Finance

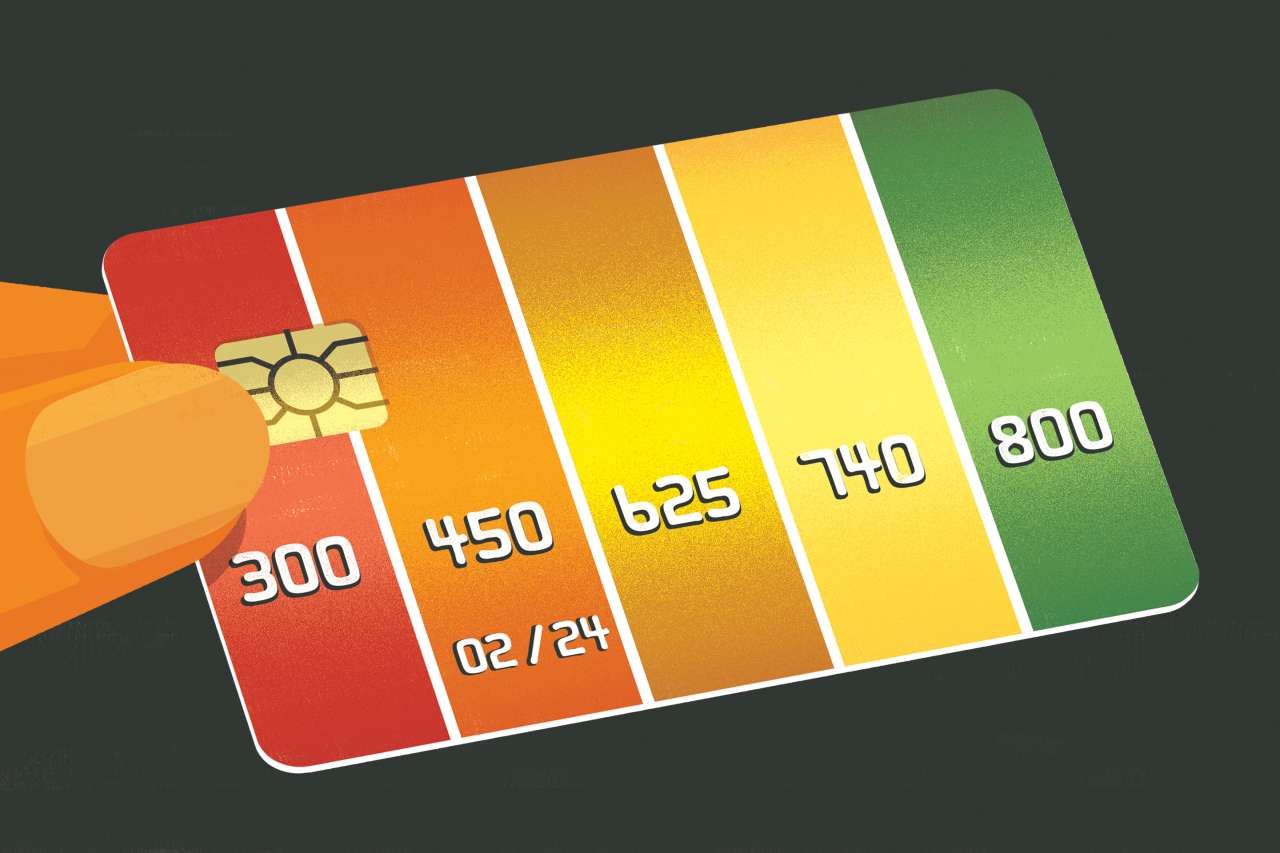

How Quickly Can A Secured Card Build Credit?

Published: March 1, 2024

Learn how a secured card can quickly build credit. Discover the best finance strategies to improve your credit score. Unlock financial freedom today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Building credit is a crucial financial step for many individuals. It opens doors to better borrowing opportunities, lower interest rates, and improved financial stability. For those starting from scratch or aiming to rebuild their credit, a secured credit card can be a valuable tool. Understanding how a secured card works and the speed at which it can build credit is essential for making informed financial decisions.

