it easier for individuals with no credit or a low credit score to qualify. However, it’s essential to review the terms and conditions, including any fees or interest rates associated with the loan, to ensure it aligns with your financial goals.

Budgeting and Payment Management: Like any other loan, it’s crucial to budget and manage your payments responsibly. Each timely payment will contribute to building your credit history. Missing payments or paying late can have a negative impact on your credit score, so ensure you have a plan in place to make payments on time each month.

Applying for a credit builder loan can be an effective way to establish credit without relying on a credit card. The structured nature of these loans helps individuals develop responsible payment habits and build a positive credit history over time.

Remember that it’s important to choose a reputable lender and loan terms that suit your financial situation. Shop around for competitive interest rates and fees, and be sure to read the loan agreement thoroughly before signing.

By successfully managing a credit builder loan, you can demonstrate your creditworthiness and pave the way for future financial opportunities. As you build credit and improve your score, you may gain access to better loan terms and enjoy increased financial flexibility.

Becoming an Authorized User on Someone Else’s Credit Card

If you’re looking to build credit without a credit card of your own, becoming an authorized user on someone else’s credit card can be a viable option. This strategy allows you to benefit from their credit history and responsible usage, helping you establish or improve your own credit profile.

Here’s what you need to know about becoming an authorized user and how it can positively impact your credit:

What is an Authorized User?

An authorized user is someone who is granted permission to use someone else’s credit card account. As an authorized user, you can make purchases using the credit card, but you are not financially responsible for the debt incurred. The primary cardholder remains responsible for all payments.

Credit Reporting:

When you become an authorized user on someone else’s credit card, the card’s history is often reported on your credit report. This means that the primary cardholder’s positive payment history and responsible credit usage can potentially benefit your credit score.

Choosing the Right Person:

Selecting the right person to become an authorized user on their credit card is crucial. Ideally, you want to choose someone with a long, positive credit history and a track record of making timely payments. It could be a family member, spouse, or close friend who is financially responsible.

Communication and Trust:

Before becoming an authorized user, it’s essential to communicate openly with the primary cardholder about their expectations and responsibilities. Make sure that both parties discuss spending limits, payment arrangements, and any concerns or boundaries upfront. Establish trust and maintain transparency throughout the process.

Monitoring Your Credit:

It’s essential to monitor your credit report regularly to ensure that the authorized card activity is accurately reported. This means verifying that the account is showing up on your credit report and that the payment history is being reflected positively. Additionally, monitoring your credit report allows you to detect any potential errors or fraudulent activity.

Building Credit Responsibly:

Becoming an authorized user does not absolve you of financial responsibility, even if you are not legally obligated to repay the debt. Be mindful of your spending habits and use the authorized card responsibly. Avoid making unnecessary purchases or using the card excessively, as this can negatively impact your relationship with the primary cardholder and potentially harm your credit.

While becoming an authorized user on someone else’s credit card can be a helpful strategy for building credit, it’s essential to communicate effectively, set clear expectations, and act responsibly. By leveraging the positive credit history of the primary cardholder, you can establish or improve your credit profile and work towards achieving your financial goals.

Using Secured Credit Cards to Build Credit

If you’re looking to build or rebuild your credit, secured credit cards can be a valuable tool. Secured credit cards are an option for individuals with no credit history or a poor credit score, as they require a security deposit that acts as collateral for the credit limit.

Here’s how using secured credit cards can help you build credit:

How Secured Credit Cards Work:

Unlike traditional credit cards, secured credit cards require an initial security deposit, which is typically equal to the credit limit. The security deposit serves as collateral in case of default or missed payments. The deposit is held by the card issuer and will be returned when you close the account or upgrade to an unsecured credit card.

Building Credit History:

Secured credit cards function similarly to regular credit cards, allowing you to make purchases, pay bills, and build credit history. The card issuer reports your payment activity to credit bureaus, helping establish a positive payment history. Consistently making on-time payments and keeping low credit utilization can significantly improve your credit score over time.

Graduating to Unsecured Credit Cards:

One of the advantages of using a secured credit card is the potential to graduate to an unsecured credit card in the future. With responsible credit card usage and timely payments, you may qualify for an unsecured card after a period of demonstrating good credit habits. This transition can provide higher credit limits and additional benefits.

Choosing the Right Secured Credit Card:

When selecting a secured credit card, it’s essential to consider factors such as annual fees, interest rates, credit reporting practices, and any other associated fees. Look for a card issuer that reports to all major credit bureaus, as this will ensure your responsible credit behavior is reflected in your credit report.

Responsible Credit Card Usage:

To effectively build credit with a secured credit card, it’s crucial to use it responsibly. Keep your credit utilization low by using a small portion of your available credit. Make timely payments in full each month to demonstrate your ability to manage credit responsibly. Avoid carrying high balances or maxing out your card, as this can negatively impact your credit score.

Regular Credit Monitoring:

Monitoring your credit is essential when using a secured credit card. Regularly check your credit reports to ensure accurate information is being reported. This allows you to identify any errors or fraudulent activity promptly. Additionally, monitoring your credit can help you track your progress and gauge your credit-building efforts.

By responsibly using a secured credit card, you have the opportunity to build or improve your credit score. It is important to be patient and consistent with your credit habits, as building credit takes time. Over time, as your creditworthiness improves, you will have access to more favorable loan terms and increased financial opportunities.

Monitoring and Managing Credit Score Progress

Building and maintaining a good credit score requires ongoing monitoring and management. Regularly checking your credit score and credit report can help you stay on top of your credit health and make informed decisions to improve your creditworthiness.

Here are some essential tips for monitoring and managing your credit score progress:

Check Your Credit Reports: Request a free copy of your credit report from each of the major credit bureaus – Equifax, Experian, and TransUnion – at least once a year. Review your reports for any errors, incorrect information, or fraudulent activity. If you find any discrepancies, promptly dispute them with the credit bureau to have them corrected.

Monitor Your Credit Score: Keep track of your credit score regularly to monitor your progress. Many websites and financial institutions provide free access to credit scores. Monitoring your score allows you to identify any sudden drops or changes that may require attention.

Understand Credit Score Factors: Familiarize yourself with the factors that influence your credit score, such as payment history, credit utilization, length of credit history, credit mix, and new credit applications. Understanding these factors can help you prioritize your efforts in improving areas that may be impacting your score negatively.

Pay Bills and Debts on Time: Payment history has a significant impact on your credit score. Make it a priority to pay all your bills, loans, and credit card balances on time. Consider setting up automatic payments or reminders to avoid accidental missed payments.

Manage Credit Utilization: Aim to keep your credit card balances low in relation to the credit limits. A high credit utilization ratio can negatively impact your credit score. Strive to use only a small percentage of your available credit and pay off balances in full each month, if possible.

Track Credit Inquiries: Limit the number of credit inquiries you make, as each inquiry can temporarily lower your credit score. Be mindful of applying for multiple credit cards or loans within a short timeframe, as it may raise concerns for lenders.

Review Credit Building Methods: Continuously assess the effectiveness of the credit-building methods you are using. Evaluate whether rent reporting services, utility payments, credit builder loans, or authorized user accounts are positively impacting your credit score. Adjust your strategy as needed to maximize your credit-building efforts.

Practice Responsible Financial Habits: Beyond credit-related factors, maintaining overall responsible financial habits is critical to long-term credit score management. Avoid excessive debt, only borrow what you can afford, and keep track of your budget. Responsible financial behavior will contribute to a positive credit history.

Patience and Persistence: Building and improving your credit score takes time. Be patient and persistent in your efforts. Consistently practicing good credit habits and monitoring your progress will eventually lead to positive results.

By actively monitoring and managing your credit score, you can improve your creditworthiness over time. Taking control of your credit health empowers you to make informed financial decisions, secure better loan terms, and achieve greater financial stability.

Conclusion

Building credit without a credit card is entirely possible with the array of alternative methods available. While credit cards can be effective tools for establishing credit, they are not the only option. By diversifying your credit-building strategies, you can work towards improving your credit score and opening up financial opportunities.

Understanding credit scores and the factors that impact them is essential in your credit-building journey. Payment history, credit utilization, length of credit history, credit mix, and new credit applications are all significant elements to consider. By focusing on these factors and implementing alternative credit-building methods, you can gradually increase your creditworthiness.

Paying bills on time, utilizing rent and utility payments to build credit, applying for a credit builder loan, becoming an authorized user on someone else’s credit card, and using secured credit cards are all effective avenues to establish or rebuild credit.

It is crucial to monitor your credit score and credit reports regularly. By checking for errors, monitoring changes, and staying informed about your credit health, you can address any issues promptly and ensure the accuracy of your credit information.

Building credit is a journey that requires patience, discipline, and responsible financial habits. Each positive step you take toward building credit will contribute to your overall financial stability and open up opportunities for better loan terms and financial flexibility.

Remember, your credit score is not defined solely by a credit card. By exploring alternative methods and maintaining good credit behavior, you take control of your creditworthiness and pave the way for a brighter financial future.