In this article, we will delve into the world of secured credit cards and explore the factors that influence the pace at which they can help establish or enhance credit scores. By the end, you will have a comprehensive understanding of the mechanics behind secured cards and the strategies that can expedite the credit-building process.

Let's embark on a journey to uncover the potential of secured credit cards in shaping one's financial future. Whether you're a credit novice or someone looking to fortify their financial standing, this exploration will equip you with the knowledge to navigate the realm of credit building with confidence.

What is a Secured Card?

A secured credit card is a financial tool designed to help individuals establish or rebuild their credit. Unlike traditional credit cards, secured cards require a security deposit, which serves as collateral and determines the card’s credit limit. This security deposit reduces the risk for the card issuer, making it an accessible option for individuals with limited or damaged credit history.

When a consumer applies for a secured card, they are typically required to deposit a certain amount of money, which often becomes their credit limit. For example, a $500 deposit would result in a $500 credit limit. This deposit is held by the card issuer as security in case the cardholder defaults on payments. It’s important to note that the security deposit does not serve as a payment for charges made with the card; it simply mitigates the risk for the issuer.

While secured cards operate similarly to traditional credit cards and can be used for purchases, they are distinct in their reliance on a security deposit. This feature makes secured cards an accessible option for those with limited credit history or a less-than-ideal credit score. By responsibly using a secured card, individuals can demonstrate their creditworthiness and work toward improving their overall credit profile.

Secured cards are often recommended for individuals who are new to credit, have experienced financial setbacks, or are working to rebuild their credit after encountering challenges. By understanding the fundamentals of secured cards, individuals can make informed decisions about their financial journey and leverage this tool to pave the way for a stronger credit foundation.

How Does a Secured Card Build Credit?

A secured credit card can serve as a powerful vehicle for building or rebuilding credit when used responsibly. When a cardholder makes purchases and pays off the balance on time, the card issuer reports this activity to the major credit bureaus. This reporting allows the cardholder to establish a positive credit history and demonstrate their ability to manage credit effectively.

Timely payments and responsible credit utilization are key factors in the credit-building process. By consistently paying off the card balance and keeping credit utilization low, individuals can showcase their creditworthiness and financial discipline. Over time, this positive payment history and responsible credit management contribute to an improved credit score.

Furthermore, the length of credit history plays a significant role in credit scoring. As individuals maintain their secured card accounts and continue to use credit responsibly, they are effectively lengthening their credit history. This demonstrates stability and reliability to potential lenders and can have a positive impact on credit scores.

It’s important to note that while secured cards offer the opportunity to build credit, mismanagement of the card can have adverse effects. Late payments, high credit utilization, and defaulting on the card can harm credit scores and impede the credit-building process. Therefore, it’s essential for cardholders to use their secured cards judiciously and manage them in a manner that fosters positive credit outcomes.

By understanding the mechanisms through which a secured card influences credit, individuals can harness the potential of this financial tool to establish a solid credit foundation or repair past credit challenges. With prudent use and a commitment to responsible credit management, a secured card can be a stepping stone toward achieving stronger financial standing and expanded borrowing opportunities.

Factors Affecting the Speed of Credit Building

The pace at which credit is built with a secured card can be influenced by various factors, each playing a distinct role in shaping the credit-building journey. Understanding these factors is essential for individuals seeking to optimize the effectiveness of their secured cards in establishing or enhancing their credit profiles.

Payment History: Timely payments are a cornerstone of credit building. Consistently paying off the secured card balance in full and on time demonstrates financial responsibility and reliability to creditors and credit bureaus. On the other hand, late or missed payments can have detrimental effects on credit scores, hindering the credit-building process.

Credit Utilization: The utilization of available credit is another critical factor. Responsible use of credit involves keeping credit utilization low, ideally below 30% of the available credit limit. High credit utilization can signal financial strain and may impact credit scores negatively.

Length of Credit History: The length of time a secured card account has been active contributes to the credit-building process. As individuals maintain their secured card accounts and demonstrate responsible credit management over an extended period, their credit history grows, potentially enhancing their credit scores.

Credit Mix: While secured cards focus on revolving credit, a diverse credit mix, including installment loans, can positively impact credit scores. However, this factor may have a relatively minor influence compared to payment history and credit utilization.

Credit Inquiries: When individuals apply for a secured card or other forms of credit, it results in a hard inquiry on their credit report. While a single inquiry may have a minimal impact, multiple inquiries within a short timeframe can raise concerns about a consumer's financial stability.

Financial Discipline: Beyond specific credit-related factors, overall financial discipline and responsible money management play a crucial role in credit building. Sound financial practices, such as budgeting, saving, and avoiding excessive debt, contribute to a positive financial image and can support credit-building efforts.

By recognizing and addressing these factors, individuals can take proactive steps to accelerate the pace of credit building with a secured card. Through conscientious financial habits and strategic credit management, they can optimize the impact of their secured cards and expedite the enhancement of their creditworthiness.

Tips for Quickly Building Credit with a Secured Card

Maximizing the potential of a secured credit card for expeditious credit building requires a strategic and disciplined approach. By implementing the following tips, individuals can accelerate the process of establishing or improving their credit scores, setting the stage for enhanced financial opportunities.

- Manage Credit Utilization: Keeping credit utilization low is paramount. Aim to utilize only a small portion of the available credit limit, ideally below 30%, to demonstrate responsible credit usage.

- Timely Payments: Consistently paying the secured card balance in full and on time is crucial. Setting up payment reminders or automatic payments can help ensure punctual payments, fostering a positive payment history.

- Regular Monitoring: Routinely monitoring the secured card account and credit report allows individuals to stay informed about their credit activity and address any discrepancies or issues promptly.

- Gradual Credit Limit Increases: Some secured card issuers may offer opportunities to increase the credit limit over time. Responsible card usage and payment history can position individuals for credit limit upgrades, which can positively impact credit scores.

- Responsible Spending: Making mindful and necessary purchases with the secured card, while refraining from excessive spending, contributes to prudent credit management and financial discipline.

- Limit New Credit Applications: Minimizing new credit applications helps prevent multiple hard inquiries, which can temporarily lower credit scores. Focused and selective credit applications can support a stable credit profile.

- Establish a Budget: Creating and adhering to a budget facilitates responsible financial behavior, ensuring that funds are allocated sensibly and that credit card payments can be made comfortably.

- Financial Education: Seeking knowledge about credit management, budgeting, and personal finance empowers individuals to make informed decisions and cultivate healthy financial habits.

By integrating these strategies into their financial routines, individuals can harness the full potential of secured credit cards as catalysts for rapid credit building. With diligence, prudence, and a focus on responsible credit management, they can expedite the enhancement of their credit profiles and pave the way for a brighter financial future.

Conclusion

Secured credit cards stand as invaluable tools for individuals seeking to establish or fortify their credit standing. By providing a structured mechanism for responsible credit usage and payment reporting to major credit bureaus, secured cards offer a pathway to building credit in a deliberate and measurable manner.

Throughout this exploration, we’ve unveiled the fundamental principles of secured cards and their role in the credit-building process. From understanding the mechanics of secured cards to identifying the factors that influence the speed of credit building, individuals have gained insights into the strategies that can propel their credit journeys forward.

It is evident that the prudent management of a secured card, encompassing timely payments, judicious credit utilization, and sustained financial discipline, can yield substantial benefits in the form of an enhanced credit profile. By adhering to sound financial practices and leveraging the tips provided, individuals can expedite the development of their creditworthiness and position themselves for improved financial opportunities.

As individuals embark on their credit-building endeavors with secured cards, they are encouraged to approach this process with patience, determination, and a commitment to responsible credit management. While the journey may present challenges, the potential for long-term financial stability and expanded access to credit underscores the significance of this pursuit.

In closing, the utilization of secured credit cards as instruments for rapid credit building holds promise for individuals navigating the complexities of credit establishment and repair. By integrating the knowledge and strategies gleaned from this exploration, individuals can embark on their credit-building odyssey with confidence, empowered to shape a robust and resilient credit foundation.